Noticias del mercado

-

21:00

Dow -0.51% 18,023.29 -92.55 Nasdaq -0.32% 5,116.37 -16.58 S&P -0.46% 2,111.47 -9.77

-

18:21

WSE: Session Results

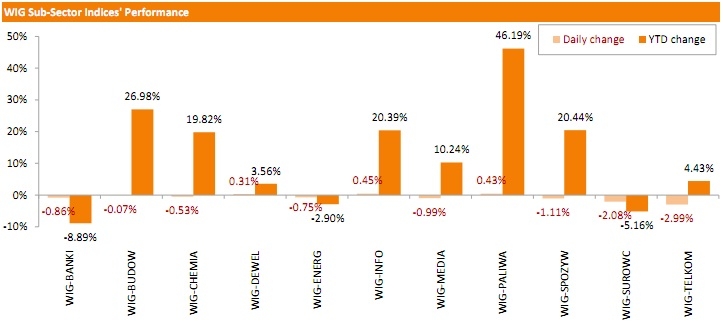

Polish equity market continued to decline on Friday. The broad market measure, the WIG index, lost 0.69%. Sector-wise, telecommunications sector (-2.99%) was the weakest, while technology (+0.45%) outperformed.

The large-cap stocks' measure, the WIG30 Index, declined by 1.34%. Within the WIG30 Index components, JSW (WSE: JSW) fared the worst, slumping 5.62%. It was followed by BZ WBK (WSE: BZW), which lost 3.93%, paring its yesterday's gains. ORANGE POLSKA (WSE: OPL) also generated solid losses, sliding down 3.26%. On the other side of the ledger, GTC (WSE: GTC) managed to record the best daily result, advancing 5.83%. ALIOR (WSE: ALR) climbed 3.67% on the CEO's statement the further mergers with PZU (WSE: PZU; -1.67%) may help the bank to keep fast net profit growth rate over next 3-4 years.

-

18:07

European stocks close: most stocks closed higher despite the uncertainty over the Greek debt talks

Most stock indices closed higher despite the uncertainty over the Greek debt talks. Yesterday's debt talks were unsuccessful. The European Commission's Valdes Dombrovskis said that the Eurogroup is ready to continue the debt talks.

European Council President Donald Tusk called the Eurozone leaders' meeting for Monday at 17:00 GMT in Brussels.

"It is time to urgently discuss the situation of Greece at the highest political level," he said.

The European Central Bank (ECB) on Friday raised the amount the Greek central bank can lend its banks by €3.3 billion.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €22.3 billion in April from €18 billion in March.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €30.4 billion in April from €21.9 billion in March, while primary income remained unchanged at €2 billion.

The surplus on services declined to €3.4 billion in April from €5.5 billion in March, while the secondary income dropped to a deficit of €13.5 billion from a deficit of €11.3 billion.

Eurozone's unadjusted current account surplus declined to €20.4 billion in April from EUR 24.4 billion in March. March's figure was revised down from a surplus of €24.9 billion.

German PPI producer prices rose 0.1% in May, missing expectations for a 0.2% increase, after a 0.1% gain in April.

On a yearly basis, German PPI dropped 1.3% in May, missing forecasts of a 1.1% decline, after a 1.5% fall in March.

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. rose to £9.35 billion in May from £5.46 billion in April, missing expectations for a rise to £10.5 billion. April's figure was revised down from £6.04 billion.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,710.45 +2.57 +0.04 %

DAX 11,040.1 -60.20 -0.54 %

CAC 40 4,815.37 +11.89 +0.25 %

-

18:00

European stocks closed: FTSE 6,710.45 +2.57 +0.04% CAC 4,815.37 +11.89 +0.25% DAX 11,040.1 -60.20 -0.54%

-

17:53

Wall Street. Major U.S. stock-indexes fell

U.S. stock-indexes lower on Friday, a day after Wall Street rallied. All three major indexes were still on track to end the week higher. On Thursday, Wall Street was boosted by strong data, which pointed to signs that the U.S. economy was recovering after growth came to a halt earlier in the year. U.S. consumer prices last month increased the most in more than two years, jobless claims applications last week fell to a near 15-year low and factory activity in the mid-Atlantic region in June accelerated to a six-month high.

Most of Dow stocks in negative area (22 of 30). Top looser - The Travelers Companies, Inc. (TRV, -1.09%). Top gainer - The Home Depot, Inc. (HD, +1.14%).

S&P index sectors mixed. Top gainer - Conglomerates (+0,4%). Top looser - Basic materials (-0.5%).

At the moment:

Dow 17996.00 -48.00 -0.27%

S&P 500 2109.00 -5.75 -0.27%

Nasdaq 100 4519.75 -11.00 -0.24%

10-year yield 2.28% -0.07

Oil 59.70 -1.12 -1.84%

Gold 1200.40 -1.60 -0.13%

-

17:02

European Central Bank raised the amount the Greek central bank can lend its banks to €87.4 billion

The European Central Bank (ECB) on Friday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA) by €3.3 billion.

Two days earlier, the ECB had raised the ELA by €1.1 billion to €84.1 billion.

According to Reuters, the ECB said on Friday that Greek banks may not open on Monday.

-

16:25

Italy’s current account surplus climbs to €5.14 billion in April

The Bank of Italy released its current account data on Friday. Italy's current account surplus climbed to €5.14 billion in April from €2.85 billion in April last year.

The goods trade surplus increased to €6.04 billion in April from €4.20 billion in April last year. The services trade balance rose to a surplus of €108 million from a deficit of €2 million.

The capital account deficit increased to €127 million in April from €13 million last year, while the financial account balance surplus jumped to €7.07 billion from €3.07 billion.

-

15:44

U.S. Stocks open: Dow -0.20%, Nasdaq -0.14%, S&P -0.19%

-

15:42

French economy is expected to expand 1.2% on average in 2015

The French statistical office Insee released its gross domestic product (GDP) data on Friday. French economy is expected to expand 1.2% on average in 2015 as a whole and 1.6% at the end of this year.

The Insee forecasts French GDP to increase 0.3% each in the second and third quarters and 0.4% in the fourth quarter.

The economy is expected to be driven by manufacturing, the rebound in energy and market-sector services.

The Insee see the unemployment rate to stabilize at 10.4% in the second quarter.

Inflation is forecast to continue increasing to 0.6 percent in December, mainly driven by higher energy prices.

-

15:28

Before the bell: S&P futures -0.06%, NASDAQ futures +0.08%

U.S. stock futures were little changed as U.S. equity investors continue to shrug off concerns about deteriorating talks between Greece and its creditors.

Global markets:

Nikkei 20,174.24 +183.42 +0.92%

Hang Seng 26,760.53 +65.87 +0.25%

Shanghai Composite 4,481.22 -304.14 -6.36%

FTSE 6,716.31 +8.43 +0.13%

CAC 4,838.71 +35.23 +0.73%

DAX 11,122.7 +22.40 +0.20%

Crude oil $59.67 (-1.22%)

Gold $1201.50 (-0.03%)

-

15:07

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Goldman Sachs

GS

214.60

0.00%

1.9K

American Express Co

AXP

80.57

-0.25%

3.5K

AT&T Inc

T

34.90

-0.34%

6.6K

Visa

V

69.59

+0.13%

0.2K

Boeing Co

BA

145.32

-0.04%

0.2K

Caterpillar Inc

CAT

87.50

+0.07%

3.0K

Chevron Corp

CVX

99.99

-0.26%

0.4K

Cisco Systems Inc

CSCO

29.25

+0.14%

1.0K

E. I. du Pont de Nemours and Co

DD

70.16

+0.01%

2.8K

Exxon Mobil Corp

XOM

85.19

-0.34%

3.0K

General Electric Co

GE

27.30

-0.26%

1.8K

Home Depot Inc

HD

111.86

+0.01%

5.1K

Intel Corp

INTC

32.46

+0.25%

13.0K

International Business Machines Co...

IBM

168.50

+0.15%

2.3K

Johnson & Johnson

JNJ

100.50

+0.14%

1.0K

JPMorgan Chase and Co

JPM

68.61

-0.25%

1.7K

McDonald's Corp

MCD

95.59

-0.60%

0.1K

Merck & Co Inc

MRK

58.45

-0.24%

10.5K

Microsoft Corp

MSFT

46.90

+0.39%

13.0K

Pfizer Inc

PFE

34.25

-0.35%

0.5K

Procter & Gamble Co

PG

80.78

-0.05%

5.6K

Travelers Companies Inc

TRV

101.39

-0.08%

2.3K

Verizon Communications Inc

VZ

47.70

-0.15%

3.2K

Wal-Mart Stores Inc

WMT

72.90

-0.11%

0.4K

Walt Disney Co

DIS

113.06

-0.14%

2.3K

ALCOA INC.

AA

11.96

+0.34%

3.3K

Apple Inc.

AAPL

128.07

+0.15%

71.1K

Barrick Gold Corporation, NYSE

ABX

11.69

-0.17%

20.1K

AMERICAN INTERNATIONAL GROUP

AIG

62.28

-0.02%

0.3K

Amazon.com Inc., NASDAQ

AMZN

441.07

+0.38%

9.1K

Citigroup Inc., NYSE

C

56.65

-0.19%

1.3K

Ford Motor Co.

F

15.16

+0.13%

0.1K

Facebook, Inc.

FB

83.02

+0.14%

26.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.88

-1.24%

1.5K

General Motors Company, NYSE

GM

36.25

+0.14%

2.3K

Google Inc.

GOOG

538.00

+0.24%

0.1K

Hewlett-Packard Co.

HPQ

32.10

+0.06%

1.8K

Starbucks Corporation, NASDAQ

SBUX

54.22

+0.20%

5.2K

Tesla Motors, Inc., NASDAQ

TSLA

261.94

+0.02%

8.8K

Twitter, Inc., NYSE

TWTR

34.88

+0.63%

12.4K

Yahoo! Inc., NASDAQ

YHOO

40.99

+0.20%

0.2K

Yandex N.V., NASDAQ

YNDX

16.90

-0.18%

13.2K

-

15:03

Canadian retail sales decline 0.1% in April

Statistics Canada released retail sales data on Friday. Canadian retail sales fell by 0.1% in April, missing expectations for a 0.7% gain, after a 0.9% rise in March. March's figure was revised up from a 0.7% increase.

The drop was driven by lower sales at food and beverage stores and at electronics and appliance stores. Sales at food and beverage stores decreased 1.3% in April, while sales at electronics and appliance stores slid 8.8%.

Sales declined in 4 of 11 subsectors.

Motor vehicle and parts sales gained 1.3% in April, sales at gasoline stations were down 0.5%.

Canadian retail sales excluding automobiles were up 0.3% in April.

-

14:44

Canadian consumer price inflation rises 0.6% in May

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.6% in May, exceeding expectations for a 0.5% rise, after a 0.1% decline in April.

On a yearly basis, the consumer price index rose to 0.9% in May from 0.8% in March. Analysts had expected inflation to remain at 0.8%.

The consumer price index was driven by higher food prices, which climbed 3.8% in May.

The energy index plunged 11.8% in May from the same month a year earlier as gasoline price dropped 17.4% in May from the same month a year earlier.

Canadian core consumer price index, which excludes some volatile goods, increased 0.4% in May, after a 0.1% gain in April.

On a yearly basis, core consumer price index in Canada fell to 2.2% in May from 2.3% in April. Analysts had expected the index to decline to 2.1%.

The Bank of Canada's inflation target is 2.0%.

-

12:02

European stock markets mid session: stocks traded higher as concerns over the debt talks eased

Stock indices traded higher as concerns over the debt talks between Athens and its creditors eased, despite the fact that yesterday's debt talks were unsuccessful. The European Commission's Valdes Dombrovskis said that the Eurogroup is ready to continue the debt talks.

European Council President Donald Tusk called the Eurozone leaders' meeting for Monday at 17:00 GMT in Brussels.

"It is time to urgently discuss the situation of Greece at the highest political level," he said.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €22.3 billion in April from €18 billion in March.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €30.4 billion in April from €21.9 billion in March, while primary income remained unchanged at €2 billion.

The surplus on services declined to €3.4 billion in April from €5.5 billion in March, while the secondary income dropped to a deficit of €13.5 billion from a deficit of €11.3 billion.

Eurozone's unadjusted current account surplus declined to €20.4 billion in April from EUR 24.4 billion in March. March's figure was revised down from a surplus of €24.9 billion.

German PPI producer prices rose 0.1% in May, missing expectations for a 0.2% increase, after a 0.1% gain in April.

On a yearly basis, German PPI dropped 1.3% in May, missing forecasts of a 1.1% decline, after a 1.5% fall in March.

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. rose to £9.35 billion in May from £5.46 billion in April, missing expectations for a rise to £10.5 billion. April's figure was revised down from £6.04 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,754.47 +46.59 +0.69 %

DAX 11,221.84 +121.54 +1.09 %

CAC 40 4,857.4 +53.92 +1.12 %

-

11:38

Eurozone’s current account surplus climbs to a seasonally adjusted €22.3 billion in April

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €22.3 billion in April from €18 billion in March.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €30.4 billion in April from €21.9 billion in March, while primary income remained unchanged at €2 billion.

The surplus on services declined to €3.4 billion in April from €5.5 billion in March, while the secondary income dropped to a deficit of €13.5 billion from a deficit of €11.3 billion.

Eurozone's unadjusted current account surplus declined to €20.4 billion in April from EUR 24.4 billion in March. March's figure was revised down from a surplus of €24.9 billion.

-

11:25

German producer prices rise 0.1% in May

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices rose 0.1% in May, missing expectations for a 0.2% increase, after a 0.1% gain in April.

PPI excluding energy sector fell by 0.3% in May.

On a yearly basis, German PPI dropped 1.3% in May, missing forecasts of a 1.1% decline, after a 1.5% fall in March.

Energy prices plunged 4.1% in May.

Consumer non-durable goods prices fell 1.5% in May, intermediate goods sector prices decreased by 0.5%, and capital goods prices increased 0.7%, while durable consumer goods sector prices rose 1.3%.

-

11:07

Public sector net borrowing in the U.K. rises to £9.35 billion in May

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. rose to £9.35 billion in May from £5.46 billion in April, missing expectations for a rise to £10.5 billion.

April's figure was revised down from £6.04 billion.

-

10:51

Bank of Japan keeps its monetary policy unchanged, BoJ Governor Haruhiko Kuroda expects consumer price inflation to achieve the central bank's 2% target around April to September 2016

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference that exports were picking up. He expects that consumer price inflation to achieve the central bank's 2% target around April to September 2016.

The BoJ said that housing investment seems to pick up, while capital expenditure grew.

-

10:35

Greece's primary budget surplus totals €1.51 billion in the first five months of the year

Greece's Finance Ministry said on Thursday that Greece's primary budget surplus totalled €1.51 billion in the first five months of the year. Finance Ministry's calculation excludes the budgets of social security organizations and local administrations. This calculation is different from the calculation by Greece' creditors.

The primary budget deficit target was €556 million for the five-month period.

Tax revenues totalled €17.05 billion (target: €18.01 billion), while public spending totalled €20.03 billion.

-

10:17

A deal between Greece and its creditors has not been reached at the Eurogroup meeting on Thursday

A deal between Greece and its creditors has not been reached at the Eurogroup meeting on Thursday in Luxembourg. The European Commission's Valdes Dombrovskis said that the Eurogroup is ready to continue the debt talks.

-

09:51

Global Stocks: U.S. rally

U.S. stocks had their best performance in a week on Thursday after the country's central bank signaled it needs to see a stronger economy before raising interest rates.

The Dow Jones industrial average gained 180.10 points, or 1%, to 18,115.84. The Standard & Poor's 500 rose 20.80 points, or 1%, to 2,121.24. The Nasdaq Composite reached a new record high, adding 68.07 points, or 1.3 percent, to close at 5,132.95.

Asian stocks have traded mixed today. China's Shanghai Composite Index fell by 2.69% or 128.53 points to 4,656.82 amid concerns that a bubble may be building up in equity markets. Hong Kong Hang Seng rose by 1.02%, or 272.31 points, to 26,966.97. Meanwhile the Nikkei rose by 0.91%, or 182.21 points, to 20,173.03 after the Bank of Japan voted 8 to 1 to leave its monetary policy unchanged. The key interest rate remained at 0%. The BOJ has also announced that the number of policy-setting meetings each year will be reduced to 8 times from current 14.

-

04:01

Nikkei 225 20,154.39 +163.57 +0.8 %, Hang Seng 26,974.05 +279.39 +1.0 %, Shanghai Composite 4,689.93 -95.43 -2.0 %

-

00:31

Stocks. Daily history for Jun 18’2015:

(index / closing price / change items /% change)

Nikkei 225 19,990.82 -228.45 -1.13 %

Hang Seng 26,694.66 -59.13 -0.22 %

S&P/ASX 200 5,524.89 -70.54 -1.26 %

Shanghai Composite 4,786.17 -181.72 -3.66 %

FTSE 100 6,707.88 +27.33 +0.41 %

CAC 40 4,803.48 +12.86 +0.27 %

Xetra DAX 11,100.3 +122.29 +1.11 %

S&P 500 2,121.24 +20.80 +0.99 %

NASDAQ Composite 5,132.95 +68.07 +1.34 %

Dow Jones 18,115.84 +180.10 +1.00 %

-