Noticias del mercado

-

20:05

American focus: the US dollar significantly higher against the сanadian dollar

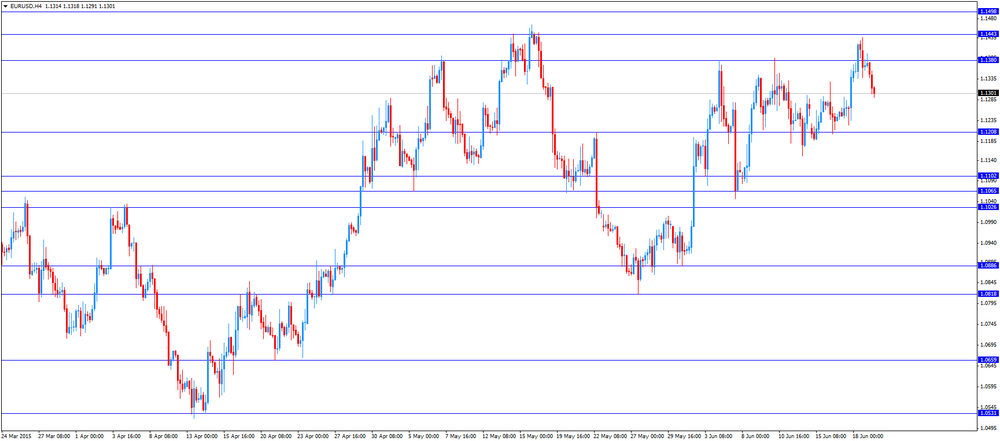

The euro retreated from a session low against the dollar, rising above $ 1.1300 and recouping more than half of the previously lost positions. However, the currency remains under pressure amid pessimism associated with the situation in Greece and the negotiations with the creditors. After yesterday's disastrous Eurogroup meeting, EU leaders plan to hold an emergency meeting on Monday. Media reports citing official sources reported that at a meeting on Monday, euro zone ministers will discuss a potential default in Greece in case Athens did not present proposals for reform. Meanwhile, the press service of the EU said: "The Eurogroup will meet in Brussels on Monday to discuss the situation with the program of financial aid to Greece." Meanwhile, German Chancellor Angela Merkel said that the summit, announced on Monday, can bring solutions, if available will be the base for work, otherwise it will be "advisory" in nature.

Support for the euro also had news from the ECB. Today the European Central Bank raised the amount of emergency financial assistance (ELA) to 1.8 billion. Euros, making it the second time this week. ECB Governing Council today held a conference call to discuss increasing the amount of emergency after investors withdrew from Greek banks 3 billion. Euro this week, fearing that Athens will not be able to negotiate with creditors. "The increase was approved by the ELA, the ECB Governing Council expects a favorable outcome of the summit on Monday," - said the source. Earlier this week, the ECB increased the ELA 1.1 billion. Euros to 84.1 billion. Euro.

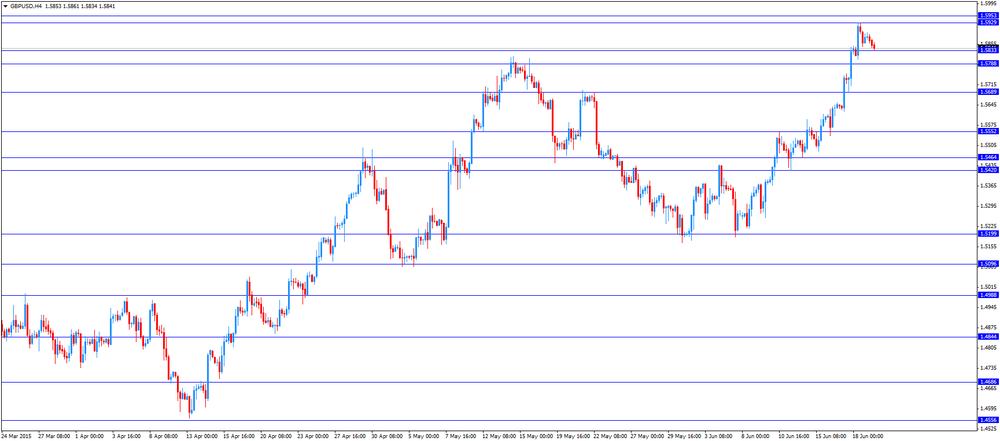

The pound strengthened moderately against the dollar, returning to the level of opening of the session, due to the correction positions before the weekend. Previously, the pressure on the pound have data from the Office for National Statistics. As it became known, the net borrowing except for the intervention of the public sector amounted to 10.1 billion pounds, or 0.5 percent of GDP in May. This was a decrease of 2.2 billion pounds in May 2014, when it was expected that the rate will fall to 10.5 billion pounds. This reduction in net borrowing was largely due to a decrease of 1.6 billion pounds of net central government borrowing, coupled with a decrease of 0.6 billion pounds of net borrowing of local government. In late May, the net debt of the public sector with the exception of public sector banks totaled 1.5 trillion pounds, or 80.8 percent of GDP, an increase of 83.2 billion pounds, compared to the previous year.

The Canadian dollar depreciated significantly against the US counterpart, approaching the level CAD1.2300 on weak retail sales data for April and CPI report for May, which was slightly stronger than expected. Recall Canadian retail sales unexpectedly fell in April, adding to fears that the economy ran into difficulties at the beginning of the second quarter, and consumer spending remains low. Retail sales fell 0.1% to a seasonally adjusted reached 42.48 billion Canadian dollars. Expectations of economists were far more significant increase of 0.7%. In volume terms, retail sales fell in April by 0.2%. Weaker sales in grocery stores, gas stations and electronics stores have been largely responsible for the decline in April.

Meanwhile, another report showed that the consumer price index (CPI) rose by 0.9% during the 12 months to May, after increasing 0.8% in April. The decline in energy prices continued to affect the slowdown in the annual growth of the CPI. Excluding energy, the CPI rose 2.2% in the 12 months to May, in line with the rise in April.

-

17:02

European Central Bank raised the amount the Greek central bank can lend its banks to €87.4 billion

The European Central Bank (ECB) on Friday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA) by €3.3 billion.

Two days earlier, the ECB had raised the ELA by €1.1 billion to €84.1 billion.

According to Reuters, the ECB said on Friday that Greek banks may not open on Monday.

-

16:25

Italy’s current account surplus climbs to €5.14 billion in April

The Bank of Italy released its current account data on Friday. Italy's current account surplus climbed to €5.14 billion in April from €2.85 billion in April last year.

The goods trade surplus increased to €6.04 billion in April from €4.20 billion in April last year. The services trade balance rose to a surplus of €108 million from a deficit of €2 million.

The capital account deficit increased to €127 million in April from €13 million last year, while the financial account balance surplus jumped to €7.07 billion from €3.07 billion.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E2.86bn), $1.1250(E510mn), $1.1450(E617mn), $1.1600(E2.1bn)

USD/JPY: Y122.00($3.52bn), Y123.00($1.6bn), Y124.00($827mn), Y124.50($1.87bn), Y125.00(Y5.23bn)

GBP/USD: $1.5500(Gbp950mn), $1.5650(Gbp1.1bn)

EUR/GBP: Gbp0.7000(E675mn)

AUD/USD: $0.7600(A$737mn), $0.7800(A$772mn), $0.7850(A$706mn)

NZD/USD: $0.6800(NZ$597mn)

USD/CAD: C$1.2200($506mn), C$1.2250($340mn)

-

15:42

French economy is expected to expand 1.2% on average in 2015

The French statistical office Insee released its gross domestic product (GDP) data on Friday. French economy is expected to expand 1.2% on average in 2015 as a whole and 1.6% at the end of this year.

The Insee forecasts French GDP to increase 0.3% each in the second and third quarters and 0.4% in the fourth quarter.

The economy is expected to be driven by manufacturing, the rebound in energy and market-sector services.

The Insee see the unemployment rate to stabilize at 10.4% in the second quarter.

Inflation is forecast to continue increasing to 0.6 percent in December, mainly driven by higher energy prices.

-

15:03

Canadian retail sales decline 0.1% in April

Statistics Canada released retail sales data on Friday. Canadian retail sales fell by 0.1% in April, missing expectations for a 0.7% gain, after a 0.9% rise in March. March's figure was revised up from a 0.7% increase.

The drop was driven by lower sales at food and beverage stores and at electronics and appliance stores. Sales at food and beverage stores decreased 1.3% in April, while sales at electronics and appliance stores slid 8.8%.

Sales declined in 4 of 11 subsectors.

Motor vehicle and parts sales gained 1.3% in April, sales at gasoline stations were down 0.5%.

Canadian retail sales excluding automobiles were up 0.3% in April.

-

14:44

Canadian consumer price inflation rises 0.6% in May

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation increased 0.6% in May, exceeding expectations for a 0.5% rise, after a 0.1% decline in April.

On a yearly basis, the consumer price index rose to 0.9% in May from 0.8% in March. Analysts had expected inflation to remain at 0.8%.

The consumer price index was driven by higher food prices, which climbed 3.8% in May.

The energy index plunged 11.8% in May from the same month a year earlier as gasoline price dropped 17.4% in May from the same month a year earlier.

Canadian core consumer price index, which excludes some volatile goods, increased 0.4% in May, after a 0.1% gain in April.

On a yearly basis, core consumer price index in Canada fell to 2.2% in May from 2.3% in April. Analysts had expected the index to decline to 2.1%.

The Bank of Canada's inflation target is 2.0%.

-

14:30

Canada: Consumer price index, y/y, May 0.9% (forecast 0.8%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, y/y, May 2.2% (forecast 2.1%)

-

14:30

Canada: Retail Sales, m/m, April -0.1% (forecast 0.7%)

-

14:30

Canada: Consumer Price Index m / m, May 0.6% (forecast 0.5%)

-

14:30

Canada: Retail Sales YoY, April 1.7%

-

14:17

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the Greek debt problem

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ Interest Rate Decision 0% 0%

05:00 Japan Bank of Japan Monetary Base Target 275 275

05:00 Japan BoJ Monetary Policy Statement

06:30 Japan All Industry Activity Index, m/m April -1.4% Revised From -1.3% 0.1%

07:00 Japan Coincident Index (Finally) April 109.2 111.1 111.0

07:00 Japan Leading Economic Index (Finally) April 106.0 107.2 106.4

08:00 Germany Producer Price Index (MoM) May 0.1% 0.2% 0.0%

08:00 Germany Producer Price Index (YoY) May -1.5% -1.1% -1.3%

08:30 Japan BOJ Press Conference

10:00 Eurozone Current account, unadjusted, bln April 24.4 Revised From 24.9 20.4

10:30 United Kingdom PSNB, bln May -5.46 Revised From -6.04 -10.5 -9.35

11:00 Eurozone ECOFIN Meetings

The U.S. dollar traded higher against the most major currencies. There will be released no major economic data in the U.S. today.

Yesterday's economic data from the U.S. supported the greenback

The euro traded lower against the U.S. dollar on the uncertainty over the Greek debt problem. Yesterday's debt talks were unsuccessful. The European Commission's Valdes Dombrovskis said that the Eurogroup is ready to continue the debt talks.

European Council President Donald Tusk called the Eurozone leaders' meeting for Monday at 17:00 GMT in Brussels.

"It is time to urgently discuss the situation of Greece at the highest political level," he said.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's current account surplus climbed to a seasonally adjusted €22.3 billion in April from €18 billion in March.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €30.4 billion in April from €21.9 billion in March, while primary income remained unchanged at €2 billion.

The surplus on services declined to €3.4 billion in April from €5.5 billion in March, while the secondary income dropped to a deficit of €13.5 billion from a deficit of €11.3 billion.

Eurozone's unadjusted current account surplus declined to €20.4 billion in April from EUR 24.4 billion in March. March's figure was revised down from a surplus of €24.9 billion.

German PPI producer prices rose 0.1% in May, missing expectations for a 0.2% increase, after a 0.1% gain in April.

On a yearly basis, German PPI dropped 1.3% in May, missing forecasts of a 1.1% decline, after a 1.5% fall in March.

The British pound traded higher against the U.S. dollar after the release of the economic data from the U.K. The public sector net borrowing in the U.K. rose to £9.35 billion in May from £5.46 billion in April, missing expectations for a rise to £10.5 billion. April's figure was revised down from £6.04 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data. The consumer price index in Canada is expected to remain unchanged at 0.8% in May.

The core consumer price index in Canada is expected to decline to 2.1% in May from 2.3% in April.

Canadian retail sales are expected to increase 0.7% in April, after a 0.7% rise in March.

EUR/USD: the currency pair decreased to $1.1291

GBP/USD: the currency pair fell to $1.5834

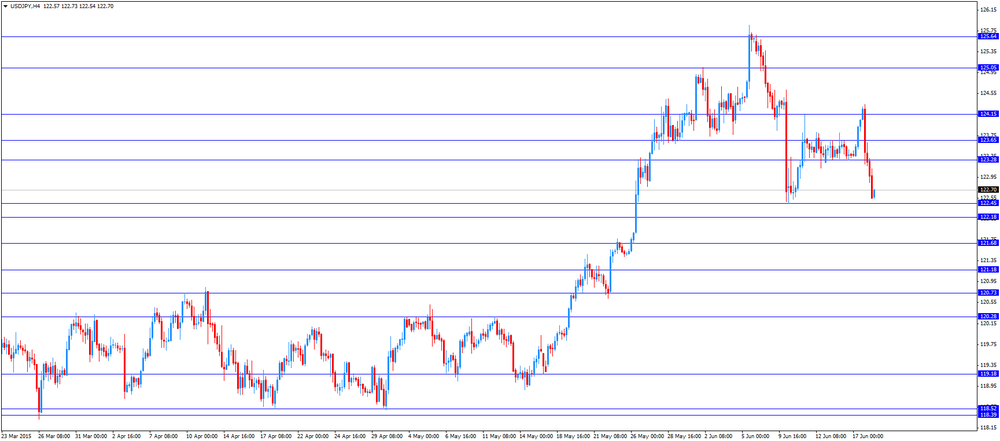

USD/JPY: the currency pair rose to Y123.19

The most important news that are expected (GMT0):

14:30 Canada Retail Sales, m/m April 0.7% 0.7%

14:30 Canada Retail Sales YoY April 3.1%

14:30 Canada Consumer Price Index m / m May -0.1% 0.5%

14:30 Canada Consumer price index, y/y May 0.8% 0.8%

14:30 Canada Bank of Canada Consumer Price Index Core, y/y May 2.3% 2.1%

14:30 Canada Bank of Canada Consumer Price Index Core, m/m May 0.0%

18:00 U.S. FOMC Member Mester Speaks

-

14:01

Orders

EUR/USD

Offers 1.1385 1.1400 1.1430 1.1450 1.1475 1.1500 1.1530 1.1550

Bids 1.1340 1.1325 1.1300 1.1285 1.1240 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5900 1.5925 1.5940 1.5960 1.5985 1.6000

Bids 1.5840 1.5820 1.5800 1.5780 1.5750 1.5730 1.5700

EUR/GBP

Offers 0.7185 0.7200 0.7220 0.7245-50 0.7270 0.7285 0.7300

Bids 0.7150 0.7130 0.7100 0.7080 0.7065 0.7050

EUR/JPY

Offers 140.00 140.20 140.50 140.80 141.00

Bids 139.50 139.00 138.80 138.50 138.30 138.00

USD/JPY

Offers 123.80 124.00 124.25 124.40 124.75-80 125.00

Bids 123.30 123.00 122.80 122.60 122.30 122.00

AUD/USD

Offers 0.7800-05 0.7830 0.7850

Bids 0.7700 0.7680 0.7650 0.7625-30 0.7600

-

11:38

Eurozone’s current account surplus climbs to a seasonally adjusted €22.3 billion in April

The European Central Bank (ECB) released its current account on Friday. Eurozone's current account surplus climbed to a seasonally adjusted €22.3 billion in April from €18 billion in March.

The surplus was driven by higher surpluses on trade in goods and primary income. The trade surplus rose to €30.4 billion in April from €21.9 billion in March, while primary income remained unchanged at €2 billion.

The surplus on services declined to €3.4 billion in April from €5.5 billion in March, while the secondary income dropped to a deficit of €13.5 billion from a deficit of €11.3 billion.

Eurozone's unadjusted current account surplus declined to €20.4 billion in April from EUR 24.4 billion in March. March's figure was revised down from a surplus of €24.9 billion.

-

11:25

German producer prices rise 0.1% in May

Destatis released its producer price index (PPI) for Germany on Wednesday. German PPI producer prices rose 0.1% in May, missing expectations for a 0.2% increase, after a 0.1% gain in April.

PPI excluding energy sector fell by 0.3% in May.

On a yearly basis, German PPI dropped 1.3% in May, missing forecasts of a 1.1% decline, after a 1.5% fall in March.

Energy prices plunged 4.1% in May.

Consumer non-durable goods prices fell 1.5% in May, intermediate goods sector prices decreased by 0.5%, and capital goods prices increased 0.7%, while durable consumer goods sector prices rose 1.3%.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E2.86bn), $1.1250(E510mn), $1.1450(E617mn), $1.1600(E2.1bn)

USD/JPY: Y122.00($3.52bn), Y123.00($1.6bn), Y124.00($827mn), Y124.50($1.87bn), Y125.00(Y5.23bn)

GBP/USD: $1.5500(Gbp950mn), $1.5650(Gbp1.1bn)

EUR/GBP: Gbp0.7000(E675mn)

AUD/USD: $0.7600(A$737mn), $0.7800(A$772mn), $0.7850(A$706mn)

NZD/USD: $0.6800(NZ$597mn)

USD/CAD: C$1.2200($506mn), C$1.2250($340mn)

-

11:07

Public sector net borrowing in the U.K. rises to £9.35 billion in May

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. rose to £9.35 billion in May from £5.46 billion in April, missing expectations for a rise to £10.5 billion.

April's figure was revised down from £6.04 billion.

-

10:51

Bank of Japan keeps its monetary policy unchanged, BoJ Governor Haruhiko Kuroda expects consumer price inflation to achieve the central bank's 2% target around April to September 2016

The Bank of Japan (BoJ) released its interest rate decision on Friday. The BoJ kept its monetary policy unchanged (interest rate: 0.00-0.10%, monetary base target: 275 trillion yen). The central bank will expand its monetary base at an annual pace of 80 trillion yen. This decision was expected by analysts.

The central bank voted 8-1 to keep its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at a press conference that exports were picking up. He expects that consumer price inflation to achieve the central bank's 2% target around April to September 2016.

The BoJ said that housing investment seems to pick up, while capital expenditure grew.

-

10:35

Greece's primary budget surplus totals €1.51 billion in the first five months of the year

Greece's Finance Ministry said on Thursday that Greece's primary budget surplus totalled €1.51 billion in the first five months of the year. Finance Ministry's calculation excludes the budgets of social security organizations and local administrations. This calculation is different from the calculation by Greece' creditors.

The primary budget deficit target was €556 million for the five-month period.

Tax revenues totalled €17.05 billion (target: €18.01 billion), while public spending totalled €20.03 billion.

-

10:30

United Kingdom: PSNB, bln, May -9.35 (forecast -10.5)

-

10:17

A deal between Greece and its creditors has not been reached at the Eurogroup meeting on Thursday

A deal between Greece and its creditors has not been reached at the Eurogroup meeting on Thursday in Luxembourg. The European Commission's Valdes Dombrovskis said that the Eurogroup is ready to continue the debt talks.

-

10:00

Eurozone: Current account, unadjusted, bln , April 20.4

-

08:28

Options levels on friday, June 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1465 (3255)

$1.1434 (2864)

$1.1414 (1861)

Price at time of writing this review: $1.1348

Support levels (open interest**, contracts):

$1.1298 (613)

$1.1248 (528)

$1.1185 (1590)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 53197 contracts, with the maximum number of contracts with strike price $1,1600 (4060);

- Overall open interest on the PUT options with the expiration date July, 2 is 84636 contracts, with the maximum number of contracts with strike price $1,1000 (12573);

- The ratio of PUT/CALL was 1.59 versus 1.54 from the previous trading day according to data from June, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.6102 (374)

$1.6004 (695)

$1.5908 (807)

Price at time of writing this review: $1.5869

Support levels (open interest**, contracts):

$1.5793 (250)

$1.5696 (581)

$1.5598 (734)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22676 contracts, with the maximum number of contracts with strike price $1,5500 (2549);

- Overall open interest on the PUT options with the expiration date July, 2 is 25613 contracts, with the maximum number of contracts with strike price $1,5100 (2113);

- The ratio of PUT/CALL was 1.13 versus 1.10 from the previous trading day according to data from June, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Germany: Producer Price Index (YoY), May -1.3% (forecast -1.1%)

-

08:02

Germany: Producer Price Index (MoM), May 0.1% (forecast 0.2%)

-

07:11

Japan: Leading Economic Index , April 106.4 (forecast 107.2)

-

07:11

Japan: Coincident Index, April 111.0 (forecast 111.1)

-

06:46

Japan: All Industry Activity Index, m/m, April 0.1%

-

05:20

Japan: BoJ Interest Rate Decision, 0%

-

05:20

Japan: Bank of Japan Monetary Base Target, 275

-

00:29

Currencies. Daily history for Jun 18’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1368 +0,25%

GBP/USD $1,5879 +0,30%

USD/CHF Chf0,9213 -0,09%

USD/JPY Y122,34 -0,88%

EUR/JPY Y139,75 -0,15%

GBP/JPY Y195,21 -0,09%

AUD/USD $0,7799 +0,64%

NZD/USD $0,6926 -0,82%

USD/CAD C$1,2224 -0,03%

-