Noticias del mercado

-

22:20

U.S. stocks closed

U.S. stocks advanced, with the Standard & Poor's 500 Index earlier rising near a record, as Cigna Corp. and Williams Cos. jumped on merger news amid optimism over Greece debt talks.

European policy makers expressed confidence that a deal with Greece was within reach after Prime Minister Alexis Tsipras's government submitted a last-minute set of proposals. Euro-area leaders are meeting in Brussels, where Tsipras has a chance to put his case to German Chancellor Angela Merkel and French President Francois Hollande.

The S&P 500 Friday posted its best weekly gain since April, after signals from the Federal Reserve that the central bank won't be raising rates quickly as officials hold out for more decisive evidence of an economic rebound.

The equity benchmark fell as much as 2.4 percent from its May record as the threat of tighter monetary policy spooked investors amid data showing the U.S. economy contracted in the first quarter. Three rounds of Fed bond purchases and borrowing costs near zero have propelled the gauge up by more than 200 percent during the six-year bull market.

Data today showed previously owned homes in May sold at the fastest pace since November 2009, adding to evidence the economy will be strong enough to withstand the first rate increase since 2006. Closings on existing properties rose 5.1 percent to a 5.35 million annualized rate, above the 5.26 million median forecast in a Bloomberg survey.

Investors and the Fed will also assess reports this week on durable goods orders, first-quarter economic growth, personal income and spending and consumer sentiment.

"The consumer is two thirds of the economy, so they need housing to do well," said Patrick Spencer, equities vice-chairman at Robert W. Baird & Co. in London. "The housing number will continue to be reasonably buoyant and that will underpin the market."

-

19:13

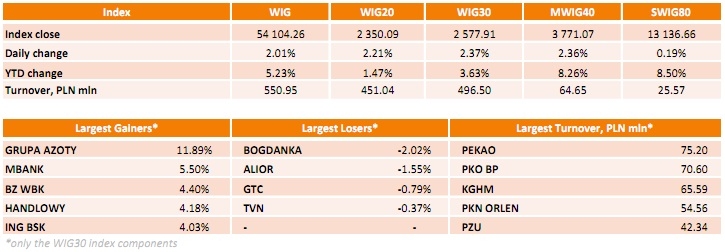

WSE: Session Results

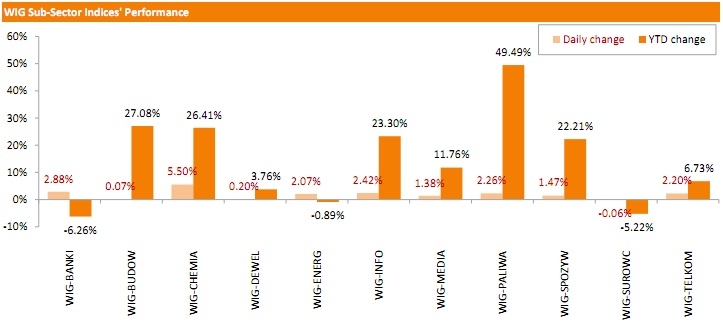

Polish equity market enjoyed a strong run on Monday with the WIG Index closing up 2.01%. Raw materials sector (-0.06%) was sole decliner within the WIG Index, while chemicals (+5.5%) outpaced.

The large-cap WIG30 Index performed better than the broad market benchmark, advancing 2.37%. A majority of the Index components returned gains, with the way up led by GRUPA AZOTY (WSE: ATT), jumping 11.89 %. Every banking name also posted solid gains (2.43%-5.5%) except for ALIOR (WSE: ALR), which corrected down 1.55%. Other weak stocks included BOGDANKA (WSE: LWB), GTC (WSE: GTC) and TVN (WSE: TVN), generating losses of 2.02%, 0.79% and 0.37% respectively.

-

18:07

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes rose on Monday, after euro zone finance ministers welcomed new Greek proposals for a cash-for-reform deal that could avert a debt default. Nasdaq rose to 5,159.36, surpassing the previous high of 5,143.32 it set last week. The Eurogroup, however, remained cautious and said the proposals required detailed study and it would take several days to determine whether they can lead to an agreement.

Almost all of Dow stocks in positive area (29 of 30). Top looser - Cisco Systems, Inc. (CSCO, -0.03%). Top gainer - Merck & Co. Inc. (MRK, +1.71%).

All S&P index sectors in positive area. Top gainer - Healthcare (+1,4%).

At the moment:

Dow 18079.00 +168.00 +0.94%

S&P 500 2119.00 +21.25 +1.01%

Nasdaq 100 4547.75 +48.00 +1.07%

10-year yield 2.35% +0.08

Oil 59.67 -0.30 -0.50%

Gold 1185.40 -16.50 -1.37%

-

18:00

European stocks closed: FTSE 100 6,825.67 +115.22 +1.72 %, CAC 40 4,998.61 +183.24 +3.81 %, DAX 11,460.5 +420.40 +3.81 %

-

18:00

European stocks close: stocks closed higher on hopes for a deal between Athens and its creditors

Stock indices closed higher on hopes for a deal between Athens and its creditors. The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"It's an opportunity to get a deal this week and that's what we'll work for," he said.

Dijsselbloem noted that the new Greek proposal was "broad and comprehensive".

"Work still needs to be done," the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said.

The Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

Earlier on Monday, European Commission President Jean-Claude Juncker said that progress has been made in the debt talks between Greece and its creditors over the weekend, but he is sceptical if a deal will be reached today.

News reported that Greek Prime Minister Alexis Tsipras said that the Greek government provided a proposal for a "mutually beneficial deal".

Meanwhile, the economic data from the Eurozone was better than expected. Eurozone's preliminary consumer confidence index remained unchanged at -5.6 in June, beating expectations for a decline to -5.8. May's figure was revised down from -5.5.

The reading remains above the levels in the recent years since the financial crisis, but it seems that the boost from lower energy prices is fading.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,825.67 +115.22 +1.72 %

DAX 11,460.5 +420.40 +3.81 %

CAC 40 4,998.61 +183.24 +3.81 %

-

17:03

Bank of Japan‘s monthly report: Japan’s economy continued to recover moderately

The Bank of Japan (BoJ) released its monthly report on Monday. The central bank said that Japan's economy continued to recover moderately. Exports picked up, the employment and income situation improved, while housing investment seems to pick up, but private consumption remained resilient, the BoJ noted.

Industrial production picked up as demand home and abroad increased.

Japan's central bank pointed out that financial conditions were accommodative.

-

16:41

Eurozone’s preliminary consumer confidence index remains unchanged at -5.6 in June

The European Commission released its preliminary consumer confidence figures for the Eurozone on Monday. Eurozone's preliminary consumer confidence index remained unchanged at -5.6 in June, beating expectations for a decline to -5.8.

May's figure was revised down from -5.5.

The reading remains above the levels in the recent years since the financial crisis, but it seems that the boost from lower energy prices is fading.

-

16:25

U.S. existing homes sales rise 5.1% in May

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes rose 5.1% to a seasonally adjusted annual rate of 5.35 million in May from 5.09 million in April. It was the highest level since November 2009.

April's figure was revised up from 5.04 million units.

Analysts had expected an increase to 5.26 million units.

The increase was driven by the return of first-time buyers onto the market.

The NAR chief economist Lawrence Yun said that "the return of first-time buyers in May is an encouraging sign and is the result of multiple factors, including strong job gains among young adults, less expensive mortgage insurance and lenders offering low downpayment programs".

He added that more first-time buyers are expected to enter the housing market in coming months.

"Overall supply still remains tight, homes are selling fast and price growth in many markets continues to teeter at or near double-digit appreciation," Yun also said.

-

16:04

European Central Bank raised the amount the Greek central bank can lend its banks

The European Central Bank (ECB) Monday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA). An amount was not disclosed by the central bank. It was the third increase in less than a week.

The ECB had raised the ELA by €3.3 billion to €87.4 billion on Friday.

It is likely to be the reaction to the massive withdrawals from the Greek banks.

-

15:57

Head of the Eurogroup Jeroen Dijsselbloem: a deal between Greece and its creditors could be reached this week

The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"It's an opportunity to get a deal this week and that's what we'll work for," he said.

Dijsselbloem noted that the new Greek proposal was "broad and comprehensive".

"Work still needs to be done," the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said.

-

15:38

Federal Reserve Bank of Cleveland President Loretta Mester: hiking interest rate by 25 basis points wouldn’t be a problem for the U.S. economy

Federal Reserve Bank of Cleveland President Loretta Mester said on Friday that hiking interest rate by 25 basis points wouldn't be a problem for the U.S. economy.

"I think the economy can support a 25-basis-point increase in interest rates. However, I also understand the argument that getting a little more confirming data before taking action is reasonable as well," she said.

Mester pointed out that she expects the Fed to start raising its interest rate this year. She does not know "how many rate increases will happen in 2015", she added.

The Federal Reserve Bank of Cleveland president also said that interest rate hike is possible in every monetary policy meeting.

Mester is not a voting member of the Federal Open Market Committee this year.

-

15:33

U.S. Stocks open: Dow +0.53%, Nasdaq +0.69%, S&P +0.61%

-

15:28

Before the bell: S&P futures +0.87%, NASDAQ futures +0.88%

U.S. stock-index futures advanced, indicating equities will rebound, after Greece submitted a new debt proposal before talks on Monday.

Global markets:

Nikkei 20,428.19 +253.95 +1.26%

Hang Seng 27,080.85 +320.32 +1.20%

FTSE 6,783.24 +72.79 +1.08%

CAC 4,933.01 +117.64 +2.44%

DAX 11,327.99 +287.89 +2.61%

Crude oil $59.71 (+0.17%)

Gold $1192.50 (-1.24%)

-

15:23

Greece’s current account deficit declines to €955 million in April

The Bank of Greece released its current account data on Monday. Greece's current account deficit fell by €196 million from last year to €955 million in April.

The Greek deficit on trade in goods and services declined to €691.5 million in April from €866.5 million in April last year.

The deficit on primary income widened to €145.9 million in April from EUR 135.1 million in April last year, while the deficit on secondary income narrowed to €118 million from €149.8 million.

The capital account deficit widened to €18.8 million from €14.2 million last year.

-

15:10

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

McDonald's Corp

MCD

96.18

+0.10%

0.3K

UnitedHealth Group Inc

UNH

120.50

+0.14%

1.4K

Ford Motor Co.

F

15.15

+0.26%

7.9K

Verizon Communications Inc

VZ

47.60

+0.29%

2.7K

Exxon Mobil Corp

XOM

85.51

+0.35%

3.9K

Nike

NKE

106.91

+0.36%

0.3K

American Express Co

AXP

80.50

+0.39%

6.2K

Johnson & Johnson

JNJ

100.25

+0.39%

0.3K

General Electric Co

GE

27.35

+0.40%

10.2K

The Coca-Cola Co

KO

40.57

+0.42%

7.8K

Cisco Systems Inc

CSCO

29.16

+0.45%

5.7K

AT&T Inc

T

35.15

+0.46%

22.8K

International Business Machines Co...

IBM

167.75

+0.46%

5.8K

Microsoft Corp

MSFT

46.31

+0.46%

18.8K

Procter & Gamble Co

PG

80.91

+0.46%

0.8K

Visa

V

69.01

+0.47%

3.4K

United Technologies Corp

UTX

115.50

+0.53%

2.3K

Intel Corp

INTC

32.25

+0.56%

9.1K

Goldman Sachs

GS

214.41

+0.57%

0.6K

Walt Disney Co

DIS

113.28

+0.59%

2.2K

Boeing Co

BA

146.00

+0.60%

0.7K

Apple Inc.

AAPL

127.36

+0.60%

322.8K

Starbucks Corporation, NASDAQ

SBUX

54.26

+0.61%

5.9K

Chevron Corp

CVX

100.09

+0.62%

4.5K

Google Inc.

GOOG

540.00

+0.62%

2.5K

E. I. du Pont de Nemours and Co

DD

70.30

+0.66%

0.2K

Hewlett-Packard Co.

HPQ

32.01

+0.66%

0.8K

Citigroup Inc., NYSE

C

56.61

+0.68%

58.1K

Yahoo! Inc., NASDAQ

YHOO

40.80

+0.72%

18.6K

Amazon.com Inc., NASDAQ

AMZN

438.19

+0.75%

6.9K

General Motors Company, NYSE

GM

36.38

+0.75%

0.1K

Pfizer Inc

PFE

34.44

+0.76%

34.7K

JPMorgan Chase and Co

JPM

68.64

+0.82%

3.5K

FedEx Corporation, NYSE

FDX

177.50

+0.88%

0.3K

Caterpillar Inc

CAT

88.30

+0.89%

2.0K

Twitter, Inc., NYSE

TWTR

36.27

+1.15%

139.7K

Merck & Co Inc

MRK

58.75

+1.22%

3.6K

Facebook, Inc.

FB

83.76

+1.52%

255.1K

Yandex N.V., NASDAQ

YNDX

17.03

+1.55%

5.1K

ALCOA INC.

AA

11.92

-0.06%

24.5K

Tesla Motors, Inc., NASDAQ

TSLA

262.25

-0.10%

40.1K

Barrick Gold Corporation, NYSE

ABX

11.43

-0.44%

3.9K

International Paper Company

IP

50.50

-1.25%

5.4K

-

14:55

Head of the Eurogroup Jeroen Dijsselbloem: it is unlikely that a deal between Greece and its creditors will be reached on Monday

The head of the Eurogroup Jeroen Dijsselbloem said on Monday that it is unlikely that a deal between Greece and its creditors will be reached on Monday as a Greek proposal arrived late on Sunday night.

"It will be impossible to have a final assessment; and we'll see what's the basis to go for final talks," he said.

-

14:49

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Alcoa (AA) downgraded from Buy to Neutral at Sterne Agee CRT

Other:

Facebook (FB) reiterated at Overweight at Piper Jaffray, target raised to $120 from $92

FedEx (FDX) reiterated at Buy at Argus, target raised to $205 from $195

-

14:33

German Finance Minister Wolfgang Schaeuble said he has not seen a new Greek proposal

German Finance Minister Wolfgang Schaeuble said on Monday that he has not seen a new Greek proposal.

"We do not have substantial proposals," he said.

Earlier, news reported that Greek Prime Minister Alexis Tsipras said that the Greek government provided a proposal for a "mutually beneficial deal".

-

12:01

European stock markets mid session: stocks traded higher on hopes for a deal between Athens and its creditors

Stock indices traded higher on hopes for a deal between Athens and its creditors. News reported that Greek Prime Minister Alexis Tsipras said that the Greek government provided a proposal for a "mutually beneficial deal".

European Council President Donald Tusk called the Eurozone leaders' meeting for Monday at 17:00 GMT in Brussels last week. "It is time to urgently discuss the situation of Greece at the highest political level," he said.

European Union (EU) Economic Commissioner Pierre Moscovici said on Monday that he was "convinced" a deal will be reached.

The Eurogroup's meeting is scheduled to be at 10:30 GMT, while the Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

European Commission President Jean-Claude Juncker said on Monday that progress has been made in the debt talks between Greece and its creditors over the weekend, but he is sceptical if a deal will be reached today.

"I don't know if we will have an agreement today," he noted.

Current figures:

Name Price Change Change %

FTSE 100 6,797.34 +86.89 +1.29 %

DAX 11,390.21 +350.11 +3.17 %

CAC 40 4,968.01 +152.64 +3.17 %

-

11:47

M3 money supply in Switzerland rises 1.5% in May

The Swiss National Bank (SNB) released its money supply data on Monday. M3 money supply in Switzerland increased 1.5% year-on-year in May, after a 1.5% rise in April.

M1 money supply declined 0.1% year-on-year in May, after a 0.1% decrease. It was the second consecutive decline.

-

11:40

European Commission President Jean-Claude Juncker: progress has been made in the debt talks between Greece and its creditors over the weekend

European Commission President Jean-Claude Juncker said on Monday that progress has been made in the debt talks between Greece and its creditors over the weekend, but he is sceptical if a deal will be reached today.

"I don't know if we will have an agreement today," he noted.

-

11:17

European Union Economic Commissioner Pierre Moscovici said he was "convinced" a deal will be reached

European Union (EU) Economic Commissioner Pierre Moscovici said on Monday that he was "convinced" a deal will be reached.

The Eurogroup's meeting is scheduled to be at 10:30 GMT, while the Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

-

10:52

Federal Reserve Bank of San Francisco President John Williams: the Fed could hike its interest rate this year as full employment will be reached by the end of this year

Federal Reserve Bank of San Francisco President John Williams said in San Francisco on Friday that the Fed could hike its interest rate this year as full employment will be reached by the end of this year.

"I still believe this will be the year for lift-off. I see a safer course in starting sooner and proceeding more gradually," he said.

"Now that wage growth is starting to take off across multiple measures, it further confirms that the labour market is nearly healed," Williams added.

Federal Reserve Bank of San Francisco president expects inflation in the U.S. to reach the Fed's 2% target by the end of the next year as oil price rises and the U.S. dollar declines.

Williams is a voting member of the Federal Open Market Committee this year.

-

10:32

Bank of England Monetary Policy Committee Member Ian McCafferty: the BoE could start raising its interest rate before the end of this year

The Bank of England (BoE) Monetary Policy Committee (MPC) Member Ian McCafferty said last week that the BoE could start raising its interest rate before the end of this year. It will depend on the incoming economic data.

-

10:24

Japanese Finance Minister Taro Aso said he closely monitors the debt talks between Greece and its creditors

Japanese Finance Minister Taro Aso said on Monday that he closely monitors the debt talks between Greece and its creditors as failure could have a significant impact on Japan's and global economy.

"Japanese media has been reporting that even if Greek finances went bust that would not impact Japan, but I cannot tell," he said.

-

09:06

Global Stocks: markets are waiting for news on Greece

U.S. stocks have given up some of their gains and ended lower ahead of Monday meeting of the euro zone leaders. This meeting should produce a decision on Greece's debt crisis and remove uncertainty, which weighs on markets.

The Dow Jones industrial average dropped 99.89 points, or 0.55%, to 18,015.95. The Standard & Poor's 500 fell by 11.25 points, or 0.53%, to 2,109.99. The Nasdaq Composite retreated by 15.95 points, or 0.31%, to close at 5,117.

Asian stocks have started this week with cautious optimism. Hong Kong Hang Seng rose by 0.40%, or 107.37 points, to 26,867.90. Meanwhile the Nikkei rose by 0.99%, or 199.03 points, to 20,373.27. China mainland markets are on holiday today.

Hopes for a Greek deal were the key positive contributor ahead of today's meeting as a deadline for a 1.6 billion euro ($1.81 billion) payment to the International Monetary Fund expires on June the 30th.

-

04:03

Nikkei 225 20,350.12 +175.88 +0.87 %, Hang Seng 26,851.59 +91.06 +0.34 %, Topix 1,641.95 +10.94 +0.67 %

-

01:40

Stocks. Daily history for Jun 19’2015:

(index / closing price / change items /% change)

Nikkei 225 20,174.24 +183.42 +0.92 %

Hang Seng 26,760.53 +65.87 +0.25 %

S&P/ASX 200 5,596.99 +72.10 +1.31 %

Shanghai Composite 4,481.22 -304.14 -6.36 %

FTSE 100 6,710.45 +2.57 +0.04 %

CAC 40 4,815.37 +11.89 +0.25 %

Xetra DAX 11,040.1 -60.20 -0.54 %

S&P 500 2,109.99 -11.25 -0.53 %

NASDAQ Composite 5,117 -15.95 -0.31 %

Dow Jones 18,015.95 -99.89 -0.55 %

-