Noticias del mercado

-

20:22

American focus: euro fluctuates on news of Greece

During the day, the euro reacts to the growth and decline of the progress of negotiations with Greece's creditors. The key event of the day was the meeting of the Eurogroup and the summit of EU leaders. Recall, Greece on Monday night presented a new plan to prevent a default, including new budget proposals that could form the basis for an agreement. If they're not satisfy the creditors, the European leaders will discuss the implications of a default by Greece at the summit on Monday. Meanwhile, the European Commission representative, Pierre Moscovici said today after a meeting of the Eurogroup emergency summit of the EU and can be found to solve the Greek debt. He also called sufficiently serious proposals to the creditors in Athens last weekend.

The pressure on the euro was reported that the European Central Bank increased again today limit the amount of funding Greek banks in the framework of emergency provision of liquidity (ELA). The amount of increase is not yet known. Thus, the ECB has made another infusion of cash into a special fund to help Greek banks already 3 times in 6 days. Last week, the Central Bank raised the upper limit of twice - on Wednesday and Friday, at € 1.1 billion. € 1.8 billion., Bringing the total funds to € 85.9 billion. Sources also claim that the ECB is ready to revise the liquidity of Greek banks in any Currently, if necessary.

Later, the euro continued to rise to new highs, while European bonds and stocks rose on optimism about the agreement with Greece, as evidenced by the comments of the EU and the Greek authorities. European Commission President Jean-Claude Juncker expressed his hope that an agreement with Greece will be reached by the end of the week. A minister of the Greek economy (as reported by BBC) noted that new proposals put forward by Greece, allowed the ice finally get under way. Meanwhile, during a meeting of the Eurogroup Deysselblum I commented that today allow to take a step in the right direction.

The Swiss franc fell moderately against the US dollar, breaking the mark of CHF0.9200. Small influenced today's data on Switzerland. The Swiss National Bank said that the growth in money supply in the country remained stable in the last month. The report stated that M3 - broad money - rose in May by 1.5 percent year on year in May. We recall that in April it was recorded a similar increase. Meanwhile, the Central Bank said that M1 declined in May by 0.1 percent in annual terms, as in the previous month. It was the second consecutive monthly fall. Another report showed that the official reserves rose to $ 600.4 billion іn April, compared to $ 582.9 billion іn March.

-

17:03

Bank of Japan‘s monthly report: Japan’s economy continued to recover moderately

The Bank of Japan (BoJ) released its monthly report on Monday. The central bank said that Japan's economy continued to recover moderately. Exports picked up, the employment and income situation improved, while housing investment seems to pick up, but private consumption remained resilient, the BoJ noted.

Industrial production picked up as demand home and abroad increased.

Japan's central bank pointed out that financial conditions were accommodative.

-

16:41

Eurozone’s preliminary consumer confidence index remains unchanged at -5.6 in June

The European Commission released its preliminary consumer confidence figures for the Eurozone on Monday. Eurozone's preliminary consumer confidence index remained unchanged at -5.6 in June, beating expectations for a decline to -5.8.

May's figure was revised down from -5.5.

The reading remains above the levels in the recent years since the financial crisis, but it seems that the boost from lower energy prices is fading.

-

16:25

U.S. existing homes sales rise 5.1% in May

The National Association of Realtors released existing homes sales figures in the U.S. on Monday. Sales of existing homes rose 5.1% to a seasonally adjusted annual rate of 5.35 million in May from 5.09 million in April. It was the highest level since November 2009.

April's figure was revised up from 5.04 million units.

Analysts had expected an increase to 5.26 million units.

The increase was driven by the return of first-time buyers onto the market.

The NAR chief economist Lawrence Yun said that "the return of first-time buyers in May is an encouraging sign and is the result of multiple factors, including strong job gains among young adults, less expensive mortgage insurance and lenders offering low downpayment programs".

He added that more first-time buyers are expected to enter the housing market in coming months.

"Overall supply still remains tight, homes are selling fast and price growth in many markets continues to teeter at or near double-digit appreciation," Yun also said.

-

16:04

European Central Bank raised the amount the Greek central bank can lend its banks

The European Central Bank (ECB) Monday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA). An amount was not disclosed by the central bank. It was the third increase in less than a week.

The ECB had raised the ELA by €3.3 billion to €87.4 billion on Friday.

It is likely to be the reaction to the massive withdrawals from the Greek banks.

-

16:00

U.S.: Existing Home Sales , May 5.35 (forecast 5.26)

-

16:00

Eurozone: Consumer Confidence, June -5.6 (forecast -5.8)

-

15:57

Head of the Eurogroup Jeroen Dijsselbloem: a deal between Greece and its creditors could be reached this week

The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"It's an opportunity to get a deal this week and that's what we'll work for," he said.

Dijsselbloem noted that the new Greek proposal was "broad and comprehensive".

"Work still needs to be done," the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said.

-

15:51

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E991mn), $1.1260(E250mn), $1.1300(E722mn), $1.1350(E544mn), $1.1400(E317mn)

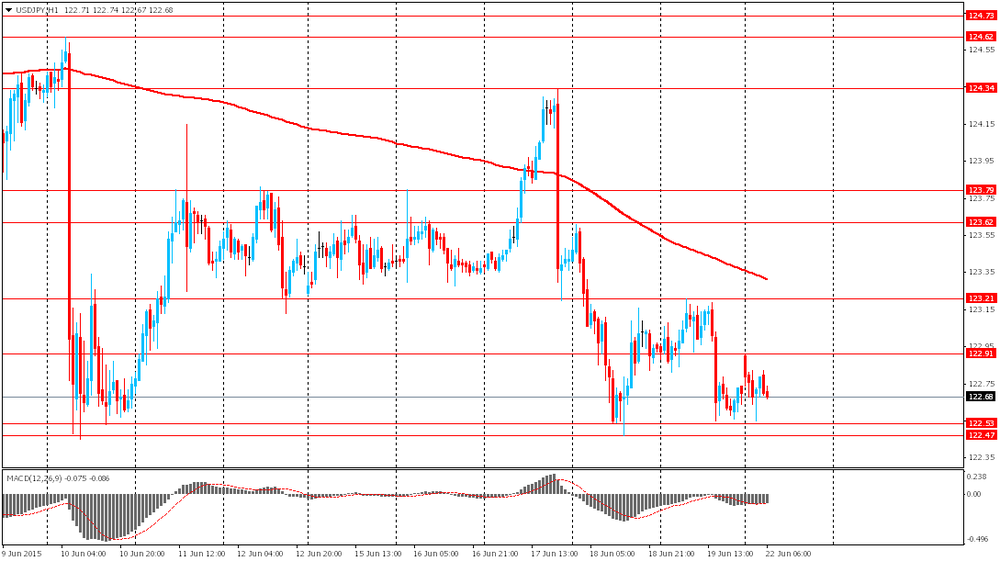

USD/JPY: Y122.00($1.56bn), Y123.50($892mn), Y124.00($481mn), Y125.00(Y4.5bn)

EUR/CHF: Chf1.0650(E432mn)

NZD/USD: $0.7000(NZ$314mn)

-

15:38

Federal Reserve Bank of Cleveland President Loretta Mester: hiking interest rate by 25 basis points wouldn’t be a problem for the U.S. economy

Federal Reserve Bank of Cleveland President Loretta Mester said on Friday that hiking interest rate by 25 basis points wouldn't be a problem for the U.S. economy.

"I think the economy can support a 25-basis-point increase in interest rates. However, I also understand the argument that getting a little more confirming data before taking action is reasonable as well," she said.

Mester pointed out that she expects the Fed to start raising its interest rate this year. She does not know "how many rate increases will happen in 2015", she added.

The Federal Reserve Bank of Cleveland president also said that interest rate hike is possible in every monetary policy meeting.

Mester is not a voting member of the Federal Open Market Committee this year.

-

15:23

Greece’s current account deficit declines to €955 million in April

The Bank of Greece released its current account data on Monday. Greece's current account deficit fell by €196 million from last year to €955 million in April.

The Greek deficit on trade in goods and services declined to €691.5 million in April from €866.5 million in April last year.

The deficit on primary income widened to €145.9 million in April from EUR 135.1 million in April last year, while the deficit on secondary income narrowed to €118 million from €149.8 million.

The capital account deficit widened to €18.8 million from €14.2 million last year.

-

14:55

Head of the Eurogroup Jeroen Dijsselbloem: it is unlikely that a deal between Greece and its creditors will be reached on Monday

The head of the Eurogroup Jeroen Dijsselbloem said on Monday that it is unlikely that a deal between Greece and its creditors will be reached on Monday as a Greek proposal arrived late on Sunday night.

"It will be impossible to have a final assessment; and we'll see what's the basis to go for final talks," he said.

-

14:33

German Finance Minister Wolfgang Schaeuble said he has not seen a new Greek proposal

German Finance Minister Wolfgang Schaeuble said on Monday that he has not seen a new Greek proposal.

"We do not have substantial proposals," he said.

Earlier, news reported that Greek Prime Minister Alexis Tsipras said that the Greek government provided a proposal for a "mutually beneficial deal".

-

14:18

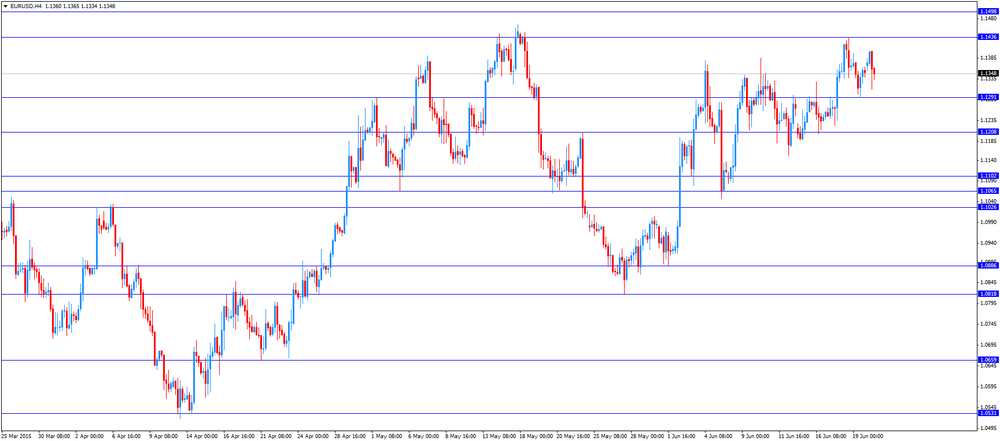

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty of the Greek debt talks

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

07:45 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

10:30 Eurozone Eurogroup Meetings

The U.S. dollar traded higher against the most major currencies ahead of the U.S. existing home sales data. The existing home sales in the U.S. are expected to increase to 5.26 million units in May from 5.04 million units in April.

The euro traded lower against the U.S. dollar on the uncertainty of the Greek debt talks. News reported that Greek Prime Minister Alexis Tsipras said that the Greek government provided a proposal for a "mutually beneficial deal".

European Council President Donald Tusk called the Eurozone leaders' meeting for Monday at 17:00 GMT in Brussels last week. "It is time to urgently discuss the situation of Greece at the highest political level," he said.

European Union (EU) Economic Commissioner Pierre Moscovici said on Monday that he was "convinced" a deal will be reached.

The Eurogroup's meeting was scheduled to be at 10:30 GMT, while the Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

European Commission President Jean-Claude Juncker said on Monday that progress has been made in the debt talks between Greece and its creditors over the weekend, but he is sceptical if a deal will be reached today.

"I don't know if we will have an agreement today," he noted.

Eurozone's consumer confidence index is expected to decline to -5.8 in June from -5.5 in May.

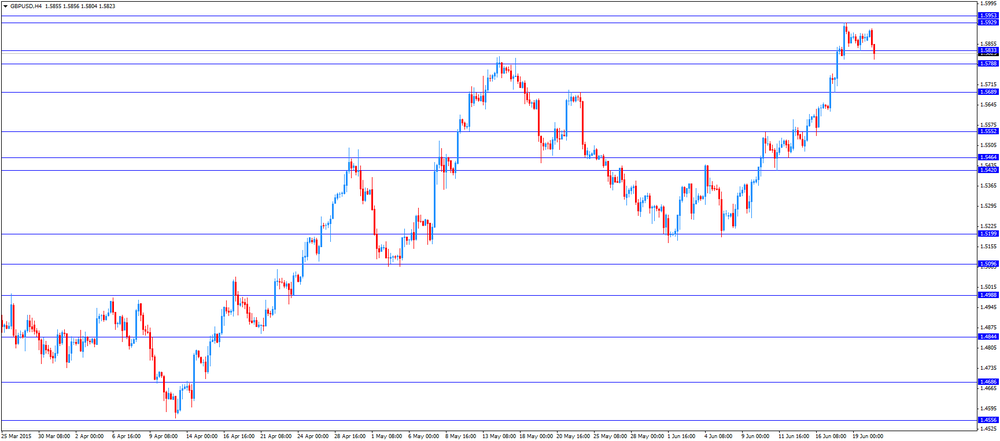

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

EUR/USD: the currency pair decreased to $1.1311

GBP/USD: the currency pair fell to $1.5804

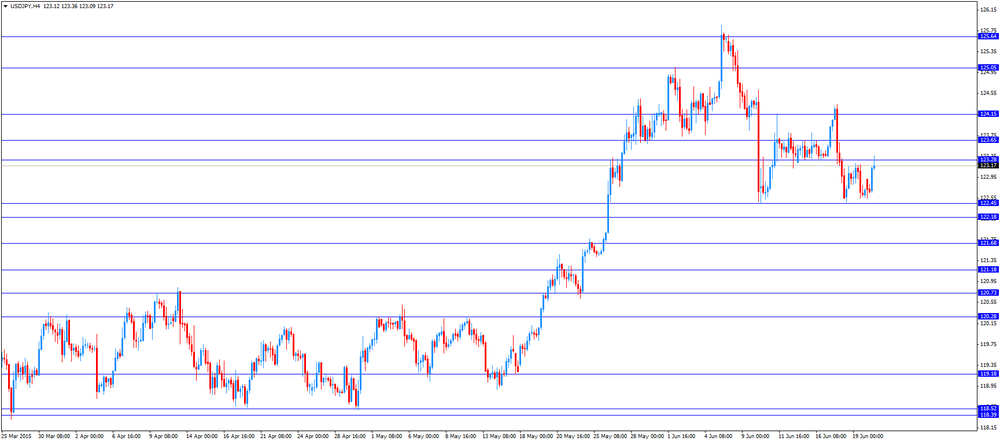

USD/JPY: the currency pair rose to Y123.15

The most important news that are expected (GMT0):

14:00 Eurozone Consumer Confidence (Preliminary) June -5.5 -5.8

14:00 U.S. Existing Home Sales May 5.04 5.26

17:00 Eurozone Euro Summit

-

14:01

Orders

EUR/USD

Offers 1.1380 1.1400 1.1430 1.1450 1.1475 1.1500 1.1530 1.1550

Ордера на покупку 1.1340 1.1325 1.1300 1.1285 1.1240 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5900-10 1.5925 1.5940 1.5960 1.5985 1.6000

Ордера на покупку 1.5850 1.5820-25 1.5800 1.5780 1.5750 1.5730 1.5700

EUR/GBP

Offers 0.7165-70 0.7185 0.7200 0.7220 0.7245-50

Ордера на покупку 0.7130 0.7100 0.7080 0.7065 0.7050

EUR/JPY

Offers 139.80 140.00 140.20 140.50 140.80 141.00

Ордера на покупку 139.20 139.00 138.80 138.50 138.30 138.00

USD/JPY

Offers 123.20 123.50 123.80 124.00 124.25 124.40

Ордера на покупку 122.75 122.50 122.30 122.00 121.85 121.65 121.50

AUD/USD

Offers 0.7800-05 0.7830 0.7850

Bids 0.7700 0.7680 0.7650 0.7625-30 0.7600

-

11:47

M3 money supply in Switzerland rises 1.5% in May

The Swiss National Bank (SNB) released its money supply data on Monday. M3 money supply in Switzerland increased 1.5% year-on-year in May, after a 1.5% rise in April.

M1 money supply declined 0.1% year-on-year in May, after a 0.1% decrease. It was the second consecutive decline.

-

11:40

European Commission President Jean-Claude Juncker: progress has been made in the debt talks between Greece and its creditors over the weekend

European Commission President Jean-Claude Juncker said on Monday that progress has been made in the debt talks between Greece and its creditors over the weekend, but he is sceptical if a deal will be reached today.

"I don't know if we will have an agreement today," he noted.

-

11:27

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E991mn), $1.1260(E250mn), $1.1300(E722mn), $1.1350(E544mn), $1.1400(E317mn)

USD/JPY: Y122.00($1.56bn), Y123.50($892mn), Y124.00($481mn), Y125.00(Y4.5bn)

EUR/CHF: Chf1.0650(E432mn)

NZD/USD: $0.7000(NZ$314mn)

-

11:17

European Union Economic Commissioner Pierre Moscovici said he was "convinced" a deal will be reached

European Union (EU) Economic Commissioner Pierre Moscovici said on Monday that he was "convinced" a deal will be reached.

The Eurogroup's meeting is scheduled to be at 10:30 GMT, while the Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

-

10:52

Federal Reserve Bank of San Francisco President John Williams: the Fed could hike its interest rate this year as full employment will be reached by the end of this year

Federal Reserve Bank of San Francisco President John Williams said in San Francisco on Friday that the Fed could hike its interest rate this year as full employment will be reached by the end of this year.

"I still believe this will be the year for lift-off. I see a safer course in starting sooner and proceeding more gradually," he said.

"Now that wage growth is starting to take off across multiple measures, it further confirms that the labour market is nearly healed," Williams added.

Federal Reserve Bank of San Francisco president expects inflation in the U.S. to reach the Fed's 2% target by the end of the next year as oil price rises and the U.S. dollar declines.

Williams is a voting member of the Federal Open Market Committee this year.

-

10:32

Bank of England Monetary Policy Committee Member Ian McCafferty: the BoE could start raising its interest rate before the end of this year

The Bank of England (BoE) Monetary Policy Committee (MPC) Member Ian McCafferty said last week that the BoE could start raising its interest rate before the end of this year. It will depend on the incoming economic data.

-

10:24

Japanese Finance Minister Taro Aso said he closely monitors the debt talks between Greece and its creditors

Japanese Finance Minister Taro Aso said on Monday that he closely monitors the debt talks between Greece and its creditors as failure could have a significant impact on Japan's and global economy.

"Japanese media has been reporting that even if Greek finances went bust that would not impact Japan, but I cannot tell," he said.

-

09:00

Foreign exchange market. Asian session: Dollar sagged slightly against almost all major currencies

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan BoJ monthly economic report

The euro has slightly gained against the dollar amid encouraging news from Greece. Sources reported that Athens prepared a new package of reforms, which will be discussed when euro zone leaders hold an emergency meeting today. Currently debt talks are in a dead lock, although Greece has less than two weeks to pay a large sum to the International Monetary Fund.

Economists expect that surveys of consumers and companies, which are to be published next week, will reflect concerns about a probable default in Greece. Analysts surveyed by Wall Street Journal expect to see that consumer confidence declined in the euro zone in June.

The U.S. dollar declined against the yen and the sterling as the latest Fed meeting suggested that the central bank is being careful about raising rates. Such conditions keep the dollar under pressure.

EUR/USD: the pair has traded above $1.1380 this morning

USD/JPY: the pair retreated to Y122.55

GBP/USD: the pair advanced to $1.5900

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 United Kingdom BOE Deputy Governor for Financial Stability Jon Cunliffe speaks

10:30 Eurozone Eurogroup Meetings

14:00 Eurozone Consumer Confidence (Preliminary) June -5.5 -5.8

14:00 U.S. Existing Home Sales May 5.04 5.26

17:00 Eurozone Euro Summit

-

08:07

Options levels on monday, June 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1479 (1962)

$1.1442 (2086)

$1.1406 (1773)

Price at time of writing this review: $1.1393

Support levels (open interest**, contracts):

$1.1286 (598)

$1.1237 (758)

$1.1174 (1783)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 55646 contracts, with the maximum number of contracts with strike price $1,1500 (4888);

- Overall open interest on the PUT options with the expiration date July, 2 is 86143 contracts, with the maximum number of contracts with strike price $1,1000 (12587);

- The ratio of PUT/CALL was 1.55 versus 1.59 from the previous trading day according to data from June, 19

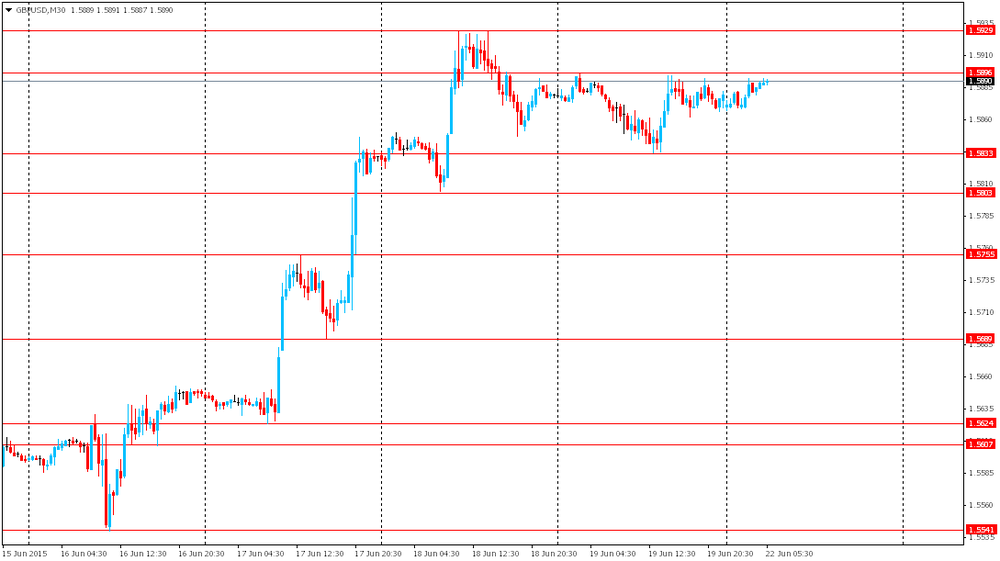

GBP/USD

Resistance levels (open interest**, contracts)

$1.6201 (350)

$1.6102 (399)

$1.6004 (618)

Price at time of writing this review: $1.5893

Support levels (open interest**, contracts):

$1.5793 (270)

$1.5696 (616)

$1.5598 (831)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22851 contracts, with the maximum number of contracts with strike price $1,5500 (2549);

- Overall open interest on the PUT options with the expiration date July, 2 is 25753 contracts, with the maximum number of contracts with strike price $1,5100 (2113);

- The ratio of PUT/CALL was 1.13 versus 1.13 from the previous trading day according to data from June, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:39

Currencies. Daily history for Jun 19’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1351 -0,15%

GBP/USD $1,5879 0,00%

USD/CHF Chf0,9169 -0,48%

USD/JPY Y122,70 +0,29%

EUR/JPY Y139,23 -0,37%

GBP/JPY Y194,8 -0,21%

AUD/USD $0,7768 -0,40%

NZD/USD $0,6908 -0,26%

USD/CAD C$1,2265 +0,33%

-

01:01

New Zealand: Visitor Arrivals, May 0.1%

-

00:00

New Zealand: Westpac Consumer Sentiment, Quarter I 113

-