Noticias del mercado

-

17:41

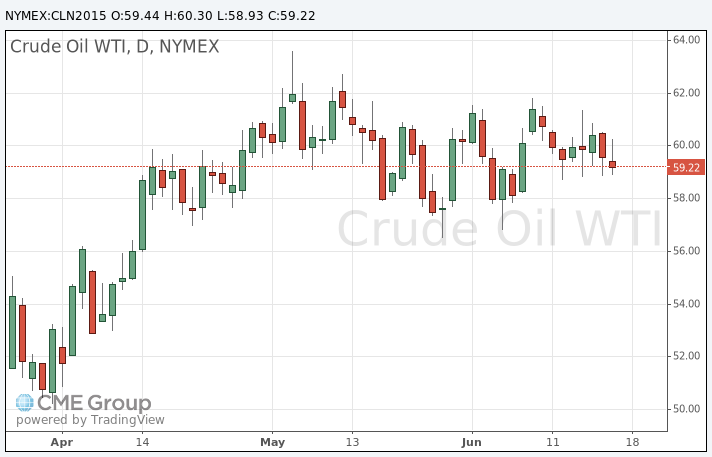

Oil prices traded lower ahead Eurozone leaders' meeting

Oil prices traded lower despite hopes for a deal between Athens and its creditors. The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"It's an opportunity to get a deal this week and that's what we'll work for," he said.

Dijsselbloem noted that the new Greek proposal was "broad and comprehensive".

"Work still needs to be done," the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said.

The Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

Concerns over global oil glut weighed on oil prices. Oil production in the U.S. continues to rise despite the decline in oil rigs. The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 4 rigs to 631 last week, the lowest weekly level since August 06, 2010. It was the 28th consecutive weekly fall.

Combined oil and gas rigs fell by 2 to 857. It was the lowest level since January 17, 2003.

WTI crude oil for July delivery decreased to $58.93 a barrel on the New York Mercantile Exchange.

Brent crude oil for July fell to $62.60 a barrel on ICE Futures Europe.

-

17:23

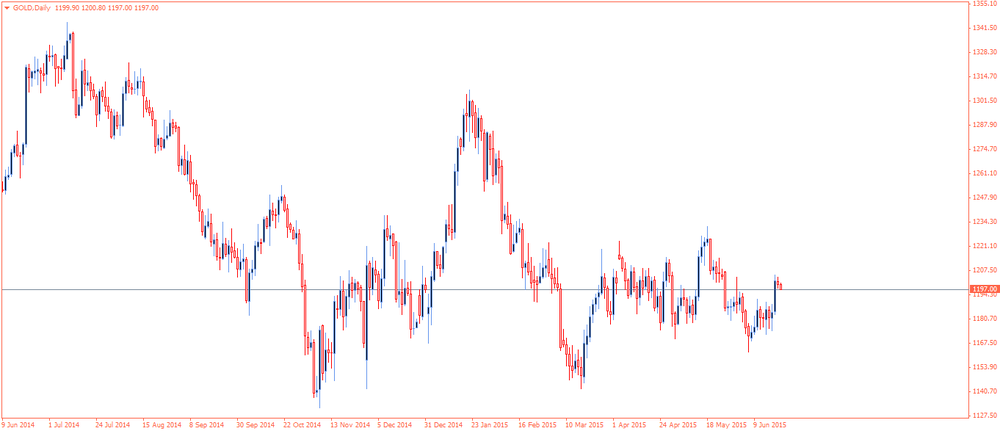

Gold price traded lower on hopes for a deal between Athens and its creditors

Gold price traded lower on hopes for a deal between Athens and its creditors. The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"It's an opportunity to get a deal this week and that's what we'll work for," he said.

Dijsselbloem noted that the new Greek proposal was "broad and comprehensive".

"Work still needs to be done," the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said.

The Eurozone leaders' meeting is scheduled to be at 17:00 GMT.

Earlier on Monday, European Commission President Jean-Claude Juncker said that progress has been made in the debt talks between Greece and its creditors over the weekend, but he is sceptical if a deal will be reached today.

News reported that Greek Prime Minister Alexis Tsipras said that the Greek government provided a proposal for a "mutually beneficial deal".

June futures for gold on the COMEX today fell to 1181.60 dollars per ounce.

-

10:09

U.S. oil and gas rigs decline by 2 to 857

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 4 rigs to 631 last week, the lowest weekly level since August 06, 2010. It was the 28th consecutive weekly fall.

Combined oil and gas rigs fell by 2 to 857. It was the lowest level since January 17, 2003.

Oil production in the U.S. continues to rise despite the decline in oil rigs.

The U.S. Energy Information Administration forecasts that U.S. crude-oil production would begin to fall from June until February 2016.

-

09:13

Oil: prices are waiting for news

West Texas Intermediate futures for July delivery, which expires today, little changed at $59.99 (+0.03%) and. Brent crude for August slightly advanced by 0.13% to $63.10 a barrel amid hopes for a deal between Greece and its lenders as the country's Prime Minister Alexis Tsipras said he prepared a new package of reforms, which will be discussed today at the emergency meeting of the euro zone leaders.

However, soon Iran, OPEC's fifth-largest producer, may add to the global supply glut issue as a June 30 deadline on nuclear deal approaches. In case sanctions are lifted the country may double its exports. Iran is currently allowed to export about 1 million barrels a day.

-

09:10

Gold retreated ahead of euro zone leaders’ meeting

This morning gold dipped below the $1,200 psychological level. The metal is currently at $1,197.60 (-0.36%) an ounce.

Last week non-interest-paying gold was boosted by a weaker dollar caused by Fed's softer rates outlook. It was also supported by safe-haven demand amid concerns over Greece. However Greece's Prime Minister Alexis Tsipras is likely to bring a new package of reforms today. Market participants are hoping that a solution will come at the last moment.

-

01:41

Commodities. Daily history for Jun 19’2015:

(raw materials / closing price /% change)

Oil 59.37 -0.40%

Gold 1,199.80 -0.17%

-