Noticias del mercado

-

17:41

Oil prices traded higher

Oil prices traded higher. The Chinese preliminary HSBC manufacturing Purchasing Managers' Index (PMI) weighed on oil prices. The Chinese preliminary HSBC manufacturing Purchasing Managers' Index (PMI) increased to 49.6 in June from 49.2 in May, exceeding expectations for a rise to 49.4. A reading below 50 indicates contraction of activity. The output index hit 50.0 in June. New export orders increased.

The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data today, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for August delivery increased to $60.94 a barrel on the New York Mercantile Exchange.

Brent crude oil for August rose to $64.15 a barrel on ICE Futures Europe.

-

17:25

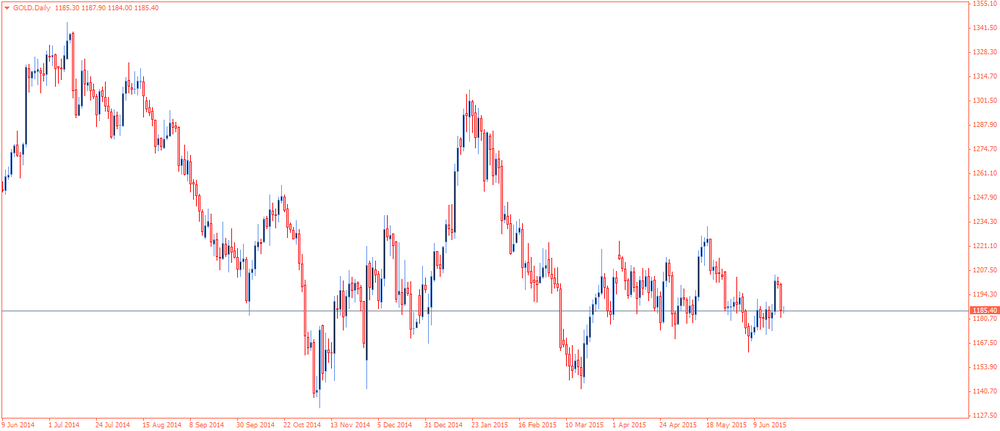

Gold price traded lower as the U.S. dollar strengthened and stocks rose

Gold price traded lower as the U.S. dollar strengthened and stocks rose on hopes for a deal between Athens and its creditors. The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"I am convinced that we will find an agreement this week. It's vital"." the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said last night.

The U.S. dollar strengthened despite the weaker-than-expected U.S. durable goods orders data. The U.S. durable goods orders dropped 1.8% in May, missing expectations for a 0.5% decrease, after a 1.5% decline in April. April's figure was revised down from a 0.5% fall.

The decline was partly driven by lower orders for aircraft. Orders for nondefense aircraft dropped 35.3.0% in May.

The U.S. durable goods orders excluding transportation rose 0.5% in May, missing expectations for a 0.6% gain, after a 0.3% decrease in April.

Gold price found some support from a 3.5 tonne rise in SPDR Gold Shares. But physical gold demand in Asia remained soft.

June futures for gold on the COMEX today fell to 1175.70 dollars per ounce.

-

10:37

Chinese preliminary HSBC manufacturing Purchasing Managers' Index rises to 49.6 in June

The Chinese preliminary HSBC manufacturing Purchasing Managers' Index (PMI) increased to 49.6 in June from 49.2 in May, exceeding expectations for a rise to 49.4.

A reading below 50 indicates contraction of activity.

The output index hit 50.0 in June. New export orders increased.

"On the one hand, the sector shows signs of improvement as output stabilized amid a slight pick-up in total new work, while purchasing activity also rose slightly over the month," Markit economist Annabel Fiddes said.

She added that the Chinese manufacturing sector lost momentum in the second quarter, and the Chinese government may add further measures "to stimulate growth and job creation".

-

09:09

Oil: prices are stuck between circumstances

West Texas Intermediate futures for August delivery holds at $60.27 (-0.18%), while Brent crude for August is at $63.32 (-0.03%) a barrel. Both managed to close with gains yesterday as investors weighed concerns about excessive supplies and hopes for an agreement between Greece and its lenders. Growing demand and reductions in new drilling helped to keep prices above $60 despite supply glut. However conditions still cannot be called favorable. That's why investors don't hope that prices will recover quickly this summer.

Oil prices declined by almost 60% between June 2014 and January 2015 and recovered by almost 35% in 2015. Although prices rebounded after setting new lows, worldwide supply still exceeds demand in a period of low global economic growth, pushing stockpiles up, weighing on prices.

-

08:59

Gold is taking breath after yesterday’s sharp decline

Gold is currently at $1,185.70 (+0.14%) an ounce. The non-interest-paying metal ended Monday with a 1.3% drop amid gains in equities and hopes for a deal between Greece and its lenders. A deal would prevent default and reduce demand for safe haven.

Gold used to be supported by uncertainty over Greece, however yesterday Greece's government presented new budget proposals and they may form a base for an agreement by the end of this week.

If the Greek factor is eliminated, bullion will respond to its fundamentals, which don't look encouraging considering a relatively strong U.S. dollar.

-

00:33

Commodities. Daily history for Jun 22’2015:

(raw materials / closing price /% change)

Oil 0.00 0.00%

Gold 1,185.10 +0.08%

-