Noticias del mercado

-

22:11

U.S. stocks closed

U.S. stocks rose, with the Standard & Poor's 500 Index near a record, as investors weighed economic data for clues on the timing of higher interest rates amid optimism that a deal on Greek aid is within reach.

The S&P 500 had its biggest weekly gain since April in the period ended Friday after the Federal Reserve signaled it won't be raising rates quickly as officials hold out for more decisive evidence of an economic rebound. Three rounds of Fed bond purchases and near-zero interest rates helped the benchmark more than triple during the six-year bull market.

Fed Governor Jerome Powell said today the chances are about 50-50 that the U.S. economy will improve enough for the central bank to raise interest rates in September, as the job market strengthens and signs of wage growth emerge.

A report Tuesday showed purchases of new homes increased more than forecast in May to the highest level in seven years. That added to data yesterday showing sales of previously owned homes climbed to their highest level since 2009, boosted by more first-time buyers.

A separate report today said orders for business equipment gained in May for just the second time this year. Orders for all durable goods declined 1.8 percent, reflecting a drop in the volatile aircraft category.

After talks on Monday, Greece now has 48 hours to bring a deal with its creditors to the finish line and end a five-month standoff over aid that risks default and possible exit from the euro. Greek Prime Minister Alexis Tsipras needs to shore up support at home for his plan, while euro-area finance ministers meet Wednesday to prepare the ground for a second, scheduled summit of European Union leaders Thursday.

-

21:00

S&P 500 2,122.96 +0.11 +0.01 %, NASDAQ 5,157.5 +3.53 +0.07 %, Dow 18,151.5 +31.72 +0.18 %

-

18:46

WSE: Session Results

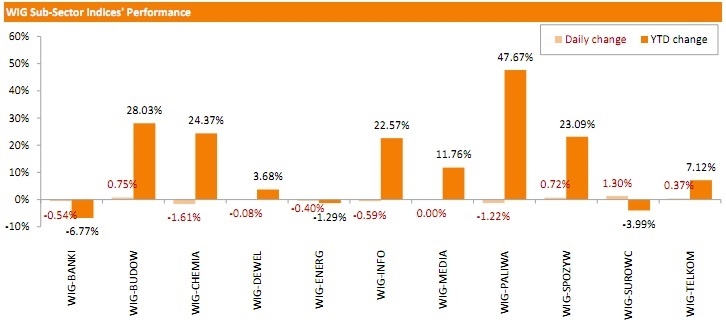

Polish equity market was modestly lower on Tuesday, with the broad market measure, the WIG index, sliding 0.16%. Sector-wise, chemicals (-1.61%) and oil & gas sector names (-1.22%) tumbled the most, while materials (+1.30%) fared the best.

Large-cap stocks lost 0.36% as measured by the WIG30 Index. PGNIG (WSE: PGN) was the biggest loser in the group, declining 3.74% on expected further cuts in gas price by Poland's energy market regulator. It was followed by yesterday's best performer GRUPA AZOTY (WSE: ATT), retreating 3.31%. GTC (WSE: GTC), MBANK (WSE: MBK), ENERGA (WSE: ENG) and BZWBK (WSE: BZW) also recorded notable losses, ranging between 2% and 2.5%. On the contrary, HANDLOWY (WSE: BHW) became the growth leader, advancing 2.12%. Other major gainers included JSW (WSE: JSW), KGHM (WSE: KGH) and ING BSK (WSE: ING), adding 1.83%, 1.45% and 1.08% respectively.

-

18:01

European stocks closed: FTSE 100 6,834.87 +9.20 +0.13 %, CAC 40 5,057.68 +59.07 +1.18 %, DAX 11,542.54 +82.04 +0.72 %

-

18:00

European stocks close: stocks closed higher on hopes for a deal between Athens and its creditors

Stock indices closed higher on hopes for a deal between Athens and its creditors. The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"I am convinced that we will find an agreement this week. It's vital"." the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said last night.

Meanwhile, the economic data from the Eurozone was better-than-expected. Eurozone's preliminary manufacturing PMI increased to 52.5 in June from 52.2 in May. Analysts had expected index to remain unchanged at 52.2.

Eurozone's preliminary services PMI rose to 54.4 in June from 53.8 in May. Analysts had expected the index to fall to 53.6.

Markit's Chief Economist Chris Williamson said that Eurozone's economy is expected to grow around 2.0% this year, depending on the outcome of the Greek debt talks.

He also said that the figures indicate a 0.4% growth of the economy in the Eurozone in the second quarter.

Germany's preliminary manufacturing PMI climbed to 51.9 in June from 51.1 in May, exceeding forecasts of an increase to 51.3.

Germany's preliminary services PMI was up to 54.2 in June from 53.0 in May. Analysts had expected index to remain unchanged at 53.0.

Markit's economist Oliver Kolodseike noted that the figures showed "a mixed picture of the health of Germany's private sector economy".

France's preliminary manufacturing PMI rose to 50.5 in June from 49.4 in May, beating forecasts of a rise to 49.5.

France's preliminary services PMI increased to 54.1 in June from 52.8 in May, beating expectations for a decline to 52.6. It was the highest level since August 2011.

The Senior Economist at Markit Jack Kennedy said that "the figures bode well for second quarter GDP".

The Confederation of British Industry (CBI) released its industrial order books balance on Tuesday. The CBI industrial order books balance dropped to -7% in June from -5% in May, missing expectations for a rise to +1%.

The decline was driven by lower exports. The export order book balance fell to -17% in June from -7% in May.

The balance for output volumes for the next three months rose to +16% in June from +15% in May.

"Output and overall orders are still doing better than average but hopes that export demand would start to drive forward have not yet been fulfilled. Improving momentum in the Eurozone is being offset by the effect of the strengthening pound on UK manufacturers' overseas sales and margins. On top of that, the ongoing Greek saga is causing uncertainty," the CBI director of economics Rain Newton-Smith said.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,834.87 +9.20 +0.13 %

DAX 11,542.54 +82.04 +0.72 %

CAC 40 5,057.68 +59.07 +1.18 %

-

17:02

Federal Reserve Governor Jerome Powell: the Fed could raise its interest rate twice this year, starting in September

Federal Reserve Governor Jerome Powell said on Tuesday that the Fed could raise its interest rate twice this year, starting in September.

"What I would say is that, if my forecast for the economy were to be realized, and that forecast includes significantly strong growth than we've realized in the first half of the year, continued progress in the labour market and a greater basis for confidence of inflation returning to 2% goal over the medium term. If those things are realized, I feel that it will be time, potentially, as soon as September," he said.

Powell add that the second interest rate hike could follow in December.

Fed governor pointed out that he does not see a bubble in stock prices.

-

16:46

Major U.S. stock-indexes little changed

Major U.S. stock-indexes are little changed on Tuesday on continued expectations that Greece is near a deal that will prevent it from defaulting on loans, and data pointing to a rebound in business investment plans. Global markets were higher, with European shares climbing to a three-week high, after Athens proposed new reforms on Monday, which were cautiously welcomed by euro zone finance ministers. The Commerce Department said on Tuesday non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, rose 0.4 percent last month, offering a tentative sign of stabilization in the manufacturing sector after activity weakened early this year.

Dow stocks trading mixed (14 in negative area, 16 in positive area). Top looser - Intel Corporation (INTC, -0.90%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.58).

S&P index sectors also mixed. Top gainer - Basic materials (+0,4%). Top looser - Utilities (-0.8%)

At the moment:

Dow 18073.00 +48.00 +0.27%

S&P 500 2116.00 +3.25 +0.15%

Nasdaq 100 4529.75 -3.00 -0.07%

10-year yield 2.40% +0.04

Oil 61.00 +0.62 +1.03%

Gold 1179.00 -5.10 -0.43%

-

16:43

Richmond Fed Manufacturing Index rises to 6 in June

The Federal Reserve Bank of Richmond released its survey of manufacturing activity on Tuesday. The lender said that "manufacturing activity grew modestly in June".

The composite index for manufacturing rose to 6 in June from 1 in June.

The increase was driven by higher volume of new orders, which rose 9 points to 11 in June.

-

16:28

New home sales hit the highest level since February 2008

The U.S. Commerce Department released new home sales data on Tuesday. New home sales increased 2.2% to a seasonally adjusted annual rate of 546,000 units in May from 534,000 units in April. It was the highest level since February 2008.

April's figure was revised up from 517,000 units.

Analysts had expected new home sales to reach 525,000 units.

The increase was driven by higher sales in the Northeast. New home sales in the Northeast climbed 87.5% in May.

The median sales price of new houses sold was $282,800 in May, down from $291,100 in April.

-

16:12

U.S. preliminary manufacturing purchasing managers' index declines to 53.4 in June

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Tuesday. The U.S. preliminary manufacturing purchasing managers' index (PMI) declined to 53.4 in June from 54.0 in May, missing expectations for an increase to 54.2. It was the lowest level since October 2013.

A reading above 50 indicates expansion in economic activity.

The decline was driven by a slower output growth.

"While the survey data points to the economy rebounding in the second quarter, the weak PMI number for June raises the possibility that we are seeing a loss of momentum heading into the third quarter " Markit Chief Economist Chris Williamson.

-

15:51

European Central Bank raised the amount the Greek central bank can lend its banks by “a bit less than one billion euros"

The European Central Bank (ECB) Tuesday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA)) by "a bit less than one billion euros" to around €89 billion, according to Reuters. It was the fourth increase in less than a week.

The ECB had raised the ELA by €1.9 billion, according to Bloomberg.

-

15:32

U.S. Stocks open: Dow +0.15%, Nasdaq +0.14%, S&P +0.16%

-

15:32

U.S. house price index rise 0.3% in April

The Federal Housing Finance Agency (FHFA) released its monthly house price index for the U.S. on Tuesday. The U.S. house price index rose 0.3% on a seasonally adjusted basis in April, after a 0.3% gain in March.

On a yearly basis, the house price index climbed 5.3% in April.

-

15:26

Before the bell: S&P futures +0.11%, NASDAQ futures +0.15%

U.S. stock-index futures rose, indicating equities will gain a second day, as investors assess economic data and optimism grew that a deal on Greek aid is within reach.

Global markets:

Nikkei 20,809.42 +381.23 +1.87%

Hang Seng 27,333.46 +252.61 +0.93%

Shanghai Composite 4,575.12 +96.76 +2.16%

FTSE 6,846.07 +20.40 +0.30%

CAC 5,060.63 +62.02 +1.24%

DAX 11,591.89 +131.39 +1.15%

Crude oil $59.85 (-0.89%)

Gold $1178.40 (-0.47%)

-

15:14

U.S. durable goods orders plunge 1.8% in May

The U.S. Commerce Department released durable goods orders data on Tuesday. The U.S. durable goods orders dropped 1.8% in May, missing expectations for a 0.5% decrease, after a 1.5% decline in April. April's figure was revised down from a 0.5% fall.

The decline was partly driven by lower orders for aircraft. Orders for nondefense aircraft dropped 35.3.0% in May.

The U.S. durable goods orders excluding transportation rose 0.5% in May, missing expectations for a 0.6% gain, after a 0.3% decrease in April.

A stronger U.S. dollar weighs on U.S. exports and makes imports more attractive for consumers in the U.S.

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Boeing Co

BA

145.72

+0.01%

0.5K

Tesla Motors, Inc., NASDAQ

TSLA

259.82

+0.01%

0.7K

Johnson & Johnson

JNJ

100.12

+0.03%

0.4K

Merck & Co Inc

MRK

58.85

+0.03%

1.3K

Goldman Sachs

GS

216.65

+0.06%

5.6K

Caterpillar Inc

CAT

88.32

+0.06%

5.0K

General Electric Co

GE

27.44

+0.07%

1.4K

Intel Corp

INTC

32.29

+0.09%

1.3K

ALCOA INC.

AA

11.77

+0.09%

1K

Wal-Mart Stores Inc

WMT

72.90

+0.15%

0.8K

Cisco Systems Inc

CSCO

28.99

+0.17%

0.3K

Twitter, Inc., NYSE

TWTR

35.61

+0.17%

10.5K

American Express Co

AXP

81.40

+0.18%

2.3K

Amazon.com Inc., NASDAQ

AMZN

437.08

+0.18%

14.7K

Nike

NKE

107.00

+0.20%

3.8K

JPMorgan Chase and Co

JPM

69.10

+0.20%

0.5K

Ford Motor Co.

F

15.16

+0.20%

32.4K

Citigroup Inc., NYSE

C

57.07

+0.21%

107.8K

Hewlett-Packard Co.

HPQ

31.77

+0.22%

0.5K

Visa

V

69.25

+0.23%

11.6K

Microsoft Corp

MSFT

46.35

+0.26%

2.3K

General Motors Company, NYSE

GM

36.30

+0.30%

8.3K

Verizon Communications Inc

VZ

47.68

+0.31%

2.5K

Facebook, Inc.

FB

85.02

+0.33%

197.1K

Starbucks Corporation, NASDAQ

SBUX

54.08

+0.33%

0.7K

UnitedHealth Group Inc

UNH

120.80

+0.46%

1.3K

Pfizer Inc

PFE

34.48

+0.49%

1K

McDonald's Corp

MCD

97.41

+0.56%

5.3K

Walt Disney Co

DIS

114.47

+0.83%

0.2K

AT&T Inc

T

35.67

+1.80%

600.9K

Home Depot Inc

HD

113.07

0.00%

0.2K

Procter & Gamble Co

PG

80.45

0.00%

3.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.40

0.00%

4.1K

The Coca-Cola Co

KO

40.46

-0.05%

1.0K

Apple Inc.

AAPL

127.54

-0.05%

83.0K

Yandex N.V., NASDAQ

YNDX

16.23

-0.18%

0.1K

Exxon Mobil Corp

XOM

85.01

-0.19%

2.8K

Barrick Gold Corporation, NYSE

ABX

11.11

-0.45%

13.0K

Travelers Companies Inc

TRV

99.19

-0.85%

0.1K

-

15:10

Upgrades and downgrades before the market open

Upgrades:

AT&T (T) upgraded to Buy from Neutral at UBS

AT&T (T) upgraded to Overweight from Equal Weight at Barclays

Downgrades:

Other: -

14:43

Italian retail sales climb at a seasonally adjusted rate of 0.7% in April

The Italian statistical office Istat released its retail sales data for Italy on Tuesday. Italian retail sales climbed at a seasonally adjusted rate of 0.7% in April, after a 0.1% decline in March.

On a yearly basis, retail sales in Italy were flat in April, after a 0.2% decrease in March.

Sales of food products dropped 0.8% year-on-year in April, while sales of non-food products climbed by 0.6%.

-

14:28

Industrial orders in Italy rise at a seasonally adjusted rate of 5.4% in April

The Italian statistical office Istat released its industrial orders data for Italy on Tuesday. Industrial orders in Italy rose at a seasonally adjusted rate of 5.4% in April, after a 0.2% decline in March.

On a yearly basis, the unadjusted industrial orders in Italy jumped 7.9% in April, after a 2.7% gain in March.

The seasonally adjusted industrial turnover in Italy fell 0.6% in April, after a 1.4% rise in March.

On a yearly basis, the adjusted industrial turnover in Italy declined 0.2% in April, after a 0.9% increase in March.

-

14:04

CBI industrial order books balance drops to -7% in June

The Confederation of British Industry (CBI) released its industrial order books balance on Tuesday. The CBI industrial order books balance dropped to -7% in June from -5% in May, missing expectations for a rise to +1%.

The decline was driven by lower exports. The export order book balance fell to -17% in June from -7% in May.

The balance for output volumes for the next three months rose to +16% in June from +15% in May.

"Output and overall orders are still doing better than average but hopes that export demand would start to drive forward have not yet been fulfilled. Improving momentum in the Eurozone is being offset by the effect of the strengthening pound on UK manufacturers' overseas sales and margins. On top of that, the ongoing Greek saga is causing uncertainty," the CBI director of economics Rain Newton-Smith said.

-

12:00

European stock markets mid session: stocks traded higher on hopes for a deal between Athens and its creditors

Stock indices traded higher on hopes for a deal between Athens and its creditors. The head of the Eurogroup Jeroen Dijsselbloem said after the Eurogroup's meeting on Monday that a deal between Greece and its creditors could be reached this week.

"I am convinced that we will find an agreement this week. It's vital"." the EU's Economic and Financial Affairs Commissioner Pierre Moscovici said last night.

Meanwhile, the economic data from the Eurozone was better-than-expected. Eurozone's preliminary manufacturing PMI increased to 52.5 in June from 52.2 in May. Analysts had expected index to remain unchanged at 52.2.

Eurozone's preliminary services PMI rose to 54.4 in June from 53.8 in May. Analysts had expected the index to fall to 53.6.

Markit's Chief Economist Chris Williamson said that Eurozone's economy is expected to grow around 2.0% this year, depending on the outcome of the Greek debt talks.

He also said that the figures indicate a 0.4% growth of the economy in the Eurozone in the second quarter.

Germany's preliminary manufacturing PMI climbed to 51.9 in June from 51.1 in May, exceeding forecasts of an increase to 51.3.

Germany's preliminary services PMI was up to 54.2 in June from 53.0 in May. Analysts had expected index to remain unchanged at 53.0.

Markit's economist Oliver Kolodseike noted that the figures showed "a mixed picture of the health of Germany's private sector economy".

France's preliminary manufacturing PMI rose to 50.5 in June from 49.4 in May, beating forecasts of a rise to 49.5.

France's preliminary services PMI increased to 54.1 in June from 52.8 in May, beating expectations for a decline to 52.6. It was the highest level since August 2011.

The Senior Economist at Markit Jack Kennedy said that "the figures bode well for second quarter GDP".

Current figures:

Name Price Change Change %

FTSE 100 6,836.74 +11.07 +0.16 %

DAX 11,563.99 +103.49 +0.90 %

CAC 40 5,048.82 +50.21 +1.00 %

-

11:43

French manufacturing confidence index declines to 100 in June

The French statistical office Istat released its manufacturing confidence index for France on Tuesday. The French manufacturing confidence index declined to 100 in June from 103 in May. It was the first fall in three months.

Past change in production index plunged to 7% in June from 16 in May.

Personal production expectations index remained unchanged at 6 in June, while general production outlook index declined to -2 in June from -1 in March.

-

11:28

France's preliminary PMIs climb in June

France's preliminary manufacturing PMI rose to 50.5 in June from 49.4 in May, beating forecasts of a rise to 49.5.

France's preliminary services PMI increased to 54.1 in June from 52.8 in May, beating expectations for a decline to 52.6. It was the highest level since August 2011.

The Senior Economist at Markit Jack Kennedy said that "the figures bode well for second quarter GDP".

-

11:05

Germany's preliminary PMIs rise in June

Germany's preliminary manufacturing PMI climbed to 51.9 in June from 51.1 in May, exceeding forecasts of an increase to 51.3.

Germany's preliminary services PMI was up to 54.2 in June from 53.0 in May. Analysts had expected index to remain unchanged at 53.0.

Markit's economist Oliver Kolodseike noted that the figures showed "a mixed picture of the health of Germany's private sector economy".

-

10:54

Eurozone's preliminary PMIs increase in June

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the Eurozone on Tuesday. Eurozone's preliminary manufacturing PMI increased to 52.5 in June from 52.2 in May. Analysts had expected index to remain unchanged at 52.2.

Eurozone's preliminary services PMI rose to 54.4 in June from 53.8 in May. Analysts had expected the index to fall to 53.6.

Markit's Chief Economist Chris Williamson said that Eurozone's economy is expected to grow around 2.0% this year, depending on the outcome of the Greek debt talks.

He also said that the figures indicate a 0.4% growth of the economy in the Eurozone in the second quarter.

-

10:37

Chinese preliminary HSBC manufacturing Purchasing Managers' Index rises to 49.6 in June

The Chinese preliminary HSBC manufacturing Purchasing Managers' Index (PMI) increased to 49.6 in June from 49.2 in May, exceeding expectations for a rise to 49.4.

A reading below 50 indicates contraction of activity.

The output index hit 50.0 in June. New export orders increased.

"On the one hand, the sector shows signs of improvement as output stabilized amid a slight pick-up in total new work, while purchasing activity also rose slightly over the month," Markit economist Annabel Fiddes said.

She added that the Chinese manufacturing sector lost momentum in the second quarter, and the Chinese government may add further measures "to stimulate growth and job creation".

-

10:17

European Commission President Jean-Claude Juncker: that he and the European Commission offered a 35 billion euro programme for Greece

European Commission President Jean-Claude Juncker said on Monday that he and the European Commission offered a 35 billion euro programme for growth-enhancing measures in Greece up to 2020.

"The Commission and I myself were proposing to our Greek friends a program of 35 billion to be disbursed from now and to 2020. This is not money, to put it simply, for the budget, but real money for the real economy. This is not only about budgetary consolidation, fiscal consolidation, although this is of permanent importance - but we need growth and we need jobs in Greece" he said.

One billion could be provided in the second half of this year, Juncker noted.

-

08:57

Global Stocks: hopes for a Greece deal push equities up

Stock indices in the U.S.A. and Asia mostly advanced and their gains were broadly driven by hopes that recent proposals by Greek PM Alexis Tsipras will help Greece and its international lenders come to an agreement.

So far there is no deal and no official statements about it, but some positive remarks made by European policymakers after yesterday's summit spurred optimism among market participants.

The Dow Jones industrial average rose by 103.83 points, or 0.58%, to 18,019.78. The Standard & Poor's 500 rose by 12.86 points, or 0.61%, to 2,122.85 (health-care companies gained 0.8%). The Nasdaq Composite gained 36.97 points, or 0.70%, to close at record 5,153.97.

In Asia Hong Kong Hang Seng rose by 0.56%, or 151.36 points, to 27,232.21. China Shanghai Composite Index declined by 0.09%, or 3.91 points, to 4,474.46. Meanwhile the Nikkei rose by 1.53%, or 311.98 points, to 20,740.17.

The Shanghai index continued last week's correction caused by liquidity concerns as new curbs on margin financing and new-share listings weighed on liquidity.

-

04:01

Nikkei 225 20,726.98 +298.79 +1.46 %, Hang Seng 27,125.59 +44.74 +0.17 %, Shanghai Composite 4,476.01 -2.35 -0.05 %

-

00:30

Stocks. Daily history for Jun 22’2015:

(index / closing price / change items /% change)

Nikkei 225 20,428.19 +253.95 +1.26 %

Hang Seng 27,080.85 +320.32 +1.20 %

S&P/ASX 200 5,610.17 +13.17 +0.24 %

FTSE 100 6,825.67 +115.22 +1.72 %

CAC 40 4,998.61 +183.24 +3.81 %

Xetra DAX 11,460.5 +420.40 +3.81 %

S&P 500 2,122.85 +12.86 +0.61 %

NASDAQ Composite 5,153.97 +36.97 +0.72 %

Dow Jones 18,119.78 +103.83 +0.58 %

-