Noticias del mercado

-

21:00

S&P 500 2,110.65 -13.55 -0.64 %, NASDAQ 5,128.11 -31.98 -0.62 %, Dow 17,999.43 -144.64 -0.80 %

-

19:25

Wall Street: Major U.S. stock-indexes fell

Major U.S. stock-indexes fell to session lows in early afternoon trading on Wednesday as the outcome of the negotiations between Greece and its international creditors remained up in the air. Creditors demanded sweeping changes to Greek Prime Minister Alexis Tsipras' tax and reforms proposals, adding fresh uncertainty to talks aimed at unlocking aid to avert a debt default next week. Greece needs fresh funds to avoid defaulting on a $1.8 billion debt repayment to the IMF on June 30.

Almost all Dow stocks trading in negative area (27 of 30). Top looser - E. I. du Pont de Nemours and Company (HD, -3.08%). Top gainer - Apple Inc. (AAPL, +1.72).

S&P index sectors also in negative area. Top looser - Healthcare (-0.7%).

At the moment:

Dow 17942.00 -125.00 -0.69%

S&P 500 2106.75 -9.75 -0.46%

Nasdaq 100 4532.50 -8.75 -0.19%

10-year yield 2.40% -0.01

Oil 60.11 -0.90 -1.48%

Gold 1172.60 -4.00 -0.34%

-

19:10

WSE: Session Results

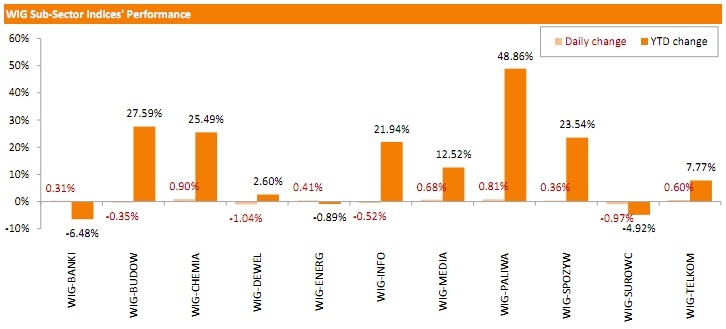

Polish equity market ended Wednesday's trading session with an uptick. The broad market measure, the WIG Index, rose 0.18%. Sector-wise, chemicals (+0.90%) and oil & gas sector names (+0.81%) performed best, while developers (-1.04%) and materials (-0.97%) lagged.

Large-cap stocks added 0.22%, as measured by the WIG30 Index. PGNIG (WSE: PGN) led the way up with a 2.24% advance, rebounding from the previous session's decline. It was followed by ALIOR (WSE: ALR), BZ WBK (WSE: BZW) and GRUPA AZOT (WSE: ATT), adding 2.23%, 1.46% and 1.34% respectively. On the other side of the ledger, ING BSK (WSE: ING) and JSW (WSE: JSW) were the biggest decliners as their stocks fell 2.69% and 2.14% respectively, reversing yesterday's gains. BOGDANKA (WSE: LWB), GTC (WSE: GTC) and MBANK (WSE: MBK) continued to plunge, losing 1.9%, 1.47% and 1.16% respectively.

-

18:04

European stocks closed: FTSE 100 6,844.8 +9.93 +0.15 %, CAC 40 5,045.35 -12.33 -0.24 %, DAX 11,471.26 -71.28 -0.62 %

-

18:03

European stocks close: stocks closed mixed on the uncertainty over debt talks between Greece and its creditors

Stock indices closed mixed on the uncertainty over debt talks between Greece and its creditors. Tsipras said before flying to Brussels on Wednesday that some latest Greek reform proposals were refused by its creditors.

Greece rejected on Wednesday a "counter proposal" from its international creditors, according a government source.

Greek Prime Minister Alexis Tsipras is set to meet European Central Bank President Mario Draghi, the International Monetary Fund Managing Director Christine Lagarde and European Commission President Jean-Claude Juncker in Brussels today.

EU officials said on Monday and on Tuesday that a deal could be reached this week.

Meanwhile, the economic data from the Eurozone was weaker than expected. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,844.8 +9.93 +0.15 %

DAX 11,471.26 -71.28 -0.62 %

CAC 40 5,045.35 -12.33 -0.24 %

-

16:55

European Central Bank (ECB) Governing Council Member Klaas Knot: quantitative easing by the ECB is reaching its limits

European Central Bank (ECB) Governing Council Member Klaas Knot said on Wednesday that quantitative easing by the ECB was reaching its limits.

"Monetary policy accommodation is now reaching its limits and if it is maintained for a significant period of time it also comes with the risk of certain negative side-effects such as new financial imbalances," he said.

-

16:33

Former Greek Prime Minister Lucas Papademos: Greece needs a debt relief

Former Greek Prime Minister Lucas Papademos said on Wednesday that Eurozone's finance ministers will speak about further debt relief for Greece. He added that Greece needs a debt relief.

Bundesbank Executive Board member Joachim Nagel dismissed the argument that hat Greece needs a debt relief later.

"Taking the current numbers, it is possible without a second debt relief to come down to more sustainable debt ratios," Nagel pointed out.

-

16:02

Swiss National Bank’s Quarterly Bulletin: the Swiss franc is still overvalued

The Swiss National Bank (SNB) released its Quarterly Bulletin on Wednesday. The central bank noted that the Swiss franc is still overvalued. The SNB expects the Swiss economy to regain momentum in the second half of the year and the Swiss GDP to grow under 1% this year, while business confidence picked up.

According to Quarterly Bulletin, in the second quarter, consumer price inflation is expected to be - 0.6% in six to twelve months, compared with −1.3% in the previous quarter.

In the second quarter, inflation forecasts for the next three to five years is expected to be 0.5%, up from the previous quarter's forecast of 0.4%.

-

15:35

U.S. Stocks open: Dow -0.37%, Nasdaq -0.19%, S&P -0.16%

-

15:28

NBB business climate rises to -3.9 in June, the highest level since July 2011

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate rose to -3.9 in June from -4.9 in May, beating forecasts for a decline to -5.1. It was the highest level since July 2011.

The gain was driven by increases in business-related services and in the manufacturing and building industries.

The business climate index for the manufacturing sector rose to -5.0 in June from -6.4 in May due to upward revision of demand forecasts.

The business climate index for the services sector was up to 13.1 in June from 9.4 in May due to more optimistic outlook about future developments and due to general market demand.

The business climate index for the building sector increased to -12.4 in June from -13.9 in May due to more favourable assessments of total order books.

The business climate index for the trade sector dropped to -13.8 in June from -1.8 in May due to downward revision of forecasts for orders and for employment.

-

15:28

Before the bell: S&P futures -0.20%, NASDAQ futures -0.17%

U.S. stock-index futures fell amid Greek debt talks.

Global markets:

Nikkei 20,868.03 +58.61 +0.3%

Hang Seng 27,404.97 +71.51 +0.3%

Shanghai Composite 4,690.08 +113.59 +2.5%

FTSE 6,843.9 +9.03 +0.1%

CAC 5,032.41 -25.27 -0.5%

DAX 11,433.19 -109.35 -0.9%

Crude oil $60.87 (-0.21%)

Gold $1170.50 (-0.53%)

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

UnitedHealth Group Inc

UNH

122.86

+0.10%

3.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.15

+0.20%

3.2K

Ford Motor Co.

F

15.48

+1.24%

94.1K

Visa

V

69.42

0.00%

2.4K

Chevron Corp

CVX

100.09

0.00%

0.2K

E. I. du Pont de Nemours and Co

DD

68.50

0.00%

0.5K

Exxon Mobil Corp

XOM

85.07

0.00%

2.4K

Intel Corp

INTC

32.09

0.00%

2.2K

International Business Machines Co...

IBM

168.62

0.00%

0.8K

Johnson & Johnson

JNJ

99.78

0.00%

1.3K

Merck & Co Inc

MRK

59.03

0.00%

0.1K

Pfizer Inc

PFE

34.50

0.00%

2.0K

Procter & Gamble Co

PG

79.79

0.00%

0.2K

The Coca-Cola Co

KO

40.38

0.00%

2.6K

Wal-Mart Stores Inc

WMT

72.57

0.00%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

63.32

0.00%

1.7K

Amazon.com Inc., NASDAQ

AMZN

445.99

0.00%

1.9K

FedEx Corporation, NYSE

FDX

175.27

0.00%

0.4K

Google Inc.

GOOG

540.48

0.00%

0.1K

HONEYWELL INTERNATIONAL INC.

HON

104.76

0.00%

0.3K

Hewlett-Packard Co.

HPQ

31.63

0.00%

0.1K

International Paper Company

IP

49.30

0.00%

11.3K

ALTRIA GROUP INC.

MO

49.08

0.00%

0.1K

Starbucks Corporation, NASDAQ

SBUX

54.12

0.00%

0.2K

Apple Inc.

AAPL

127.00

-0.02%

126.3K

AT&T Inc

T

35.87

-0.11%

67.2K

Walt Disney Co

DIS

114.20

-0.18%

0.4K

Deere & Company, NYSE

DE

93.50

-0.19%

0.4K

Twitter, Inc., NYSE

TWTR

35.30

-0.20%

39.0K

JPMorgan Chase and Co

JPM

69.59

-0.23%

5.5K

American Express Co

AXP

81.16

-0.25%

4.0K

General Electric Co

GE

27.48

-0.25%

0.2K

Home Depot Inc

HD

112.90

-0.25%

0.4K

McDonald's Corp

MCD

96.94

-0.25%

3.3K

ALCOA INC.

AA

11.71

-0.26%

2.0K

Nike

NKE

106.91

-0.27%

1.2K

Verizon Communications Inc

VZ

47.64

-0.27%

4.9K

Caterpillar Inc

CAT

88.19

-0.29%

1.7K

United Technologies Corp

UTX

114.89

-0.30%

2.2K

Yahoo! Inc., NASDAQ

YHOO

40.53

-0.30%

3.7K

Facebook, Inc.

FB

87.60

-0.32%

140.0K

3M Co

MMM

159.26

-0.36%

1.8K

Barrick Gold Corporation, NYSE

ABX

11.12

-0.36%

1.8K

Tesla Motors, Inc., NASDAQ

TSLA

266.68

-0.37%

4.7K

Travelers Companies Inc

TRV

99.58

-0.42%

1.4K

Cisco Systems Inc

CSCO

28.65

-0.47%

0.4K

Microsoft Corp

MSFT

45.66

-0.54%

2.1K

Yandex N.V., NASDAQ

YNDX

15.83

-0.63%

10.9K

Boeing Co

BA

143.44

-0.69%

1.9K

Goldman Sachs

GS

216.83

-0.72%

5.3K

Citigroup Inc., NYSE

C

56.90

-0.85%

25.7K

General Motors Company, NYSE

GM

35.80

-1.38%

14.6K

-

15:05

U.S. final GDP drops 0.2% in the first quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Wednesday. The U.S. final GDP declined 0.2% in the first quarter, in line with expectations, up from the previous estimate of a 0.7% drop.

The upward revision was partly driven by an upward revision to consumer spending. Consumer spending rose by 2.1% in the first quarter, up from the previous estimate of a 1.8% increase.

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Ford (F) upgraded to Buy from Neutral at Goldman

Downgrades:

Citi (C) downgraded to Hold from Buy at Deutsche Bank

Goldman Sachs (GS) downgraded to Hold from Buy at Deutsche Bank

General Motors (GM) downgraded to Neutral from Buy at Goldman

Other:

Amazon (AMZN) target raised to $500 from $460 at Axiom Capital

-

14:39

Italian non-EU trade surplus climbs to €2.9 billion in May

The statistical office Istat released its non-EU trade data on Wednesday. The Italian trade surplus climbed to €2.9 billion in May from €2.4 billion in May last year.

Exports increased at an annual rate of 0.2% in May, while imports dropped by 3.1%.

On a seasonally adjusted basis, exports were up 0.4% month-on month in May, while imports gained by 1.9%.

-

12:00

European stock markets mid session: stocks traded mixed, debt talks between Greece and its creditors remain in focus

Stock indices traded mixed, debt talks between Greece and its creditors remain in focus. Greek Prime Minister Alexis Tsipras is set to meet European Central Bank President Mario Draghi, the International Monetary Fund Managing Director Christine Lagarde and European Commission President Jean-Claude Juncker in Brussels today.

The Eurogroup's meeting is scheduled to be later in the day, while next Eurozone leaders' meeting is scheduled to be tomorrow.

EU officials said on Monday and on Tuesday that a deal could be reached this week.

Meanwhile, the economic data from the Eurozone was weaker than expected. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

Current figures:

Name Price Change Change %

FTSE 100 6,840.83 +5.96 +0.09 %

DAX 11,415.29 -127.25 -1.10 %

CAC 40 5,011.95 -45.73 -0.90 %

-

11:44

European Central Bank approved the amount of emergency funding (ELA) on Wednesday

Reuters reported that the European Central Bank (ECB) approved the amount of emergency funding (ELA) that Greece requested for its banks on Wednesday. The amount has not been disclosed.

The European Central Bank (ECB) Tuesday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA)) by "a bit less than one billion euros" to around €89 billion, according to Reuters. It was the fourth increase in less than a week.

-

11:29

International Monetary Fund warns Australia that its economic growth is likely to remain below potential if the country will not implement reforms

The International Monetary Fund (IMF) released its annual review of Australia on Wednesday. The IMF warned Australia that its economic growth is likely to remain below potential if the country will not implement reforms.

"Over the medium term and without reform, growth is likely to converge to a slower potential rate, reflecting less capital accumulation and only modest productivity growth. This lower potential would still mean income growth in line with other advanced countries, but significantly slower than Australians have been used to over the last two decades," the IMF said.

The IMF urged Australia to implement tax reform and to increase infrastructure spending.

The IMF also said that the Reserve Bank of Australia might cut its interest rate again if the financial stability risks remained contained.

-

11:12

Number of mortgage approvals in the U.K. is up to 42,530 in May

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

"The numbers show that the property market remains buoyant after the general election. Personal borrowing by British families also seems to be strong -- the uptake of personal loans and credit card borrowing is further proof of consumers' confidence," the chief economist at the BBA, Richard Woolhouse, said.

-

10:57

French final GDP rises 0.6% in the first quarter

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP rose 0.6% in the first quarter, in line with the preliminary estimate, after a 0.1% increase in the fourth quarter. It was the biggest increase since the second quarter of 2013.

Household spending gained 0.9% in the first quarter, while government spending remained unchanged at 0.5%.

Exports climbed 1.1% in the first quarter, while imports rose 2.6%.

-

10:44

German business confidence index drops to 107.4 in June

German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

-

10:27

UBS consumption index rises to 1.73 in May

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.73 in May from 1.67 in April.

April's figure was revised up from 1.25.

The increase was driven by a rise in new car registrations and retailer sentiment. New car registrations rose 6.0% in May, while the retailer sentiment index increased to -11 in May from -12 in April.

These figures indicate robust growth in private consumption.

-

10:15

Bank of Japan’s May monetary policy meeting minutes: the country’s economy continued to recover moderately, but there are downside risks to the recovery

The Bank of Japan (BoJ) released its May monetary policy meeting minutes on late Tuesday. According to minutes, the country's economy continued to recover moderately. But there are downside risks to the recovery from developments in emerging and commodity-driven economies as well as the Greek debt problem and the possible tightening of monetary policy in the US.

The BoJ expects the consumer price inflation to be "about 0% for the time being" as energy prices remain low.

Private consumption was resilient, while housing investment showed some signs of picking up, the central bank noted.

Minutes showed that the central bank wants to continue its monetary policy until the 2% inflation target will be reached, and it will adjust its monetary policy if needed.

The BoJ decided to keep unchanged its monetary policy at its May meeting.

-

09:11

Global Stocks: equities report modest gains

U.S. stocks gained amid May data on sales of new single-family homes, which showed that new homes were sold at an annual rate of 546,000. This is the fastest pace since February 2008. April numbers were revised up. However orders for durable U.S. goods fell by a seasonally adjusted 1.8% in May, mostly because of a 35.3% drop in nondefense aircraft & parts orders.

The Dow Jones industrial average rose by 24.29 points, or 0.13%, to 18,144.07. The Standard & Poor's 500 rose by 1.35 points, or 0.06%, to 2,124.20. The Nasdaq Composite gained 6.12 points, or 0.12%, to close at 5,160.09 (the second consecutive session of closing at record).

In Asia Hong Kong Hang Seng rose by 0.08%, or 21.18 points, to 27,354.64. China Shanghai Composite Index advanced by 0.08%, or 3.76 points, to 4,580.25. Meanwhile the Nikkei rose by 0.51%, or 105.90 points, to 20,915.32.

Asian stocks advanced following modest gains in U.S. equity markets. Investors were also optimistic that Greece would find understanding with its lenders and a deal would be reached.

-

03:57

Nikkei 225 20,922 +112.58 +0.54 %, Hang Seng 27,404.16 +70.70 +0.26 %, Shanghai Composite 4,639.82 +63.33 +1.38 %

-

03:30

Stocks. Daily history for Jun 23’2015:

(index / closing price / change items /% change)

Nikkei 225 20,739.37 +311.18 +1.52 %

Hang Seng 27,114.44 +33.59 +0.12 %

S&P/ASX 200 5,674.5 +64.33 +1.15 %

Shanghai Composite 4,270.98 -207.38 -4.63 %

Topix 1,672.07 +23.46 +1.42 %

FTSE 100 6,834.87 +9.20 +0.13 %

CAC 40 5,057.68 +59.07 +1.18 %

Xetra DAX 11,542.54 +82.04 +0.72 %

S&P 500 2,124.2 +1.35 +0.06 %

NASDAQ Composite 5,160.1 +6.12 +0.12 %

Dow Jones 18,144.07 +24.29 +0.13 %

-