Noticias del mercado

-

23:59

Schedule for today, Thursday, Jun 25’2015:

(time / country / index / period / previous value / forecast)

06:00 Germany Gfk Consumer Confidence Survey July 10.2 10.2

08:00 Switzerland SNB Chairman Jordan Speaks

12:30 U.S. Continuing Jobless Claims June 2222 2215

12:30 U.S. Initial Jobless Claims June 267 272

12:30 U.S. Personal Income, m/m May 0.4% 0.5%

12:30 U.S. Personal spending May 0.0% 0.7%

12:30 U.S. PCE price index ex food, energy, m/m May 0.1% 0.1%

12:30 U.S. PCE price index ex food, energy, Y/Y May 1.2% 0.8%

13:45 U.S. Services PMI (Preliminary) June 56.2 56.8

13:45 U.S. FOMC Member Jerome Powell Speaks

16:10 Canada BOC Deputy Governor Lawrence Schembri Speaks

22:45 New Zealand Trade Balance, mln May 123 -100

23:30 Japan Unemployment Rate May 3.3% 3.3%

23:30 Japan Household spending Y/Y May -1.3% 3.4%

23:30 Japan Tokyo Consumer Price Index, y/y June 0.5%

23:30 Japan Tokyo CPI ex Fresh Food, y/y June 0.2% 0.1%

23:30 Japan National Consumer Price Index, y/y May 0.6%

23:30 Japan National CPI Ex-Fresh Food, y/y May 0.3% 0.0%

-

21:00

S&P 500 2,110.65 -13.55 -0.64 %, NASDAQ 5,128.11 -31.98 -0.62 %, Dow 17,999.43 -144.64 -0.80 %

-

19:25

Wall Street: Major U.S. stock-indexes fell

Major U.S. stock-indexes fell to session lows in early afternoon trading on Wednesday as the outcome of the negotiations between Greece and its international creditors remained up in the air. Creditors demanded sweeping changes to Greek Prime Minister Alexis Tsipras' tax and reforms proposals, adding fresh uncertainty to talks aimed at unlocking aid to avert a debt default next week. Greece needs fresh funds to avoid defaulting on a $1.8 billion debt repayment to the IMF on June 30.

Almost all Dow stocks trading in negative area (27 of 30). Top looser - E. I. du Pont de Nemours and Company (HD, -3.08%). Top gainer - Apple Inc. (AAPL, +1.72).

S&P index sectors also in negative area. Top looser - Healthcare (-0.7%).

At the moment:

Dow 17942.00 -125.00 -0.69%

S&P 500 2106.75 -9.75 -0.46%

Nasdaq 100 4532.50 -8.75 -0.19%

10-year yield 2.40% -0.01

Oil 60.11 -0.90 -1.48%

Gold 1172.60 -4.00 -0.34%

-

19:10

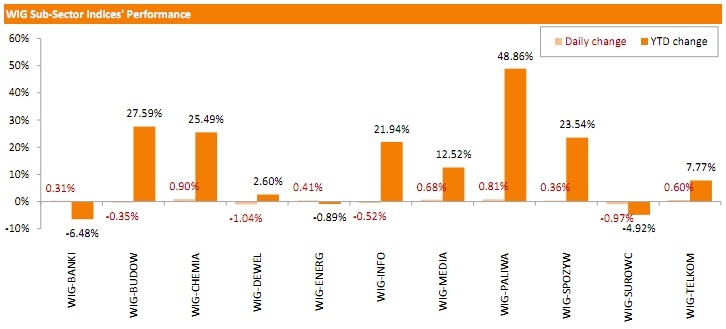

WSE: Session Results

Polish equity market ended Wednesday's trading session with an uptick. The broad market measure, the WIG Index, rose 0.18%. Sector-wise, chemicals (+0.90%) and oil & gas sector names (+0.81%) performed best, while developers (-1.04%) and materials (-0.97%) lagged.

Large-cap stocks added 0.22%, as measured by the WIG30 Index. PGNIG (WSE: PGN) led the way up with a 2.24% advance, rebounding from the previous session's decline. It was followed by ALIOR (WSE: ALR), BZ WBK (WSE: BZW) and GRUPA AZOT (WSE: ATT), adding 2.23%, 1.46% and 1.34% respectively. On the other side of the ledger, ING BSK (WSE: ING) and JSW (WSE: JSW) were the biggest decliners as their stocks fell 2.69% and 2.14% respectively, reversing yesterday's gains. BOGDANKA (WSE: LWB), GTC (WSE: GTC) and MBANK (WSE: MBK) continued to plunge, losing 1.9%, 1.47% and 1.16% respectively.

-

18:04

European stocks closed: FTSE 100 6,844.8 +9.93 +0.15 %, CAC 40 5,045.35 -12.33 -0.24 %, DAX 11,471.26 -71.28 -0.62 %

-

18:03

European stocks close: stocks closed mixed on the uncertainty over debt talks between Greece and its creditors

Stock indices closed mixed on the uncertainty over debt talks between Greece and its creditors. Tsipras said before flying to Brussels on Wednesday that some latest Greek reform proposals were refused by its creditors.

Greece rejected on Wednesday a "counter proposal" from its international creditors, according a government source.

Greek Prime Minister Alexis Tsipras is set to meet European Central Bank President Mario Draghi, the International Monetary Fund Managing Director Christine Lagarde and European Commission President Jean-Claude Juncker in Brussels today.

EU officials said on Monday and on Tuesday that a deal could be reached this week.

Meanwhile, the economic data from the Eurozone was weaker than expected. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,844.8 +9.93 +0.15 %

DAX 11,471.26 -71.28 -0.62 %

CAC 40 5,045.35 -12.33 -0.24 %

-

17:41

WTI crude oil prices traded higher as U.S. crude oil inventories declined last week

WTI crude oil prices traded higher as U.S. crude oil inventories declined last week. The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 4.9 million barrels to 463 million in the week to June 19. It was the eight consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

Gasoline inventories were up by 680,000 barrels to 218.5 million barrels last week, according to the EIA.

U.S. oil production increased to 9.6 million barrels a day from 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 1.87 million barrels to 56.2 million barrels.

U.S. crude oil imports declined by 432,000 barrels per day.

Refineries in the U.S. were running at 94.0% of capacity, down from 93.1% the previous week.

Kuwaiti Oil Minister Ali al-Omair said on Tuesday that oil prices are expected to rise as stockpiles and the number of drilling rigs declined.

"We have reached a stage where a drop in oil prices is unlikely," he said.

WTI crude oil for August delivery increased to $61.57 a barrel on the New York Mercantile Exchange.

Brent crude oil for August fell to $64.25 a barrel on ICE Futures Europe.

-

17:25

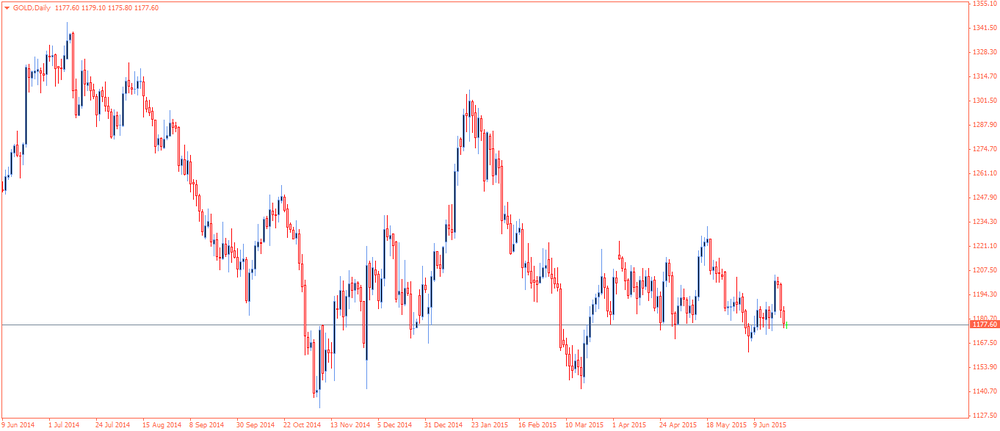

Gold price traded lower as the U.S. dollar strengthened after the release of the final U.S. gross domestic product

Gold price traded lower as the U.S. dollar strengthened after the release of the final U.S. gross domestic product (GDP). The U.S. final GDP declined 0.2% in the first quarter, in line with expectations, up from the previous estimate of a 0.7% drop.

The upward revision was partly driven by an upward revision to consumer spending. Consumer spending rose by 2.1% in the first quarter, up from the previous estimate of a 1.8% increase.

Debt talks between Greece and its creditors remain in focus. Tsipras said before flying to Brussels on Wednesday that some latest Greek reform proposals were refused by its creditors.

Greece rejected on Wednesday a "counter proposal" from its international creditors, according a government source.

August futures for gold on the COMEX today fell to 1168.10 dollars per ounce.

-

17:14

U.S. crude inventories decline by 4.9 million barrels in the week to June 19

The U.S. Energy Information Administration (EIA) released its crude oil inventories data on Wednesday. U.S. crude inventories declined by 4.9 million barrels to 463 million in the week to June 19. It was the eight consecutive weekly decline.

Analysts had expected a decline of 1.8 million barrels.

Gasoline inventories were up by 680,000 barrels to 218.5 million barrels last week, according to the EIA.

U.S. oil production increased to 9.6 million barrels a day from 9.59 million barrels a day.

Crude stocks at the Cushing, Oklahoma, decreased by 1.87 million barrels to 56.2 million barrels.

U.S. crude oil imports declined by 432,000 barrels per day.

Refineries in the U.S. were running at 94.0% of capacity, down from 93.1% the previous week.

-

16:55

European Central Bank (ECB) Governing Council Member Klaas Knot: quantitative easing by the ECB is reaching its limits

European Central Bank (ECB) Governing Council Member Klaas Knot said on Wednesday that quantitative easing by the ECB was reaching its limits.

"Monetary policy accommodation is now reaching its limits and if it is maintained for a significant period of time it also comes with the risk of certain negative side-effects such as new financial imbalances," he said.

-

16:33

Former Greek Prime Minister Lucas Papademos: Greece needs a debt relief

Former Greek Prime Minister Lucas Papademos said on Wednesday that Eurozone's finance ministers will speak about further debt relief for Greece. He added that Greece needs a debt relief.

Bundesbank Executive Board member Joachim Nagel dismissed the argument that hat Greece needs a debt relief later.

"Taking the current numbers, it is possible without a second debt relief to come down to more sustainable debt ratios," Nagel pointed out.

-

16:30

U.S.: Crude Oil Inventories, June -4.934 (forecast -1.8)

-

16:02

Swiss National Bank’s Quarterly Bulletin: the Swiss franc is still overvalued

The Swiss National Bank (SNB) released its Quarterly Bulletin on Wednesday. The central bank noted that the Swiss franc is still overvalued. The SNB expects the Swiss economy to regain momentum in the second half of the year and the Swiss GDP to grow under 1% this year, while business confidence picked up.

According to Quarterly Bulletin, in the second quarter, consumer price inflation is expected to be - 0.6% in six to twelve months, compared with −1.3% in the previous quarter.

In the second quarter, inflation forecasts for the next three to five years is expected to be 0.5%, up from the previous quarter's forecast of 0.4%.

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1130/40(E624mn), $1.1180(E395mn), $1.1200(E1.2bn)

USD/JPY: Y123.50($280mn), Y123.90/00($282mn), Y125.00($232mn)

EUR/JPY: Y138.40(E443mn)

EUR/STG: stg0.7100(E220mn)

AUD/USD: $0.7820(A$220mn)

USD/CAD: Cad1.2465($300mn)

NZD/USD: $0.6960 (NZ$280mn)

-

15:35

U.S. Stocks open: Dow -0.37%, Nasdaq -0.19%, S&P -0.16%

-

15:28

NBB business climate rises to -3.9 in June, the highest level since July 2011

The National Bank of Belgium (NBB) released its business survey on Wednesday. The business climate rose to -3.9 in June from -4.9 in May, beating forecasts for a decline to -5.1. It was the highest level since July 2011.

The gain was driven by increases in business-related services and in the manufacturing and building industries.

The business climate index for the manufacturing sector rose to -5.0 in June from -6.4 in May due to upward revision of demand forecasts.

The business climate index for the services sector was up to 13.1 in June from 9.4 in May due to more optimistic outlook about future developments and due to general market demand.

The business climate index for the building sector increased to -12.4 in June from -13.9 in May due to more favourable assessments of total order books.

The business climate index for the trade sector dropped to -13.8 in June from -1.8 in May due to downward revision of forecasts for orders and for employment.

-

15:28

Before the bell: S&P futures -0.20%, NASDAQ futures -0.17%

U.S. stock-index futures fell amid Greek debt talks.

Global markets:

Nikkei 20,868.03 +58.61 +0.3%

Hang Seng 27,404.97 +71.51 +0.3%

Shanghai Composite 4,690.08 +113.59 +2.5%

FTSE 6,843.9 +9.03 +0.1%

CAC 5,032.41 -25.27 -0.5%

DAX 11,433.19 -109.35 -0.9%

Crude oil $60.87 (-0.21%)

Gold $1170.50 (-0.53%)

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

UnitedHealth Group Inc

UNH

122.86

+0.10%

3.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.15

+0.20%

3.2K

Ford Motor Co.

F

15.48

+1.24%

94.1K

Visa

V

69.42

0.00%

2.4K

Chevron Corp

CVX

100.09

0.00%

0.2K

E. I. du Pont de Nemours and Co

DD

68.50

0.00%

0.5K

Exxon Mobil Corp

XOM

85.07

0.00%

2.4K

Intel Corp

INTC

32.09

0.00%

2.2K

International Business Machines Co...

IBM

168.62

0.00%

0.8K

Johnson & Johnson

JNJ

99.78

0.00%

1.3K

Merck & Co Inc

MRK

59.03

0.00%

0.1K

Pfizer Inc

PFE

34.50

0.00%

2.0K

Procter & Gamble Co

PG

79.79

0.00%

0.2K

The Coca-Cola Co

KO

40.38

0.00%

2.6K

Wal-Mart Stores Inc

WMT

72.57

0.00%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

63.32

0.00%

1.7K

Amazon.com Inc., NASDAQ

AMZN

445.99

0.00%

1.9K

FedEx Corporation, NYSE

FDX

175.27

0.00%

0.4K

Google Inc.

GOOG

540.48

0.00%

0.1K

HONEYWELL INTERNATIONAL INC.

HON

104.76

0.00%

0.3K

Hewlett-Packard Co.

HPQ

31.63

0.00%

0.1K

International Paper Company

IP

49.30

0.00%

11.3K

ALTRIA GROUP INC.

MO

49.08

0.00%

0.1K

Starbucks Corporation, NASDAQ

SBUX

54.12

0.00%

0.2K

Apple Inc.

AAPL

127.00

-0.02%

126.3K

AT&T Inc

T

35.87

-0.11%

67.2K

Walt Disney Co

DIS

114.20

-0.18%

0.4K

Deere & Company, NYSE

DE

93.50

-0.19%

0.4K

Twitter, Inc., NYSE

TWTR

35.30

-0.20%

39.0K

JPMorgan Chase and Co

JPM

69.59

-0.23%

5.5K

American Express Co

AXP

81.16

-0.25%

4.0K

General Electric Co

GE

27.48

-0.25%

0.2K

Home Depot Inc

HD

112.90

-0.25%

0.4K

McDonald's Corp

MCD

96.94

-0.25%

3.3K

ALCOA INC.

AA

11.71

-0.26%

2.0K

Nike

NKE

106.91

-0.27%

1.2K

Verizon Communications Inc

VZ

47.64

-0.27%

4.9K

Caterpillar Inc

CAT

88.19

-0.29%

1.7K

United Technologies Corp

UTX

114.89

-0.30%

2.2K

Yahoo! Inc., NASDAQ

YHOO

40.53

-0.30%

3.7K

Facebook, Inc.

FB

87.60

-0.32%

140.0K

3M Co

MMM

159.26

-0.36%

1.8K

Barrick Gold Corporation, NYSE

ABX

11.12

-0.36%

1.8K

Tesla Motors, Inc., NASDAQ

TSLA

266.68

-0.37%

4.7K

Travelers Companies Inc

TRV

99.58

-0.42%

1.4K

Cisco Systems Inc

CSCO

28.65

-0.47%

0.4K

Microsoft Corp

MSFT

45.66

-0.54%

2.1K

Yandex N.V., NASDAQ

YNDX

15.83

-0.63%

10.9K

Boeing Co

BA

143.44

-0.69%

1.9K

Goldman Sachs

GS

216.83

-0.72%

5.3K

Citigroup Inc., NYSE

C

56.90

-0.85%

25.7K

General Motors Company, NYSE

GM

35.80

-1.38%

14.6K

-

15:05

U.S. final GDP drops 0.2% in the first quarter

The U.S. Commerce Department released gross domestic product (GDP) figures on Wednesday. The U.S. final GDP declined 0.2% in the first quarter, in line with expectations, up from the previous estimate of a 0.7% drop.

The upward revision was partly driven by an upward revision to consumer spending. Consumer spending rose by 2.1% in the first quarter, up from the previous estimate of a 1.8% increase.

-

15:02

Upgrades and downgrades before the market open

Upgrades:

Ford (F) upgraded to Buy from Neutral at Goldman

Downgrades:

Citi (C) downgraded to Hold from Buy at Deutsche Bank

Goldman Sachs (GS) downgraded to Hold from Buy at Deutsche Bank

General Motors (GM) downgraded to Neutral from Buy at Goldman

Other:

Amazon (AMZN) target raised to $500 from $460 at Axiom Capital

-

15:01

Belgium: Business Climate, June -3.9 (forecast -5.1)

-

14:39

Italian non-EU trade surplus climbs to €2.9 billion in May

The statistical office Istat released its non-EU trade data on Wednesday. The Italian trade surplus climbed to €2.9 billion in May from €2.4 billion in May last year.

Exports increased at an annual rate of 0.2% in May, while imports dropped by 3.1%.

On a seasonally adjusted basis, exports were up 0.4% month-on month in May, while imports gained by 1.9%.

-

14:30

U.S.: GDP, q/q, Quarter I -0.2% (forecast -0.2%)

-

14:21

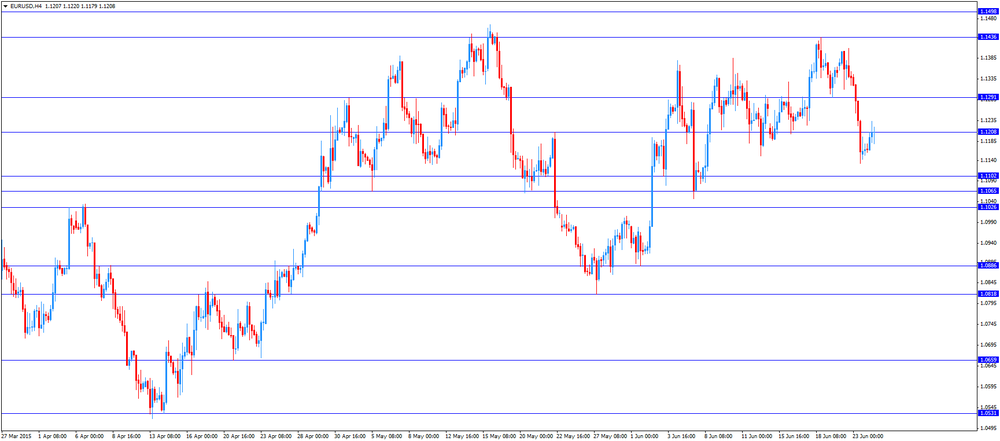

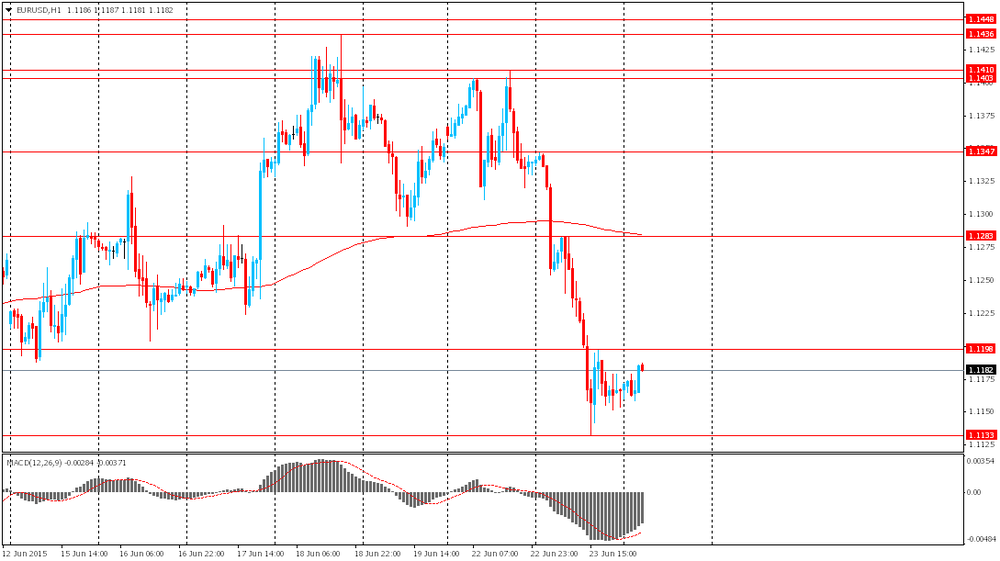

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on hopes for a deal between Greece and its creditors

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

06:00 Switzerland UBS Consumption Indicator May 1.67 Revised From 1.25 1.73

08:00 Germany IFO - Business Climate June 108.5 108.1 107.4

08:00 Germany IFO - Current Assessment June 114.3 114.1 113.1

08:00 Germany IFO - Expectations June 103.0 102.5 102.0

08:30 United Kingdom BBA Mortgage Approvals May 42.0 Revised From 42.1 42.5

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications June -5.5% 1.6%

The U.S. dollar traded mixed against the most major currencies ahead of the final U.S. gross domestic product (GDP) data. The final U.S. GDP is expected to decline 0.2% in the first quarter.

The euro traded higher against the U.S. dollar on hopes for a deal between Greece and its creditors. Greek Prime Minister Alexis Tsipras is set to meet European Central Bank President Mario Draghi, the International Monetary Fund Managing Director Christine Lagarde and European Commission President Jean-Claude Juncker in Brussels today.

Tsipras said before flying to Brussels that some latest Greek reform proposals were refused by its creditors.

The Eurogroup's meeting is scheduled to be later in the day, while next Eurozone leaders' meeting is scheduled to be tomorrow.

EU officials said on Monday and on Tuesday that a deal could be reached this week.

Meanwhile, the economic data from the Eurozone was weaker than expected. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

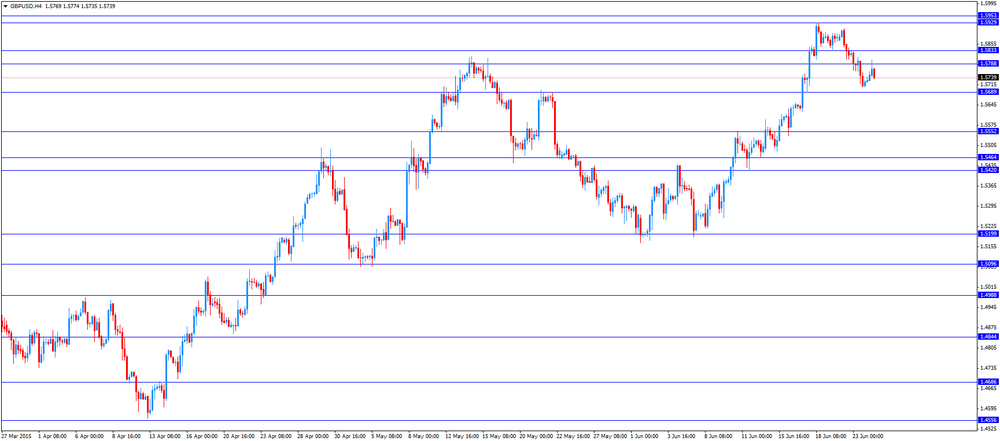

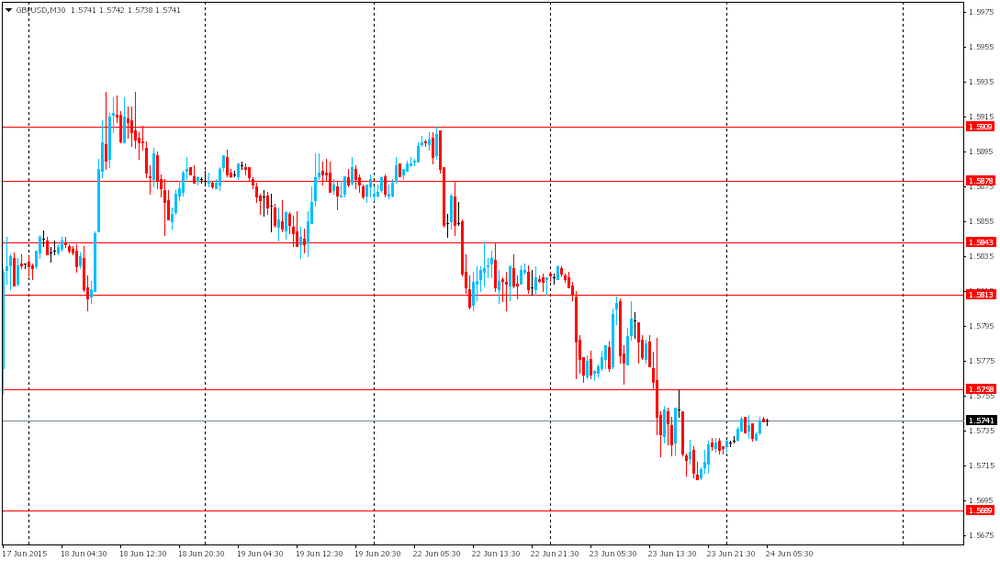

The British pound traded mixed against the U.S. dollar after the number of mortgage approvals data in the U.K. The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

EUR/USD: the currency pair increased to $1.1234

GBP/USD: the currency pair traded mixed

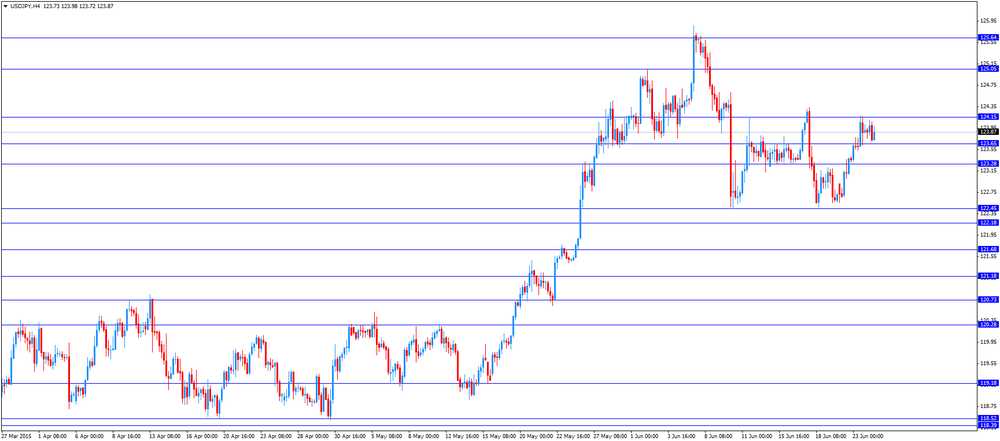

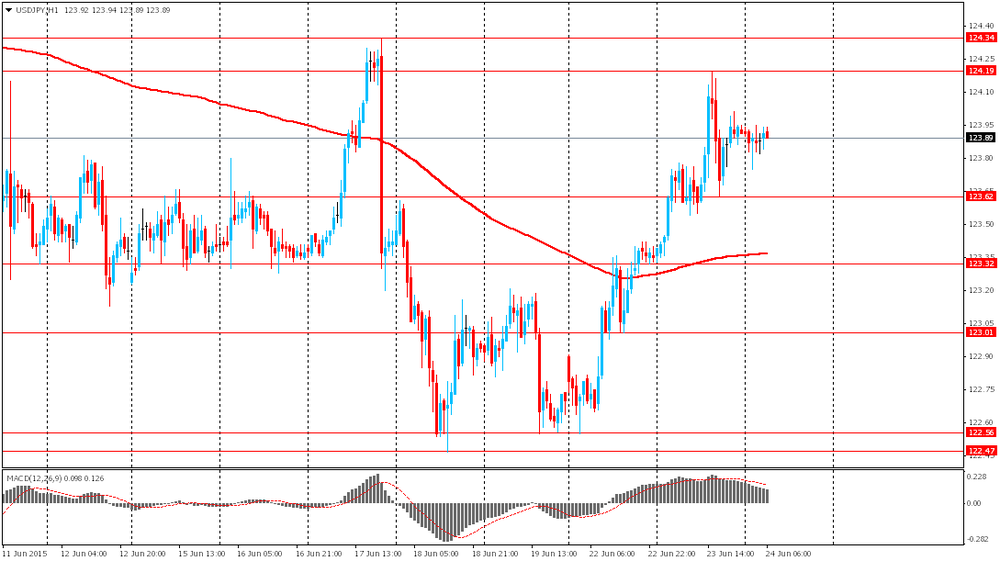

USD/JPY: the currency pair fell to Y123.71

The most important news that are expected (GMT0):

12:30 U.S. GDP, q/q (Finally) Quarter I 2.2% -0.2%

13:00 Belgium Business Climate June -4.9 -5.1

13:00 Switzerland SNB Quarterly Bulletin

14:30 U.S. Crude Oil Inventories June -2.676 -1.8

-

14:00

Orders

EUR/USD

Offers 1.1220 1.1240-4 1.1280 1.1300 1.1330 1.1350 1.1365

Bids 1.1170 1.1150 1.1130 1.1100 1.1080 1.1050 1.1030 1.1000

GBP/USD

Offers 1.5820-25 1.5850 1.5875 1.5900 1.5925 1.5940 1.5960

Bids 1.5760-65 1.5750 1.5725 1.5700 1.5680 1.5650 1.5630

EUR/GBP

Offers 0.7125 0.7140 0.7150 0.7170 0.7180-85 0.7200 0.7220

Bids 0.7080-85 0.7065 0.7050 0.7030 0.7000

EUR/JPY

Offers 139.30 139.50 139.80 140.00 140.20 140.50 140.80 141.00

Bids 138.75 138.60 138.35 138.00 137.80 137.50

USD/JPY

Offers 124.20-25 124.40 124.50 124.75 125.00 125.25

Bids 123.70-75 123.50 123.20 123.00122.75 122.50 122.30

AUD/USD

Offers 0.7750-60 0.7785 0.7800 0.7825-30 0.7850

Bids 0.7720 0.7700 0.7680 0.7650 0.7630 0.7600

-

13:00

U.S.: MBA Mortgage Applications, June 1.6%

-

12:00

European stock markets mid session: stocks traded mixed, debt talks between Greece and its creditors remain in focus

Stock indices traded mixed, debt talks between Greece and its creditors remain in focus. Greek Prime Minister Alexis Tsipras is set to meet European Central Bank President Mario Draghi, the International Monetary Fund Managing Director Christine Lagarde and European Commission President Jean-Claude Juncker in Brussels today.

The Eurogroup's meeting is scheduled to be later in the day, while next Eurozone leaders' meeting is scheduled to be tomorrow.

EU officials said on Monday and on Tuesday that a deal could be reached this week.

Meanwhile, the economic data from the Eurozone was weaker than expected. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

Current figures:

Name Price Change Change %

FTSE 100 6,840.83 +5.96 +0.09 %

DAX 11,415.29 -127.25 -1.10 %

CAC 40 5,011.95 -45.73 -0.90 %

-

11:44

European Central Bank approved the amount of emergency funding (ELA) on Wednesday

Reuters reported that the European Central Bank (ECB) approved the amount of emergency funding (ELA) that Greece requested for its banks on Wednesday. The amount has not been disclosed.

The European Central Bank (ECB) Tuesday raised the amount the Greek central bank can lend its banks (the emergency liquidity assistance (ELA)) by "a bit less than one billion euros" to around €89 billion, according to Reuters. It was the fourth increase in less than a week.

-

11:29

International Monetary Fund warns Australia that its economic growth is likely to remain below potential if the country will not implement reforms

The International Monetary Fund (IMF) released its annual review of Australia on Wednesday. The IMF warned Australia that its economic growth is likely to remain below potential if the country will not implement reforms.

"Over the medium term and without reform, growth is likely to converge to a slower potential rate, reflecting less capital accumulation and only modest productivity growth. This lower potential would still mean income growth in line with other advanced countries, but significantly slower than Australians have been used to over the last two decades," the IMF said.

The IMF urged Australia to implement tax reform and to increase infrastructure spending.

The IMF also said that the Reserve Bank of Australia might cut its interest rate again if the financial stability risks remained contained.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1130/40(E624mn), $1.1180(E395mn), $1.1200(E1.2bn)

USD/JPY: Y123.50($280mn), Y123.90/00($282mn), Y125.00($232mn)

EUR/JPY: Y138.40(E443mn)

EUR/STG: stg0.7100(E220mn)

AUD/USD: $0.7820(A$220mn)

USD/CAD: Cad1.2465($300mn)

NZD/USD: $0.6960 (NZ$280mn)

-

11:12

Number of mortgage approvals in the U.K. is up to 42,530 in May

The British Bankers' Association (BBA) released the number of mortgage approvals in the U.K. on Tuesday. The number of mortgage approvals increased to 42,530 in May from 42,020 in April. It was the highest reading since March 2014.

"The numbers show that the property market remains buoyant after the general election. Personal borrowing by British families also seems to be strong -- the uptake of personal loans and credit card borrowing is further proof of consumers' confidence," the chief economist at the BBA, Richard Woolhouse, said.

-

10:57

French final GDP rises 0.6% in the first quarter

The French statistical office Insee released its final gross domestic product data for France on Wednesday. The French final GDP rose 0.6% in the first quarter, in line with the preliminary estimate, after a 0.1% increase in the fourth quarter. It was the biggest increase since the second quarter of 2013.

Household spending gained 0.9% in the first quarter, while government spending remained unchanged at 0.5%.

Exports climbed 1.1% in the first quarter, while imports rose 2.6%.

-

10:44

German business confidence index drops to 107.4 in June

German Ifo Institute released its business confidence figures for Germany on Wednesday. German business confidence index dropped to 107.4 in June from 108.5 in May, missing expectations for a decline to 108.1.

"The outlook for the German economy is overcast," Ifo President Hans-Werner Sinn said.

The Ifo current conditions index fell to 113.1 from 114.3, missing forecasts of a decline to 114.1.

The Ifo expectations index declined to 102 from 103. Analysts had expected the index to decrease to 102.5.

-

10:30

United Kingdom: BBA Mortgage Approvals, May 42.5

-

10:27

UBS consumption index rises to 1.73 in May

UBS released its consumption index for Switzerland on Wednesday. The UBS consumption index increased to 1.73 in May from 1.67 in April.

April's figure was revised up from 1.25.

The increase was driven by a rise in new car registrations and retailer sentiment. New car registrations rose 6.0% in May, while the retailer sentiment index increased to -11 in May from -12 in April.

These figures indicate robust growth in private consumption.

-

10:15

Bank of Japan’s May monetary policy meeting minutes: the country’s economy continued to recover moderately, but there are downside risks to the recovery

The Bank of Japan (BoJ) released its May monetary policy meeting minutes on late Tuesday. According to minutes, the country's economy continued to recover moderately. But there are downside risks to the recovery from developments in emerging and commodity-driven economies as well as the Greek debt problem and the possible tightening of monetary policy in the US.

The BoJ expects the consumer price inflation to be "about 0% for the time being" as energy prices remain low.

Private consumption was resilient, while housing investment showed some signs of picking up, the central bank noted.

Minutes showed that the central bank wants to continue its monetary policy until the 2% inflation target will be reached, and it will adjust its monetary policy if needed.

The BoJ decided to keep unchanged its monetary policy at its May meeting.

-

10:00

Germany: IFO - Business Climate, June 107.4 (forecast 108.1)

-

10:00

Germany: IFO - Current Assessment , June 113.1 (forecast 114.1)

-

10:00

Germany: IFO - Expectations , June 102.0 (forecast 102.5)

-

09:18

Oil: prices are waiting for news

West Texas Intermediate futures for August delivery climbed to $61.12 (+0.18%), while Brent crude for August advanced to $64.59 (+0.22%) a barrel. Today investors are waiting for data on U.S. crude inventories (14:30 GMT), while the deadline for an agreement on Iran nuclear program will be the center of attention next week (June the 30th).

Some sources say that Iran has at least 34 tankers of oil ready to be sold as soon as sanctions are lifted. At the same time Saudi Arabia, OPEC's largest producer, is not going to reduce output to allow Iran claim its market share. This could push oil prices down. In addition to that, Gulf exporters may offer discounts to their customers to protect their own interests.

However there are still obstacles on the way to an agreement and the June 30 dead line could be postponed.

-

09:14

Gold is weighed by gains in equities and hopes for a Greek deal

Gold is currently at $1,176.80 (+0.02%) an ounce. The non-interest-paying metal has declined for a fourth session in a row amid a stronger dollar and equity markets' optimism about Greek debt agreement.

Gold is losing its appeal as a safe-haven asset as Greek officials express confidence that a deal with Greece's international lenders will be reached soon.

Gold is also experiencing pressure from expectations that the Federal Reserve will raise rates this year. The dollar's strength is also a negative factor for bullion.

Physical demand in Asia remained weak.

-

09:11

Global Stocks: equities report modest gains

U.S. stocks gained amid May data on sales of new single-family homes, which showed that new homes were sold at an annual rate of 546,000. This is the fastest pace since February 2008. April numbers were revised up. However orders for durable U.S. goods fell by a seasonally adjusted 1.8% in May, mostly because of a 35.3% drop in nondefense aircraft & parts orders.

The Dow Jones industrial average rose by 24.29 points, or 0.13%, to 18,144.07. The Standard & Poor's 500 rose by 1.35 points, or 0.06%, to 2,124.20. The Nasdaq Composite gained 6.12 points, or 0.12%, to close at 5,160.09 (the second consecutive session of closing at record).

In Asia Hong Kong Hang Seng rose by 0.08%, or 21.18 points, to 27,354.64. China Shanghai Composite Index advanced by 0.08%, or 3.76 points, to 4,580.25. Meanwhile the Nikkei rose by 0.51%, or 105.90 points, to 20,915.32.

Asian stocks advanced following modest gains in U.S. equity markets. Investors were also optimistic that Greece would find understanding with its lenders and a deal would be reached.

-

09:06

Foreign exchange market. Asian session: the dollar extended gains

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

06:00 Switzerland UBS Consumption Indicator May 1.25 1.73

The euro stayed near yesterday's lows. This single currency is still weighed by positive attitude towards the dollar, ECB's quantitative easing and expectations of a deal between Greece and its lenders. Yesterday an official from Greece said that the country is ready to meet its obligations and make a payment to the IMF on June the 30th.

The sterling was suppressed by CBI's data, which showed that UK industry orders fell to their lowest level since July 2013 in June. The CBI Industrial Trends total order book balance fell to -7 from -5 in May. Export orders fell to -17 in June from -7 in May.

Meanwhile U.S. durable orders data for May were mixed, indicating that the country's manufacturing might remain quite weak in the coming months. May durable goods orders fell by -1.8%. The decline was driven by the aircraft industry. Orders except transportation posted +0.5%, ex defense orders posted -2.1%. Nondefense capital goods orders ex aircraft came in at +0.4%. However nondefense aircraft & parts orders fell by 35.3%.

EUR/USD: the pair has traded around $1.1160-85 this morning

USD/JPY: the pair traded around Y123.95

GBP/USD: the pair traded around $1.5725-45

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Germany IFO - Business Climate June 108.5 108.1

08:00 Germany IFO - Current Assessment June 114.3 114.1

08:00 Germany IFO - Expectations June 103.0 102.5

08:30 United Kingdom BBA Mortgage Approvals May 42.1

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications June -5.5%

12:30 U.S. GDP, q/q (Finally) Quarter I 2.2% -0.2%

13:00 Belgium Business Climate June -4.9 -5.1

13:00 Switzerland SNB Quarterly Bulletin

14:30 U.S. Crude Oil Inventories

-

08:12

Options levels on wednesday, June 24, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1348 (3671)

$1.1289 (3350)

$1.1246 (1731)

Price at time of writing this review: $1.1195

Support levels (open interest**, contracts):

$1.1132 (2075)

$1.1091 (4202)

$1.1034 (5066)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 56656 contracts, with the maximum number of contracts with strike price $1,1500 (5273);

- Overall open interest on the PUT options with the expiration date July, 2 is 88053 contracts, with the maximum number of contracts with strike price $1,1000 (13884);

- The ratio of PUT/CALL was 1.55 versus 1.56 from the previous trading day according to data from June, 23

GBP/USD

Resistance levels (open interest**, contracts)

$1.6001 (613)

$1.5902 (702)

$1.5804 (1223)

Price at time of writing this review: $1.5762

Support levels (open interest**, contracts):

$1.5692 (631)

$1.5596 (782)

$1.5498 (639)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22402 contracts, with the maximum number of contracts with strike price $1,5500 (2544);

- Overall open interest on the PUT options with the expiration date July, 2 is 25710 contracts, with the maximum number of contracts with strike price $1,5100 (2113);

- The ratio of PUT/CALL was 1.15 versus 1.14 from the previous trading day according to data from June, 23

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Switzerland: UBS Consumption Indicator, May 1.73

-

03:57

Nikkei 225 20,922 +112.58 +0.54 %, Hang Seng 27,404.16 +70.70 +0.26 %, Shanghai Composite 4,639.82 +63.33 +1.38 %

-

03:31

Commodities. Daily history for Jun 23’2015:

(raw materials / closing price /% change)

Oil 61.13 +0.20%

Gold 1,176.40 -0.02%

-

03:30

Stocks. Daily history for Jun 23’2015:

(index / closing price / change items /% change)

Nikkei 225 20,739.37 +311.18 +1.52 %

Hang Seng 27,114.44 +33.59 +0.12 %

S&P/ASX 200 5,674.5 +64.33 +1.15 %

Shanghai Composite 4,270.98 -207.38 -4.63 %

Topix 1,672.07 +23.46 +1.42 %

FTSE 100 6,834.87 +9.20 +0.13 %

CAC 40 5,057.68 +59.07 +1.18 %

Xetra DAX 11,542.54 +82.04 +0.72 %

S&P 500 2,124.2 +1.35 +0.06 %

NASDAQ Composite 5,160.1 +6.12 +0.12 %

Dow Jones 18,144.07 +24.29 +0.13 %

-

03:28

Currencies. Daily history for Jun 23’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1166 -1,56%

GBP/USD $1,5725 -0,62%

USD/CHF Chf0,9341 +1,37%

USD/JPY Y123,91 +0,45%

EUR/JPY Y138,37 -1,09%

GBP/JPY Y194,85 -0,16%

AUD/USD $0,7733 +0,05%

NZD/USD $0,6851 -0,18%

USD/CAD C$1,2330 +0,15%

-

03:01

Schedule for today, Wednesday, Jun 24’2015:

(time / country / index / period / previous value / forecast)

06:00 Switzerland UBS Consumption Indicator May 1.25

08:00 Germany IFO - Business Climate June 108.5 108.1

08:00 Germany IFO - Current Assessment June 114.3 114.1

08:00 Germany IFO - Expectations June 103.0 102.5

08:30 United Kingdom BBA Mortgage Approvals May 42.1

09:00 Eurozone Eurogroup Meetings

11:00 U.S. MBA Mortgage Applications June -5.5%

12:30 U.S. GDP, q/q (Finally) Quarter I 2.2% -0.2%

13:00 Belgium Business Climate June -4.9 -5.1

13:00 Switzerland SNB Quarterly Bulletin

14:30 U.S. Crude Oil Inventories June -2.676 -1.8

-