Noticias del mercado

-

22:05

Major US stock indexes finished trading above zero

Major US stock indexes rose modestly Tuesday after two sessions of losses. The dynamics of trade enjoyed M & A activity in the consumer market and the health care market. Investors are also awaiting the results of the two-day Federal Reserve meeting. The central bank is unlikely to raise rates at this meeting, but investors will be watching for any hints of this from Janet Yellen at a press conference after a meeting on Wednesday. The Fed said that it remains dependent on makroekonomicheskih data raise rates only when it sees an improvement in the economy. In the second quarter data indicate a recovery of growth arrest at the beginning of the year.

In addition, as sobschilo Ministry of Commerce on Tuesday, the pace of construction of houses has slowed in May, after the rapid growth in early spring, but the underlying demand for homes seems to be increasing, as more Americans get jobs and wages rise. Bookmarks new homes in the US fell by 11.1% compared to the previous month and reached a seasonally adjusted annual rate of 1,036 thousand. Units. Nevertheless, bookmarks were up 22.1% in April, more than preliminary estimates. Economists had expected the establishment of new homes will be reduced to the level of 1100 thousand. In May.

However, the price of oil rose slightly today, due to expectations of an increase in demand and the threat of tropical storms along the Gulf Coast. Experts note that a tropical storm is forecast, could reach the Texas coast Tuesday morning. Along the Gulf Coast in the state is over 45% of oil refining and gas processing facilities about half of the United States.

Most components of the index DOW closed in positive territory (27 of 30). Most remaining shares rose UnitedHealth Group Incorporated (UNH, + 2.12%). Outsider shares were Caterpillar Inc. (CAT, -0.64%).

Almost all sectors of the S & P recorded a positive trend. Most consumer goods sector grew (+ 0.9%). Reduction showed only the sector of conglomerates (-1.0%).

At the close:

Dow + 0.63% 17,903.68 +112.51

Nasdaq + 0.51% 5,055.55 +25.58

S & P + 0.57% 2,096.31 +11.88

-

21:00

Dow +0.65% 17,906.35 +115.18 Nasdaq +0.59% 5,059.67 +29.70 S&P +0.58% 2,096.53 +12.10

-

20:20

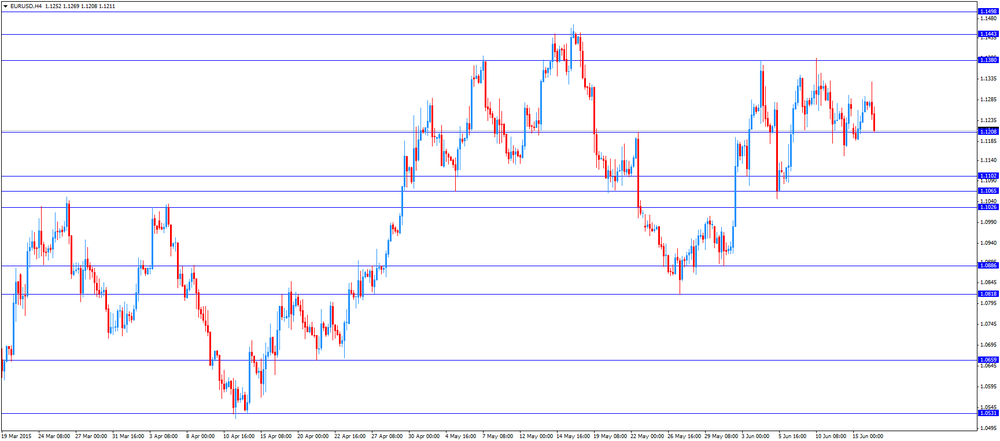

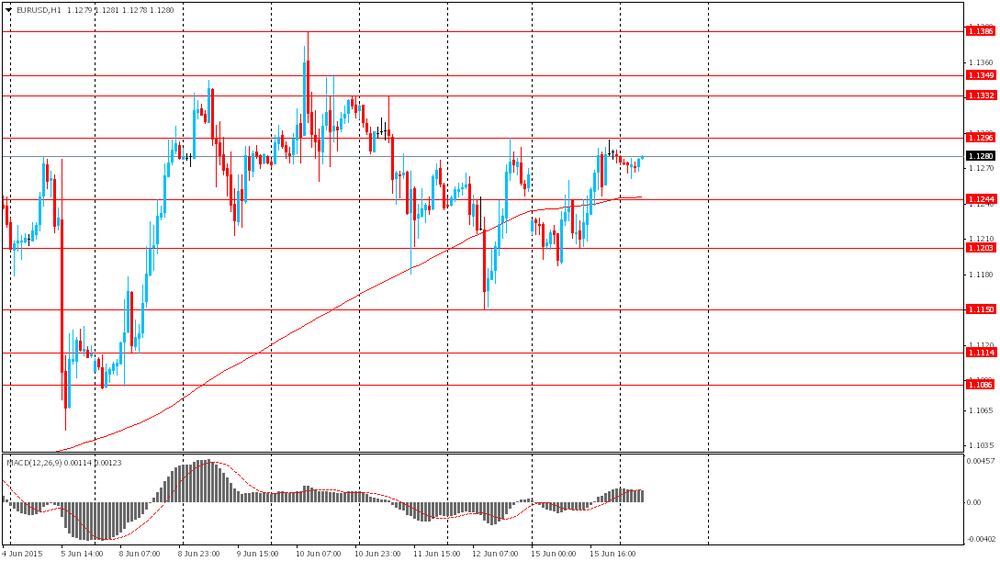

American focus: the euro fell against the US dollar

The dollar appreciated strongly against the euro, approaching to $ 1.12. Experts note that the euro under pressure in light of the lack of progress in the Greek negotiations. Also today, the German publication Bild reported that Greece plans to defer payment of the IMF in June for 6 months. The publication Bild quoted unnamed sources in Europe. However, the Greek government has denied reports that Athens plans to delay debt payments. Earlier today, it was rumored that on Sunday held an extraordinary meeting of eurozone authorities. In turn, German Chancellor Merkel said that almost no information on the progress in the negotiations between Greece and its creditors. Merkel added that she is not sure that will be possible to reach an agreement by Thursday.

In addition, investors caution pending the outcome of the next meeting of the Federal Reserve System (FRS) the USA, which will be held June 16-17. According to the consensus forecast, the Fed will refrain from raising interest rates in June, but it may toughen the wording of the statement in preparation for the normalization of monetary policy.

Small influenced today's data on the US housing market. The Commerce Department reported that the establishment of new homes in the US fell by 11.1% compared to the previous month and reached a seasonally adjusted annual rate of 1,036 thousand. Units. Nevertheless, bookmarks were up 22.1% in April, more than preliminary estimates. Economists had expected the establishment of new homes will be reduced to the level of 1100 thousand. In May. Report on Tuesday suggests that the pace of construction can recover later this year. Building permits rose 11.8% last month to equal 1275 thousand., Exceeding economists' expectations in 1100 thousand. Permits. Data on housing starts are inaccurate and often revised as more data become available. Broader trends show a marked increase in activity. Bookmarks new homes were 5.1% higher in May compared with a year earlier, while building permits were more than 25.4%.

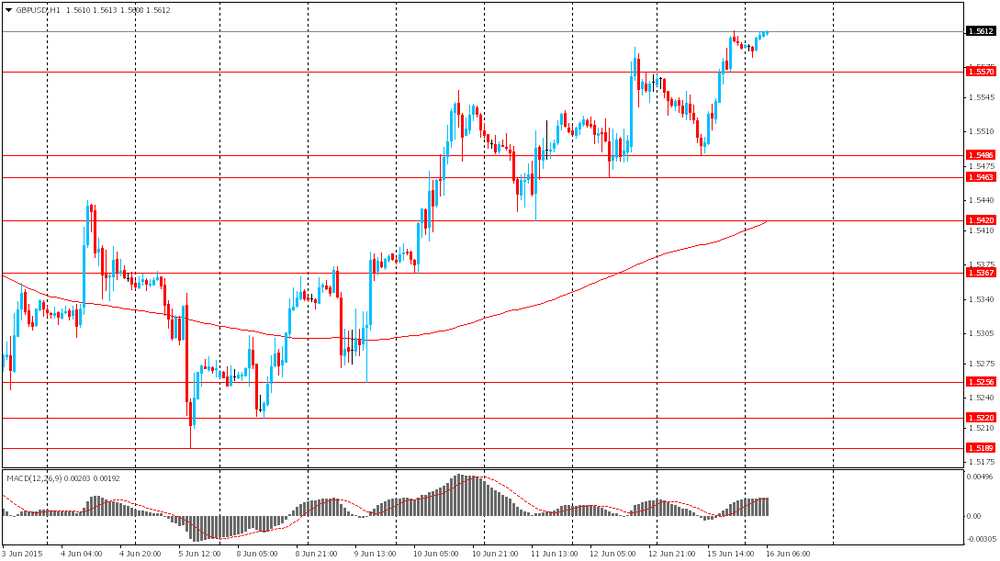

The pound rose against the dollar, recovering all the lost ground earlier and reached a three-week high as investors turn their attention to tomorrow's meeting of the FOMC. Despite the fact that the increase in June, almost no one expects the market will closely monitor the language of the statement. Support currency also had a report from the Conference Board, which showed that the results of April leading economic index (LEI) for the UK increased by 0.4 percent to 113.6 points (2010 = 100) after rising 0.3 percent in March and an increase of 0.7 percent in February. Within six months (April), this figure rose by 1.4 percent (about 2.9 per cent per annum) compared with an increase of 0.6 percent (about 1.3 per cent per annum) over the previous six months. Meanwhile, the coincident economic indicator (CEI) improved by 0.2 percent to 106.0 (2010 = 100), after rising 0.2 percent in March and February. For the six-month period (April) index rose by 1.4 percent (about 2.9 per cent per annum compared with 0.6 percent (about 1.2 per cent per annum) over the previous six months. Taken together, the changes of the composite index suggests that the economy It is likely to continue to grow moderately during the summer, and has the potential to accelerate growth.

Earlier significant pressure on the pound have inflation data. As it became known, in the UK, consumer prices rose in May after falling for the first time since 1960. Consumer prices rose by 0.1 percent compared to last year as economists expected, offsetting 0.1 percent drop in April. On a monthly measurement of consumer price index rose 0.2 percent, as in April, and in accordance with expectations. Core inflation, which excludes energy, food, alcoholic beverages and tobacco increased by 0.9 percent compared to 0.8 percent in April. Another report from the ONS showed that producer prices fell by 1.6 percent, according to the forecast, and slower than the 1.7 percent decline in April. This was the eleventh consecutive decline in prices. As expected, a monthly measurement of producer prices rose 0.1 percent for the third month in a row in May.

-

19:08

WSE: Session Results

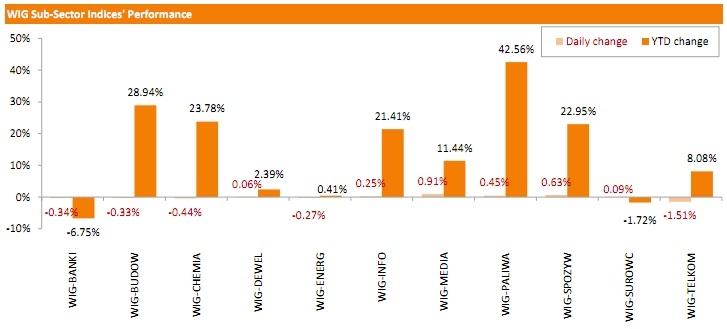

Polish equity market closed lower on Tuesday with the broad measure, the WIG index, sliding 0.08%. Sector performance within the WIG Index was mixed. Media companies (+0.91%) and food names (+0.63%) were the biggest gainers, while telecommunications (-1.51%) recorded the most notable drop.

The large-cap companies' benchmark, the WIG30 Index, recorded a modest loss of 0.02%. BOGDANKA (WSE: LWB) became the best performer among the WIG30 Index constituents, rebounding by 2.95% after a drastic 12-session decline. It was followed by GTC (WSE: GTC) and MBANK (WSE: MBK), advancing 2.43% and 2.07% respectively. At the same time, EUROCASH (WSE: EUR), ENEA (WSE: ENA) and JSW (WSEP: JSW) lagged, correcting down by 3.05%, 2.83% and 2.17%.

-

18:45

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes were up on Tuesday, after two straight sessions of losses, as deal activity picked up in the consumer and healthcare sectors and investors waited for the outcome of a two-day Federal Reserve meeting. The central bank is unlikely to raise rates in this meeting but investors will watch for any hints from Fed Chair Janet Yellen at a press conference after the meeting on Wednesday about the timing of a possible rate increase - the first in about a decade. The Fed has said it remains data-dependent and will raise rates only when it sees an improvement in the economy. Second-quarter data points to a recovery after a halt in growth earlier in the year. U.S. housing starts fell in May after a sharp increase the previous month, but a surge in permits for future construction to a near eight-year high suggested the pullback was temporary and pointed to underlying strength in housing.

Almost all of Dow stocks in positive area (25 of 30). Top looser - Caterpillar Inc. (CAT, -0.93%). Top gainer - UnitedHealth Group Incorporated (UNH, +1.74%).

S&P index sectors are mixed. Top gainer - Consumer goods (+0,7%). Top looser - Conglomerates (-0.7%).

At the moment:

Dow 17793.00 +81.00 +0.46%

S&P 500 2083.00 +7.50 +0.36%

Nasdaq 100 4438.75 +10.75 +0.24%

10-year yield 2.32% -0.04

Oil 60.01 +0.49 +0.82%

Gold 1180.80 -5.00 -0.42%

-

18:02

European stocks close: most stocks closed higher despite concerns over the possible Greek default

Most stock indices closed higher despite concerns over the possible Greek default. The weekend's debt talks between Greece and its creditors were unsuccessful.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Investors are also awaiting the release of the Fed's monetary policy meeting results. The results are scheduled to be released tomorrow. Analysts expect that the central bank will keep unchanged its monetary policy.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index slid to 31.5 in June from 41.9 in May, missing expectations for a decline to 37.1.

The ZEW President Clemens Fuest said that "the ongoing uncertainty over Greece's future and the restrained dynamic of the global economy" weighed on the German economy.

Eurozone's ZEW economic sentiment index dropped to 53.7 in June from 61.2 in May.

Employment in the Eurozone climbed 0.1% in the first quarter, after a 0.1% rise in the fourth quarter.

German final consumer price index rose 0.1% in May, in line with the preliminary estimate, after a flat reading in April.

The increase was driven by higher food and non-alcoholic beverages costs.

On a yearly basis, German final consumer price index increased to 0.7% in May from 0.5% in April, in line with the preliminary estimate. It was the highest level since October 2014.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% in May from -0.1% in April, in line with expectations.

The increase was driven by higher prices for airfares and smaller declines in food and fuel prices than a year earlier.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 0.9% in May from 0.8% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,710.1 -0.42 -0.01 %

DAX 11,044.01 +59.04 +0.54 %

CAC 40 4,839.86 +24.50 +0.51 %

-

18:00

European stocks closed: FTSE 100 6,710.1 -0.42 -0.01% CAC 40 4,839.86 +24.50 +0.51% DAX 11,044.01 +59.04 +0.54%

-

17:43

Oil prices traded higher on speculation on the higher oil demand as a tropical storm Bill headed towards the oil-producing state of Texas

Oil prices traded higher on speculation on the higher oil demand as a tropical storm Bill headed towards the oil-producing state of Texas. More than 45% of U.S. oil refining capacity is located along the Gulf Coast.

Investors are awaiting the release of the U.S. oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data today, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

The debt talks between Greece and its creditors remained in focus. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Investors are also awaiting the release of the Fed's monetary policy meeting results. The results are scheduled to be released tomorrow. Analysts expect that the central bank will keep unchanged its monetary policy.

WTI crude oil for July delivery increased to $59.88 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $63.97 a barrel on ICE Futures Europe.

-

17:25

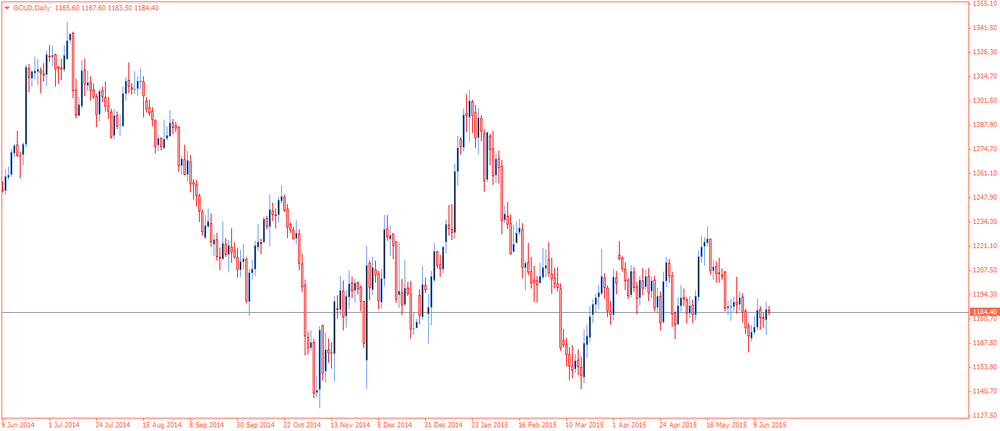

Gold price traded lower on a stronger U.S. dollar

Gold price traded lower on a stronger U.S. dollar. The U.S. dollar rose other currencies ahead of the release of the Fed's monetary policy meeting results. The results are scheduled to be released tomorrow. Analysts expect that the central bank will keep unchanged its monetary policy. Market participants will monitor closely a speech by the Fed Chair Janet Yellen for signs when the central bank starts raising its interest rate.

The debt talks between Greece and its creditors remained in focus. Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Assets at SPDR Gold Trust declined 0.3% to 701.9 tonnes on Monday, the lowest level since 2008.

Speculation on that the Fed start raising its interest rate this year weighed on gold price.

Lower physical demand in Asia also weighed on gold price.

June futures for gold on the COMEX today fell to 1177.00 dollars per ounce.

-

16:18

Greek Finance Minister Yanis Varoufakis: Athens will not provide a new reform proposal to its creditors at the upcoming meeting of finance ministers

Greek Finance Minister Yanis Varoufakis said on Tuesday that Athens will not provide a new reform proposal to its creditors at the upcoming meeting of finance ministers.

"The Eurogroup is not the right place to present proposals which haven't been discussed and negotiated on a lower level before," he noted.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Varoufakis added that Greece is ready to continue the debt talks.

-

15:57

German newspaper Süddeutsche Zeitung: capital controls by the European Central Bank could be imposed this weekend

German newspaper Süddeutsche Zeitung reported on Monday that capital controls by the European Central Bank could be imposed this weekend. Athens denied this report.

According to Süddeutsche Zeitung, Athens' creditors will provide an ultimatum proposal to Greece. If the debt talks does not make any progress this week, capital controls will be imposed.

Capital controls were last imposed in Cyprus in 2013.

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: Jun17 $1.1200(E500mn); Jun19 $1.1200(2.7bn)

USD/JPY: Jun18 Y124.00($732mn); Jun19 Y122.00($2.8bn), Y124.50($1.7bn), Y125.00($4.0bn)

GBP/USD: Jun18 $1.5400(Gbp1.0bn); Jun19 $1.55(Gbp900mn)

AUD/USD: Jun18 $0.7700(A$1.42bn); Jun19 $0.7600(A$637mn)

NZD/USD: Jun18 $0.6975(NZ$2.21bn), $0.7000(NZ$701mn)

USD/CAD: Jun16 C$1.2185($1.0bn), 1.2500-10($1.2bn)

-

15:38

June’s Reserve Bank of Australia monetary policy meeting: further interest rate cut is possible

The Reserve Bank of Australia (RBA) released its minutes from June monetary policy meeting on Tuesday. The RBA said that the monetary policy should be accommodative.

The Australian dollar's exchanged rate "continued to offer less assistance", according to the central bank. Board members pointed out that further depreciation of the Australian dollar "seemed to be both likely and necessary". The interest rate cut will be depend on the incoming economic data.

The RBA kept unchanged its interest rate at 2.00% in June.

-

15:33

U.S. Stocks open: Dow +0.01%, Nasdaq -0.06%, S&P -0.08%

-

15:27

Before the bell: S&P futures -0.18%, NASDAQ futures -0.30%

U.S. stock-index futures declined as the Federal Reserve begins a two-day meeting and investors watch for progress in negotiations between Greece and its creditors.

Global markets:

Nikkei 20,257.94 -129.85 -0.64%

Hang Seng 26,566.7 -295.11 -1.10%

Shanghai Composite 4,888.65 -174.35 -3.44%

FTSE 6,684.72 -25.80 -0.38%

CAC 4,809.2 -6.16 -0.13%

DAX 10,947.31 -37.66 -0.34%

Crude oil $59.71 (+0.32%)

Gold $1182.10 (-0.31%)

-

15:15

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

The Coca-Cola Co

KO

39.63

+0.10%

14.2K

Walt Disney Co

DIS

110.29

+0.10%

0.3K

Apple Inc.

AAPL

127.10

+0.14%

322.9K

Nike

NKE

103.57

+0.21%

0.2K

UnitedHealth Group Inc

UNH

119.65

+0.56%

0.8K

Home Depot Inc

HD

111.00

+0.90%

1.0K

Procter & Gamble Co

PG

79.70

+2.02%

15.8K

Chevron Corp

CVX

99.29

0.00%

1.2K

E. I. du Pont de Nemours and Co

DD

69.05

0.00%

0.1K

Pfizer Inc

PFE

34.04

0.00%

0.1K

Exxon Mobil Corp

XOM

83.70

-0.02%

2.3K

AT&T Inc

T

34.40

-0.03%

8.1K

Wal-Mart Stores Inc

WMT

71.90

-0.04%

4.3K

Tesla Motors, Inc., NASDAQ

TSLA

250.20

-0.07%

4.5K

American Express Co

AXP

79.15

-0.13%

8.5K

Facebook, Inc.

FB

80.60

-0.14%

17.1K

General Electric Co

GE

27.17

-0.15%

16.3K

Johnson & Johnson

JNJ

97.33

-0.16%

1.8K

Amazon.com Inc., NASDAQ

AMZN

423.00

-0.16%

3.4K

Yandex N.V., NASDAQ

YNDX

17.22

-0.17%

5.2K

Goldman Sachs

GS

211.38

-0.18%

6.2K

Merck & Co Inc

MRK

57.02

-0.18%

1.5K

Microsoft Corp

MSFT

45.39

-0.19%

0.6K

Verizon Communications Inc

VZ

46.91

-0.19%

2.5K

Cisco Systems Inc

CSCO

28.42

-0.21%

0.6K

FedEx Corporation, NYSE

FDX

182.00

-0.22%

0.1K

International Business Machines Co...

IBM

165.87

-0.23%

1.5K

JPMorgan Chase and Co

JPM

67.82

-0.25%

5.5K

ALCOA INC.

AA

11.97

-0.25%

12.9K

Visa

V

68.39

-0.26%

0.5K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.54

-0.26%

3.4K

Boeing Co

BA

141.91

-0.27%

0.6K

Intel Corp

INTC

31.30

-0.29%

1.5K

McDonald's Corp

MCD

94.00

-0.32%

0.8K

Ford Motor Co.

F

15.00

-0.33%

14.7K

Caterpillar Inc

CAT

86.83

-0.34%

1K

3M Co

MMM

155.30

-0.37%

0.1K

Barrick Gold Corporation, NYSE

ABX

11.42

-0.44%

2.5K

Citigroup Inc., NYSE

C

56.40

-0.44%

8.0K

Yahoo! Inc., NASDAQ

YHOO

40.29

-0.44%

5.1K

Starbucks Corporation, NASDAQ

SBUX

52.01

-0.49%

0.1K

AMERICAN INTERNATIONAL GROUP

AIG

62.25

-0.51%

2.9K

Google Inc.

GOOG

524.24

-0.56%

0.3K

Twitter, Inc., NYSE

TWTR

34.32

-1.01%

238.5K

-

15:14

U.S. housing market is mixed in May

The U.S. Commerce Department released the housing market data on Tuesday. Housing starts in the U.S. declined 11.1% to 1,036 million annualized rate in May from a 1,165 million pace in April, exceeding expectations for a rise to 1.019 million. April's figure was revised up from 1,135 million units.

The decline was driven by a falls in both starts of single-family and multi-family homes.

Building permits in the U.S. climbed 11.8% to 1.275 million annualized rate in May from a 1.140 million pace in April. It was the highest level since August 2007.

Analysts had expected building permits to increase to 1.100 million units.

Starts of single-family homes dropped 5.7% in May. Building permits for single-family homes rose 2.6%.

Starts of multifamily buildings plunged 20.2% in May. Permits for multi-family housing jumped 24.9%.

Housing market activity may accelerate this year due to the improvements in the labour market.

-

15:07

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

American Intl (AIG) downgraded to Hold from Buy at Deutsche Bank

Other:

NIKE (NKE) target raised to $118 from $110 at Stifel

-

14:55

Foreign investors purchase C$12.94 billion of Canadian securities in April

Statistics Canada released foreign investment figures on Tuesday. Foreign investors purchased C$12.94 billion of Canadian securities in April, after a purchase of C$22.56 billion in March. It was the highest inflow since May 2012.

March's figure was revised up from a purchase of C$22.47 billion.

Canadian investors purchased C$6.6 billion of foreign securities in April, mainly non-US foreign securities.

-

14:39

Employment in the Eurozone climbs 0.1% in the first quarter

Eurostat released its employment data for the Eurozone on Tuesday. Employment in the Eurozone climbed 0.1% in the first quarter, after a 0.1% rise in the fourth quarter. Eurostat estimates that 150.3 million people were employed in the Eurozone in the first quarter of 2015.

The highest rises were recorded in Latvia (+1.5%), Estonia (+0.9%), Spain (+0.8%), Ireland, and Portugal (all +0.7%).

Employment was stable in Germany, France, Italy and the Netherlands.

-

14:30

U.S.: Building Permits, May 1275 (forecast 1100)

-

14:30

U.S.: Housing Starts, May 1036 (forecast 1100)

-

14:30

Canada: Foreign Securities Purchases, April 12.94

-

14:23

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on concerns over the Greek debt problem

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (YoY) May 2.8% 0.8%

01:30 Australia New Motor Vehicle Sales (MoM) May -1.5% -1.3%

01:30 Australia RBA Meeting's Minutes

05:45 Switzerland SECO Economic Forecasts

06:00 Germany CPI, m/m (Finally) May 0.0% 0.1% 0.1%

06:00 Germany CPI, y/y (Finally) May 0.5% 0.7% 0.7%

08:30 United Kingdom Retail Price Index, m/m May 0.4% 0.3% 0.2%

08:30 United Kingdom Retail prices, Y/Y May 0.9% 1.1% 1%

08:30 United Kingdom Producer Price Index - Input (MoM) May 1.4% Revised From 0.4% 0.4% -0.9%

08:30 United Kingdom Producer Price Index - Input (YoY) May -11.0% Revised From -11.7% -11.4% -12.0%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.1% 0.1% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May -1.7% -1.6% -1.6%

08:30 United Kingdom HICP, m/m May 0.2% 0.2% 0.2%

08:30 United Kingdom HICP, Y/Y May -0.1% 0.1% 0.1%

08:30 United Kingdom HICP ex EFAT, Y/Y May 0.8% 0.9%

09:00 Eurozone Employment Change Quarter I 0.1% 0.1%

09:00 Eurozone ZEW Economic Sentiment June 61.2 53.7

09:00 Germany ZEW Survey - Economic Sentiment June 41.9 37.1 31.5

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. housing market data. Housing starts in the U.S. are expected to decline to 1.100 million units in May from 1.135 million units in April.

The number of building permits is expected to fall to 1.100 million units in May from 1.140 million units in April.

The euro traded lower against the U.S. dollar on concerns over the Greek debt problem. The weekend's debt talks between Greece and its creditors were unsuccessful.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index slid to 31.5 in June from 41.9 in May, missing expectations for a decline to 37.1.

The ZEW President Clemens Fuest said that "the ongoing uncertainty over Greece's future and the restrained dynamic of the global economy" weighed on the German economy.

Eurozone's ZEW economic sentiment index dropped to 53.7 in June from 61.2 in May.

Employment in the Eurozone climbed 0.1% in the first quarter, after a 0.1% rise in the fourth quarter.

German final consumer price index rose 0.1% in May, in line with the preliminary estimate, after a flat reading in April.

The increase was driven by higher food and non-alcoholic beverages costs.

On a yearly basis, German final consumer price index increased to 0.7% in May from 0.5% in April, in line with the preliminary estimate. It was the highest level since October 2014.

The British pound traded mixed against the U.S. dollar in the release of the consumer inflation data from the U.K. The U.K. consumer price index rose to 0.1% in May from -0.1% in April, in line with expectations.

The increase was driven by higher prices for airfares and smaller declines in food and fuel prices than a year earlier.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 0.9% in May from 0.8% the month before.

The consumer price inflation is below the Bank of England's 2% target.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian foreign securities purchases data.

The Swiss franc traded lower against the U.S. dollar. The State Secretariat for Economic Affairs (SECO) released its economic growth forecasts for Switzerland on Tuesday. SECO lowered its economic growth forecast for 2015 to 0.8% from its March estimate of 0.9% due to a weak economic activity in the first quarter of 2015 and due to the downward revision of the U.S. economic growth in 2015.

SECO forecasted the growth of 1.6% in 2016, down from its March estimate of 1.8%.

Inflation forecasts were left unchanged. Inflation is expected to be -1% this year and +0.3% in 2016.

Unemployment rate is expected to be at 3.3% this year, at 3.5% in 2016, up from its March estimate of 3.4%.

EUR/USD: the currency pair decreased to $1.1208

GBP/USD: the currency pair traded mixed

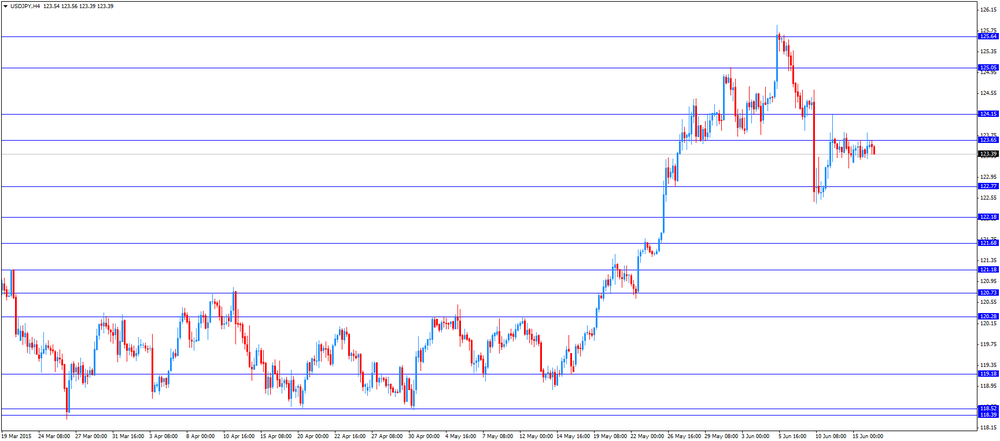

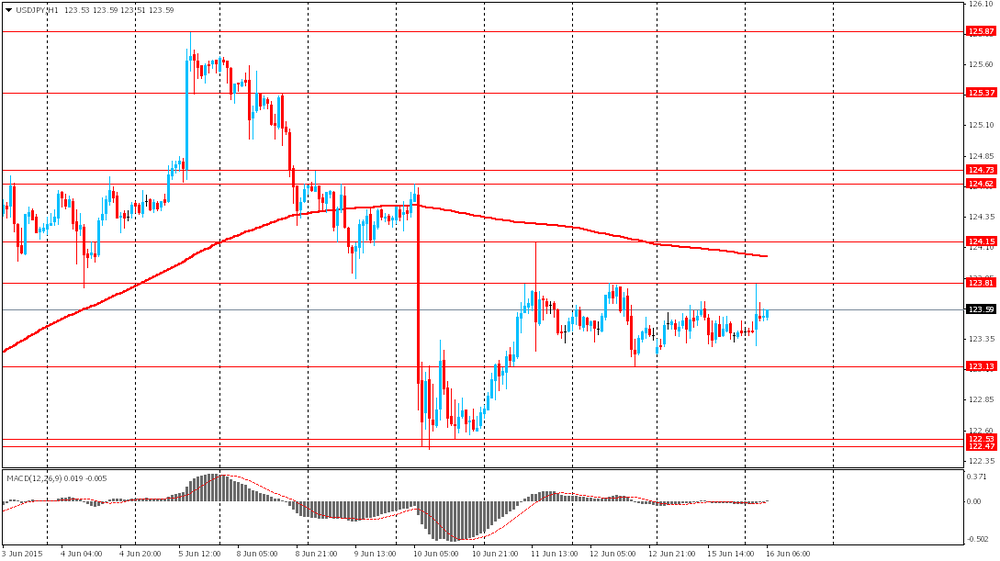

USD/JPY: the currency pair fell to Y123.39

The most important news that are expected (GMT0):

12:30 Canada Foreign Securities Purchases April 22.47

12:30 U.S. Housing Starts May 1135 1100

12:30 U.S. Building Permits May 1140 1100

22:45 New Zealand Current Account Quarter I -3190 235

23:50 Japan Trade Balance Total, bln May -53.4 -226

-

14:00

Orders

EUR/USD

Offers 1.1260 1.1280 1.1300 1.1320 1.1340 1.1365 1.1380 1.1400

Bids 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100 1.1080-85 1.1065 1.1050

GBP/USD

Offers 1.5650 1.5670 1.5685 1.5700 1.5725 1.5745 1.5780 1.5800

Bids 1.5585 1.5565 1.5540 1.5520-25 1.5500 1.5480-85 1.5460 1.5440-45 1.5425 1.5400

EUR/GBP

Offers 0.7250-55 0.7270 0.7285 0.7300 0.7320-25 0.7350

Bids 0.7210 0.7200 0.7185 0.7160 0.7130 0.7100

EUR/JPY

Offers 139.80 140.00 140.20 140.50 140.80 141.00

Bids 139.00 138.80 138.50 138.30 138.00 137.50 137.00

USD/JPY

Offers 123.80 124.00 124.25 124.40 124.75-80 125.00

Bids 123.30 123.00 122.80 122.60 122.30 122.00

AUD/USD

Offers 0.7730 0.7750 0.7770 0.7785 0.7800 0.7830 0.7850 0.7865 0.7880 0.7900

Bids 0.7700 0.7680 0.7650 0.7625-30 0.7600 0.7585 0.7550

-

12:01

European stock markets mid session: stocks traded lower on concerns over the Greek debt problem

Stock indices traded lower on concerns over the Greek debt problem. The weekend's debt talks between Greece and its creditors were unsuccessful.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Greek Finance Minister Yanis Varoufakis said that Athens will not provide a new reform proposal.

German newspaper Süddeutsche Zeitung reported that capital controls could be imposed this week. Athens denied this report.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index slid to 31.5 in June from 41.9 in May, missing expectations for a decline to 37.1.

The ZEW President Clemens Fuest said that "the ongoing uncertainty over Greece's future and the restrained dynamic of the global economy" weighed on the German economy.

Eurozone's ZEW economic sentiment index dropped to 53.7 in June from 61.2 in May.

Employment in the Eurozone climbed 0.1% in the first quarter, after a 0.1% rise in the fourth quarter.

German final consumer price index rose 0.1% in May, in line with the preliminary estimate, after a flat reading in April.

The increase was driven by higher food and non-alcoholic beverages costs.

On a yearly basis, German final consumer price index increased to 0.7% in May from 0.5% in April, in line with the preliminary estimate. It was the highest level since October 2014.

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% in May from -0.1% in April, in line with expectations.

The increase was driven by higher prices for airfares and smaller declines in food and fuel prices than a year earlier.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 0.9% in May from 0.8% the month before.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 6,681.66 -28.86 -0.43 %

DAX 10,873.66 -111.31 -1.01 %

CAC 40 4,777.72 -37.64 -0.78 %

-

11:42

State Secretariat for Economics (SECO) cut its growth forecasts for Switzerland

The State Secretariat for Economic Affairs (SECO) released its economic growth forecasts for Switzerland on Tuesday. SECO lowered its economic growth forecast for 2015 to 0.8% from its March estimate of 0.9% due to a weak economic activity in the first quarter of 2015 and due to the downward revision of the U.S. economic growth in 2015.

SECO forecasted the growth of 1.6% in 2016, down from its March estimate of 1.8%.

Inflation forecasts were left unchanged. Inflation is expected to be -1% this year and +0.3% in 2016.

Unemployment rate is expected to be at 3.3% this year, at 3.5% in 2016, up from its March estimate of 3.4%.

SECO warned that there is a risk on the Swiss economy due to the sharp appreciation of the Swiss franc.

SECO expects the Swiss economy to improve in the coming quarters.

-

11:25

Germany's ZEW economic sentiment index drops to 31.5 in June

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index slid to 31.5 in June from 41.9 in May, missing expectations for a decline to 37.1.

The ZEW President Clemens Fuest said that "the ongoing uncertainty over Greece's future and the restrained dynamic of the global economy" weighed on the German economy.

Eurozone's ZEW economic sentiment index dropped to 53.7 in June from 61.2 in May.

-

11:18

Option expiries for today's 10:00 ET NY cut

EUR/USD: Jun17 $1.1200(E500mn); Jun19 $1.1200(2.7bn)

USD/JPY: Jun18 Y124.00($732mn); Jun19 Y122.00($2.8bn), Y124.50($1.7bn), Y125.00($4.0bn)

GBP/USD: Jun18 $1.5400(Gbp1.0bn); Jun19 $1.55(Gbp900mn)

AUD/USD: Jun18 $0.7700(A$1.42bn); Jun19 $0.7600(A$637mn)

NZD/USD: Jun18 $0.6975(NZ$2.21bn), $0.7000(NZ$701mn)

USD/CAD: Jun16 C$1.2185($1.0bn), 1.2500-10($1.2bn)

-

11:16

Eurozone: ZEW Economic Sentiment, June 53.7

-

11:11

UK consumer price inflation rises to 0.1% in May

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% in May from -0.1% in April, in line with expectations.

The increase was driven by higher prices for airfares and smaller declines in food and fuel prices than a year earlier.

The Bank of England Governor (BoE) Mark Carney expects the consumer price inflation to rise towards the end of the year.

On a monthly basis, U.K. consumer prices increased 0.2% in May, in line with expectations, after a 0.2% rise in April.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 0.9% in May from 0.8% the month before.

The Retail Prices Index rose to 1.0% in May from 0.9% in April, missing expectations for an increase to 1.1%.

The consumer price inflation is below the Bank of England's 2% target.

-

11:00

Germany: ZEW Survey - Economic Sentiment, June 31.5 (forecast 37.1)

-

11:00

Eurozone: Employment Change, Quarter I 0.1%

-

10:55

German final consumer price inflation rises 0.1% in May

Destatis released its final consumer price data for Germany on Tuesday. German final consumer price index rose 0.1% in May, in line with the preliminary estimate, after a flat reading in April.

The increase was driven by higher food and non-alcoholic beverages costs. Food and non-alcoholic beverages climbed 1.4% year-on-year in May, while recreation and culture prices rose 1.7%.

On a yearly basis, German final consumer price index increased to 0.7% in May from 0.5% in April, in line with the preliminary estimate. It was the highest level since October 2014.

-

10:37

Bank of Japan Governor Haruhiko Kuroda said on he did not want to influence the yen’s exchange rate last week

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Tuesday that he did not want to influence the yen's exchange rate saying the yen was "very weak " last week.

"I didn't mean to evaluate the current nominal exchange rate or forecast the outlook. I just gave a theoretical explanation in response to a question about real effective rates," Kuroda noted today.

The BoJ pointed out that a weak yen boosts exports and revenues at companies operating overseas, but it hurts households and non-manufacturers as import costs rise.

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , May -1.6% (forecast -1.6%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), May 0.1% (forecast 0.1%)

-

10:30

United Kingdom: Retail Price Index, m/m, May 0.2% (forecast 0.3%)

-

10:30

United Kingdom: HICP, m/m, May 0.2% (forecast 0.2%)

-

10:30

United Kingdom: Retail prices, Y/Y, May 1% (forecast 1.1%)

-

10:30

United Kingdom: Producer Price Index - Input (YoY) , May -12.0% (forecast -11.4%)

-

10:30

United Kingdom: HICP, Y/Y, May 0.1% (forecast 0.1%)

-

10:30

United Kingdom: Producer Price Index - Input (MoM), May -0.9% (forecast 0.4%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, May 0.9%

-

10:15

Greek banks see deposit outflows

According to banking sources, the outflows totalled €400 million yesterday. Money continues to flee the Greek financial system. Difficult negotiations between Athens and its creditors increase uncertainty and fears about the possible introduction of capital controls.

Greek banks saw deposit outflows of €200-250 million a day.

-

09:48

Oil: prices rebounded amid signs of declines in US crude inventories

West Texas Intermediate crude prices for July delivery advanced 60 cents to $60.12 while Brent crude for August rose by 32 cents to $64.27 a barrel this morning. The rise in crude oil futures corresponds with the generally better trade data from Asia, which might be partly driven by a softer dollar despite worries over supply issues and the struggling Greece's debt negotiations.

API Crude Oil Inventories data will be published today 20:30 GMT. Analysts surveyed by Bloomberg believe that crude inventories might have declined for the seventh week in a row.

-

09:34

Gold limited gains ahead of the FOMC meeting

The precious metal traded in a narrow range ahead of the Federal Reserve policy meeting that may provide clues on the timing of the data-dependent first rate hike. U.S. economic data on Monday showed weakness in industrial production despite recent strong data on retail sales, employment, consumer and small business confidence.

Recently prices were upbeat amid uncertainty about Greece debt talks.

Spot gold was up 0.5% at $1,186.60 an ounce, while US gold futures for August delivery gained $6.60 an ounce at $1,185.80.

-

09:20

Global Stocks: Greece weighs on indices

U.S. stocks declined amid concerns over Greece's debt. The S&P 500 lost 9.68 points, or 0.46%, to 2,084.43. The Dow Jones industrial average declined by 107.67 points, or 0.6%, to 17,791.17. The Nasdaq Composite tumbled 21.13 points, or 0.42 percent, to 5,029.97.

The U.S. industrial production index missed expectations for a 0.3% growth in May on a monthly basis and fell by 0.2%. On a y/y basis the index rose by 1.4% vs 1.9% reported previously.

Stocks fell across Asia. Japanese Nikkei 225 declined by 129.85 or 0.64% to 20,257.94, Shanghai Composite Index lost 161.05 or 3.18% to 4,901.94, while Hong Kong Hang Seng dropped 213.49 (-0.79%) to 26,648.32.

-

09:05

Foreign exchange market. Asian session: U.S. dollar steady ahead of Fed rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (YoY) May 2.8% 0.8%

01:30 Australia RBA Meeting's Minutes

05:45 Switzerland SECO Economic Forecasts

06:00 Germany CPI, y/y May 0.5% 0.7% 0.7%

The U.S. dollar started Tuesday moving sideways as traders anticipate Wednesday's Federal Open Market Committee interest rate decision. The rate is expected to remain unchanged; however policymakers' comments and the FOMC statement may provide some clues on the timing of the liftoff. Yesterday data showed that the U.S. industrial production index missed expectations for a 0.3% growth in May on a monthly basis and fell by 0.2%. On a y/y basis the index rose by 1.4% vs 1.9% reported previously.

The euro slightly edged up amid the weaker-than-expected data on the U.S. economy. Market participants are waiting for news on Greece when the euro zone finance ministers meet on Thursday.

The pound is steady ahead of inflation data.

The Australian dollar is currently at $0.7751 ahead of the Fed meeting. June 2015 Monetary Policy Meeting minutes reiterated that the AUD was likely to decline.

The New Zealand dollar slightly shifted down to $0.6982.

The Japanese yen weakened against the U.S. dollar. It's currently at Y123.59. Bank of Japan Governor Haruhiko Kuroda said that his remarks about the yen's weakness shouldn't be understood as clues for the currency's direction.

EUR/USD: the dollar is muted ahead of Fed interest rate decision

USD/JPY: the U.S. dollar slightly advanced against the yen

GBP/USD: the sterling continued to gain at a moderate pace

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Retail Price Index, m/m May 0.4% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 0.9% 1.1%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.4% 0.4%

08:30 United Kingdom Producer Price Index - Input (YoY) May -11.7% -11.4%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.1% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May -1.7% -1.6%

08:30 United Kingdom HICP, m/m May 0.2% 0.2%

08:30 United Kingdom HICP, Y/Y May -0.1% 0.1%

08:30 United Kingdom HICP ex EFAT, Y/Y May 0.8%

09:00 Eurozone Employment Change Quarter I 0.1%

09:00 Eurozone ZEW Economic Sentiment June 61.2

09:00 Germany ZEW Survey - Economic Sentiment June 41.9 37.1

12:30 Canada Foreign Securities Purchases April 22.47

12:30 U.S. Housing Starts May 1135 1100

12:30 U.S. Building Permits May 1140 1100

20:30 U.S. API Crude Oil Inventories June -6.7

22:45 New Zealand Current Account Quarter I -3190 235

23:50 Japan Trade Balance Total, bln May -53.4 -226

-

08:19

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia New Motor Vehicle Sales (YoY) May 2.8% 0.8%

01:30 Australia New Motor Vehicle Sales (MoM) May -1.5% -1.3%

01:30 Australia RBA Meeting's Minutes

The yen slid after Bank of Japan Governor Haruhiko Kuroda told parliament Tuesday that he didn't mean to predict a future nominal exchange rate when discussing the yen's weakness last week. Sixteen of 35 economists surveyed by Bloomberg see the BOJ adding to its unprecedented easing by the end of October, down from 21 of 36 in May.

Germany and the U.K. update consumer prices data Tuesday, and the ZEW survey of growth expectations in the euro region is due.

While U.S. data from hiring to spending has supported the case for tighter monetary policy, the Fed -- which starts a two-day meeting Tuesday -- isn't projected to move on interest rates until at least September.

EUR / USD: during the Asian session, the pair was trading around $ 1.1275

GBP / USD: during the Asian session the pair rose to $ 1.5610

USD / JPY: during the Asian session the pair rose to Y123.80

-

08:13

Options levels on tuesday, June 16, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1410 (2871)

$1.1376 (1876)

$1.1334 (976)

Price at time of writing this review: $1.1269

Support levels (open interest**, contracts):

$1.1226 (1394)

$1.1191 (532)

$1.1144 (1423)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 51041 contracts, with the maximum number of contracts with strike price $1,1600 (3605);

- Overall open interest on the PUT options with the expiration date July, 2 is 77563 contracts, with the maximum number of contracts with strike price $1,0500 (8372);

- The ratio of PUT/CALL was 1.52 versus 1.62 from the previous trading day according to data from June, 15

GBP/USD

Resistance levels (open interest**, contracts)

$1.5903 (749)

$1.5805 (2107)

$1.5709 (605)

Price at time of writing this review: $1.5597

Support levels (open interest**, contracts):

$1.5491 (339)

$1.5394 (1166)

$1.5296 (2033)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 22205 contracts, with the maximum number of contracts with strike price $1,5500 (2552);

- Overall open interest on the PUT options with the expiration date July, 2 is 22702 contracts, with the maximum number of contracts with strike price $1,5250 (2120);

- The ratio of PUT/CALL was 1.02 versus 0.99 from the previous trading day according to data from June, 15

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: CPI, m/m, May 0.1 (forecast 0.1%)

-

08:00

Germany: CPI, y/y , May 0.7% (forecast 0.7%)

-

04:01

Nikkei 225 20,243.58 -144.21 -0.7 %, Hang Seng 26,767.04 -94.77 -0.4%, Shanghai Composite 5,062.04 -0.95 0.0%

-

03:31

Australia: New Motor Vehicle Sales (MoM) , May -1.3%

-

03:31

Australia: New Motor Vehicle Sales (YoY) , May 0.8%

-

00:33

Commodities. Daily history for Jun 15’2015:

(raw materials / closing price /% change)

Oil 59.61 +0.15%

Gold 1,185.70 -0.01%

-

00:31

Stocks. Daily history for Jun 15’2015:

(index / closing price / change items /% change)

Nikkei 225 20,387.79 -19.29 -0.09 %

Hang Seng 26,861.81 -418.73 -1.53 %

S&P/ASX 200 5,538.77 -6.48 -0.12 %

Shanghai Composite 5,062.99 -103.36 -2.00 %

FTSE 100 6,710.52 -74.40 -1.10 %

CAC 40 4,815.36 -85.83 -1.75 %

Xetra DAX 10,984.97 -211.52 -1.89 %

S&P 500 2,084.43 -9.68 -0.46 %

NASDAQ Composite 5,029.97 -21.13 -0.42 %

Dow Jones 17,791.17 -107.67 -0.60 %

-

00:30

Currencies. Daily history for Jun 15’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1281 +0,14%

GBP/USD $1,5595 +0,22%

USD/CHF Chf0,9298 +0,25%

USD/JPY Y123,40 +0,02%

EUR/JPY Y139,21 +0,15%

GBP/JPY Y192,44 +0,71%

AUD/USD $0,7760 +0,39%

NZD/USD $0,6996 +0,17%

USD/CAD C$1,2318 0,00%

-

00:00

Schedule for today, Tuesday, Jun 16’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia New Motor Vehicle Sales (YoY) May 2.8%

01:30 Australia New Motor Vehicle Sales (MoM) May -1.5%

01:30 Australia RBA Meeting's Minutes

05:45 Switzerland SECO Economic Forecasts

06:00 Germany CPI, m/m (Finally) May 0.0% 0.1%

06:00 Germany CPI, y/y (Finally) May 0.5% 0.7%

08:30 United Kingdom Retail Price Index, m/m May 0.4% 0.3%

08:30 United Kingdom Retail prices, Y/Y May 0.9% 1.1%

08:30 United Kingdom Producer Price Index - Input (MoM) May 0.4% 0.4%

08:30 United Kingdom Producer Price Index - Input (YoY) May -11.7% -11.4%

08:30 United Kingdom Producer Price Index - Output (MoM) May 0.1% 0.1%

08:30 United Kingdom Producer Price Index - Output (YoY) May -1.7% -1.6%

08:30 United Kingdom HICP, m/m May 0.2% 0.2%

08:30 United Kingdom HICP, Y/Y May -0.1% 0.1%

08:30 United Kingdom HICP ex EFAT, Y/Y May 0.8%

09:00 Eurozone Employment Change Quarter I 0.1%

09:00 Eurozone ZEW Economic Sentiment June 61.2

09:00 Germany ZEW Survey - Economic Sentiment June 41.9 37.1

12:30 Canada Foreign Securities Purchases April 22.47

12:30 U.S. Housing Starts May 1135 1100

12:30 U.S. Building Permits May 1140 1100

20:30 U.S. API Crude Oil Inventories June -6.7

22:45 New Zealand Current Account Quarter I -3190

23:50 Japan Trade Balance Total, bln May -53.4 -226

-