Noticias del mercado

-

22:09

Major US stock indices declined moderately

Major US stock indexes ended today's trading in negative territory, while the index Dow Jones Industrial Average went into the negative zone since the beginning of the year. Dynamics of prices today dictate the news from Europe, namely Greece, which is close to default after talks with international creditors. Talks between Greece and its creditors broke up less than an hour on Sunday, resulting in Athens can not repay the $ 1.8 billion debt to the International Monetary Fund before the end of this month.

It should also be noted that industrial production in the US fell in May, this is a sign that the weak global demand and a strong dollar continues to constrain economic growth. As reported by the Federal Reserve, industrial production, which measures the release of US manufacturers, utilities and mines fell a seasonally adjusted 0.2% compared with the previous month. Capacity utilization, a measure of load in the industrial sector fell by two tenths of a percentage point to 78.1% in May. Given the decline, capacity utilization by two percentage points below its long-term average, marked since 1972.

At the same time, self-builders in the market of newly built single-family homes in June rose by five points to the level of 59, showed Housing Market Index (HMI) of the National Association of Home Builders / Wells Fargo, published on Monday. This is the highest since September 2014.

Almost all components of the index DOW closed in the red (27 of 30). Outsider shares were United Technologies Corporation (UTX, -2.40%). Most remaining shares rose UnitedHealth Group Incorporated (UNH, + 1.34%).

All sectors of the index S & P showed a negative trend. Outsiders were conglomerates sector (-1.8%).

At the close:

Dow -0.60% 17,791.04 -107.80

Nasdaq -0.42% 5,029.97 -21.13

S & P -0.46% 2,084.44 -9.67

-

22:00

U.S.: Net Long-term TIC Flows , April 53.9

-

22:00

U.S.: Total Net TIC Flows, April 106.6

-

21:00

Dow -0.64% 17,784.10 -114.74 Nasdaq -0.47% 5,027.52 -23.58 S&P -0.51% 2,083.40 -10.71

-

19:16

WSE: Session Results

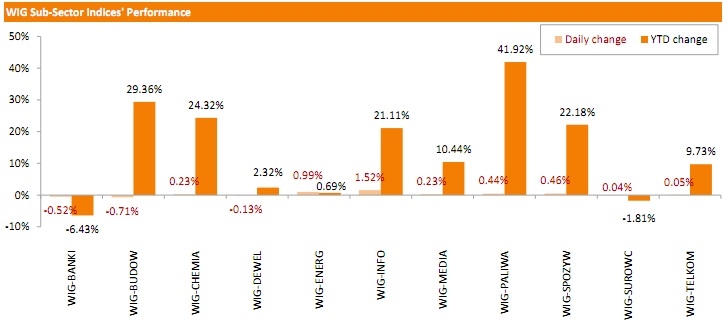

Polish equity market ended Monday's session with a modest gain of 0.04%. Sector-wise, construction companies (-0.71%), banks (-052%) and developers (-0.13%) lagged, whereas technologies (+1.52%) and utilities (+0.99%) outperformed.

The large-cap stocks' measure, the WIG30 Index, inched down by 0.01%. Within the indicator's constituents, BOGDANKA (WSE: LWB) tumbled the most, down 6.63%, after the stock was significantly downgraded by analysts. It was followed by PKO BP (WSE: PKO) and CCC (WSE: CCC), which posted less severe losses of 1.04% and 0.85% respectively. On the other side of the ledger, JSW (WSE: JSW) became the growth leader, gaining 3.69% on announcement the company is to sign a PLN 1.7bln agreement with ArcelorMittal Poland SA for the deliveries of coking coal in 2015. SYNTHOS (WSE: SNS), EUROCASH (WSE: EUR), ENEA (WSE: ENA), ENERGA (WSE: ENG) and TAURON PE (WSE: TPE) did well too, recouping some of their Friday's losses.

-

18:15

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes lower on Monday, with the Dow Jones Industrial Average in negative territory from the year beginning, as Greece came closer to a debt default after talks with its international creditors fell apart. Talks between Greece and its creditors broke up after less than an hour on Sunday, raising the prospect of Athens being unable to repay $1.8 billion owed to the International Monetary Fund by the end of this month.

Almost all of Dow stocks in negative area (28 of 30). Top looser - United Technologies Corporation (UTX, -1.91%). Top gainer - Intel Corporation (INTC, +0.43%).

S&P index sectors in negative area. Top looser - Conglomerates (-1.4%).

At the moment:

Dow 17698.00 -121.00 -0.68%

S&P 500 2075.25 -9.75 -0.47%

Nasdaq 100 4416.25 -31.00 -0.70%

10-year yield 2.35% -0.04

Oil 59.59 -0.37 -0.62%

Gold 1188.30 +9.10 +0.77%

-

18:00

European stocks closed: FTSE 100 6,710.52 -74.40 -1.10% CAC 40 4,815.36 -85.83 -1.75% DAX 10,984.97 -1.89%

-

18:00

European stocks close: stocks closed lower on concerns over the possible Greek default

Stock indices closed lower on concerns over the possible Greek default. The weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

European Central Bank (ECB) President Mario Draghi said on Monday before the European Parliament's Economic and Monetary Affair's Committee that the ball lies in Athens' court to act. He noted that a "strong and comprehensive agreement" between Greece and its creditors was needed as soon as possible.

Standard & Poor's (S&P) said on Monday that it would not downgrade Greece's credit rating even if the country failed to meet the payment deadline in July and August.

Standard & Poor's downgraded its outlook on the U.K.'s credit rating to negative on Friday.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,710.52 -74.40 -1.10 %

DAX 10,984.97 -211.52 -1.89 %

CAC 40 4,815.36 -85.83 -1.75 %

-

17:42

Oil prices traded mixed on concerns over the global oil glut

Oil prices traded mixed on concerns over the global oil glut. Oil production in the U.S. remains at high level despite the falling number of oil rigs.

The debt talks between Greece and its creditors also weighed on oil prices. the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

European Central Bank (ECB) President Mario Draghi said on Monday before the European Parliament's Economic and Monetary Affair's Committee that the ball lies in Athens' court to act. He noted that a "strong and comprehensive agreement" between Greece and its creditors was needed as soon as possible.

Investors are awaiting the Fed's interest rate decision on Wednesday. It is unlikely that the Fed start raising its interest rate in June as U.S. industrial production dropped in May. The U.S. industrial production dropped 0.2% in May, missing expectations for a 0.3% increase, after a 0.5% decline in April.

The decline was driven by lower mining output. Mining output dropped by 0.3% in May as oil and gas well drilling plunged 7.9%.

Capacity utilisation rate fell to 78.1% in May from 78.3% in April. April's figure was revised up 78.2%. Analysts had expected a capacity utilisation rate of 78.3%.

WTI crude oil for July delivery decreased to $59.46 a barrel on the New York Mercantile Exchange.

Brent crude oil for July rose to $64.08 a barrel on ICE Futures Europe.

-

17:25

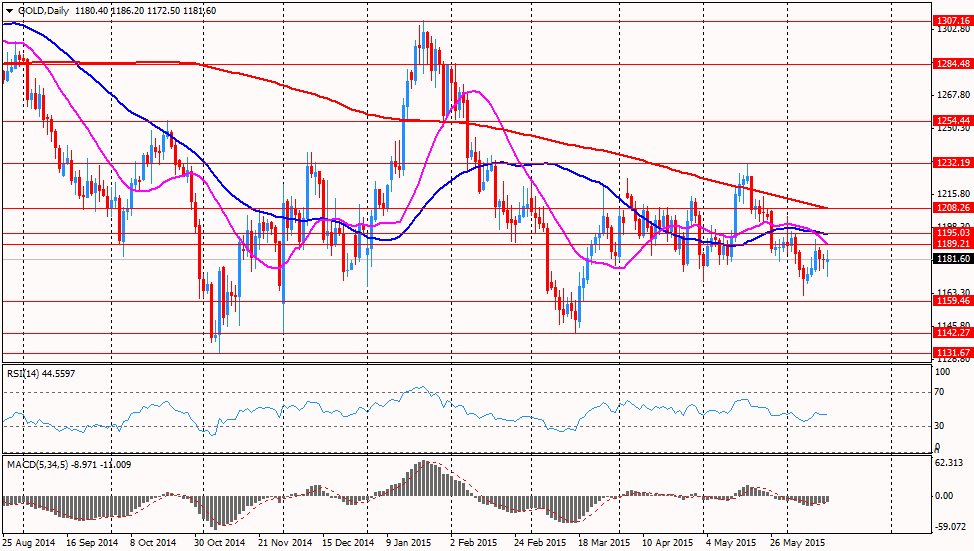

Gold price traded higher as the weekend's debt talks between Greece and its creditors were unsuccessful

Gold price traded higher as the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

European Central Bank (ECB) President Mario Draghi said on Monday before the European Parliament's Economic and Monetary Affair's Committee that the ball lies in Athens' court to act. He noted that a "strong and comprehensive agreement" between Greece and its creditors was needed as soon as possible.

Speculation on that the Fed start raising its interest rate this year weighed on gold price.

Lower physical demand in Asia also weighed on gold price.

June futures for gold on the COMEX today rose to 1180.40 dollars per ounce.

-

17:07

Reserve Bank of Australia Assistant Governor Christopher Kent: the central bank’s monetary policy is working

Reserve Bank of Australia (RBA) Assistant Governor Christopher Kent said on Monday that the central bank's monetary policy was working despite strong headwinds like "the significant decline in mining investment, fiscal consolidation at state and federal levels and the exchange rate".

He pointed out that rising house prices in combination with strong growth of credit are potential risk for Australia's economy.

"Consumption growth has picked up since 2013. But it is still a little weaker than suggested by historical experience," the RBA assistant governor said.

-

16:57

European Central Bank President Mario Draghi: a "strong and comprehensive agreement" between Greece and its creditors is needed as soon as possible

European Central Bank (ECB) President Mario Draghi said on Monday before the European Parliament's Economic and Monetary Affair's Committee that the ball lies in Athens' court to act. He noted that a "strong and comprehensive agreement" between Greece and its creditors was needed as soon as possible.

Draghi pointed out that emergency funding for Greek banks will be extended "as long as Greek banks are solvent and have sufficient collateral". He also said that the ECB provides €118 billion in funds to Greek banks, equivalent to 66% of Greece's gross domestic product (GDP).

The ECB president noted that Eurozone's economy continued to recover moderately, while inflation is expected to remain low in the coming months before rising.

-

16:39

European Central Bank Executive Board Member Peter Praet: more structural reforms needed to be implement in the Eurozone

European Central Bank (ECB) Executive Board Member Peter Praet said on Monday that more structural reforms needed to be implement in the Eurozone and the monetary policy should create the conditions for sustainable long-run growth.

"The main point I would like to make is as follows. For many euro area countries structural reforms are central to higher long-run growth. And that each economy achieves this is in turn critical to an efficient implementation of monetary policy and, over time, to the integrity of monetary union. But there is no "one size fits all" model for how countries should go about tackling structural challenges," he noted.

"Structural reforms can raise long-run growth in two ways: by raising the trend of long-term growth, and by reducing the fluctuations around that trend," Praet added.

-

16:18

NAHB housing market index jumps to 59 in June

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Monday. The NAHB housing market index jumped to 59 in June from 54 in May. It was the highest level since September 2014.

Analysts had expected the index to rise to 56.

A level above 50.0 is considered positive, below indicates a negative outlook.

The increase was driven by a rise in all three components of the index. The current sales conditions subindex rose seven points to 65 in June, the subindex measuring sales expectations in the next six months climbed six points to 69, while the buyer traffic subindex was up five points to 44.

"Builders are reporting more serious and committed buyers at their job sites and this is reflected in recent government data showing that new-home sales and single-family construction are gaining momentum," the NAHB Chairman Tom Woods said.

The NAHB Chief Economist David Crowe noted that current and future sales expectations subindices indicate the housing market will continue to strengthen in the coming months.

-

16:00

U.S.: NAHB Housing Market Index, June 59 (forecast 56)

-

15:54

U.S. industrial production declines 0.2% in May

The Federal Reserve released its industrial production report on Monday. The U.S. industrial production dropped 0.2% in May, missing expectations for a 0.3% increase, after a 0.5% decline in April. April's figure was revised down from a 0.3% decrease.

The decline was driven by lower mining output. Mining output dropped by 0.3% in May as oil and gas well drilling plunged 7.9%.

Utility output climbed by 0.2% in May, after a 3.7% drop in April.

The U.S. manufacturing production declined 0.2% in May.

Capacity utilisation rate fell to 78.1% in May from 78.3% in April. April's figure was revised up 78.2%. Analysts had expected a capacity utilisation rate of 78.3%.

These figures are pointing to a slower economic growth in the U.S.

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E539mn), $1.1250(E327mn), $1.1335(E506mn)

USD/JPY: Y122.00($810mn), Y123.00($1.4bn), Y123.35-50($1.2bn)

GBP/USD: $1.5420(Gbp219mn) * EUR/GBP: Gbp0.7300(E850mn)

USD/CHF: Chf0.9250($500mn), Chf0.9450($500mn)

AUD/USD: $0.7600(A$400mn), $0.7650(A$510mn), $0.7700(A$596mn), $0.7735(A$610mn)

AUD/NZD: NZ$1.0900(A$374mn): AUD/JPY: Y95.00(A$200mn)

USD/CAD: C$1.2100($895mn), C$1.2400-15($400mn)

-

15:32

U.S. Stocks open: Dow -0.78%, Nasdaq -0.93%, S&P -0.74%

-

15:29

-

15:29

Central Bank of Russia lowers its key interest rate to 11.5%

The Central Bank of Russia (CBR) lowered its key interest rate to 11.5% from 12.5% on Monday. This decision was widely expected by analysts.

This decision indicates that inflationary pressure in Russia was weakening.

It was the fourth cut in 2015.

The central bank noted that it was ready for further interest rate cut.

-

15:24

Before the bell: S&P futures -0.61%, NASDAQ futures -0.64%

U.S. stock-index futures fell after weekend negotiations between Greece and its creditors broke down.

Global markets:

Nikkei 20,387.79 -19.29 -0.09%

Hang Seng 26,861.81 -418.73 -1.53%

Shanghai Composite 5,062.99 -103.36 -2.00%

FTSE 6,722.93 -61.99 -0.91%

CAC 4,815.48 -85.71 -1.75%

DAX 10,972.67 -223.82 -2.00%

Crude oil $59.10 (-1.42%)

Gold $1179.50 (+0.03%)

-

15:15

U.S.: Capacity Utilization, May 78.1% (forecast 78.3%)

-

15:15

U.S.: Industrial Production (MoM), May -0.2% (forecast 0.3%)

-

15:15

U.S.: Industrial Production YoY , May 1.4%

-

15:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

FedEx Corporation, NYSE

FDX

183.68

+0.03%

2.9K

Hewlett-Packard Co.

HPQ

32.40

-0.03%

0.3K

ALTRIA GROUP INC.

MO

48.00

-0.08%

2.1K

Boeing Co

BA

142.60

-0.14%

0.3K

Barrick Gold Corporation, NYSE

ABX

11.25

-0.18%

11.4K

Amazon.com Inc., NASDAQ

AMZN

429.15

-0.18%

2.5K

International Business Machines Co...

IBM

166.67

-0.19%

0.00

Verizon Communications Inc

VZ

47.15

-0.21%

5.8K

E. I. du Pont de Nemours and Co

DD

68.95

-0.25%

0.9K

Tesla Motors, Inc., NASDAQ

TSLA

250.00

-0.28%

1.3K

Intel Corp

INTC

31.23

-0.29%

7.1K

3M Co

MMM

157.50

-0.34%

2.6K

Wal-Mart Stores Inc

WMT

72.16

-0.37%

4.5K

AT&T Inc

T

34.52

-0.38%

9.4K

Merck & Co Inc

MRK

57.65

-0.38%

0.4K

The Coca-Cola Co

KO

39.81

-0.38%

0.7K

Johnson & Johnson

JNJ

97.95

-0.41%

2.6K

Pfizer Inc

PFE

34.07

-0.41%

6.6K

Google Inc.

GOOG

530.05

-0.43%

1K

General Electric Co

GE

27.27

-0.44%

11.2K

Starbucks Corporation, NASDAQ

SBUX

52.40

-0.44%

8.8K

Visa

V

69.00

-0.48%

4.8K

Microsoft Corp

MSFT

45.75

-0.48%

5.1K

Yahoo! Inc., NASDAQ

YHOO

40.33

-0.48%

22.8K

Yandex N.V., NASDAQ

YNDX

17.54

-0.48%

8.9K

McDonald's Corp

MCD

94.59

-0.49%

0.5K

Ford Motor Co.

F

15.15

-0.53%

26.5K

Home Depot Inc

HD

110.00

-0.54%

0.4K

Facebook, Inc.

FB

81.05

-0.59%

10.1K

American Express Co

AXP

79.04

-0.61%

0.7K

Walt Disney Co

DIS

109.28

-0.61%

3.7K

Citigroup Inc., NYSE

C

56.76

-0.61%

6.3K

HONEYWELL INTERNATIONAL INC.

HON

103.40

-0.62%

0.3K

Procter & Gamble Co

PG

78.37

-0.63%

1.3K

Chevron Corp

CVX

99.21

-0.66%

3.3K

Cisco Systems Inc

CSCO

28.35

-0.67%

3.6K

Exxon Mobil Corp

XOM

83.45

-0.67%

8.3K

Apple Inc.

AAPL

126.26

-0.72%

257.7K

Goldman Sachs

GS

211.50

-0.73%

0.1K

JPMorgan Chase and Co

JPM

67.75

-0.73%

3.5K

Nike

NKE

103.01

-0.74%

1.7K

ALCOA INC.

AA

11.97

-0.75%

28.7K

General Motors Company, NYSE

GM

35.41

-0.84%

0.6K

Twitter, Inc., NYSE

TWTR

35.58

-0.89%

179.3K

United Technologies Corp

UTX

115.50

-1.79%

3.1K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.40

-2.05%

18.1K

-

15:01

NY Fed Empire State manufacturing index plunges to -1.98 in June

The New York Federal Reserve released its survey on Monday. The NY Fed Empire State manufacturing index declined to -1.98 in June from 3.09 in May, missing expectations for an increase to 5.2. It was lowest level since January 2013.

The decline was driven by a drop in new orders. The new orders index dropped to -2.12 in June from 3.85 in May.

The price-paid index increased to 9.62 in June from 9.38 in May.

The index for the number of employees climbed to 8.65 in June from 5.21 last month.

The general business conditions expectations index for the next six months was down to 25.84 in June from 29.81 in May.

-

14:52

Canadian manufacturing shipments drop 2.1% in April

Statistics Canada released manufacturing shipments on Monday. Canadian manufacturing shipments dropped 2.1% in April, missing forecasts of a 1.0% decrease, after a 2.7% rise in March. March's figure was revised down from a 2.9% gain.

The drop was driven by lower sales of food, aerospace products and parts, and petroleum and coal products. Sales of food plunged 5.7% in April, production of aerospace products and parts dropped 17.8%, while sales of petroleum and coal products fell 2.7%

Sales decreased in 8 of 21 categories.

-

14:41

Italian consumer prices climb 0.1% in May

The Italian statistical office Istat released its consumer price inflation data on Monday. Italian consumer prices rose 0.1% in May, after 0.1% in April. April's figure was revised down from a 0.2% increase.

The rise was driven by higher prices of non-regulated energy products (+1.8%) and higher prices of services.

On a yearly basis, Italian consumer prices climbed 0.1% in May, after a 0.1% decline in April. April's figure was revised down from a 0.2% gain.

The increase was driven by lower decline in prices of non-regulated energy products (May: -7.2% vs. -8.7% in April) and by higher prices of services (May: +0.8% vs. -0.6% in April).

-

14:32

U.S.: NY Fed Empire State manufacturing index , June -1.98 (forecast 5.2)

-

14:30

Canada: Manufacturing Shipments (MoM), April -2.1% (forecast -1.0%)

-

14:23

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as the weekend's debt talks between Greece and its creditors were unsuccessful

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

07:00 Eurozone ECB's Jens Weidmann Speaks

07:15 Switzerland Producer & Import Prices, m/m May -2.1% -0.8%

07:15 Switzerland Producer & Import Prices, y/y May -5.2% -6%

07:15 Switzerland Retail Sales (MoM) April 0.7% 2.1%

07:15 Switzerland Retail Sales Y/Y April -2.4% Revised From -2.8% 1.6%

07:30 Australia RBA Assist Gov Kent Speaks

09:00 Eurozone Trade balance unadjusted April 22.9 Revised From 23.4 24.9

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. The U.S. industrial production is expected to climb 0.3% in May, after a 0.3% drop in April. The NAHB housing market index is expected to climb to 56 in June from 54 in May.

The euro traded lower against the U.S. dollar as the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Germany' Bundesbank President Jens Weidmann said on Monday that time is running out for Greece to reach a new debt agreement with its creditors. He added that Athens should act quickly.

Meanwhile, Eurostat released its trade data for the Eurozone on Monday. Eurozone's unadjusted trade surplus rose to €24.9 billion in April from €22.9 billion in March. March's figure was revised down from a surplus of €23.4 billion.

Exports climbed by seasonally adjusted rate of 1.1%, while imports declined 1.6%.

The European Central Bank President Mario Draghi is scheduled to speak at 13:00 GMT.

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

Standard & Poor's downgraded its outlook on the U.K.'s credit rating to negative on Friday.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data. Canada's manufacturing shipments are expected to decrease 1.0% in April, after a 2.9% rise in April.

The Swiss franc traded lower against the U.S. dollar despite the mostly better-than-expected economic data from Switzerland. Switzerland's producer and import prices fell 0.8% in May, after a 2.1% drop in April.

On a yearly basis, producer and import prices plunged 6.0% in May, after a 5.2% drop in April.

The decline was driven by lower prices for chemical and pharmaceutical products. Prices for petroleum and petroleum products increased in May.

Retail sales in Switzerland rose at an annual rate of 1.6% in April, after a 2.4% decline in March. March's figure was revised up from a 2.8% drop.

Sales of food, beverages and tobacco fell at an annual rate of 0.4%, while non-food sales increased 3.9%.

On a monthly basis, retail sales excluding petrol prices climbed by 2.2% in April. Sales of food, beverages and tobacco were up 1.4%, while non-food sales rose 3.9%.

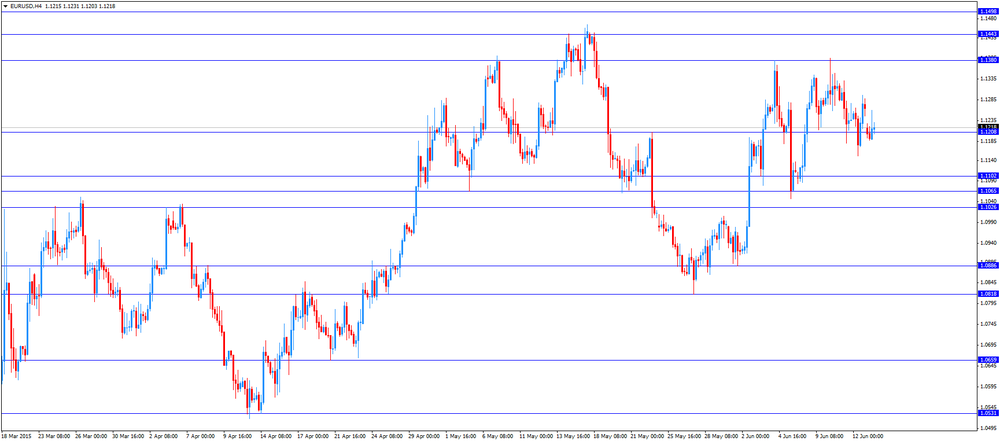

EUR/USD: the currency pair decreased to $1.1203

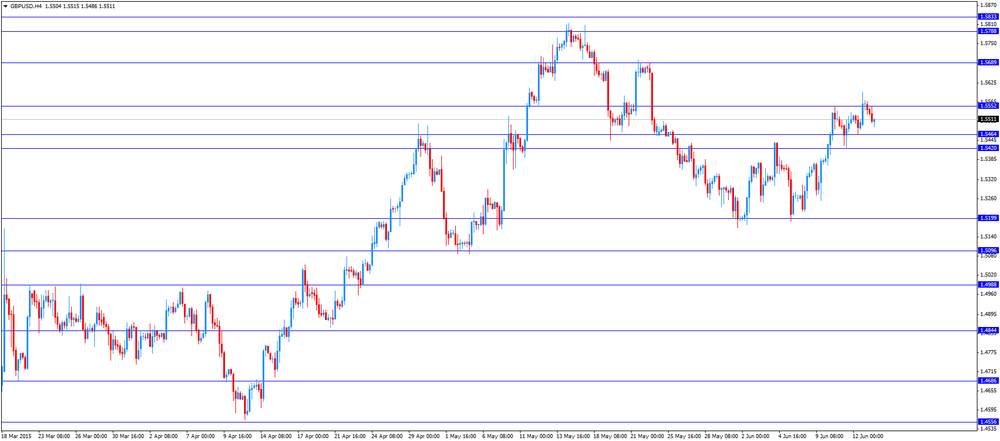

GBP/USD: the currency pair declined to $1.5486

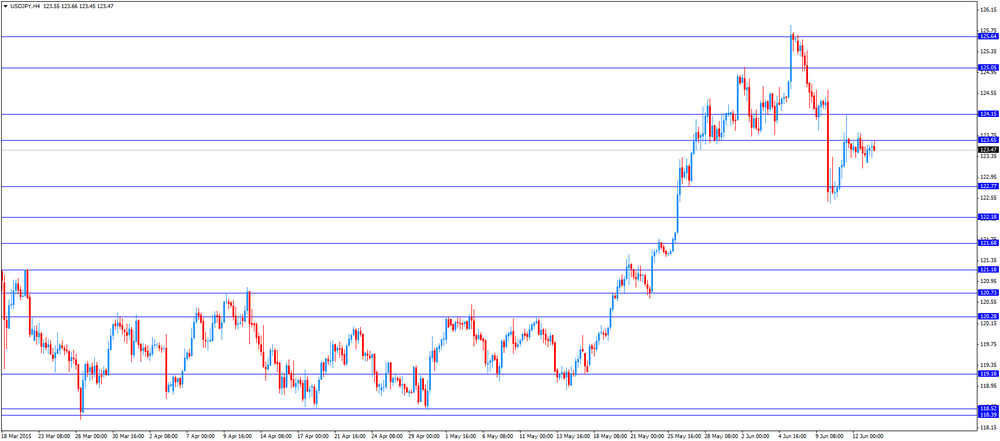

USD/JPY: the currency pair rose to Y123.66

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) April 2.9% -1.0%

12:30 U.S. NY Fed Empire State manufacturing index June 3.09 5.2

13:00 Eurozone ECB President Mario Draghi Speaks

13:15 U.S. Capacity Utilization May 78.2% 78.3%

13:15 U.S. Industrial Production (MoM) May -0.3% 0.3%

13:15 U.S. Industrial Production YoY May 1.9%

14:00 U.S. NAHB Housing Market Index June 54 56

20:00 U.S. Net Long-term TIC Flows April 17.6

21:55 Australia RBA Assist Gov Debelle Speaks

-

14:00

Orders

EUR/USD

Offers 1.1260 1.1280 1.1300 1.1320 1.1340 1.1365 1.1380 1.1400

Bids 1.1220 1.1200 1.1185 1.1150 1.1130 1.1100 1.1080-85 1.1065 1.1050

GBP/USD

Offers 1.5550 1.5580 1.5600 1.5625 1.5650 1.5675 1.5700

Bids 1.5500-10 1.5480-85 1.5460 1.5440-45 1.5425 1.5400

EUR/GBP

Offers 0.7250 0.7265 0.7280 0.7300 0.7320-25 0.7350

Bids 0.7210 0.7200 0.7185 0.7160 0.7130 0.7100

EUR/JPY

Offers 139.20 139.50 139.80 140.00 140.20 140.50

Bids 138.50 138.30 138.00 137.50 137.00

USD/JPY

Offers 123.80 124.00 124.25 124.40 124.75-80 125.00

Bids 123.30 123.00 122.80 122.60 122.30 122.00

AUD/USD

Offers 0.7730 0.7750 0.7770 0.7785 0.7800 0.7830 0.7850 0.7865 0.7880 0.7900

Bids 0.7700 0.7680 0.7650 0.7625-30 0.7600 0.7585 0.7550

-

12:02

European stock markets mid session: stocks traded lower as the weekend's debt talks between Greece and its creditors were unsuccessful

Stock indices traded lower as the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

Germany' Bundesbank President Jens Weidmann said on Monday that time is running out for Greece to reach a new debt agreement with its creditors. He added that Athens should act quickly.

Meanwhile, Eurostat released its trade data for the Eurozone on Monday. Eurozone's unadjusted trade surplus rose to €24.9 billion in April from €22.9 billion in March. March's figure was revised down from a surplus of €23.4 billion.

Exports climbed by seasonally adjusted rate of 1.1%, while imports declined 1.6%.

Current figures:

Name Price Change Change %

FTSE 100 6,732.83 -52.09 -0.77 %

DAX 11,042.87 -153.62 -1.37 %

CAC 40 4,851 -50.19 -1.02 %

-

11:51

Germany’ Bundesbank President Jens Weidmann: time is running out for Greece to reach a new debt agreement with its creditors

Germany' Bundesbank President Jens Weidmann said on Monday that time is running out for Greece to reach a new debt agreement with its creditors. He added that Athens should act quickly.

"We need to ensure that Greece can stand on its own legs without the help of partners. That's why the ball is clearly in the court of the Greek government," Weidmann said.

The Bundesbank president also said that high debt and the resulting tax burden for companies and households could have a negative impact on the growth in the Eurozone.

"The fact is that the circumstances named are all factors that burden growth and that cannot be eliminated with a monetary policy that is still so expansionary," he noted.

-

11:40

Eurozone's unadjusted trade surplus rises to €24.9 billion in April

Eurostat released its trade data for the Eurozone on Monday. Eurozone's unadjusted trade surplus rose to €24.9 billion in April from €22.9 billion in March. March's figure was revised down from a surplus of €23.4 billion.

Exports climbed by seasonally adjusted rate of 1.1%, while imports declined 1.6%.

-

11:28

Switzerland's producer and import prices fall 0.8% in May

The Federal Statistical Office released its producer and import prices data on Monday. Switzerland's producer and import prices fell 0.8% in May, after a 2.1% drop in April.

On a yearly basis, producer and import prices plunged 6.0% in May, after a 5.2% drop in April.

The decline was driven by lower prices for chemical and pharmaceutical products. Prices for petroleum and petroleum products increased in May.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E539mn), $1.1250(E327mn), $1.1335(E506mn)

USD/JPY: Y122.00($810mn), Y123.00($1.4bn), Y123.35-50($1.2bn)

GBP/USD: $1.5420(Gbp219mn) * EUR/GBP: Gbp0.7300(E850mn)

USD/CHF: Chf0.9250($500mn), Chf0.9450($500mn)

AUD/USD: $0.7600(A$400mn), $0.7650(A$510mn), $0.7700(A$596mn), $0.7735(A$610mn)

AUD/NZD: NZ$1.0900(A$374mn): AUD/JPY: Y95.00(A$200mn)

USD/CAD: C$1.2100($895mn), C$1.2400-15($400mn)

-

11:09

Swiss retail sales rise 1.6% in April

The Federal Statistical Office released its retail sales data for Switzerland on Monday. Retail sales in Switzerland rose at an annual rate of 1.6% in April, after a 2.4% decline in March.

March's figure was revised up from a 2.8% drop.

Sales of food, beverages and tobacco fell at an annual rate of 0.4%, while non-food sales increased 3.9%.

On a monthly basis, retail sales excluding petrol prices climbed by 2.2% in April. Sales of food, beverages and tobacco were up 1.4%, while non-food sales rose 3.9%.

-

11:00

Eurozone: Trade balance unadjusted, April 24.9

-

10:53

According to a poll, 51% of German respondents would prefer the Greek exit from the Eurozone

According to a new poll from the German broadcaster ZDF, 51% of German respondents would prefer the Greek exit from the Eurozone, while 41% of German respondents would prefer to keep Greece in the Eurozone.

1,230 randomly selected people were asked.

70% of respondents said that they want no more concessions in the debt talks between Greece and its creditors.

65% of respondents believe that there will no damage on the German economy if Greece leaves the Eurozone.

-

10:34

Fitch Ratings affirms the credit ratings of the U.K., France and Sweden

Fitch Ratings has affirmed the credit ratings of the U.K., France and Sweden. According to Fitch Ratings, the UK's Long-term foreign and local currency Issuer Default Ratings (IDRs) has been affirmed at 'AA+', while the outlook was stable.

France's Long-term foreign and local currency Issuer Default Ratings (IDR) has been affirmed at 'AA' with a stable outlook.

Fitch has affirmed Sweden's Long-term foreign and local currency Issuer Default Ratings (IDR) at 'AAA' with a stable outlook. "Sweden's 'AAA' ratings reflect its high income per capita, strong governance and human development indicators, and a track record of sound economic policy implementation," Fitch said.

-

10:22

The weekend’s debt talks between Greece and its creditors were unsuccessful

The European Commission said on Sunday that the weekend's debt talks between Greece and its creditors were unsuccessful. An EU Commission official said that there are still big differences between the Greek reform plan and the demand of the creditors.

European Commission President Jean-Claude Juncker noted that a new debt deal could be reached until the end of the month.

The next round of talks is scheduled to at the finance ministers' meeting this Thursday in Luxembourg.

-

10:08

U.S. oil and gas rigs decline by 9 to 859

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 7 rigs to 635 last week, the lowest weekly level since August 2010. It was the 27th consecutive weekly fall.

Combined oil and gas rigs fell by 9 to 859.

The U.S. Energy Information Administration forecasts that U.S. crude-oil production would begin to fall from June until February 2016.

-

09:15

Switzerland: Producer & Import Prices, y/y, May -6%

-

09:15

Switzerland: Producer & Import Prices, m/m, May -0.8%

-

09:15

Switzerland: Retail Sales Y/Y, April 1.6%

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

---

Euro dropped for the first time in four days after the latest round of negotiations between Greece and its creditors fell apart. The latest failed attempt to find a formula to unlock as much as 7.2 billion euros ($8.1 billion) in aid for the anti-austerity government of Prime Minister Alexis Tsipras means Greece has two weeks until its euro-area bailout expires with no future financing arrangement in place. The burden of finding a resolution now shifts to a meeting of euro-area finance ministers set for June 18.

The dollar gain as data showing the U.S. economy continues to gain speed. Wholesale prices in the U.S. rose in May, giving the figure gains in two of the past three months that may eventually filter through to consumers, helping reassure Federal Reserve policy makers that inflation is progressing toward their target.

EUR / USD: during the Asian session the pair fell to $ 1.1190

GBP / USD: during the Asian session the pair fell to $ 1.5525

USD / JPY: during the Asian session the pair rose to Y123.55

-

08:06

Options levels on monday, June 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1367 (1899)

$1.1327 (879)

$1.1294 (185)

Price at time of writing this review: $1.1197

Support levels (open interest**, contracts):

$1.1126 (1435)

$1.1072 (3740)

$1.1041 (1800)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 47135 contracts, with the maximum number of contracts with strike price $1,1400 (3267);

- Overall open interest on the PUT options with the expiration date July, 2 is 776523 contracts, with the maximum number of contracts with strike price $1,0500 (8494);

- The ratio of PUT/CALL was 1.62 versus 1.67 from the previous trading day according to data from June, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.5805 (2112)

$1.5707 (596)

$1.5611 (1623)

Price at time of writing this review: $1.5533

Support levels (open interest**, contracts):

$1.5488 (335)

$1.5392 (1165)

$1.5295 (1997)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 21950 contracts, with the maximum number of contracts with strike price $1,5500 (2551);

- Overall open interest on the PUT options with the expiration date July, 2 is 21790 contracts, with the maximum number of contracts with strike price $1,5300 (1997);

- The ratio of PUT/CALL was 0.99 versus 1.02 from the previous trading day according to data from June, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

04:01

Nikkei 225 20,354.5 -52.58 -0.26 %, Hang Seng 27,080.7 -199.84 -0.73 %%, Shanghai Composite 5,149.15 -17.20 -0.33 %

-

00:38

Commodities. Daily history for Jun 12’2015:

(raw materials / closing price /% change)

Oil 59.96 -1.33%

Gold 1,179.20 -0.10%

-

00:34

Stocks. Daily history for Jun 12’2015:

(index / closing price / change items /% change)

Nikkei 225 20,407.08 +24.11 +0.12 %

Hang Seng 27,280.54 +372.69 +1.39 %

S&P/ASX 200 5,545.25 -11.40 -0.21 %

Shanghai Composite 5,166.35 +44.76 +0.87 %

FTSE 100 6,784.92 -61.82 -0.90 %

CAC 40 4,901.19 -70.18 -1.41 %

Xetra DAX 11,196.49 -136.29 -1.20 %

S&P 500 2,094.11 -14.75 -0.70 %

NASDAQ Composite 5,051.1 -31.41 -0.62 %

Dow Jones 17,898.84 -140.53 -0.78 %

-

00:30

Currencies. Daily history for Jun 12’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1265 +0,25%

GBP/USD $1,5560 +0,32%

USD/CHF Chf0,9275 -0,67%

USD/JPY Y123,38 -0,08%

EUR/JPY Y139,00 +0,17%

GBP/JPY Y191,08 -0,23%

AUD/USD $0,7730 -0,30%

NZD/USD $0,6984 -0,42%

USD/CAD C$1,2318 + 0,18%

-

00:01

Schedule for today, Monday, Jun 15’2015:

(time / country / index / period / previous value / forecast)

07:00 Eurozone ECB's Jens Weidmann Speaks

07:15 Switzerland Producer & Import Prices, m/m May -2.1%

07:15 Switzerland Producer & Import Prices, y/y May -5.2%

07:15 Switzerland Retail Sales (MoM) April 0.7%

07:15 Switzerland Retail Sales Y/Y April -2.8%

07:30 Australia RBA Assist Gov Kent Speaks

09:00 Eurozone Trade balance unadjusted April 23.4

12:30 Canada Manufacturing Shipments (MoM) April 2.9% -1.0%

12:30 U.S. NY Fed Empire State manufacturing index June 3.09 5.2

13:00 Eurozone ECB President Mario Draghi Speaks

13:15 U.S. Capacity Utilization May 78.2% 78.3%

13:15 U.S. Industrial Production (MoM) May -0.3% 0.3%

13:15 U.S. Industrial Production YoY May 1.9%

14:00 U.S. NAHB Housing Market Index June 54 56

20:00 U.S. Total Net TIC Flows April -100.9

20:00 U.S. Net Long-term TIC Flows April 17.6

21:55 Australia RBA Assist Gov Debelle Speaks

-