Noticias del mercado

-

21:01

S&P 500 2,094.29 -14.57 -0.69 %, NASDAQ 5,050.69 -31.82 -0.63 %, Dow 17,881.52 -157.85 -0.88 %

-

18:55

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell, pressured by a setback in Greece's debt talks and increased possibility of a September rate hike. Still, the S&P 500 and the Dow Jones Industrial Average were on track to close higher for the week, after posting declines for two weeks in a row. Greece said it would not cross its "red lines" as it looked to intensify political negotiations for an agreement, saying the International Monetary Fund's move to quit bailout talks was aimed at putting pressure on Athens. Investors were also edgy ahead of the U.S. Federal Reserve's Open Market Committee meeting next week - the central bank's last meeting before September - which may provide clues on the timing of an interest rate hike.

All of Dow stocks in negative area (30 of 30). Top looser - Merck & Co. Inc. (MRK, -1.51%).

S&P index sectors in negative area. Top looser - Healthcare (-1.0%).

At the moment:

Dow 17809.00 -153.00 -0.85%

S&P 500 2085.75 -15.75 -0.75%

Nasdaq 100 4450.75 -33.25 -0.74%

10-year yield 2.36% -0.02

Oil 60.18 -0.59 -0.97%

Gold 1179.60 -0.80 -0.07%

-

18:07

European stocks close: stocks closed lower on the uncertainty over the Greek debt talks

Stock indices closed lower on the uncertainty over the Greek debt talks. The International Monetary Fund (IMF) spokesman Gerry Rice said on Thursday that the IMF's technical team has left the debt talks in Brussels. The reason is "major differences", he noted. "There are major differences between us in most key areas," Rice said.

News reported that Germany was preparing for a Greek default.

According to European officials, they discussed a "plan B" for a Greek debt default.

Industrial production in the Eurozone rose 0.1% in April, missing expectations for a 0.3% gain, after a 0.4% decline in March. March's figure was revised down from a 0.3% decrease.

The increase was driven by a rise in durable consumer goods and capital goods output. Durable consumer goods were up 1.0%, while capital goods rose by 0.7%.

On a yearly basis, Eurozone's industrial production gained 0.8% in April, missing expectations for a 1.1% rise, after a 2.1% increase in March. March's figure was revised up from a 1.8 gain.

The increase was driven by a rise in durable consumer goods and in production of capital goods. Durable consumer goods climbed by 1.7% in April from a year ago, while capital goods output rose by 2.1%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.8% in April, after a 1.4% rise in March.

The decline was driven by a drop in repair and maintenance, which plunged 4.8% in April.

New work increased 1.6% in April.

On a yearly basis, construction output climbed 1.6% in April.

The ONS revised its methodology for measuring construction. For the first quarter as a whole, construction output was down 0.2%.

According to the ONS, the revision could have an impact the U.K. GDP growth. The economy could have expanded at 0.4% in the first quarter rather than 0.3%.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,784.92 -61.82 -0.90 %

DAX 11,196.49 -136.29 -1.20 %

CAC 40 4,901.19 -70.18 -1.41 %

-

18:06

WSE: Session Results

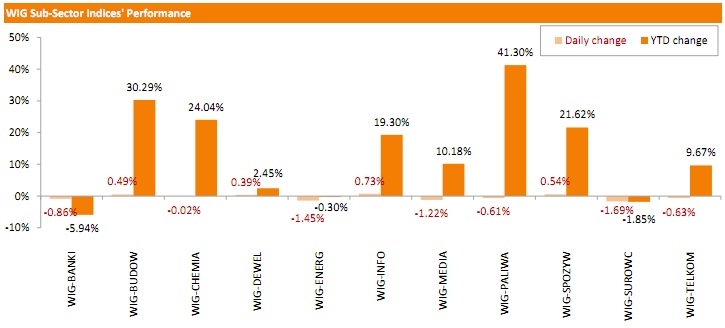

Polish equity market closed lower on Friday. The broad market measure, the WIG Index, fell by 0.74%. From a sector perspective, materials were depressed the most, recording a 1.69% drop. On the contrary, technologies outperformed, climbing 0.73%.

The large-cap stocks' measure, the WIG30 Index, declined by 0.90%. BOGDANKA (WSE: LWB) kept its position as the worst performing name among the large-cap stocks as its quotations continued to record steep declines, posting a 6.36% slump. It was followed by JSW (WSE: JSW), CYFROWY POLSAT (WSE: CPS) and LPP (WSE: LPP), losing 2.81%, 2.78% and 2.44% respectively. At the same time, KERNEL (WSE: KER) was the biggest gainer, adding 2.68%. GTC (WSE: GTC), ASSECO POLAND (WSE: ACP) and GRUPA AZOTY (WSE: ATT) also were on upstream, advancing a respective 1.77%, 1.73% and 1.17%.

-

18:00

European stocks closed: FTSE 100 6,784.92 -61.82 -0.90 %, CAC 40 4,901.19 -70.18 -1.41 %, DAX 11,196.49 -136.29 -1.20 %

-

16:44

Thomson Reuters/University of Michigan preliminary consumer sentiment index jumps to 94.6 in June

The Thomson Reuters/University of Michigan preliminary consumer sentiment index rose to 94.6 in June from a final reading of 90.7 in May, exceeding expectations for an increase to 91.5.

The Surveys of Consumers chief economist at the University of Michigan Richard Curtin said that consumer confidence rebounded in June.

Mr Curtin added that consumers remained optimistic about their future personal finances.

"The June gain was due to the most favorable personal financial prospects since 2007, with households expecting the largest wage gains since 2008," he noted.

The increase in the index was mainly driven by a rise in the index of current economic conditions, which jumped to 106.8 in June from 100.8 in May.

The index of consumer expectations climbed to 86.8 from 84.2.

The one-year inflation expectations in June fell to 2.7% from 2.8% in May.

-

16:14

Bank of England Monetary Policy Committee Member Ian McCafferty: the U.K. economy staring to return to normal conditions and the time to begin raising interest rate is nearing

The Bank of England (BoE) Monetary Policy Committee (MPC) Member Ian McCafferty said that the U.K. economy staring to return to normal conditions and the time to begin raising interest rate is nearing. The text of his speech was published by the central bank on Friday.

"The economy is starting to return to more normal conditions, after arguably the biggest shock in over a hundred years, and we expect this healing process to continue over the forecast. As a result, the time of the extraordinary policy stance of recent years is gradually drawing to a close," McCafferty said.

McCafferty and Martin Weale voted for an interest rate hike last year.

The MPC member pointed out that the timing of the interest rate hike will depend on the incoming economic data.

McCafferty noted that it is unlikely that low inflation will last for a longer period.

-

15:39

Greek import prices climb 1.4% in April

The Hellenic Statistical Authority released its import prices data for Greece on Friday. Greek import prices climbed 1.4% in April, after a 0.6% fall in March.

On a yearly basis, import prices dropped 9.2% in April, after a 10.5% decline in March.

Import prices for energy plunged by 29.4%, while price for non-durable consumer goods declined by 0.3 percent.

Prices of capital goods rose 0.3% in April, while intermediate goods prices increased 1.3%.

-

15:35

U.S. Stocks open: Dow -0.43%, Nasdaq -0.43%, S&P -0.39%

-

15:28

Before the bell: S&P futures -0.39%, NASDAQ futures -0.54%

U.S. stock-index futures retreated, with equities poised to trim a weekly gain, amid concern Greece won't reach a deal with its creditors as its debt negotiations drag on.

Global markets:

Nikkei 20,407.08 +24.11 +0.12%

Hang Seng 27,280.54 +372.69 +1.39%

Shanghai Composite 5,166.35 +44.76 +0.87%

FTSE 6,800.39 -46.35 -0.68%

CAC 4,904.71 -66.66 -1.34%

DAX 11,206.49 -126.29 -1.11%

Crude oil $60.19 (-0.93%)

Gold $1177.40 (-0.25%)

-

15:07

U.S. producer price index is up 0.5% in May, the largest increase since September 2012

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index increased 0.5% in May, exceeding expectations for a 0.4% gain, after a 0.4% drop in April. It was the largest increase since September 2012.

On a yearly basis, the producer price index decreased 1.1% in April, in line with expectations, after a 1.3% fall in April.

The rise was driven by higher food and gasoline prices. Gasoline prices jumped 17.0% in May, the largest rise since August 2009. Food prices climbed by 0.8%, driven by a shortage of eggs, and as wholesale egg prices jumped a 56.4% in May.

The producer price index excluding food and energy climbed 0.1% in May, in line with expectations, after a 0.2% decrease in April.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in May, missing forecasts of a 0.7% increase, after a 0.8% rise in April.

The figures added to speculation on that the Fed will start raising its interest rate this year.

-

15:05

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Wal-Mart Stores Inc

WMT

72.95

+0.01%

10.7K

American Express Co

AXP

80.32

+0.02%

0.5K

HONEYWELL INTERNATIONAL INC.

HON

105.01

+0.10%

0.1K

Twitter, Inc., NYSE

TWTR

37.10

+3.52%

1.8M

Boeing Co

BA

142.80

-0.11%

0.4K

The Coca-Cola Co

KO

40.05

-0.12%

4.0K

Johnson & Johnson

JNJ

99.09

-0.15%

0.1K

Home Depot Inc

HD

111.10

-0.17%

0.2K

ALCOA INC.

AA

12.07

-0.17%

1.7K

ALTRIA GROUP INC.

MO

48.25

-0.17%

0.6K

Tesla Motors, Inc., NASDAQ

TSLA

250.99

-0.17%

2.5K

Barrick Gold Corporation, NYSE

ABX

11.25

-0.18%

2.2K

Apple Inc.

AAPL

128.34

-0.19%

99.9K

Cisco Systems Inc

CSCO

28.80

-0.21%

1.1K

Exxon Mobil Corp

XOM

84.89

-0.24%

3.7K

Hewlett-Packard Co.

HPQ

32.44

-0.25%

1.0K

Merck & Co Inc

MRK

58.74

-0.29%

0.6K

McDonald's Corp

MCD

95.30

-0.30%

0.5K

AT&T Inc

T

34.77

-0.32%

1.1K

Citigroup Inc., NYSE

C

57.02

-0.33%

0.2K

Ford Motor Co.

F

15.23

-0.33%

5.1K

Visa

V

69.40

-0.34%

0.3K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.86

-0.35%

0.8K

General Electric Co

GE

27.40

-0.39%

10.7K

Nike

NKE

103.47

-0.39%

0.1K

JPMorgan Chase and Co

JPM

68.25

-0.39%

1.8K

Goldman Sachs

GS

213.09

-0.40%

0.8K

Yahoo! Inc., NASDAQ

YHOO

40.77

-0.40%

17.1K

General Motors Company, NYSE

GM

35.40

-0.42%

0.5K

Amazon.com Inc., NASDAQ

AMZN

431.00

-0.45%

1.1K

Intel Corp

INTC

31.70

-0.47%

15.7K

Deere & Company, NYSE

DE

92.76

-0.48%

0.2K

Google Inc.

GOOG

532.00

-0.49%

0.1K

Facebook, Inc.

FB

81.41

-0.51%

2.7K

Microsoft Corp

MSFT

46.20

-0.52%

12.2K

Starbucks Corporation, NASDAQ

SBUX

52.21

-0.53%

2.9K

Walt Disney Co

DIS

110.00

-0.56%

1.8K

Chevron Corp

CVX

100.50

-0.61%

0.4K

AMERICAN INTERNATIONAL GROUP

AIG

61.59

-0.65%

0.3K

Verizon Communications Inc

VZ

47.40

-0.75%

2.1K

-

14:53

Consumer prices in Spain climb by 0.5% in May

The Spanish statistical office INE released its final consumer price inflation data for Spain on Friday. Consumer prices in Spain climbed by 0.5% in May, after a 0.3% rise in April.

On a yearly basis, Spanish consumer price inflation declined 0.2% in May, after a 0.6% drop in April. Consumer prices have been declining since July 2014.

Housing prices plunged at an annual rate of 2.4% in May, while transport prices dropped by 2.2 percent.

Food and non-alcoholic beverages prices climbed by 1.3%.

-

14:45

German wholesale prices rise 0.5% in May

The German statistical office Destatis released its wholesale prices for Germany on Friday. German wholesale prices rose 0.5% in May, after a 0.4% increase in April.

On a yearly basis, wholesale prices in Germany declined 0.4% in May, after a 0.9% drop in April. Wholesale prices have been declining since July 2013.

The fall was largely driven by a 8.8% decline in the wholesale prices of solid fuels and related products.

-

14:22

KOF Swiss Economic Institute upgrades its economic growth forecasts for Switzerland but downgrades its inflation forecasts

The KOF Swiss Economic Institute Friday upgraded its economic growth forecasts for Switzerland but downgraded its inflation forecasts. The Swiss economy is expected to rise 0.4% in 2015, up from the March estimate of 0.2%. The economic growth in 2016 is expected to be 1.3%, up from the March estimate of 1.0%.

The strong Swiss franc and a slowdown in the global economy weighed on the Swiss economy.

The Swiss consumer price inflation is expected to decline 1.1% in 2015, down from the March estimate of -0.8%. The consumer price inflation in 2016 is expected to decline 0.3%, down from the March estimate of 0.0%.

-

12:05

European stock markets mid session: stocks traded lower on the uncertainty over the Greek debt talks and on the weaker-than-expected industrial production data from the Eurozone

Stock indices traded lower on the uncertainty over the Greek debt talks and on the weaker-than-expected industrial production data from the Eurozone. The International Monetary Fund (IMF) spokesman Gerry Rice said on Thursday that the IMF's technical team has left the debt talks in Brussels. The reason is "major differences", he noted. "There are major differences between us in most key areas," Rice said.

News reported that Germany was preparing for a Greek default.

Industrial production in the Eurozone rose 0.1% in April, missing expectations for a 0.3% gain, after a 0.4% decline in March. March's figure was revised down from a 0.3% decrease.

The increase was driven by a rise in durable consumer goods and capital goods output. Durable consumer goods were up 1.0%, while capital goods rose by 0.7%.

On a yearly basis, Eurozone's industrial production gained 0.8% in April, missing expectations for a 1.1% rise, after a 2.1% increase in March. March's figure was revised up from a 1.8 gain.

The increase was driven by a rise in durable consumer goods and in production of capital goods. Durable consumer goods climbed by 1.7% in April from a year ago, while capital goods output rose by 2.1%.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.8% in April, after a 1.4% rise in March.

The decline was driven by a drop in repair and maintenance, which plunged 4.8% in April.

New work increased 1.6% in April.

On a yearly basis, construction output climbed 1.6% in April.

The ONS revised its methodology for measuring construction. For the first quarter as a whole, construction output was down 0.2%.

According to the ONS, the revision could have an impact the U.K. GDP growth. The economy could have expanded at 0.4% in the first quarter rather than 0.3%.

Current figures:

Name Price Change Change %

FTSE 100 6,812.7 -34.04 -0.50 %

DAX 11,282.36 -50.42 -0.44 %

CAC 40 4,947.61 -23.76 -0.48 %

-

11:44

UK’s construction output declines 0.8% in April

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 0.8% in April, after a 1.4% rise in March.

The decline was driven by a drop in repair and maintenance, which plunged 4.8% in April.

New work increased 1.6% in April.

On a yearly basis, construction output climbed 1.6% in April.

The ONS revised its methodology for measuring construction. For the first quarter as a whole, construction output was down 0.2%.

According to the ONS, the revision could have an impact the U.K. GDP growth. The economy could have expanded at 0.4% in the first quarter rather than 0.3%.

-

11:27

Eurozone’s industrial production rises 0.1% in April

Eurostat released its industrial production data for the Eurozone on Friday. Industrial production in the Eurozone rose 0.1% in April, missing expectations for a 0.3% gain, after a 0.4% decline in March. March's figure was revised down from a 0.3% decrease.

The increase was driven by a rise in durable consumer goods and capital goods output. Durable consumer goods were up 1.0%, while capital goods rose by 0.7%.

Non-durable consumer goods declined by 0.8%, while energy output dropped by 1.6%.

On a yearly basis, Eurozone's industrial production gained 0.8% in April, missing expectations for a 1.1% rise, after a 2.1% increase in March. March's figure was revised up from a 1.8 gain.

The increase was driven by a rise in durable consumer goods and in production of energy. Durable consumer goods climbed by 1.7% in April from a year ago, while capital goods output rose by 2.1%.

Non-durable consumer goods declined by 0.3%.

-

10:51

The Wall Street Journal’s survey: the Fed could downgrade its forecasts for economic growth this year and for interest rates in the coming three years

The Fed could downgrade its forecasts for economic growth this year and for interest rates in the coming three years, according the survey by The Wall Street Journal. The central bank is scheduled to release its forecasts at its next meeting.

Private analysts surveyed by The Wall Street Journal expect the U.S. economy to expand at 2.1% in 2015, down from the March forecast of 2.9%, driven by the weak first quarter. The growth of 2.1% is below the Fed's March forecast of 2.5%.

Private analysts' forecasts for unemployment and inflation are little changed.

Private analysts expect the Fed to start raising its interest rate in September.

-

10:35

Spokesman of the Greek government Gabriel Sakellaridis: Athens is ready to intensify the debt talks

Spokesman of the Greek government Gabriel Sakellaridis said on Thursday that Athens is ready to intensify the debt talks.

"The Greek delegation, as agreed, is ready to intensify deliberations in order to conclude a deal soon, even in the coming days," he said.

Earlier, the International Monetary Fund (IMF) spokesman Gerry Rice said that the IMF's technical team has left the debt talks in Brussels. The reason is "major differences", he noted. "There are major differences between us in most key areas," Rice said.

-

10:17

Bank of Canada’s financial system review: lower oil prices could lead to widespread job losses and falling incomes

The Bank of Canada (BoC) warned in its latest financial system review on Thursday that lower oil prices could lead to widespread job losses and falling incomes. But the central bank added that the probability of a recession remains low.

The BoC said that the increasing level of household debt and the overvalued real estate market are key vulnerabilities in the financial system. According to the financial system review, the risk of a correction in house prices has "increased marginally".

"There's more debt to income, relatively, than we've ever seen before," the BoC Governor Stephen Poloz said.

-

04:01

Nikkei 225 20,404.12 +21.15 +0.10 %, Hang Seng 27,077.76 +169.91 +0.63 %, Shanghai Composite 5,137.24 +15.64 +0.31 %

-

01:00

Stocks. Daily history for Jun 11’2015:

(index / closing price / change items /% change)

Nikkei 225 20,382.97 +336.61 +1.68 %

Hang Seng 26,907.85 +220.21 +0.83 %

S&P/ASX 200 5,556.65 +78.02 +1.42 %

Shanghai Composite 5,122.15 +16.12 +0.32 %

FTSE 100 6,846.74 +16.47 +0.24 %

CAC 40 4,971.37 +36.46 +0.74 %

Xetra DAX 11,332.78 +67.39 +0.60 %

S&P 500 2,108.86 +3.66 +0.17 %

NASDAQ Composite 5,082.51 +5.82 +0.11 %

Dow Jones 18,039.37 +38.97 +0.22 %

-