Noticias del mercado

-

20:20

American focus: the US dollar rose

The US dollar traded higher against the euro and the Japanese yen, despite the fact that US data indicate uneven economic recovery.

The dollar lost ground in the beginning of the session after news that US retail sales in May rose slightly less than expected, and applications for unemployment benefits last week rose slightly more than expected. The data sparked concerns about the fact that the economy is recovering too slowly A tightening of monetary policy, which would increase demand for the dollar.

The number of Americans who first applied for unemployment benefits rose last week but remained near the values indicating a stable situation on the labor market. This was reported in the Labor Department report. The number of initial applications for unemployment benefits rose by 2,000 to a seasonally adjusted, reaching 279,000 in the week ended June 6th. Economists had expected 277,000 new claims. We also add the figure for the previous week was revised up to 277,000 from 276,000.

Retail sales in the US increased significantly the end of May, accelerating from the previous month, a sign of increasing consumer spending after a weak start to the year. This was reported in the statement of the Ministry of Commerce. According to data seasonally adjusted retail sales rose in May by 1.2%, reaching $ 444.9 billion. We also add the figure for April was revised up to + 0.2% from 0.0% per cent, and in March the volume sales up + 1.5% to + 0.9%, the largest monthly gain in the last five years. Economists had expected sales to rise 1.1%.

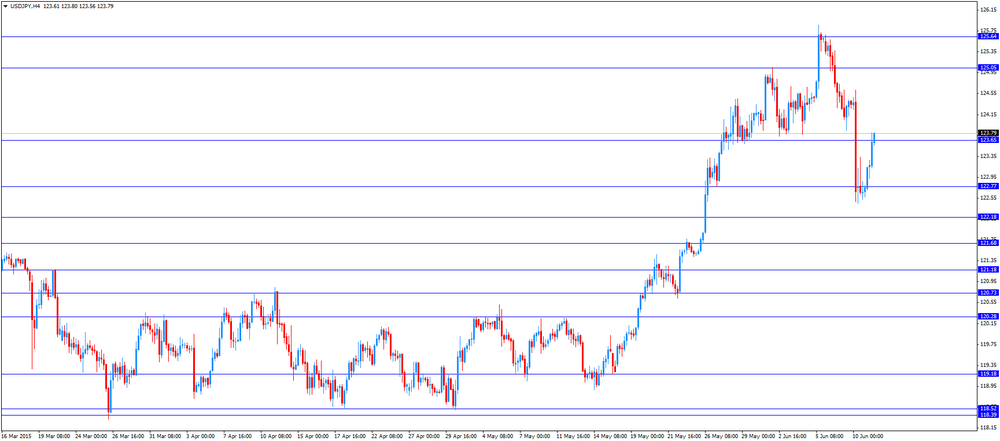

However, later in the session the dollar rebounded as some investors are once again opened their positions in anticipation of the growth of the dollar, which they closed on Wednesday, when the yen rose on comments Governor of the Bank of Japan Haruhiko Kuroda.

A further decline in the euro constrain new projections from the World Bank. Experts pointed out that the euro zone economy in 2015 will recover faster than expected. The forecast of world economic growth for the current year rate of monetary union increased to 1.5 per cent. Previously, experts came from growth of 1.1 percent. As economists say, growth in the euro area contribute to the weak euro, and falling oil prices. In 2016 and 2017 figure, according to World Bank forecasts, will amount to 1.8 and 1.6 percent respectively.

The yen depreciated considerably against the dollar, having lost more than half earned last position, which helped comments Source of the Government of Japan. Who requested anonymity, a source from the Cabinet Office of Japan, he said that the comments of the Bank of Japan Kuroda against the yen were careless and did not express the position of the Prime Shinjo Abe. Yesterday the manager of the Central Bank Haruhiko Kuroda said that the real effective exchange rate of the yen is unlikely to continue to decline. Speaking in parliament, he said that the yen against the currencies of trading partners in Japan "significantly low" if it is to adjust to the difference in the levels of inflation in these countries.

-

17:19

Greek unemployment rate climbs to 26.6% in the first quarter

The Hellenic Statistical Authority released its labour market data for Greece on Thursday. The Greek unemployment rate climbed to 26.6% in the first quarter from 26.1% in the previous quarter.

The number of unemployed people rose by 2.1% to 1.3 million in the first quarter.

The youth unemployment rate was 51.9% in the first quarter.

-

17:15

OECD: G20 area expands at 0.7% in the first quarter

The Organization for Economic Co-operation and Development (OECD) released its economic growth figures for G20 area on Thursday. The G20 area expanded at 0.7% in the first quarter, after a 0.8% gain in the fourth quarter.

Eurozone's growth was 0.4% in first quarter. Germany's and the United Kingdom's economy climbed by 0.3% each in the first quarter, while France's economy grew by 0.6.

The United States' economy contracted 0.1% in first quarter, while Canada's economy shrank 0.1%.

Growth in China declined to 1.3% in the first quarter from 1.5% in the previous quarter, India's economy grew 2.1%.

On a yearly basis, the G20 area expanded at 3.3% in the first quarter, after a 3.2% in the fourth quarter.

-

17:03

World Bank lowered its global economic forecast for 2015

The World Bank cut its global economic growth forecast for 2015 and 2016 on Thursday, saying that developing countries will face problems from rising U.S. interest rates and lower commodity prices. The World Bank said that the Fed should wait until the next year before raising its interest rate.

The International Monetary Fund (IMF) also warned last week that the Fed should delay its interest rate hike until the first half of 2016.

The World Bank expects that the global economy would grow 2.8% in 2015, down from its January forecast of 3.0%. The global growth was left unchanged at 3.3% in 2016 and at 3.2% in 2017.

China's economy is expected to expand 7.1% in 2015 (7.4% in 2014), 7% in 2016 and 6.9% in 2017.

Growth in the U.S. is expected to accelerate to 2.7% in 2015, down from its January forecast of 3.2, to 2.8% in 2016, down from its January forecast of 3.0%, and to 2.4% in 2017. The World Bank said that a stronger U.S. dollar slowed the U.S. economy more than expected.

In the Eurozone, the economy is expected to grow 1.5% in 2015, up from its January forecast of 1.1%, 1.8% in 2016, up from its January forecast of 1.6%, and 1.6% in 2017.

In Japan, the economy is expected to expand at 1.1% in 2015, down from its January forecast of 1.2%, at 1.7% in 2016 and at 1.2% in 2017.

Developing countries are expected to grow by 4.4% in 2015, by 5.2% in 2016, and by 5.4% in 2017.

-

16:44

Australia's unemployment rate declines to 6.0% in May

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate declined to 6.0% in May from 6.1% in April, beating expectations for a rise to 6.2%. April's figure was revised down from 6.2%.

The number of employed people in Australia climbed by 42,000 in May, exceeding expectations for an increase by 11,000, after a decline by 13,700 in April. April's figure was revised down from a decrease by 2,900.

The increase in employment was driven by a rise in part-time employment for females, which gained by 29,800, and full-time employment for males, which increased by 15,900.

Full-time employment rose by 14,700, while part-time employment increased by 27,300.

The participation rate was 64.7%.

-

16:29

U.S. business inventories rise 0.4% in April

The U.S. Commerce Department released the business inventories data on Thursday. The U.S. business inventories rose 0.4% in April, beating expectations for a 0.2% increase, after a 0.1% gain in March.

The increase was driven by a rise in retail inventories. Retail inventories climbed 0.8% in April.

Business sales climbed 0.6% in April.

The business inventories/sales ratio remained unchanged at 1.36 months in April. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:00

U.S.: Business inventories , April 0.4% (forecast 0.2%)

-

15:55

Canada’s new housing price index climbs 0.1% in April

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in April, in line with expectations, after a flat reading in March.

The increase was driven by gains in Toronto, Oshawa, Ontario and Vancouver.

On a yearly basis, new housing price index in Canada climbed 1.1% in April. It was the slowest pace since February 2010.

-

15:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E756mn), $1.1230-70(E2.0bn), $1.1350-60(E1.1bn), $1.1375(E750mn), $1.1400(E1.2bn)

USD/JPY: Y122.00($455mn), Y123.00($830mn), Y124.00($450mn), Y125.00($600mn), Y125.25($600mn)

GBP/USD: $1.5200(Gbp520mn), $1.5400(Gbp329mn)

AUD/NZD: NZ$1.0700(A$402mn)

NZD/USD: $0.7200(NZ$376mn), $0.7300(NZ$847mn)

USD/CAD: C$1.2300($270mn), C$1.2425($705mn)

-

15:27

U.S. import price index jumps 1.3% in May

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index climbed by 1.3% in May, exceeding expectations for a 0.8% increase, after a 0.2% decline in April. It was the first rise since June 2014.

April's figure was revised up from a 0.3% decrease.

The rise was driven by higher fuel import prices, which climbed 12.7% in May.

Prices for automobiles, natural gas, nonfuel industrial supplies and capital goods declined in May.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices increased by 0.6% in May, after a 0.7% drop in April. It was the biggest gain since March 2014.

-

15:12

U.S. retail sales soar 1.2% in May

The U.S. Commerce Department released the retail sales data on Thursday. The U.S. retail sales jumped 1.2% in May, exceeding expectations for a 1.1% increase, after a 0.2% gain in April. April's figure was revised up from a flat reading.

The increase was driven by higher automobiles and gasoline purchases. Automobiles sales increased 2.0% in May, while gasoline station sales climbed 3.7%.

Retail sales excluding automobiles increased 1.0% in May, beating forecasts for a 0.7% rise, after a 0.1% gain in April.

Sales at clothing retailers climbed 1.5%. Sales at building material and garden equipment stores were up 2.1% and sales at restaurants and bars increased 0.1%.

Sales at electronics and appliance outlets were up 0.1% in May, whiles sales at online stores gained 1.4%.

These figures indicate that U.S. economy was finding momentum after a slow start of the second quarter.

-

14:45

Initial jobless claims rise by 2,000 to 279,000 in the week ending June 06

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending June 06 in the U.S. climbed by 2,000 to 279,000 from 277,000 in the previous week. The previous week's reading was revised down from 276,000.

Analysts had expected the number of initial jobless claims to be 277,000.

Jobless claims remained below 300,000 the 14th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims climbed by 61,000 to 2,265,000 in the week ended May 30.

-

14:31

U.S.: Retail sales, May 1.2% (forecast 1.1%)

-

14:30

U.S.: Initial Jobless Claims, June 279 (forecast 277)

-

14:30

U.S.: Import Price Index, May 1.2% (forecast 0.8%)

-

14:30

U.S.: Continuing Jobless Claims, May 2265 (forecast 2188)

-

14:30

U.S.: Retail sales excluding auto, June 1.0% (forecast 0.7%)

-

14:30

Canada: New Housing Price Index, MoM, April 0.1% (forecast 0.1%)

-

14:22

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite hopes for a deal between Greece and its creditors

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:00 Australia Consumer Inflation Expectation June 3.6% 3.0%

01:30 Australia Unemployment rate May 6.1% Revised From 6.2% 6.2% 6.0%

01:30 Australia Changing the number of employed May -13.7 Revised From -2.9 11 42

05:30 China Retail Sales y/y May 10.0% 10.1% 10.1%

05:30 China Industrial Production y/y May 5.9% 6.0% 6.1%

05:30 China Fixed Asset Investment April 12.0% Revised From 13.5% 12% 11.4%

06:45 France CPI, m/m May 0.1% 0.2%

06:45 France CPI, y/y May 0.1% 0.3%

The U.S. dollar traded higher against the most major currencies ahead of U.S. economic data. The U.S. retail sales are expected to rise 1.1% in May, after a flat reading in April.

Retail sales excluding automobiles are expected to climb 0.7% in May, after a 0.1% increase in April.

The number of initial jobless claims in the U.S. is expected to increase by 1,000 to 277,000 last week.

The U.S. business inventories are expected to rise 0.2% in April, after a 0.1% gain in March.

The euro traded lower against the U.S. dollar despite hopes for a deal between Greece and its creditors. Greek Prime Minister Alexis Tsipras, German Chancellor Angela Merkel and French President François Hollande Wednesday agreed to intensify the debt talks.

The head of the Eurogroup Jeroen Dijsselbloem said in Helsinki on Wednesday that a deal between Greece and its creditors can still be reached. But he warned that the time was running out.

Yields of German government bonds continued to rise on Thursday.

Meanwhile, the economic from the Eurozone was positive. The French statistical office Insee said its consumer price inflation for France. The French consumer price inflation rose 0.2% in May, after a 0.1% increase in April.

On a yearly basis, the consumer price index climbed 0.3% in May, after a 0.1% rise.

Fresh food prices rose 6.4% year-on-year in May, while petroleum products prices dropped by 6.3%.

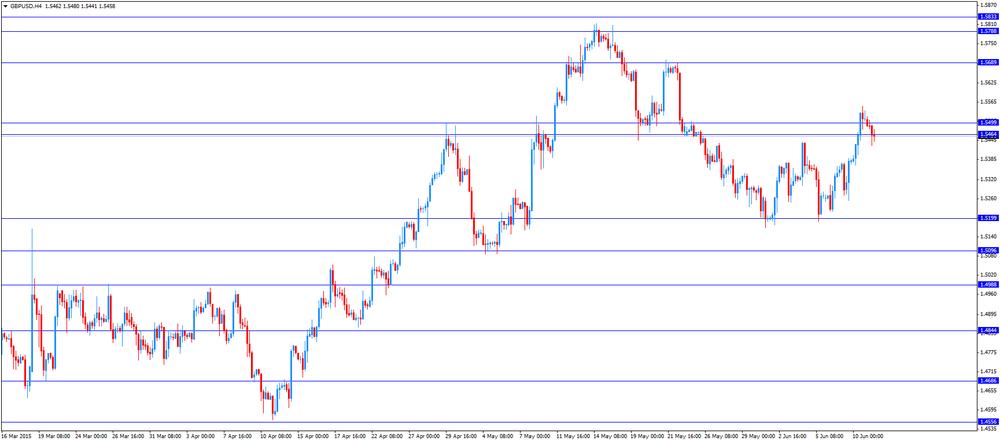

The British pound traded lower against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian housing market data. Canada's new housing price index is expected to rise 0.1% in April, after a flat reading in March.

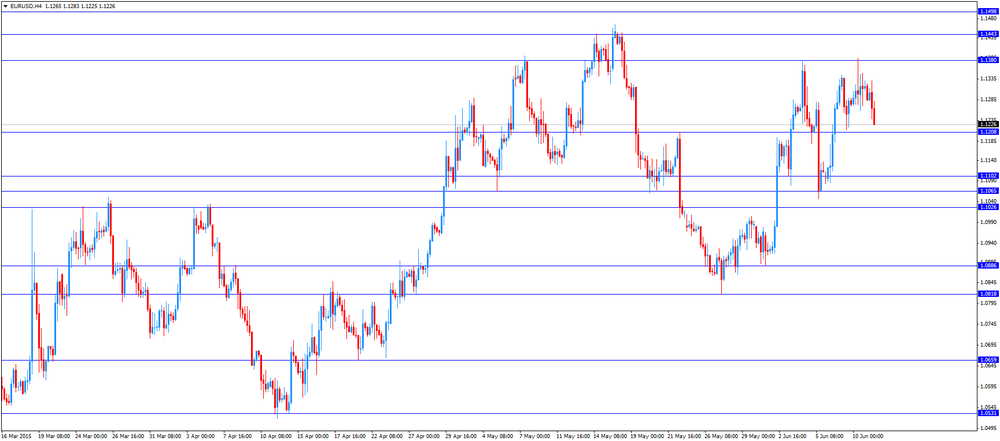

EUR/USD: the currency pair decreased to $1.1225

GBP/USD: the currency pair declined to $1.5425

USD/JPY: the currency pair rose to Y123.80

The most important news that are expected (GMT0):

12:30 Canada New Housing Price Index, MoM April 0% 0.1%

12:30 U.S. Retail sales May 0.0% 1.1%

12:30 U.S. Retail sales excluding auto June 0.1% 0.7%

12:30 U.S. Initial Jobless Claims June 276 277

14:00 U.S. Business inventories April 0.1% 0.2%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 51.8

-

14:00

Orders

EUR/USD

Offers 1.1300 1.1320 1.1340 1.1365 1.1380 1.1400 1.1430 1.1450 1.1475 1.1500

Bids 1.1275-80 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5480 1.5500 1.5530 1.5550 1.5580 1.5600

Bids 1.5440-45 1.5425 1.5400 1.5380 1.5365 1.5345 1.5330 1.5300

EUR/GBP

Offers 0.7320-25 0.7350 0.7365 0.7385 0.7400 0.7425-30 0.7450 0.7475 0.7500

Bids 0.7280-85 0.7265 0.7250 0.7220 0.7200

EUR/JPY

Offers 139.20 139.50 139.80 140.00 140.20 140.50 140.85 141.00

Bids 138.70 138.50 138.30 138.00 137.50 137.00

USD/JPY

Offers 123.80 124.00 124.25 124.40 124.75-80 125.00

Bids 123.25 123.00 122.80 122.60 122.30 122.00 121.75-80 121.50 121.30 121.00

AUD/USD

Offers 0.7790 0.7800 0.7830 0.7850 0.7865 0.7880 0.7900

Bids 0.7700 0.7680 0.7650 0.7625-30 0.7600 0.7585 0.7550

-

11:41

Reserve Bank of New Zealand cuts its interest rate to 3.25% from 3.50%

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The central bank cut its interest rate to 3.25% from 3.50%. It was the first cut since 2011.

The RBNZ Governor Graeme Wheeler said that the interest rate cut was "appropriate given low inflationary pressures and the expected weakening in demand, and to ensure that medium term inflation converges towards the middle of the target range".

He pointed out that the further interest rate cut is possible, but it will depend on the incoming economic data.

-

11:27

French consumer price inflation rises 0.2% in May

The French statistical office Insee said its consumer price inflation for France. The French consumer price inflation rose 0.2% in May, after a 0.1% increase in April.

On a yearly basis, the consumer price index climbed 0.3% in May, after a 0.1% rise.

Fresh food prices rose 6.4% year-on-year in May, while petroleum products prices dropped by 6.3%.

-

11:22

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1200(E756mn), $1.1230-70(E2.0bn), $1.1350-60(E1.1bn), $1.1375(E750mn), $1.1400(E1.2bn)

USD/JPY: Y122.00($455mn), Y123.00($830mn), Y124.00($450mn), Y125.00($600mn), Y125.25($600mn)

GBP/USD: $1.5200(Gbp520mn), $1.5400(Gbp329mn)

AUD/NZD: NZ$1.0700(A$402mn)

NZD/USD: $0.7200(NZ$376mn), $0.7300(NZ$847mn)

USD/CAD: C$1.2300($270mn), C$1.2425($705mn)

-

11:08

Standard & Poor's downgrades the long-term sovereign credit rating on Greece to ‘CCC’

Standard and Poor's Ratings Services has downgraded the long-term sovereign credit rating on Greece to 'CCC' from 'CCC+' because of the absence of a deal between Greece and its creditors. The outlook is negative.

The agency noted that Athens will likely default on its commercial debt within the next 12 months.

"As its liquidity position continues to deteriorate, Greece appears to be prioritizing other spending items over debt servicing. In our view, without a turnaround in the trajectory of nominal GDP and deep public-sector reform, Greece's debt is unsustainable. The downgrade reflects our view that in the absence of an agreement with its official creditors, Greece will likely default on its commercial debt within the next 12 months," S&P said in its statement.

-

10:54

Standard & Poor's affirms the U.S.’s AA+ credit rating with a stable outlook

Standard & Poor's Ratings Services affirmed the U.S.'s AA+ credit rating with a stable outlook. According to S&P analysts, the U.S. credit rating was underpinned by the resiliency and diversity of the U.S. economy, and the U.S. role as the issuer of the world's reserve currency.

-

10:35

U.S. federal budget declines to $82.4 billion in May

The U.S. Treasury Department released its federal budget data on Wednesday. The budget deficit declined to $82.4 billion in May, down from a deficit of $130 billion in May 2014. Analysts had expect a decline to $98 billion.

The budget deficit declined as revenue was higher than expenses.

Receipts in May rose 6% from the same period last year, while outlays declined 11% from the same period last year.

-

10:18

Head of the Eurogroup Jeroen Dijsselbloem: a deal between Greece and its creditors can still be reached

The head of the Eurogroup Jeroen Dijsselbloem said in Helsinki on Wednesday that a deal between Greece and its creditors can still be reached. But he warned that the time was running out.

"We are still open to serious alternatives, but the alternatives of the last couple of days have not been of a high enough standard," Dijsselbloem said.

-

10:08

European Central Bank raises the amount the Greek central bank can lend its banks by €2.3 billion to €83.0 billion

The European Central Bank (ECB) on Wednesday raised the amount the Greek central bank can lend its banks by €2.3 billion to €83.0 billion from €80.7 billion, according to people familiar with the decision. It was the biggest weekly rise since February 18.

The ECB declined to comment.

The total level of available ELA has increased by more than €23 billion since February.

-

08:45

France: CPI, y/y, May 0.3%

-

08:45

France: CPI, m/m, May 0.2%

-

08:22

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

Euro fell despite optimism progress is being made in Greece's debt talks. Speculation increased that the standoff over Greece will reach a favorable resolution as the European Central Bank raised the level of emergency cash available to the country's banks by 2.3 billion euros ($2.6 billion). German Chancellor Angela Merkel said Wednesday her goal is "to keep Greece in the euro area."

The yen weakened dollar, after jumping 1.4 percent Wednesday as Bank of Japan Governor Haruhiko Kuroda said it was hard to see further losses.

The kiwi sank after the Reserve Bank of New Zealand's decision, the currency's weakest intraday level since September 2010. It lost 2.6 percent to neighboring Australia's dollar, which erased earlier declines after government data showed unemployment unexpectedly fell in May to the lowest in a year.

EUR / USD: during the Asian session the pair fell to $ 1.1285

GBP / USD: during the Asian session the pair fell to $ 1.5485

USD / JPY: during the Asian session the pair rose to Y123.20

-

08:13

Options levels on thursday, June 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1411 (1931)

$1.1387 (1470)

$1.1362 (407)

Price at time of writing this review: $1.1294

Support levels (open interest**, contracts):

$1.1237 (1394)

$1.1197 (529)

$1.1147 (1260)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 44241 contracts, with the maximum number of contracts with strike price $1,1500 (3084);

- Overall open interest on the PUT options with the expiration date July, 2 is 74009 contracts, with the maximum number of contracts with strike price $1,0500 (8138);

- The ratio of PUT/CALL was 1.67 versus 1.63 from the previous trading day according to data from June, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5805 (2171)

$1.5707 (572)

$1.5611 (1160)

Price at time of writing this review: $1.5482

Support levels (open interest**, contracts):

$1.5390 (934)

$1.5293 (1786)

$1.5195 (698)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 20694 contracts, with the maximum number of contracts with strike price $1,5500 (2194);

- Overall open interest on the PUT options with the expiration date July, 2 is 20759 contracts, with the maximum number of contracts with strike price $1,5250 (1922);

- The ratio of PUT/CALL was 1.00 versus 1.06 from the previous trading day according to data from June, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:31

China: Fixed Asset Investment, April 11.4% (forecast 12%)

-

07:30

China: Industrial Production y/y, May 6.1% (forecast 6.0%)

-

07:30

China: Retail Sales y/y, May 10.1% (forecast 10.1%)

-

03:30

Australia: Unemployment rate, May 6.0% (forecast 6.2%)

-

03:30

Australia: Changing the number of employed, May 42 (forecast 11)

-

01:51

Japan: BSI Manufacturing Index, Quarter II -6

-

01:01

Currencies. Daily history for Jun 10’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1318 +0,38%

GBP/USD $1,5512 +0,85%

USD/CHF Chf0,9319 +0,11%

USD/JPY Y122,75 -1,29%

EUR/JPY Y138,93 -0,90%

GBP/JPY Y190,4 -0,44%

AUD/USD $0,7740 +0,67%

NZD/USD $0,7070 -1,02%

USD/CAD C$1,2270 -1,37%

-