Noticias del mercado

-

23:59

Schedule for today, Thursday, Jun 11’2015:

(time / country / index / period / previous value / forecast)

01:00 Australia Consumer Inflation Expectation June 3.6%

01:30 Australia Unemployment rate May 6.2% 6.2%

01:30 Australia Changing the number of employed May -2.9 11

05:30 China Retail Sales y/y May 10.0% 10.1%

05:30 China Industrial Production y/y May 5.9% 6.0%

05:30 China Fixed Asset Investment April 13.5% 12%

06:45 France CPI, m/m May 0.1%

06:45 France CPI, y/y May 0.1%

12:30 Canada New Housing Price Index, MoM April 0% 0.1%

12:30 U.S. Continuing Jobless Claims May 2196 2188

12:30 U.S. Import Price Index May -0.3% 0.8%

12:30 U.S. Retail sales May 0.0% 1.1%

12:30 U.S. Retail sales excluding auto June 0.1% 0.7%

12:30 U.S. Initial Jobless Claims June 276 277

14:00 U.S. Business inventories April 0.1% 0.2%

15:15 Canada BOC Gov Stephen Poloz Speaks

22:30 New Zealand Business NZ PMI May 51.8

22:45 New Zealand Food Prices Index, m/m May -0.3%

22:45 New Zealand Food Prices Index, y/y May 1.0%

-

23:00

New Zealand: RBNZ Interest Rate Decision, 3.25% (forecast 3.5%)

-

20:20

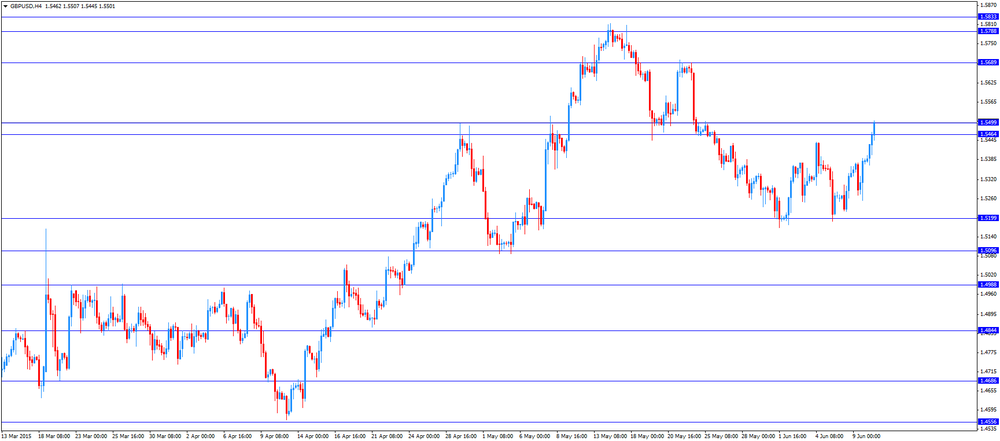

American focus: the pound rose

The pound rose significantly against the US dollar, breaking the mark of $ 1.55, which helped to data on industrial production in Britain. The report submitted by the Office for National Statistics, showed that Britain's industrial output grew moderately by the end of April, surpassing in this assessment experts, helped by a surge in the sectors of oil and gas. According to the data, in April industrial production increased by 0.4 percent compared to the average forecast of 0.1 percent. Also added output growth for March was revised upward - up to 0.6 percent from 0.5 percent. Meanwhile, it became known that the output in the manufacturing sector decreased by 0.4 percent, which was mainly due to a 6-percent decline in the area of pharmaceuticals. It was expected that the index increased 0.1 percent after rising 0.4 percent in March. The report also stated that oil and gas production increased by 8.7 percent for the month, recording the fastest pace since February 2014, which was due to the resumption of work in the North Sea.

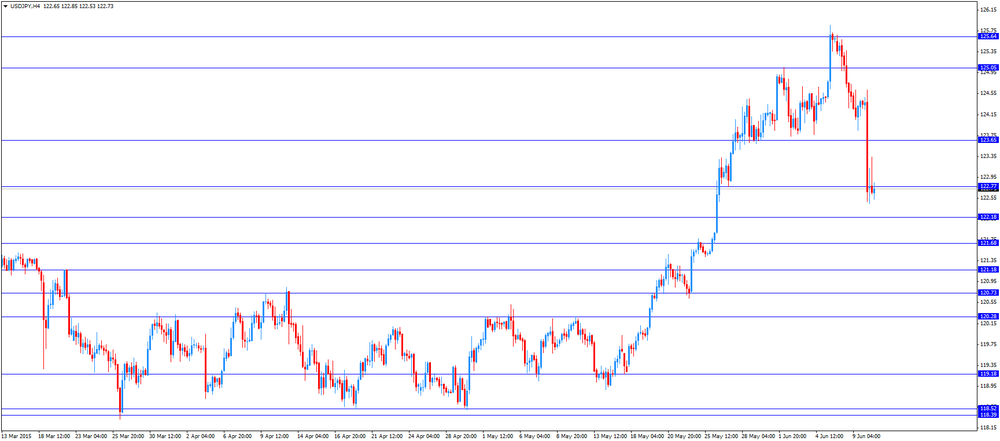

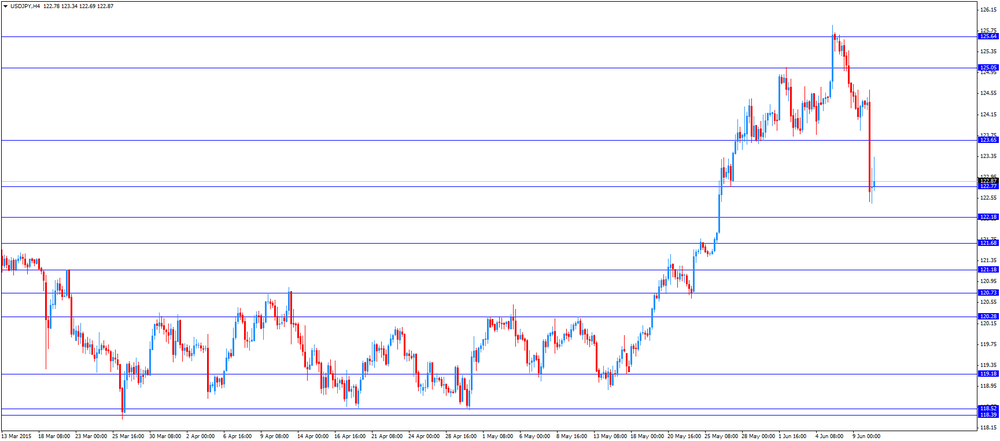

The yen strengthened sharply against the US currency, updating the maximum on May 27 that was associated with the statements of the head of the Bank of Japan Kuroda. He noted that the effective exchange rate of the yen is unlikely to continue to decline, hinting at the same time that the Fed's rate hike may have already laid markets in prices. Comments have been made after last Friday the dollar against the yen peaked nearly 13 years against the publication of strong data on US employment. Positive data reinforced expectations that the Federal Reserve will begin raising short-term interest rates later in the year. Meanwhile, the Bank of Japan Sato said today that a weak yen could have a positive impact on exports and dynamics of the stock markets, but at the same time reduce the profits of importers and cause a decline in real income.

Also today, it was reported that orders in the mechanical engineering sector in Japan in May exceeded forecasts, increasing by 3.8% over the month and by 3.0% per annum. The price index for corporate goods fell weaker than expected 2.1%.

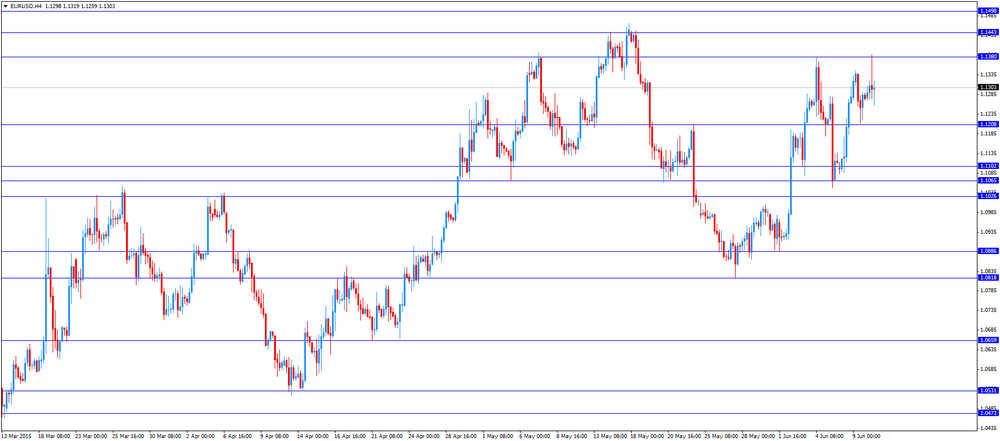

The euro fell against the US dollar, as the new wave of sales of German bonds provoked an increase in the yield above the critical level of 1.0%, after which, however, was made a rollback. Recall recent sales bunds provide good support for the euro. Last week there was the strongest fall in prices of German government bonds since 1998.

Main influenced by expectations of a meeting with Greek Prime Minister Alexis Tsipras with German Chancellor Angela Merkel and French President Francois Hollande, to be held later today in Brussels. They will try to "break the deadlock" negotiations between Greece and its creditors to grant her bailout in exchange for structural economic reforms. Recall, last week, Athens rejected the plan of reforms proposed by the creditors and postponed payment to the IMF at the end of this month. On Tuesday, Greece has sent its own reform proposals, which, according to sources, does not fully reflect the previous agreement of the parties. Greece fresh offer international creditors increased targets for the primary surplus of the state budget, said on Tuesday, two representatives of the European authorities. According to the proposal of Greece involves achieving a primary surplus (excess of revenues over expenses before interest payments) of 0.75% of GDP in 2015, 1.75% in 2016 and 2.5% in 2017. This is lower previous creditors' claims, but above the initial offer Greece. The project also involves an increase in revenues from VAT. According to their estimates, in 2016, revenues from VAT reached 1.36 billion euros. Lenders in Greece is still insisting also on the reform of the VAT system, that would bring the budget to 1.8 billion euros, or about 1% of GDP.

-

20:00

U.S.: Federal budget , May -82.4 (forecast -98)

-

18:05

USD/JPY traded lower on comment by the Bank of Japan Governor Haruhiko Kuroda

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that it is unlikely that yen will decline further as it is already "very weak". He added that even if the Fed starts to raise its interest rate, the yen does not have to increase as traders may have already priced into the market this possibility.

-

16:30

U.S.: Crude Oil Inventories, June -6.812 (forecast -1.7)

-

16:29

NIESR’s gross domestic product rises by 0.6% in three months to May

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.6% in three months to May, after a 0.5% growth in three months to April. The previous three months' figure was revised up from a 0.4% rise.

The NIESR said that the current estimate is consistent with a rebound of the economic growth in the U.K. in the second quarter, and it expects the U.K. economy to expand at 2.5% this year, and 2.4% next year.

-

16:00

United Kingdom: NIESR GDP Estimate, May 0.6%

-

15:53

Core machinery orders in Japan jumps 3.8% in April

Japan's Cabinet Office released its core machinery orders data for Japan on Wednesday. Core machinery orders in Japan jumped 3.8% in April, beating expectations for a 2.0% drop, after a 2.9% gain in March.

On a yearly basis, Japan's core machinery orders gained 3.0% in April, beating forecasts of a 1.3% decline, after a 2.6% rise in March.

These figures are signs that Japanese companies may be expanding their capital expenditure.

The Cabinet Office upgraded its assessment of machinery orders saying they were picking up, compared with the previous view that machinery orders were "showing a gradual pickup."

-

15:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E448mn), $1.1115-25(E717mn), $1.1150(E313mn), $1.1200(E590mn), $1.1265(E458mn)

USD/JPY: Y123.00(1.7bn), Y124.00($911mn), Y125.25($500mn), Y127.00($1.64bn)

GBP/USD: $1.5050(Gbp200mn), $1.5075(Gbp200mn), $1.5445-50(Gbp355mn)

EUR/GBP: Gbp0.7200-15(E376mn)

AUD/USD: $0.7625(A$200mn), $0.7745(A$200mn), $0.7850(A$668mn)

USD/CAD: C$1.2300($260mn)

-

15:28

Industrial production in Italy falls 0.3% in April

The Italian statistical office Istat released its industrial production data on Wednesday. Industrial production in Italy declined at a seasonally-adjusted rate of 0.3% in April, after a 0.5% gain in March. It was the first fall in three months.

Output in the energy sector dropped 1.3% in April, while production in the consumer goods sector declined 1.2%.

On a yearly basis, industrial production in Italy rose at a seasonally-adjusted rate of 0.1% in April, after a 1.4% increase in March.

During the first quarter of the year, Italian industrial production fell 0.1%.

-

15:07

Greek consumer prices decline 0.8% in May

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices fell 0.8% in May, after the 0.5% increase in April. It was the first decline in three months.

On a yearly basis, the Greek consumer price index declined 2.1% in May, after a 2.1 drop in April. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 6.9% in May, transport costs dropped by 2.9%, clothing and footwear prices declined 5.5%, while household equipment prices were down 2.1%.

Prices of food and non-alcoholic beverages increased 0.5% in May, while alcoholic beverages and tobacco prices climbed by 2%.

-

14:47

Reserve Bank of Australia Governor Glenn Stevens: the central bank remains “open to the possibility of further policy easing”

The Reserve Bank of Australia (RBA) Governor Glenn Stevens said in Brisbane on Wednesday that the central bank remains "open to the possibility of further policy easing" if it is needed for sustainable growth.

"The bigger point is that monetary policy alone can't deliver everything we need and expecting too much from it can lead, in time, to much bigger problems," the RBA governor added.

Stevens pointed out that there are a lot of countries that would prefer a lower exchange rate to boost exports.

He also said that he was concerned about housing property boom.

-

14:23

Foreign exchange market. European session: the euro traded lower against the U.S. dollar on the uncertainty over the Greek debt talks

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 6.4% -6.9%

02:50 Australia RBA's Governor Glenn Stevens Speech

06:45 France Industrial Production, m/m April 0.0% Revised From -0.3% 0.4% -0.9%

06:45 France Industrial Production, y/y April 1.3% 1.1%

08:30 United Kingdom Industrial Production (MoM) April 0.6% Revised From 0.5% 0.1% 0.4%

08:30 United Kingdom Industrial Production (YoY) April 1.1% Revised From 0.7% 0.6% 1.2%

08:30 United Kingdom Manufacturing Production (MoM) April 0.4% 0.1% -0.4%

08:30 United Kingdom Manufacturing Production (YoY) April 1.2% Revised From 1.1% 0.4% 0.2%

11:00 U.S. MBA Mortgage Applications June -7.6% 8.4%

The U.S. dollar traded mixed against the most major currencies. There will be released no major economic reports from the U.S. today.

The euro traded lower against the U.S. dollar on the uncertainty over the Greek debt talks. The Greek government has submitted a new reform plan to the European Union (EU) and International Monetary Fund (IMF) on Tuesday. According to European officials, the new proposal was insufficient.

Greek Prime Minister Alexis Tsipras will meet German Chancellor Angela Merkel and French President François Hollande later in the day.

Higher yields of the European governments bonds supported the euro. German government bonds hit the 1% barrier due to a selloff in bonds markets. It was the highest levels since September 2014.

Meanwhile, the economic data from the Eurozone was mixed. The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France fell 0.9% in April, missing expectations for a 0.4% gain, after a 0.3% decline in March. It was the first decrease in five months.

The decline was driven by declines in aerospace, automobiles and textiles.

On a yearly basis, the French industrial production rose 1.1% in April, after a 1.3% gain in March.

France's current account increased to a surplus of €0.4 billion in April from a deficit of €1.4 billion in March.

The trade surplus was driven by a drop in imports of crude oil imports.

The merchandise trade deficit narrowed to €1.1 billion in April from €3.2 billion in March.

The surplus in the services trade fell to €1.3 billion from €1.5 billion. The decline was driven by higher imports of telecommunication and information technology equipment.

The British pound traded higher against the U.S. dollar after the mixed economic data from the U.K. Manufacturing production in the U.K. dropped 0.4% in April, missing expectations for a 0.1% gain, after a 0.4% increase in March.

Manufacturing output was driven by a decline in a decline in pharmaceuticals, which dropped 6.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.2% in April, missing forecast of a 0.4% gain, after a 1.2% rise in March. March's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.4% in April, beating forecasts of a 0.1% rise, after a 0.6% gain in March. March's figure was revised up from 0.5% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 8.7% in April, the fastest pace since February 2014.

On a yearly basis, industrial production in the U.K. gained 1.2% in April, exceeding expectations for a 0.6% rise, after a 1.1% increase in March. March's figure was revised up a 0.7% rise.

EUR/USD: the currency pair decreased to $1.1259

GBP/USD: the currency pair rose to $1.5507

USD/JPY: the currency pair fell to Y122.45

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate May 0.4%

18:00 U.S. Federal budget May 157 -98

20:00 United Kingdom BOE Gov Mark Carney Speaks

21:00 New Zealand RBNZ Interest Rate Decision 3.5% 3.5%

21:00 New Zealand RBNZ Rate Statement

21:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter II 2.4

-

14:01

Orders

EUR/USD

Offers 1.1380 1.1400 1.1430 1.1450 1.1475 1.1500

Bids 1.1330 1.1300 1.1285 1.1250 1.1230 1.1200 1.1185 1.1150 1.1130 1.1100

GBP/USD

Offers 1.5475 1.5500-10 1.5530 1.5550 1.5580 1.5600

Bids 1.5400 1.5380 1.5365 1.5345 1.5330 1.5300 1.5285 1.5265 1.5240 1.5225 1.5200

EUR/GBP

Offers 0.7365 0.7385 0.7400 0.7425-30 0.7450 0.7475 0.7500

Bids 0.7320 0.7300 0.7285 0.7265 0.7250

EUR/JPY

Offers 139.80 140.00 140.20 140.50 140.85 141.00

Bids 139.00 138.50 138.30 138.00 137.50

USD/JPY

Offers 123.00 123.20 123.50 123.80 124.00 124.25 124.40 124.75-80 125.00

Ордера на покупку 122.30 122.00 121.75-80 121.50 121.30 121.00

AUD/USD

Offers 0.7785 0.7800 0.7830 0.7850 0.7865 0.7880 0.7900

Bids 0.7730 0.7700 0.7680 0.7650 0.7625-30 0.7600 0.7585 0.7550

-

13:00

U.S.: MBA Mortgage Applications, June 8.4%

-

11:39

France’s current account increases to a surplus of €0.4 billion in April

The Bank of France released its current account data on Wednesday. France's current account increased to a surplus of €0.4 billion in April from a deficit of €1.4 billion in March.

The trade surplus was driven by a drop in imports of crude oil imports.

The merchandise trade deficit narrowed to €1.1 billion in April from €3.2 billion in March.

The surplus in the services trade fell to €1.3 billion from €1.5 billion. The decline was driven by higher imports of telecommunication and information technology equipment.

-

11:21

French industrial production declines 0.9% in April

The French statistical office Insee its industrial production figures on Wednesday. Industrial production in France fell 0.9% in April, missing expectations for a 0.4% gain, after a 0.3% decline in March. It was the first decrease in five months.

The decline was driven by declines in aerospace, automobiles and textiles.

Output in the transport equipment sector plunged 3.3% in April due to a 5.0% drop in transport equipment and a 1.4% decline in the automobile sector.

On a yearly basis, the French industrial production rose 1.1% in April, after a 1.3% gain in March.

Construction output declined 0.8% in April, after a 0.5% increase in March.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E448mn), $1.1115-25(E717mn), $1.1150(E313mn), $1.1200(E590mn), $1.1265(E458mn)

USD/JPY: Y123.00(1.7bn), Y124.00($911mn), Y125.25($500mn), Y127.00($1.64bn)

GBP/USD: $1.5050(Gbp200mn), $1.5075(Gbp200mn), $1.5445-50(Gbp355mn)

EUR/GBP: Gbp0.7200-15(E376mn)

AUD/USD: $0.7625(A$200mn), $0.7745(A$200mn), $0.7850(A$668mn)

USD/CAD: C$1.2300($260mn)

-

11:05

U.K. manufacturing production drops 0.4% in April

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. dropped 0.4% in April, missing expectations for a 0.1% gain, after a 0.4% increase in March.

Manufacturing output was driven by a decline in a decline in pharmaceuticals, which dropped 6.0%.

On a yearly basis, manufacturing production in the U.K. increased 0.2% in April, missing forecast of a 0.4% gain, after a 1.2% rise in March. March's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.4% in April, beating forecasts of a 0.1% rise, after a 0.6% gain in March. March's figure was revised up from 0.5% increase.

The increase in the industrial output was driven by higher oil and gas production. Oil and gas extraction increased 8.7% in April, the fastest pace since February 2014.

On a yearly basis, industrial production in the U.K. gained 1.2% in April, exceeding expectations for a 0.6% rise, after a 1.1% increase in March. March's figure was revised up a 0.7% rise.

-

10:44

Bank of Japan (BoJ) Governor Haruhiko Kuroda said: it is unlikely that yen will decline further as it is already "very weak"

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Wednesday that it is unlikely that yen will decline further as it is already "very weak". He added that even if the Fed starts to raise its interest rate, the yen does not have to increase as traders may have already priced into the market this possibility.

"If you look at the real effective exchange rate, it shows that the yen is already very weak. Even further declines on a real effective exchange rate basis are not likely to happen," Kuroda noted.

-

10:30

United Kingdom: Industrial Production (MoM), April 0.4% (forecast 0.1%)

-

10:30

United Kingdom: Industrial Production (YoY), April 1.2% (forecast 0.6%)

-

10:30

United Kingdom: Manufacturing Production (YoY), April 0.2% (forecast 0.4%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , April -0.4% (forecast 0.1%)

-

10:29

European Central Bank Governing Council Member Jozef Makuch: the central bank’s quantitative easing has led to an increase in inflation, to a higher economic growth and to a weaker euro against the U.S. dollar

The European Central Bank (ECB) Governing Council Member Jozef Makuch said on Tuesday that the central bank's quantitative easing has led to an increase in inflation, to a higher economic growth and to a weaker euro against the U.S. dollar.

"We can say it has been a successful operation, it was the correct move which is being shown in the rise of inflation, which was the main motive, and also (there is) the indirect effect of higher GDP growth and the wholly indirect, though visible effect in the form of a low exchange rate of the euro to other currencies, mainly to the US dollar," Makuch noted.

He also said that the ECB governing council wants to keep Greece in the Eurozone if it meets its commitments.

-

10:18

Small business owners in the U.S. are more confident about their economic situation

The National Federation of Independent Business (NFIB) its small-business optimism data for the U.S. on Tuesday. The small-business optimism index rose to 98.3 in May from 96.9 in April. Small business owners in the U.S. are more confident about their economic situation. Higher sales were pushing small firms to add workers and raise selling prices.

The earnings trend index rose 9 percentage points to -7%.

7% of businesses were reporting higher nominal sales during the three months ended in May, up 11 percentage points. The business conditions expectations climbed 3 points to -3%.

The index covering hiring plans was up 1 point to 12% in May.

In the three months ended in May, 6% of owners raised selling prices, up 4 percentage points.

-

10:07

Targets in Greece’s new proposal are still lower than Greece’s creditors have proposed

The Greek government has submitted a new reform plan to the European Union (EU) and International Monetary Fund (IMF) on Tuesday. According to European officials, Athens has proposed following targets for primary surplus: 0.75% of gross domestic product (GDP) in 2015, 1.75% in 2016, and 2.5% in 2017. These targets are lower than Greece's creditors have proposed, but higher than in Athens previous proposal.

Greece's proposal contains higher revenue from value-added tax (VAT). Greece estimated revenue from the tax at €1.36 billion in 2016, but Greece's creditors proposed to implement measures that would generate €1.8 billion, or about 1% of GDP.

Greece's proposal does not contain any details about reforms of the Greek labour market.

-

09:01

France: Industrial Production, y/y, April 1.1%

-

08:46

France: Industrial Production, m/m, April -0.9% (forecast 0.4%)

-

08:19

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence June 6.4% -6.9%

02:50 Australia RBA's Governor Glenn Stevens Speech

The yen surged after Bank of Japan Governor Haruhiko Kuroda said it was hard to see the currency falling further. The yen climbed after Kuroda said the currency has returned to levels it was at before collapse of Lehman Brothers Holdings Inc. He cited the real effective exchange rate, which is adjusted for inflation rates and trade with other nations.

The Bloomberg Dollar Spot Index, a gauge of the U.S. currency versus 10 major peers, dropped 0.3 percent, extending its decline this week to 1.4 percent. Economists see almost a 40 percent chance that the Fed will delay a rate increase beyond September if jobs gains stumble or inflation fails to move higher, according to a Bloomberg News survey. Investors are looking ahead to retail sales data in the U.S. Thursday, after last week's jobs report showed the strongest hiring in five months.

EUR / USD: during the Asian session the pair rose to $ 1.1305

GBP / USD: during the Asian session, the pair was trading around $ 1.5380

USD / JPY: during the Asian session the pair fell to Y122.75

-

08:16

Options levels on wednesday, June 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1418 (2530)

$1.1383 (1931)

$1.1356 (1480)

Price at time of writing this review: $1.1292

Support levels (open interest**, contracts):

$1.1240 (364)

$1.1214 (1395)

$1.1178 (544)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 44669 contracts, with the maximum number of contracts with strike price $1,1450 (3424);

- Overall open interest on the PUT options with the expiration date July, 2 is 72793 contracts, with the maximum number of contracts with strike price $1,0500 (8144);

- The ratio of PUT/CALL was 1.63 versus 1.60 from the previous trading day according to data from June, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5703 (541)

$1.5605 (1169)

$1.5508 (2194)

Price at time of writing this review: $1.5412

Support levels (open interest**, contracts):

$1.5289 (1765)

$1.5192 (698)

$1.5095 (1686)

Comments:

- Overall open interest on the CALL options with the expiration date July, 2 is 19628 contracts, with the maximum number of contracts with strike price $1,5500 (2194);

- Overall open interest on the PUT options with the expiration date July, 2 is 20711 contracts, with the maximum number of contracts with strike price $1,5250 (1912);

- The ratio of PUT/CALL was 1.06 versus 1.12 from the previous trading day according to data from June, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:30

Australia: Westpac Consumer Confidence, June -6.9%

-

01:55

Japan: Core Machinery Orders, y/y, April 3.0% (forecast -1.3%)

-

01:54

Japan: Core Machinery Orders, April 3.8% (forecast -2.0%)

-

00:29

Currencies. Daily history for Jun 9’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1275 -0,04%

GBP/USD $1,5380 +0,25%

USD/CHF Chf0,9309 +0,37%

USD/JPY Y124,33 -0,19%

EUR/JPY Y140,18 -0,24%

GBP/JPY Y191,23 +0,06%

AUD/USD $0,7688 -0,05%

NZD/USD $0,7142 +0,17%

USD/CAD C$1,2438 + 0,25%

-

00:00

Schedule for today, Wednesday, Jun 10’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence June 6.4%

02:50 Australia RBA's Governor Glenn Stevens Speech

06:45 France Industrial Production, m/m April -0.3% 0.4%

06:45 France Industrial Production, y/y April 1.3%

08:30 United Kingdom Industrial Production (MoM) April 0.5% 0.1%

08:30 United Kingdom Industrial Production (YoY) April 0.7% 0.6%

08:30 United Kingdom Manufacturing Production (MoM) April 0.4%

08:30 United Kingdom Manufacturing Production (YoY) April 1.1% 0.4%

11:00 U.S. MBA Mortgage Applications June -7.6%

14:00 United Kingdom NIESR GDP Estimate May 0.4%

14:30 U.S. Crude Oil Inventories June -1.948

18:00 U.S. Federal budget May 157 -97.5

20:00 United Kingdom BOE Gov Mark Carney Speaks

21:00 New Zealand RBNZ Interest Rate Decision 3.5% 3.5%

21:00 New Zealand RBNZ Rate Statement

21:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter II 2.4

-