Noticias del mercado

-

17:34

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies in the absence of any major U.S. economic reports

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major U.S. economic reports on Monday.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded lower against the U.S. dollar. The Sentix investor confidence index for the Eurozone rose to 18.6 in March from 12.4 in February, exceeding expectations for an increase to 15.0.That was the highest level since August 2007.

The index benefited from a weaker euro, lower oil prices and quantitative easing.

Germany's trade surplus narrowed to €19.7 billion in January from €21.6 billion in December, missing expectations for a rise to €22.3 billion. December's figure was revised down from a surplus of €21.8 billion.

People with knowledge of the transactions said that the European Central Bank (ECB) has purchased German, Italia, French and Belgian bonds.

A spokesman for the ECB declined to comment.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports in the U.K.

The Canadian dollar traded mixed against the U.S. dollar. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February from a revised reading of 187,025 units in January. January's figure revised down from 187,276 units. Analysts had expected an increase to 191,000 units.

The New Zealand dollar traded mixed against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback. Job advertisements in Australia increased 0.9% in February, after a 1.2% rise in January. January's figure was revised down from a 1.3% gain.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the mixed economic data from Japan. Japan's gross domestic product (GDP) was revised down to an annual increase of 1.5% in the fourth quarter from the preliminary estimate of a 2.2% rise.

Japan's adjusted current account surplus rose to 1,058.1 billion yen in January from 850.0 billion yen in December.

Japan's economy watchers' current conditions index climbed to 50.1 in February from 45.6 in January, exceeding expectations for an increase to 46.7.

Japan's economy watchers' future conditions index rose to 53.2 in February from 50.0 in January.

-

16:30

ECB starts its quantitative easing

People with knowledge of the transactions said that the European Central Bank (ECB) has purchased German, Italia, French and Belgian bonds.

A spokesman for the ECB declined to comment.

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E372mn), $1.1000(E837mn)

USD/JPY: Y119.75($308mn), Y121.00($235mn)

GBP/USD: $1.5250(Gbp230mn)

AUD/USD: $0.7700(A$1.15bn)

USD/CAD: C$1.2550($400mn), C$1.2800($220mn)

-

14:28

Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Monday. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February from a revised reading of 187,025 units in January. January's figure revised down from 187,276 units.

Analysts had expected an increase to 191,000 units.

The CMHC's Chief Economist Bob Dugan said that "the trend in housing starts decreased for a fifth consecutive month in February and reflects a decreasing trend in multiple starts".

-

14:00

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia ANZ Job Advertisements (MoM) February +1.3% +0.9%

05:00 Japan Eco Watchers Survey: Current February 45.6 46.7 50.1

05:00 Japan Eco Watchers Survey: Outlook February 50.0 53.2

07:00 Germany Trade Balance January 21.6 Revised From 21.8 22.3 19.7

09:30 Eurozone Sentix Investor Confidence March 12.4 15.0 18.6

10:00 Eurozone Eurogroup Meetings

12:15 Canada Housing Starts February 187 191 156

The U.S. dollar traded mixed against the most major currencies. There will be released no major U.S. economic reports on Monday.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. The Sentix investor confidence index for the Eurozone rose to 18.6 in March from 12.4 in February, exceeding expectations for an increase to 15.0.That was the highest level since August 2007.

The index benefited from a weaker euro, lower oil prices and quantitative easing.

Germany's trade surplus narrowed to €19.7 billion in January from €21.6 billion in December, missing expectations for a rise to €22.3 billion. December's figure was revised down from a surplus of €21.8 billion.

The Eurogroup of euro zone finance ministers will discuss proposed Greek economic reforms.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports in the U.K.

The Canadian dollar traded mixed against the U.S. dollar after the weaker-than-expected Canadian housing starts data. Housing starts in Canada decreased to a seasonally adjusted annualized rate of 156,276 units in February from a revised reading of 187,025 units in January. January's figure revised down from 187,276 units. Analysts had expected an increase to 191,000 units.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5111

USD/JPY: the currency pair increased to Y121.06

-

13:50

Orders

EUR/USD

Offers 1.0900 1.0925 1.0940 1.0965 1.0980 1.1000 1.1020

Bids 1.0860 1.0840 1.0825 1.0800 1.0785 1.0750

GBP/USD

Offers 1.5100 1.5120-25 1.5150 1.5180 1.5200

Bids 1.5060 1.5040 1.5025 1.5000 1.4985 1.4965 1.4950

EUR/JPY

Offers 131.80 132.00 132.20 132.50 132.80 133.00

Bids 131.20 131.00 130.80 130.50 130.30 130.00

USD/JPY

Offers 121.00 121.20 121.45-50 121.80 122.00

Bids 120.60-65 1.2025-30 120.00 119.80 119.50 119.20 119.00

EUR/GBP

Offers 0.7220-25 0.7245-50 0.7265 0.7285 0.7300-05 0.7320-25

Bids 0.7195 0.7180 0.7165 0.7150 0.7130 0.7100-10

AUD/USD

Offers 0.7740 0.7760 0.7785 0.7800 0.7815

Bids 0.7700 0.7685 0.7665 0.7650

-

13:15

Canada: Housing Starts, February 156 (forecast 191)

-

11:20

Eurozone: Sentix Investor Confidence at 7-year high

Market research group Sentix reported data on Investor Confidence today. The survey was conducted among 1000 private and institutional investors. Investor Confidence for March came in at 18.6, climbing 6.2 points, compared to forecasts of 15 points and a previous reading of 12.4, reaching the highest reading since August 2007.

The stronger-than-expected data eases concerns over the economic outlook of the Eurozone. A weaker Euro, Quantitative Easing and lower oil prices boost the European economy. A level above zero shows that optimism prevails, below zero indicates pessimism.

-

11:09

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E372mn), $1.1000(E837mn)

USD/JPY: Y119.75($308mn), Y121.00($235mn)

GBP/USD: $1.5250(Gbp230mn)

AUD/USD: $0.7700(A$1.15bn)

USD/CAD: C$1.2550($400mn), C$1.2800($220mn)

-

10:30

Eurozone: Sentix Investor Confidence, March 18.6 (forecast 15.0)

-

10:20

Press Review: Eurogroup's Dijsselbloem: Greece reform outline 'far from complete'

BLOOMBERG

RBNZ Likely Looking at New Tools to Avoid Rate Rises, Key Says

(Bloomberg) -- New Zealand's central bank is probably investigating new tools to slow housing demand because it is unable to raise interest rates in a low-inflation environment, Prime Minister John Key says.

The Reserve Bank said last week it was seeking views on how to define property investment loans, adding to signs it may tighten rules in an attempt to cool surging house prices. Key said he hadn't been briefed on the issue by the RBNZ while a spokesman for the central bank declined to comment.

"It's clearly trying to ensure there's not a bubble emerging in the housing market," Key told reporters in Wellington Monday. "It's doing so in such a way that it's not having to lift interest rates."

REUTERS

Eurogroup's Dijsselbloem: Greece reform outline 'far from complete'

(Reuters) - A list of reforms proposed by Greece last week to help it win creditor support is "far from complete," the head of the Eurogroup said.

Speaking at an event in Amsterdam on Sunday, Jeroen Dijsselbloem, who is also Dutch finance minister, said the Greek proposal was "serious" but not enough.

Dijsselbloem, whose Eurogroup of euro zone finance ministers will discuss Greece at a meeting on Monday, said Athens had submitted six proposals, with more expected to come.

Source: http://www.reuters.com/article/2015/03/09/us-eurozone-greece-dijsselbloem-idUSKBN0M50IY20150309

BLOOMBERG

ECB Said to Begin Buying German Government Bonds in QE

(Bloomberg) -- The European Central Bank was said to start buying euro-area government bonds as it took the first step of its expanded quantitative-easing plan designed to boost price growth in the region.

Central banks from the region bought German bonds, said two traders in government debt, who asked not to be identified because the transactions are confidential. Sovereign securities across the region advanced. A spokesman for the ECB declined to comment on the purchases.

Bonds rallied. The yield on Germany's 10-year bunds fell four basis points, or 0.04 percentage point, to 0.35 percent at 8:54 a.m. London time, approaching the record-low 0.283 percent set on Feb. 26. Italy's 10-year yield dropped four basis points to 1.28 percent.

-

09:30

German Trade Balance below expectations

Today Destatis reported data on the Trade Balance of Eurozone's biggest economy that showed a decline from January's Balance and was below expectations. The Trade Balance fell from revised 21.6 billion euros (21.8) to 19.7 billion. Economist expected a rise to 22.3 billion euros.

Exports showed the sharpest decline in five months and slumped by 2.1% after strong gains in December although the weaker euro should bolster exports in the future. Imports declined by 0.3%.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia ANZ Job Advertisements (MoM) February +1.3% +0.9%

05:00 Japan Eco Watchers Survey: Current February 45.6 46.7 50.1

05:00 Japan Eco Watchers Survey: Outlook February 50.0 53.2

07:00 Germany Trade Balance January 21.8 22.3 19.7

The U.S. dollar traded mixed against its major peers on Monday after the better-than-expected U.S. labour market data reported on Friday. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. January's figure was revised down from a rise of 257,000 jobs - the data fuelled expectations of a mid-year rate hike by the Federal Reserve.

The euro and sterling rebounded slightly after Friday's slump versus the greenback.

The Australian dollar declined traded almost flat against the greenback currently quoted at USD0.7713. ANZ Job Advertisements (MoM) came in at +0.9% in February compared to +1.3% in January.

New Zealand's dollar lost ground against the greenback and is trading at three-wekk lows in the absence any major economic reports from New Zealand.

The Japanese yen traded lower against the greenback on Monday not far from Friday's three-month low of USD121.28 and close to a 7-1/2 year low hit in December. Data on the Japanese Eco Watchers Survey was reported. The Current Survey showed an increase from 45.6 to 50.1, beating an estimated increase to 46.7 points. -the Outlook came in at 53.2 in February coming from 50.0 in January.

EUR/USD: the euro traded higher against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling recovered moderately against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 Eurozone Sentix Investor Confidence March 12.4 15.0

10:00 Eurozone Eurogroup Meetings

12:15 Canada Housing Starts February 187 191

-

08:06

Options levels on monday, March 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1033 (425)

$1.0982 (284)

$1.0929 (139)

Price at time of writing this review: $1.0854

Support levels (open interest**, contracts):

$1.0808 (4194)

$1.0766 (3028)

$1.0711 (2956)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 37511 contracts, with the maximum number of contracts with strike price $1,1600 (2987);

- Overall open interest on the PUT options with the expiration date April, 2 is 45537 contracts, with the maximum number of contracts with strike price $1,1000 (4194);

- The ratio of PUT/CALL was 1.21 versus 0.96 from the previous trading day according to data from March, 6

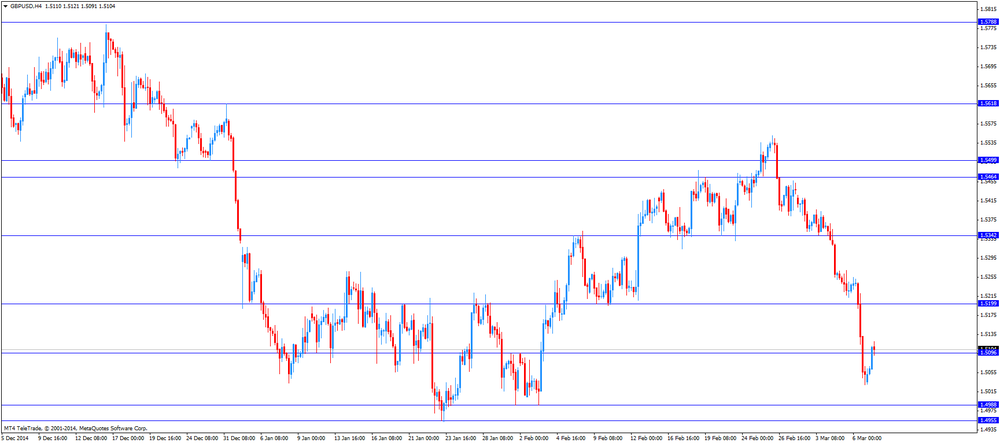

GBP/USD

Resistance levels (open interest**, contracts)

$1.5303 (356)

$1.5206 (389)

$1.5110 (803)

Price at time of writing this review: $1.5073

Support levels (open interest**, contracts):

$1.4989 (1620)

$1.4893 (802)

$1.4795 (1094)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 14805 contracts, with the maximum number of contracts with strike price $1,5600 (1365);

- Overall open interest on the PUT options with the expiration date April, 2 is 20183 contracts, with the maximum number of contracts with strike price $1,5000 (1620);

- The ratio of PUT/CALL was 1.36 versus 1.14 from the previous trading day according to data from March, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Germany: Trade Balance, January 19.7 (forecast 22.3)

-

06:02

Japan: Eco Watchers Survey: Current , February 50.1 (forecast 46.7)

-

01:30

Australia: ANZ Job Advertisements (MoM), February +0.9%

-

00:57

Japan: Current Account (adjusted), bln, January 1058.1

-

00:52

Japan: GDP, y/y, Quarter IV +1.5%

-

00:50

Japan: GDP, q/q, Quarter IV +0.4%

-

00:20

Currencies. Daily history for Mar 6’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0849 -1,67%

GBP/USD $1,5052 -1,23%

USD/CHF Chf0,9850 +1,13%

USD/JPY Y120,68 +0,46%

EUR/JPY Y130,93 -1,16%

GBP/JPY Y181,63 -0,78%

AUD/USD $0,7717 -0,82%

NZD/USD $0,7362 -1,66%

USD/CAD C$1,2611 +1,01%

-