Noticias del mercado

-

17:34

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. job openings figures

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. job openings figures. Job openings climbed to 4.998 million in January from 4.877 million in December. That was the highest level since January 2001.

December's figure was revised down from 5.028 million.

Analysts had expected job openings to rise to 5.030 million.

Wholesale inventories in the U.S. rose 0.3% in January, missing expectations for a flat reading, after a flat reading in December. December's figure was revised up from a 0.1% increase.

Inventories of durable goods increased 0.6% in January, while inventories of non-durable goods fell by 0.1%.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro declined against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro. European finance ministers piled pressure on Greece to examine its books in order to obtain more aid.

The European Central Bank President Mario Draghi asked on Monday Greece to allow new visits from technical experts. Greece agreed to allow experts to examine its books in Athens on Wednesday.

The Eurogroup of euro zone finance ministers discussed proposed Greek economic reforms.

Industrial production in France climbed 0.4% in January, missing expectations for a 0.8% gain, after a 1.4% rise in December. December's figure was revised down from a 1.5% increase.

The British pound traded higher against the U.S. dollar after comments by the Bank of England (BoE) Governor Mark Carney. Carney was speaking in the Economics Affairs Committee in the House of Lords in Britain's parliament on Tuesday. He said that consumer price inflation will decline to around zero in the coming months and stay there for much of the rest of the year. Carney added that decline in consumer inflation was driven by declines in energy and food prices, particularly lower oil prices.

The BoE governor noted it would be "extremely foolish" to ease the monetary policy in an attempt to boost inflation caused by falling oil prices.

The Swiss franc traded lower against the U.S. dollar. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback after the weak business confidence index from Australia. The National Australia Bank's business confidence index dropped to 0 in February from 3 in January.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback. Japan's preliminary machine tool orders climbed to 28.9% in February from 20.4% in January.

-

16:34

Bank of England Governor Mark Carney: consumer price inflation in the U.K. will decline to around zero in the coming months

The Bank of England (BoE) Governor Mark Carney was speaking in the Economics Affairs Committee in the House of Lords in Britain's parliament on Tuesday. He said that consumer price inflation will decline to around zero in the coming months and stay there for much of the rest of the year. Carney added that decline in consumer inflation was driven by declines in energy and food prices, particularly lower oil prices.

The BoE governor noted it would be "extremely foolish" to ease the monetary policy in an attempt to boost inflation caused by falling oil prices.

Carney also said that the labour market strengthened, and there are increasing signs that wages picking up.

-

16:01

Wholesale inventories in the U.S. rises 0.3% in January

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.3% in January, missing expectations for a flat reading, after a flat reading in December. December's figure was revised up from a 0.1% increase.

Inventories of durable goods increased 0.6% in January, while inventories of non-durable goods fell by 0.1%.

Wholesale sales declined by 3.1% in January, the largest decline since March 2009, driven by a 4.6% fall in sales of non-durable goods.

-

15:35

Job openings increased to 4.998 million in January, the highest level since January 2001

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 4.998 million in January from 4.877 million in December. That was the highest level since January 2001.

December's figure was revised down from 5.028 million.

Analysts had expected job openings to rise to 5.030 million.

The number of job openings rose for total private (4.523 million), while decreased for government (475,000) in January.

The hires rate was 3.5% in January.

Total separations declined to 4.821 million in January from 4.901 million in December.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:02

U.S.: JOLTs Job Openings, January 4998 (forecast 5030)

-

15:00

U.S.: Wholesale Inventories, January +0.3% (forecast 0.0%)

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0850(E226mn), $1.0900(E283mn), $1.0940-50(E670mn), $1.1000(E1.8bn)

USD/JPY: Y120.50($1.1bn), Y121.00($280mn), Y121.25($220mn), Y123.00($770mn)

GBP/USD: $1.5230(Gbp357mn)

AUD/USD: $0.7740(A$1.3bn)

USD/CAD: C$1.2700($430mn)

-

14:45

Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February

The State Secretariat for Economic Affairs (Seco) released its labour market data on Tuesday. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

The number of people registered at regional job offices declined by 1,025 to 149,921 in February from January.

The jobless rate for foreigners remained unchanged at 7%, while the rate for Swiss citizens fell to 2.3% in February from 2.4% in January.

-

14:05

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2% +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3 0

01:30 China PPI y/y February -4.3% -4.2% -4.8%

01:30 China CPI y/y February +0.8% +1.0% +1.4%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4% +28.9%

06:45 Switzerland Unemployment Rate February 3.2% Revised From 3.1% 3.2% 3.2%

07:45 France Industrial Production, m/m January +1.4% Revised From +1.5% +0.8% +0.4%

07:45 France Industrial Production, y/y January -1.3% +0.6%

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 5.030 million in January from 5.028 million in December.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro. European finance ministers piled pressure on Greece to examine its books in order to obtain more aid.

The European Central Bank President Mario Draghi asked on Monday Greece to allow new visits from technical experts. Greece agreed to allow experts to examine its books in Athens on Wednesday.

Industrial production in France climbed 0.4% in January, missing expectations for a 0.8% gain, after a 1.4% rise in December. December's figure was revised down from a 1.5% increase.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after the unemployment rate data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

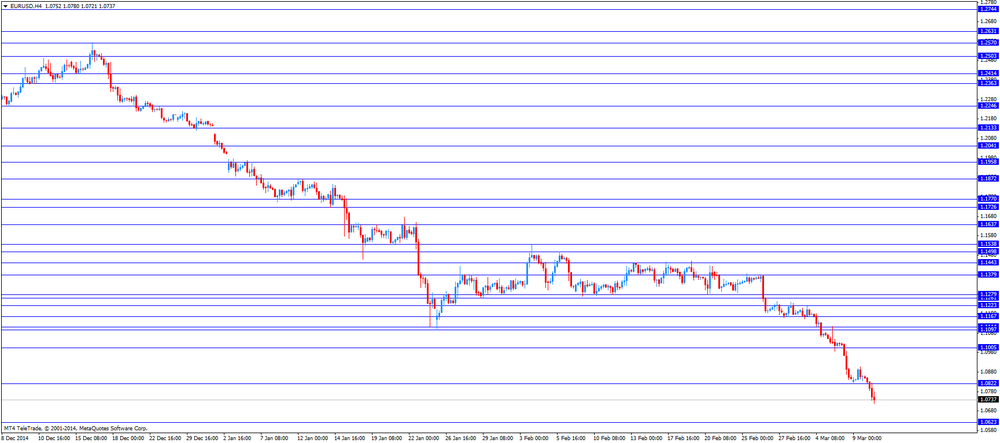

EUR/USD: the currency pair fell to $1.0721

GBP/USD: the currency pair traded mixed

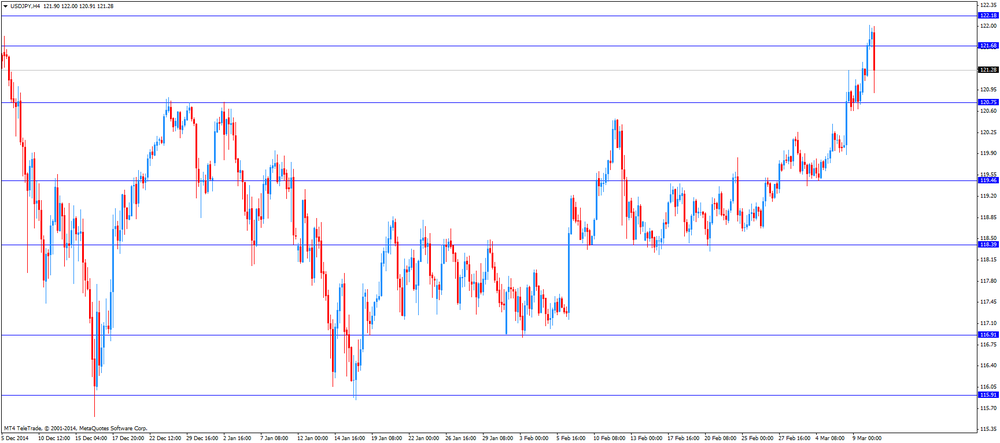

USD/JPY: the currency pair declined to Y120.91

The most important news that are expected (GMT0):

14:00 U.S. JOLTs Job Openings January 5028 5030

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

-

13:50

Orders

EUR/USD

Offers 1.0800 1.0820-25 1.0845-50 1.0880 1.0900 1.0925 1.0940 1.0965 1.0980 1.1000

Bids 1.0765 1.0750 1.0730 1.0700 1.0685 1.0650

GBP/USD

Offers 1.5100 1.5120-25 1.5150 1.5180 1.5200 1.5220

Bids 1.5060 1.5040 1.5025 1.5000 1.4985 1.4965 1.4950

EUR/JPY

Offers 131.30 131.70 132.00 132.20 132.50

Bids 130.85 130.50 130.30 130.00

USD/JPY

Offers 122.00-10 122.35 122.50 122.80 123.00

Bids 121.60 121.40 121.25 121.00 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7165 0.7185 0.7200 0.7220-25 0.7245-50 0.7265 0.7285 0.7300-05

Bids 0.7125-30 0.7100-10 0.7085 0.7065 0.7050

AUD/USD

Offers 0.7625 0.7640 0.7665 0.7680 0.7700 0.7740 0.7760

Bids 0.7600 0.7585 0.7565 0.7550 0.7530 0.7500

-

11:10

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0850(E226mn), $1.0900(E283mn), $1.0940-50(E670mn), $1.1000(E1.8bn)

USD/JPY: Y120.50($1.1bn), Y121.00($280mn), Y121.25($220mn), Y123.00($770mn)

GBP/USD: $1.5230(Gbp357mn)

AUD/USD: $0.7740(A$1.3bn)

USD/CAD: C$1.2700($430mn)

-

10:20

Press Review: Varoufakis unsettles Germans with admission Greece won't repay debts

BLOOMBERG

Apple CEO Tim Cook Embraces Technology and Luxury to Win in Smartwatches

Apple Inc. is betting that its first new gadget in five years, a smartwatch costing from $349 to more than $10,000, will offer the right blend of technology and luxury to lure even more customers and boost sales.

Apple Watch has a customizable face and will run 18 hours with typical use, Chief Executive Officer Tim Cook said at an event in San Francisco Monday. He was making the case for why consumers would want to add another digital product to their daily lives, highlighting the watch's ability to track health, send notifications and serve as a status symbol.

"Apple Watch is the most personal device we have ever created -- it's not just with you, it's on you," Cook said. "Since what you wear is an expression of who you are, we designed Apple Watch to appeal to a whole variety of people with different tastes and different preferences."

REUTERS

Varoufakis unsettles Germans with admission Greece won't repay debts(Reuters) - Greek Finance Minister Yanis Varoufakis has described his country as the most bankrupt in the world and said European leaders knew all along that Athens would never repay its debts, in blunt comments that sparked a backlash in the German media on Tuesday.

A documentary about the Greek debt crisis on German public broadcaster ARD was aired on the same day euro zone finance ministers met in Brussels to discuss whether to provide Athens with further funding in exchange for delivering reforms.

"Clever people in Brussels, in Frankfurt and in Berlin knew back in May 2010 that Greecewould never pay back its debts. But they acted as if Greece wasn't bankrupt, as if it just didn't have enough liquid funds," Varoufakis told the documentary.

Source: http://www.reuters.com/article/2015/03/10/us-eurozone-greece-varoufakis-idUSKBN0M60MN20150310

REUTERS

Brent falls while U.S. crude gains on easing stockbuild

(Reuters) - Brent prices fell 2 percent on Monday pressured by European Central Bank bond-buying, while U.S. crude rose about 1 percent on a smaller-than-expected build in inventories at the key Cushing oil hub, leading to a narrowing gap between the two benchmarks.

Brent's premium to U.S. crude CL-LCO1=R, one of the biggest oil plays, narrowed to less than $9 a barrel, tripping up some traders who had bet the spread would expand this week after a recent 13-month high above $13.

Brent was pressured as the ECB started buying bonds under its quantitative easing program, a move that implies a certain level of deflation, said Bob Yawger at Mizuho Securities in New York.

Source: http://www.reuters.com/article/2015/03/09/us-markets-oil-idUSKBN0M505B20150309

-

08:46

France: Industrial Production, m/m, January +0.4% (forecast +0.8%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2% +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3 0

01:30 China PPI y/y February -4.3% -4.2% -4.8%

01:30 China CPI y/y February +0.8% +1.0% +1.4%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4% +28.9%

06:45 Switzerland Unemployment Rate February 3.1% 3.2%

The U.S. dollar traded broadly stronger against its major peers on Tuesday as speculations on a rate hike in June continue to support the currency after the better-than-expected U.S. labour market data reported on Friday. All eyes are now on next week's FOMC meeting to get any further indication on the timing.

The euro and sterling continued to fall after yesterday's rebound from Friday's slump. Yesterday the ECB started its massive bond-buying program worth euro 60 billion a month, also known as QE, quantitative easing. Continuing uncertainty over Greece put further pressure on the single currency. The euro is trading close to 12-year lows against the greenback.

The Australian dollar declined against the greenback to a five-week low at USD0.7630 currently quoted at USD0.7655 after the National Australia Bank's Business Confidence declined from a previous reading of 3 to zero. Lacklustre data from China put further pressure on the currency. China is Australia's biggest trade partner and the aussie often trades as a proxy to China's economic development.

Later in the day RBA Assist Governor Kent speaks at 22:05 GMT and at 23:30 GMT the Westpac Consumer Confidence index is due. Last month the RBA cut interest rates to a record low.

Chinese Producer Prices year on year declined -4.8% in February, more than the expected -4.2%. Consumer Prices rose +1.4% beating expectations of an increase of +1.0%. As the data showed the risk of deflation in the world's second largest economy further measures by the PBoC will be in the focus.

New Zealand's dollar lost ground against the greenback in the absence any major economic reports from New Zealand.

The Japanese yen traded lower against the greenback on Tuesday setting a new 8-year low at USD122.02, currently trading a little higher at USD121.73. Preliminary Machine Tool Orders rose by +28.9% year on year in February with a previous reading of +20.4%. Late in the day data on Core Machinery orders is due at 23:50 GMT.

EUR/USD: the euro lower higher against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling recovered moderately against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Industrial Production, m/m January +1.5% +0.8%

07:45 France Industrial Production, y/y January -1.3%

10:00 Eurozone ECOFIN Meetings

14:00 U.S. Wholesale Inventories January +0.1% 0.0%

14:00 U.S. JOLTs Job Openings January 5028 5030

20:30 U.S. API Crude Oil Inventories March +2.9

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

-

08:18

Options levels on tuesday, March 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1027 (828)

$1.0976 (477)

$1.0925 (139)

Price at time of writing this review: $1.0800

Support levels (open interest**, contracts):

$1.0747 (2269)

$1.0717 (3098)

$1.0684 (1518)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 39181 contracts, with the maximum number of contracts with strike price $1,1400 (2671);

- Overall open interest on the PUT options with the expiration date April, 2 is 52725 contracts, with the maximum number of contracts with strike price $1,1000 (4163);

- The ratio of PUT/CALL was 1.35 versus 1.21 from the previous trading day according to data from March, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5305 (695)

$1.5209 (609)

$1.5114 (1256)

Price at time of writing this review: $1.5085

Support levels (open interest**, contracts):

$1.4992 (1615)

$1.4895 (1087)

$1.4797 (1120)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 16690 contracts, with the maximum number of contracts with strike price $1,5100 (1256);

- Overall open interest on the PUT options with the expiration date April, 2 is 22519 contracts, with the maximum number of contracts with strike price $1,5100 (1620);

- The ratio of PUT/CALL was 1.35 versus 1.36 from the previous trading day according to data from March, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:45

Switzerland: Unemployment Rate, February 3.2% (forecast 3.2%)

-

07:01

Japan: Prelim Machine Tool Orders, y/y , February +28.9%

-

02:30

China: CPI y/y, February +1.4% (forecast +1.0%)

-

02:30

China: PPI y/y, February -4.8% (forecast -4.2%)

-

01:30

Australia: National Australia Bank's Business Confidence, February 0

-

01:01

United Kingdom: BRC Retail Sales Monitor y/y, February +0.2%

-

00:33

Currencies. Daily history for Mar 9’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0852 +0,03%

GBP/USD $1,5128 +0,50%

USD/CHF Chf0,9855 +0,05%

USD/JPY Y121,20 +0,43%

EUR/JPY Y131,52 +0,45%

GBP/JPY Y183,34 +0,93%

AUD/USD $0,7703 -0,18%

NZD/USD $0,7353 -0,12%

USD/CAD C$1,2601 -0,08%

-

00:00

Schedule for today, Tuesday, Mar 10’2015:

(time / country / index / period / previous value / forecast)

0:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3

01:30 China PPI y/y February -4.3% -4.2%

01:30 China CPI y/y February +0.8% +1.0%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4%

06:45 Switzerland Unemployment Rate February 3.1% 3.2%

07:45 France Industrial Production, m/m January +1.5% +0.8%

07:45 France Industrial Production, y/y January -1.3%

10:00 Eurozone ECOFIN Meetings

14:00 U.S. Wholesale Inventories January +0.1% 0.0%

14:00 U.S. JOLTs Job Openings January 5028 5030

20:30 U.S. API Crude Oil Inventories March +2.9

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

-