Noticias del mercado

-

20:00

Dow -1.63% 17,702.01 -293.71 Nasdaq -1.45% 4,870.61 -71.83 S&P -1.48% 2,048.68 -30.77

-

18:05

European stocks close: stocks closed lower on concerns over Greece's further bailout policy

Stock indices closed lower on concerns over Greece's further bailout policy. European finance ministers piled pressure on Greece to examine its books in order to obtain more aid.

The European Central Bank President Mario Draghi asked on Monday Greece to allow new visits from technical experts. Greece agreed to allow experts to examine its books in Athens on Wednesday.

The Eurogroup of euro zone finance ministers discussed proposed Greek economic reforms.

Industrial production in France climbed 0.4% in January, missing expectations for a 0.8% gain, after a 1.4% rise in December. December's figure was revised down from a 1.5% increase.

The Bank of England (BoE) Governor Mark Carney was speaking in the Economics Affairs Committee in the House of Lords in Britain's parliament on Tuesday. He said that consumer price inflation will decline to around zero in the coming months and stay there for much of the rest of the year. Carney added that decline in consumer inflation was driven by declines in energy and food prices, particularly lower oil prices.

The BoE governor noted it would be "extremely foolish" to ease the monetary policy in an attempt to boost inflation caused by falling oil prices.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,702.84 -173.63 -2.52 %

DAX 11,500.38 -81.73 -0.71 %

CAC 40 4,881.95 -55.25 -1.12 %

-

18:00

European stocks closed: FTSE 100 6,702.84 -173.63 -2.52% CAC 40 4,881.95 -55.25 -1.12% DAX 11,500.38 -81.73 -0.71%

-

17:40

Oil: а review of the market situation

Futures for Brent crude fell significantly today, dropping at the same time below $ 57, which is associated with the growth of the US currency. Meanwhile, the price of WTI crude oil fell by more than 1%, as market participants await fresh data on oil reserves.

The American Petroleum Institute plans to publish its report on stocks today, while government data will be presented on Wednesday (experts expect that oil reserves for the week ending March 6, rose by 4.2 million barrels)..

"Crude oil inventories in the United States certainly increased over the past week, we still just do not know how - said the expert Energy Analytics Group Tom Finlon. - The US dollar strengthened, and against this background it is difficult to play on the rising cost of oil. "

Effect on the price of oil also have concerns its excess in the market. According to analysts Energy Aspects, refinery production facilities around the world in April nearer to a peak of 5.7 million barrels per day.

"The problem of excess supply will not go away - said a senior analyst at CMC Markets Plc in London Michael Hewson. - Crude oil inventories continue to grow, although the fall in oil prices has stopped. It will be interesting to see whether the US will cut production when the storage capacity will be exhausted. "

Meanwhile, investors have paid attention to the report from the Energy Information Administration (EIA), which showed that the net increase in production of shale oil in the US in April 2015 may be compared with March only 1 thousand. Barrels per day. This is the lowest rate since 2011. Under the net production growth EIA understands production growth due to the introduction of new wells in the oil section of net production, due to the drop-down production of existing wells.

A sharp decline in oil prices also contributed to data from the National Bureau of Statistics of China on the reduction of import commodities. In particular, because of the long New Year holidays imports of oil, iron ore, copper, and aluminum and steel fell in February to 20.5% in annual terms. Analysts had expected the index to reduce by 10%. A faster rate in February was down oil imports, which amounted to 25.55 million tons, which is 8.7% less than in January.

April futures price for US light crude oil WTI (Light Sweet Crude Oil) dropped to 48.53 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea Brent crude oil mix fell $ 1.80 to 56.66 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:34

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. job openings figures

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. job openings figures. Job openings climbed to 4.998 million in January from 4.877 million in December. That was the highest level since January 2001.

December's figure was revised down from 5.028 million.

Analysts had expected job openings to rise to 5.030 million.

Wholesale inventories in the U.S. rose 0.3% in January, missing expectations for a flat reading, after a flat reading in December. December's figure was revised up from a 0.1% increase.

Inventories of durable goods increased 0.6% in January, while inventories of non-durable goods fell by 0.1%.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

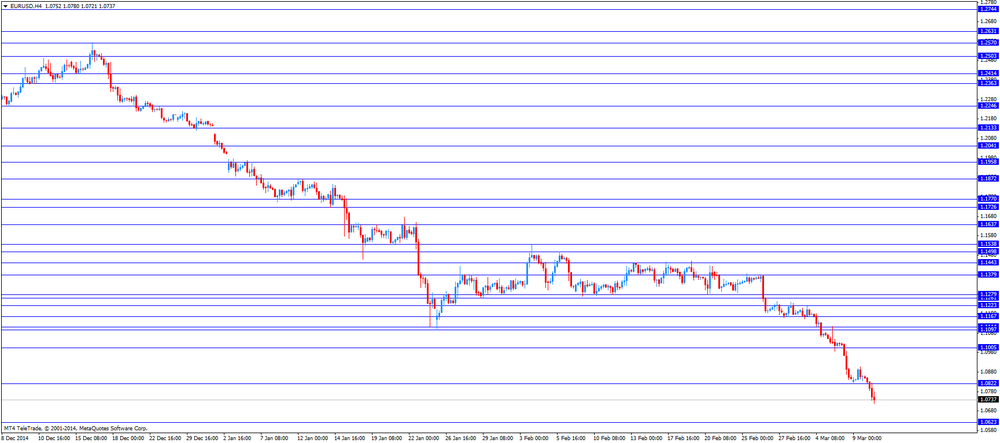

The euro declined against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro. European finance ministers piled pressure on Greece to examine its books in order to obtain more aid.

The European Central Bank President Mario Draghi asked on Monday Greece to allow new visits from technical experts. Greece agreed to allow experts to examine its books in Athens on Wednesday.

The Eurogroup of euro zone finance ministers discussed proposed Greek economic reforms.

Industrial production in France climbed 0.4% in January, missing expectations for a 0.8% gain, after a 1.4% rise in December. December's figure was revised down from a 1.5% increase.

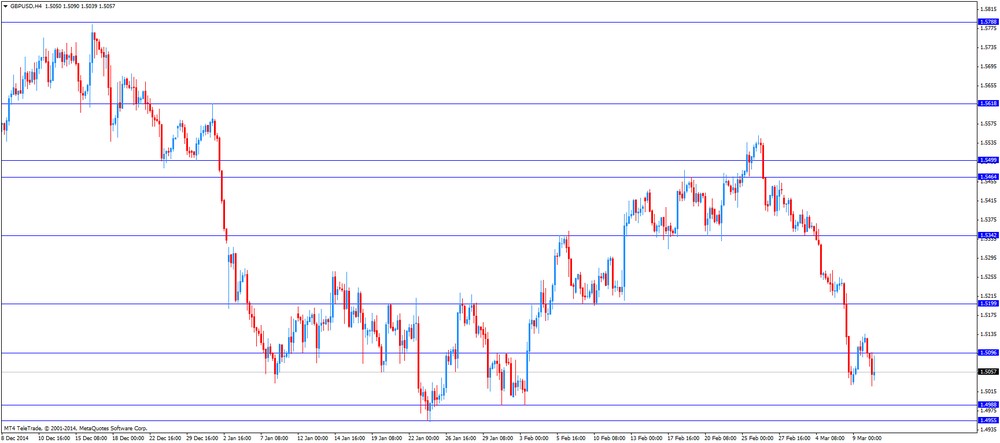

The British pound traded higher against the U.S. dollar after comments by the Bank of England (BoE) Governor Mark Carney. Carney was speaking in the Economics Affairs Committee in the House of Lords in Britain's parliament on Tuesday. He said that consumer price inflation will decline to around zero in the coming months and stay there for much of the rest of the year. Carney added that decline in consumer inflation was driven by declines in energy and food prices, particularly lower oil prices.

The BoE governor noted it would be "extremely foolish" to ease the monetary policy in an attempt to boost inflation caused by falling oil prices.

The Swiss franc traded lower against the U.S. dollar. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback after the weak business confidence index from Australia. The National Australia Bank's business confidence index dropped to 0 in February from 3 in January.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback. Japan's preliminary machine tool orders climbed to 28.9% in February from 20.4% in January.

-

17:20

Gold: a review of the market situation

Gold prices fell today, updating the three-month low, but was later able to recover some lost ground. The pressure on the precious metal has continued strengthening of the US dollar against the backdrop of improving the prospects of an early Fed rate.

Experts note that the Fed is likely to start raising interest rates in the middle of this year. Fears of imminent rate hike in the United States have strengthened after the publication of strong data on unemployment in February. Decreased to 5.5% from 5.7% in January. The number of jobs in the non-agricultural sector grew by 295,000. The analysts predicted a decline in unemployment to 5.6% growth in the number of jobs to 241 thousand.

As investors await the outcome of the Fed meeting to find out whether policies have not abandoned his intention to be "patient" in the timing recovery rates. Recall expectations of interest on loans have a negative impact on the precious metal because it fails to compete with earning assets during the period of rising rates.

The course of trade is also affected by uncertainty about Greece. Today, experts in finance from Greece to start negotiations with the representatives of the EU, the ECB and the IMF on economic reforms in the country to get new loans. "If the debt situation in Greece will not come significant deterioration, pessimistic mood in the gold market is likely to continue, which will reduce its appeal as a safe-haven" - said an analyst at Phillip Futures Howie Lee.

Higher prices for precious metals helps present downturn in the stock markets of Europe. "If the stock markets are in the process of correction, the gold may be one of the main beneficiaries in the short term," - said an analyst at Forex.com Fawad Razakzada. The expert also noted that in respect of gold, much will depend on the activity in the stock markets, which, despite the sale, are a priority among investors due to record low interest rates.

Meanwhile, today it became known that the stocks of the world's largest gold ETF-secured fund SPDR Gold Trust at the end of Monday declined by 0.43% - to the level of 753.04 tons.

April futures price of gold on the COMEX today fell to 1162.30 dollars per ounce.

-

16:34

Bank of England Governor Mark Carney: consumer price inflation in the U.K. will decline to around zero in the coming months

The Bank of England (BoE) Governor Mark Carney was speaking in the Economics Affairs Committee in the House of Lords in Britain's parliament on Tuesday. He said that consumer price inflation will decline to around zero in the coming months and stay there for much of the rest of the year. Carney added that decline in consumer inflation was driven by declines in energy and food prices, particularly lower oil prices.

The BoE governor noted it would be "extremely foolish" to ease the monetary policy in an attempt to boost inflation caused by falling oil prices.

Carney also said that the labour market strengthened, and there are increasing signs that wages picking up.

-

16:01

Wholesale inventories in the U.S. rises 0.3% in January

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.3% in January, missing expectations for a flat reading, after a flat reading in December. December's figure was revised up from a 0.1% increase.

Inventories of durable goods increased 0.6% in January, while inventories of non-durable goods fell by 0.1%.

Wholesale sales declined by 3.1% in January, the largest decline since March 2009, driven by a 4.6% fall in sales of non-durable goods.

-

15:35

Job openings increased to 4.998 million in January, the highest level since January 2001

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 4.998 million in January from 4.877 million in December. That was the highest level since January 2001.

December's figure was revised down from 5.028 million.

Analysts had expected job openings to rise to 5.030 million.

The number of job openings rose for total private (4.523 million), while decreased for government (475,000) in January.

The hires rate was 3.5% in January.

Total separations declined to 4.821 million in January from 4.901 million in December.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:02

U.S.: JOLTs Job Openings, January 4998 (forecast 5030)

-

15:00

U.S.: Wholesale Inventories, January +0.3% (forecast 0.0%)

-

14:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0850(E226mn), $1.0900(E283mn), $1.0940-50(E670mn), $1.1000(E1.8bn)

USD/JPY: Y120.50($1.1bn), Y121.00($280mn), Y121.25($220mn), Y123.00($770mn)

GBP/USD: $1.5230(Gbp357mn)

AUD/USD: $0.7740(A$1.3bn)

USD/CAD: C$1.2700($430mn)

-

14:45

Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February

The State Secretariat for Economic Affairs (Seco) released its labour market data on Tuesday. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

The number of people registered at regional job offices declined by 1,025 to 149,921 in February from January.

The jobless rate for foreigners remained unchanged at 7%, while the rate for Swiss citizens fell to 2.3% in February from 2.4% in January.

-

14:33

U.S. Stocks open: Dow -0.78%, Nasdaq -0.89%, S&P -0.76%

-

14:28

Before the bell: S&P futures -0.77%, DOW futures -0.81%

U.S. stock-index futures fell as the dollar strengthened to the highest level in more than seven years versus the yen amid speculation the U.S. is moving closer to raising interest rates.

Global markets:

Nikkei 18,665.11 -125.44 -0.67%

Hang Seng 23,896.98 -226.07 -0.94%

Shanghai Composite 3,287.1 -15.31 -0.46%

FTSE 6,780.25 -96.22 -1.40%

CAC 4,882.67 -54.53 -1.10%

DAX 11,442.08 -140.03 -1.21%

Crude oil $49.82 (-0.50%)

Gold $1167.40 (+0.09%)

-

14:07

Wall Street. Stocks before the bell

Stocks before the bell

(company / ticker / price / change, % / volume)

Barrick Gold Corporation, NYSE

ABX

10.85

+0.46%

16.4K

Hewlett-Packard Co.

HPQ

33.10

+0.46%

58.3K

UnitedHealth Group Inc

UNH

114.76

-0.12%

0.1K

E. I. du Pont de Nemours and Co

DD

78.23

-0.43%

2.1K

Wal-Mart Stores Inc

WMT

82.50

-0.46%

2.2K

Merck & Co Inc

MRK

56.99

-0.47%

2.9K

Twitter, Inc., NYSE

TWTR

47.34

-0.53%

20.9K

Home Depot Inc

HD

113.98

-0.59%

1.8K

Yandex N.V., NASDAQ

YNDX

14.59

-0.61%

10.0K

Apple Inc.

AAPL

126.35

-0.62%

424.2K

ALTRIA GROUP INC.

MO

53.48

-0.65%

2.2K

AT&T Inc

T

33.13

-0.66%

18.8K

Nike

NKE

96.79

-0.66%

1.0K

McDonald's Corp

MCD

97.05

-0.68%

1.8K

The Coca-Cola Co

KO

41.10

-0.70%

1.9K

AMERICAN INTERNATIONAL GROUP

AIG

55.59

-0.71%

0.3K

Exxon Mobil Corp

XOM

84.55

-0.72%

29.2K

Amazon.com Inc., NASDAQ

AMZN

375.69

-0.76%

7.1K

General Motors Company, NYSE

GM

37.35

-0.82%

16.0K

Visa

V

269.00

-0.89%

1.3K

Johnson & Johnson

JNJ

99.76

-0.89%

1.2K

Procter & Gamble Co

PG

82.33

-0.91%

0.2K

Facebook, Inc.

FB

78.72

-0.91%

30.2K

Pfizer Inc

PFE

33.71

-0.94%

5.5K

3M Co

MMM

164.75

-0.97%

0.4K

General Electric Co

GE

25.39

-0.98%

16.4K

Google Inc.

GOOG

563.25

-0.98%

0.6K

Yahoo! Inc., NASDAQ

YHOO

42.55

-1.00%

6.7K

Verizon Communications Inc

VZ

47.74

-1.02%

8.5K

Starbucks Corporation, NASDAQ

SBUX

92.07

-1.04%

2.8K

Ford Motor Co.

F

15.86

-1.06%

4.6K

American Express Co

AXP

79.65

-1.07%

5.4K

Cisco Systems Inc

CSCO

29.04

-1.09%

5.3K

Chevron Corp

CVX

102.80

-1.11%

3.3K

Deere & Company, NYSE

DE

90.98

-1.13%

3.9K

Walt Disney Co

DIS

104.05

-1.15%

0.2K

International Business Machines Co...

IBM

158.90

-1.16%

1.5K

JPMorgan Chase and Co

JPM

60.77

-1.19%

0.1K

ALCOA INC.

AA

13.53

-1.24%

48.4K

Goldman Sachs

GS

185.39

-1.35%

1.4K

Microsoft Corp

MSFT

42.27

-1.35%

2.9K

Citigroup Inc., NYSE

C

52.23

-1.36%

19.9K

Caterpillar Inc

CAT

79.70

-1.37%

6.3K

Boeing Co

BA

152.60

-1.39%

1K

Tesla Motors, Inc., NASDAQ

TSLA

188.21

-1.40%

4.3K

International Paper Company

IP

54.24

-1.47%

1.1K

Intel Corp

INTC

32.15

-1.74%

5.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.11

-2.60%

6.4K

-

14:05

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2% +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3 0

01:30 China PPI y/y February -4.3% -4.2% -4.8%

01:30 China CPI y/y February +0.8% +1.0% +1.4%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4% +28.9%

06:45 Switzerland Unemployment Rate February 3.2% Revised From 3.1% 3.2% 3.2%

07:45 France Industrial Production, m/m January +1.4% Revised From +1.5% +0.8% +0.4%

07:45 France Industrial Production, y/y January -1.3% +0.6%

10:00 Eurozone ECOFIN Meetings

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 5.030 million in January from 5.028 million in December.

The greenback remained supported by Friday's labour market data. The U.S. economy added 295,000 jobs in February, exceeding expectations for a rise of 241,000 jobs, after a gain of 239,000 jobs in January. J

The U.S. unemployment rate fell to 5.5% in February from 5.7% in January, beating forecast of a decline to 5.6%. That was lowest level since May 2008.

Investors expect that the Fed might start to raise its interest rate sooner than expected.

The euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro. European finance ministers piled pressure on Greece to examine its books in order to obtain more aid.

The European Central Bank President Mario Draghi asked on Monday Greece to allow new visits from technical experts. Greece agreed to allow experts to examine its books in Athens on Wednesday.

Industrial production in France climbed 0.4% in January, missing expectations for a 0.8% gain, after a 1.4% rise in December. December's figure was revised down from a 1.5% increase.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after the unemployment rate data from Switzerland. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in February, in line with expectations. January's figure was revised down from 3.1%.

EUR/USD: the currency pair fell to $1.0721

GBP/USD: the currency pair traded mixed

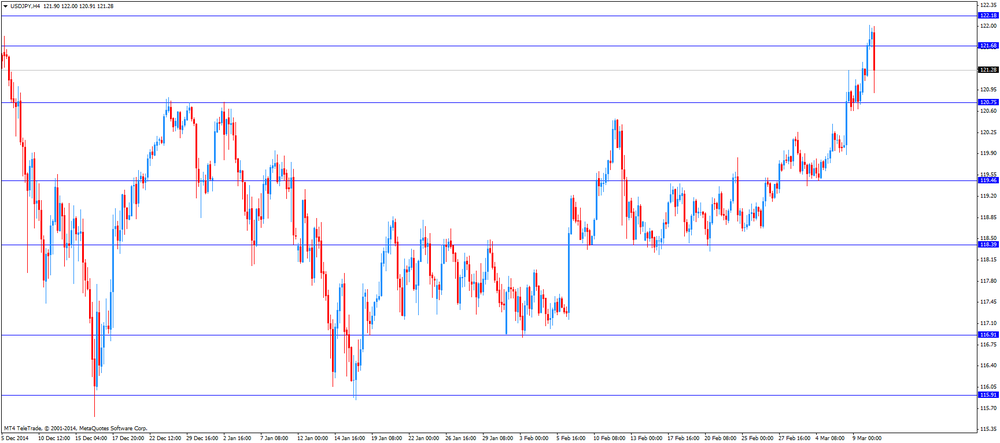

USD/JPY: the currency pair declined to Y120.91

The most important news that are expected (GMT0):

14:00 U.S. JOLTs Job Openings January 5028 5030

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

-

13:50

Orders

EUR/USD

Offers 1.0800 1.0820-25 1.0845-50 1.0880 1.0900 1.0925 1.0940 1.0965 1.0980 1.1000

Bids 1.0765 1.0750 1.0730 1.0700 1.0685 1.0650

GBP/USD

Offers 1.5100 1.5120-25 1.5150 1.5180 1.5200 1.5220

Bids 1.5060 1.5040 1.5025 1.5000 1.4985 1.4965 1.4950

EUR/JPY

Offers 131.30 131.70 132.00 132.20 132.50

Bids 130.85 130.50 130.30 130.00

USD/JPY

Offers 122.00-10 122.35 122.50 122.80 123.00

Bids 121.60 121.40 121.25 121.00 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7165 0.7185 0.7200 0.7220-25 0.7245-50 0.7265 0.7285 0.7300-05

Bids 0.7125-30 0.7100-10 0.7085 0.7065 0.7050

AUD/USD

Offers 0.7625 0.7640 0.7665 0.7680 0.7700 0.7740 0.7760

Bids 0.7600 0.7585 0.7565 0.7550 0.7530 0.7500

-

12:35

European stock markets mid-session: Stocks can’t track U.S. gains

European stocks continue to decline after a negative start and did not pick up the bullish sentiment that led the Wall Street higher. Yesterday the ECB started its massive bond-buying program worth euro 60 billion a month, also known as QE, quantitative easing. Continuing uncertainty over Greece weighs on the markets. The country remains in the focus as the proposed list of measures is far from complete, the head of Eurogroup Jeroen Dijsselbloem said on Sunday. On Monday ECB president Mario Draghi urged Greek officials to let return Eurozone-representatives to Greece in order to examine the government's books as a precondition for further financial aid. Greece agreed on allowing experts from the ECB and IMF to start their work on Wednesday.

French Industrial Production on a yearly basis grew in January by +0.6% compared to a previous reading of -1.3%. Month on month Industrial Production rose less-than-expected by +0.4%, compared with estimates of an increase of +0.8%. In December Industrial Production rose +1.5%.

At 10:00 GMT Eurozone's ECOFIN Meetings started.

Chinese inflation was unexpectedly higher in February, producer prices slid more than predicted, adding pressure on the PBoC to spur economic growth.

The FTSE 100 index is currently trading -0.74% quoted at 6,825.92. Germany's DAX 30 lost -0.55% trading at 11,518.13. France's CAC 40 is currently trading at 4,911.38 points, -0.74%.

-

12:15

Oil: Prices further decline on strong U.S. dollar - Crude at 2-week low

Oil traded lower on Tuesday with Brent Crude losing -1.38%, currently trading at USD57.72 a barrel - the lowest in two weeks. West Texas Intermediate declined -0.66% currently quoted at USD49.67.

Market participants now look ahead to the API Crude Oil Inventories to see whether stockpiles in the U.S., the world's largest consumer of oil, grew. Tomorrow the government report on stockpiles is expected to show an increase.

Weaker than expected Chinese PPI data reported today fuelled concerns about economic growth of the world's second largest consumer of oil.

On Sunday OPEC Secretary-General Abdullah al-Badri said that OPEC members should not lower production as this would only help U.S. producers with their higher-cost shale. Data from Baker Hughes on Friday showed that U.S. rig-numbers further declined by 63 - the lowest count since June 2011.

Oil prices declined by almost 60% between June 2014 and January 2015 and recovered by almost 35% in 2015.Although prices rebounded after setting new lows, worldwide supply still exceeds demand in a period of low global economic growth, pushing stockpiles to record highs and weighing on prices.

-

11:50

Gold at 15-week low as strong greenback weighs

Gold continued to decline and is trading at 15-week lows as a stronger U.S. dollar weighs. Better-than-expected U.S. jobs data reported last Friday added to expectations that the FED will hike interest rates rather sooner than later sending the precious metal down. A U.S. rate hike is now expected to happen possibly as soon as June.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as the precious metal is dollar-denominated and not yield-bearing.

Continuing uncertainty over Greece could not support the price of gold. The country remains in the focus as the proposed list of measures is far from complete, the head of Eurogroup Jeroen Dijsselbloem said on Sunday. On Monday ECB president Mario Draghi urged Greek officials to let return Eurozone-representatives to Greece in order to examine the government's books as a precondition for further financial aid. Greece agreed on allowing experts from the ECB and IMF to start their work on Wednesday.

Gold is currently quoted at USD1,161.50, +0,46% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40.

-

11:10

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0850(E226mn), $1.0900(E283mn), $1.0940-50(E670mn), $1.1000(E1.8bn)

USD/JPY: Y120.50($1.1bn), Y121.00($280mn), Y121.25($220mn), Y123.00($770mn)

GBP/USD: $1.5230(Gbp357mn)

AUD/USD: $0.7740(A$1.3bn)

USD/CAD: C$1.2700($430mn)

-

10:20

Press Review: Varoufakis unsettles Germans with admission Greece won't repay debts

BLOOMBERG

Apple CEO Tim Cook Embraces Technology and Luxury to Win in Smartwatches

Apple Inc. is betting that its first new gadget in five years, a smartwatch costing from $349 to more than $10,000, will offer the right blend of technology and luxury to lure even more customers and boost sales.

Apple Watch has a customizable face and will run 18 hours with typical use, Chief Executive Officer Tim Cook said at an event in San Francisco Monday. He was making the case for why consumers would want to add another digital product to their daily lives, highlighting the watch's ability to track health, send notifications and serve as a status symbol.

"Apple Watch is the most personal device we have ever created -- it's not just with you, it's on you," Cook said. "Since what you wear is an expression of who you are, we designed Apple Watch to appeal to a whole variety of people with different tastes and different preferences."

REUTERS

Varoufakis unsettles Germans with admission Greece won't repay debts(Reuters) - Greek Finance Minister Yanis Varoufakis has described his country as the most bankrupt in the world and said European leaders knew all along that Athens would never repay its debts, in blunt comments that sparked a backlash in the German media on Tuesday.

A documentary about the Greek debt crisis on German public broadcaster ARD was aired on the same day euro zone finance ministers met in Brussels to discuss whether to provide Athens with further funding in exchange for delivering reforms.

"Clever people in Brussels, in Frankfurt and in Berlin knew back in May 2010 that Greecewould never pay back its debts. But they acted as if Greece wasn't bankrupt, as if it just didn't have enough liquid funds," Varoufakis told the documentary.

Source: http://www.reuters.com/article/2015/03/10/us-eurozone-greece-varoufakis-idUSKBN0M60MN20150310

REUTERS

Brent falls while U.S. crude gains on easing stockbuild

(Reuters) - Brent prices fell 2 percent on Monday pressured by European Central Bank bond-buying, while U.S. crude rose about 1 percent on a smaller-than-expected build in inventories at the key Cushing oil hub, leading to a narrowing gap between the two benchmarks.

Brent's premium to U.S. crude CL-LCO1=R, one of the biggest oil plays, narrowed to less than $9 a barrel, tripping up some traders who had bet the spread would expand this week after a recent 13-month high above $13.

Brent was pressured as the ECB started buying bonds under its quantitative easing program, a move that implies a certain level of deflation, said Bob Yawger at Mizuho Securities in New York.

Source: http://www.reuters.com/article/2015/03/09/us-markets-oil-idUSKBN0M505B20150309

-

10:00

European stock markets First hour: Stocks decline in early trade

European stocks did not pick up the bullish sentiment that led the Wall Street higher and fall at the start. Yesterday the ECB started its massive bond-buying program worth euro 60 billion a month, also known as QE, quantitative easing. Continuing uncertainty over Greece weighs on the markets. The country remains in the focus as the proposed list of measures is far from complete, the head of Eurogroup Jeroen Dijsselbloem said on Sunday. On Monday ECB president Mario Draghi urged Greek officials to let return Eurozone-representatives to Greece in order to examine the government's books as a precondition for further financial aid. Greece agreed on allowing experts from the ECB and IMF to start their work on Wednesday.

French Industrial Production on a yearly basis grew in January by +0.6% compared to a previous reading of -1.3%. Month on month Industrial Production rose less-than-expected by +0.4%, compared with estimates of an increase of +0.8%. In December Industrial Production rose +1.5%.

At 10:00 GMT Eurozone's ECOFIN Meetings will start.

The FTSE 100 index is currently trading -0.20% quoted at 6,862.83. Germany's DAX 30 lost -0.21% trading at 11,558.07, France's CAC 40 is currently trading at 4,928.51 points, -0.18%.

-

09:00

Global Stocks: Wall Street rebounds, Asian stocks decline

U.S. stocks rebounded on Monday following one of the worst performing days in the year as sentiment turned bullish and risk appetite returned. Yesterday Apple presented the highly anticipated I-Watch at a media event in California.

The S&P 500 closed +0.39% with a final quote of 2,079.43 points. The DOW JONES index added +0.78% closing at 17,995.72 points, missing the psychologically important 18,000 points mark by less than 5 points.

Chinese stocks declined on Tuesday. Hong Kong's Hang Seng is trading lower -0.82% at 23,925.44 points. China's Shanghai Composite closed at 3,287.10 points losing -0.46% at the close. Chinese Producer Prices year on year declined -4.8% in February, more than the expected -4.2%. Consumer Prices rose +1.4% beating expectations of an increase of +1.0%. As the data showed the risk of deflation in the world's second largest economy further measures by the PBoC will be in the focus.

The Nikkei lost further ground on Tuesday in volatile trading. Banking stocks slumped on a report that the Basel Committee may ask banks to boost capital. The Nikkei closed -0.67% with a final quote of 18,665.11 points. Preliminary Machine Tool Orders rose by +28.9% year on year in February with a previous reading of +20.4%. Late in the day data on Core Machinery orders is due at 23:50 GMT. A weaker yen failed to support stocks.

-

08:46

France: Industrial Production, m/m, January +0.4% (forecast +0.8%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2% +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3 0

01:30 China PPI y/y February -4.3% -4.2% -4.8%

01:30 China CPI y/y February +0.8% +1.0% +1.4%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4% +28.9%

06:45 Switzerland Unemployment Rate February 3.1% 3.2%

The U.S. dollar traded broadly stronger against its major peers on Tuesday as speculations on a rate hike in June continue to support the currency after the better-than-expected U.S. labour market data reported on Friday. All eyes are now on next week's FOMC meeting to get any further indication on the timing.

The euro and sterling continued to fall after yesterday's rebound from Friday's slump. Yesterday the ECB started its massive bond-buying program worth euro 60 billion a month, also known as QE, quantitative easing. Continuing uncertainty over Greece put further pressure on the single currency. The euro is trading close to 12-year lows against the greenback.

The Australian dollar declined against the greenback to a five-week low at USD0.7630 currently quoted at USD0.7655 after the National Australia Bank's Business Confidence declined from a previous reading of 3 to zero. Lacklustre data from China put further pressure on the currency. China is Australia's biggest trade partner and the aussie often trades as a proxy to China's economic development.

Later in the day RBA Assist Governor Kent speaks at 22:05 GMT and at 23:30 GMT the Westpac Consumer Confidence index is due. Last month the RBA cut interest rates to a record low.

Chinese Producer Prices year on year declined -4.8% in February, more than the expected -4.2%. Consumer Prices rose +1.4% beating expectations of an increase of +1.0%. As the data showed the risk of deflation in the world's second largest economy further measures by the PBoC will be in the focus.

New Zealand's dollar lost ground against the greenback in the absence any major economic reports from New Zealand.

The Japanese yen traded lower against the greenback on Tuesday setting a new 8-year low at USD122.02, currently trading a little higher at USD121.73. Preliminary Machine Tool Orders rose by +28.9% year on year in February with a previous reading of +20.4%. Late in the day data on Core Machinery orders is due at 23:50 GMT.

EUR/USD: the euro lower higher against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling recovered moderately against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Industrial Production, m/m January +1.5% +0.8%

07:45 France Industrial Production, y/y January -1.3%

10:00 Eurozone ECOFIN Meetings

14:00 U.S. Wholesale Inventories January +0.1% 0.0%

14:00 U.S. JOLTs Job Openings January 5028 5030

20:30 U.S. API Crude Oil Inventories March +2.9

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

-

08:18

Options levels on tuesday, March 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1027 (828)

$1.0976 (477)

$1.0925 (139)

Price at time of writing this review: $1.0800

Support levels (open interest**, contracts):

$1.0747 (2269)

$1.0717 (3098)

$1.0684 (1518)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 39181 contracts, with the maximum number of contracts with strike price $1,1400 (2671);

- Overall open interest on the PUT options with the expiration date April, 2 is 52725 contracts, with the maximum number of contracts with strike price $1,1000 (4163);

- The ratio of PUT/CALL was 1.35 versus 1.21 from the previous trading day according to data from March, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5305 (695)

$1.5209 (609)

$1.5114 (1256)

Price at time of writing this review: $1.5085

Support levels (open interest**, contracts):

$1.4992 (1615)

$1.4895 (1087)

$1.4797 (1120)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 16690 contracts, with the maximum number of contracts with strike price $1,5100 (1256);

- Overall open interest on the PUT options with the expiration date April, 2 is 22519 contracts, with the maximum number of contracts with strike price $1,5100 (1620);

- The ratio of PUT/CALL was 1.35 versus 1.36 from the previous trading day according to data from March, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:45

Switzerland: Unemployment Rate, February 3.2% (forecast 3.2%)

-

07:01

Japan: Prelim Machine Tool Orders, y/y , February +28.9%

-

03:29

Nikkei 225 18,880.86 +90.31 +0.5 %, Hang Seng 24,081.05 -42.00 -0.2 %, Shanghai Composite 3,287.52 -14.89 -0.5 %

-

02:30

China: CPI y/y, February +1.4% (forecast +1.0%)

-

02:30

China: PPI y/y, February -4.8% (forecast -4.2%)

-

01:30

Australia: National Australia Bank's Business Confidence, February 0

-

01:01

United Kingdom: BRC Retail Sales Monitor y/y, February +0.2%

-

00:35

Commodities. Daily history for Mar 9’2015:

(raw materials / closing price /% change)

Oil 50.00 +0.79%

Gold 1,166.30 -0.02%

-

00:34

Stocks. Daily history for Mar 9’2015:

(index / closing price / change items /% change)

Nikkei 225 18,790.55 -180.45 -0.95%

Hang Seng 24,123.05 -40.95 -0.17%

Shanghai Composite 3,302.16 +60.98 +1.88%

FTSE 100 6,876.47 -35.33 -0.51%

CAC 40 4,937.2 -27.15 -0.55%

Xetra DAX 11,582.11 +31.14 +0.27%

S&P 500 2,079.43 +8.17 +0.39%

NASDAQ Composite 4,942.44 +15.07 +0.31%

Dow Jones 17,995.72ь+138.94 +0.78%

-

00:33

Currencies. Daily history for Mar 9’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0852 +0,03%

GBP/USD $1,5128 +0,50%

USD/CHF Chf0,9855 +0,05%

USD/JPY Y121,20 +0,43%

EUR/JPY Y131,52 +0,45%

GBP/JPY Y183,34 +0,93%

AUD/USD $0,7703 -0,18%

NZD/USD $0,7353 -0,12%

USD/CAD C$1,2601 -0,08%

-

00:00

Schedule for today, Tuesday, Mar 10’2015:

(time / country / index / period / previous value / forecast)

0:01 United Kingdom BRC Retail Sales Monitor y/y February +0.2%

00:30 Australia National Australia Bank's Business Confidence February 3

01:30 China PPI y/y February -4.3% -4.2%

01:30 China CPI y/y February +0.8% +1.0%

06:00 Japan Prelim Machine Tool Orders, y/y February +20.4%

06:45 Switzerland Unemployment Rate February 3.1% 3.2%

07:45 France Industrial Production, m/m January +1.5% +0.8%

07:45 France Industrial Production, y/y January -1.3%

10:00 Eurozone ECOFIN Meetings

14:00 U.S. Wholesale Inventories January +0.1% 0.0%

14:00 U.S. JOLTs Job Openings January 5028 5030

20:30 U.S. API Crude Oil Inventories March +2.9

22:05 Australia RBA Assist Gov Kent Speaks

23:30 Australia Westpac Consumer Confidence March +8.0%

23:50 Japan Core Machinery Orders January +8.3% -3.8%

23:50 Japan Core Machinery Orders, y/y January +11.4%

-