Noticias del mercado

-

21:00

New Zealand: RBNZ Interest Rate Decision, 3.50% (forecast 3.50%)

-

20:00

Dow +0.16% 17,692.06 +29.12 Nasdaq +0.08% 4,863.62 +3.82 S&P +0.13% 2,046.85 +2.69

-

18:20

Monetary Policy Committee member Martin Weale: the Bank of England should raise its interest rate sooner

The Monetary Policy Committee member Martin Weale said on Wednesday that the Bank of England should raise its interest rate sooner than expected if wages continue to grow over the next few months.

Weale noted that there is a risk that inflation could decline further, but he expects that it will recover back towards the BoE's 2% target.

He pointed out that a stronger pound could also be a risk.

-

18:05

European stocks close: stocks closed higher on a weaker euro

Stock indices closed higher on a weaker euro. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro. The ECB had started to purchase government bonds on Monday.

The ECB President Mario Draghi said on Wednesday that bond purchases should help to boost inflation and encourage investors to shift to riskier assets. He noted that quantitative easing was unconventional but "not unorthodox".

The Eurogroup of euro zone finance ministers continued to discuss proposed Greek economic reforms.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.6% in three months to February, after a 0.6% growth in three months to January, which figure was revised down from a 0.7% increase.

Manufacturing production in the U.K. fell 0.5% in January, missing expectations for a 0.3% rise, after a 0.1% rise in December.

The decline was driven by lower output in the computer, electronic and optical sector. Output dropped by 9.5%, the biggest monthly decline since early 2002.

On a yearly basis, manufacturing production in the U.K. increased 1.9% in January, after a 2.6% rise in December. December's figure was revised up from a 2.4% gain.

Industrial production in the U.K. decreased 0.1% in January, missing forecasts of a 0.2% rise, after a 0.2% decline in December.

The U.K. oil and gas production rose 2.4% in January as production at North Sea oil and gas fields increased.

On a yearly basis, industrial production in the U.K. rose 1.3% in January, after a 0.8% gain in December. December's figure was revised up from a 0.5% rise.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,721.51 +18.67 +0.28 %

DAX 11,805.99 +305.61 +2.66 %

CAC 40 4,997.75 +115.80 +2.37 %

-

18:00

European stocks closed: FTSE 100 6,721.51 +18.67 +0.28% CAC 40 4,997.75 +115.80 +2.37% DAX 11,805.99 +305.61 +2.66%

-

17:40

Oil: а review of the market situation

Prices for WTI crude oil fell sharply, dropping below $ 48 per barrel, which was associated with the publication of a report on stocks of petroleum products in the United States. Meanwhile, the price of Brent crude oil rose slightly, reaching $ 57 per barrel.

US Department of Energy reported that in the week from 28 February to 6 March crude oil reserves rose by 4.5 million barrels to 448.9 million barrels, while experts had expected growth to 4.8 million. Barrels. Commercial oil reserves in the US, according to figures remain at historical highs over the past 80 years. Oil reserves in Cushing terminal rose by 2.3 million barrels to 51.5 million barrels. Stocks has exceeded 50 million barrels for the first time on 31 May 2013. Gasoline inventories fell by 187,000 barrels to 239.9 million barrels, while analysts had expected a decline of 1.7 million barrels. Distillate stocks rose 2.5 million barrels to 125.5 million barrels. It was expected that the stock will decline by 2.3 million. Barrels. Meanwhile, refining capacity utilization rate increased by 1.2% - to 87.8%. Analysts expected a decline of 0.4%.

Recall yesterday's data from the American Petroleum Institute (API) showed that:

- Crude oil inventories in the US last week fell to 0.404 million. Barrels

- Distillate stocks in the United States for the week rose by 1.7 million. Barrels

- Gasoline inventories in the US for the week increased by 1.7 million. Barrels

- Utilization of oil refining in the US 87.5% versus 87.3% in the previous week

Pressure on prices also has a strengthening US dollar. The dollar index, which measures the strength of the US dollar against a basket of six major currencies, has now reached a maximum in April 2003. Recall, the dollar raises the price of US goods to importers that use different currencies such as the yen or the euro.

"A strong dollar creates unexpected difficulties for the oil market. Brent brings them heavier than WTI, as investors close their positions and take profit on the spread between the two brands, "- said the manager of commodity fund Tyche Capital Advisors Tariq Zahir. The price spread between WTI and Brent lost almost 40% since then, as the end of February reached a 13-month high of $ 13.

April futures price for US light crude oil WTI (Light Sweet Crude Oil) dropped to 47.66 dollars per barrel on the New York Mercantile Exchange.

April futures price for North Sea petroleum mix of Brent rose $ 0.23 to 57.10 dollars a barrel on the London Stock Exchange ICE Futures Europe.

-

17:31

Foreign exchange market. American session: the U.S. dollar traded mixed to higher against the most major currencies in the absence of any major U.S. economic reports

The U.S. dollar traded mixed to higher against the most major currencies in the absence of any major U.S. economic reports.

The greenback remained supported by speculation that the Fed might start to raise its interest rate sooner than expected.

The euro traded mixed against the U.S. dollar. Concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) still weighed on the euro. The ECB had started to purchase government bonds on Monday.

The ECB President Mario Draghi said on Wednesday that bond purchases should help to boost inflation and encourage investors to shift to riskier assets. He noted that quantitative easing was unconventional but "not unorthodox".

The Eurogroup of euro zone finance ministers continued to discuss proposed Greek economic reforms.

The British pound fell against the U.S. dollar after the weak economic data from the U.K. The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.6% in three months to February, after a 0.6% growth in three months to January, which figure was revised down from a 0.7% increase.

Manufacturing production in the U.K. fell 0.5% in January, missing expectations for a 0.3% rise, after a 0.1% rise in December.

The decline was driven by lower output in the computer, electronic and optical sector. Output dropped by 9.5%, the biggest monthly decline since early 2002.

On a yearly basis, manufacturing production in the U.K. increased 1.9% in January, after a 2.6% rise in December. December's figure was revised up from a 2.4% gain.

Industrial production in the U.K. decreased 0.1% in January, missing forecasts of a 0.2% rise, after a 0.2% decline in December.

The U.K. oil and gas production rose 2.4% in January as production at North Sea oil and gas fields increased.

On a yearly basis, industrial production in the U.K. rose 1.3% in January, after a 0.8% gain in December. December's figure was revised up from a 0.5% rise.

The New Zealand dollar traded lower against the U.S. dollar ahead of the Reserve Bank of New Zealand's interest rate decision. Analysts expect interest rate to remain unchanged at 3.50%.

In the overnight trading session, the kiwi traded lower against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback after the weak economic data from Australia. Home loans in Australia dropped 3.5% in January, missing expectations for a 1.9% decline, after a 2.7% increase in December.

The Melbourne Institute and Westpac Bank released its consumer sentiment index for Australia on late Tuesday. The consumer sentiment index for Australia fell 1.2% in March, after a 8.0% rise in February.

The Japanese yen traded mixed against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback. Japan's core machinery orders declined 1.7% in January, beating expectations for a 3.8% drop, after a 8.3% rise in December.

On a yearly basis, Japan's core machinery orders climbed 1.9% in January, after a 11.4% rise in December.

-

17:20

Gold: а review of the market situation

Gold prices dropped significantly today, while reaching the lowest level in more than three months, due to the ongoing strengthening of the dollar and expectations of an earlier interest rate increase by the US Federal Reserve. It is worth emphasizing the precious metal may go down even more if the US stock indices and bond yields continue to rise.

Experts note that the Fed could start raising rates in the middle of this year (probably in June), and investors are preparing for the Fed next week to find out if he has not given up his intention to be patient regarding the timing recovery rates. Expectations of an increase of interest on loans have a negative impact on the precious metal because it fails to compete with earning assets during the period of rising rates.

Pressure on prices also has increasing European stock markets after a marked decline in the previous session.

Meanwhile, recent data by Bloomberg showed that the assets of exchange traded funds that invest in gold, fell to its lowest level in the last month and a half. By the closing bell Tuesday they dropped to 6.5 tons - up to 1653 tons. This is the lowest figure since January 26. Within two weeks of continuous decline fund assets fell by 27 tons. The main outflow of clients' funds fell on the world's largest exchange-traded fund SPDR Gold Trust, whose assets have declined over the two weeks of 18.2 tons to 753 tons.

Small effect has also statistics on China. As previously reported, the volume of industrial production grew by + 6.8% compared to the same period last year, after rising 7.9% in December. Industrial production growth was below economists' forecasts (+ 7.6%). Investments in fixed assets in urban China in January-February compared to the same period last year increased by 13.9%. Thus, the growth of this important indicator of activity in the construction sector fell short of economists' forecast was 15.1%. Growth in retail sales in January-February compared to the same period last year was 10.7%, slowing down against the annual growth in December at 11.9%. The forecast for January and February was + 11.5%. Weaker-than-expected data highlighted concerns about the Chinese economy, reviving speculation that policy makers will have to resort to fresh stimulus measures.

As for the situation in the physical market, the decline in prices to a minimum of three little increased demand for the precious metal from Asian buyers. Prize for gold in China compared to London was about $ 5 per ounce.

April futures price of gold on the COMEX today fell to 1150.90 dollars per ounce.

-

17:03

NIESR’s gross domestic product rose by 0.6% in three months to February

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.6% in three months to February, after a 0.6% growth in three months to January, which figure was revised down from a 0.7% increase.

According to NIESR, the economy is expected to grow 2.9% in 2015 and 2.3% in 2016.

-

16:17

St. Louis Fed President James Bullard: the Fed is already a "little bit too late" in the tightening of its monetary policy

The St. Louis Fed President James Bullard said in an interview with the Financial Times on Wednesday that the Fed is already a "little bit too late" in the tightening of its monetary policy. He noted that inflation excluding oil prices is not far below the Fed's 2% target.

Bullard pointed out that recent weak U.S. economic data was likely due to cold winter.

The St. Louis Fed president does not have a vote on the Fed's policy committee.

-

16:00

United Kingdom: NIESR GDP Estimate, February +0.6%

-

15:31

British Chambers of Commerce upgraded its forecasts for the U.K. GDP

The British Chambers of Commerce (BCC) upgraded its forecasts for the U.K. GDP (gross domestic product) on Wednesday. The upgrade was driven by stronger than expected improvements in household consumption and services.

The BCC predicts 2.7% GDP growth for 2015, up from the previous forecast of 2.6%.

The GDP growth in 2016 is expected to be 2.6%, up from a 2.4% rise.

-

15:30

U.S.: Crude Oil Inventories, March +4.5

-

14:44

European Central Bank (ECB) President Mario Draghi: bond purchases should help to boost inflation and encourage investors to shift to riskier assets

The European Central Bank (ECB) President Mario Draghi said at a conference of economists and central bankers in Frankfurt on Wednesday that bond purchases should help to boost inflation and encourage investors to shift to riskier assets. He noted that quantitative easing was unconventional but "not unorthodox".

Draghi rejected criticism that the ECB should implement quantitative easing sooner. He pointed out that the ECB has introduced a negative rate on bank deposits parked at the ECB and has purchased covered bank bonds and asset-backed securities.

The ECB had started to purchase government bonds on Monday.

-

14:40

U.S. Stocks open: Dow +0.29%, Nasdaq +0.08%, S&P +0.26%

-

14:24

Before the bell: S&P futures +0.36%, NASDAQ futures +0.24%

U.S. stock-index futures rose after a surging dollar sparked the biggest equities selloff in more than two months.

Global markets:

Nikkei 18,723.52 +58.41 +0.31%

Hang Seng 23,717.97 -179.01 -0.75%

Shanghai Composite 3,291.48 +5.41 +0.16%

FTSE 6,714.76 +11.92 +0.18%

CAC 4,971.9 +89.95 +1.84%

DAX 11,706.56 +206.18 +1.79%

Crude oil $48.63 (+0.70%)

Gold $1156.90 (-0.28%)

-

14:11

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

AMERICAN INTERNATIONAL GROUP

AIG

54.46

+0.07%

7.9K

Visa

V

265.50

+0.11%

0.6K

McDonald's Corp

MCD

96.40

+0.11%

17.9K

Nike

NKE

96.65

+0.15%

3.4K

Pfizer Inc

PFE

33.83

+0.15%

1.0K

United Technologies Corp

UTX

117.65

+0.21%

0.1K

Verizon Communications Inc

VZ

47.62

+0.23%

0.6K

General Electric Co

GE

25.23

+0.24%

7.0K

Wal-Mart Stores Inc

WMT

81.80

+0.27%

0.3K

International Business Machines Co...

IBM

158.25

+0.28%

1.1K

The Coca-Cola Co

KO

40.81

+0.29%

0.3K

American Express Co

AXP

79.35

+0.30%

0.1K

Google Inc.

GOOG

556.65

+0.30%

0.1K

AT&T Inc

T

32.88

+0.31%

13.4K

Cisco Systems Inc

CSCO

28.75

+0.31%

5.3K

Johnson & Johnson

JNJ

99.89

+0.36%

0.8K

Walt Disney Co

DIS

103.47

+0.37%

0.1K

Exxon Mobil Corp

XOM

84.61

+0.42%

10.7K

Chevron Corp

CVX

103.35

+0.43%

1.0K

Home Depot Inc

HD

113.05

+0.44%

0.2K

Facebook, Inc.

FB

77.89

+0.44%

68.2K

Goldman Sachs

GS

183.54

+0.45%

0.9K

Microsoft Corp

MSFT

42.22

+0.45%

7.7K

Yahoo! Inc., NASDAQ

YHOO

42.87

+0.46%

2.4K

Hewlett-Packard Co.

HPQ

32.83

+0.49%

2.2K

Apple Inc.

AAPL

125.15

+0.51%

160.2K

Ford Motor Co.

F

15.80

+0.51%

4.4K

JPMorgan Chase and Co

JPM

60.27

+0.52%

2.1K

Amazon.com Inc., NASDAQ

AMZN

371.50

+0.54%

2.0K

Twitter, Inc., NYSE

TWTR

46.10

+0.57%

60.6K

Caterpillar Inc

CAT

80.40

+0.61%

1.2K

Citigroup Inc., NYSE

C

51.55

+0.62%

11.6K

Tesla Motors, Inc., NASDAQ

TSLA

191.50

+0.62%

3.1K

Merck & Co Inc

MRK

56.95

+0.65%

0.5K

Boeing Co

BA

153.47

+0.69%

0.1K

ALCOA INC.

AA

13.60

+0.74%

0.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

18.99

+0.80%

0.7K

Intel Corp

INTC

32.00

+0.95%

28.6K

E. I. du Pont de Nemours and Co

DD

79.62

+1.08%

3.7K

Yandex N.V., NASDAQ

YNDX

14.43

+2.20%

0.2K

Barrick Gold Corporation, NYSE

ABX

10.67

-0.09%

3.5K

Procter & Gamble Co

PG

81.37

-0.21%

1.1K

-

14:02

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Home Loans January +2.7% -1.9% -3.5%

05:30 China Retail Sales y/y February +11.9% +11.6% +10.7%

05:30 China Industrial Production y/y February +7.9% +7.7% +6.8%

05:30 China Fixed Asset Investment February +15.7% +15.1% +13.9%

06:30 France Non-Farm Payrolls (Finally) Quarter IV 0.0% 0.0% 0.0%

09:30 United Kingdom Industrial Production (MoM) January -0.2% +0.2% -0.1%

09:30 United Kingdom Industrial Production (YoY) January +0.8% +1.3%

09:30 United Kingdom Manufacturing Production (MoM) January +0.1% +0.3% -0.5%

09:30 United Kingdom Manufacturing Production (YoY) January +2.6% +1.9%

The U.S. dollar traded mixed against the most major currencies. There will be released no major U.S. economic reports on Wednesday.

The greenback remained supported by speculation that the Fed might start to raise its interest rate sooner than expected.

The euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy and quantitative easing by the European Central Bank (ECB) weighed on the euro. The ECB had started to purchase government bonds on Monday.

The ECB President Mario Draghi said on Wednesday that bond purchases should help to boost inflation and encourage investors to shift to riskier assets. He noted that quantitative easing was unconventional but "not unorthodox".

The Eurogroup of euro zone finance ministers continued to discuss proposed Greek economic reforms.

The British pound traded lower against the U.S. dollar after the mostly weaker-than-expected data from the U.K. Manufacturing production in the U.K. fell 0.5% in January, missing expectations for a 0.3% rise, after a 0.1% rise in December.

The decline was driven by lower output in the computer, electronic and optical sector. Output dropped by 9.5%, the biggest monthly decline since early 2002.

On a yearly basis, manufacturing production in the U.K. increased 1.9% in January, after a 2.6% rise in December. December's figure was revised up from a 2.4% gain.

Industrial production in the U.K. decreased 0.1% in January, missing forecasts of a 0.2% rise, after a 0.2% decline in December.

The U.K. oil and gas production rose 2.4% in January as production at North Sea oil and gas fields increased.

On a yearly basis, industrial production in the U.K. rose 1.3% in January, after a 0.8% gain in December. December's figure was revised up from a 0.5% rise.

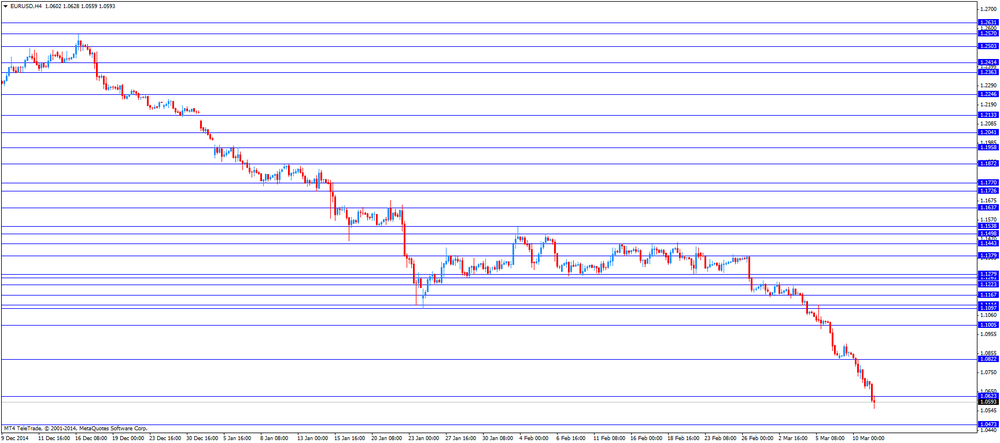

EUR/USD: the currency pair fell to $1.0593

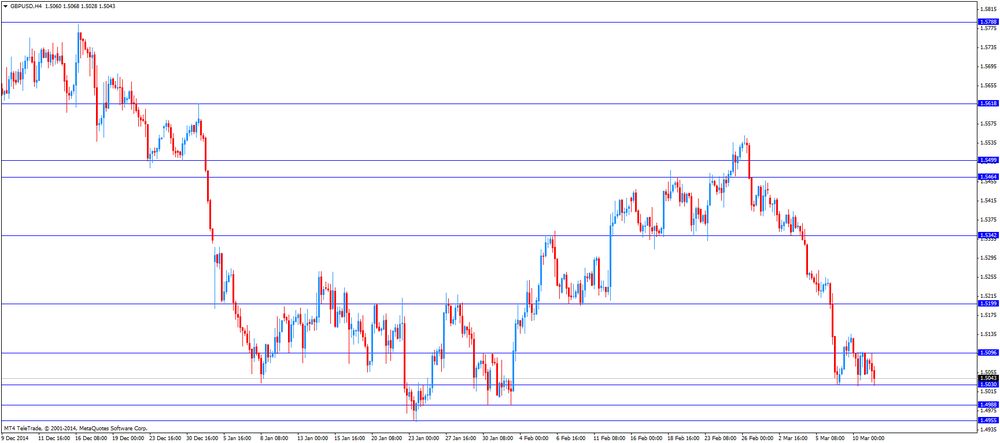

GBP/USD: the currency pair declined to $1.5028

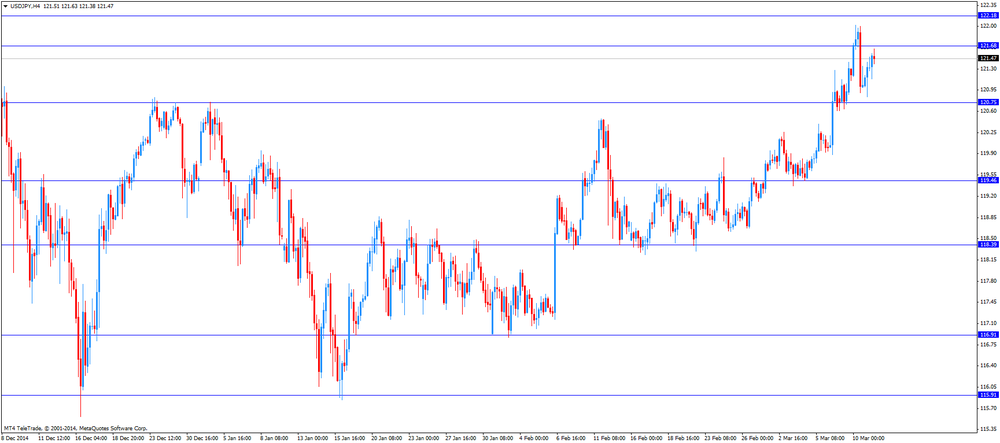

USD/JPY: the currency pair rose to Y121.63

The most important news that are expected (GMT0):

15:00 United Kingdom NIESR GDP Estimate February +0.7%

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

23:50 Japan BSI Manufacturing Index Quarter I 8.1 5.7

-

13:56

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

DuPont (DD) target raised to $91 from $84 at Jefferies

Starbucks (SBUX) initiated at Neutral at Credit Suisse, target $97

McDonald's (MCD) initiated at Neutral at Credit Suisse

Starbucks (SBUX) target raised from $94 to $100 at RBC Capital Mkts

-

13:50

Orders

EUR/USD

Offers 1.0680 1.0700 1.0720 1.0735 1.0750 1.0780 1.0800 1.0820-25 1.0845-50

Bids 1.0635 1.0620 1.0600 1.0585 1.0565 1.0550

GBP/USD

Offers 1.5100 1.5120-25 1.5150 1.5180 1.5200 1.5220

Bids 1.5045-50 1.5025 1.5000 1.4985 1.4965 1.4950

EUR/JPY

Offers 129.60 129.80 130.00 130.20 130.80 130.80 131.00 131.30

Bids 129.00 128.85 128.50 128.30 128.00

USD/JPY

Offers 121.50 121.80 122.00-10 122.35 122.50 122.80 123.00

Bids 121.20 121.00 120.80 120.60-65 1.2025-30 120.00

EUR/GBP

Offers 0.7100 0.7120 0.7145-50 0.7185 0.7200 0.7220-25 0.7245-50

Bids 0.7050 0.7035 0.7020 0.7000 0.6985

AUD/USD

Offers 0.7640 0.7660 0.7680 0.7700 0.7740 0.7760

Bids 0.7600 0.7585 0.7565 0.7550 0.7530 0.7500

-

13:32

Manufacturing production in the U.K. declines 0.5% in January

The U.K. Office for National Statistics released manufacturing and industrial production figures on Wednesday. Manufacturing production in the U.K. fell 0.5% in January, missing expectations for a 0.3% rise, after a 0.1% rise in December.

The decline was driven by lower output in the computer, electronic and optical sector. Output dropped by 9.5%, the biggest monthly decline since early 2002.

On a yearly basis, manufacturing production in the U.K. increased 1.9% in January, after a 2.6% rise in December. December's figure was revised up from a 2.4% gain.

Industrial production in the U.K. decreased 0.1% in January, missing forecasts of a 0.2% rise, after a 0.2% decline in December.

The U.K. oil and gas production rose 2.4% in January as production at North Sea oil and gas fields increased.

On a yearly basis, industrial production in the U.K. rose 1.3% in January, after a 0.8% gain in December. December's figure was revised up from a 0.5% rise.

-

13:00

European stock markets mid-session: Stocks rally on euro at 12-year low and QE

European stocks rebound from the recent selloff on Wednesday despite the slump on Wall Street yesterday. The Quantitative Easing of the ECB, its massive bond-buying program worth euro 60 billion a month, started on Monday buying German, Belgian, French, Italian and Spanish bonds this week lend support to the stock markets. In addition the broadly weaker euro, hitting a 12-year low against the greenback, boosts exporter shares.

Continuing uncertainty over Greece weighs on the markets. Yesterday German Finance Minister Wolfgang Schäuble said that Greek officials must stop wasting time and work on the planned reforms. Talks of EU finance ministers continue today in Brussels. They discuss Greece's planned reforms.

Final data on French Non-Farm Payrolls for the fourth quarter came in in-line with expectations and unchanged from a previous reading at 0.0%.

Data on Manufacturing Production in the U.K. dropped unexpectedly, Industrial Production also declined.

The FTSE 100 index is currently trading +0.07% quoted at 6,707.45. Germany's DAX 30 added +1.66% trading at 11,691.72 setting a new all-time high at 11,718,41 points. France's CAC 40 is currently trading at 4,971.12 points, +1.83%.

-

12:20

Oil: Brent Crude further down after yesterday's slump – WTI up

Oil traded mixed on Wednesday with Brent Crude losing -0.11%, currently trading at USD56.33 a barrel - setting new one-month lows. Yesterday Brent slumped by -3.30%. West Texas Intermediate added +0.19% currently quoted at USD48.38.

Brent Crude was weighed down by a broadly stronger U.S. dollar as the commodity is dollar-denominated. WTI took some support from U.S. stockpiles who registered an unexpected drop. Stockpiles of the world largest consumer of oil declined by more than 400,000 barrels, reported the American Petroleum Institute.

Now all eyes are on official data from the U.S. Energy Information Administration on U.S. Crude Oil Inventories due at 14:40 GMT.

In Libya two oil fields are shut after IS attacks fuelling concerns over supply risks.

On Sunday OPEC Secretary-General Abdullah al-Badri said that OPEC members should not lower production as this would only help U.S. producers with their higher-cost shale. Data from Baker Hughes on Friday showed that U.S. rig-numbers further declined by 63 - the lowest count since June 2011.

Oil prices declined by almost 60% between June 2014 and January 2015 and recovered by almost 35% in 2015.Although prices rebounded after setting new lows, worldwide supply still exceeds demand in a period of low global economic growth, pushing stockpiles to record highs, weighing on prices.

-

12:00

Gold at 3-month low as strong greenback weighs

Gold continued to decline for the eight consecutive day and is trading at 3-month lows as a stronger U.S. dollar weighs - with the euro trading at 12-year lows and racing toward a record quarterly drop. Better-than-expected U.S. jobs data reported last Friday added to expectations that the FED will hike interest rates rather sooner than later sending the precious metal down. A U.S. rate hike is now expected to happen possibly as soon as June. Physical demand for bullion could not support the price of gold.

A stronger U.S. dollar and the prospect for higher U.S. rates recently weighed on the precious metal as the precious metal is dollar-denominated and not yield-bearing.

Continuing uncertainty over Greece could not support the price of gold Continuing uncertainty over Greece weighs on the markets. On Monday ECB president Mario Draghi urged Greek officials to let return Eurozone-representatives to Greece in order to examine the government's books as a precondition for further financial aid. Greece agreed on allowing experts from the ECB and IMF to start their work today. Yesterday German Finance Minister Wolfgang Schäuble said that Greek officials must stop wasting time and work on the planned reforms.

Gold is currently quoted at USD1,156.80, +0,40% a troy ounce. On Thursday the 22nd of January gold reached a five-month high at USD1,307.40. Yesterday bullion traded as low as USD1,155.00.

-

10:50

China: Industrial Production, Retail Sales and Investment grew less than expected

Data on Industrial Production, Retail Sales and Fixed Asset Investment all missed forecasts as stimulus measures by the Peoples Bank of China effects are limited so far and do not boost the world's second largest economy enough. The data fuels concerns over economic growth and that further measures will have to be taken by the PBoC.

Data for January and February were combined as a consequence of the long Lunar New Year public holiday.

Growth in Industrial Production had the lowest reading since 2009. Industrial Production grew +6.8% year on year, below estimates of an increase of +7.7%. Last year's reading was +7.9%.

Retail Sales grew +10.7% in February compared to +11.9% last year. Analysts expected an increase of +7.7%.

Fixed Asset Investment grew +13.9%, below the estimated +15.1%.

-

10:30

United Kingdom: Industrial Production (MoM), January -0.1% (forecast +0.2%)

-

10:30

United Kingdom: Industrial Production (YoY), January +1.3%

-

10:20

Press Review: Draghi Says ECB Measures Can And Will Restore Inflation to Goal

BLOOMBERG

Draghi Says ECB Measures Can And Will Restore Inflation to Goal

(Bloomberg) -- Mario Draghi said the European Central Bank's expanded asset purchases will succeed in pushing inflation in the euro area back toward its goal.

"We can deploy and we will deploy monetary policy in a way that can and will stabilize inflation in line with our objective," the ECB president said at a conference in Frankfurt, three days into his 1.1 trillion-euro ($1.2 trillion) bond-buying program. "Our monetary policy is certainly supporting the recovery."

In his first public appearance since QE started, Draghi can point to falling yields on government debt and a slide in the euro as signs that the program to buy 60 billion euros a month of sovereign and private-sector debt is making a mark. What he can't yet show is whether banks and companies will respond by putting the fresh cash to work in the real economy.

REUTERS

Kuwait expects OPEC to continue policy beyond June(Reuters) - OPEC is likely to maintain its production policy at a meeting in June, Kuwait's OPEC governor said on Tuesday in the first public comment on what would be a crucial decision to determine the direction of global oil prices in the second half of the year.

Many OPEC oil ministers including Saudi Arabia's Ali al-Naimi have defended the organization's November decision not to cut production but instead defend market share and curtail the output of more expensive producers such as the United States.

The accord sent oil prices below $50 per barrel, extending a sharp decline that began in June amid a global glut of crude.

Source: http://www.reuters.com/article/2015/03/10/us-eurozone-greece-varoufakis-idUSKBN0M60MN20150310

BLOOMBERG

Japan Still Far From Done Cheapening Yen, Survey Suggests

(Bloomberg) -- Japan's central bank is far from done driving down the yen if it wants to secure a 2 percent inflation target next year, a survey of economists by Bloomberg News shows.

The median estimate of 27 economists in a survey March 5-10 shows that the yen needs to fall to 140 per dollar, a level last seen in 1998, to help the Bank of Japan meet its goal. Even after a 23 percent decline since Governor Haruhiko Kuroda began record monetary stimulus, that means a further 13 percent drop from the current level.

Kuroda and his colleagues are projected to step up their stimulus later this year, once it becomes clear that it's unlikely to achieve a 2 percent increase in consumer prices in or around the 12 months starting in April, a separate survey shows. What's unclear is whether politicians, Japan's trading partners and the small companies hurt by a weaker yen would tolerate actions that sent the yen down so much.

-

10:00

European stock markets First hour: Stocks rebound, German DAX at new all-time high

European stocks rebound from the recent selloff on Wednesday despite the slump on Wall Street yesterday. The Quantitative Easing of the ECB, its massive bond-buying program worth euro 60 billion a month, started on Monday buying German, Belgian, French, Italian and Spanish bonds this week lend support to the stock markets.

Continuing uncertainty over Greece weighs on the markets. On Monday ECB president Mario Draghi urged Greek officials to let return Eurozone-representatives to Greece in order to examine the government's books as a precondition for further financial aid. Greece agreed on allowing experts from the ECB and IMF to start their work today. Yesterday German Finance Minister Wolfgang Schäuble said that Greek officials must stop wasting time and work on the planned reforms.

Final data on French Non-Farm Payrolls for the fourth quarter came in in-line with expectations and unchanged from a previous reading at 0.0%.

The FTSE 100 index is currently trading +0.40% quoted at 6,729.93. Germany's DAX 30 added +0.95% trading at 11,609.46, France's CAC 40 is currently trading at 4,940.95 points, +1.21%.

-

09:00

Global Stocks: Wall Street slumps on rate speculations, Nikkei up

U.S. stocks slumped on Tuesday with both indices being negative for the year. Speculations on the FED hiking interest rates weighs on the markets. The S&P 500 closed -1.70% with a final quote of 2,044.16 points, the biggest drop in almost two months. The DOW JONES index dropped -1.85% closing at 17,662.94 points, now significantly below the psychologically important 18,000 points mark.

Chinese stocks were mixed on Wednesday after data came in weaker and below expectations. Hong Kong's Hang Seng is trading lower -0.66% at 23,740.30 points. China's Shanghai Composite closed at 3,291.48 points gaining +0.16% at the close. Retail Sales rose less-than expected +10.7%. Analyst expected +11.6% in February compared to +11.9% in January. Industrial Production in the second largest economy rose +6.8% year on year, below the estimated growth of +7.7%. Fixed Asset Investment came in at +13.9%, also below expectations of an increase of 15.1%.

The Nikkei posted gains on Wednesday despite a lower Wall Street. Construction stocks led the index higher. The Nikkei closed +0.31% with a final quote of 18,723.52 points. Core Machinery Orders for January declined less-than-expected in January with a reading of -1.7% compared to +8.3% in the previous month and forecasts of a decline of -3.8%.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Home Loans January +2.7% -1.9% -3.5%

05:30 China Retail Sales y/y February +11.9% +11.6% +10.7%

05:30 China Industrial Production y/y February +7.9% +7.7% +6.8%

05:30 China Fixed Asset Investment February +15.7% +15.1% +13.9%

06:30 France Non-Farm Payrolls (Finally) Quarter IV 0.0% 0.0% 0.0%

The U.S. dollar traded mixed against its major peers on Wednesday, still supported by speculations on a rate hike in June. Job openings climbed to 4.998 million in January from 4.877 million in December. That was the highest level since January 2001. Wholesale inventories in the U.S. rose 0.3% in January, missing expectations for a flat reading. Inventories of durable goods increased 0.6% in January, while inventories of non-durable goods fell by 0.1%.

The euro and sterling stabilized after yesterday's plunge with sterling slightly positive and the euro currently at USD1.0673. Quantitative Easing and concerns over Greece weigh on the single currency.

The Australian dollar declined against the greenback to a new five-week low at USD0.7586 currently quoted at USD0.7604. The Westpac Consumer Confidence index declined by -1.2% for the month of March. Assistant Governor of the RBA Christopher Kent said that the record low interest rate of 2.25% together with other steps taken by the bank should help to boost economic growth, sustain activity in the housing sector and support household wealth. Home Loans declined by -3.5% in January, more than the expected -1.9%.

Chinese Retail Sales rose less-than expected +10.7%. Analyst expected +11.6% in February compared to +11.9% in January. Industrial Production in the second largest economy rose +6.8% year on year, below the estimated growth of +7.7%. Fixed Asset Investment came in at +13.9%, also below expectations of an increase of 15.1%.

New Zealand's dollar lost ground against the greenback in the absence any major economic reports from New Zealand. Today markets await the RBNZ Interest Rate Decision and the following Rate Statement at 20:00 GMT. At 21:45 GMT data on Food Prices are to be reported.

The Japanese yen traded lower against the greenback on Wednesday but above the new 8-year low at USD122.02 set yesterday. Core Machinery Orders for January declined less-than-expected in January with a reading of -1.7% compared to +8.3% in the previous month and forecasts of a deline of -3.8%.

EUR/USD: the euro lower higher against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling recovered moderately against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Industrial Production (MoM) January -0.2% +0.2%

09:30 United Kingdom Industrial Production (YoY) January +0.5%

09:30 United Kingdom Manufacturing Production (MoM) January +0.1% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) January +2.4%

14:30 U.S. Crude Oil Inventories March +10.3

15:00 United Kingdom NIESR GDP Estimate February +0.7%

18:00 U.S. Federal budget February -17.5 -187.3

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

21:45 New Zealand Food Prices Index, m/m February +1.3%

21:45 New Zealand Food Prices Index, y/y February +1.2%

23:50 Japan Tertiary Industry Index January -0.3% +0.6%

23:50 Japan BSI Manufacturing Index Quarter I 8.1 5.7

-

08:13

Options levels on wednesday, March 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0883 (1167)

$1.0831 (301)

$1.0763 (178)

Price at time of writing this review: $1.0681

Support levels (open interest**, contracts):

$1.0646 (2100)

$1.0627 (3647)

$1.0605 (1472)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 46431 contracts, with the maximum number of contracts with strike price $1,1500 (2711);

- Overall open interest on the PUT options with the expiration date April, 2 is 55718 contracts, with the maximum number of contracts with strike price $1,0600 (5870);

- The ratio of PUT/CALL was 1.20 versus 1.35 from the previous trading day according to data from March, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5304 (965)

$1.5207 (875)

$1.5111 (1672)

Price at time of writing this review: $1.5068

Support levels (open interest**, contracts):

$1.4990 (1608)

$1.4893 (1151)

$1.4796 (1231)

Comments:

- Overall open interest on the CALL options with the expiration date April, 2 is 18824 contracts, with the maximum number of contracts with strike price $1,5100 (1672);

- Overall open interest on the PUT options with the expiration date April, 2 is 24367 contracts, with the maximum number of contracts with strike price $1,5050 (2381);

- The ratio of PUT/CALL was 1.29 versus 1.35 from the previous trading day according to data from March, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:30

France: Non-Farm Payrolls, Quarter IV 0.0% (forecast 0.0%)

-

06:31

China: Industrial Production y/y, February +6.8% (forecast +7.7%)

-

06:31

China: Fixed Asset Investment, February +13.9% (forecast +15.1%)

-

06:30

China: Retail Sales y/y, February +10.7% (forecast +11.6%)

-

03:04

Nikkei 225 18,756.34 +91.23 +0.49 %, Hang Seng 23,887.66 -9.32 -0.04 %, Shanghai Composite 3,295.73 +9.66 +0.29 %

-

01:30

Australia: Home Loans , January -3.5% (forecast -1.9%)

-

01:02

Commodities. Daily history for Mar 10’2015:

(raw materials / closing price /% change)

Oil 48.29 -3.42%

Gold 1,161.70 +0.14%

-

01:01

Stocks. Daily history for Mar 10’2015:

(index / closing price / change items /% change)

Nikkei 225 18,665.11 -125.44 -0.67%

Hang Seng 23,896.98 -226.07 -0.94%

Shanghai Composite 3,286.07 -16.34 -0.49%

FTSE 100 6,702.84 -173.63 -2.52%

CAC 40 4,881.95 -55.25 -1.12%

Xetra DAX 11,500.38 -81.73 -0.71%

S&P 500 2,044.16 -35.27 -1.70%

NASDAQ Composite 4,859.8 -82.64 -1.67%

Dow Jones 17,662.94 -332.78 -1.85%

-

01:00

Currencies. Daily history for Mar 10’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0679 -1,62%

GBP/USD $1,5052 -0,50%

USD/CHF Chf0,9992 +1,37%

USD/JPY Y121,15 -0,04%

EUR/JPY Y129,39 -1,65%

GBP/JPY Y182,37 -0,53%

AUD/USD $0,7623 -1,05%

NZD/USD $0,7270 -1,14%

USD/CAD C$1,2685 +0,66%

-

00:51

Japan: Core Machinery Orders, January -1.7% (forecast -3.8%)

-

00:50

Japan: Core Machinery Orders, y/y, January +1.9%

-

00:30

Australia: Westpac Consumer Confidence, March -1.2%

-

00:00

Schedule for today, Wednesday, Mar 11’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Home Loans January +2.7% -1.9%

02:00 China New Loans February 1470 755

05:30 China Retail Sales y/y February +11.9% +11.6%

05:30 China Industrial Production y/y February +7.9% +7.7%

05:30 China Fixed Asset Investment February +15.7% +15.1%

06:30 France Non-Farm Payrolls (Finally) Quarter IV 0.0% 0.0%

09:30 United Kingdom Industrial Production (MoM) January -0.2% +0.2%

09:30 United Kingdom Industrial Production (YoY) January +0.5%

09:30 United Kingdom Manufacturing Production (MoM) January +0.1% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) January +2.4%

14:30 U.S. Crude Oil Inventories March +10.3

15:00 United Kingdom NIESR GDP Estimate February +0.7%

18:00 U.S. Federal budget February -17.5 -187.3

20:00 New Zealand RBNZ Interest Rate Decision 3.50% 3.50%

20:00 New Zealand RBNZ Rate Statement

20:05 New Zealand RBNZ Press Conference

21:45 New Zealand Food Prices Index, m/m February +1.3%

21:45 New Zealand Food Prices Index, y/y February +1.2%

23:50 Japan Tertiary Industry Index January -0.3% +0.6%

23:50 Japan BSI Manufacturing Index Quarter I 8.1 5.7

-