Noticias del mercado

-

23:59

Schedule for today, Wednesday, Feb 11’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Westpac Consumer Confidence February +2.4%

02:00 Japan Bank holiday

02:30 Australia Home Loans December -0.7% +2.3%

04:00 China New Loans January 697 1355

11:00 Eurozone Eurogroup Meetings

17:30 U.S. Crude Oil Inventories February +6.3

21:00 U.S. Federal budget January 1.9 -2.6

23:30 New Zealand Business NZ PMI January 57.7

-

18:28

FOMC member Jeffrey Lacker: interest rate hike in June is “the attractive option”

The Federal Reserve Bank of Richmond President Jeffrey Lacker said on Tuesday that interest rate hike in June is "the attractive option" for him.

Lacker is a voting member of the Federal Open Market Committee this year. He is a regular critic of the Fed's stimulus measures.

-

18:11

Bank of Canada Governor Stephen Poloz rejects that he has been talking down the Canadian dollar

The Bank of Canada (BoC) Governor Stephen Poloz rejected on Tuesday that he has been talking down the Canadian dollar. He added that the decline of the loonie depends on Canada's economy.

The BoC governor noted that oil prices are responsible for the performance of the economy.

The Canadian dollar fell 3.2% since interest rate cut by the Bank of Canada on January 21. The central bank lowered its interest rate to 0.75% from 1.00%.

Poloz pointed out that the further interest rate cut will depend on the economy's fundamentals.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed higher against the most major currencies despite the better-than-expected U.S. job openings figures

The U.S. dollar traded mixed higher against the most major currencies despite the better-than-expected U.S. job openings figures. Job openings climbed to 5.028 million in December from 4.847 million in November. That was the highest level since January 2001.

November's figure was revised down from 4.972 million.

Analysts had expected job openings to rise to 4.992 million.

Wholesale inventories in the U.S. rose 0.1% in December, missing expectations for a 0.2% increase, after a 0.8% gain in November.

The euro traded higher against the U.S. dollar. Concerns over Greece's further bailout policy still weighed on the euro.

Industrial production in France climbed 1.5% in December, exceeding expectations for a 0.3% gain, after a 0.2% drop in November. November's figure was revised up from a 0.3% decline.

The British pound traded higher against the U.S. dollar after the solid U.K. GDP estimate. The NIESR GDP estimate rose to 0.7% in three months to January, up from 0.5% in the fourth quarter of 2014.

The increase was driven by growth in services.

Manufacturing production in the U.K. rose 0.1% in December, missing expectations for a 0.3% rise, after a 0.8% increase in November. November's figure was revised up from a 0.7% gain.

On a yearly basis, manufacturing production in the U.K. increased 2.4% in December, beating expectations for a 2.0% gain, after a 3.0% rise in November. November's figure was revised up from a 2.7% increase.

Industrial production in the U.K. decreased 0.2% in December, missing forecasts of a 0.3% rise, after a flat reading in November. November's figure was revised up from a 0.1% decrease.

The decline was driven by falls in mining and energy sectors.

On a yearly basis, industrial production in the U.K. rose 0.5% in December, missing expectations for a 0.8% increase, after a 1.1% gain in November.

The Swiss franc traded mixed against the U.S. dollar. Switzerland's consumer price index dropped 0.4% in January, in line with expectations, after a 0.5% decline in December.

On a yearly basis, Switzerland's consumer price index declined to -0.5% in January from -0.3% in December, beating expectations for a 0.6% drop.

These figures have added to concerns over deflation in Switzerland.

Switzerland's unemployment rate remained unchanged at 3.1% in January. December's figure was revised up from 3.2%. Analysts had expected the unemployment rate to rise to 3.2%.

The Canadian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Canada.

The Bank of Canada Governor Stephen Poloz rejected on Tuesday that he has been talking down the Canadian dollar.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi increased against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded mixed against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback after the mixed economic data from Australia. The National Australia Bank's business confidence index rose to 3 in January from 2 in December.

Australia's house price index was up 1.9% in the fourth quarter, missing expectations for a 2.0% rise, after a 1.4% increase in the third quarter. The third quarter's figure was revised down from a 1.5% gain.

The Japanese yen declined against the U.S. dollar due to decreasing demand in the safe-haven currency. In the overnight trading session, the yen traded mixed against the greenback. Japan's tertiary industry index fell 0.3% in December, missing expectations for a 0.1% rise, after a 0.2% increase in November.

-

17:14

NIESR’s gross domestic product rose to 0.7% in three months to January

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose to 0.7% in three months to January, up from 0.5% in the fourth quarter of 2014.

The increase was driven by growth in services.

According to NIESR, the economy is expected to grow 2.9% in 2015 and 2.3% in 2016.

The economy will benefit from lower oil prices, NIESR said.

NIESR forecasts that inflation will be about 0.5% in 2015, while unemployment rate will be about 5.25% by the end of the year.

-

16:57

Wholesale inventories in the U.S. rose 0.1% in December

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.1% in December, missing expectations for a 0.2% increase, after a 0.8% gain in November.

Inventories of durable goods increased 0.2% in December, while inventories of non-durable goods fell by 0.1%.

Inventories of computers, peripheral equipment, and software climbed by 2.6 percent, while inventories of petroleum and petroleum products dropped by 6.2%.

Wholesale sales declined by 0.4 percent in December, driven by a 1.7% fall in sales of non-durable goods.

-

16:34

Job openings increased to 5.028 million in December, the highest level since January 2001

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings climbed to 5.028 million in December from 4.847 million in November. That was the highest level since January 2001.

November's figure was revised down from 4.972 million.

Analysts had expected job openings to rise to 4.992 million.

The number of job openings was little changed for total private (4.5 million), while increased for government (518,000) in December.

The hires rate was 3.7% in December.

Total separations rose to 4.886 million in December from 4.700 million in November. That was the highest level since October 2008.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:02

U.S.: JOLTs Job Openings, December 5028 (forecast 4992)

-

16:00

United Kingdom: NIESR GDP Estimate, January +0.7%

-

16:00

U.S.: Wholesale Inventories, December +0.1% (forecast +0.2%)

-

14:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1350(E516mn), $1.1450(E1.2bn)

USD/JPY: Y117.00($2.5bn), Y118.00($1.37bn), Y118.50($546mn), Y119.00($380mn)

GBP/USD: $1.5000(Gbp771mn), $1.5100(Gbp1.6bn), $1.5300(Gbp1.83bn)

AUD/USD: $0.7650(A$529mn), $0.7900(A$202mn), $0.7925(A$417mn)

AUD/JPY: Y94.00(A$350mn)

NZD/USD: $0.7350(NZ$201mn)

USD/CAD: C$1.2350($300mn), C$1.2415($385mn), C$1.2450($495mn), C$1.2500($381mn)

-

14:00

Foreign exchange market. European session: the euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:01 United Kingdom BRC Retail Sales Monitor y/y January -0.4% +0.2%

00:30 Australia National Australia Bank's Business Confidence January 2 3

00:30 Australia House Price Index (QoQ) Quarter IV +1.4% Revised From +1.5% +2.0% +1.9%

00:30 Australia House Price Index (YoY) Quarter IV +9.1% +6.8%

01:30 China PPI y/y January -3.3% -3.7% -4.3%

01:30 China CPI y/y January +1.5% +1.1% +0.8%

06:45 Switzerland Unemployment Rate January 3.1% Revised From 3.2% 3.2% 3.1%

07:45 France Industrial Production, m/m December -0.2% Revised From -0.3% +0.3% +1.5%

07:45 France Industrial Production, y/y December -2.6% -0.1%

08:00 G20 G20 Meetings

08:15 Switzerland Consumer Price Index (MoM) January -0.5% -0.4% -0.4%

08:15 Switzerland Consumer Price Index (YoY) January -0.3% -0.6% -0.5%

09:30 United Kingdom Industrial Production (MoM) December 0.0% Revised From -0.1% +0.3% -0.2%

09:30 United Kingdom Industrial Production (YoY) December +1.1% +0.8% +0.5%

09:30 United Kingdom Manufacturing Production (MoM) December +0.8% Revised From +0.7% +0.3% +0.1%

09:30 United Kingdom Manufacturing Production (YoY) December +3.0% Revised From +2.7% +2.0% +2.4%

The U.S. dollar traded higher against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to rise to 4.99 million in December from 4.97 million in November.

The euro traded lower against the U.S. dollar as concerns over Greece's further bailout policy weighed on the euro.

Industrial production in France climbed 1.5% in December, exceeding expectations for a 0.3% gain, after a 0.2% drop in November. November's figure was revised up from a 0.3% decline.

The British pound traded lower against the U.S. dollar after the mostly weaker-than expected manufacturing output data from the U.K. Manufacturing production in the U.K. rose 0.1% in December, missing expectations for a 0.3% rise, after a 0.8% increase in November. November's figure was revised up from a 0.7% gain.

On a yearly basis, manufacturing production in the U.K. increased 2.4% in December, beating expectations for a 2.0% gain, after a 3.0% rise in November. November's figure was revised up from a 2.7% increase.

Industrial production in the U.K. decreased 0.2% in December, missing forecasts of a 0.3% rise, after a flat reading in November. November's figure was revised up from a 0.1% decrease.

The decline was driven by falls in mining and energy sectors.

On a yearly basis, industrial production in the U.K. rose 0.5% in December, missing expectations for a 0.8% increase, after a 1.1% gain in November.

The Swiss franc traded lower against the U.S. dollar. Switzerland's consumer price index dropped 0.4% in January, in line with expectations, after a 0.5% decline in December.

On a yearly basis, Switzerland's consumer price index declined to -0.5% in January from -0.3% in December, beating expectations for a 0.6% drop.

These figures have added to concerns over deflation in Switzerland.

Switzerland's unemployment rate remained unchanged at 3.1% in January. December's figure was revised up from 3.2%. Analysts had expected the unemployment rate to rise to 3.2%.

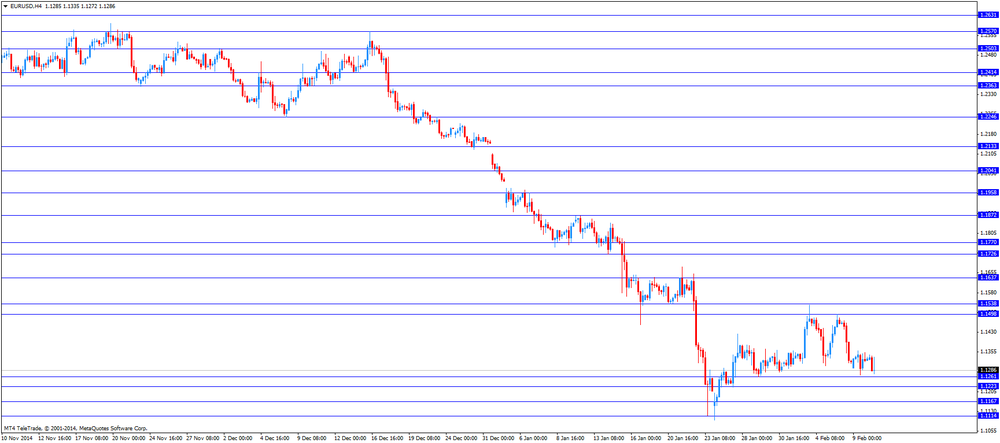

EUR/USD: the currency pair fell to $1.1272

GBP/USD: the currency pair decreased to $1.5195

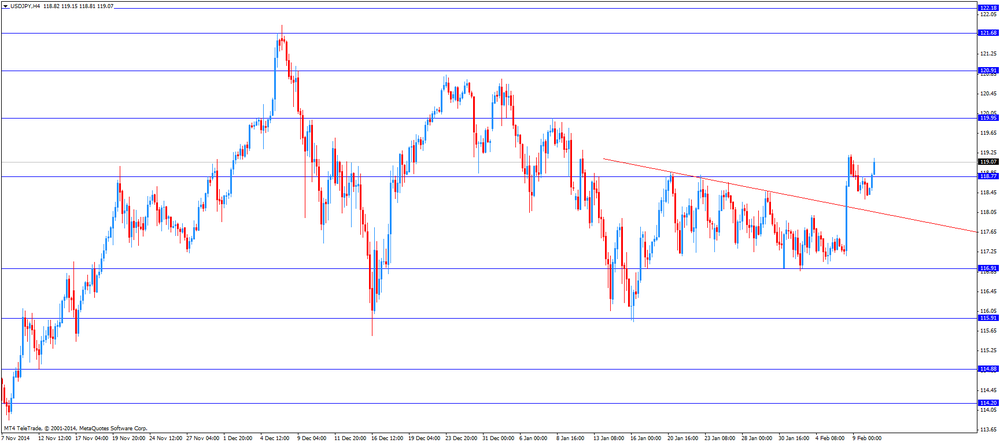

USD/JPY: the currency pair rose to Y119.15

The most important news that are expected (GMT0):

13:20 U.S. FOMC Member Laker Speaks

15:00 United Kingdom NIESR GDP Estimate January +0.6%

15:00 U.S. JOLTs Job Openings December 4970 4992

17:45 Canada Gov Council Member Wilkins Speaks

23:30 Australia Westpac Consumer Confidence February +2.4%

-

13:50

Orders

EUR/USD

Offers $1.1410-20, $1.1400, $1.1370, $1.1320

Bids $1.1270-65, $1.1260-50, $1.1200, $1.1100

GBP/USD

Offers $1.5350-55, $1.5295/305

Bids $1.5155-45, $1.5105/00, $1.5085/80

AUD/USD

Offers $0.7900, $0.7845/50

Bids $0.7700, $0.7655/50

EUR/JPY

Offers Y135.50, Y135.00

Bids Y134.00, Y133.50, Y133.00

USD/JPY

Offers Y120.50, Y120.00, Y119.40/60

Bids Y118.50, Y118.10/00

EUR/GBP

Offers stg0.7495/500

Bids stg0.7400

-

13:29

Switzerland’s consumer price inflation dropped 0.4% in January

The Swiss Federal Statistics Office released its consumer inflation data on Tuesday. Switzerland's consumer price index dropped 0.4% in January, in line with expectations, after a 0.5% decline in December.

On a yearly basis, Switzerland's consumer price index declined to -0.5% in January from -0.3% in December, beating expectations for a 0.6% drop.

These figures have added to concerns over deflation in Switzerland.

-

11:30

U.K.: Industrial Production declines, Manufacturing Production rises

While Industrial Production declined, Manufacturing Production rose in December.

U.K.'s Industrial Production declined by -0.2% on a monthly basis in December according to the U.K. Office for National Statistics, short of expectations for an +0.3% increase. On a yearly basis Industrial Production grew less than predicted +0.5% compared to forecasts of +0.8%.

Manufacturing Production grew by a seasonally adjusted 0.1% in December, compared to expectations for an increase of +0.3%. Year on year it rose by +2.4%, beating expectations of +2.0%.

Markets await the NIESR GDP Estimate scheduled for 15:00 GMT.

-

11:06

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1350(E516mn), $1.1450(E1.2bn)

USD/JPY: Y117.00($2.5bn), Y118.00($1.37bn), Y118.50($546mn), Y119.00($380mn)

GBP/USD: $1.5000(Gbp771mn), $1.5100(Gbp1.6bn), $1.5300(Gbp1.83bn)

AUD/USD: $0.7650(A$529mn), $0.7900(A$202mn), $0.7925(A$417mn)

AUD/JPY: Y94.00(A$350mn)

NZD/USD: $0.7350(NZ$201mn)

USD/CAD: C$1.2350($300mn), C$1.2415($385mn), C$1.2450($495mn), C$1.2500($381mn)

-

10:40

China’s consumer inflation hits a five-year low – fuelling easing hopes

Weak data from China fuelled expectations on further monetary easing by the People's Bank of China. China's consumer inflation hit a five-year low rising just 0.8% from a year before and factory deflation further grew.

The Chinese PPI declined for the 35th consecutive time. Deflation grew more-than-expected by -4.3% in January. Economists expected a reading of -3.7%. In December the PPI was at -3.3%.

CPI for January came in at +0.8%, lower than the estimated +1.1%, further slowing compared to +1.5% in December.

-

10:31

United Kingdom: Industrial Production (YoY), December +0.5% (forecast +0.8%)

-

10:31

United Kingdom: Manufacturing Production (YoY), December +2.4% (forecast +2.0%)

-

10:30

United Kingdom: Industrial Production (MoM), December -0.2% (forecast +0.3%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , December +0.1% (forecast +0.3%)

-

10:20

Press Review: Brent crude rally ends as China inflation hits five-year low

BLOOMBERG

Low-Inflation Inertia Adds Risk of Misfire in Fed Rate-Rise Plan

(Bloomberg) -- Prices go up and prices go down. At the Federal Reserve, a bigger worry now is that they stay the same.

U.S. central bankers are betting the economy is near an inflection point where demand is strong enough to create more jobs, eventually nudging both wages and prices higher. A report Friday showed payrolls in the past three months rose the most in 17 years while wages showed the biggest gains since 2008, reinforcing views the threshold is close.

That should help meet Fed Chair Janet Yellen's requirement for officials to be "reasonably confident" inflation is heading higher before raising interest rates this year.

The nagging problem that's making them "nervous," says St. Louis Fed President James Bullard: the longer inflation stays below the Fed's 2 percent target -- as it has for 32 months -- the higher the risk that it remains stuck in a low range.

REUTERS

Brent crude rally ends as China inflation hits five-year low(Reuters) - Brent fell below $58 a barrel on Tuesday after China's consumer inflation came in at a five-year low for January, raising worries about oil demand in the world's second-largest economy.

The International Energy Agency (IEA) also said the United States will remain the world's top source of oil supply growth up to 2020, defying expectations of a dramatic slowdown in shale output and keeping fears of a continuing glut at the forefront.

Brent crude slipped 64 cents to $57.70 by 0730 GMT (2:30 a.m. EST), ending a three-day rally. The benchmark gained more than 9 percent last week, its biggest weekly rise since February 2011.

Source: http://www.reuters.com/article/2015/02/10/us-markets-oil-idUSKBN0LE06820150210

REUTERS

UK's Osborne says danger of 'very bad outcome' on Greece increasing: Bloomberg(Reuters) - British finance minister George Osborne said the danger of a miscalculation leading to a "very bad outcome" between Greece and the euro area is increasing, Bloomberg reported.

"It's clear that the risks to the world economy, the risk to the British economy of this standoff between the euro zone and Greece, is growing each day," Osborne said in an interview with Bloomberg Television in Istanbul late on Monday.

"The risks of a miscalculation or a misstep leading to a very bad outcome are growing as well," Osborne said.

Source: http://www.reuters.com/article/2015/02/10/us-eurozone-greece-britain-idUSKBN0LE0GQ20150210

-

09:20

France: Industrial Production rose more-than-expected in December

The French Industrial Production, month on month, rose by +1.5% in December, beating forecasts for an increase by +0.3%. The solid growth in December came after disappointing data from November with a revised negative growth -0.2%.

Year on year Industry output declined -0.1% compared to -2.6% in November.

The Euro is still trading flat against the greenback at currently USD1.1323.

-

09:15

Switzerland: Consumer Price Index (MoM) , January -0.4% (forecast -0.4%)

-

09:15

Switzerland: Consumer Price Index (YoY), January -0.5% (forecast -0.6%)

-

08:50

France: Industrial Production, y/y, December -0.1%

-

08:45

France: Industrial Production, m/m, December +1.5% (forecast +0.3%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly lower against the most major currencies

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:01 United Kingdom BRC Retail Sales Monitor y/y January -0.4% +0.2%

00:30 Australia National Australia Bank's Business Confidence January 2 3

00:30 Australia House Price Index (QoQ) Quarter IV +1.4% Revised From +1.5% +2.0% +1.9%

00:30 Australia House Price Index (YoY) Quarter IV +9.1% +6.8%

01:30 China PPI y/y January -3.3% -3.7% -4.3%

01:30 China CPI y/y January +1.5% +1.1% +0.8%

06:45 Switzerland Unemployment Rate January 3.2% 3.2% 3.1%

The U.S. dollar traded lower against most major currencies but the greenback remained supported and losses were limited by Friday's labour market data. The U.S. economy added 257,000 jobs in January, exceeding expectations for a rise of 231,000 jobs, after a gain of 329,000 jobs in December. December's figure was revised up from a rise of 252,000 jobs. The upbeat jobs report is seen as a strong indication that the Federal Reserve is on track to hike benchmark interest rates in the middle of the year.

The euro traded almost flat after Friday's slump and yesterday's weak recovery on worries over Greek debt negotiations. On late Friday S&P downgraded Greece from B- to B, only one notch higher than "default" and kept the outlook for Greece negative.

The Australian dollar rose versus the greenback in Asian trade after data showed moderate housing and business conditions. The National Australia Bank's Business Confidence rose for January to 3 points with a previous reading of 2. The House Price Index quarter on quarter grew less-than-expected by +1.9%in the IV quarter compared to revised +1.4% in the III quarter. Analysts expected a reading of +2.0%. On a yearly basis the Index grew +6.8% in the fourth quarter. In the previous quarter the index grew by +9.1%.

Weak data from China, Australia's biggest trade partner, fuelled expectations on further monetary easing by the People's Bank of China. China's consumer inflation hit a five-year low and factory deflation deepened. The Chinese PPI declined more-than-expected by -4.3% in January. Economists expected a reading of -3.7%. In December the PPI was at -3.3%. CPI for January came in at +0.8%, lower than the estimated +1.1% further slowing compared to +1.5% in December.

New Zealand's dollar added gains against the greenback in Asian trade. The RBNZ Governor Graeme Wheeler said on Wednesday last week that interest rates will remain on hold "for some time".

The Japanese yen traded flat against the greenback on Tuesday. Japan's Tertiary Industry Index came in lower than expected at -0.3% for December. Analysts expected the index to rise by +0.1% compared to +0.2% in the previous month.

EUR/USD: the euro traded slightly higher against the greenback

USD/JPY: the U.S. dollar almost flat against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France Industrial Production, m/m December -0.3% +0.3%

07:45 France Industrial Production, y/y December -2.6%

08:00 G20 G20 Meetings

08:15 Switzerland Consumer Price Index (MoM) January -0.5% -0.4%

08:15 Switzerland Consumer Price Index (YoY) January -0.3% -0.6%

09:30 United Kingdom Industrial Production (MoM) December -0.1% +0.3%

09:30 United Kingdom Industrial Production (YoY) December +1.1% +0.8%

09:30 United Kingdom Manufacturing Production (MoM) December +0.7% +0.3%

09:30 United Kingdom Manufacturing Production (YoY) December +2.7% +2.0%

13:20 U.S. FOMC Member Laker Speaks

15:00 United Kingdom NIESR GDP Estimate January +0.6%

15:00 U.S. Wholesale Inventories December +0.8% +0.2%

15:00 U.S. JOLTs Job Openings December 4970 4992

17:45 Canada Gov Council Member Wilkins Speaks

21:30 U.S. API Crude Oil Inventories February +6.1

-

07:45

Switzerland: Unemployment Rate, January 3.1% (forecast 3.2%)

-

07:23

Options levels on tuesday, February 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1513 (2066)

$1.1444 (366)

$1.1396 (236)

Price at time of writing this review: $1.1337

Support levels (open interest**, contracts):

$1.1230 (2220)

$1.1187 (2301)

$1.1129 (2025)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 97500 contracts, with the maximum number of contracts with strike price $1,1500 (4903);

- Overall open interest on the PUT options with the expiration date March, 6 is 97424 contracts, with the maximum number of contracts with strike price $1,1200 (4697);

- The ratio of PUT/CALL was 1.00 versus 0.88 from the previous trading day according to data from February, 6

GBP/USD

Resistance levels (open interest**, contracts)

$1.5505 (1670)

$1.5407 (512)

$1.5311 (1452)

Price at time of writing this review: $1.5244

Support levels (open interest**, contracts):

$1.5186 (540)

$1.5090 (667)

$1.4993 (1875)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 21514 contracts, with the maximum number of contracts with strike price $1,5500 (1670);

- Overall open interest on the PUT options with the expiration date March, 6 is 27168 contracts, with the maximum number of contracts with strike price $1,5000 (1875);

- The ratio of PUT/CALL was 1.26 versus 0.99 from the previous trading day according to data from February, 6

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:32

China: PPI y/y, January -4.3% (forecast -3.7%)

-

02:30

China: CPI y/y, January +0.8% (forecast +1.1%)

-

01:32

Australia: House Price Index (YoY), Quarter IV +6.8%

-

01:30

Australia: National Australia Bank's Business Confidence, January 3

-

01:30

Australia: House Price Index (QoQ), Quarter IV +1.9% (forecast +2.0%)

-

01:02

United Kingdom: BRC Retail Sales Monitor y/y, January +0.2%

-

00:52

Japan: Tertiary Industry Index , December -0.3% (forecast +0.1%)

-

00:30

Currencies. Daily history for Feb 9’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1324 +0,04%

GBP/USD $1,5215 -0,13%

USD/CHF Chf0,9234 -0,19%

USD/JPY Y118,64 -0,16%

EUR/JPY Y134,34 -0,13%

GBP/JPY Y180,49 -0,30%

AUD/USD $0,7800 +0,03%

NZD/USD $0,7408 +0,73%

USD/CAD C$1,2466 -0,45%

-

00:00

Schedule for today, Tuesday, Feb 10’2015:

(time / country / index / period / previous value / forecast)

01:50 Japan Tertiary Industry Index December +0.2% +0.1%

02:01 United Kingdom BRC Retail Sales Monitor y/y January -0.4%

02:30 Australia National Australia Bank's Business Confidence January 2

02:30 Australia House Price Index (QoQ) Quarter IV +1.5% +2.0%

02:30 Australia House Price Index (YoY) Quarter IV +9.1%

03:30 China PPI y/y January -3.3% -3.7%

03:30 China CPI y/y January +1.5% +1.1%

08:45 Switzerland Unemployment Rate January 3.2% 3.2%

09:45 France Industrial Production, m/m December -0.3% +0.3%

09:45 France Industrial Production, y/y December -2.6%

10:00 G20 G20 Meetings

10:15 Switzerland Consumer Price Index (MoM) January -0.5% -0.4%

10:15 Switzerland Consumer Price Index (YoY) January -0.3% -0.6%

11:30 United Kingdom Industrial Production (MoM) December -0.1% +0.3%

11:30 United Kingdom Industrial Production (YoY) December +1.1% +0.8%

11:30 United Kingdom Manufacturing Production (MoM) December +0.7% +0.3%

11:30 United Kingdom Manufacturing Production (YoY) December +2.7% +2.0%

15:20 U.S. FOMC Member Laker Speaks

17:00 United Kingdom NIESR GDP Estimate January +0.6%

17:00 U.S. Wholesale Inventories December +0.8% +0.2%

17:00 U.S. JOLTs Job Openings December 4970 4992

19:45 Canada Gov Council Member Wilkins Speaks

23:30 U.S. API Crude Oil Inventories February +6.1

-