Noticias del mercado

-

17:34

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies despite the better-than-expected U.S. import price index

The U.S. dollar traded lower against the most major currencies despite the better-than-expected U.S. import price index. The U.S. import price index dropped by 0.3% in March, beating expectations for a 0.4% decline, after a 0.2% increase in February. February's figure was revised down from a 0.4% gain.

The decline was driven by a fall in prices for non-fuel imports.

The euro traded higher against the U.S. dollar. Industrial production in France was flat in February, beating expectations for a 0.1% decline, after a 0.3% rise in January. January's figure was revised down from a 0.4% increase.

On a yearly basis, the French industrial production rose 0.3% in February, after a 0.6% gain in January.

Concerns over Greece's debt problems continue to weigh on the euro. Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros on Thursday.

The British pound traded higher against the U.S. dollar. The National Institute of Economic and Social Research's estimate of gross domestic product (GDP) for the U.K. rose by 0.6% in three months to March, after a 0.6% growth in three months to February.

Manufacturing production in the U.K. rose 0.4% in February, in line with expectations, after a 0.6% decline in January. January's figure was revised down from a 0.5% decrease.

On a yearly basis, manufacturing production in the U.K. increased 1.1% in February, missing expectations for a 1.3% gain, after a 1.7% rise in January. January's figure was revised down from a 1.9% gain.

Industrial production in the U.K. climbed 0.1% in February, missing forecasts of a 0.3% rise, after a 0.1% decline in January.

On a yearly basis, industrial production in the U.K. gained 0.1% in February, missing expectations for a 0.3% rise, after a 1.2% increase in January. January's figure was revised down from a 1.3% rise.

The Canadian dollar traded higher against the U.S. dollar after the better-than-expected Canadian labour market data. Canada's unemployment rate remained unchanged at 6.8% in March, in line with expectations.

The number of employed people increased by 28,700 jobs in March, exceeding expectations for a gain of 100 jobs, after a 1,000 decline in February.

The gain was driven by an increase in part-time jobs.

The Swiss franc traded higher against the U.S. dollar. Switzerland's unemployment rate remained unchanged at a seasonally adjusted 3.2% in March, in line with expectations.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback in the absence of any economic reports from New Zealand.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie declined against the greenback. Home loans in Australia rose 1.2% in February, missing expectations for a 3.1% gain, after a 1.7% decrease in January. January's figure was revised down from a 3.5% fall.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback in the absence of any economic reports from Japan.

-

17:07

NIESR’s gross domestic product rose by 0.6% in three months to March

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Friday. The GDP estimate rose by 0.6% in three months to March, after a 0.6% growth in three months to February.

According to NIESR, the recent weak performance in the production and construction sectors weighed on economic growth in the first quarter.

-

16:53

Richmond Fed President Jeffrey Lacker: the Fed could start to raise its interest rate in June

The Richmond Fed President Jeffrey Lacker said on Friday that the Fed could start to raise its interest rate in June if "incoming economic reports diverge substantially from projections".

He added that it would be ok if the Fed will cut interest rate after rate hike if needed.

The Richmond Fed president expects that U.S. inflation will pick up toward the Fed's 2% target.

Lacker is a voting member of the Federal Open Market Committee this year.

-

16:25

U.S. import price index declines 0.3% in March

The U.S. Labor Department released its import and export prices data on Friday. The U.S. import price index dropped by 0.3% in March, beating expectations for a 0.4% decline, after a 0.2% increase in February.

February's figure was revised down from a 0.4% gain.

The decline was driven by a fall in prices for non-fuel imports. Non-fuel imports prices decreased 0.4% in March.

A stronger U.S. currency lowers the price of imported goods.

Petroleum import prices climbed 0.8% in March.

U.S. export prices rose by 0.1% in March, after a revised 0.2% drop in February. It was the first rise since July 2014.

-

16:00

United Kingdom: NIESR GDP Estimate, March 0.6%

-

15:54

Housing starts in Canada increased to a seasonally adjusted annualized rate of 189,708 units in March

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Friday. Housing starts in Canada increased to a seasonally adjusted annualized rate of 189,708 units in March from a revised reading of 151,238 units in February. February's figure revised down from 156,276 units.

Analysts had expected an increase to 175,000 units.

The CMHC's Chief Economist Bob Dugan said that "the trend in housing starts essentially held steady in March compared to February".

"However, the trend in housing construction has moved lower since September 2014, partly reflecting efforts to manage the level of completed but unsold units," Dugan noted.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0600(E300mn), $1.0700(E729mn), $1.0750(E339mn), $1.0800, $1.0950(E591mn)

USD/JPY: Y118.80($500mn), Y119.00/15($584mn), Y119.50($1.0bn), Y120.00($383mn), Y121.00($1.1bn)

EUR/JPY: Y132.00(E1.4bn)

GBP/USD: $1.4650(Gbp341mn)

AUD/USD: $0.7700(A$1.3bn)

USD/CAD: Cad1.2500($665mn), Cad1.2570($1.3bn), Cad1.2600($4.1bn)

NZD/USD: $0.7400(NZ$337mn), $0.7750(NZ$882mn)

-

15:27

Canada’s economy added 28,700 jobs in March, driven by an increase in part-time jobs

Statistics Canada released the labour market data on Friday. Canada's unemployment rate remained unchanged at 6.8% in March, in line with expectations.

The number of employed people increased by 28,700 jobs in March, exceeding expectations for a gain of 100 jobs, after a 1,000 decline in February.

The gain was driven by an increase in part-time jobs.

Full-time employment in March declined by 28,200 jobs, while part-time work rose by 56,800.

The manufacturing sector cut 16,500 jobs in March, while natural resources added 6,300 jobs.

The services sector added 45,300 jobs, while the construction sector shed 12,100 jobs.

Self-employment declined by 17,000.

The labour participation rate rose to 65.9% in March from 65.8 in February.

The Bank of Canada monitors closely the labour participation rate.

-

14:55

International Monetary Fund Managing Director Christine Lagarde: the IMF expects a stronger growth in the U.S. and U.K.

The International Monetary Fund (IMF) Managing Director Christine Lagarde said on Thursday that low interest rates are fuelling asset bubbles around the world.

She also noted that the IMF expects a stronger growth in the U.S. and U.K. and improving outlook for the Eurozone. The IMF expects a weaker growth outlook for China, Brazil and Russia, Lagarde said.

-

14:30

Canada: Employment , March 28.7K (forecast 0.1)

-

14:30

Canada: Unemployment rate, March 6.8% (forecast 6.8%)

-

14:30

U.S.: Import Price Index, March -0.3% (forecast -0.4%)

-

14:14

Canada: Housing Starts, March 189.7K (forecast 175)

-

14:09

Foreign exchange market. European session: the euro declined against the U.S. dollar after weak French industrial production figures

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

03:30 Australia Home Loans February -1.7% Revised From -3.5% 3.1% +1.2%

03:30 China PPI y/y March -4.8% -4.7% -4.6%

03:30 China CPI y/y March 1.4% 1.3% 1.4%

04:00 China New Loans March 1020 1050

07:45 Switzerland Unemployment Rate (non s.a.) March 3.5% 3.5% 3.4%

08:45 France Industrial Production, m/m February 0.3% Revised From 0.4% -0.1% 0.0%

08:45 France Industrial Production, y/y February 0.6% 0.3%

10:30 United Kingdom Industrial Production (MoM) February -0.1% 0.3% 0.1%

10:30 United Kingdom Industrial Production (YoY) February 1.2% Revised From 1.3% 0.3% 0.1%

10:30 United Kingdom Manufacturing Production (MoM) February -0.6% Revised From -0.5% 0.4% 0.4%

10:30 United Kingdom Manufacturing Production (YoY) February 1.7% Revised From 1.9% 1.3% 1.1%

The U.S. dollar traded mixed to higher against the most major currencies ahead of the U.S. import price index. The index is expected to decline 0.4% in March, after a 0.4% gain in February.

The greenback was supported by the speculation the Fed could start to hike its interest rate in June.

The euro declined against the U.S. dollar after weak French industrial production figures. Industrial production in France was flat in February, beating expectations for a 0.1% decline, after a 0.3% rise in January. January's figure was revised down from a 0.4% increase.

On a yearly basis, the French industrial production rose 0.3% in February, after a 0.6% gain in January.

Concerns over Greece's debt problems continue to weigh on the euro. Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros on Thursday.

The British pound dropped against the U.S. dollar after the mostly weaker-than-expected U.K. manufacturing production data. Manufacturing production in the U.K. rose 0.4% in February, in line with expectations, after a 0.6% decline in January. January's figure was revised down from a 0.5% decrease.

On a yearly basis, manufacturing production in the U.K. increased 1.1% in February, missing expectations for a 1.3% gain, after a 1.7% rise in January. January's figure was revised down from a 1.9% gain.

Industrial production in the U.K. climbed 0.1% in February, missing forecasts of a 0.3% rise, after a 0.1% decline in January.

On a yearly basis, industrial production in the U.K. gained 0.1% in February, missing expectations for a 0.3% rise, after a 1.2% increase in January. January's figure was revised down from a 1.3% rise.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian labour market data. The unemployment rate in Canada is expected to remain unchanged at 6.8% in March.

Canada's economy is expected to add 100 jobs in March.

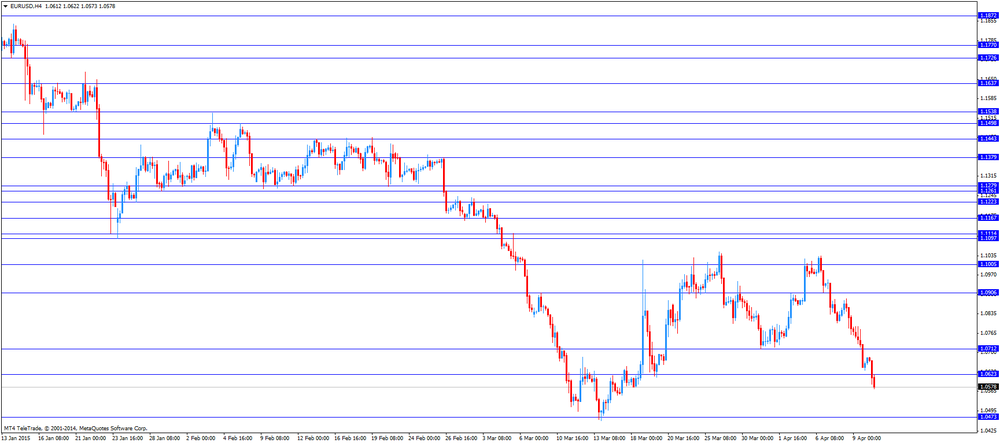

EUR/USD: the currency pair fell to $1.0573

GBP/USD: the currency pair decreased to $1.4590

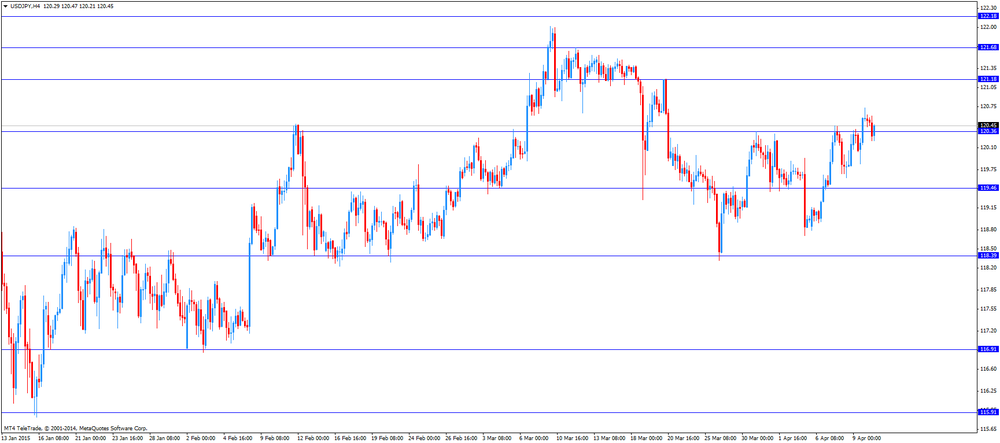

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

14:30 Canada Employment March -1.0 0.1

14:30 Canada Unemployment rate March 6.8% 6.8%

14:30 U.S. FOMC Member Laсker Speaks

14:30 U.S. Import Price Index March 0.4% -0.4%

16:00 United Kingdom NIESR GDP Estimate March 0.6%

-

13:50

Orders

EUR/USD

Offers 1.0750 1.0720/30 1.0700 1.0650

Bids 1.0555/50 1.0500 1.0450

GBP/USD

Offers 1.4800 1.4750 1.4700

Bids 1.4620 1.4600 1.4550 1.4510/05 1.4500

EUR/JPY

Offers 129.20 129.00 128.50 128.00/20

Bids 127.00 126.50

USD/JPY

Offers 122.00 121.50 121.00

Bids 120.10/00 119.50

EUR/GBP

Offers 0.7290/00

Bids 0.7210/00 0.7150 0.7080/75

AUD/USD

Offers 0.7850 0.7780/00 0.7750

Bids 0.7650 0.7610/00 0.7550

-

13:25

U.S. Treasury Department criticised Europe and Japan for its reliance on monetary policy to spur the economy

The Obama administration criticised Europe and Japan for its reliance on monetary policy to spur the economy. The administration added that it worried that a failure to implement other policy tools could further undermine a global economic outlook.

"The global economy should not again rely on the U.S. to be the only engine of demand," the administration said.

"Not only has global growth failed to accelerate, but there is worry that the composition of global output is increasingly unbalanced," the administration added.

The U.S. Treasury Department also criticised China and South Korea for its currency policies that hurt other trading partners including the U.S. China's currency remains "significantly undervalued," the Treasury Department said.

-

11:20

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0600(E300mn), $1.0700(E729mn), $1.0750(E339mn), $1.0800, $1.0950(E591mn)

USD/JPY: Y118.80($500mn), Y119.00/15($584mn), Y119.50($1.0bn), Y120.00($383mn), Y121.00($1.1bn)

EUR/JPY: Y132.00(E1.4bn)

GBP/USD: $1.4650(Gbp341mn)

AUD/USD: $0.7700(A$1.3bn)

USD/CAD: Cad1.2500($665mn), Cad1.2570($1.3bn), Cad1.2600($4.1bn)

NZD/USD: $0.7400(NZ$337mn), $0.7750(NZ$882mn)

-

11:20

U.K.’s Industrial Production below forecasts, Manufacturing Production in line

Today the Office for National Statistics reported U.K.'s Industrial and Manufacturing Production data for the month of March.

Industrial Production only rose +0.1%, below the estimated increase of +0.3%. The output was dragged down by a strong decline in energy. In February Industrial Production declined -0.1%.

Manufacturing Production rose +0.4%, in line with expectations from -0.5% in the preceding month. The best performing sectors out of the 13 were transport equipment, machinery and metals. Seven sectors posted gains.

-

10:40

Chinese inflation steady in March at 1.4% - PPI fell less than predicted

Early in the day Chinese CPI and PPI data for the month of March was reported. Year on year the PPI declined by -4.6%, slightly less than the predicted -4.7% and less than the previous reading of -4.8%. PPI has been negative for the last three years - a sign of pressure on profit margins of Chinese companies.

The consumer price inflation in March remained unchanged with a reading of +1.4%. Analyst expected a CPI reading of 1.3%. As consumer Inflation is still far below the targeted 3% for 2015 fuelling concerns over a deflation in the world's second largest economy. So far the impact of the measures taken by the People's Bank of China is very limited and suggests that further steps will have to be taken by the PBoC.

-

10:30

United Kingdom: Industrial Production (MoM), March 0.1% (forecast 0.3%)

-

10:30

United Kingdom: Industrial Production (YoY), March 0.1% (forecast 0.3%)

-

10:30

United Kingdom: Manufacturing Production (YoY), March 0.4% (forecast 1.3%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , March 0.4% (forecast 0.4%)

-

10:20

Press Review: BOJ's Nakaso warns market against betting on more easing

BLOOMBERG

We Traveled Across China and Returned Terrified for the Economy

China's steel and metals markets, a barometer of the world's second-biggest economy, are "a lot worse than you think," according to a Bloomberg Intelligence analyst who just completed a tour of the country.

What he saw: idle cranes, empty construction sites and half-finished, abandoned buildings in several cities. Conversations with executives reinforced the "gloomy" outlook.

"China's metals demand is plummeting," wrote Kenneth Hoffman, the metals analyst who spent a week traveling across the country, meeting with executives, traders, industry groups and analysts. "Demand is rapidly deteriorating as the government slows its infrastructure building and transforms into a consumer economy."

REUTERS

Exclusive - BOJ's Nakaso warns market against betting on more easing

(Reuters) - Bank of Japan Deputy Governor Hiroshi Nakaso has tempered market expectations that the bank will expand its stimulus program later this month, saying a cut in its inflation forecast would not be enough to justify more monetary easing.

Nakaso, one of Governor Haruhiko Kuroda's two deputies, said that while slumping oil costs have pushed inflation back to zero, rising wages and a steady economic recovery will underpin a long-term rise in prices.

"What's important is the underlying trend of inflation dynamics, which are steadily improving," Nakaso told Reuters in an interview on Thursday, his first with non-Japanese media in nearly a year.

Source: http://www.reuters.com/article/2015/04/10/us-japan-economy-boj-idUSKBN0N10KX20150410

BLOOMBERG

Putin's Surprising New Ruble Problem Threatens Russian Coffers

Vladimir Putin is facing a problem few could have anticipated: The ruble is becoming too strong.

Last year's worst-performing major currency is this year's best and while that's buoying the nation's bonds, driving yields to the lowest in four months, it's also crimping Russia's export revenue. Even though oil is little changed in dollars this year, the price when converted to rubles has plunged to the lowest since 2011.

The currency rout in 2014 helped Russia to keep its budget deficit within 1 percent of gross domestic product as the ruble weakened in lockstep with a 50 percent slump in oil. Now, with the cease-fire in Ukraine and the allure of higher-yielding assets attracting investors to ruble debt, the government is seeing the opposite effect.

-

09:01

France: Industrial Production, y/y, February 0.3%

-

08:46

France: Industrial Production, m/m, February 0.0% (forecast -0.1%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly lower against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans February -1.7% 3.1 1.2%%

01:30 China PPI y/y March -4.8% -4.7% -4.6%

01:30 China CPI y/y March 1.4% 1.3% 1.4%

02:00 China New Loans March 1020 1050

05:45 Switzerland Unemployment Rate March 3.2% 3.2% 3.4%

The U.S. dollar is trading broadly lower against its major peers. Yesterday's data showed that the number of initial jobless claims in the week ending April 04 in the U.S. rose by 14,000 to 281,000 from 267,000 in the previous week. The previous week's figure was revised up from 268,000. Analysts had expected the number of initial jobless claims to increase to 271,000.Wholesale inventories in the U.S. rose 0.3% in February, missing expectations for a 0.1% gain, after a 0.4% increase in January. January's figure was revised down from a 0.3% rise.

The Australian dollar added small gains against the U.S. dollar - entering the fourth straight day of gains. Data on Home Loans came in at +1.2%, below the estimated growth of +3.1%. The January reading was revised up from -3.5% to -1.7%.

Early in the day Chinese CPI and PPI data for the month of March was reported. Year on year the PPI declined by -4.6%, slightly less than the predicted -4.7% and less than the previous reading of -4.8%. The consumer price inflation in March remained unchanged with a reading of +1.4%. Analyst expected a CPI reading of 1.3%.

New Zealand's dollar booked gains against the greenback during the Asian in the absence of any major economic news.

The Japanese yen traded moderately higher against the greenback in Asian trade.

EUR/USD: the euro traded slightly higher against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling booked losses against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Industrial Production, m/m February 0.4% -0.1%

06:45 France Industrial Production, y/y February 0.6%

08:30 United Kingdom Industrial Production (MoM) March -0.1% 0.3%

08:30 United Kingdom Industrial Production (YoY) March 1.3% 0.3%

08:30 United Kingdom Manufacturing Production (MoM) March -0.5% 0.4%

08:30 United Kingdom Manufacturing Production (YoY) March 1.9% 1.3%

12:15 Canada Housing Starts March 156 175

12:30 Canada Employment March -1.0 0.1

12:30 Canada Unemployment rate March 6.8% 6.8%

12:30 U.S. FOMC Member Laсker Speaks

12:30 U.S. Import Price Index March 0.4% -0.4%

14:00 United Kingdom NIESR GDP Estimate March 0.6%

18:00 U.S. Federal budget March -192.3 -43.2

-

08:20

Options levels on friday, April 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0910 (3372)

$1.0844 (1237)

$1.0769 (1123)

Price at time of writing this review: $1.0661

Support levels (open interest**, contracts):

$1.0601 (1789)

$1.0573 (2803)

$1.0532 (4046)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 47319 contracts, with the maximum number of contracts with strike price $1,1200 (5992);

- Overall open interest on the PUT options with the expiration date May, 8 is 60828 contracts, with the maximum number of contracts with strike price $1,0000 (7357);

- The ratio of PUT/CALL was 1.29 versus 1.34 from the previous trading day according to data from April, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5009 (2090)

$1.4912 (675)

$1.4816 (1034)

Price at time of writing this review: $1.4694

Support levels (open interest**, contracts):

$1.4582 (580)

$1.4486 (1189)

$1.4389 (1469)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 19540 contracts, with the maximum number of contracts with strike price $1,5000 (2090);

- Overall open interest on the PUT options with the expiration date May, 8 is 26996 contracts, with the maximum number of contracts with strike price $1,4700 (2806);

- The ratio of PUT/CALL was 1.38 versus 1.46 from the previous trading day according to data from April, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:45

Switzerland: Unemployment Rate, March 3.4% (forecast 3.2%)

-

03:33

China: PPI y/y, March -4.6% (forecast -4.7%)

-

03:32

Australia: Home Loans , February +1.2% (forecast 3.1%)

-

03:30

China: CPI y/y, March 1.4% (forecast 1.3%)

-

00:28

Currencies. Daily history for Apr 9’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0661 -1,13%

GBP/USD $1,4706 -1,11%

USD/CHF Chf0,9772 +1,13%

USD/JPY Y120,57 +0,34%

EUR/JPY Y128,55 -0,77%

GBP/JPY Y177,3 -0,77%

AUD/USD $0,7694 +0,12%

NZD/USD $0,7560 +0,15%

USD/CAD C$1,2582 +0,34%

-