Noticias del mercado

-

23:58

Schedule for today, Friday, Apr 10’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans February -3.5% 3.1%

01:30 China PPI y/y March -4.8% -4.7%

01:30 China CPI y/y March 1.4% 1.3%

02:00 China New Loans March 1020 1050

05:45 Switzerland Unemployment Rate March 3.2% 3.2%

06:45 France Industrial Production, m/m February 0.4% -0.1%

06:45 France Industrial Production, y/y February 0.6%

08:30 United Kingdom Industrial Production (MoM) March -0.1% 0.3%

08:30 United Kingdom Industrial Production (YoY) March 1.3% 0.3%

08:30 United Kingdom Manufacturing Production (MoM) March -0.5% 0.4%

08:30 United Kingdom Manufacturing Production (YoY) March 1.9% 1.3%

12:15 Canada Housing Starts March 156 175

12:30 Canada Employment March -1.0 0.1

12:30 Canada Unemployment rate March 6.8% 6.8%

12:30 U.S. FOMC Member Laсker Speaks

12:30 U.S. Import Price Index March 0.4% -0.4%

14:00 United Kingdom NIESR GDP Estimate March 0.6%

18:00 U.S. Federal budget March -192.3 -43.2

-

18:07

Bank of Japan’ monthly economic report: the economy recovered moderately

The Bank of Japan (BoJ) released its monthly economic report on Wednesday. The BoJ said that the economy recovered moderately. Exports are expected to rise due to the recovery in overseas economies.

"Private consumption is expected to remain resilient," the central bank said.

The BoJ expects the consumer price inflation to be about 0% year-on-year.

-

17:35

Foreign exchange market. American session: the U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims from the U.S.

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims from the U.S. The number of initial jobless claims in the week ending April 04 in the U.S. rose by 14,000 to 281,000 from 267,000 in the previous week. The previous week's figure was revised up from 268,000. Analysts had expected the number of initial jobless claims to increase to 271,000.

Wholesale inventories in the U.S. rose 0.3% in February, missing expectations for a 0.1% gain, after a 0.4% increase in January. January's figure was revised down from a 0.3% rise.

The increase was driven by lower wholesale sales.

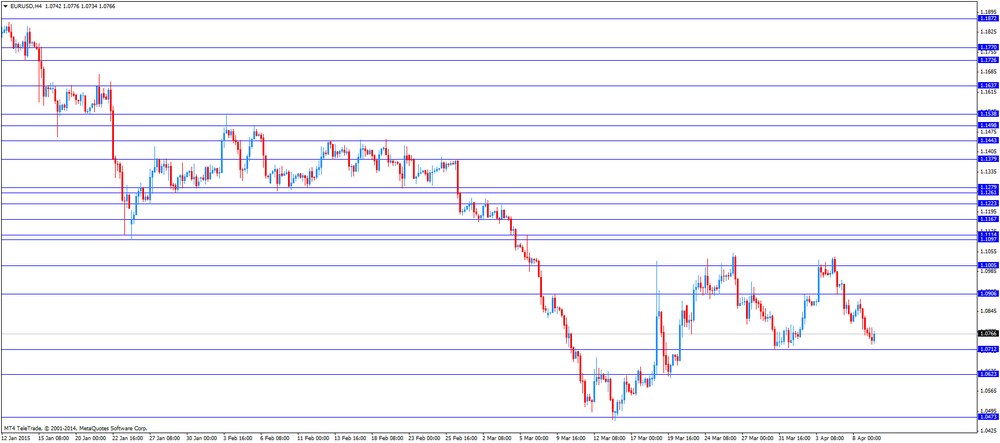

The euro declined against the U.S. dollar. German industrial production increased 0.2% in February, exceeding expectations for a 0.1% rise, after a 0.4% decline in January. January's figure was revised down from a 0.6% increase.

Concerns over Greece's debt problems continue to weigh on the euro. Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros today.

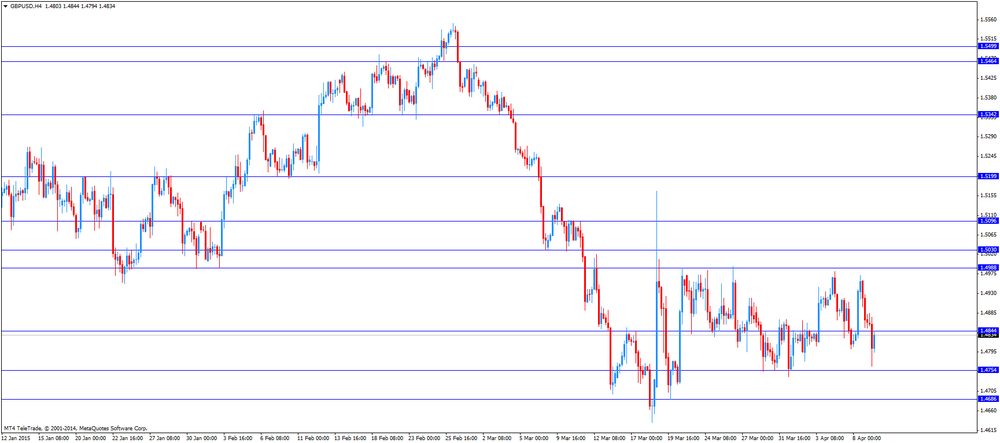

The British pound traded lower against the U.S. dollar. The Bank of England kept its monetary policy unchanged today.

The U.K. trade deficit in goods widened to £10.3 billion in February from £9.2 billion in January, missing expectations for a deficit of £9.1 billion. January's figure was revised down from a deficit of £8.4 billion.

The increase of the deficit was driven by a decline in exports of goods to countries outside the European Union.

The U.K. Halifax house price index climbed 0.4% in March, after a 0.4% decline in February. February's figure was revised down from a 0.3% decrease.

The Canadian dollar traded lower against the U.S. dollar after the mixed Canadian housing market data. Building permits in Canada declined 0.9% in February, missing expectations for a 5.1% gain, after a 12.3% drop in January. January's figure was revised up from a 12.9% fall.

New housing price index in Canada rose 0.2% in February, exceeding expectations for a 0.1% gain, after a 0.1% decrease in January.

The increase was driven by gains in the Toronto and Oshawa region where prices rose 0.3% as some builders offered promotional packages.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded mixed against the greenback. The Australian Industry Group's construction index supported the Aussie. The index rose to 50.1 in March from 43.9 in February.

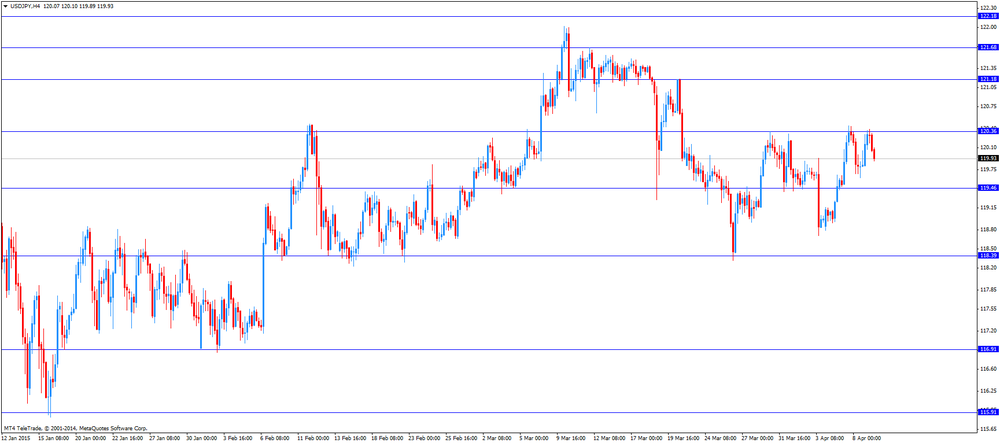

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback. Japan's preliminary machine tool orders dropped to 14.6% in March from 28.9% in February.

The Bank of Japan (BoJ) released its monthly economic report on Wednesday. The BoJ said that the economy recovered moderately. Exports are expected to rise due to the recovery in overseas economies.

-

17:17

OECD expects the economic growth to strengthen in the Eurozone

The Organization for Economic Cooperation and Development released its monthly growth outlook on Thursday. The composite leading indicator remained unchanged at 100.3 in February.

The OECD said that growth momentum will be stable in the United States, the United Kingdom and Japan.

Growth momentum is expected to ease in China, Canada, Russia and Brazil.

In the Eurozone, growth momentum is expected to strengthen.

-

17:08

Bank of France upgrades its first quarter growth forecast for the French economy

The Bank of France Thursday upgraded its first quarter growth forecast for the French economy to 0.4% due to the growth in industrial production and stronger foreign demand.

The central bank had cut its forecast to 0.3% in March, down from a previous estimate of 0.4%.

The French economy grew 0.1% in the fourth quarter.

The European Commission forecast that the French economy will increase by 1% in 2015 and by 1.8% in 2014.

The French economy expanded 0.4% in 2014.

The French government has also estimated 1% growth for 2015.

-

16:57

U.K. Halifax house price index climbs 0.4% in March

The Halifax releases its house price index data for the U.K. on Thursday. The U.K. Halifax house price index climbed 0.4% in March, after a 0.4% decline in February. February's figure was revised down from a 0.3% decrease.

The increase was driven by wages growth and low mortgage rates.

On y yearly basis, U.K. Halifax house price index rose 8.1% in March, after a 8.3% increase in February.

"The recent return to real earnings growth for the first time in several years, very low mortgage rates and last December's stamp duty changes are supporting housing demand," the Halifax economist Martin Ellis said.

He added that the rising level of prices in relation to earnings should curb price growth and activity.

-

16:44

Wholesale inventories in the U.S. rises 0.3% in February

The U.S. Commerce Department released wholesale inventories on Thursday. Wholesale inventories in the U.S. rose 0.3% in February, missing expectations for a 0.1% gain, after a 0.4% increase in January. January's figure was revised down from a 0.3% rise.

The increase was driven by lower wholesale sales. Wholesale sales declined by 0.2% in February, driven by a 2.4% fall in sales of durable goods.

Inventories of durable goods increased 0.3% in February, while inventories of non-durable goods climbed by 0.2%.

-

16:15

Canada’s new housing price index climbs 0.2% in February

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.2% in February, exceeding expectations for a 0.1% gain, after a 0.1% decrease in January.

The increase was driven by gains in the Toronto and Oshawa region where prices rose 0.3% as some builders offered promotional packages.

Prices were unchanged in nine of the 21 metropolitan areas.

On a yearly basis, new housing price index in Canada climbed 1.4% in February, after a 1.4% increase in January.

-

16:00

U.S.: Wholesale Inventories, February 0.3% (forecast 0.1%)

-

15:53

Building permits in Canada declines 0.9% in February

Statistics Canada released housing market data on Thursday. Building permits in Canada declined 0.9% in February, missing expectations for a 5.1% gain, after a 12.3% drop in January. January's figure was revised up from a 12.9% fall.

Building permits for non-residential construction plunged 5.4% in February, while permits in the residential sector rose 1.5%.

Lower non-residential permits were driven by weaker demand in central Canada and Alberta.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0750/55, $1.0760, $1.0800(E1.3bn), $1.0900, $1.0950(E2.75bn)

USD/JPY: Y119.00($1.0bn), Y120.00($545mn), Y121.00($1.4bn)

GBP/USD: $1.4750(Gbp826mn), $1.4955, $1.4970(Gbp450mn)

AUD/USD: $0.7705(A$295mn), $0.7745(A$310mn)

USD/CAD: Cad1.2375($360mn)

NZD/USD: $0.7495(NZ$404mn)

-

15:24

U.K. trade deficit in goods widened to £10.3 billion in February

The U.K. Office for National Statistics (ONS) released trade data on Thursday. The U.K. trade deficit in goods widened to £10.3 billion in February from £9.2 billion in January, missing expectations for a deficit of £9.1 billion. It was the lowest level since July 2014.

January's figure was revised down from a deficit of £8.4 billion.

The increase of the deficit was driven by a decline in exports of goods to countries outside the European Union. The value of exports decreased to the lowest level since September 2010.

Exports fell by 3.7% in February, while imports rose by 0.8%.

Shipments to the EU decreased 0.3%, while exports to non-EU countries dropped by 6.6%.

The total trade deficit, including services, widened to £2.86 billion in February from £1.54 billion in January.

-

14:45

Bank of England keeps its interest rate on hold at 0.5% in April

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Low inflation weighed on the BoE's interest rate decision. The U.K. consumer price index declined to zero in February from 0.3% in January. It was the lowest level since 1989.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

Investors are awaiting the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on April 22.

All members voted in March to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

-

14:31

Canada: New Housing Price Index, YoY, February 1.4%

-

14:30

Canada: New Housing Price Index, MoM, February 0.2% (forecast 0.1%)

-

14:30

U.S.: Initial Jobless Claims, April 281K (forecast 271)

-

14:30

U.S.: Continuing Jobless Claims, April 2304K

-

14:30

Canada: Building Permits (MoM) , February -0.9% (forecast 5.1%)

-

14:08

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar after the better-than-expected German industrial production figures

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) February -0.4% Revised From 0.6% 0.1% 0.2%

06:00 Germany Industrial Production (YoY) February 0.9% -0.3%

06:00 Japan Prelim Machine Tool Orders, y/y March 28.9% 14.6%

07:00 United Kingdom Halifax house price index March -0.4% 0.4%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3% 8.1%

08:30 United Kingdom Total Trade Balance February -1.53 Revised From -0.62 -2.85

08:30 United Kingdom Trade in goods February -9.2 Revised From -8.4 -9.1 -10.3

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375 375

11:00 United Kingdom MPC Rate Statement

The U.S. dollar traded mixed against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to rise by 3,000 to 271,000.

The euro traded mixed against the U.S. dollar after the better-than-expected German industrial production figures. German industrial production increased 0.2% in February, exceeding expectations for a 0.1% rise, after a 0.4% decline in January. January's figure was revised down from a 0.6% increase.

Concerns over Greece's debt problems continue to weigh on the euro. Greece repaid the International Monetary Fund (IMF) tranche of 448 million euros today.

The British pound traded lower against the U.S. dollar. The Bank of England kept its monetary policy unchanged today.

The U.K. trade deficit in goods widened to £10.3 billion in February from £9.2 billion in January, missing expectations for a deficit of £9.1 billion. January's figure was revised down from a deficit of £8.4 billion.

The increase of the deficit was driven by a decline in exports of goods to countries outside the European Union.

The U.K. Halifax house price index climbed 0.4% in March, after a 0.4% decline in February. February's figure was revised down from a 0.3% decrease.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian housing market data. Building permits in Canada are expected to climb 5.1% in February, after a 12.9% drop in January.

Canada's new housing price index is expected to rise 0.1% in February, after a 0.1% decline in January.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair decreased to $1.4763

USD/JPY: the currency pair fell to Y119.89

The most important news that are expected (GMT0):

12:30 Canada Building Permits (MoM) February -12.9% 5.1%

12:30 Canada New Housing Price Index, MoM February -0.1% 0.1%

12:30 Canada New Housing Price Index, YoY March 1.4%

12:30 U.S. Initial Jobless Claims April 268 271

-

13:50

Orders

EUR/USD

Offers 1.0850 1.0820 1.0800

Bids 1.0700 1.0650

GBP/USD

Offers 1.4950 1.4900 1.4850

Bids 1.4750 1.4725/20 1.4720/00 1.4685/80

EUR/JPY

Offers 130.50 130.00 129.25/30

Bids 128.50 128.00 127.50

USD/JPY

Offers 121.50 121.00 120.50

Bids 120.00 119.90 119.50

EUR/GBP

Offers 0.7290/00

Bids 0.7210/00 0.7150

AUD/USD

Offers 0.7850 0.7780/00 0.7750

Bids 0.7685/80 0.7650 0.7610/00 0.7550

-

13:37

FOMC’s March minutes: Fed officials were divided over when to start to hike interest rate

Federal Reserve released its March monetary policy meeting minutes on Wednesday. Fed officials were divided over when to start to hike interest rate. Some official said that it is better to raise interest rate in June, some officials would like to wait longer and some officials would prefer to wait until 2016.

The Fed dropped "patient" from its outlook for monetary policy at its March monetary policy meeting. Investors expected that the central bank may start to hike its interest rate in June. But the released economic data showed that the U.S. economy slowed in early 2015.

-

13:01

United Kingdom: Asset Purchase Facility, 375 (forecast 375)

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.50%)

-

11:12

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0750/55, $1.0760, $1.0800(E1.3bn), $1.0900, $1.0950(E2.75bn)

USD/JPY: Y119.00($1.0bn), Y120.00($545mn), Y121.00($1.4bn)

GBP/USD: $1.4750(Gbp826mn), $1.4955, $1.4970(Gbp450mn)

AUD/USD: $0.7705(A$295mn), $0.7745(A$310mn)

USD/CAD: Cad1.2375($360mn)

NZD/USD: $0.7495(NZ$404mn)

-

10:37

United Kingdom: Total Trade Balance, February -2.85

-

10:20

Press Review: Tsipras Returns to Reality After Meetings with Putin

BLOOMBERG

Tsipras Returns to Reality After Meetings with Putin

When his plane touches back down in Athens, Greek Prime Minister Alexis Tsipras will be quickly reacquainted with reality.

Talks with Russian President Vladimir Putin in Moscow on Wednesday focused on a proposed energy pipeline, future investments and sanctions over the conflict in Ukraine, a meeting that had been dismissed before it began by Germany and France as a sideshow. With a payment made to the International Monetary Fund on Thursday depleting Greek cash reserves still further, it's back to haggling with creditors in the euro region over a financial lifeline.

"There's been a big fuss over this trip without immediate economic benefits," said Dimitris Sotiropoulos, an associate professor of political science at the University of Athens. "Now he needs to do something quickly. There's an unbalanced negotiation now, where the Greek side is prepared on some issues and completely unprepared on others."

REUTERS

Fed officials say June rate hike still in play, hinges on data(Reuters) - The Federal Reserve could still hike interest rates in June despite weak recent U.S. data and investor skepticism, two influential officials with the central bank said on Wednesday, putting the spotlight squarely on the economy's performance in the next two months.

Disappointing U.S. jobs growth, manufacturing activity, and retail sales over the winter had pushed market expectations for a rate hike to later in the year. June has long been seen as the earliest the Fed could tighten policy, after more than six years of near-zero rates.

But New York Fed President William Dudley and Fed Governor Jerome Powell on Wednesday sketched out scenarios in which the central bank could make an initial move earlier than many now expect and then proceed in a slow and gradual manner on further rate increases.

Source: http://www.reuters.com/article/2015/04/09/us-usa-fed-idUSKBN0MZ1UK20150409

BLOOMBERG

For Yuan Short-Sellers, There's One Big Reason to Drop the Trade

There are plenty of things luring short-sellers to the Chinese yuan right now.

Growth is slowing. Capital is flowing out. And by some measures, the yuan is the most overvalued currency in the world.

Yet there's one big reason not to bet against it: the People's Bank of China is on the other side of the trade.

Chinese policy makers will do whatever it takes to ensure a stable exchange rate before the International Monetary Fund starts discussing the possibility of adding the yuan to the ranks of the world's reserve currencies in May, according to Barclays Plc and DBS Group Holdings. They've already been tapping their almost $4 trillion in foreign reserves to do this, spending an estimated $33 billion in the first quarter to halt a slump that had sent the yuan to a two-year low in March.

-

09:01

Germany: Industrial Production (YoY), February -0.3%

-

08:59

United Kingdom: Halifax house price index 3m Y/Y, March 8.1%

-

08:59

United Kingdom: Halifax house price index, March 0.4%

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded mixed against its major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) February 0.6% 0.1% 0.2%

06:00 Germany Industrial Production (YoY) February 0.9%

06:00 Japan Prelim Machine Tool Orders, y/y March 28.9% 14.6%

The U.S. dollar is trading mixed against its major peers after yesterday the minutes of the last FOMC meeting were published. The minutes show that the board is divided on whether to hike interest rates in June or not. As a consequence of the weaker-than-expected GDP growth and disappointing labour market data a potential interest rate hike might be delayed till September.

The Australian dollar added small gains against the U.S. dollar. The AiG Performance of Construction Index for March came in at 50.1 compared to a previous reading of 43.9 - back in expansion territory.

New Zealand's dollar booked gains against the greenback during the Asian in the absence of any major economic news.

The Japanese yen traded lower against the greenback in Asian trade. Prelim Machine Tool Orders rose year on year by +14.6% in March compared to a previous reading of 28.9%.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded higher against the yen

GPB/USD: Sterling booked losses against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 United Kingdom Halifax house price index March -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3%

08:30 United Kingdom Total Trade Balance February -0.62

08:30 United Kingdom Trade in goods February -8.4 -9.1

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

12:30 Canada Building Permits (MoM) February -12.9% 5.1%

12:30 Canada New Housing Price Index, MoM March -0.1% 0.1%

12:30 Canada New Housing Price Index, YoY March 1.4%

12:30 U.S. Continuing Jobless Claims April 2325

12:30 U.S. Initial Jobless Claims April 268 271

14:00 U.S. Wholesale Inventories February 0.3% 0.1%

-

08:14

Options levels on thursday, April 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.0965 (1333)

$1.0920 (1064)

$1.0871 (1115)

Price at time of writing this review: $1.0761

Support levels (open interest**, contracts):

$1.0716 (1783)

$1.0667 (3211)

$1.0607 (3978)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 45348 contracts, with the maximum number of contracts with strike price $1,1200 (6081);

- Overall open interest on the PUT options with the expiration date May, 8 is 60704 contracts, with the maximum number of contracts with strike price $1,0000 (7582);

- The ratio of PUT/CALL was 1.34 versus 1.38 from the previous trading day according to data from April, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5112 (1345)

$1.5016 (2113)

$1.4921 (684)

Price at time of writing this review: $1.4859

Support levels (open interest**, contracts):

$1.4781 (2415)

$1.4685 (2760)

$1.4588 (607)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 19442 contracts, with the maximum number of contracts with strike price $1,5000 (2113);

- Overall open interest on the PUT options with the expiration date May, 8 is 28346 contracts, with the maximum number of contracts with strike price $1,4700 (2760);

- The ratio of PUT/CALL was 1.46 versus 1.38 from the previous trading day according to data from April, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Industrial Production s.a. (MoM), February 0.2% (forecast 0.1%)

-

08:01

Japan: Prelim Machine Tool Orders, y/y , March 14.6

-

01:32

Australia: AiG Performance of Construction Index, March 50.1

-

00:29

Currencies. Daily history for Apr 8’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,0781 -0,28%

GBP/USD $1,4869 +0,38%

USD/CHF Chf0,9662 -0,01%

USD/JPY Y120,16 -0,12%

EUR/JPY Y129,54 -0,40%

GBP/JPY Y178,66 +0,26%

AUD/USD $0,7685 +0,62%

NZD/USD $0,7549 +0,69%

USD/CAD C$1,2539 +0,26%

-

00:01

Schedule for today, Thursday, Apr 9’2015:

(time / country / index / period / previous value / forecast)

02:00 China New Loans March 1020 1050

05:00 Japan BoJ monthly economic report

06:00 Germany Industrial Production s.a. (MoM) February 0.6% 0.1%

06:00 Germany Industrial Production (YoY) February 0.9%

06:00 Japan Prelim Machine Tool Orders, y/y March 28.9%

07:00 United Kingdom Halifax house price index March -0.3%

07:00 United Kingdom Halifax house price index 3m Y/Y March 8.3%

08:30 United Kingdom Total Trade Balance February -0.62

08:30 United Kingdom Trade in goods February -8.4 -9.1

11:00 United Kingdom BoE Interest Rate Decision 0.50% 0.50%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

12:30 Canada Building Permits (MoM) February -12.9% 5.1%

12:30 Canada New Housing Price Index, MoM March -0.1% 0.1%

12:30 Canada New Housing Price Index, YoY March 1.4%

12:30 U.S. Continuing Jobless Claims April 2325

12:30 U.S. Initial Jobless Claims April 268 271

14:00 U.S. Wholesale Inventories February 0.3% 0.1%

-