Noticias del mercado

-

23:59

Schedule for today, Tuesday, Aug 11’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence July 10

06:00 Japan Prelim Machine Tool Orders, y/y July 6.6%

09:00 Eurozone ZEW Economic Sentiment August 42.7

09:00 Germany ZEW Survey - Economic Sentiment August 29.7 32

12:15 Canada Housing Starts July 202.8

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.1% 1.6%

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II 6.7% 0.1%

14:00 U.S. Wholesale Inventories June 0.8% 0.4%

20:30 U.S. API Crude Oil Inventories August -2.4

23:50 Japan Monetary Policy Meeting Minutes

-

17:17

Greece hopes to reach a deal with its creditors "by Monday night or early Tuesday"

Reuters reported on Monday that Greece hopes to reach a deal with its creditors "by Monday night or early Tuesday", according a Greek government official.

"When the new bailout comes to parliament for a vote it will be one bill with two articles - one article will be the loan agreement and the MoU (memorandum of understanding) and the second article will be the prior actions," a Greek official said.

A third bailout programme needs to be approved by several EU member states.

-

17:04

Japan’s consumer confidence index declines to 40.3 in July

Japan's Cabinet Office released its consumer confidence index on Monday. The consumer confidence index declined to 40.3 in July from 41.7 in June. It was the lowest level in six months.

The decline was driven by falls in all sub-indexes. The overall livelihood sub-index fell to 38.1 in July from 39.4 in June, the income growth sub-index was down to 39.6 from 40.3, the employment sub-index dropped to 44.7 from 47.3, while the willingness to buy durable goods sub-index decreased to 38.8 from 39.9.

-

16:52

European Central Bank purchases €10.81 billion of government bonds last week

The European Central Bank (ECB) purchased €10.81 billion of government bonds under its quantitative-easing program last week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €2.64 billion of covered bonds, and €889 million of asset-backed securities.

-

16:02

U.S.: Labor Market Conditions Index, July 1.1

-

15:50

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E551mn), $1.0900(E546mn), $1.1000(E1.5bn)

USD/JPY: Y124.00($2.99bn), Y125.00($1.34bn), Y125.25($958mn)

EUR/JPY: Y136.00(E375mn)

GBP/USD: $1.5405(Gbp230), $1.5515(Gbp477mn)

EUR/GBP: Gbp0.7000(E405mn)

AUD/USD: $0.7200(A$1.7bn), $0.7400(A$459mn)

NZD/USD: $0.6590(NZ$400mn)

USD/CAD: C$1.3100/15($565mn)

-

15:40

OECD’s composite leading indicator remains unchanged at 100.0 in June

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Monday. The composite leading indicator remained unchanged at 100.0 in June.

It signalled stable growth in Germany, Japan and India.

The growth momentum firmed in the Eurozone.

The index for the U.S. and the U.K. pointed to an easing in growth momentum.

The index for Brazil and China showed signs of a loss in growth momentum.

-

15:13

Fed Vice Chairman Stanley Fischer: inflation in the U.S. is very low, but is temporary

Fed Vice Chairman Stanley Fischer said in an interview Monday on Bloomberg Television on Monday that inflation in the U.S. is very low, but is temporary. Fischer pointed out that inflation was low due to declines in oil prices and in raw materials.

The Fed vice chairman noted that the Fed's quantitative led to the improvement in the U.S. labour market.

Fischer also said that the Fed monitors economic developments abroad.

"Of course, what happens abroad affects us. If the rest of the works is slower, that's not good for the U.S. economy," he said.

-

14:38

Foreign exchange market. European session: the euro traded lower against the U.S. dollar after the release of the Sentix index from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

05:00 Japan BoJ monthly economic report

05:00 Japan Consumer Confidence July 41.7 40.3

08:00 Eurozone Sentix Investor Confidence July 18.5 18.4

11:15 U.S. FED Vice Chairman Stanley Fischer Speaks

The U.S. dollar traded mixed against the most major currencies after comments by the Fed Vice Chairman Stanley Fischer. He said on Monday that inflation in the U.S. is very low, but it is temporary. Fischer pointed out that inflation was low due to declines in oil prices and in raw materials.

The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 215,000 jobs in July, missing expectations for a rise of 223,000 jobs, after a gain of 231,000 jobs in June. June's figure was revised up from a rise of 223,000 jobs.

The U.S. unemployment rate remained unchanged at 5.3% in July, in line with expectations. It was the lowest level since April 2008.

Average hourly earnings rose 0.2% in July, in line with forecasts, after a flat reading in June.

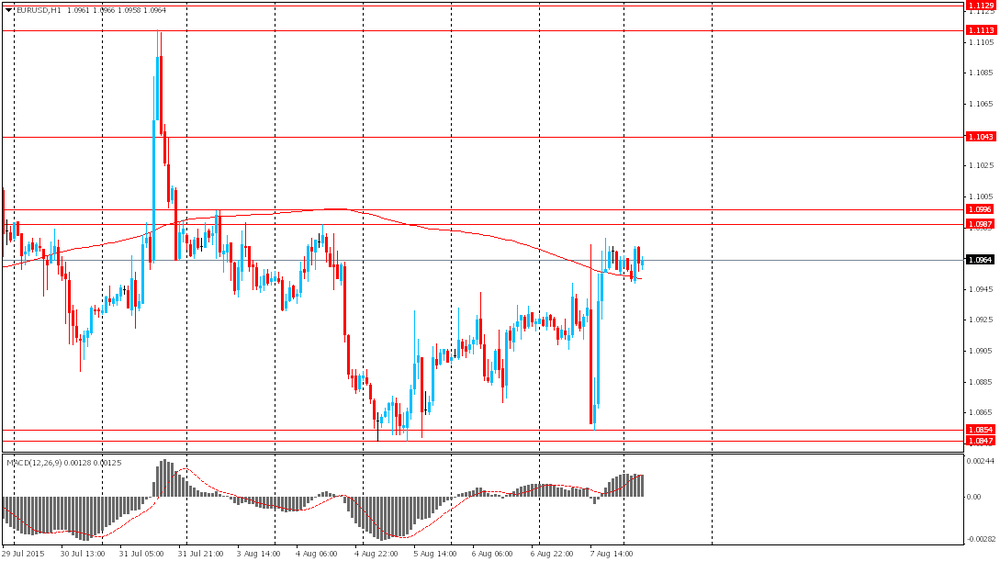

The euro traded lower against the U.S. dollar after the release of the Sentix index from the Eurozone. Sentix investor confidence index for the Eurozone fell to 18.4 in August from 18.5 in July.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Despite the global headwinds, the euro zone's economy appears to be in relatively good form. The euro zone has swallowed the turmoil surrounding Greece and a further collapse in economic momentum there relatively well," Manfred Huebner from Sentix said.

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.3% in the third quarter.

The second quarter's forecast was revised down to a 0.2% rise from a 0.3% gain.

The British pound traded mixed against the U.S. dollar in the absence of any major economic reports from the U.K.

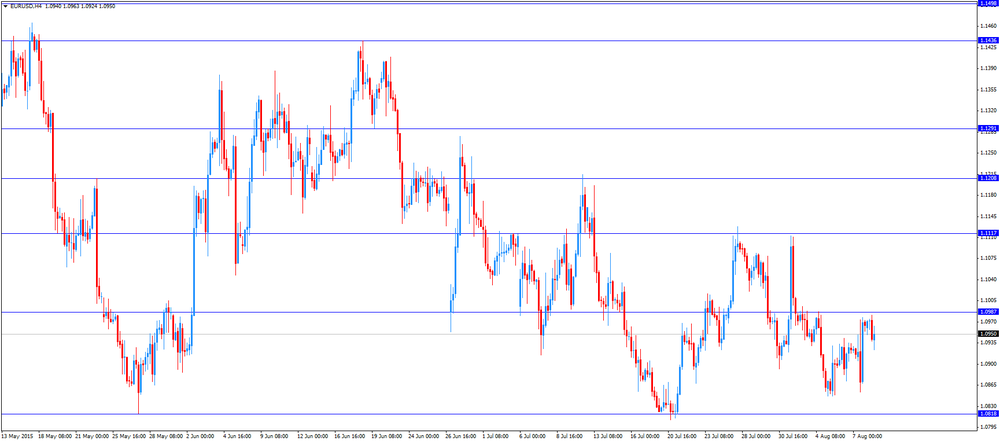

EUR/USD: the currency pair decreased to $1.0924

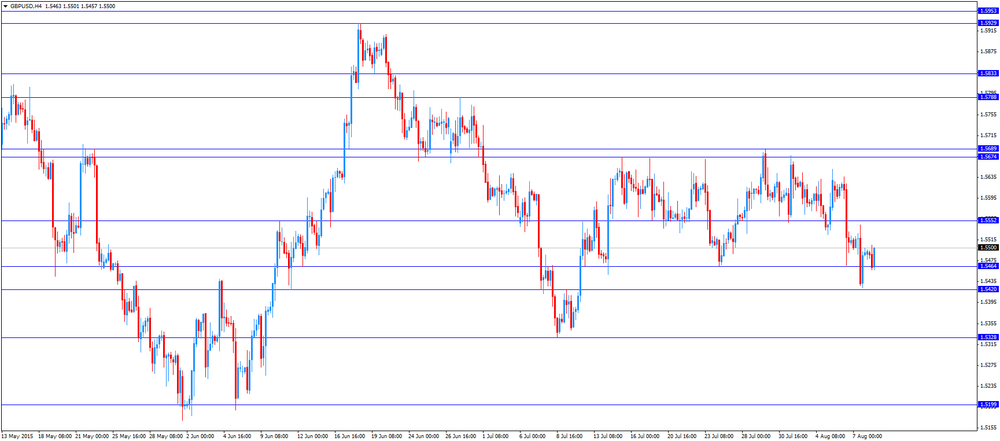

GBP/USD: the currency pair traded mixed

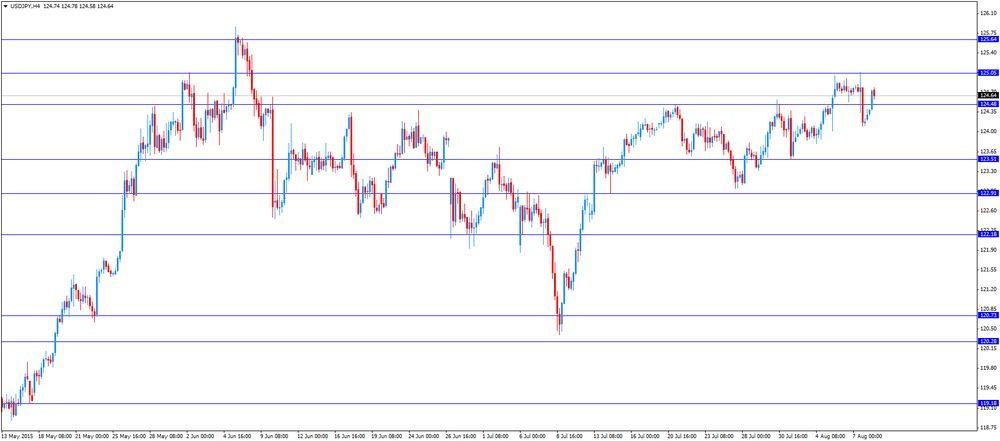

USD/JPY: the currency pair rose to Y124.78

The most important news that are expected (GMT0):

13:00 U.S. FOMC Member Dennis Lockhart Speaks

16:25 U.S. FOMC Member Dennis Lockhart Speaks

-

14:15

Greek industrial production rises 4.5% in June

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Monday. Greek industrial production climbed 4.5% in June, after a 1.6% drop in May.

On a yearly basis, industrial production in Greece plunged at an adjusted rate of 4.5% in June, after a 4.3% fall in May. It was the biggest decline since August 2014.

Production in the manufacturing sector fell at an annual rate of 3.6% in June, output in the mining and quarrying sector slid 4.9%, while electricity production plunged by 8.2%.

-

13:50

Orders

EUR/USD

Offers 1.0985 1.1000 1.1020 1.1050 1.1065 1.1080-85 1.1100 1.1125 1.1150

Bids 1.0950 1.0900 1.0880 1.0850 1.0820-25 1.0800 1.0780 1.0750

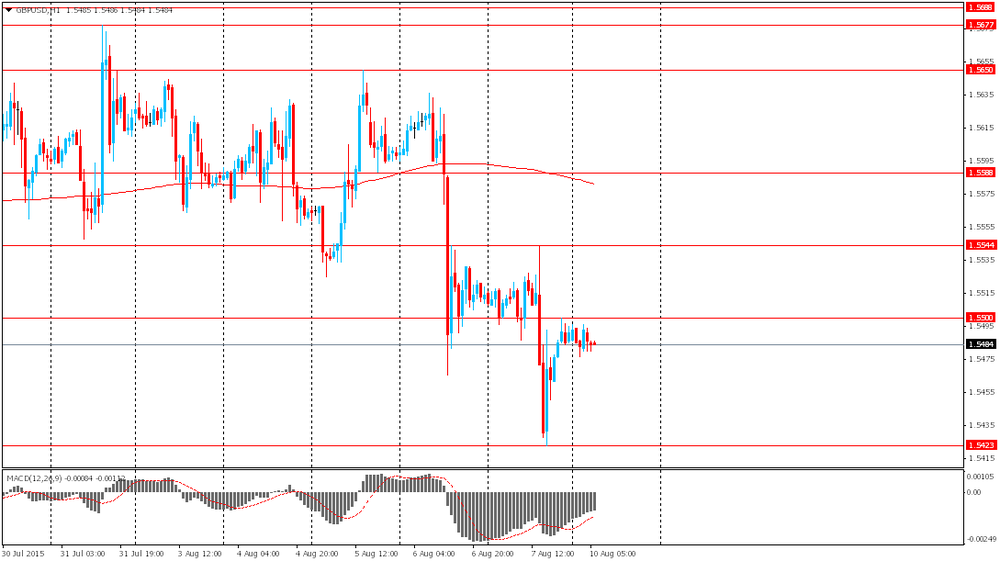

GBP/USD

Offers 1.5520-25 1.5550 1.5580-85 1.5600 1.5625 1.5650 1.5680 1.5700-10

Bids 1.5485 1.5465 1.5450 1.5425-30 1.5400 1.5385 1.5360 1.5330 1.5300

EUR/GBP

Offers 0.7100-05 0.7125 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7070 0.7050 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

EUR/JPY

Offers 136.80 137.00 137.30 137.50 137.75 138.00 138.50

Bids 136.20 136.00 135.80 135.60 135.20 135.00 134.85 134.50

USD/JPY

Offers 124.50 124.70 124.85 125.00 125.30 125.50 125.75 126.00 126.25 126.50

Bids 124.25 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7400-05 0.7425 0.7450 0.7475 0.7500

Bids 0.7380 0.7345-50 0.7320 0.7300 0.7280 0.7250 0.7230 0.7200

-

11:37

China's trade surplus declines to $43.03 billion in July

The Chinese Customs Office released its trade data on Saturday. China's trade surplus fell to $43.03 billion in July from $46.54 billion in June, missing expectations for a rise to a surplus of $53.25 billion.

Exports fell at an annual rate of 0.9% in July, while Imports slid at an annual rate of 14.6%, the ninth consecutive decline.

China's trade with the European Union declined by 7.6% year-on-year in the first seven months to 1.98 trillion yuan.

Trade with Japan plunged 11.1%, while trade with the US increased 2.7%.

-

11:24

Bank of France expects the country’s economy to expand at 0.3% in the third quarter

The Bank of France released its gross domestic product (GDP) forecasts for France on Monday. French economy is expected to expand at 0.3% in the third quarter.

The second quarter's forecast was revised down to a 0.2% rise from a 0.3% gain.

The manufacturing business confidence index remained unchanged at 98 in July.

The services business sentiment index remained unchanged at 96. But services companies expect a slight rise in activity in August.

The construction business sentiment index was up to 94 in July from 93 in June. Companies expect a decrease in activity in August.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0800(E551mn), $1.0900(E546mn), $1.1000(E1.5bn)

USD/JPY: Y124.00($2.99bn), Y125.00($1.34bn), Y125.25($958mn)

EUR/JPY: Y136.00(E375mn)

GBP/USD: $1.5405(Gbp230), $1.5515(Gbp477mn)

EUR/GBP: Gbp0.7000(E405mn)

AUD/USD: $0.7200(A$1.7bn), $0.7400(A$459mn)

NZD/USD: $0.6590(NZ$400mn)

USD/CAD: C$1.3100/15($565mn)

-

11:14

Sentix investor confidence index for the Eurozone is down to 18.4 in August

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index fell to 18.4 in August from 18.5 in July.

A reading above 0.0 indicates optimism, below indicates pessimism.

"Despite the global headwinds, the euro zone's economy appears to be in relatively good form. The euro zone has swallowed the turmoil surrounding Greece and a further collapse in economic momentum there relatively well," Manfred Huebner from Sentix said.

The current conditions index climbed to 15.3 in August, the highest level since July 2011.

The expectations index dropped to 21.5 in August from 22.3 in July.

German investor confidence index declined slightly.

-

10:59

People's Bank of China’s second-quarter monetary policy report: the exchange rate of the yuan should be kept at a reasonable level and should be more flexible

The People's Bank of China released its second-quarter monetary policy report on Friday. The central bank said that the country's economy is "still relatively reliant on policies intended to stabilize growth and on government-led investment".

According to the report, the monetary policy should be kept "appropriate", and the exchange rate of the yuan should be kept at a reasonable level and should be more flexible.

-

10:48

Swiss National Bank's foreign exchange reserves increase to 531. 8 billion Swiss francs in July

The Swiss National Bank's foreign exchange reserves increased to 531. 8 billion Swiss francs in July from 516. 0 billion francs in June.

The increase was partly driven by the appreciation of the euro. The SNB intervention could also be a reason.

The central bank has discontinued the 1.20 per euro exchange rate floor on January 15th.

The SNB President Thomas Jordan said on June 29 that the Greek debt crisis was the reason for the discontinuation of the cap.

-

10:34

Consumer credit in the U.S. climbs by $20.74 billion in June

The Fed released its consumer credits figures on Friday. Consumer credit in the U.S. rose by $20.74 billion in June, exceeding expectations for a $17.0 billion increase, after a $16.52 billion gain May.

May's figure was revised up from a $16.09 billion rise.

The increase was driven by gains in both revolving and non-revolving credit. Revolving credit climbed by $5.5 billion in June, while non-revolving credit jumped by $15.2 billion.

-

10:25

China's foreign exchange reserves fall by $42.5 billion in July

China's foreign exchange reserves declined by $42.5 billion to $3.65 trillion in July. It was the lowest level since August 2013. The reason for the decline in reserves could be an economic slowdown in China and concerns over the crisis in the stock market.

The People's Bank of China release its monthly data for the first time. It was used to release the quarterly data.

China's gold reserves to $59.2 billion in July from $62.4 billion in June.

-

10:18

Chinese consumer price index rises at annual rate of 1.6% in July

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Sunday. The Chinese consumer price index (CPI) rose at annual rate of 1.6% in July, exceeding expectations for a 1.5% increase, after a 1.4% gain in May.

The increase was driven by rises in food and non-food prices. Food prices rose at an annual rate of 2.7% in July, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation increased 0.3% in July, after a flat reading in June.

The Chinese producer price index (PPI) dropped 5.4% in July, missing forecasts of a 5.0% fall, after a 4.8% decline in June. It was the biggest decline since October 2009.

-

10:11

Japan’s current account surplus declines to ¥558.6 billion in June

Japan's Ministry of Finance released its current account data for Japan late Sunday evening. Japan's current account surplus dropped to ¥558.6 billion in June from ¥1,880.9 billion in May, missing expectations for a surplus of ¥738 billion.

Japan benefits from a weaker yen.

Japan's trade balance surplus was ¥102.6 billion in June, after a deficit of ¥47.3 billion in the previous month.

Exports rose at an annual rate of 5.6% in June, while imports dropped 4.6%.

-

08:18

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

05:00 Japan BoJ monthly economic report

05:00 Japan Consumer Confidence July 41.7 40.3

The euro little changed. Euro zone GDP report will be published this week. Data are likely to show that modest growth persisted. Median forecast suggests a 0.4% growth rate in the second quarter (just like in the first quarter). Meanwhile analysts also say that growth has probably slowed in France and Italy, which would underline uneven recovery in the single currency area, where Germany leads compared to other economies.

The yen weakened against the U.S. dollar after its Friday rally. Data showed that Japan Current account growth has persisted for 12 months and came in at ¥558.6 billion. The indicator has overcome its level seen before the 2011 catastrophe for the first time. This fact suggests substantial volumes of capital inflows from overseas.

The Australian dollar slightly declined against the greenback amid China data. China consumer price index came in at 1.6% y/y in July vs expectations for a 1.5% reading. Inflation growth has advanced compared to +1.4% in June, but it's well below the 3% threshold set by the government for this year. In 2014 the index posted 2%.

EUR/USD: the pair traded within $1.0950-75 in Asian trade

USD/JPY: the pair rose to Y124.40

GBP/USD: the pair traded within $1.5475-95

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 Eurozone Sentix Investor Confidence July 18.5

11:15 U.S. FED Vice Chairman Stanley Fischer Speaks

13:00 U.S. FOMC Member Dennis Lockhart Speaks

14:00 U.S. Labor Market Conditions Index July 0.8

16:25 U.S. FOMC Member Dennis Lockhart Speaks

-

07:16

Japan: Consumer Confidence, July 40.3

-

06:51

Options levels on monday, August 10, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1088 (1935)

$1.1049 (2442)

$1.1011 (332)

Price at time of writing this review: $1.0966

Support levels (open interest**, contracts):

$1.0920 (1652)

$1.0886 (2060)

$1.0864 (5484)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 70605 contracts, with the maximum number of contracts with strike price $1,1100 (4652);

- Overall open interest on the PUT options with the expiration date September, 4 is 107425 contracts, with the maximum number of contracts with strike price $1,0500 (7159);

- The ratio of PUT/CALL was 1.52 versus 1.16 from the previous trading day according to data from August, 7

GBP/USD

Resistance levels (open interest**, contracts)

$1.5802 (1839)

$1.5704 (1409)

$1.5607 (2024)

Price at time of writing this review: $1.5485

Support levels (open interest**, contracts):

$1.5392 (1551)

$1.5295 (2169)

$1.5197 (1585)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 23725 contracts, with the maximum number of contracts with strike price $1,5750 (2073);

- Overall open interest on the PUT options with the expiration date September, 4 is 30490 contracts, with the maximum number of contracts with strike price $1,5300 (2169);

- The ratio of PUT/CALL was 1.29 versus 1.02 from the previous trading day according to data from August, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:51

Japan: Current Account, bln, June 558.6 (forecast 738)

-

00:33

Currencies. Daily history for Aug 7’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,0964 +0,36%

GBP/USD $1,5491 -0,15%

USD/CHF Chf0,9838 +0,33%

USD/JPY Y124,18 -0,43%

EUR/JPY Y136,21 -0,01%

GBP/JPY Y192,45 -0,53%

AUD/USD $0,7416 +0,97%

NZD/USD $0,6622 +1,07%

USD/CAD C$1,3131 +0,17%

-

00:27

Schedule for today, Monday, Aug 10’2015:

(time / country / index / period / previous value / forecast)

05:00 Japan Eco Watchers Survey: Current July 51.0

05:00 Japan Eco Watchers Survey: Outlook July 53.5

05:00 Japan BoJ monthly economic report

05:00 Japan Consumer Confidence July 41.7

08:00 Eurozone Sentix Investor Confidence July 18.5

11:15 U.S. FED Vice Chairman Stanley Fischer Speaks

13:00 U.S. FOMC Member Dennis Lockhart Speaks

14:00 U.S. Labor Market Conditions Index July 0.8

16:25 U.S. FOMC Member Dennis Lockhart Speaks

-