Noticias del mercado

-

23:59

Schedule for today, Wednesday, Aug 12’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence August -3.2%

01:30 Australia Wage Price Index, y/y Quarter II 2.3% 2.3%

01:30 Australia Wage Price Index, q/q Quarter II 0.5% 0.6%

04:30 Japan Industrial Production (YoY) (Finally) June -3.9% 2.0%

04:30 Japan Industrial Production (MoM) (Finally) June -2.1% 0.8%

05:30 China Industrial Production y/y July 6.8% 6.6%

05:30 China Retail Sales y/y July 10.6% 10.6%

05:30 China Fixed Asset Investment June 11.4% 11.5%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.8% 2.8%

08:30 United Kingdom Average Earnings, 3m/y June 3.2% 2.8%

08:30 United Kingdom ILO Unemployment Rate June 5.6% 5.6%

08:30 United Kingdom Claimant count July 7 1.5

09:00 Eurozone Industrial production, (MoM) June -0.4% -0.2%

09:00 Eurozone Industrial Production (YoY) June 1.6% 1.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August -5.4

10:00 Australia RBA Assist Gov Lowe Speaks

11:00 U.S. MBA Mortgage Applications August 4.7%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. JOLTs Job Openings June 5.363 5.3

14:30 U.S. Crude Oil Inventories August -4.407

18:00 U.S. Federal budget July 51.8 -132

22:30 New Zealand Business NZ PMI July 55.2

23:50 Japan Core Machinery Orders June 0.6% -5.6%

23:50 Japan Core Machinery Orders, y/y June 19.3% 16.4%

-

16:50

European Commission confirms a deal on a third Greek bailout programme

The European Commission has confirmed that a deal on a third Greek bailout programme has been reached.

"We have achieved an agreement in principle on a technical basis and talks are still ongoing on details… What we don't have at the moment is a political agreement and that's what we need," the European Commission spokeswoman Annika Breidthardt said on Tuesday.

She also said that deputy finance ministers from the 28 EU countries will hold a telephone conference today.

-

16:24

Wholesale inventories in the U.S. rises 0.9% in June

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.9% in June, beating expectations for a 0.4% gain, after a 0.6% increase in May. May's figure was revised down from a 0.8% rise.

The increase was partly driven by a rise inventories of non-durable goods. Inventories of non-durable goods increased 2.3% in June, while inventories of durable goods gained 0.1%.

Wholesale sales climbed by 0.1% in June, after a 0.2% rise in May.

-

16:00

U.S.: Wholesale Inventories, June 0.9% (forecast 0.4%)

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E565mn), $1.1000(E678mn)

USD/JPY: Y125.00($215mn)

GBP/USD: $1.5500(Gbp217), $1.5525(Gbp168mn)

AUD/USD: $0.7300(A$1.2bn), $0.7435(A$150mn)

AUD/JPY: Y91.80(A$106mn)

NZD/USD: $0.6550(NZ$100mn), $6700(NZ$373mn)

USD/CAD: C$1.3000($125mn)

-

15:03

Productivity in the U.S. non-farm businesses rises 1.3% in the second quarter

The U.S. Labor Department released non-farm productivity figures on Tuesday. Preliminary productivity in the U.S. non-farm businesses rose at a 1.3% annual rate in the second quarter, missing expectations for a 1.6% increase, after a 1.1% drop in the first quarter. The first quarter's figure was revised up from a 3.1% fall.

The increase was driven by higher output, which rose 2.8%. Hours worked climbed by 1.5%.

Preliminary unit labour costs increased 0.5% in the second quarter, exceeding expectations for a 0.1% rise, after a 2.3 gain in the first quarter. The first quarter's figure was revised down from a 6.7% increase.

-

14:41

Housing starts in Canada declines to a seasonally adjusted annualized rate of 193,032 units in July

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Tuesday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 193,032 units in July from a revised reading of 202,338 units in June. June's figure was revised down from 202,818 units.

The decrease was driven by a decline in single starts.

"The decline in single starts is in line with CMHC's expectations of buyers shifting demand away from higher priced new single-detached homes towards lower-priced alternatives. Gains in multiple starts are largely due to higher rental apartment starts, a substantial portion of which are seniors' residences," the CMHC's Chief Economist Bob Dugan said.

-

14:31

U.S.: Nonfarm Productivity, q/q, Quarter II 1.3% (forecast 1.6%)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter II 1.3% (forecast 0.1%)

-

14:15

Canada: Housing Starts, July 193 (forecast 195)

-

14:12

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on news that Athens reached a deal with its lenders

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence July 8 Revised From 10 4

06:00 Japan Prelim Machine Tool Orders, y/y July 6.6% 1.6%

09:00 Eurozone ZEW Economic Sentiment August 42.7 47.6

09:00 Germany ZEW Survey - Economic Sentiment August 29.7 32 25

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Preliminary productivity in the U.S. non-farm businesses is expected to rise at a 1.6% annual rate in the second quarter, after a 3.1% drop in the first quarter.

Preliminary unit labour costs are expected to increase 0.1% in the second quarter, after a 6.7 gain in the first quarter.

Wholesale inventories in the U.S. are expected to rise 0.4% in June, after a 0.8% gain in May.

The greenback remained supported by the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

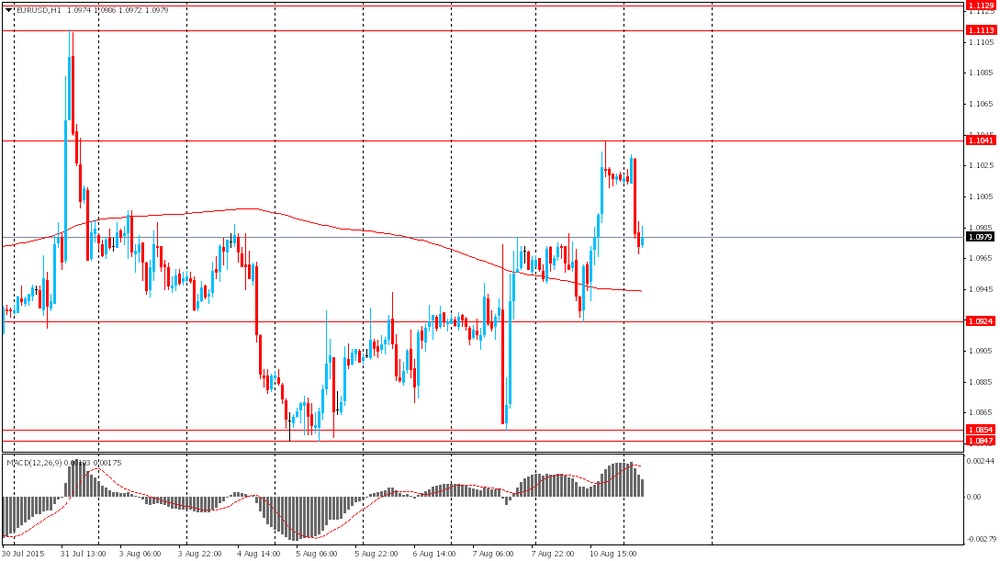

The euro traded higher against the U.S. dollar on news that Athens reached a deal. The Greek government said on Tuesday that it reached a deal on the third bailout programme with its international lenders.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index declined to 25.0 in August from 29.7 in July, missing expectations for a rise to 32.0.

"The German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 47.6 in August from 42.7 in July.

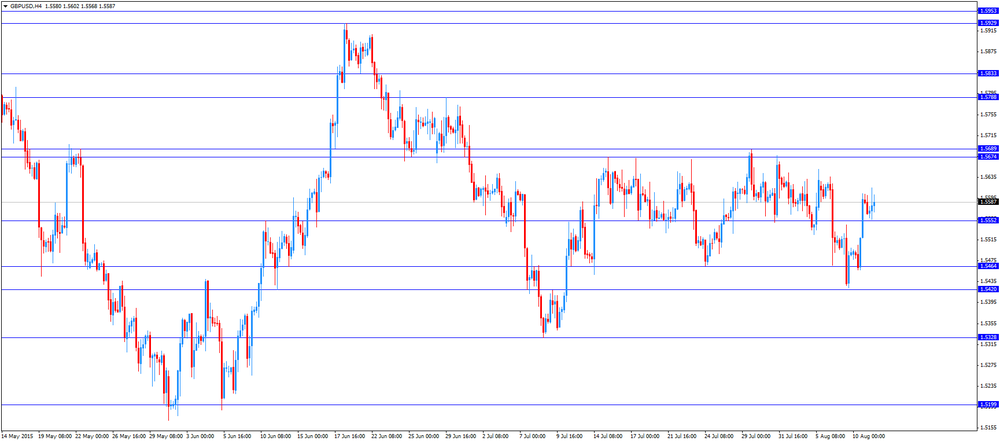

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release Canadian housing starts data. Housing starts in Canada are expected to decline to 195,000 units July from 202,800 units in June.

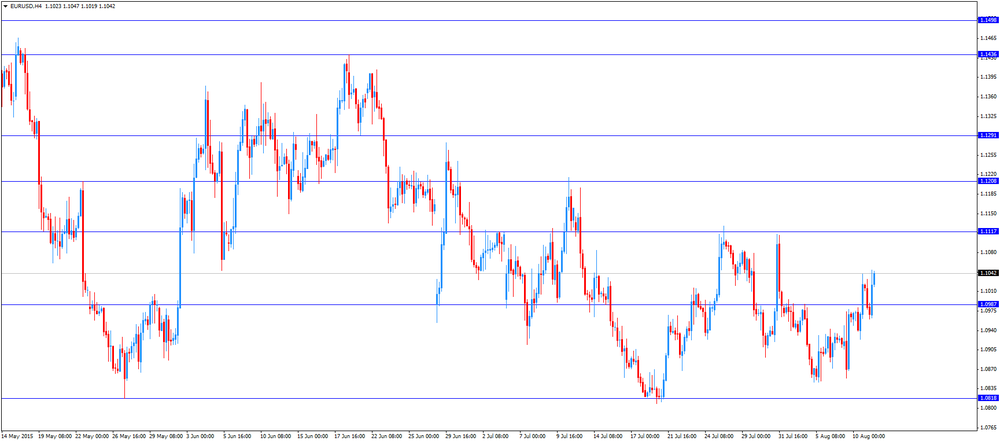

EUR/USD: the currency pair climbed to $1.1049

GBP/USD: the currency pair increased to $1.5615

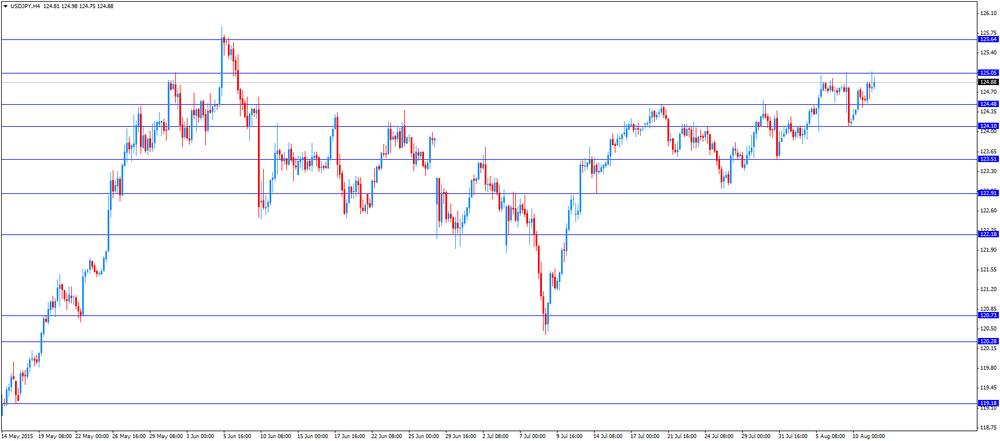

USD/JPY: the currency pair rose to Y125.01

The most important news that are expected (GMT0):

12:15 Canada Housing Starts July 202.8 195

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.1% 1.6%

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II 6.7% 0.1%

14:00 U.S. Wholesale Inventories June 0.8% 0.4%

23:50 Japan Monetary Policy Meeting Minutes

-

13:45

Orders

EUR/USD

Offers 1.1030-35 1.1050 1.1065 1.1080-85 1.1100 1.1125 1.1150

Bids 1.0985 1.0965 1.0950 1.0900 1.0880 1.0850 1.0820-25 1.0800

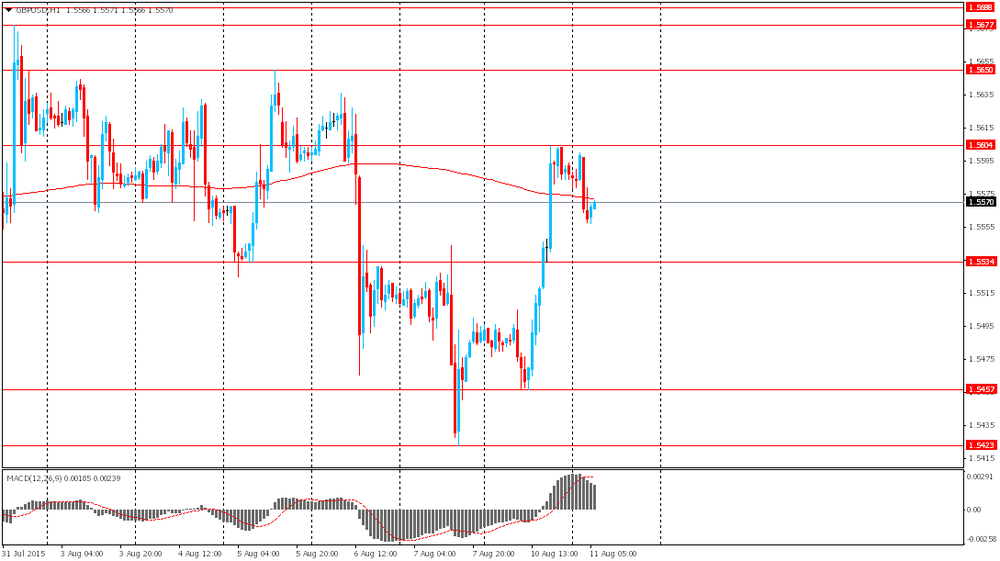

GBP/USD

Offers 1.5600 1.5625 1.5650 1.5680 1.5700-10 1.5730 1.5750

Bids 1.5550 1.5525 -30 1.5500 1.5485 1.5465 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7080-85 0.7100-05 0.7125 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7050 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

EUR/JPY

Offers 137.75 138.00 138.30 138.50 138.80 139.00

Bids 137.45 137.25 137.00 136.80 136.50 136.25-30 136.00

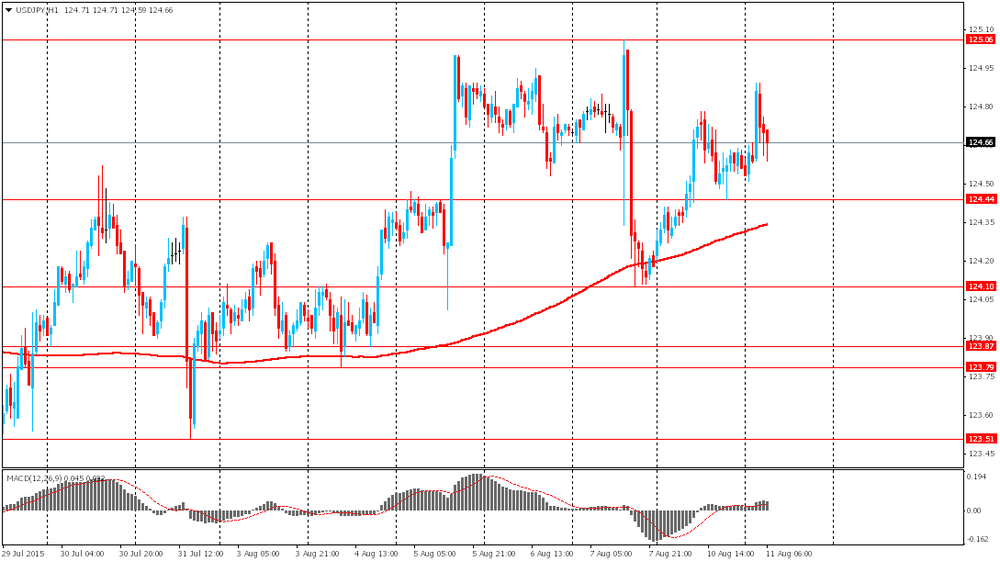

USD/JPY

Offers 125.20-25 125.50 125.75 126.00 126.25 126.50

Bids 124.65 124.50 124.25 124.00 123.75-80 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7365 0.7380 0.7400-05 0.7425 0.7450 0.7475 0.7500

Bids 0.7320-25 0.7300 0.7280 0.7250 0.7230 0.7200

-

11:52

German wholesale prices rise 0.1% in July

The German statistical office Destatis released its wholesale prices for Germany on Tuesday. German wholesale prices rose 0.1% in July, after a 0.2% decrease in June.

On a yearly basis, wholesale prices in Germany fell 0.5% in July, after a 0.5% drop in June. Wholesale prices have been declining since July 2013.

The fall was largely driven by a 12.1% decline in the wholesale prices of solid fuels and related products.

-

11:41

Final consumer prices in Italy decrease 0.1% in July

The Italian statistical office Istat released its final consumer price inflation data for Italy on Tuesday. Final consumer prices in Italy decreased 0.1% in July, in line with the preliminary reading, after a 0.2% gain June.

The decline was mainly driven by falls in fresh fruit (-8.1%) and fresh vegetables (-7.2%) prices Fresh fruit prices dropped 8.1% in July, while fresh vegetables prices plunged 7.2%.

On a yearly basis, consumer prices climbed 0.2% in July, in line with the preliminary reading, after a 0.2% increase in June.

The annual inflation was driven by a slower decline in energy prices and an increase in prices of some services.

-

11:24

Germany's ZEW economic sentiment index declines to 25.0 in August

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 25.0 in August from 29.7 in July, missing expectations for a rise to 32.0.

"The German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 47.6 in August from 42.7 in July.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E565mn), $1.1000(E678mn)

USD/JPY: Y125.00($215mn)

GBP/USD: $1.5500(Gbp217), $1.5525(Gbp168mn)

AUD/USD: $0.7300(A$1.2bn), $0.7435(A$150mn)

AUD/JPY: Y91.80(A$106mn)

NZD/USD: $0.6550(NZ$100mn), $6700(NZ$373mn)

USD/CAD: C$1.3000($125mn)

-

11:01

Eurozone: ZEW Economic Sentiment, August 47.6

-

11:00

Germany: ZEW Survey - Economic Sentiment, August 25 (forecast 32)

-

10:54

The Greek government reaches an agreement with international lenders on the primary budget targets

The Greek government has reached an agreement with international lenders on the issue of the primary budget targets for 2015-2018. That gives hope for a less difficult negotiations.

The primary budget targets are a primary deficit of 0.25% of gross domestic product in 2015, a 0.5% surplus in 2016, a 1.75% surplus in 2017 and a 3.15% surplus in 2018.

The Greek government does not need to implement additional reforms this and the next year.

-

10:44

The yuan devaluates almost 2% against the U.S. dollar on Tuesday

The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

-

10:41

National Australia Bank’s business confidence index for Australia drops to 4 in July

The National Australia Bank released its business confidence index for Australia on Tuesday. The index dropped to 4 in July from 8 in June. June's figure was revised down from 10.

The decline was driven by weaker conditions for employment, forward orders and exports.

-

10:23

The Halle Institute for Economic Research: the German government benefited from the debt crisis in Greece and several other Eurozone countries

A study by the Halle Institute for Economic Research (IWH) showed that the German government has saved up to €100 billion in interest on its debt since 2010. The government benefited from the debt crisis in Greece and several other Eurozone countries as German debt is considering it to be a "safe haven investment".

The savings will offset the costs, even if Greece fails to repay all of the debt.

-

10:08

Atlanta Fed President Dennis Lockhart: the time of the interest rate hike by the Fed is nearing

Atlanta Fed President Dennis Lockhart said on Monday that the time of the interest rate hike by the Fed is nearing.

"I think the point of 'lift-off' is close," he said. Lockhart noted that the U.S. economy has largely returned to normal.

He added that the interest rate hike in September is possible, and the increase in the interest rate would be gradual.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

08:30

Options levels on tuesday, August 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1108 (2645)

$1.1075 (2429)

$1.1046 (332)

Price at time of writing this review: $1.0978

Support levels (open interest**, contracts):

$1.0920 (2083)

$1.0895 (5553)

$1.0866 (3040)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 78357 contracts, with the maximum number of contracts with strike price $1,1300 (5859);

- Overall open interest on the PUT options with the expiration date September, 4 is 108563 contracts, with the maximum number of contracts with strike price $1,0500 (7059);

- The ratio of PUT/CALL was 1.39 versus 1.52 from the previous trading day according to data from August, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1584)

$1.5804 (1829)

$1.5707 (1548)

Price at time of writing this review: $1.5588

Support levels (open interest**, contracts):

$1.5493 (2108)

$1.5396 (1708)

$1.5298 (2285)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 25882 contracts, with the maximum number of contracts with strike price $1,5600 (2827);

- Overall open interest on the PUT options with the expiration date September, 4 is 32441 contracts, with the maximum number of contracts with strike price $1,5450 (2441);

- The ratio of PUT/CALL was 1.25 versus 1.29 from the previous trading day according to data from August, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:09

Foreign exchange market. Asian session: the euro climbed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia National Australia Bank's Business Confidence July 8 Revised From 10 4

06:00 Japan Prelim Machine Tool Orders, y/y July 6.6% 1.6%

The euro advanced amid a weaker dollar. The greenback declined because investors were waiting for more obvious signs of a liftoff in rates in September. Jobs data published on Friday pointed to stable growth in employment, however slow progress in wages and consumer prices continued disappointing economists.

This week investors are waiting for euro zone GDP data. The report is likely to show that the economy continued modest recovery. Median forecast suggests a 0.4% growth rate in the second quarter (just like in the first quarter). Meanwhile analysts also say that growth has probably slowed in France and Italy, which would underline uneven recovery in the single currency area, where Germany leads compared to other economies.

The Australian dollar dropped against the U.S. dollar after data from the National Bank of Australia showed that the business confidence index fell to 4 in July from 10 reported previously. The Australian and New Zealand dollars were also affected by yuan's depreciation against the greenback. China's central bank said it took this step to ease pressure on the economy.

EUR/USD: the pair fell to $1.0970 in Asian trade

USD/JPY: the pair rose to Y124.90

GBP/USD: the pair declined to $1.5555

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone ZEW Economic Sentiment August 42.7

09:00 Germany ZEW Survey - Economic Sentiment August 29.7 32

12:15 Canada Housing Starts July 202.8 195

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.1% 1.6%

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II 6.7% 0.1%

14:00 U.S. Wholesale Inventories June 0.8% 0.4%

20:30 U.S. API Crude Oil Inventories August -2.4

23:50 Japan Monetary Policy Meeting Minutes

-

08:01

Japan: Prelim Machine Tool Orders, y/y , July 1.6%

-

03:46

Australia: National Australia Bank's Business Confidence, July 4

-

01:03

Currencies. Daily history for Aug 10’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1016 +0,47%

GBP/USD $1,5587 +0,62%

USD/CHF Chf0,9835 -0,03%

USD/JPY Y124,56 +0,31%

EUR/JPY Y137,21 +0,73%

GBP/JPY Y194,15 +0,88%

AUD/USD $0,7407 -0,12%

NZD/USD $0,6607 -0,23%

USD/CAD C$1,3006 -0,96%

-