Noticias del mercado

-

23:59

Schedule for today, Wednesday, Aug 12’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence August -3.2%

01:30 Australia Wage Price Index, y/y Quarter II 2.3% 2.3%

01:30 Australia Wage Price Index, q/q Quarter II 0.5% 0.6%

04:30 Japan Industrial Production (YoY) (Finally) June -3.9% 2.0%

04:30 Japan Industrial Production (MoM) (Finally) June -2.1% 0.8%

05:30 China Industrial Production y/y July 6.8% 6.6%

05:30 China Retail Sales y/y July 10.6% 10.6%

05:30 China Fixed Asset Investment June 11.4% 11.5%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.8% 2.8%

08:30 United Kingdom Average Earnings, 3m/y June 3.2% 2.8%

08:30 United Kingdom ILO Unemployment Rate June 5.6% 5.6%

08:30 United Kingdom Claimant count July 7 1.5

09:00 Eurozone Industrial production, (MoM) June -0.4% -0.2%

09:00 Eurozone Industrial Production (YoY) June 1.6% 1.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August -5.4

10:00 Australia RBA Assist Gov Lowe Speaks

11:00 U.S. MBA Mortgage Applications August 4.7%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. JOLTs Job Openings June 5.363 5.3

14:30 U.S. Crude Oil Inventories August -4.407

18:00 U.S. Federal budget July 51.8 -132

22:30 New Zealand Business NZ PMI July 55.2

23:50 Japan Core Machinery Orders June 0.6% -5.6%

23:50 Japan Core Machinery Orders, y/y June 19.3% 16.4%

-

21:00

Dow -1.24% 17,396.09 -219.08 Nasdaq -1.42% 5,029.31 -72.49 S&P -1.05% 2,082.02 -22.16

-

19:00

WSE: Session Results

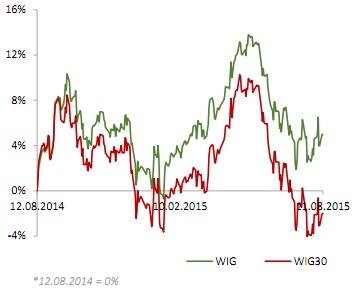

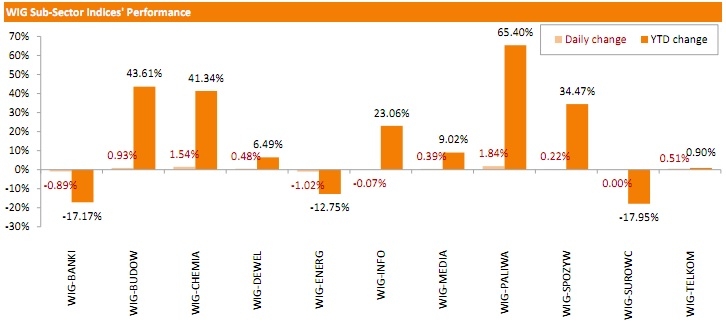

Polish equity market closed flat on Tuesday. The broad market measure, the WIG Index inched up 0.01%. Sector-wise, utilities stocks were depressed the most (-1.02%), while oil and gas sector names outperformed (+1.84%).

The large-cap stocks' measure, the WIG30 Index, edged up 0.08%. Within the Index components, GRUPA AZOTY (WSE: ATT) led the gainers with a 4.49% advance. JSW (WSE: JSW) and BOGDANKA (WSE: LWB) also posted solid surge, adding 3.55% and 2.34% respectively. Elsewhere, LOTOS (WSE: LTS) jumped by 2.20% on better-than-expected 2Q15 results. It was followed by its oil and gas sector peers PKN ORLEN (WSE: PKN) and PGNIG (WSE: PGN), which added a respective 2.07% and 1.53%. On the other side of the ledger, PEKAO (WSE: PEO) fared the worst, tumbling by 2.07%. Quotations of PGE (WSE: PGE) and ENEA (WSE: ENA) slid down 1.93% and 1.26% respectively, as the generating companies reduced electricity output due to continued heatwave.and low water levels, which caused problems with cooling of their coal-fired power plants.

-

18:00

European stocks closed: FTSE 100 6,664.54 -71.68 -1.06% CAC 40 5,099.03 -96.38 -1.86% DAX 11,293.65 -311.13 -2.68%

-

18:00

European stocks close: stocks closed lower on the yuan devaluation

Stock indices closed lower on the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

The Greek government said on Tuesday that it reached a deal on the third bailout programme with its international lenders.

The European Commission has confirmed that a deal on a third Greek bailout programme has been reached.

"We have achieved an agreement in principle on a technical basis and talks are still ongoing on details… What we don't have at the moment is a political agreement and that's what we need," the European Commission spokeswoman Annika Breidthardt said on Tuesday.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index declined to 25.0 in August from 29.7 in July, missing expectations for a rise to 32.0.

"The German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 47.6 in August from 42.7 in July.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,664.54 -71.68 -1.06 %

DAX 11,293.65 -311.13 -2.68 %

CAC 40 5,099.03 -96.38 -1.86 %

-

17:41

Oil prices decline on the yuan devaluation

Oil prices dropped on the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Market participants are concerned that the oil demand from China could be weak.

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Tuesday. OPEC upgraded its forecast of 2015 oil supplies from non-member countries y 90,000 barrels per day.

"U.S. onshore production from unconventional sources is currently expected to decline marginally in the second half of 2015 through year-end, while U.S. offshore production is expected to grow due to project start-ups," OPEC noted.

OPEC also upgraded its forecast of 2015 world oil demand growth by 90,000 barrels per day, while the demand for OPEC crude oil remained unchanged at 29.23 million barrels per day.

OPEC oil production was 31.5 million barrels per day in July, the highest level since May 2012.

Market participants are awaiting the release of U.S. crude oil inventories data. The American Petroleum Institute (API) is scheduled to release its U.S. oil inventories data later in the day, and U.S. oil inventories data from the U.S. Energy Information Administration is expected on Wednesday.

WTI crude oil for September delivery declined to $43.19 a barrel on the New York Mercantile Exchange.

Brent crude oil for September fell to $48.75 a barrel on ICE Futures Europe.

-

17:24

Gold rises on the yuan devaluation

Gold traded higher on the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Gold price was also supported be a deal on a third Greek bailout programme. The Greek government said on Tuesday that it reached a deal on the third bailout programme with its international lenders.

The European Commission has confirmed that a deal on a third Greek bailout programme has been reached.

"We have achieved an agreement in principle on a technical basis and talks are still ongoing on details… What we don't have at the moment is a political agreement and that's what we need," the European Commission spokeswoman Annika Breidthardt said on Tuesday.

She also said that deputy finance ministers from the 28 EU countries will hold a telephone conference today.

October futures for gold on the COMEX today rose to 1106.60 dollars per ounce.

-

17:12

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell in early trading on Tuesday in a broad-based retreat as China's surprise devaluation of the yuan pushed the dollar higher and pressured commodity-related shares. Oil erased most of its gains from Monday following the devalution by the world's top energy consumer. Other commodities such as copper, aluminum, nickel and zinc also fell.

Almost all of Dow stocks in negative area (25 of 30). Top looser - Apple Inc. (AAPL, -2.69%). Top gainer - Verizon Communications Inc. (VZ, +1.23).

All S&P index sectors also in negative area. Top gainer - Basic Materials (-2.1%).

At the moment:

Dow 17384.00 -169.00 -0.96%

S&P 500 2082.50 -17.25 -0.82%

Nasdaq 100 4536.00 -30.00 -0.66%

10 Year yield 2,14% -0,09

Oil 43.07 -1.89 -4.20%

Gold 1106.60 +2.50 +0.23%

-

16:50

European Commission confirms a deal on a third Greek bailout programme

The European Commission has confirmed that a deal on a third Greek bailout programme has been reached.

"We have achieved an agreement in principle on a technical basis and talks are still ongoing on details… What we don't have at the moment is a political agreement and that's what we need," the European Commission spokeswoman Annika Breidthardt said on Tuesday.

She also said that deputy finance ministers from the 28 EU countries will hold a telephone conference today.

-

16:24

Wholesale inventories in the U.S. rises 0.9% in June

The U.S. Commerce Department released wholesale inventories on Tuesday. Wholesale inventories in the U.S. rose 0.9% in June, beating expectations for a 0.4% gain, after a 0.6% increase in May. May's figure was revised down from a 0.8% rise.

The increase was partly driven by a rise inventories of non-durable goods. Inventories of non-durable goods increased 2.3% in June, while inventories of durable goods gained 0.1%.

Wholesale sales climbed by 0.1% in June, after a 0.2% rise in May.

-

16:00

U.S.: Wholesale Inventories, June 0.9% (forecast 0.4%)

-

15:47

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E565mn), $1.1000(E678mn)

USD/JPY: Y125.00($215mn)

GBP/USD: $1.5500(Gbp217), $1.5525(Gbp168mn)

AUD/USD: $0.7300(A$1.2bn), $0.7435(A$150mn)

AUD/JPY: Y91.80(A$106mn)

NZD/USD: $0.6550(NZ$100mn), $6700(NZ$373mn)

USD/CAD: C$1.3000($125mn)

-

15:38

U.S. Stocks open: Dow -0.86%, Nasdaq -0.46%, S&P -0.67%

-

15:27

Before the bell: S&P futures -0.82%, NASDAQ futures -0.55%

U.S. stock-index futures slid as China's currency devaluation sparked concern across global markets that the world's second-largest economy is headed for a deeper slowdown.

Global Stocks:

Nikkei 20,720.75 -87.94 -0.42%

Hang Seng 24,498.21 -22.91 -0.09%

Shanghai Composite 3,928.46 +0.04 0.00%

FTSE 6,681.71 -54.51 -0.81%

CAC 5,110.91 -84.50 -1.63%

DAX 11,345.3 -259.48 -2.24%

Crude oil $43.76 (-2.65%)

Gold $1107.40 (+0.30%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Verizon Communications Inc

VZ

47.40

+0.36%

33.1K

Barrick Gold Corporation, NYSE

ABX

07.78

+2.23%

62.8K

Google Inc.

GOOG

669.99

+5.72%

73.4K

Hewlett-Packard Co.

HPQ

30.20

-0.14%

0.1K

HONEYWELL INTERNATIONAL INC.

HON

107.10

-0.19%

0.1K

Boeing Co

BA

145.54

-0.22%

0.4K

ALTRIA GROUP INC.

MO

55.59

-0.22%

0.4K

Pfizer Inc

PFE

35.25

-0.31%

1.7K

Facebook, Inc.

FB

93.81

-0.36%

78.6K

Johnson & Johnson

JNJ

99.40

-0.39%

0.1K

Procter & Gamble Co

PG

76.08

-0.39%

0.5K

Wal-Mart Stores Inc

WMT

71.20

-0.39%

5.0K

AT&T Inc

T

34.64

-0.40%

5.9K

Amazon.com Inc., NASDAQ

AMZN

521.61

-0.46%

4.5K

The Coca-Cola Co

KO

41.47

-0.50%

0.9K

Nike

NKE

114.77

-0.51%

0.4K

Home Depot Inc

HD

116.99

-0.52%

2.4K

United Technologies Corp

UTX

99.00

-0.55%

0.1K

International Business Machines Co...

IBM

155.75

-0.64%

2.7K

Goldman Sachs

GS

204.58

-0.67%

7.2K

American Express Co

AXP

80.70

-0.69%

0.4K

Walt Disney Co

DIS

110.13

-0.78%

10.7K

General Electric Co

GE

26.01

-0.88%

11.2K

Yandex N.V., NASDAQ

YNDX

13.53

-0.88%

0.2K

Tesla Motors, Inc., NASDAQ

TSLA

239.00

-0.89%

15.9K

JPMorgan Chase and Co

JPM

68.25

-0.93%

12.7K

Visa

V

73.65

-0.98%

3.6K

Exxon Mobil Corp

XOM

77.25

-0.99%

24.4K

Cisco Systems Inc

CSCO

28.30

-1.01%

0.1K

Microsoft Corp

MSFT

46.85

-1.01%

14.1K

Yahoo! Inc., NASDAQ

YHOO

36.77

-1.02%

4.7K

Citigroup Inc., NYSE

C

58.13

-1.04%

8.6K

Intel Corp

INTC

29.29

-1.18%

8.2K

Starbucks Corporation, NASDAQ

SBUX

55.60

-1.19%

5.2K

Chevron Corp

CVX

84.80

-1.27%

12.2K

Ford Motor Co.

F

14.80

-1.27%

75.7K

Apple Inc.

AAPL

118.10

-1.35%

604.0K

Caterpillar Inc

CAT

79.00

-1.45%

5.5K

General Motors Company, NYSE

GM

31.30

-2.00%

36.0K

Twitter, Inc., NYSE

TWTR

28.90

-2.03%

111.3K

ALCOA INC.

AA

09.84

-2.38%

106.7K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11.19

-3.95%

128.2K

-

15:10

Gold rose to 3-week high on the yuan devaluation

The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

-

15:03

Productivity in the U.S. non-farm businesses rises 1.3% in the second quarter

The U.S. Labor Department released non-farm productivity figures on Tuesday. Preliminary productivity in the U.S. non-farm businesses rose at a 1.3% annual rate in the second quarter, missing expectations for a 1.6% increase, after a 1.1% drop in the first quarter. The first quarter's figure was revised up from a 3.1% fall.

The increase was driven by higher output, which rose 2.8%. Hours worked climbed by 1.5%.

Preliminary unit labour costs increased 0.5% in the second quarter, exceeding expectations for a 0.1% rise, after a 2.3 gain in the first quarter. The first quarter's figure was revised down from a 6.7% increase.

-

15:00

Upgrades and downgrades before the market open

Upgrades:

Verizon (VZ) upgraded to Buy from Neutral at MoffettNathanson, target $54

Google A (GOOGL) upgraded to Buy from Neutral at Monness Crespi & Hardt, target $900

Google A (GOOGL) upgraded to Buy from Hold at Stifel, target $850

Google A (GOOGL) upgraded to Buy from Neutral at Nomura, target $715

Downgrades:

Other:

Apple (AAPL) target lowered to $130 from $135 at Jefferies

Google A (GOOGL) target raised to $840 from $780 at Deutsche Bank

-

14:41

Housing starts in Canada declines to a seasonally adjusted annualized rate of 193,032 units in July

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Tuesday. Housing starts in Canada fell to a seasonally adjusted annualized rate of 193,032 units in July from a revised reading of 202,338 units in June. June's figure was revised down from 202,818 units.

The decrease was driven by a decline in single starts.

"The decline in single starts is in line with CMHC's expectations of buyers shifting demand away from higher priced new single-detached homes towards lower-priced alternatives. Gains in multiple starts are largely due to higher rental apartment starts, a substantial portion of which are seniors' residences," the CMHC's Chief Economist Bob Dugan said.

-

14:31

U.S.: Nonfarm Productivity, q/q, Quarter II 1.3% (forecast 1.6%)

-

14:30

U.S.: Unit Labor Costs, q/q, Quarter II 1.3% (forecast 0.1%)

-

14:15

Canada: Housing Starts, July 193 (forecast 195)

-

14:12

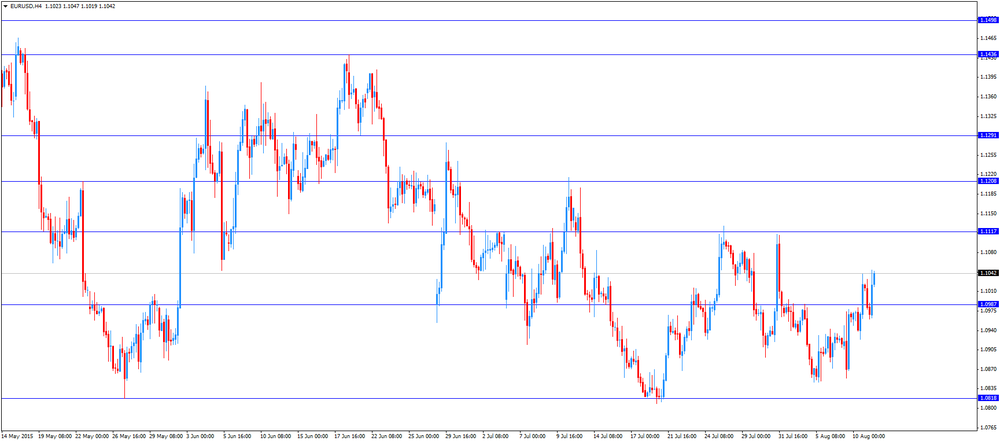

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on news that Athens reached a deal with its lenders

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence July 8 Revised From 10 4

06:00 Japan Prelim Machine Tool Orders, y/y July 6.6% 1.6%

09:00 Eurozone ZEW Economic Sentiment August 42.7 47.6

09:00 Germany ZEW Survey - Economic Sentiment August 29.7 32 25

The U.S. dollar traded mixed against the most major currencies ahead of the U.S. economic data. Preliminary productivity in the U.S. non-farm businesses is expected to rise at a 1.6% annual rate in the second quarter, after a 3.1% drop in the first quarter.

Preliminary unit labour costs are expected to increase 0.1% in the second quarter, after a 6.7 gain in the first quarter.

Wholesale inventories in the U.S. are expected to rise 0.4% in June, after a 0.8% gain in May.

The greenback remained supported by the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

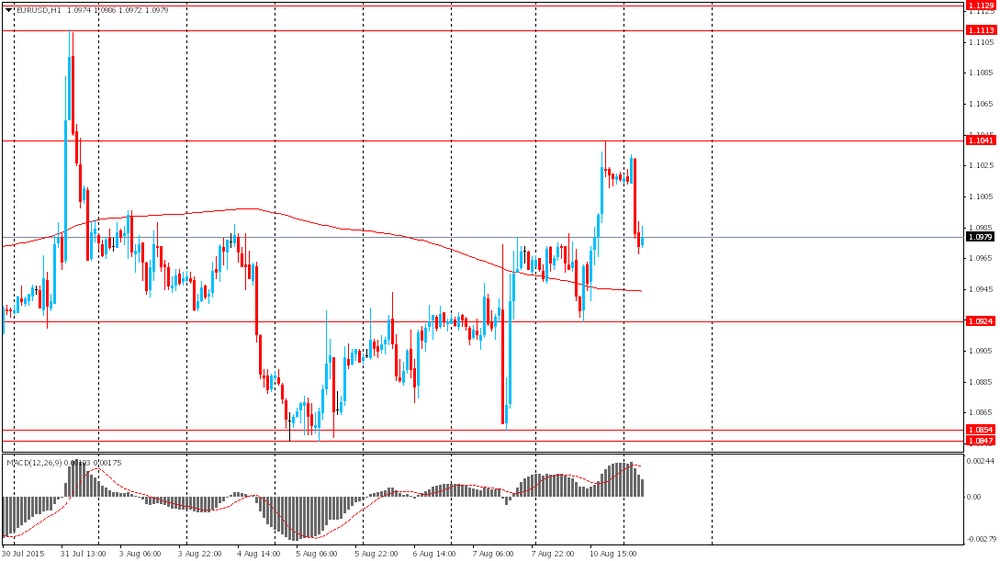

The euro traded higher against the U.S. dollar on news that Athens reached a deal. The Greek government said on Tuesday that it reached a deal on the third bailout programme with its international lenders.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index declined to 25.0 in August from 29.7 in July, missing expectations for a rise to 32.0.

"The German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 47.6 in August from 42.7 in July.

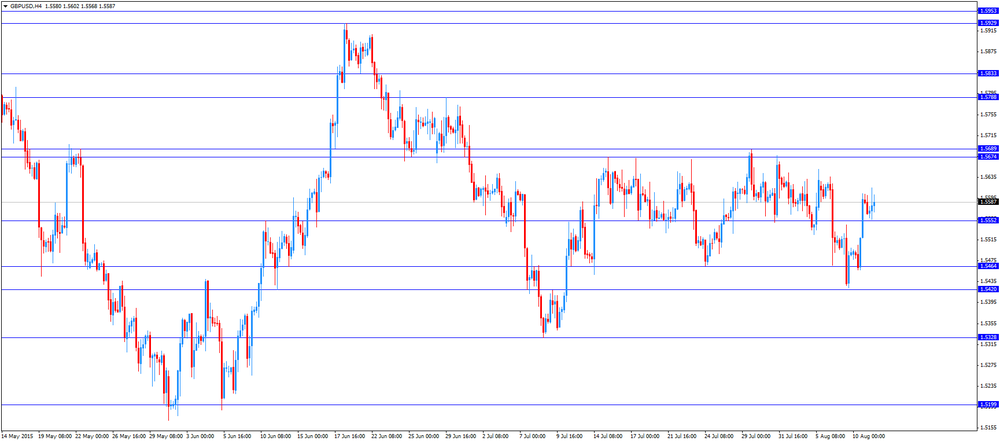

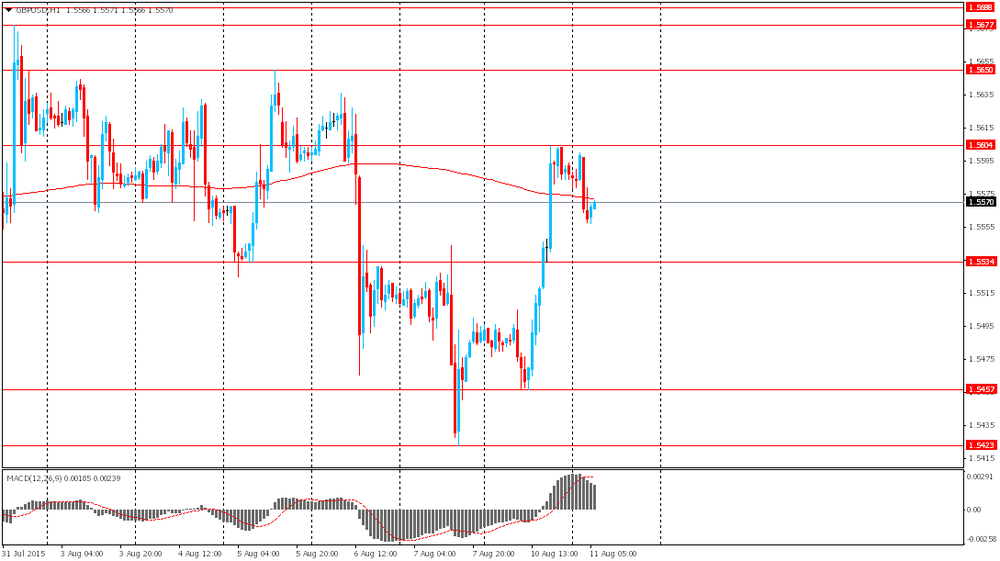

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded mixed against the U.S. dollar ahead of the release Canadian housing starts data. Housing starts in Canada are expected to decline to 195,000 units July from 202,800 units in June.

EUR/USD: the currency pair climbed to $1.1049

GBP/USD: the currency pair increased to $1.5615

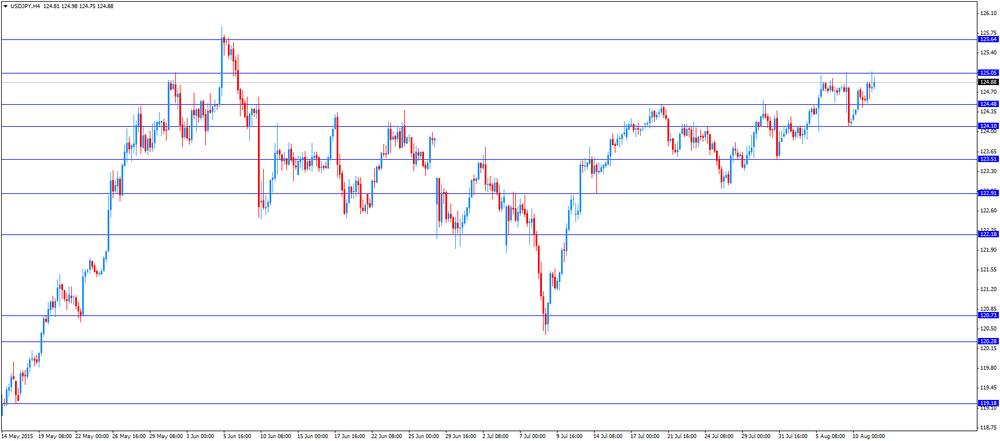

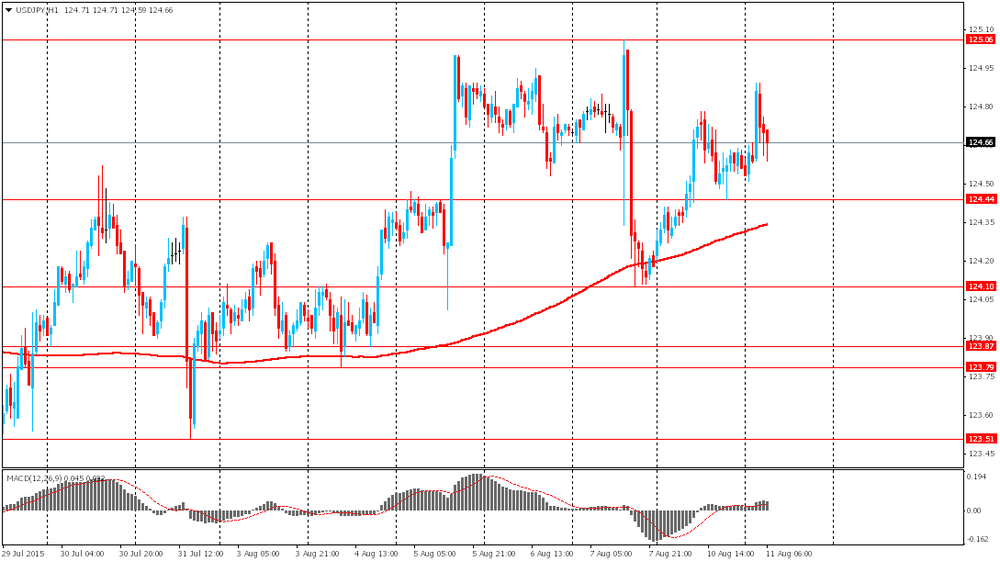

USD/JPY: the currency pair rose to Y125.01

The most important news that are expected (GMT0):

12:15 Canada Housing Starts July 202.8 195

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.1% 1.6%

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II 6.7% 0.1%

14:00 U.S. Wholesale Inventories June 0.8% 0.4%

23:50 Japan Monetary Policy Meeting Minutes

-

13:45

Orders

EUR/USD

Offers 1.1030-35 1.1050 1.1065 1.1080-85 1.1100 1.1125 1.1150

Bids 1.0985 1.0965 1.0950 1.0900 1.0880 1.0850 1.0820-25 1.0800

GBP/USD

Offers 1.5600 1.5625 1.5650 1.5680 1.5700-10 1.5730 1.5750

Bids 1.5550 1.5525 -30 1.5500 1.5485 1.5465 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7080-85 0.7100-05 0.7125 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7050 0.7030-35 0.7020 0.7000 0.6985 0.6965 0.6950 0.6930 0.6900

EUR/JPY

Offers 137.75 138.00 138.30 138.50 138.80 139.00

Bids 137.45 137.25 137.00 136.80 136.50 136.25-30 136.00

USD/JPY

Offers 125.20-25 125.50 125.75 126.00 126.25 126.50

Bids 124.65 124.50 124.25 124.00 123.75-80 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7365 0.7380 0.7400-05 0.7425 0.7450 0.7475 0.7500

Bids 0.7320-25 0.7300 0.7280 0.7250 0.7230 0.7200

-

12:00

European stock markets mid session: stocks traded lower on the yuan devaluation

Stock indices traded lower on the yuan devaluation. The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

The Greek government said on Tuesday that it reached a deal on the third bailout programme with its international lenders.

Meanwhile, the economic data from the Eurozone was mixed. Germany's ZEW economic sentiment index declined to 25.0 in August from 29.7 in July, missing expectations for a rise to 32.0.

"The German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 47.6 in August from 42.7 in July.

Current figures:

Name Price Change Change %

FTSE 100 6,679.65 -56.57 -0.84 %

DAX 11,421.28 -183.50 -1.58 %

CAC 40 5,130.01 -65.40 -1.26 %

-

11:52

German wholesale prices rise 0.1% in July

The German statistical office Destatis released its wholesale prices for Germany on Tuesday. German wholesale prices rose 0.1% in July, after a 0.2% decrease in June.

On a yearly basis, wholesale prices in Germany fell 0.5% in July, after a 0.5% drop in June. Wholesale prices have been declining since July 2013.

The fall was largely driven by a 12.1% decline in the wholesale prices of solid fuels and related products.

-

11:41

Final consumer prices in Italy decrease 0.1% in July

The Italian statistical office Istat released its final consumer price inflation data for Italy on Tuesday. Final consumer prices in Italy decreased 0.1% in July, in line with the preliminary reading, after a 0.2% gain June.

The decline was mainly driven by falls in fresh fruit (-8.1%) and fresh vegetables (-7.2%) prices Fresh fruit prices dropped 8.1% in July, while fresh vegetables prices plunged 7.2%.

On a yearly basis, consumer prices climbed 0.2% in July, in line with the preliminary reading, after a 0.2% increase in June.

The annual inflation was driven by a slower decline in energy prices and an increase in prices of some services.

-

11:24

Germany's ZEW economic sentiment index declines to 25.0 in August

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index declined to 25.0 in August from 29.7 in July, missing expectations for a rise to 32.0.

"The German economic engine is still running smoothly. However, under the current geopolitical and global economic circumstances a substantial improvement of the economic situation in Germany over the medium term is improbable. That is why economic sentiment has declined," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 47.6 in August from 42.7 in July.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.0900(E565mn), $1.1000(E678mn)

USD/JPY: Y125.00($215mn)

GBP/USD: $1.5500(Gbp217), $1.5525(Gbp168mn)

AUD/USD: $0.7300(A$1.2bn), $0.7435(A$150mn)

AUD/JPY: Y91.80(A$106mn)

NZD/USD: $0.6550(NZ$100mn), $6700(NZ$373mn)

USD/CAD: C$1.3000($125mn)

-

11:01

Eurozone: ZEW Economic Sentiment, August 47.6

-

11:00

Germany: ZEW Survey - Economic Sentiment, August 25 (forecast 32)

-

10:54

The Greek government reaches an agreement with international lenders on the primary budget targets

The Greek government has reached an agreement with international lenders on the issue of the primary budget targets for 2015-2018. That gives hope for a less difficult negotiations.

The primary budget targets are a primary deficit of 0.25% of gross domestic product in 2015, a 0.5% surplus in 2016, a 1.75% surplus in 2017 and a 3.15% surplus in 2018.

The Greek government does not need to implement additional reforms this and the next year.

-

10:44

The yuan devaluates almost 2% against the U.S. dollar on Tuesday

The yuan devaluated almost 2% against the U.S. dollar on Tuesday. The People's Bank of China set Tuesday's daily fixing at 6.2298 per U.S. dollar, down from 6.1162 on Monday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

-

10:41

National Australia Bank’s business confidence index for Australia drops to 4 in July

The National Australia Bank released its business confidence index for Australia on Tuesday. The index dropped to 4 in July from 8 in June. June's figure was revised down from 10.

The decline was driven by weaker conditions for employment, forward orders and exports.

-

10:32

OPEC: there is no plans for an emergency meeting to discuss the decline in oil prices before a next scheduled meeting on December 04

Two OPEC officials said that there is no plans for an emergency meeting to discuss the decline in oil prices before a next scheduled meeting on December 04. OPEC kept its oil output unchanged at its last meeting held in June.

OPEC countries are discussing developments in the market.

"Consultations are ongoing to take a decision," Algerian Energy Minister Salah Khebri said.

-

10:23

The Halle Institute for Economic Research: the German government benefited from the debt crisis in Greece and several other Eurozone countries

A study by the Halle Institute for Economic Research (IWH) showed that the German government has saved up to €100 billion in interest on its debt since 2010. The government benefited from the debt crisis in Greece and several other Eurozone countries as German debt is considering it to be a "safe haven investment".

The savings will offset the costs, even if Greece fails to repay all of the debt.

-

10:08

Atlanta Fed President Dennis Lockhart: the time of the interest rate hike by the Fed is nearing

Atlanta Fed President Dennis Lockhart said on Monday that the time of the interest rate hike by the Fed is nearing.

"I think the point of 'lift-off' is close," he said. Lockhart noted that the U.S. economy has largely returned to normal.

He added that the interest rate hike in September is possible, and the increase in the interest rate would be gradual.

Lockhart is a voting member of the Federal Open Market Committee this year.

-

08:52

Oil prices tumbled

West Texas Intermediate futures for September delivery declined to $44.61 (-0.78%), while Brent crude slid to $50.19 (-0.46%) retreating from yesterday's highs. Luckily for oil prices Xinhua agency reported on Monday that China (second-biggest consumer of oil after the U.S.) imported 30.71 million tonnes of crude in July, up 29% compared to last year. This information was based on data by general administration of customs.

Nevertheless this morning oil prices dropped after the Peolple's Bank of China devalued the yuan by nearly 2% in order to support the economy after a sequence of disappointing economic reports.

-

08:30

Gold slid after yesterday's gains

Gold is currently at $1,100.80 (-0.30%). On Monday the precious metal advanced significantly as comments from Federal Reserve officials questioned the likeliness of a rate hike in September. Federal Reserve Vice Chairman Stanley Fischer said on Monday that the labor market improved and got close to full employment. At the same time he noted that inflation remained weak. Both employment and inflation are closely watched by policymakers and progress in these spheres will determine the data-dependant rate increase.

This morning bullion slid as the People's Bank of China decided to devalue the yuan. Top consumer China accounts for nearly a third of global demand for the precious metal. A weaker yuan will make gold more expensive for Chinese importers.

-

08:30

Options levels on tuesday, August 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1108 (2645)

$1.1075 (2429)

$1.1046 (332)

Price at time of writing this review: $1.0978

Support levels (open interest**, contracts):

$1.0920 (2083)

$1.0895 (5553)

$1.0866 (3040)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 78357 contracts, with the maximum number of contracts with strike price $1,1300 (5859);

- Overall open interest on the PUT options with the expiration date September, 4 is 108563 contracts, with the maximum number of contracts with strike price $1,0500 (7059);

- The ratio of PUT/CALL was 1.39 versus 1.52 from the previous trading day according to data from August, 10

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (1584)

$1.5804 (1829)

$1.5707 (1548)

Price at time of writing this review: $1.5588

Support levels (open interest**, contracts):

$1.5493 (2108)

$1.5396 (1708)

$1.5298 (2285)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 25882 contracts, with the maximum number of contracts with strike price $1,5600 (2827);

- Overall open interest on the PUT options with the expiration date September, 4 is 32441 contracts, with the maximum number of contracts with strike price $1,5450 (2441);

- The ratio of PUT/CALL was 1.25 versus 1.29 from the previous trading day according to data from August, 10

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:13

Global Stocks: Asian indices traded mixed amid news from China

U.S. stock indices advanced on Monday supported by deals in the industrial sector. Berkshire Hathaway Inc. announced it would buy Precision Castparts Corp. for approximately $32 billion. The company's shares jumped 19% making it the biggest gainer in the S&P 500. The announcement spurred the broader industrial sector, which gained 1.9%.

The Dow Jones Industrial Average rose 241.79 points, or 1.4%, 17615.17. The S&P 500 added 26.61 points, or 1.3%, to 2104.18. The Nasdaq Composite advanced 58.25 points, or 1.2%, to 5101.80.

Federal Reserve Vice Chairman Stanley Fischer said on Monday that the labor market improved and got close to full employment. At the same time he noted that inflation remained weak.

This morning in Asia Hong Kong Hang Seng rose 0.96%, or 234.39 points, to 24,755.51. China Shanghai Composite Index fell 0.40%, or 15.56 points, to 3,912.86. The Nikkei fell 0.60%, or 124.65 points, to 20,684.04.

Asian stocks traded mixed on surprising yuan's depreciation of nearly 2% against the U.S. dollar after the People's Bank of China announced changes to the way it sets daily midpoints for the national currency. These midpoints used to be completely controlled by the central bank, however from now on they will be based on the previous day's closing price.

-

08:09

Foreign exchange market. Asian session: the euro climbed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia National Australia Bank's Business Confidence July 8 Revised From 10 4

06:00 Japan Prelim Machine Tool Orders, y/y July 6.6% 1.6%

The euro advanced amid a weaker dollar. The greenback declined because investors were waiting for more obvious signs of a liftoff in rates in September. Jobs data published on Friday pointed to stable growth in employment, however slow progress in wages and consumer prices continued disappointing economists.

This week investors are waiting for euro zone GDP data. The report is likely to show that the economy continued modest recovery. Median forecast suggests a 0.4% growth rate in the second quarter (just like in the first quarter). Meanwhile analysts also say that growth has probably slowed in France and Italy, which would underline uneven recovery in the single currency area, where Germany leads compared to other economies.

The Australian dollar dropped against the U.S. dollar after data from the National Bank of Australia showed that the business confidence index fell to 4 in July from 10 reported previously. The Australian and New Zealand dollars were also affected by yuan's depreciation against the greenback. China's central bank said it took this step to ease pressure on the economy.

EUR/USD: the pair fell to $1.0970 in Asian trade

USD/JPY: the pair rose to Y124.90

GBP/USD: the pair declined to $1.5555

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone ZEW Economic Sentiment August 42.7

09:00 Germany ZEW Survey - Economic Sentiment August 29.7 32

12:15 Canada Housing Starts July 202.8 195

12:30 U.S. Nonfarm Productivity, q/q (Preliminary) Quarter II -3.1% 1.6%

12:30 U.S. Unit Labor Costs, q/q (Preliminary) Quarter II 6.7% 0.1%

14:00 U.S. Wholesale Inventories June 0.8% 0.4%

20:30 U.S. API Crude Oil Inventories August -2.4

23:50 Japan Monetary Policy Meeting Minutes

-

08:01

Japan: Prelim Machine Tool Orders, y/y , July 1.6%

-

04:05

Nikkei 225 20,850.15 +41.46 +0.20%, Hang Seng 24,823.74 +302.62 +1.23%, Shanghai Composite 3,944.11 +15.70 +0.40%

-

03:46

Australia: National Australia Bank's Business Confidence, July 4

-

01:06

Commodities. Daily history for Aug 10’2015:

(raw materials / closing price /% change)

Oil 44.83 -0.29%

Gold 1,103.60 -0.05%

-

01:04

Stocks. Daily history for Aug 10’2015:

(index / closing price / change items /% change)

Nikkei 225 20,808.69 +84.13 +0.41 %

Hang Seng 24,521.12 -31.35 -0.13 %

S&P/ASX 200 5,509.16 +34.38 +0.63 %

Shanghai Composite 3,928.82 +184.62 +4.93 %

FTSE 100 6,736.22 +17.73 +0.26 %

CAC 40 5,195.41 +40.66 +0.79 %

Xetra DAX 11,604.78 +113.95 +0.99 %

S&P 500 2,104.18 +26.61 +1.28 %

NASDAQ Composite 5,101.8 +58.26 +1.16 %

Dow Jones 17,615.17 +241.79 +1.39 %

-

01:03

Currencies. Daily history for Aug 10’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1016 +0,47%

GBP/USD $1,5587 +0,62%

USD/CHF Chf0,9835 -0,03%

USD/JPY Y124,56 +0,31%

EUR/JPY Y137,21 +0,73%

GBP/JPY Y194,15 +0,88%

AUD/USD $0,7407 -0,12%

NZD/USD $0,6607 -0,23%

USD/CAD C$1,3006 -0,96%

-