Noticias del mercado

-

23:59

Schedule for today, Thursday, Aug 13’2015:

(time / country / index / period / previous value / forecast)

06:00 Germany CPI, m/m (Finally) July -0.1% 0.2%

06:00 Germany CPI, y/y (Finally) July 0.3% 0.2%

06:45 France CPI, m/m July -0.1%

06:45 France CPI, y/y July 0.3%

07:15 Switzerland Producer & Import Prices, m/m July -0.1%

07:15 Switzerland Producer & Import Prices, y/y July -6.1%

11:30 Eurozone ECB Monetary Policy Meeting Accounts

12:30 Canada New Housing Price Index, MoM June 0.2% 0.1%

12:30 U.S. Initial Jobless Claims August 270 270

12:30 U.S. Continuing Jobless Claims August 2255 2247

12:30 U.S. Retail sales July -0.3% 0.5%

12:30 U.S. Retail sales excluding auto August -0.1% 0.4%

14:00 U.S. Business inventories June 0.3% 0.3%

22:45 New Zealand Retail Sales YoY Quarter II 7.4%

22:45 New Zealand Retail Sales, q/q Quarter II 2.7%

-

20:00

U.S.: Federal budget , July -149.2 (forecast -132)

-

17:11

Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe: an increase in property prices could hurt the country’s economy if there are no income rises

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe warned on Wednesday that an increase in property prices could hurt the country's economy if there are no income rises.

"Ever-rising housing prices, relative to our incomes, do increase risks in the economy and are unlikely to make us better off as a nation. Rising housing prices are best matched by rising incomes," he said.

Low also said that an extended period of low interest rates lead to low returns to savers and low underlying returns on assets.

-

16:47

Reuters reported on Wednesday Greek government wants to approve bailout draft before Friday's Eurogroup meeting

-

16:42

German government called a deal on reforms between Greece and its international lenders as a "substantial result"

The German government called a deal on reforms between Greece and its international lenders as a "substantial result".

"So one can say that the agreement goes in the right direction. But at this hour it is not yet possible to say whether we are at the point where we can start the national process, in other words call for a vote in the Bundestag," German Chancellor Angela Merkel's spokesman, Steffen Seibert, said on Wednesday.

-

16:37

Greek Prime Minister Alexis Tsipras: a deal on the third Greek bailout programme will end the uncertainty in the country

Greek Prime Minister Alexis Tsipras said on Wednesday that a deal on the third Greek bailout programme will end the uncertainty in the country.

"Despite the obstacles that some are trying to put into our path, I'm optimistic we will get to an agreement, loan support from the European mechanism, which will put a final end to economic uncertainty," he said.

-

16:30

U.S.: Crude Oil Inventories, August -1.682 (forecast -2.0)

-

16:11

Job openings fall to 5.249 million in June

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Wednesday. Job openings fell to 5.249 million in June from 5.357 million in May. May's figure was revised down from 5.363 million.

The number of job openings decreased for total private (4.762 million) and for government (487,000) in April.

The hires rate was 3.7% in June.

Total separations climbed to 4.931 million in June from 4.799 million in May.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:01

U.S.: JOLTs Job Openings, June 5.249 (forecast 5.3)

-

15:51

New York Fed President William Dudley: the yuan devaluation is probably appropriate

New York Fed President William Dudley said on Wednesday that the yuan devaluation is probably appropriate.

"Obviously if the Chinese economy is weaker than maybe what the Chinese authorities anticipated, it's probably not inappropriate for the currency to adjust in consequence to that weakness," he said, adding that the Fed closely monitors decisions of China's central bank.

Dudley noted the U.S. companies should invest in workforce development, saying that the Fed' monetary policy cannot solve skill mismatches.

New York Fed president said nothing about the timing of the interest rate hike.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E501mn), $1.1065(E626mn)

USD/JPY: Y124.00($1.41bn), Y124.50($1.11bn)

GBP/USD: $1.5500(Gbp307), $1.5625(Gbp102mn)

AUD/USD: $0.7300(A$101mn)

NZD/USD: $0.6625(NZ$329mn)

USD/CAD: C$1.3025($500mn)

-

14:19

Foreign exchange market. European session: the U.S. dollar traded lower against the most major currencies on the further yuan devaluation

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence August -3.2% 7.8%

01:30 Australia Wage Price Index, y/y Quarter II 2.3% 2.3% 2.3%

01:30 Australia Wage Price Index, q/q Quarter II 0.5% 0.6% 0.6%

04:30 Japan Industrial Production (YoY) (Finally) June -3.9% 2.0% 2.3%

04:30 Japan Industrial Production (MoM) (Finally) June -2.1% 0.8% 0.8%

05:30 China Industrial Production y/y July 6.8% 6.6% 6.0%

05:30 China Retail Sales y/y July 10.6% 10.6% 10.5%

05:30 China Fixed Asset Investment June 11.4% 11.5% 11.2%

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.8% 2.8% 2.8%

08:30 United Kingdom Average Earnings, 3m/y June 3.2% 2.8% 2.4%

08:30 United Kingdom ILO Unemployment Rate June 5.6% 5.6% 5.6%

08:30 United Kingdom Claimant count July 0.2 Revised From 7 1.5 -4.9

09:00 Eurozone Industrial production, (MoM) June -0.4% -0.2% -0.4%

09:00 Eurozone Industrial Production (YoY) June 1.6% 1.5% 1.2%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August -5.4 5.9

10:00 Australia RBA Assist Gov Lowe Speaks

11:00 U.S. MBA Mortgage Applications August 4.7% 0.1%

The U.S. dollar traded lower against the most major currencies on the further yuan devaluation. China's central bank set Wednesday's daily fixing at 6.3306 per U.S. dollar, down from 6.3231 on Tuesday.

The central bank said on Tuesday that it was a "one-off depreciation".

"Looking at the international and domestic economic situation, currently there is no basis for a sustained depreciation trend for the yuan," the central bank said on Wednesday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Job openings in the U.S. are expected to decline to 5.3 million in June from 5.363 million in May.

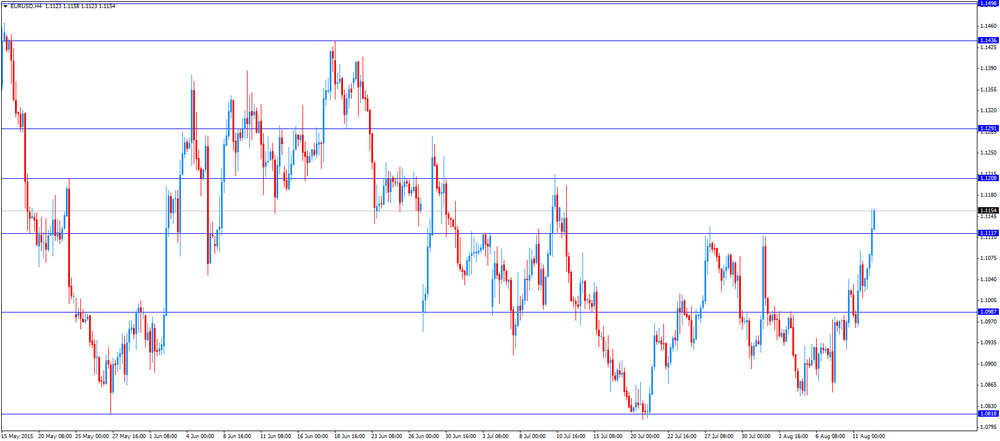

The euro traded higher against the U.S. dollar despite the weaker-than-expected economic data from the Eurozone. Industrial production in the Eurozone fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.4% drop in May.

The decrease was driven by a drop in durable consumer goods and capital output. Durable consumer goods were down 2.0% in June, while capital goods output slid by 1.8%.

On a yearly basis, Eurozone's industrial production gained 1.2% in June, missing expectations for a 1.5% rise, after a 1.6% increase in May.

The increase was driven by a rise in non-durable consumer goods, capital goods and intermediate goods. Non-durable consumer goods climbed by 2.2% in June from a year ago, capital goods rose by 1.7%, while intermediate goods output gained by 0.2%.

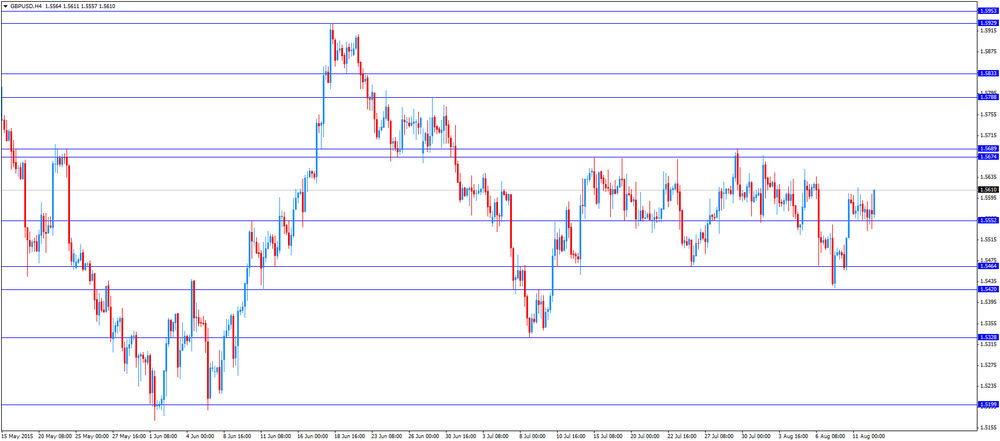

The British pound traded higher against the U.S. dollar after the mixed U.K. labour market data. The U.K. unemployment rate remained unchanged at 5.6% in the April to June quarter, in line with expectations.

The claimant count fell by 4,900 people in July, beating expectations for a rise by 1,500, after an increase of 200 people in June. June's figure was revised down from a rise of 7,000.

U.K. unemployment in the April to June period rose by 25,000 to 1.85 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the April to June quarter, in line with expectations, after a 2.8% gain in the January to March quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the April to June quarter, missing expectations for a gain of 2.8%, after a 3.2% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

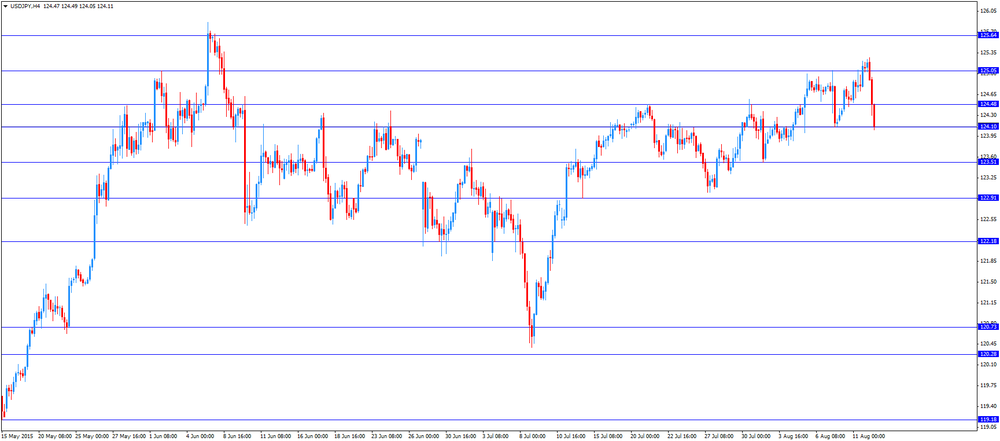

The yen traded higher against the U.S. dollar on the higher demand in the safe-haven currency.

EUR/USD: the currency pair climbed to $1.1158

GBP/USD: the currency pair increased to $1.5611

USD/JPY: the currency pair fell to Y124.05

The most important news that are expected (GMT0):

2:30 U.S. FOMC Member Dudley Speak

14:00 U.S. JOLTs Job Openings June 5.363 5.3

22:30 New Zealand Business NZ PMI July 55.2

23:50 Japan Core Machinery Orders June 0.6% -5.6%

23:50 Japan Core Machinery Orders, y/y June 19.3% 16.4%

-

13:50

Orders

EUR/USD

Offers 1.1125 1.1150 1.1165 1.1180 1.1200 1.2220 1.1245

Bids 1.1080 1.1050 1.1020 1.1000 1.0985 1.0965 1.0950 1.0900 1.0880 1.0850

GBP/USD

Offers 1.5600 1.5625 1.5650 1.5680 1.5700-10 1.5730 1.5750

Bids 1.5570 1.5550 1.5525 -30 1.5500 1.5485 1.5465 1.5450 1.5425-30 1.5400

EUR/GBP

Offers 0.7130-35 0.7150-55 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7110 0.7090 0.7075 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 138.80 139.00 139.30 139.50 139.75 140.00

Bids 138.00 137.80 137.60 137.45 137.25 137.00 136.80 136.50

USD/JPY

Offers 124.65 124.80 125.00 125.20-25 125.50 125.75 126.00

Bids 124.25 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7320-25 0.7365 0.7380 0.7400-05 0.7425 0.7450

Bids 0.7260 0.7300 0.7280 0.7250 0.7230 0.7200 0.7185 0.7150

-

13:01

U.S.: MBA Mortgage Applications, August 0.1%

-

11:52

France’s current account surplus rises to €1.0 billion in June

The Bank of France released its current account data on Wednesday. France's current account surplus increased to €1.0 billion in June from €0.2 billion in May. It was the highest level since November 2011.

The increase in current account surplus was driven by a lower goods deficit. The deficit in the trade of goods dropped to €1 billion in June from €1.7 billion in the previous month.

-

11:43

Italy’ trade surplus falls to €2.8 billion in June

The Italian statistical office Istat released its trade data for Italy on Wednesday. Italy' trade surplus declined to a seasonally adjusted €2.8 billion in June from €4.1 billion in May.

Exports fell 0.6% in June, while imports increased 4.3%.

On a yearly basis, exports climbed 9.4% in June, while imports rose 12.2%.

The trade surplus with the EU was a seasonally adjusted €596 million in June, while the trade surplus with non-EU countries was €2.2 billion.

-

11:34

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 5.9 points in August

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index jumped to 5.9 points in August from -5.4 points in July.

The current conditions rose by 4.0 points to -17.6 points in August from -21.6 points in July.

-

11:28

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E501mn), $1.1065(E626mn)

USD/JPY: Y124.00($1.41bn), Y124.50($1.11bn)

GBP/USD: $1.5500(Gbp307), $1.5625(Gbp102mn)

AUD/USD: $0.7300(A$101mn)

NZD/USD: $0.6625(NZ$329mn)

USD/CAD: C$1.3025($500mn)

-

11:17

Eurozone’s industrial production drops in June

Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.4% drop in May.

The decrease was driven by a drop in durable consumer goods and capital output. Durable consumer goods were down 2.0% in June, while capital goods output slid by 1.8%.

Intermediate goods declined by 0.5% in June, energy output climbed by 3.3%, while non-durable consumer goods output was flat.

On a yearly basis, Eurozone's industrial production gained 1.2% in June, missing expectations for a 1.5% rise, after a 1.6% increase in May.

The increase was driven by a rise in non-durable consumer goods, capital goods and intermediate goods. Non-durable consumer goods climbed by 2.2% in June from a year ago, capital goods rose by 1.7%, while intermediate goods output gained by 0.2%.

Durable consumer goods were up by 0.1%, while energy output was flat.

-

11:07

U.K. unemployment rate remains unchanged to 5.6% in the April to June quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.6% in the April to June quarter, in line with expectations.

The claimant count fell by 4,900 people in July, beating expectations for a rise by 1,500, after an increase of 200 people in June. June's figure was revised down from a rise of 7,000.

U.K. unemployment in the April to June period rose by 25,000 to 1.85 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the April to June quarter, in line with expectations, after a 2.8% gain in the January to March quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the April to June quarter, missing expectations for a gain of 2.8%, after a 3.2% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

11:00

Eurozone: Industrial production, (MoM), June 0.4% (forecast -0.2%)

-

11:00

Eurozone: Industrial Production (YoY), June 1.2% (forecast 1.5%)

-

11:00

Switzerland: Credit Suisse ZEW Survey (Expectations), August 5.9

-

10:54

Bank of Japan’s July monetary policy meeting minutes: at least two board members noted inflation expectations have either weakened or are lower

The Bank of Japan (BoJ) released its July monetary policy minutes on late Tuesday evening. The board members noted that overseas economies would continue to recover and Japan's economy is expected to recover moderately. But a slowdown in China's economy may hurt Japanese exports, the board members said.

At least two board members noted that inflation expectations have either weakened or are lower.

The majority of board members expect the inflation to reach 2% target by September 2016.

The board members pointed out that the weakness in consumption was temporary.

The BoJ board members voted 8-1 to keep monetary policy unchanged in July.

-

10:39

The yuan devaluates 1.6% against the U.S. dollar

The People's Bank of China (PBoC) has devaluated the yuan for the second day. China's central bank set Wednesday's daily fixing at 6.3306 per U.S. dollar, down from 6.3231 on Tuesday.

The PBoC said on Tuesday that it was a "one-off depreciation".

"Looking at the international and domestic economic situation, currently there is no basis for a sustained depreciation trend for the yuan," the central bank said on Wednesday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

-

10:30

United Kingdom: Claimant count , July -4.9 (forecast 1.5)

-

10:30

United Kingdom: Average Earnings, 3m/y , June 2.4% (forecast 2.8%)

-

10:30

United Kingdom: ILO Unemployment Rate, June 5.6% (forecast 5.6%)

-

10:30

United Kingdom: Average earnings ex bonuses, 3 m/y, June 2.8% (forecast 2.8%)

-

10:25

U.S. Treasury Department is cautious regarding the yuan devaluation

The U.S. Treasury Department is cautious regarding the yuan devaluation.

"While it is too early to judge the full implications of the change in the [People's Bank of China] reference rate, China has indicated that the changes announced today are another step in its move to a more market-determined exchange rate," a U.S. Treasury Department spokeswoman said.

The U.S. Treasury Department encourages further monetary policy changes in China.

-

10:13

International Monetary Fund (IMF): the yuan devaluation is “a welcome step”

The International Monetary Fund (IMF) said on Wednesday that the yuan devaluation was "a welcome step".

"Greater exchange rate flexibility is important for China as it strives to give market forces a decisive role in the economy and is rapidly integrating into global financial markets," the IMF statement said.

The IMF noted that China should "achieve an effectively floating exchange rate system within two to three years".

-

09:16

Japan: Industrial Production (YoY), June 2.3% (forecast 2.0%)

-

08:24

Options levels on wednesday, August 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1142 (4512)

$1.1121 (2676)

$1.1104 (1686)

Price at time of writing this review: $1.1078

Support levels (open interest**, contracts):

$1.1025 (651)

$1.0991 (1547)

$1.0962 (1643)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 81919 contracts, with the maximum number of contracts with strike price $1,1300 (5789);

- Overall open interest on the PUT options with the expiration date September, 4 is 113878 contracts, with the maximum number of contracts with strike price $1,0500 (7680);

- The ratio of PUT/CALL was 1.39 versus 1.39 from the previous trading day according to data from August, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5803 (1871)

$1.5706 (1578)

$1.5609 (2823)

Price at time of writing this review: $1.5576

Support levels (open interest**, contracts):

$1.5491 (2128)

$1.5395 (1723)

$1.5297 (2287)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 26402 contracts, with the maximum number of contracts with strike price $1,5600 (2823);

- Overall open interest on the PUT options with the expiration date September, 4 is 32947 contracts, with the maximum number of contracts with strike price $1,5450 (2367);

- The ratio of PUT/CALL was 1.25 versus 1.25 from the previous trading day according to data from August, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:18

Foreign exchange market. Asian session: the U.S. dollar strengthened

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Westpac Consumer Confidence August -3.2% 7.8%

01:30 Australia Wage Price Index, y/y Quarter II 2.3% 2.3% 2.3%

01:30 Australia Wage Price Index, q/q Quarter II 0.5% 0.6% 0.6%

04:30 Japan Industrial Production (YoY) (Finally) June -3.9% 2.0%

04:30 Japan Industrial Production (MoM) (Finally) June -2.1% 0.8% 0.8%

05:30 China Industrial Production y/y July 6.8% 6.6% 6.0%

05:30 China Retail Sales y/y July 10.6% 10.6% 10.5%

05:30 China Fixed Asset Investment June 11.4% 11.5% 11.2%

The U.S. dollar advanced against major currencies after the People's Bank of China unexpectedly conducted 1.9% yuan devaluation.

Investors intensified purchases of the dollar as they seem to be convinced that the U.S. economy is strong enough for the Federal Reserve to raise interest rates for the first time in nearly a decade. Higher rates would make the U.S. dollar more attractive for investors seeking higher yields.

Yuan devaluation weighed on the Australian and New Zealand dollars. The Kiwi fell to a six-year low against the greenback. The unexpected move by the PBOC outweighed favorable data on the Australian economy. Westpac reported that the index of confidence of Australian consumers rose by 7.8% to 99.5 in August, although it remained below the 100 threshold, which separates pessimism from optimism.

EUR/USD: the pair fluctuated within $1.1025-60 in Asian trade

USD/JPY: the pair rose to Y125.25

GBP/USD: the pair declined to $1.5535

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Average earnings ex bonuses, 3 m/y June 2.8% 2.8%

08:30 United Kingdom Average Earnings, 3m/y June 3.2% 2.8%

08:30 United Kingdom ILO Unemployment Rate June 5.6% 5.6%

08:30 United Kingdom Claimant count July 7 1.5

09:00 Eurozone Industrial production, (MoM) June -0.4% -0.2%

09:00 Eurozone Industrial Production (YoY) June 1.6% 1.5%

09:00 Switzerland Credit Suisse ZEW Survey (Expectations) August -5.4

10:00 Australia RBA Assist Gov Lowe Speaks

11:00 U.S. MBA Mortgage Applications August 4.7%

12:30 U.S. FOMC Member Dudley Speak

14:00 U.S. JOLTs Job Openings June 5.363 5.3

14:30 U.S. Crude Oil Inventories August -4.407 -2.0

18:00 U.S. Federal budget July 51.8 -132

22:30 New Zealand Business NZ PMI July 55.2

23:50 Japan Core Machinery Orders June 0.6% -5.6%

23:50 Japan Core Machinery Orders, y/y June 19.3% 16.4%

-

07:30

China: Fixed Asset Investment, June 11.2% (forecast 11.5%)

-

07:30

China: Retail Sales y/y, July 10.5% (forecast 10.6%)

-

07:30

China: Industrial Production y/y, July 6.0% (forecast 6.6%)

-

06:46

Japan: Industrial Production (MoM) , June 0.8% (forecast 0.8%)

-

03:30

Australia: Wage Price Index, y/y, Quarter II 2.3% (forecast 2.3%)

-

03:30

Australia: Wage Price Index, q/q, Quarter II 0.6% (forecast 0.6%)

-

02:33

Australia: Westpac Consumer Confidence, August 7.8%

-

00:29

Currencies. Daily history for Aug 11’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1042 +0,24%

GBP/USD $1,5574 -0,08%

USD/CHF Chf0,988 +0,46%

USD/JPY Y125,11 +0,44%

EUR/JPY Y138,14 +0,67%

GBP/JPY Y194,83 +0,35%

AUD/USD $0,7304 -1,41%

NZD/USD $0,6539 -1,04%

USD/CAD C$1,3112 +0,81%

-