Noticias del mercado

-

21:00

Dow -0.24% 17,361.65 -41.19 Nasdaq +0.05% 5,039.51 +2.72 S&P -0.10% 2,082.06 -2.01

-

18:54

WSE: Session Results

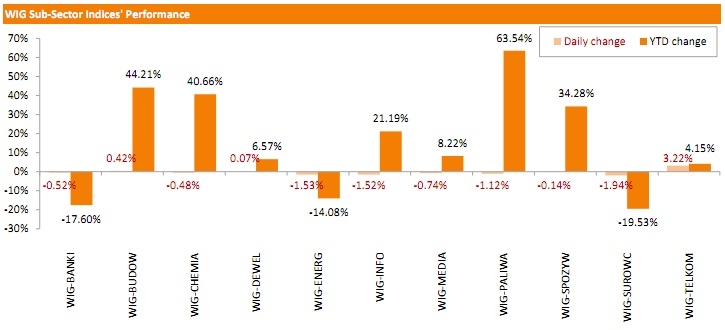

Polish equity market closed lower on Wednesday. The broad market measure, the WIG Index, fell by 0.72%. Sector-wise, materials (-1.94%) fared the worst, while telecommunication sector (+3.22%) was the best-performer.

The large-cap stocks' measure, the WIG30 Index, dropped by 0.76%. Within the WIG30 Index components, TAURON PE (WSE: TPE) recorded the biggest decline, down 4.47%, on news that State Treasury dismissed three supervisory board members. It was followed by ENERGA (WSE: ENG), which quotations slid down 3.16% following worse-than-expected bottom line result for 2Q15. Other major laggards were ASSECO POLAND (WSE: ACP), BOGDANKA (WSE: LWB), PKN ORLEN and KGHM (WSE: KGH), losing 1.94%-2.58%. On the contrary, ORANGE POLSKA (WSE: OPL) and GTC (WSE: GTC) became the biggest advancers, adding 4.53% and 3.84% respectively.

-

18:01

Wall Street. Major U.S. stock-indexes fell

Major U.S. stock-indexes fell more than 1 percent for the second day in a row, with the S&P 500 briefly turning negative for the year, as the continued decline in the yuan exacerbated fears about a global economic slowdown. The Dow fell to a six-month low on Wednesday, while the Nasdaq and the S&P hit a one-month low in a broad decline. The yuan hit a four-year low on Wednesday, falling for a second day after Chinese authorities devalued it, and sources said clamor in government circles to help struggling exporters would put pressure on the central bank to let it drop lower still.

Almost all of Dow stocks in negative area (28 of 30). Top looser - JPMorgan Chase & Co. (JPM, -2.84%). Top gainer - Intel Corporation (INTC, +0.66).

Almost all S&P index sectors also in negative area. Top looser - Financial (-1.8%). Top gainer - Utilities (+0,4%).

At the moment:

Dow 17128.00 -227.00 -1.31%

S&P 500 2054.00 -25.75 -1.24%

Nasdaq 100 4454.75 -56.00 -1.24%

10 Year yield 2,09% -0,05

Oil 43.06 -0.02 -0.05%

Gold 1123.70 +16.00 +1.44%

-

18:00

European stocks closed: FTSE 100 6,571.19 -93.35 -1.40% CAC 40 4,925.43 -173.60 -3.40% DAX 10,924.61 -369.04 -3.27%

-

18:00

European stocks close: stocks closed lower on the further yuan devaluation

Stock indices closed lower on the further yuan devaluation. The yuan devaluated 1.6% against the U.S. dollar on Wednesday, after a 1.9% depreciation on Tuesday.

The central bank said on Tuesday that it was a "one-off depreciation".

"Looking at the international and domestic economic situation, currently there is no basis for a sustained depreciation trend for the yuan," the central bank said on Wednesday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Reuters reported on Wednesday that the Greek government wants to approve a bailout draft before Friday's Eurogroup meeting.

Meanwhile, the economic data from the Eurozone was weaker than expected. Industrial production in the Eurozone fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.4% drop in May.

The decrease was driven by a drop in durable consumer goods and capital output. Durable consumer goods were down 2.0% in June, while capital goods output slid by 1.8%.

On a yearly basis, Eurozone's industrial production gained 1.2% in June, missing expectations for a 1.5% rise, after a 1.6% increase in May.

The increase was driven by a rise in non-durable consumer goods, capital goods and intermediate goods. Non-durable consumer goods climbed by 2.2% in June from a year ago, capital goods rose by 1.7%, while intermediate goods output gained by 0.2%.

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.6% in the April to June quarter, in line with expectations.

The claimant count fell by 4,900 people in July, beating expectations for a rise by 1,500, after an increase of 200 people in June. June's figure was revised down from a rise of 7,000.

U.K. unemployment in the April to June period rose by 25,000 to 1.85 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the April to June quarter, in line with expectations, after a 2.8% gain in the January to March quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the April to June quarter, missing expectations for a gain of 2.8%, after a 3.2% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,571.19 -93.35 -1.40 %

DAX 10,924.61 -369.04 -3.27 %

CAC 40 4,925.43 -173.60 -3.40 %

-

17:11

Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe: an increase in property prices could hurt the country’s economy if there are no income rises

The Reserve Bank of Australia (RBA) Deputy Governor Philip Lowe warned on Wednesday that an increase in property prices could hurt the country's economy if there are no income rises.

"Ever-rising housing prices, relative to our incomes, do increase risks in the economy and are unlikely to make us better off as a nation. Rising housing prices are best matched by rising incomes," he said.

Low also said that an extended period of low interest rates lead to low returns to savers and low underlying returns on assets.

-

16:47

Reuters reported on Wednesday Greek government wants to approve bailout draft before Friday's Eurogroup meeting

-

16:42

German government called a deal on reforms between Greece and its international lenders as a "substantial result"

The German government called a deal on reforms between Greece and its international lenders as a "substantial result".

"So one can say that the agreement goes in the right direction. But at this hour it is not yet possible to say whether we are at the point where we can start the national process, in other words call for a vote in the Bundestag," German Chancellor Angela Merkel's spokesman, Steffen Seibert, said on Wednesday.

-

16:37

Greek Prime Minister Alexis Tsipras: a deal on the third Greek bailout programme will end the uncertainty in the country

Greek Prime Minister Alexis Tsipras said on Wednesday that a deal on the third Greek bailout programme will end the uncertainty in the country.

"Despite the obstacles that some are trying to put into our path, I'm optimistic we will get to an agreement, loan support from the European mechanism, which will put a final end to economic uncertainty," he said.

-

16:11

Job openings fall to 5.249 million in June

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Wednesday. Job openings fell to 5.249 million in June from 5.357 million in May. May's figure was revised down from 5.363 million.

The number of job openings decreased for total private (4.762 million) and for government (487,000) in April.

The hires rate was 3.7% in June.

Total separations climbed to 4.931 million in June from 4.799 million in May.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:51

New York Fed President William Dudley: the yuan devaluation is probably appropriate

New York Fed President William Dudley said on Wednesday that the yuan devaluation is probably appropriate.

"Obviously if the Chinese economy is weaker than maybe what the Chinese authorities anticipated, it's probably not inappropriate for the currency to adjust in consequence to that weakness," he said, adding that the Fed closely monitors decisions of China's central bank.

Dudley noted the U.S. companies should invest in workforce development, saying that the Fed' monetary policy cannot solve skill mismatches.

New York Fed president said nothing about the timing of the interest rate hike.

-

15:31

U.S. Stocks open: Dow -0.72%, Nasdaq -0.81%, S&P -0.63%

-

15:11

Before the bell: S&P futures -0.71%, NASDAQ futures -0.75%

U.S. stock-index futures dropped amid concern that a slowdown in China's economy will weigh on global growth.

Global Stocks:

Nikkei 20,392.77 -327.98 -1.58%

Hang Seng 23,916.02 -582.19 -2.38%

Shanghai Composite 3,887.3 -40.60 -1.03%

FTSE 6,590.71 -73.83 -1.11%

CAC 4,974.92 -124.11 -2.43%

DAX 11,037.11 -256.54 -2.27%

Crude oil $43.53 (+1.02%)

Gold $1117.50 (+0.95%)

-

14:59

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

76.39

+0.22%

4.4K

Google Inc.

GOOG

665.70

+0.74%

3.9K

Barrick Gold Corporation, NYSE

ABX

07.90

+2.86%

110.0K

Exxon Mobil Corp

XOM

77.45

-0.05%

16.7K

Yandex N.V., NASDAQ

YNDX

13.19

-0.15%

3.8K

Boeing Co

BA

143.78

-0.19%

0.1K

ALTRIA GROUP INC.

MO

55.61

-0.22%

7.0K

American Express Co

AXP

81.15

-0.23%

1.3K

Pfizer Inc

PFE

35.01

-0.31%

2.3K

Visa

V

73.00

-0.33%

1.2K

Wal-Mart Stores Inc

WMT

71.64

-0.40%

10.0K

UnitedHealth Group Inc

UNH

121.75

-0.42%

0.6K

Johnson & Johnson

JNJ

98.51

-0.50%

2.6K

Amazon.com Inc., NASDAQ

AMZN

524.80

-0.50%

6.9K

Chevron Corp

CVX

85.32

-0.54%

2.1K

E. I. du Pont de Nemours and Co

DD

52.70

-0.58%

0.8K

International Paper Company

IP

46.60

-0.58%

0.5K

McDonald's Corp

MCD

98.19

-0.62%

0.4K

International Business Machines Co...

IBM

154.50

-0.65%

0.9K

HONEYWELL INTERNATIONAL INC.

HON

104.67

-0.66%

2.1K

Microsoft Corp

MSFT

46.10

-0.67%

1.0K

Intel Corp

INTC

28.77

-0.69%

18.9K

General Electric Co

GE

25.52

-0.74%

46.2K

Nike

NKE

113.60

-0.75%

0.5K

Home Depot Inc

HD

116.80

-0.76%

1.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.14

-0.78%

312.8K

United Technologies Corp

UTX

97.20

-0.79%

1K

Facebook, Inc.

FB

92.87

-0.80%

116.8K

Starbucks Corporation, NASDAQ

SBUX

55.88

-0.83%

6.5K

Caterpillar Inc

CAT

77.38

-0.85%

3.3K

ALCOA INC.

AA

09.39

-0.95%

45.4K

Cisco Systems Inc

CSCO

27.75

-0.96%

1.5K

Verizon Communications Inc

VZ

47.13

-0.99%

124.3K

Ford Motor Co.

F

14.55

-1.02%

3.9K

Goldman Sachs

GS

199.55

-1.06%

4.7K

Apple Inc.

AAPL

112.27

-1.07%

1.1M

General Motors Company, NYSE

GM

30.50

-1.07%

32.6K

Hewlett-Packard Co.

HPQ

29.00

-1.09%

0.3K

AMERICAN INTERNATIONAL GROUP

AIG

62.60

-1.12%

6.4K

Walt Disney Co

DIS

106.72

-1.19%

39.7K

JPMorgan Chase and Co

JPM

67.40

-1.21%

23.1K

Citigroup Inc., NYSE

C

56.94

-1.21%

21.8K

Tesla Motors, Inc., NASDAQ

TSLA

234.00

-1.42%

18.8K

Twitter, Inc., NYSE

TWTR

29.17

-1.53%

78.5K

Merck & Co Inc

MRK

56.79

-1.68%

0.4K

AT&T Inc

T

33.88

-2.22%

263.3K

Yahoo! Inc., NASDAQ

YHOO

34.55

-4.12%

424.1K

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Google A (GOOGL) upgraded to Overweight from Equal-Weight at Morgan Stanley

Downgrades:

Other:

-

12:05

European stock markets mid session: stocks traded lower on the further yuan devaluation

Stock indices traded lower on the further yuan devaluation. China's central bank set Wednesday's daily fixing at 6.3306 per U.S. dollar, down from 6.3231 on Tuesday.

The central bank said on Tuesday that it was a "one-off depreciation".

"Looking at the international and domestic economic situation, currently there is no basis for a sustained depreciation trend for the yuan," the central bank said on Wednesday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

Meanwhile, the economic data from the Eurozone was weaker than expected. Industrial production in the Eurozone fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.4% drop in May.

The decrease was driven by a drop in durable consumer goods and capital output. Durable consumer goods were down 2.0% in June, while capital goods output slid by 1.8%.

On a yearly basis, Eurozone's industrial production gained 1.2% in June, missing expectations for a 1.5% rise, after a 1.6% increase in May.

The increase was driven by a rise in non-durable consumer goods, capital goods and intermediate goods. Non-durable consumer goods climbed by 2.2% in June from a year ago, capital goods rose by 1.7%, while intermediate goods output gained by 0.2%.

Current figures:

Name Price Change Change %

FTSE 100 6,575.75 -88.79 -1.33 %

DAX 11,042.69 -250.96 -2.22 %

CAC 40 4,963.65 -135.38 -2.66 %

-

11:52

France’s current account surplus rises to €1.0 billion in June

The Bank of France released its current account data on Wednesday. France's current account surplus increased to €1.0 billion in June from €0.2 billion in May. It was the highest level since November 2011.

The increase in current account surplus was driven by a lower goods deficit. The deficit in the trade of goods dropped to €1 billion in June from €1.7 billion in the previous month.

-

11:43

Italy’ trade surplus falls to €2.8 billion in June

The Italian statistical office Istat released its trade data for Italy on Wednesday. Italy' trade surplus declined to a seasonally adjusted €2.8 billion in June from €4.1 billion in May.

Exports fell 0.6% in June, while imports increased 4.3%.

On a yearly basis, exports climbed 9.4% in June, while imports rose 12.2%.

The trade surplus with the EU was a seasonally adjusted €596 million in June, while the trade surplus with non-EU countries was €2.2 billion.

-

11:34

ZEW Institute and Credit Suisse Group’s survey: Switzerland's economic sentiment index climbs to 5.9 points in August

A survey by the ZEW Institute and Credit Suisse Group showed on Wednesday that Switzerland's economic sentiment index jumped to 5.9 points in August from -5.4 points in July.

The current conditions rose by 4.0 points to -17.6 points in August from -21.6 points in July.

-

11:17

Eurozone’s industrial production drops in June

Eurostat released its industrial production data for the Eurozone on Wednesday. Industrial production in the Eurozone fell 0.4% in June, missing expectations for a 0.2% decline, after a 0.4% drop in May.

The decrease was driven by a drop in durable consumer goods and capital output. Durable consumer goods were down 2.0% in June, while capital goods output slid by 1.8%.

Intermediate goods declined by 0.5% in June, energy output climbed by 3.3%, while non-durable consumer goods output was flat.

On a yearly basis, Eurozone's industrial production gained 1.2% in June, missing expectations for a 1.5% rise, after a 1.6% increase in May.

The increase was driven by a rise in non-durable consumer goods, capital goods and intermediate goods. Non-durable consumer goods climbed by 2.2% in June from a year ago, capital goods rose by 1.7%, while intermediate goods output gained by 0.2%.

Durable consumer goods were up by 0.1%, while energy output was flat.

-

11:07

U.K. unemployment rate remains unchanged to 5.6% in the April to June quarter

The Office for National Statistics (ONS) released its labour market data on Wednesday. The U.K. unemployment rate remained unchanged at 5.6% in the April to June quarter, in line with expectations.

The claimant count fell by 4,900 people in July, beating expectations for a rise by 1,500, after an increase of 200 people in June. June's figure was revised down from a rise of 7,000.

U.K. unemployment in the April to June period rose by 25,000 to 1.85 million from the previous quarter.

Average weekly earnings, excluding bonuses, climbed by 2.8% in the April to June quarter, in line with expectations, after a 2.8% gain in the January to March quarter. It was the highest gain in more than six years.

The previous three months' figure was revised up from a 2.2% increase.

Average weekly earnings, including bonuses, rose by 2.4% in the April to June quarter, missing expectations for a gain of 2.8%, after a 3.2% increase in the January to March quarter.

The Bank of England monitors closely the wages growth it considers when to start hiking its interest rate.

-

10:54

Bank of Japan’s July monetary policy meeting minutes: at least two board members noted inflation expectations have either weakened or are lower

The Bank of Japan (BoJ) released its July monetary policy minutes on late Tuesday evening. The board members noted that overseas economies would continue to recover and Japan's economy is expected to recover moderately. But a slowdown in China's economy may hurt Japanese exports, the board members said.

At least two board members noted that inflation expectations have either weakened or are lower.

The majority of board members expect the inflation to reach 2% target by September 2016.

The board members pointed out that the weakness in consumption was temporary.

The BoJ board members voted 8-1 to keep monetary policy unchanged in July.

-

10:39

The yuan devaluates 1.6% against the U.S. dollar

The People's Bank of China (PBoC) has devaluated the yuan for the second day. China's central bank set Wednesday's daily fixing at 6.3306 per U.S. dollar, down from 6.3231 on Tuesday.

The PBoC said on Tuesday that it was a "one-off depreciation".

"Looking at the international and domestic economic situation, currently there is no basis for a sustained depreciation trend for the yuan," the central bank said on Wednesday.

A weaker yuan should help to boost the activity in the manufacturing sector and exports, which dropped 8.3% year-on-year in July.

-

10:25

U.S. Treasury Department is cautious regarding the yuan devaluation

The U.S. Treasury Department is cautious regarding the yuan devaluation.

"While it is too early to judge the full implications of the change in the [People's Bank of China] reference rate, China has indicated that the changes announced today are another step in its move to a more market-determined exchange rate," a U.S. Treasury Department spokeswoman said.

The U.S. Treasury Department encourages further monetary policy changes in China.

-

10:13

International Monetary Fund (IMF): the yuan devaluation is “a welcome step”

The International Monetary Fund (IMF) said on Wednesday that the yuan devaluation was "a welcome step".

"Greater exchange rate flexibility is important for China as it strives to give market forces a decisive role in the economy and is rapidly integrating into global financial markets," the IMF statement said.

The IMF noted that China should "achieve an effectively floating exchange rate system within two to three years".

-

08:21

Global Stocks: indices declined worldwide amid yuan devaluation

U.S. stock indices declined after the People's Bank of China depreciated the yuan on Tuesday. Concerns about demand for the iPhone in the world's second-biggest economy weighed on Apple Inc driving its shares 5.2% lower and making it the biggest loser in all three major indices.

The Dow Jones industrial average fell 212.33 points, or 1.21%, to 17,402.84. The S&P 500 index lost 20.11 points, or 0.96%, to 2,084.07. The Nasdaq Composite tumbled 65.01 points, or 1.27%, to 5,036.79.

U.S. National Federation of Independent Business reported on Tuesday that the index of small business optimism rose by 1.3 point to 95.4 in July, while economists had expected the index to rise to 95.5. Seven out of ten sub-indexes improved.

This morning in Asia Hong Kong Hang Seng dropped 1.99%, or 486.57 points, to 24,011.64. China Shanghai Composite Index fell 0.25%, or 9.63 points, to 3,918.28. The Nikkei lost 1.48%, or 306.22 points, to 20,414.53.

Asian stocks traded lower amid the unexpected yuan devaluation. Today People's Bank of China cut yuan's exchange rate further by 1.6%. Broad declines in U.S. equities put additional pressure on Chinese indices.

-

04:04

Nikkei 225 20,460.27 -260.48 -1.3 %, Hang Seng 24,194.43 -303.78 -1.2 %, Shanghai Composite 3,880.8 -47.11 -1.2 %

-

00:30

Stocks. Daily history for Aug 11’2015:

(index / closing price / change items /% change)

Nikkei 225 20,720.75 -87.94 -0.42 %

Hang Seng 24,498.21 -22.91 -0.09 %

S&P/ASX 200 5,473.23 -35.93 -0.65 %

Shanghai Composite 3,928.46 +0.04 0.00%

FTSE 100 6,664.54 -71.68 -1.06 %

CAC 40 5,099.03 -96.38 -1.86 %

Xetra DAX 11,293.65 -311.13 -2.68 %

S&P 500 2,084.07 -20.11 -0.96 %

NASDAQ Composite 5,036.79 -65.01 -1.27 %

Dow Jones 17,402.84 -212.33 -1.21 %

-