Noticias del mercado

-

17:10

Bank of Japan Governor Haruhiko Kuroda: Japan’s economy will likely avoid a recession

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said on Thursday that Japan's economy will likely avoid a recession.

He also said that it is possible that the central bank's 2% inflation will not be achieved next year if oil prices decline further.

Kuroda pointed out that the BoJ would not lower a 0.1% interest rate floor.

-

17:02

Chinese Premier Li Keqiang: there will be no hard landing in China

Chinese Premier Li Keqiang said at the World Economic Forum in Dalian that there will be no hard landing in China as the government is capable to support the economy.

"If there are signs that our economy is sliding, we have the adequate resources to deal with it," he said.

Li pointed out that China meet all its economic targets for this year.

-

17:00

U.S.: Crude Oil Inventories, September 2.570 (forecast 0.2)

-

16:37

Core machine orders in Japan drop 3.6% in August

Japan's Cabinet Office released its core machine orders data on Thursday. Core machine orders in Japan dropped 3.6% in August, missing expectations for a 3.7% rise, after a 7.9% decline in July.

On a yearly basis, core machine orders in Japan rose 2.8% in August, missing forecasts of a 10.5% gain, after a 16.6% rise in July.

The total number of machinery orders gained 2.2% in August.

Manufacturing orders slid 5.3% in August, while non-manufacturing orders fell 6.0%.

-

16:25

Wholesale inventories in the U.S. falls 0.1% in July

The U.S. Commerce Department released wholesale inventories on Thursday. Wholesale inventories in the U.S. fell 0.1% in July, beating expectations for a 0.3% gain, after a 0.9% increase in June. It was the first decline since May 2013.

June's figure was revised down from a 0.9% rise.

The decrease was partly driven by a drop in inventories of non-durable goods. Inventories of non-durable goods declined 0.5% in July, while inventories of durable goods gained 0.1%.

Wholesale sales fell by 0.3% in July, after a 0.4% rise in June.

-

16:04

Japan’s ruling Liberal Democratic Party member Kozo Yamamoto: the Bank of Japan's monetary policy meeting on October 30 would be a “good opportunity” for further easing

Japan's ruling Liberal Democratic Party member Kozo Yamamoto said in an interview on Thursday that the Bank of Japan's monetary policy meeting on October 30 would be a "good opportunity" to ease monetary policy further. He pointed out that the central bank should raise the annual pace of asset purchases by at least 10 trillion yen.

-

16:00

U.S.: Wholesale Inventories, July -0.1% (forecast 0.3%)

-

15:46

Bank of England's Monetary Policy Committee minutes: 8-1 split to keep monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its September meeting minutes on Thursday. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate by 0.25%.

MPC members noted that the risks from the slowdown in the Chinese economy rose since August.

"Global developments do not as yet appear sufficient to alter materially the central outlook described in the August Report, but the greater downside risks to the global environment merit close monitoring for any impact on domestic economic activity," the statement said.

MPC members said that the healthy domestic expansion continued.

"Domestic momentum is being underpinned by robust real income growth, supportive credit condition, and elevated business and consumer confidence," the minutes said.

MPC members pointed that the interest rate hike will be gradual when the Bank of England starts to raise its interest rate.

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E680mn), $1.1150(E893mn), $1.1200(E1.16bn)

USD/JPY: Y118.75-85($1.0bn), Y120.00($1.74bn), Y120.60-70($650mn), Y121.00($1.4bn), Y121.05-20($900mn), Y121.50($919mn)

EUR/JPY: Y135.00(E300mn)

GBP/USD: $1.5400(GBP239mn), $1.5520(Gbp235mn) *EUR/GBP: GBP0.7300(E542mn)

AUD/USD: $0.7000(A$697mn, $0.7100(A$294mn) *NZD/USD: $0.6500(NZ1.47bn)

USD/CAD: C$1.3100($583mn), C$1.3200($466mn), C$1.3300($375mn), C$1.3350($1.12bn)

-

15:04

U.S. import price index drops 1.8% in August

The U.S. Labor Department released its import and export prices data on Thursday. The U.S. import price index plunged by 1.8% in August, missing expectations for a 1.6% decrease, after a 0.9% decline in July. It was the largest fall since January.

The decline was mainly driven by lower fuel import prices, which dropped 14.2% in August.

Imported food prices were up 0.3% in August, while prices for imported capital goods decreased 0.2%.

A stronger U.S. currency lowers the price of imported goods.

U.S. export prices declined by 1.4% in August, after a revised 0.4% fall in July. July's figure was revised down from a 0.2% decline.

-

14:55

Canadian capacity utilisation rate is down to 81.3% in the second quarter

Statistics Canada released its capacity utilisation rate on Thursday. Canadian capacity utilisation rate declined to 81.3% in the second quarter from 82.6% in the first quarter. The first quarter's figure was revised down from 82.7%.

The decline was driven by a fall in the mining, quarrying, and oil and gas extraction and manufacturing industries. The capacity utilisation rate in the mining, quarrying, and oil and gas extraction industry dropped to 75.9% in the second quarter decreased from 78.9% in the first quarter.

The capacity utilization rate fell in 13 of the 21 major categories in the manufacturing sector in the second quarter.

-

14:47

Initial jobless claims decline by 6,000 to 275,000 in the week ending September 05

The U.S. Labor Department released its jobless claims figures on Thursday. The number of initial jobless claims in the week ending September 05 in the U.S. declined by 6,000 to 275,000 from 281,000 in the previous week, in line with expectations. The previous week's figure was revised down from 282,000.

Jobless claims remained below 300,000 the 19th straight week. This threshold is associated with the strengthening of the labour market.

Continuing jobless claims increased by 1,000 to 2,260,000 in the week ended August 29.

-

14:41

Canada’s new housing price index climbs 0.1% in July

Statistics Canada released its new housing price index on Thursday. New housing price index in Canada rose 0.1% in July, missing expectations of a 0.2% gain, after a 0.3% rise in June.

The increase was driven by gains in Toronto and Oshawa region.

On a yearly basis, new housing price index in Canada climbed 1.3% in July, after a 1.3% gain in June.

-

14:35

Bank of England keeps its interest rate on hold at 0.5% in September

The Bank of England (BoE) released its interest rate decision on Thursday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

The central bank cut its GDP forecast for the third quarter to 0.6% from 0.7% due to the recent weak manufacturing and industrial production data

-

14:30

U.S.: Import Price Index, August -1.8% (forecast -1.6%)

-

14:30

Canada: Capacity Utilization Rate, Quarter II 81.3% (forecast 81.7%)

-

14:30

Canada: New Housing Price Index, MoM, July 0.1% (forecast 0.2%)

-

14:30

U.S.: Initial Jobless Claims, September 275 (forecast 275)

-

14:30

U.S.: Continuing Jobless Claims, August 2260 (forecast 2250)

-

14:21

Greek unemployment rate rises to 25.2% in June

The Hellenic Statistical Authority released its unemployment data on Thursday. The seasonally adjusted unemployment rate in Greece rose to 25.2% in June from 25.0% in May.

The number of unemployed fell by 2,609 persons compared with May 2015.

The youth unemployment rate declined to 48.3% in June.

-

14:13

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the release of the Bank of England’s (BoE) interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Changing the number of employed August 39.2 Revised From 37.9 5 17.4

01:30 Australia Unemployment rate August 6.3% 6.2% 6.2%

01:30 China PPI y/y August -5.4% -5.5% -5.9%

01:30 China CPI y/y August 1.6% 1.8% 2.0%

06:45 France Industrial Production, m/m July 0.0% Revised From -0.1% 0.2% -0.8%

06:45 France Industrial Production, y/y July 1.0% Revised From 0.7% 0.7%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility

11:00 United Kingdom MPC Rate Statement

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data. The number of initial jobless claims in the U.S. is expected to decrease by 7,000 to 275,000 last week.

Wholesale inventories in the U.S. are expected to rise 0.3% in July, after a 0.9% gain in June.

The euro traded slightly lower against the U.S. dollar after the mixed economic data from the Eurozone. The French statistical office Insee its industrial production figures on Thursday. Industrial production in France fell 0.8% in July, missing expectations for a 0.2% rise, after a flat reading in June. June's figure was revised up from a 0.1% decline.

The decline was driven by a drop in electrical and electronic equipment output, which fell 2.0%.

On a yearly basis, the French industrial production rose 0.7% in July, after a 1.0% gain in June. June's figure was revised up from a 0.7% increase.

Spanish statistical office INE released its industrial production figures for Spain on Thursday. Industrial production in Spain was up 0.6% in July, after a 0.4% gain in June.

On a yearly basis, industrial production in Spain climbed at adjusted 5.2% in July, after a 4.5% increase in June.

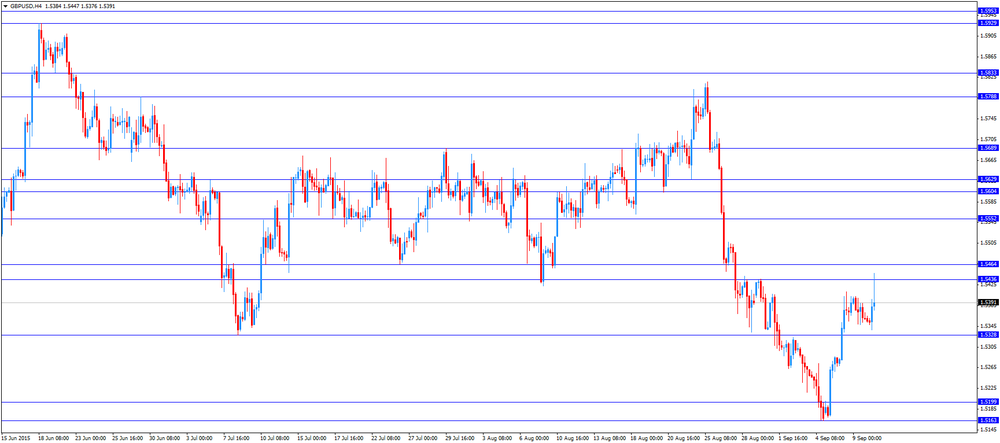

The British pound traded higher against the U.S. dollar after the release of the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The Bank of England's Monetary Policy Committee (MPC) released its September meeting minutes today. 8 members voted to keep the central bank's monetary policy unchanged. Ian McCafferty voted to hike interest rate.

MPC members noted that the risks from the slowdown in the Chinese economy rose since August.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of the economic data from Canada. Canada's new housing price index is expected to rise 0.2% in July, after a 0.3% gain in June.

The Canadian capacity utilization rate is expected to decrease 81.7% in the second quarter from 82.7% in the first quarter.

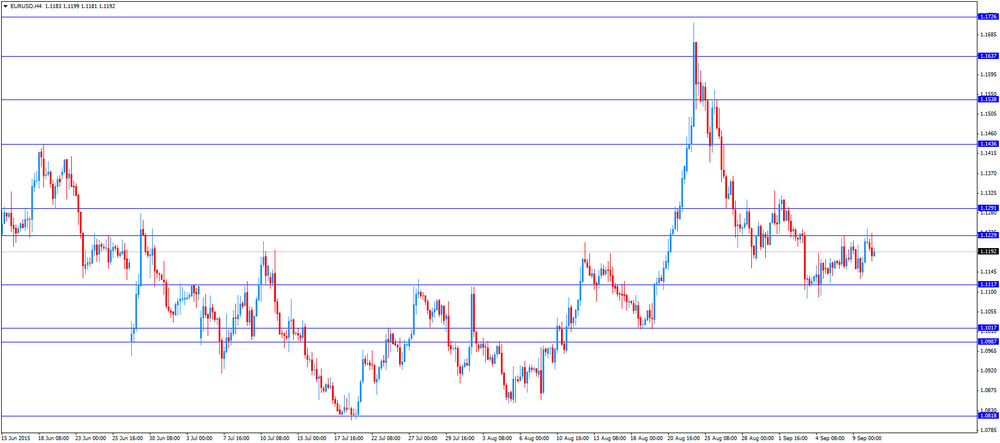

EUR/USD: the currency pair fell to $1.1171

GBP/USD: the currency pair rose to $1.5447

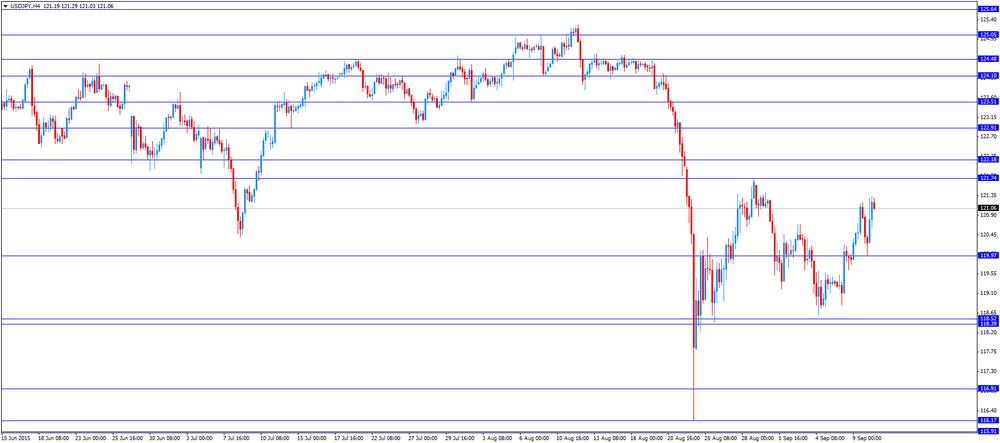

USD/JPY: the currency pair increased to Y121.33

The most important news that are expected (GMT0):

12:30 Canada Capacity Utilization Rate Quarter II 82.7% 81.7%

12:30 Canada New Housing Price Index, MoM July 0.3% 0.2%

12:30 U.S. Import Price Index August -0.9% -1.6%

12:30 U.S. Initial Jobless Claims September 282 275

14:00 U.S. Wholesale Inventories July 0.9% 0.3%

23:50 Japan BSI Manufacturing Index Quarter III -6

-

13:49

Orders

EUR/USD

Offers 1.1225 1.1250 1.1270-75 1.1300 1.1320 1.1335 1.1350 1.1390-1.140

Bids 1.1175-80 1.1160 1.1145-50 1.1120 1.1100 1.1085 1.1070 1.1050

GBP/USD

Offers 1.5500/10 1.5450

Bids 1.5330/20 1.5305/00 1.5290

EUR/GBP

Offers 0.7300-05 0.7320 0.7350 0.7380-85 0.7400

Bids 0.7260-65 0.7250 0.7225-30 0.7200 0.7185 0.7155-60

EUR/JPY

Offers 135.50 135.80 136.00 136.30 136.50 136.80 137.00

Bids 135.00 134.80-85 134.65 134.50 134.30 134.00

USD/JPY

Offers 121.00 121.20 121.35 121.50 121.80 122.00

Bids 102.60-65 120.40 120.25 120.00 119.80-85 119.50

AUD/USD

Offers 0.7080-85 0.7100 0.0.7120-25 0.7150 0.7180 0.7200

Bids 0.7045-50 0.7020 0.7000 0.6980-85 0.6965 0.6950

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

11:33

Reserve Bank of New Zealand lowers its interest rate to 2.75 from 3.00%

The Reserve Bank of New Zealand (RBNZ) released its interest rate decision on Wednesday. The RBNZ lowered its interest rate to 2.75% from 3.00% on Wednesday as widely expected by analysts. The central bank noted that further monetary policy easing is possible.

"Some further easing in the Official Cash Rate (OCR) seems likely. This will depend on the emerging flow of economic data," the RBNZ Governor Graeme Wheeler said.

Market participants were surprised by the RBNZ governor's comments.

Wheeler noted the country's economy is adjusting to the drop in export prices, and is now growing at an annual rate of around 2%.

He pointed out that further depreciation of the New Zealand dollar is appropriate.

-

11:21

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E680mn), $1.1150(E893mn), $1.1200(E1.16bn)

USD/JPY: Y118.75-85($1.0bn), Y120.00($1.74bn), Y120.60-70($650mn), Y121.00($1.4bn), Y121.05-20($900mn), Y121.50($919mn)

EUR/JPY: Y135.00(E300mn)

GBP/USD: $1.5400(GBP239mn), $1.5520(Gbp235mn) *EUR/GBP: GBP0.7300(E542mn)

AUD/USD: $0.7000(A$697mn, $0.7100(A$294mn) *NZD/USD: $0.6500(NZ1.47bn)

USD/CAD: C$1.3100($583mn), C$1.3200($466mn), C$1.3300($375mn), C$1.3350($1.12bn)

-

11:07

House prices in the U.K. rise 2.7% in August

Halifax released its house prices data for the U.K. on Thursday. House prices in the U.K. increased 2.7% in August, after a 0.4% fall in July. July's figure was revised up from a 0.6% decline.

On a yearly basis, house prices climbed 9.0% in the three months to August, after a 7.8% increase in the three months to July. July's figure was revised down from a 7.8% gain.

"The shortage of second-hand properties for sale on the market is resulting in upward pressure on house prices. At the same time, economic recovery, real earnings growth and very low mortgage rates are supporting housing demand. Strengthening demand and highly constrained supply are likely to mean that house price growth continues to be robust in the short-term," Halifax's housing economist Martin Ellis said.

-

10:51

Industrial production in Spain increases 0.6% in July

Spanish statistical office INE released its industrial production figures for Spain on Thursday. Industrial production in Spain was up 0.6% in July, after a 0.4% gain in June.

On a yearly basis, industrial production in Spain climbed at adjusted 5.2% in July, after a 4.5% increase in June.

Output of capital goods jumped 10.2% year-on-year in July, output of intermediate goods climbed 3.6%, energy production was up 9.4%, while consumer goods output rose 1.5%.

-

10:43

French industrial production falls 0.8% in July

The French statistical office Insee its industrial production figures on Thursday. Industrial production in France fell 0.8% in July, missing expectations for a 0.2% rise, after a flat reading in June. June's figure was revised up from a 0.1% decline.

The decline was driven by a drop in electrical and electronic equipment output, which fell 2.0%.

Manufacturing output was down 1.0% in July, while construction output increased 1.0%.

Output in mining and quarrying, energy, water supply and waste management declined 0.4% in July.

On a yearly basis, the French industrial production rose 0.7% in July, after a 1.0% gain in June. June's figure was revised up from a 0.7% increase.

-

10:33

Australia's unemployment rate is down to 6.2% in August

The Australian Bureau of Statistics released its labour market data on Thursday. Australia's unemployment rate fell to 6.2% in August from 6.3% in July, in line with expectations.

The number of employed people in Australia climbed by 17,400 in August, beating forecast of a rise by 5,000, after a gain by 39,200 in July. July's figure was revised up from a rise by 37,900.

Full-time employment rose by 11,500 in August, while part-time employment climbed by 5,900.

The participation rate declined to 65.0% in August from 65.1% in July.

-

10:25

Chinese consumer price index rises at annual rate of 2.0% in August

The Chinese National Bureau of Statistics released its consumer and producer price inflation data for China on Thursday. The Chinese consumer price index (CPI) rose at annual rate of 2.0% in August, exceeding expectations for a 1.8% increase, after a 1.6% gain in July.

The increase was driven by rises in food prices. Food prices rose at an annual rate of 3.7% in August, while non-food prices increased 1.1%.

On a monthly basis, consumer price inflation increased 0.5% in August, after a 0.3% rise in July.

The Chinese producer price index (PPI) dropped 5.9% in August, missing forecasts of a 5.5% fall, after a 5.4% decline in July. It was the biggest decline since 2009.

-

08:47

France: Industrial Production, y/y, July 0.7%

-

08:46

France: Industrial Production, m/m, July -0.8% (forecast 0.2%)

-

08:33

Options levels on thursday, September 10, 2015:

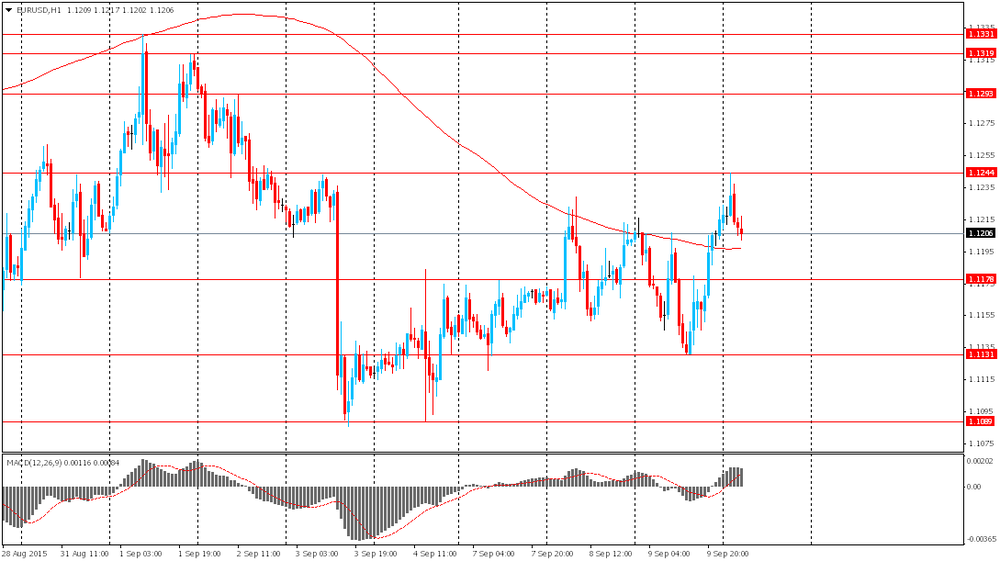

EUR / USD

Resistance levels (open interest**, contracts)

$1.1382 (1210)

$1.1334 (1207)

$1.1297 (530)

Price at time of writing this review: $1.1222

Support levels (open interest**, contracts):

$1.1153 (422)

$1.1123 (972)

$1.1082 (2127)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 45296 contracts, with the maximum number of contracts with strike price $1,1500 (4642);

- Overall open interest on the PUT options with the expiration date October, 9 is 58282 contracts, with the maximum number of contracts with strike price $1,0700 (5833);

- The ratio of PUT/CALL was 1.29 versus 1.33 from the previous trading day according to data from September, 9

GBP/USD

Resistance levels (open interest**, contracts)

$1.5605 (1353)

$1.5508 (2180)

$1.5412 (647)

Price at time of writing this review: $1.5367

Support levels (open interest**, contracts):

$1.5289 (678)

$1.5193 (2694)

$1.5095 (1450)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 19602 contracts, with the maximum number of contracts with strike price $1,5500 (2180);

- Overall open interest on the PUT options with the expiration date October, 9 is 18023 contracts, with the maximum number of contracts with strike price $1,5200 (2694);

- The ratio of PUT/CALL was 0.92 versus 0.90 from the previous trading day according to data from September, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

Foreign exchange market. Asian session: the New Zealand dollar fell after a rate cut

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia Changing the number of employed August 39.2 Revised From 37.9 5 17.4

01:30 Australia Unemployment rate August 6.3% 6.2% 6.2%

01:30 China PPI y/y August -5.4% -5.5% -5.9%

01:30 China CPI y/y August 1.6% 1.8% 2.0%

The yen fell against the U.S. dollar after senior LDP lawmaker Yamamoto unexpectedly said that the Bank of Japan should expand its asset purchases by ¥10 trillion at its meeting on October 30. He added that reaching the 2% inflation target in the first half of 2016 is BOJ's top priority. Earlier Japan Prime Minister Abe also noted the need for additional stimulating measures. His words have great influence on markets as his party will stay in charge for the coming three years.

The Australian dollar advanced against the greenback amid positive employment data. The unemployment rate came in at 6.2% in August. The reading matched expectations and slid below the 6.3% level seen in July.

The New Zealand dollar fell against the U.S. dollar after the Reserve Bank of New Zealand cut its benchmark rate by 25 basis points to 2.75% and signaled that further easing is possible. RBNZ Governor Wheeler said that lower official cash rate was needed to cushion drop in export prices

EUR/USD: the pair fluctuated within $1.1195-45 in Asian trade

USD/JPY: the pair rose to Y121.30

GBP/USD: the pair traded within $1.5350-60

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Industrial Production, m/m July -0.1% 0.2%

06:45 France Industrial Production, y/y July 1.0%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility

11:00 United Kingdom MPC Rate Statement

12:30 Canada Capacity Utilization Rate Quarter II 82.7% 81.7%

12:30 Canada New Housing Price Index, MoM July 0.3% 0.2%

12:30 U.S. Import Price Index August -0.9% -1.6%

12:30 U.S. Continuing Jobless Claims August 2257 2250

12:30 U.S. Initial Jobless Claims September 282 275

14:00 U.S. Wholesale Inventories July 0.9% 0.3%

15:00 U.S. Crude Oil Inventories September 4.667 0.2

23:50 Japan BSI Manufacturing Index Quarter III -6

-

03:31

Australia: Changing the number of employed, August 17.4 (forecast 5)

-

03:30

China: CPI y/y, August 2.0% (forecast 1.8%)

-

03:30

China: PPI y/y, August -5.9% (forecast -5.5%)

-

03:30

Australia: Unemployment rate, August 6.2% (forecast 6.2%)

-

01:51

Japan: Core Machinery Orders, August -3.6% (forecast 3.7%)

-

01:51

Japan: Core Machinery Orders, y/y, August 2.8% (forecast 10.5%)

-

00:37

Currencies. Daily history for Sep 9’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1215 +0,12%

GBP/USD $1,5359 -0,20%

USD/CHF Chf0,9754 -0,32%

USD/JPY Y120,40 +0,43%

EUR/JPY Y135,01 +0,53%

GBP/JPY Y184,91 +0,23%

AUD/USD $0,6982 -0,53%

NZD/USD $0,6288 -0,81%

USD/CAD C$1,3260 +0,38%

-

00:00

Schedule for today, Thursday, Sep 10’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Changing the number of employed August 38.5 5

01:30 Australia Unemployment rate August 6.3% 6.2%

01:30 China PPI y/y August -5.4% -5.5%

01:30 China CPI y/y August 1.6% 1.8%

06:45 France Industrial Production, m/m July -0.1% 0.2%

06:45 France Industrial Production, y/y July 1.0%

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility

11:00 United Kingdom MPC Rate Statement

12:30 Canada Capacity Utilization Rate Quarter II 82.7% 81.7%

12:30 Canada New Housing Price Index, MoM July 0.3% 0.2%

12:30 U.S. Import Price Index August -0.9% -1.6%

12:30 U.S. Continuing Jobless Claims August 2257 2250

12:30 U.S. Initial Jobless Claims September 282 275

14:00 U.S. Wholesale Inventories July 0.9% 0.3%

15:00 U.S. Crude Oil Inventories September 4.667

23:50 Japan BSI Manufacturing Index Quarter III -6

-