Noticias del mercado

-

23:00

New Zealand: RBNZ Interest Rate Decision, 2.75% (forecast 2.75%)

-

18:00

European stocks closed: FTSE 100 6,229.01 +82.91 +1.35% CAC 40 4,664.59 +66.33 +1.44% DAX 10,303.12 +31.76 +0.31%

-

17:03

NIESR’s gross domestic product rises by 0.5% in three months to August

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to August, after a 0.6% growth in three months to July. The previous reading was revised down from a 0.7% growth.

"We expect an average rate of growth of 2.5 per cent for 2015 as a whole," the NIESR said.

The think tank expects the Bank of England to raise its interest rate in February 2016.

-

16:45

China’s National Bureau of Statistics (NBS) plans to change the GDP calculation

China's National Bureau of Statistics (NBS) said on Wednesday that it plans to change the GDP calculation. The statistics bureau wants to adopt international standards and to improve the accuracy.

The third-quarter GDP data is scheduled to be released on October 19. The statistics bureau wants to use the new methodology.

-

16:33

Bank of Canada kept its interest rate unchanged at 0.50%

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%. This decision was expected by analysts.

The BoC said that inflation in Canada was driven by lower energy prices.

The central bank noted that "Canada's resource sector continues to adjust to lower prices for oil and other commodities".

The BoC pointed out that the pace of the global recovery is unclear as uncertainty about growth prospects for China and other emerging economies increased.

Risks to the country's financial stability are evolving as expected, the central bank said.

The BoC lowered its interest rate to 0.50% from 0.75% at its last meeting in July.

-

16:21

Job openings jump to 5.753 million in July, the highest reading since December 2000

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Wednesday. Job openings jumped to 5.753 million in July from 5.323 million in June. It was the highest reading since the series began in December 2000.

June's figure was revised up from 5.249 million.

The number of job openings increased for total private (5.266 million) and for government (486,000) in July.

The hires rate was 3.5% in July.

Total separations declined to 4.716 million in July from 4.906 million in June.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:02

U.S.: JOLTs Job Openings, July 5.753 (forecast 5.288)

-

16:00

United Kingdom: NIESR GDP Estimate, Quarter III 0.5%

-

16:00

Canada: Bank of Canada Rate, 0.5% (forecast 0.5%)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E924mn), $1.1050(E557mn), $1.1100(E276mn), $1.1175(E540mn)

USD/JPY: Y120.00($2.32bn), Y121.00($352mn), Y122.00($535mn)

EUR/GBP: GBP0.7400(E617mn)

AUD/USD: $0.7000(A$379mn), $0.7160(A$301mn)

USD/CAD: C$1.3200($336mn)

-

15:20

Unemployment rate in the OECD area remains unchanged at 6.8% in July

The Organization for Economic Cooperation and Development (OECD) released its unemployment rate figures on Wednesday. The OECD unemployment rate remained unchanged at 6.8% in July.

The unemployment rate in Eurozone was down by 0.2% to 10.9% in July. The highest unemployment rate was recorded in Spain with 22.2%.

The U.S. unemployment rate fell by 0.2% to 5.1% in August from 5.3 in July.

41.6 million people were unemployed in the OECD area in July.

The youth unemployment fell to 14.0% in July from 14.3 in June. The highest youth unemployment was in Spain with 48.6%, followed by Italy with 40.5% and Portugal with 31%.

-

15:02

Greek consumer prices decline 0.4% in August

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices fell 0.4% in August, after the 1.3% drop in July.

On a yearly basis, the Greek consumer price index declined 1.5% in August, after a 2.2 drop in July. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 7.3% in August, transport costs dropped by 4.3%, clothing and footwear prices declined 6.8%, while household equipment prices were down 2.2%.

Prices of food and non-alcoholic beverages increased at an annual rate of 4.3% in August, while alcoholic beverages and tobacco prices climbed by 2.1%.

-

14:48

Greek industrial production climbs 7.5% in July

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Wednesday. Greek industrial production climbed 7.5% in July, after a 4.2% rise in June.

On a yearly basis, industrial production in Greece declined at an adjusted rate of 1.6% in July, after a 4.7% fall in June. June's figure was revised down from a 4.5% decrease.

Production in the manufacturing sector fell at an annual rate of 5.7% in July, output in the mining and quarrying sector slid 4.8%, while electricity production jumped by 13.8%.

-

14:37

Building permits in Canada fall 0.6% in July

Statistics Canada released housing market data on Wednesday. Building permits in Canada fell 0.6% in July, beating expectations for a 5.0% drop, after a 15.5% rise in June. June's figure was revised up from a 14.8% increase.

The decline was driven by lower construction intentions in the non-residential sector.

Building permits for non-residential construction dropped 13.9% in July, while permits in the residential sector climbed 8.7%.

-

14:30

Canada: Building Permits (MoM) , July -0.6% (forecast -5%)

-

14:24

Housing starts in Canada rises to a seasonally adjusted annualized rate of 216,924 units in August

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Wednesday. Housing starts in Canada rose to a seasonally adjusted annualized rate of 216,924 units in August from a revised reading of 193,253 units in July. July's figure was revised up from 193,032 units.

The increase was driven by a rise in condominium activity in Toronto.

"Housing starts have been trending up, supported by strong condominium activity in Toronto," the CMHC's Chief Economist Bob Dugan said.

He added that demand shifted from new higher-priced single-detached homes towards lower-priced alternatives.

-

14:14

Canada: Housing Starts, August 216.9 (forecast 190)

-

14:11

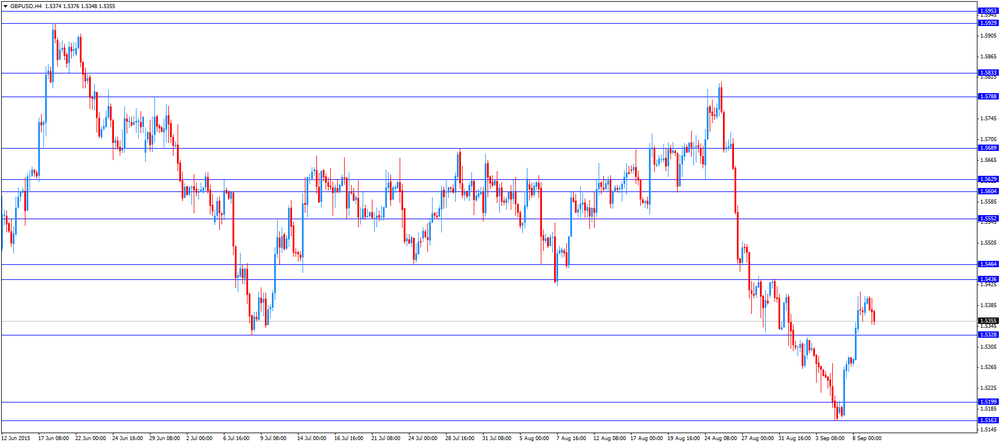

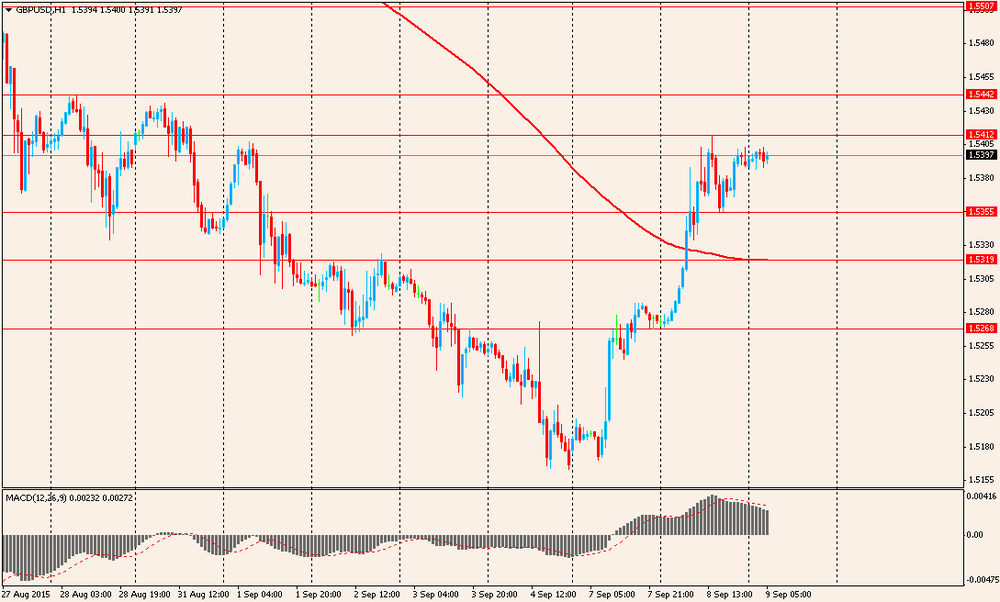

Foreign exchange market. European session: the British pound traded lower against the U.S. dollar after the release of the weak economic data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia Westpac Consumer Confidence September 7.8% -5.6%

01:30 Australia Home Loans July 4.8% Revised From 4.4% 0.8% 0.3%

02:00 Australia RBA Assist Gov Lowe Speaks

05:00 Japan Consumer Confidence August 40.3 41.7

06:00 Japan Prelim Machine Tool Orders, y/y August 1.7% Revised From 1.6% -16.5%

08:30 United Kingdom Industrial Production (MoM) July -0.4% 0.1% -0.4%

08:30 United Kingdom Industrial Production (YoY) July 1.5% 1.4% 0.8%

08:30 United Kingdom Manufacturing Production (MoM) July 0.2% 0.2% -0.8%

08:30 United Kingdom Manufacturing Production (YoY) July 0.5% 0.5% -0.5%

08:30 United Kingdom Total Trade Balance July -0.82 Revised From -1.6 -3.37

09:00 Australia RBA Assist Gov Debelle Speaks

11:00 U.S. MBA Mortgage Applications September 11.3% -6.2%

The U.S. dollar traded mixed against the most major currencies ahead of the release job openings data from the U.S. Job openings in the U.S. are expected to rise to 5.288 million in July from 5.249 million in June.

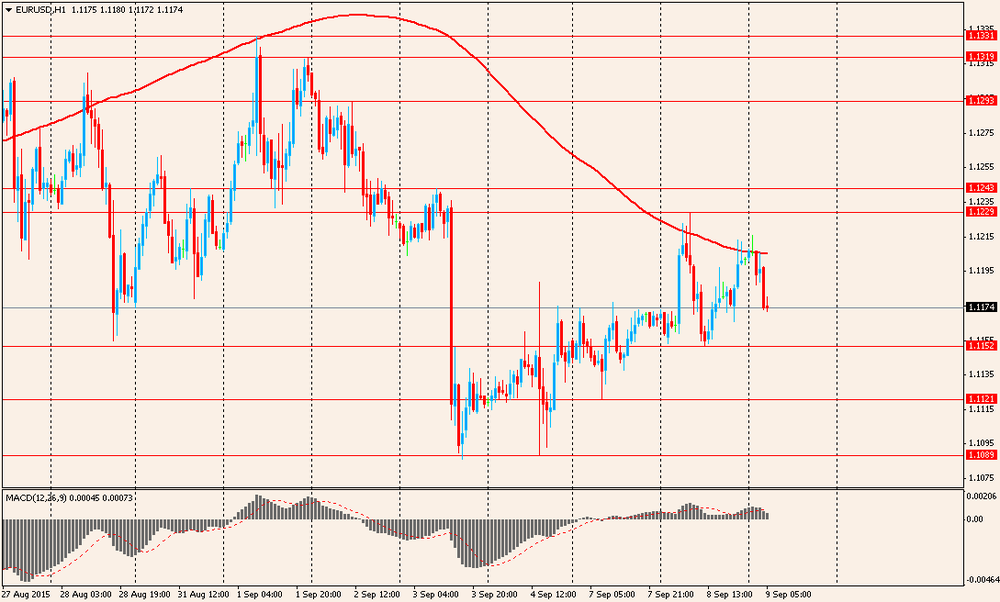

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

The British pound traded lower against the U.S. dollar after the release of the weak economic data from the U.K. The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. decline 0.8% in July, missing expectations for a 0.2% gain, after a 0.2% increase in June.

Manufacturing output was driven by a drop in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.5% in July, missing forecast of a 0.5% gain, after a 0.5% rise in June.

Industrial production in the U.K. dropped 0.4% in July, missing forecasts of a 0.1% rise, after a 0.4% fall in June.

On a yearly basis, industrial production in the U.K. gained 0.8% in July, missing expectations for a 1.4% rise, after a 1.5% increase in June.

The U.K. trade deficit in goods widened to £11.1 billion in July from £8.51 billion in June.

Exports of goods fell 9.2% in July, the biggest decline in percentage terms since July 2006, while imports rose 0.8%.

The rise in the trade deficit was driven by a decline in exports of chemicals and manufactured goods.

The total trade deficit, including services, widened to £3.37 billion in July from £0.82 billion in June. June's figure was revised up from a deficit of £1.6 billion.

The Canadian dollar traded lower against the U.S. dollar ahead of the Bank of Canada's interest rate decision. Analysts expect the central bank to keep its interest rate unchanged at 0.5%.

Housing starts in Canada are expected to decline to 190,000 units August from 193,000 units in July.

The Canadian building permits are expected to drop 5.0% in July, after a 14.8% rise in June.

EUR/USD: the currency pair fell to $1.1134

GBP/USD: the currency pair declined to $1.5348

USD/JPY: the currency pair increased to Y120.94

The most important news that are expected (GMT0):

12:15 Canada Housing Starts August 193 190

12:30 Canada Building Permits (MoM) July 14.8% -5%

14:00 United Kingdom NIESR GDP Estimate Quarter III 0.7%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 U.S. JOLTs Job Openings July 5.249 5.288

21:00 New Zealand RBNZ Interest Rate Decision 3% 2.75%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders August -7.9% 3.7%

23:50 Japan Core Machinery Orders, y/y August 16.6% 10.5%

-

13:45

Orders

EUR/USD

Offers 1.1270/75 1.1220/30

Bids 1.1140 1.1125/20 1.1070-50 1.1000

GBP/USD

Offers 1.5500/10

Bids 1.5330/20 1.5305/00

EUR/GBP

Offers 0.7395/00

Bids 0.7200/190

EUR/JPY

Offers 136.00 135.20

Bids 134.75/70 134.00 133.20/00

USD/JPY

Offers 122.00 121.45/50 121.00

Bids 120.05/00 119.40/25 119.05/00

AUD/USD

Offers 0.7200 0.7120 0.7100

Bids 0.7000 0.6950 0.6910/00

-

13:00

U.S.: MBA Mortgage Applications, September -6.2%

-

11:28

U.K. trade deficit in goods widens to £11.1 billion in July

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Wednesday. The U.K. trade deficit in goods widened to £11.1 billion in July from £8.51 billion in June.

Exports of goods fell 9.2% in July, the biggest decline in percentage terms since July 2006, while imports rose 0.8%.

The rise in the trade deficit was driven by a decline in exports of chemicals and manufactured goods.

The total trade deficit, including services, widened to £3.37 billion in July from £0.82 billion in June. June's figure was revised up from a deficit of £1.6 billion.

-

11:23

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E924mn), $1.1050(E557mn), $1.1100(E276mn), $1.1175(E540mn)

USD/JPY: Y120.00($2.32bn), Y121.00($352mn), Y122.00($535mn)

EUR/GBP: GBP0.7400(E617mn)

AUD/USD: $0.7000(A$379mn), $0.7160(A$301mn)

USD/CAD: C$1.3200($336mn)

-

11:15

U.K. manufacturing production declines 0.8% in July, but industrial production drops 0.4%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. decline 0.8% in July, missing expectations for a 0.2% gain, after a 0.2% increase in June.

Manufacturing output was driven by a drop in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.5% in July, missing forecast of a 0.5% gain, after a 0.5% rise in June.

Industrial production in the U.K. dropped 0.4% in July, missing forecasts of a 0.1% rise, after a 0.4% fall in June.

On a yearly basis, industrial production in the U.K. gained 0.8% in July, missing expectations for a 1.4% rise, after a 1.5% increase in June.

-

11:07

Consumer confidence in Australia drops 5.6% in September

According to a survey from Westpac Bank and the Melbourne Institute, consumer confidence in Australia dropped 5.6% in September, after a 7.8% in August.

The decline was driven by a weak GDP data and a drop in the Australian dollar.

-

11:01

Home loans in Australia are up 0.3% in July

The Australian Bureau of Statistics released its home loans data on Tuesday. Home loans in Australia increased 0.3% in July, missing expectations for a 0.8% gain, after 4.8% rise in June. June's figure was revised up from 4.4% gain.

The value of home loans rose 2.2% in July, investment lending increased 0.5%, while the number of loans for the construction of dwellings declined 0.9%.

-

10:50

Consumer credit in the U.S. increases by $19.1 billion in July

The Fed released its consumer credits figures on Tuesday. Consumer credit in the U.S. rose by $19.1 billion in July, exceeding expectations for a $18.5 billion increase, after a $27.02 billion gain June. June's figure was revised up from a $20.74 billion rise.

The increase was driven by gains in both revolving and non-revolving credit. Revolving credit climbed by $5.7 billion in July, while non-revolving credit jumped by $7.0 billion.

-

10:43

Conference Board’s employment trends index for the U.S. rises to 128.82 in August

The Conference Board (CB) released its employment trends index for the U.S. on Tuesday. The index rose to 128.82 in August from 127.64 in July. July's figure was revised down from 127.89.

"The large increase in the Employment Trends Index in August suggests that a significant moderation in employment growth is unlikely to occur in the coming months. With solid job growth expected to continue, the unemployment rate is likely to go below 5 percent by year's end," Gad Levanon, director of macroeconomic research at the CB, said.

-

10:34

French Finance Minister Michel Sapin: the recovery in France is better, but not sufficient

French Finance Minister Michel Sapin said on Tuesday that the recovery in France is better, but not sufficient. He expects the economic growth to exceed 1% this year.

The government forecasts the French economy to expand 1.5% by the end of the year.

Sapin noted that a 1.5% growth could lead to a sustainable reduction in unemployment.

-

10:30

United Kingdom: Industrial Production (MoM), July -0.4% (forecast 0.1%)

-

10:30

United Kingdom: Industrial Production (YoY), July 0.8% (forecast 1.4%)

-

10:30

United Kingdom: Manufacturing Production (YoY), July -0.5% (forecast 0.5%)

-

10:30

United Kingdom: Total Trade Balance, July -3.37

-

10:30

United Kingdom: Manufacturing Production (MoM) , July -0.8% (forecast 0.2%)

-

10:17

A European business lobby: the Chinese government is losing momentum in the implementation of reforms

A European business lobby said on Tuesday that the Chinese government is losing momentum in the implementation of reforms.

China is expected to show its slowest economic growth in 25 years in 2015 and stock markets dropped 40% since mid-June.

The European Union Chamber President Joerg Wuttke said that there is still strong potential for growth in China but the Chinese government should implement reforms faster.

-

10:12

Oil production from the Organization of the Petroleum Exporting Countries (OPEC) declines by 140,000 barrels per day in August

According to Platts, a global provider of energy, petrochemicals, metals and agriculture information, oil production from the Organization of the Petroleum Exporting Countries (OPEC) declined by 140,000 barrels per day (b/d) to 31.26 million b/d in August from 31.4 million b/d in July as several member countries, including Saudi Arabia, cut its output.

Margaret McQuaile, senior correspondent for Platts, said that it is the first decline in oil production since February. She added that "it shouldn't be over-interpreted".

"The August total still puts OPEC exceeding its official ceiling by 1.26 million b/d and Saudi oil is still flowing at record levels," McQuaile pointed out.

-

08:28

Options levels on wednesday, September 9, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1330 (1342)

$1.1292 (530)

$1.1252 (725)

Price at time of writing this review: $1.1162

Support levels (open interest**, contracts):

$1.1095 (933)

$1.1050 (2835)

$1.1023 (1690)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 43144 contracts, with the maximum number of contracts with strike price $1,1500 (4189);

- Overall open interest on the PUT options with the expiration date October, 9 is 57482 contracts, with the maximum number of contracts with strike price $1,0700 (5856);

- The ratio of PUT/CALL was 1.33 versus 1.34 from the previous trading day according to data from September, 8

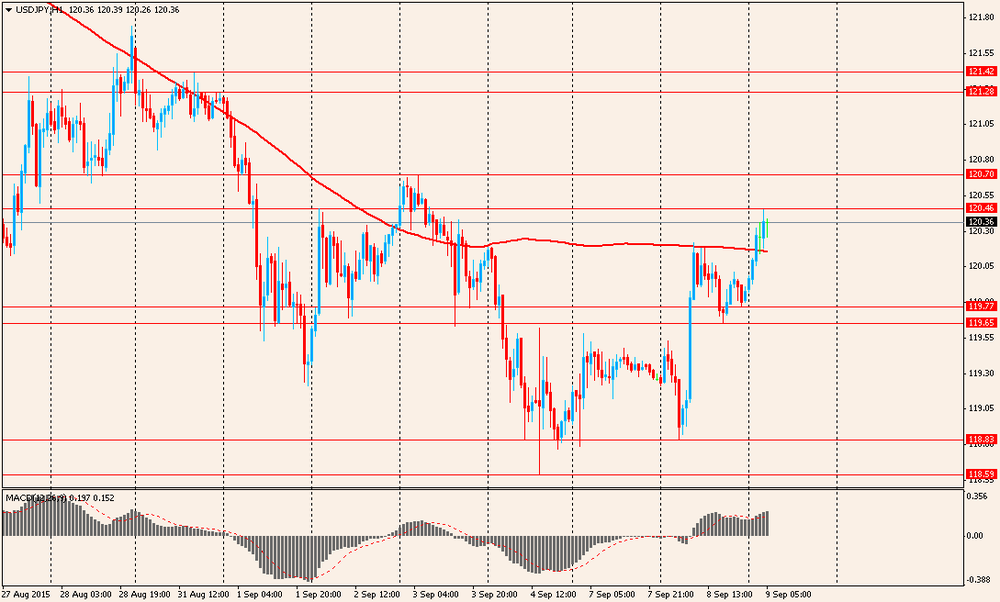

GBP/USD

Resistance levels (open interest**, contracts)

$1.5606 (1160)

$1.5509 (1948)

$1.5414 (648)

Price at time of writing this review: $1.5373

Support levels (open interest**, contracts):

$1.5290 (449)

$1.5193 (1967)

$1.5095 (1243)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 18211 contracts, with the maximum number of contracts with strike price $1,5500 (1948);

- Overall open interest on the PUT options with the expiration date October, 9 is 16469 contracts, with the maximum number of contracts with strike price $1,5200 (1967);

- The ratio of PUT/CALL was 0.90 versus 0.97 from the previous trading day according to data from September, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:25

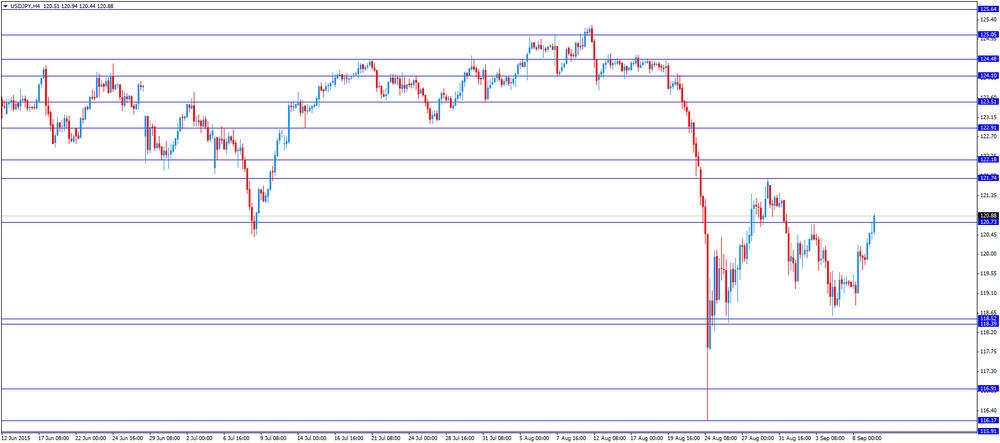

Foreign exchange market. Asian session: the yen declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia Westpac Consumer Confidence September 7.8% -5.6%

01:30 Australia Home Loans July 4.4% 0.8% 0.3%

02:00 Australia RBA Assist Gov Lowe Speaks

05:00 Japan Consumer Confidence August 40.3 41.7

06:00 Japan Prelim Machine Tool Orders, y/y August 1.6% -16.5%

The yen continued weakening against the U.S. dollar as gains in Asian stock markets reduced demand for this safe-haven currency. Today Japanese Nikkei climbed over 5%. Investors were optimistic as Chinese and U.S. markets closed with gains previously. Besides, yesterday's weak data from China spurred hopes for additional stimulating steps from the People's Bank of China.

The Australian dollar rose slightly despite pessimistic consumer confidence and home loans data. Westpac consumer confidence index declined to -5.6% in September from 7.8% reported previously because of volatility in financial markets and concerns over China's economy. Meanwhile the number of home loans fell to 0.3% in July from 4.4% reported previously. Economists expected a 0.8% reading.

The Canadian dollar rose against the greenback ahead of meetings of central banks of corresponding countries. Analysts tend to believe that both banks will keep their interest rates unchanged. The central bank of Canada meets today, while Federal Reserve policymakers meet next week.

EUR/USD: the pair fell to $1.1165 in Asian trade

USD/JPY: the pair rose to Y120.45

GBP/USD: the pair traded within $1.5385-05

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:30 United Kingdom Industrial Production (MoM) July -0.4% 0.1%

08:30 United Kingdom Industrial Production (YoY) July 1.5% 1.4%

08:30 United Kingdom Manufacturing Production (MoM) July 0.2% 0.2%

08:30 United Kingdom Manufacturing Production (YoY) July 0.5% 0.5%

08:30 United Kingdom Total Trade Balance July -1.6

09:00 Australia RBA Assist Gov Debelle Speaks

11:00 U.S. MBA Mortgage Applications September 11.3%

12:15 Canada Housing Starts August 193 190

12:30 Canada Building Permits (MoM) July 14.8% -5%

14:00 United Kingdom NIESR GDP Estimate Quarter III 0.7%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 U.S. JOLTs Job Openings July 5.249 5.288

21:00 New Zealand RBNZ Interest Rate Decision 3% 2.75%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders August -7.9% 3.7%

23:50 Japan Core Machinery Orders, y/y August 16.6% 10.5%

-

08:02

Japan: Prelim Machine Tool Orders, y/y , August -16.5%

-

07:46

Japan: Consumer Confidence, August 41.7

-

03:30

Australia: Home Loans , July 0.3% (forecast 0.8%)

-

02:30

Australia: Westpac Consumer Confidence, September -5.6%

-

00:27

Currencies. Daily history for Sep 8’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1202 +0,31%

GBP/USD $1,5389 +0,75%

USD/CHF Chf0,9785 +0,36%

USD/JPY Y119,88 +0,52%

EUR/JPY Y134,30 +0,83%

GBP/JPY Y184,49 +1,27%

AUD/USD $0,7019 +1,30%

NZD/USD $0,6339 +1,10%

USD/CAD C$1,3209 -0,72%

-