Noticias del mercado

-

21:00

Dow -0.70% 16,376.83 -115.85 Nasdaq -0.41% 4,792.04 -19.89 S&P -0.64% 1,956.73 -12.68

-

18:24

WSE: Session Results

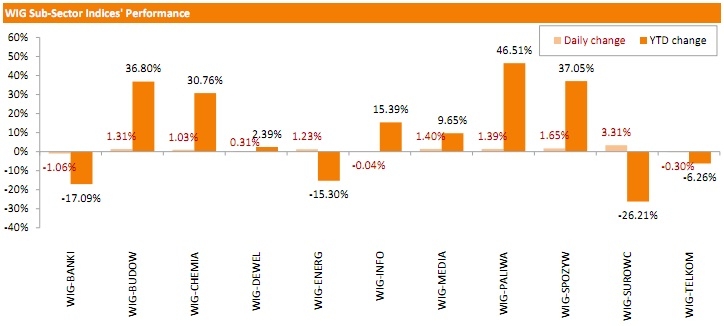

Polish equity market closed higher on Wednesday. The broad market measure, the WIG Index, rose by 0.32%. Sector-wise, materials sector (+3.31%) fared the best, while banking sector (-1.06%) lagged behind.

The large-cap stocks' measure, the WIG30 Index, surged by 0.48%. Within the WIG30 Index components, KGHM (WSE: KGH) led the gainers pack with a 3.67% advance, supported by uptick in copper prices. It was followed by LOTOS (WSE: LTS), KERNEL (WSE: KER) and ENERGA (WSE: ENG), gaining 3.08%, 3.06% and 2.98% respectively. On the other side of the ledger, all banking names, but for ING BSK (WSE: ING; +0.78%) tumbled, losing between 0.45-2.31%. Elsewhere, PKP CARGO (WSE: PKP) closed its first day as index component with a 1.21% drop. The stock replaced TVN, which is to be delisted from the WSE.

-

18:13

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes trimmed early gains and was little changed in late morning trading on Wednesday as the rally fueled by hopes of further stimulus measures in China faded. China's Ministry of Finance said on Wednesday the government will strengthen fiscal policy, boost infrastructure spending and speed up reform of its tax system, adding to other steps to reenergize sputtering growth.

Most of Dow stocks in negative area (20 of 30). Top looser - The Walt Disney Company (DIS, -0.71%). Top gainer - The Goldman Sachs Group, Inc. (GS, +1.36).

Most of S&P index sectors also in negative area. Top looser - Healthcare (-0.5%). Top gainer - Conglomerates (+0,4%).At the moment:

Dow 16492.00 +40.00 +0.24%

S&P 500 1969.50 +3.75 +0.19%

Nasdaq 100 4312.00 +13.50 +0.31%

10 Year yield 2,23% +0,03

Oil 45.15 -0.79 -1.72%

Gold 1106.60 -14.40 -1.28%

-

18:00

European stocks close: stocks closed higher as Asian stock indices rose on news from China

Stock indices closed higher as Asian stock indices rose on news from China. China's Finance Ministry announced on Wednesday that it would strengthen fiscal policy to boost the economy.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. decline 0.8% in July, missing expectations for a 0.2% gain, after a 0.2% increase in June.

Manufacturing output was driven by a drop in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.5% in July, missing forecast of a 0.5% gain, after a 0.5% rise in June.

Industrial production in the U.K. dropped 0.4% in July, missing forecasts of a 0.1% rise, after a 0.4% fall in June.

On a yearly basis, industrial production in the U.K. gained 0.8% in July, missing expectations for a 1.4% rise, after a 1.5% increase in June.

The U.K. trade deficit in goods widened to £11.1 billion in July from £8.51 billion in June.

Exports of goods fell 9.2% in July, the biggest decline in percentage terms since July 2006, while imports rose 0.8%.

The rise in the trade deficit was driven by a decline in exports of chemicals and manufactured goods.

The total trade deficit, including services, widened to £3.37 billion in July from £0.82 billion in June. June's figure was revised up from a deficit of £1.6 billion.

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to August, after a 0.6% growth in three months to July. The previous reading was revised down from a 0.7% growth.

"We expect an average rate of growth of 2.5 per cent for 2015 as a whole," the NIESR said.

The think tank expects the Bank of England to raise its interest rate in February 2016.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,229.01 +82.91 +1.35 %

DAX 10,303.12 +31.76 +0.31 %

CAC 40 4,664.59 +66.33 +1.44 %

-

17:03

NIESR’s gross domestic product rises by 0.5% in three months to August

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Wednesday. The GDP estimate rose by 0.5% in three months to August, after a 0.6% growth in three months to July. The previous reading was revised down from a 0.7% growth.

"We expect an average rate of growth of 2.5 per cent for 2015 as a whole," the NIESR said.

The think tank expects the Bank of England to raise its interest rate in February 2016.

-

16:45

China’s National Bureau of Statistics (NBS) plans to change the GDP calculation

China's National Bureau of Statistics (NBS) said on Wednesday that it plans to change the GDP calculation. The statistics bureau wants to adopt international standards and to improve the accuracy.

The third-quarter GDP data is scheduled to be released on October 19. The statistics bureau wants to use the new methodology.

-

16:33

Bank of Canada kept its interest rate unchanged at 0.50%

The Bank of Canada (BoC) released its interest rate decision on Wednesday. The central bank kept its interest rate unchanged at 0.50%. This decision was expected by analysts.

The BoC said that inflation in Canada was driven by lower energy prices.

The central bank noted that "Canada's resource sector continues to adjust to lower prices for oil and other commodities".

The BoC pointed out that the pace of the global recovery is unclear as uncertainty about growth prospects for China and other emerging economies increased.

Risks to the country's financial stability are evolving as expected, the central bank said.

The BoC lowered its interest rate to 0.50% from 0.75% at its last meeting in July.

-

16:21

Job openings jump to 5.753 million in July, the highest reading since December 2000

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Wednesday. Job openings jumped to 5.753 million in July from 5.323 million in June. It was the highest reading since the series began in December 2000.

June's figure was revised up from 5.249 million.

The number of job openings increased for total private (5.266 million) and for government (486,000) in July.

The hires rate was 3.5% in July.

Total separations declined to 4.716 million in July from 4.906 million in June.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

15:32

U.S. Stocks open: Dow +0.80%, Nasdaq +0.92%, S&P +0.72%

-

15:24

Before the bell: S&P futures +1.06%, NASDAQ futures +1.29%

U.S. stock-index futures advanced, after equities posted their second-biggest rally this year, as Japanese shares surged while optimism increased that China can tame its volatile markets.

Global Stocks:

Nikkei 18,770.51 +1,343.43 +7.71%

Hang Seng 22,131.31 +872.27 +4.10%

Shanghai Composite 3,243.92 +73.47 +2.32%

FTSE 6,273.56 +127.46 +2.07%

CAC 4,720.29 +122.03 +2.65%

DAX 10,459.3 +187.94 +1.83%

Crude oil $45.43 (-1.11%)

Gold $1118.40 (-0.23%)

-

15:20

Unemployment rate in the OECD area remains unchanged at 6.8% in July

The Organization for Economic Cooperation and Development (OECD) released its unemployment rate figures on Wednesday. The OECD unemployment rate remained unchanged at 6.8% in July.

The unemployment rate in Eurozone was down by 0.2% to 10.9% in July. The highest unemployment rate was recorded in Spain with 22.2%.

The U.S. unemployment rate fell by 0.2% to 5.1% in August from 5.3 in July.

41.6 million people were unemployed in the OECD area in July.

The youth unemployment fell to 14.0% in July from 14.3 in June. The highest youth unemployment was in Spain with 48.6%, followed by Italy with 40.5% and Portugal with 31%.

-

15:04

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.64

2.31%

107.4K

Tesla Motors, Inc., NASDAQ

TSLA

253.27

2.06%

14.6K

ALCOA INC.

AA

9.9

1.85%

12.2K

Goldman Sachs

GS

189.26

1.82%

7.5K

Yandex N.V., NASDAQ

YNDX

11.72

1.82%

1.7K

UnitedHealth Group Inc

UNH

117.65

1.78%

1K

Boeing Co

BA

136.09

1.70%

0.4K

AMERICAN INTERNATIONAL GROUP

AIG

59.99

1.27%

0.2K

Apple Inc.

AAPL

113.73

1.26%

558.7K

Nike

NKE

113

1.12%

0.1K

E. I. du Pont de Nemours and Co

DD

50.16

1.11%

0.5K

General Motors Company, NYSE

GM

30.2

1.07%

3.7K

Citigroup Inc., NYSE

C

52.2

1.06%

13.5K

Facebook, Inc.

FB

90.45

1.03%

114.2K

Amazon.com Inc., NASDAQ

AMZN

522.8

1.02%

18.4K

Cisco Systems Inc

CSCO

26.56

0.99%

6.9K

Google Inc.

GOOG

620.74

0.99%

2.3K

Twitter, Inc., NYSE

TWTR

27.45

0.99%

64.7K

JPMorgan Chase and Co

JPM

63.78

0.98%

5.0K

Pfizer Inc

PFE

32.85

0.98%

4.1K

Starbucks Corporation, NASDAQ

SBUX

55.75

0.98%

4.8K

Procter & Gamble Co

PG

70.65

0.96%

2.4K

The Coca-Cola Co

KO

39.27

0.95%

2.1K

Microsoft Corp

MSFT

44.3

0.93%

8.5K

Johnson & Johnson

JNJ

94.8

0.92%

3.9K

Verizon Communications Inc

VZ

46.3

0.92%

7.9K

Intel Corp

INTC

29.75

0.85%

26.9K

Walt Disney Co

DIS

104.86

0.82%

18.8K

Home Depot Inc

HD

117.35

0.79%

1.2K

AT&T Inc

T

33.4

0.78%

6.4K

ALTRIA GROUP INC.

MO

53.9

0.77%

3.2K

Hewlett-Packard Co.

HPQ

27.8

0.76%

0.3K

International Business Machines Co...

IBM

148.32

0.74%

0.7K

Ford Motor Co.

F

13.77

0.73%

50.6K

General Electric Co

GE

25.14

0.72%

39.0K

Wal-Mart Stores Inc

WMT

66.85

0.71%

3.7K

Caterpillar Inc

CAT

74.8

0.67%

0.6K

Chevron Corp

CVX

77.3

0.60%

0.6K

Exxon Mobil Corp

XOM

73.9

0.54%

4.5K

McDonald's Corp

MCD

97.3

0.54%

1.0K

Merck & Co Inc

MRK

52.91

0.42%

1.9K

American Express Co

AXP

75.7

0.28%

0.4K

Visa

V

70

-0.75%

5.0K

Barrick Gold Corporation, NYSE

ABX

6.45

-1.07%

2.0K

Yahoo! Inc., NASDAQ

YHOO

30.4

-1.62%

458.6K

-

15:02

Greek consumer prices decline 0.4% in August

The Hellenic Statistical Authority released its consumer price inflation data for Greece on Wednesday. Greek consumer prices fell 0.4% in August, after the 1.3% drop in July.

On a yearly basis, the Greek consumer price index declined 1.5% in August, after a 2.2 drop in July. Consumer prices in Greece declined since March 2013.

Housing prices plunged at an annual rate of 7.3% in August, transport costs dropped by 4.3%, clothing and footwear prices declined 6.8%, while household equipment prices were down 2.2%.

Prices of food and non-alcoholic beverages increased at an annual rate of 4.3% in August, while alcoholic beverages and tobacco prices climbed by 2.1%.

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Goldman Sachs (GS) upgraded to Buy from Neutral at BofA/Merrill, target $220

Downgrades:

Other:

Intel (INTC) initiated with a Buy at Sterne Agee CRT

Tesla (TSLA) initiated with Outperform at Oppenheimer, target $340

Yahoo! (YHOO) target lowered to $44 from $51 at JP Morgan

Yahoo! (YHOO) target lowered to $43 from $48 at Mizuho

-

14:48

Greek industrial production climbs 7.5% in July

The Hellenic Statistical Authority released its preliminary industrial production data for Greece on Wednesday. Greek industrial production climbed 7.5% in July, after a 4.2% rise in June.

On a yearly basis, industrial production in Greece declined at an adjusted rate of 1.6% in July, after a 4.7% fall in June. June's figure was revised down from a 4.5% decrease.

Production in the manufacturing sector fell at an annual rate of 5.7% in July, output in the mining and quarrying sector slid 4.8%, while electricity production jumped by 13.8%.

-

14:37

Building permits in Canada fall 0.6% in July

Statistics Canada released housing market data on Wednesday. Building permits in Canada fell 0.6% in July, beating expectations for a 5.0% drop, after a 15.5% rise in June. June's figure was revised up from a 14.8% increase.

The decline was driven by lower construction intentions in the non-residential sector.

Building permits for non-residential construction dropped 13.9% in July, while permits in the residential sector climbed 8.7%.

-

14:24

Housing starts in Canada rises to a seasonally adjusted annualized rate of 216,924 units in August

The Canada Mortgage and Housing Corporation (CMHC) released housing starts data on Wednesday. Housing starts in Canada rose to a seasonally adjusted annualized rate of 216,924 units in August from a revised reading of 193,253 units in July. July's figure was revised up from 193,032 units.

The increase was driven by a rise in condominium activity in Toronto.

"Housing starts have been trending up, supported by strong condominium activity in Toronto," the CMHC's Chief Economist Bob Dugan said.

He added that demand shifted from new higher-priced single-detached homes towards lower-priced alternatives.

-

12:03

European stock markets mid session: stocks traded higher as Asian stock indices rose on news from China

Stock indices traded higher as Asian stock indices rose on news from China. China's Finance Ministry announced on Wednesday that it would strengthen fiscal policy to boost the economy.

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. decline 0.8% in July, missing expectations for a 0.2% gain, after a 0.2% increase in June.

Manufacturing output was driven by a drop in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.5% in July, missing forecast of a 0.5% gain, after a 0.5% rise in June.

Industrial production in the U.K. dropped 0.4% in July, missing forecasts of a 0.1% rise, after a 0.4% fall in June.

On a yearly basis, industrial production in the U.K. gained 0.8% in July, missing expectations for a 1.4% rise, after a 1.5% increase in June.

The U.K. trade deficit in goods widened to £11.1 billion in July from £8.51 billion in June.

Exports of goods fell 9.2% in July, the biggest decline in percentage terms since July 2006, while imports rose 0.8%.

The rise in the trade deficit was driven by a decline in exports of chemicals and manufactured goods.

The total trade deficit, including services, widened to £3.37 billion in July from £0.82 billion in June. June's figure was revised up from a deficit of £1.6 billion.

Current figures:

Name Price Change Change %

FTSE 100 6,258.9 +112.80 +1.84 %

DAX 10,456.79 +185.43 +1.81 %

CAC 40 4,705.74 +107.48 +2.34 %

-

11:28

U.K. trade deficit in goods widens to £11.1 billion in July

The U.K. Office for National Statistics (ONS) released trade data for the U.K. on Wednesday. The U.K. trade deficit in goods widened to £11.1 billion in July from £8.51 billion in June.

Exports of goods fell 9.2% in July, the biggest decline in percentage terms since July 2006, while imports rose 0.8%.

The rise in the trade deficit was driven by a decline in exports of chemicals and manufactured goods.

The total trade deficit, including services, widened to £3.37 billion in July from £0.82 billion in June. June's figure was revised up from a deficit of £1.6 billion.

-

11:15

U.K. manufacturing production declines 0.8% in July, but industrial production drops 0.4%

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Wednesday. Manufacturing production in the U.K. decline 0.8% in July, missing expectations for a 0.2% gain, after a 0.2% increase in June.

Manufacturing output was driven by a drop in the vehicle production.

On a yearly basis, manufacturing production in the U.K. decreased 0.5% in July, missing forecast of a 0.5% gain, after a 0.5% rise in June.

Industrial production in the U.K. dropped 0.4% in July, missing forecasts of a 0.1% rise, after a 0.4% fall in June.

On a yearly basis, industrial production in the U.K. gained 0.8% in July, missing expectations for a 1.4% rise, after a 1.5% increase in June.

-

11:07

Consumer confidence in Australia drops 5.6% in September

According to a survey from Westpac Bank and the Melbourne Institute, consumer confidence in Australia dropped 5.6% in September, after a 7.8% in August.

The decline was driven by a weak GDP data and a drop in the Australian dollar.

-

11:01

Home loans in Australia are up 0.3% in July

The Australian Bureau of Statistics released its home loans data on Tuesday. Home loans in Australia increased 0.3% in July, missing expectations for a 0.8% gain, after 4.8% rise in June. June's figure was revised up from 4.4% gain.

The value of home loans rose 2.2% in July, investment lending increased 0.5%, while the number of loans for the construction of dwellings declined 0.9%.

-

10:50

Consumer credit in the U.S. increases by $19.1 billion in July

The Fed released its consumer credits figures on Tuesday. Consumer credit in the U.S. rose by $19.1 billion in July, exceeding expectations for a $18.5 billion increase, after a $27.02 billion gain June. June's figure was revised up from a $20.74 billion rise.

The increase was driven by gains in both revolving and non-revolving credit. Revolving credit climbed by $5.7 billion in July, while non-revolving credit jumped by $7.0 billion.

-

10:43

Conference Board’s employment trends index for the U.S. rises to 128.82 in August

The Conference Board (CB) released its employment trends index for the U.S. on Tuesday. The index rose to 128.82 in August from 127.64 in July. July's figure was revised down from 127.89.

"The large increase in the Employment Trends Index in August suggests that a significant moderation in employment growth is unlikely to occur in the coming months. With solid job growth expected to continue, the unemployment rate is likely to go below 5 percent by year's end," Gad Levanon, director of macroeconomic research at the CB, said.

-

10:34

French Finance Minister Michel Sapin: the recovery in France is better, but not sufficient

French Finance Minister Michel Sapin said on Tuesday that the recovery in France is better, but not sufficient. He expects the economic growth to exceed 1% this year.

The government forecasts the French economy to expand 1.5% by the end of the year.

Sapin noted that a 1.5% growth could lead to a sustainable reduction in unemployment.

-

10:17

A European business lobby: the Chinese government is losing momentum in the implementation of reforms

A European business lobby said on Tuesday that the Chinese government is losing momentum in the implementation of reforms.

China is expected to show its slowest economic growth in 25 years in 2015 and stock markets dropped 40% since mid-June.

The European Union Chamber President Joerg Wuttke said that there is still strong potential for growth in China but the Chinese government should implement reforms faster.

-

08:28

Global Stocks: U.S. and Asian stock indices gained

U.S. stock markets reopened on Tuesday and indices gained amid hopes for stimulus from China's government.

The Dow Jones Industrial Average rose 390.30 points, or 2.4%, to 16492.68. The S&P 500 gained 48.19 points, or 2.5% to 1969.41. The Nasdaq Composite Index climbed 128.01 points, or 2.7%, to 4811.93.

U.S. small business confidence was almost unchanged in August. The National Federation of Independent Business small business confidence index bounced after a sharp drop in June. The index rose to 95.9 in August from 95.4 in July, while economists had expected it to climb to 95.5.

The indices were slightly weighed by uncertainty over prospects of a rate hike in the U.S. The payrolls report failed to clarify this situation.

This morning in Asia Hong Kong Hang Seng added 2.97%, or 630.50 points, to 21,889.54. China Shanghai Composite Index gained 1.69%, or 53.66 points, to 3,224.12. The Nikkei jumped 5.79%, or 1,009.49 points, to 18,436.57.

Chinese stocks rose on expectations of further stimulus from the government. The Ministry of Finance said late Tuesday that major construction projects will be accelerated, the management of local government debt will be standardized, and taxes will be reformed. Authorities also said the National Development and Reform Commission would remove personal income tax on dividends for shareholders, who hold stocks for more than a year, in order to stimulate long-term investment.

-

04:01

Nikkei 225 18,415.2 +988.12 +5.67 %, Hang Seng 21,878.89 +619.85 +2.92 %, Shanghai Composite 3,237.02 +66.57 +2.10 %

-

00:29

Stocks. Daily history for Sep 8’2015:

(index / closing price / change items /% change)

Nikkei 225 17,427.08 -433.39 -2.43 %

Hang Seng 21,259.04 +675.52 +3.28 %

S&P/ASX 200 5,115.25 +84.83 +1.69 %

Shanghai Composite 3,170.57 +90.15 +2.93 %

FTSE 100 6,146.1 +71.58 +1.18 %

CAC 40 4,598.26 +48.62 +1.07 %

Xetra DAX 10,271.36 +162.75 +1.61 %

S&P 500 1,969.41 +48.19 +2.51 %

NASDAQ Composite 4,811.93 +128.01 +2.73 %

Dow Jones 16,492.68 +390.30 +2.42 %

-