Noticias del mercado

-

21:00

Dow +2.23% 16,462.05 +359.67 Nasdaq +2.35% 4,793.81 +109.89 S&P +2.18% 1,963.17 +41.95

-

19:27

WSE: Session Results

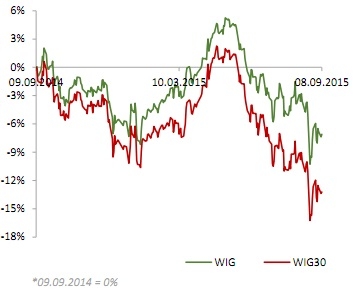

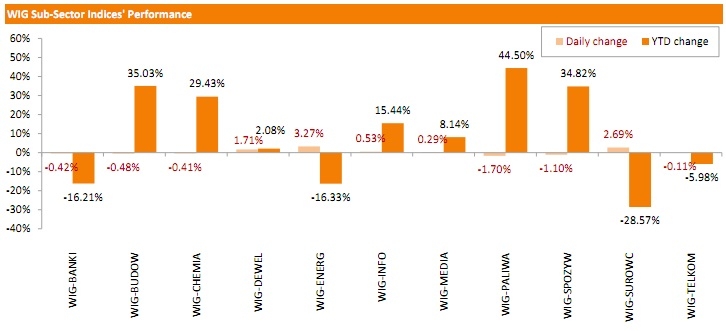

Polish equities advanced on Tuesday. The broad market measure, the WIG Index, added 0.29%. Sector-wise, oil and gas sector (-1.70%) was the day's biggest laggard, while utilities (+3.27%) benefited the most.

The large-cap stocks' measure, the WIG30 Index, advanced by 0.17%. In the index basket, utilities names ENEA (WSE: ENA), PGE (WSE: PGE) and TAURON PE (WSE: TPE) were the strongest performers, each of which gained more than 4% on news the Polish government approved plan for fund to support troubled coal miner Kompania Weglowa. They were followed by KGHM (WSE: KGH) and CCC (WSE: CCC), climbing 3.14% and 2.47% respectively. On the other side of the ledger, PKN ORLEN (WSE: PKN) and KERNEL (WSE: KER) fared the worst, retreating 3.3% and 1.85% respectively. Other major decliners were stocks from banking sector, namely ALIOR (WSE: ALR), MBANK (WSE: MBK) and BZ WBK (WSE: BZW), which fell by a respective 1.68%, 1.62% and 1.25% as issues relating to conversion of Swiss franc-denominated mortgages into Polish zloty raised again.

-

18:00

European stocks closed: FTSE 100 6,146.1 +71.58 +1.18% CAC 40 4,598.26 +48.62 +1.07% DAX 10,271.36 +162.75 +1.61%

-

18:00

European stocks close: stocks closed higher on the mostly positive economic data from the Eurozone

Stock indices closed higher on the mostly positive economic data from the Eurozone. Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

Eurostat released its revised GDP data today. Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,146.1 +71.58 +1.18 %

DAX 10,271.36 +162.75 +1.61 %

CAC 40 4,598.26 +48.62 +1.07 %

-

17:28

Wall Street. Major U.S. stock-indexes rose

Major U.S. stock-indexes higher on Tuesday after weak economic data out of China bolstered hopes of more stimulus measures from the Chinese government. China's imports shrank far more than expected in August, falling for the 10th straight month. Imports fell 13.8% from a year earlier, more than the 8.2% drop economists had expected. However, Chinese stocks rose nearly 3% on Tuesday as a surge in late-afternoon buying helped erase early losses. Late on Monday, China said it would remove tax on dividend incomes for investors who hold stocks for more than a year in an effort to encourage longer-term investment.

All Dow stocks in positive area (30 of 30). Top gainer - General Electric Company (GE, +2.83).

All S&P index sectors also in positive area. Top gainer - Technology (+2,0%).

At the moment:

Dow 16348.00 +229.00 +1.42%

S&P 500 1948.75 +27.00 +1.40%

Nasdaq 100 4260.50 +66.50 +1.59%

10 Year yield 2,18% +0,05

Oil 46.22 +0.17 +0.37%

Gold 1122.50 +1.10 +0.10%

-

16:55

National Federation of Independent Business’s small-business optimism index for the U.S. increases to 95.9 in August

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index increased to 95.9 in August from 95.4 in July.

The increase was partly driven by a rise in job openings and earnings trends.

5 of 10 subindexes rose last month, while three fell and two were unchanged.

The NFIB surveyed 656 small business owners.

-

15:53

Bank of France expects the French economy to expand 0.3% in the third quarter

Bank of France expects the French economy to expand 0.3% in the third quarter

The Bank of France released its monthly report on Tuesday. The central bank expects the French economy to expand 0.3% in the third quarter.

The Bank of France noted that industrial activity increased slightly in August due to weak performance of chemicals and metalworking sectors.

The activity in the services sector rose in August due to a rise in temporary work and transport services.

The central bank expects the economy to grow 1.2% in 2015, 1.8% in 2016 and 1.9% in 2017.

-

15:37

U.S. Stocks open: Dow +1.59%, Nasdaq +1.81%, S&P +1.62%

-

15:29

Before the bell: S&P futures +1.68%, NASDAQ futures +1.60%

U.S. index futures rose, after the Standard & Poor's 500 Index's second-biggest weekly retreat this year, after a late rally in Chinese stock markets led global equities higher.

Global Stocks:

Nikkei 17,427.08 -433.39 -2.43%

Hang Seng 21,259.04 +675.52 +3.28%

Shanghai Composite 3,170.57 +90.15 +2.93%

FTSE 6,174.7 +100.18 +1.65%

CAC 4,638.79 +89.15 +1.96%

DAX 10,343.01 +234.40 +2.32%

Crude oil $45.52 (-1.15%)

Gold $1122.20 (+0.07%)

-

15:14

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.31

6.18%

411.9K

ALCOA INC.

AA

09.08

3.27%

77.4K

Yahoo! Inc., NASDAQ

YHOO

32.4

2.60%

94.3K

Procter & Gamble Co

PG

70.3

2.24%

7.1K

Deere & Company, NYSE

DE

80.91

2.13%

4.2K

Visa

V

70.6

2.08%

3.4K

Barrick Gold Corporation, NYSE

ABX

6.54

2.03%

30.7K

Goldman Sachs

GS

184

2.01%

0.5K

General Motors Company, NYSE

GM

29.46

2.01%

20.8K

United Technologies Corp

UTX

92.49

2.00%

3.1K

Apple Inc.

AAPL

111.42

1.97%

377.1K

Walt Disney Co

DIS

102.92

1.93%

27.5K

Caterpillar Inc

CAT

74.5

1.92%

1.5K

JPMorgan Chase and Co

JPM

62.67

1.90%

17.5K

General Electric Co

GE

24.45

1.87%

58.5K

International Business Machines Co...

IBM

146.39

1.87%

0.3K

Cisco Systems Inc

CSCO

25.99

1.84%

17.4K

Intel Corp

INTC

29.04

1.82%

26.1K

E. I. du Pont de Nemours and Co

DD

49.48

1.81%

1.5K

Citigroup Inc., NYSE

C

51.5

1.80%

64.6K

Pfizer Inc

PFE

31.93

1.79%

0.1K

Twitter, Inc., NYSE

TWTR

28.65

1.78%

29.5K

American Express Co

AXP

75.39

1.77%

0.8K

Nike

NKE

111.62

1.76%

1.4K

3M Co

MMM

142.29

1.75%

0.3K

Boeing Co

BA

132

1.73%

5.1K

Google Inc.

GOOG

611.11

1.73%

6.9K

Tesla Motors, Inc., NASDAQ

TSLA

246.08

1.72%

26.3K

Amazon.com Inc., NASDAQ

AMZN

507.44

1.69%

5.5K

Home Depot Inc

HD

116.34

1.68%

2.2K

Travelers Companies Inc

TRV

98.75

1.65%

0.2K

Microsoft Corp

MSFT

43.3

1.62%

11.6K

Starbucks Corporation, NASDAQ

SBUX

55.16

1.62%

10.1K

The Coca-Cola Co

KO

39.14

1.61%

2.7K

Johnson & Johnson

JNJ

92.77

1.60%

3.8K

Facebook, Inc.

FB

89.67

1.60%

206.1K

Verizon Communications Inc

VZ

45.52

1.56%

20.7K

AMERICAN INTERNATIONAL GROUP

AIG

58.98

1.55%

9.5K

Ford Motor Co.

F

13.77

1.55%

61.8K

Wal-Mart Stores Inc

WMT

64.85

1.50%

0.3K

AT&T Inc

T

33.04

1.47%

40.0K

ALTRIA GROUP INC.

MO

53.14

1.45%

3.8K

Hewlett-Packard Co.

HPQ

27.38

1.44%

0.6K

Exxon Mobil Corp

XOM

73.49

1.42%

16.3K

Chevron Corp

CVX

77.72

1.37%

5.6K

McDonald's Corp

MCD

96.11

1.33%

1.1K

Yandex N.V., NASDAQ

YNDX

11.62

1.04%

8.3K

UnitedHealth Group Inc

UNH

112.35

-0.01%

1.1K

Merck & Co Inc

MRK

51.58

-0.01%

7.5K

-

15:12

Federal Reserve Bank of San Francisco President John Williams: the U.S. economic outlook was better than he expected

The Federal Reserve Bank of San Francisco President John Williams said in an interview with The Wall Street Journal on Friday that the U.S. economic outlook was better than he expected. But he added that "there are some pretty significant headwinds".

"All of the data that we have had up until now has been, I think, encouraging. It has been about as good, or better, than I was expecting, in terms of the U.S. economy," Williams said.

The San Francisco president noted that he wouldn't say whether the interest rate hike by the Fed in September is now in order.

Williams is a voting member of the Federal Open Market Committee this year.

-

14:58

Upgrades and downgrades before the market open

Upgrades:

Bank of America (BAC) upgraded to Buy from Neutral at Nomura

Procter & Gamble (PG) upgraded to Buy from Neutral at Sun Trust Rbsn Humphrey

Alcoa (AA) upgraded to Buy from Neutral at BofA/Merril

Downgrades:

Other:

-

14:39

OECD’s composite leading indicator declines to 100.0 in July

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator fell to 100.0 in July from 100.1 in June.

"Stable growth momentum confirmed in the OECD area but the outlook deteriorates in most major emerging economies," the OECD said.

It signalled stable growth in the Eurozone, particularly in Germany and Italy.

There were signs of firming growth in France and India.

The index for the U.S., the U.K. and Canada pointed to a moderate growth.

The index for China pointed to a loss of growth momentum.

The index for Russia showed signs of slowing growth momentum.

-

12:00

European stock markets mid session: stocks traded higher on German trade data

Stock indices traded higher on German trade data. Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

Eurostat released its revised GDP data today. Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

Current figures:

Name Price Change Change %

FTSE 100 6,175.66 +101.14 +1.66 %

DAX 10,335.4 +226.79 +2.24 %

CAC 40 4,639.86 +90.22 +1.98 %

-

11:43

Germany’s labour costs per hour worked rise 0.9% in the second quarter

The German statistical office Destatis relased its labour costs data for the second quarter on Tuesday. Labour costs per hour worked rose 0.9% in the second quarter on a seasonally and calendar adjusted basis, after a 0.8% increase in the first quarter.

On a yearly basis, labour costs per hour worked increased 3.1% in the second quarter on a calendar adjusted basis, after a 2.8% gain in the first quarter.

The costs of gross earnings climbed 3.4% year-on-year in the second quarter, while non-wage costs were up 2.0% in calendar adjusted terms.

-

11:34

Germany’s manufacturing turnover climbs by 1.9% in July

Destatis released its manufacturing turnover data for Germany on Tuesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.9% in July, after a 1.9% drop in June.

Meanwhile, domestic turnover increased slightly by 0.2% in July, while the business with foreign customers jumped 3.7%.

Sales to euro area countries rose 2.4% in July, while sales to other countries climbed 4.7%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 2.5% in July, after a 1.6% gain in June.

-

11:24

Eurozone's revised GDP climbs 0.4% in second quarter

Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Household spending gained 0.4% in the second quarter, while gross fixed capital formation was down 0.5%.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

-

11:09

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.3% in August

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.2% in August from 3.1% in July.

The number of unemployed people in Switzerland rose to 136,983 in August from 133,754 in July.

The youth unemployment rate was up to 3.6% in August from 3.0% in July.

-

10:59

France's trade deficit widens to €3.3 billion in July

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

-

10:53

Germany's seasonally adjusted trade surplus climbs to €22.8 billion in July

Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

-

10:44

China's trade surplus rises to $60.24 billion in August

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus rose to $60.24 billion in August from $43.03 billion in July, beating expectations for a rise to a surplus of $48.20 billion.

Exports fell at an annual rate of 5.5% in August, while Imports slid at an annual rate of 13.8%, the tenth consecutive decline.

-

10:40

Japan’s final GDP declines 0.3% in the second quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP decreased by 0.3% in the second quarter, up from the preliminary reading of a 0.4% fall, after a 1.0% rise in the first quarter.

Business investment declined 0.9% in the second quarter, while inventories increased 0.3%. Household spending fell 0.7% in the second quarter.

On a yearly basis, Japan's economy contracted by 1.2% in the second quarter, up from the preliminary reading of a 1.8% rise, after a 4.5% increase in the first quarter. The first quarter's figure was revised up from a 3.9% gain.

-

10:27

OECD Deputy Secretary-General Rintaro Tamaki: it is too early to say that the yuan devaluation was an attempt to boost exports

The Organisation for Economic Cooperation and Development (OECD) Deputy Secretary-General Rintaro Tamaki said at a news conference in Tokyo on Monday that it is too early to say that the yuan devaluation was an attempt to boost exports.

"It's premature to think that action, taken to let the yuan move more in line with the market, was aimed at bringing China back to being an export-driven economy," he said.

Tamaki noted that it is important to monitor whether China can implement reforms to achieve stable and sustainable economic growth.

-

10:18

Head of the European Stability Mechanism (ESM) Klaus Regling is confident the International Monetary Fund (IMF) would participate in the third Greek bailout program

The head of the European Stability Mechanism (ESM) Klaus Regling said on Monday that he was confident the International Monetary Fund (IMF) would participate in the third Greek bailout program.

"It has not been defined to what extent the IMF will contribute but I'm confident that they will participate later this year," he said.

Regling also said that he was confident that there is no need for the full fiscal union.

"I don't think we need to go a lot further for a good functioning of the euro zone area," he said.

-

10:11

International Monetary Fund (IMF) Managing Director Christine Lagarde urges the world’s largest economies to implement structural reforms

The International Monetary Fund (IMF) Managing Director Christine Lagarde urged the world's largest economies to implement structural reforms at the G20 summit on Saturday.

"Downside risks to the outlook have increased, particularly for emerging market economies. Against this backdrop, policy priorities have taken on even more urgency since we last met in April," she said.

Lagarde pointed out that growth remains too low, trade is too low, investment is too low and unemployment is too high.

The IMF managing director also said that the Fed should delay its interest rate hike until 2016 due to the global implications.

-

08:38

Global Stocks: Asian stock indices mostly fell

U.S. stock markets were closed on Monday.

This morning in Asia Hong Kong Hang Seng added 0.04%, or 9.15 points, to 20,592.67. China Shanghai Composite Index fell 1.38%, or 42.37 points, to 3,038.05. The Nikkei lost 1.77%, or 316.04 points, to 17,544.43.

Asian stock indices mostly fell amid concerns over China's economy. Japanese stocks edged up at the beginning of the session due to revised GDP data for the second quarter of the current year. Japan GDP contracted by 1.2% in Q2 compared to a 1.6% contraction stated in a preliminary report published on August 17. Weaker exports resulted in slower economic activity. Japan is influenced by China's economy.

Another report showed that Japan trade surplus came in at ¥1808.6 billion in July compared to ¥1715 billion expected. This surplus suggests that capital inflows are greater than outflows.

Meanwhile China's trade surplus came in at $60.24 billion in August beating expectations for $48.2 billion. Exports fell by 5.5% y/y compared to -8.3% reported previously and -6.0% expected. At the same time imports fell by 14.3% in August compared to -8.1% in July. Imports missed expectations too.

-

04:01

Nikkei 225 17,764.77 -95.70 -0.54 %, Hang Seng 20,676.41 +92.89 +0.45 %, Shanghai Composite 3,081.34 +0.92 +0.03 %

-

00:30

Stocks. Daily history for Sep 7’2015:

(index / closing price / change items /% change)

Nikkei 225 17,860.47 +68.31 +0.38 %

Hang Seng 20,583.52 -257.09 -1.23 %

S&P/ASX 200 5,030.42 -10.18 -0.20 %

Shanghai Composite 3,080.42 -79.75 -2.52 %

FTSE 100 6,074.52 +31.60 +0.52 %

CAC 40 4,549.64 +26.56 +0.59 %

Xetra DAX 10,108.61 +70.57 +0.70 %

-