Noticias del mercado

-

23:58

Schedule for today, Wednesday, Sep 9’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia Westpac Consumer Confidence September 7.8%

01:30 Australia Home Loans July 4.4% 0.8%

02:00 Australia RBA Assist Gov Lowe Speaks

05:00 Japan Consumer Confidence August 40.3

06:00 Japan Prelim Machine Tool Orders, y/y August 1.6%

08:30 United Kingdom Industrial Production (MoM) July -0.4% 0.1%

08:30 United Kingdom Industrial Production (YoY) July 1.5% 1.4%

08:30 United Kingdom Manufacturing Production (MoM) July 0.2% 0.2%

08:30 United Kingdom Manufacturing Production (YoY) July 0.5% 0.5%

08:30 United Kingdom Total Trade Balance July -1.6

09:00 Australia RBA Assist Gov Debelle Speaks

11:00 U.S. MBA Mortgage Applications September 11.3%

12:15 Canada Housing Starts August 193 190

12:30 Canada Building Permits (MoM) July 14.8% -5%

14:00 United Kingdom NIESR GDP Estimate Quarter III 0.7%

14:00 Canada Bank of Canada Rate 0.5% 0.5%

14:00 Canada BOC Rate Statement

14:00 U.S. JOLTs Job Openings July 5.249 5.288

21:00 New Zealand RBNZ Interest Rate Decision 3% 2.75%

21:00 New Zealand RBNZ Rate Statement

21:00 New Zealand RBNZ Press Conference

23:50 Japan Core Machinery Orders August -7.9% 3.7%

23:50 Japan Core Machinery Orders, y/y August 16.6% 10.5%

-

21:00

U.S.: Consumer Credit , July 19.1 (forecast 18.5)

-

16:55

National Federation of Independent Business’s small-business optimism index for the U.S. increases to 95.9 in August

The National Federation of Independent Business (NFIB) released its small-business optimism index for the U.S. on Tuesday. The index increased to 95.9 in August from 95.4 in July.

The increase was partly driven by a rise in job openings and earnings trends.

5 of 10 subindexes rose last month, while three fell and two were unchanged.

The NFIB surveyed 656 small business owners.

-

15:53

Bank of France expects the French economy to expand 0.3% in the third quarter

Bank of France expects the French economy to expand 0.3% in the third quarter

The Bank of France released its monthly report on Tuesday. The central bank expects the French economy to expand 0.3% in the third quarter.

The Bank of France noted that industrial activity increased slightly in August due to weak performance of chemicals and metalworking sectors.

The activity in the services sector rose in August due to a rise in temporary work and transport services.

The central bank expects the economy to grow 1.2% in 2015, 1.8% in 2016 and 1.9% in 2017.

-

15:12

Federal Reserve Bank of San Francisco President John Williams: the U.S. economic outlook was better than he expected

The Federal Reserve Bank of San Francisco President John Williams said in an interview with The Wall Street Journal on Friday that the U.S. economic outlook was better than he expected. But he added that "there are some pretty significant headwinds".

"All of the data that we have had up until now has been, I think, encouraging. It has been about as good, or better, than I was expecting, in terms of the U.S. economy," Williams said.

The San Francisco president noted that he wouldn't say whether the interest rate hike by the Fed in September is now in order.

Williams is a voting member of the Federal Open Market Committee this year.

-

14:39

OECD’s composite leading indicator declines to 100.0 in July

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator fell to 100.0 in July from 100.1 in June.

"Stable growth momentum confirmed in the OECD area but the outlook deteriorates in most major emerging economies," the OECD said.

It signalled stable growth in the Eurozone, particularly in Germany and Italy.

There were signs of firming growth in France and India.

The index for the U.S., the U.K. and Canada pointed to a moderate growth.

The index for China pointed to a loss of growth momentum.

The index for Russia showed signs of slowing growth momentum.

-

14:21

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the mostly positive economic data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence August 4 1

02:00 China Trade Balance, bln August 43.03 48.2 60.24

05:00 Japan Eco Watchers Survey: Current August 51.6 49.3

05:00 Japan Eco Watchers Survey: Outlook August 51.9 48.2

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1% 3.2%

06:00 Germany Current Account July 24.4 23.4

06:00 Germany Trade Balance July 24.2 Revised From 24.1 25.0

06:45 France Trade Balance, bln July -2.76 Revised From -2.7 -3.3

09:00 Eurozone GDP (QoQ) (Revised) Quarter II 0.5% Revised From 0.4% 0.3% 0.4%

09:00 Eurozone GDP (YoY) (Revised) Quarter II 1.0% 1.2% 1.5%

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S.

The situation regarding the interest rate hike by the Fed remained unclear. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The euro traded lower against the U.S. dollar despite the mostly positive economic data from the Eurozone. Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

Eurostat released its revised GDP data today. Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

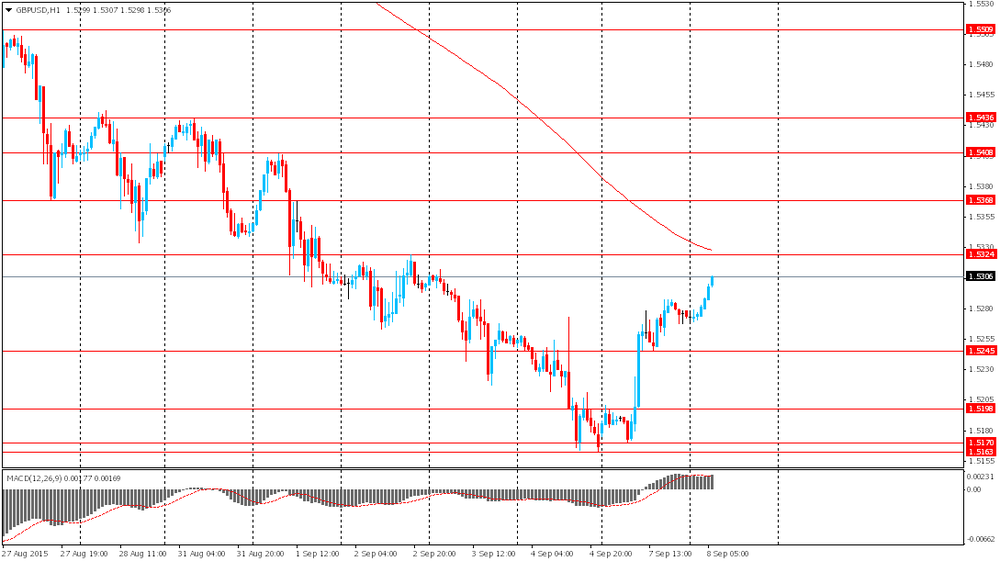

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Swiss franc traded lower against the U.S. dollar after the labour market data from Switzerland. The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.2% in August from 3.1% in July.

The number of unemployed people in Switzerland rose to 136,983 in August from 133,754 in July.

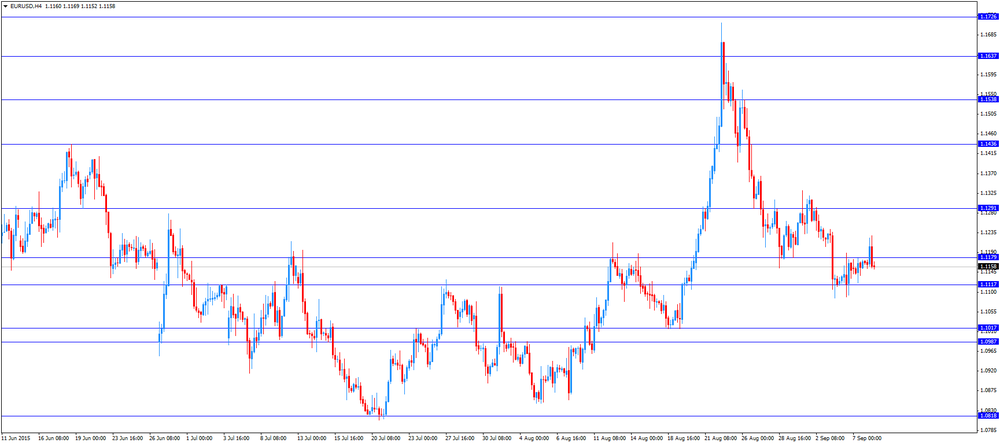

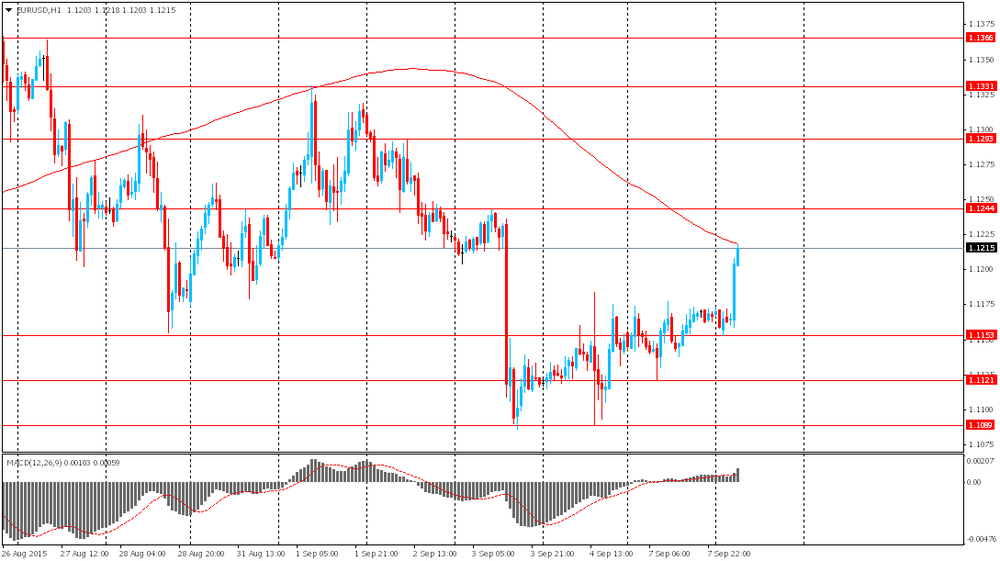

EUR/USD: the currency pair fell to $1.1152

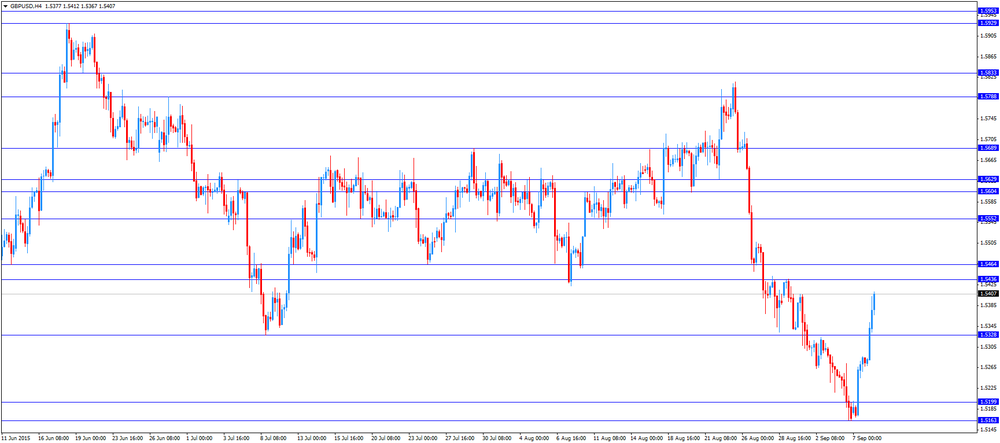

GBP/USD: the currency pair rose to $1.5412

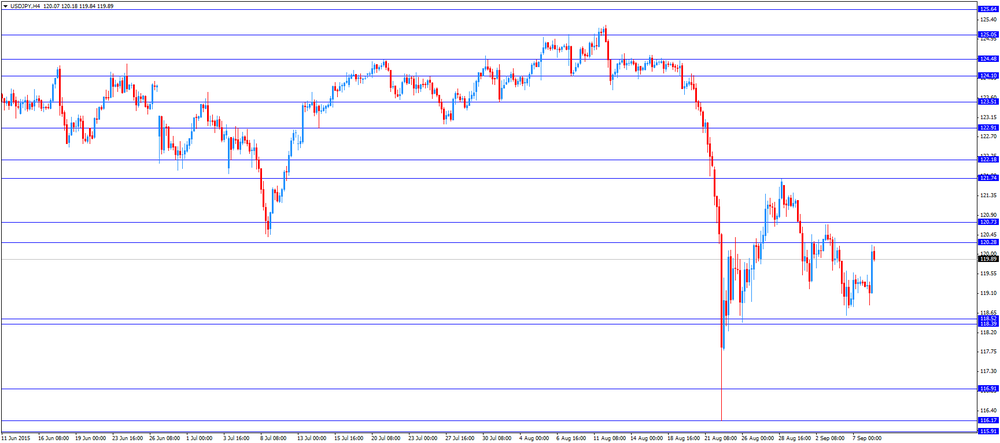

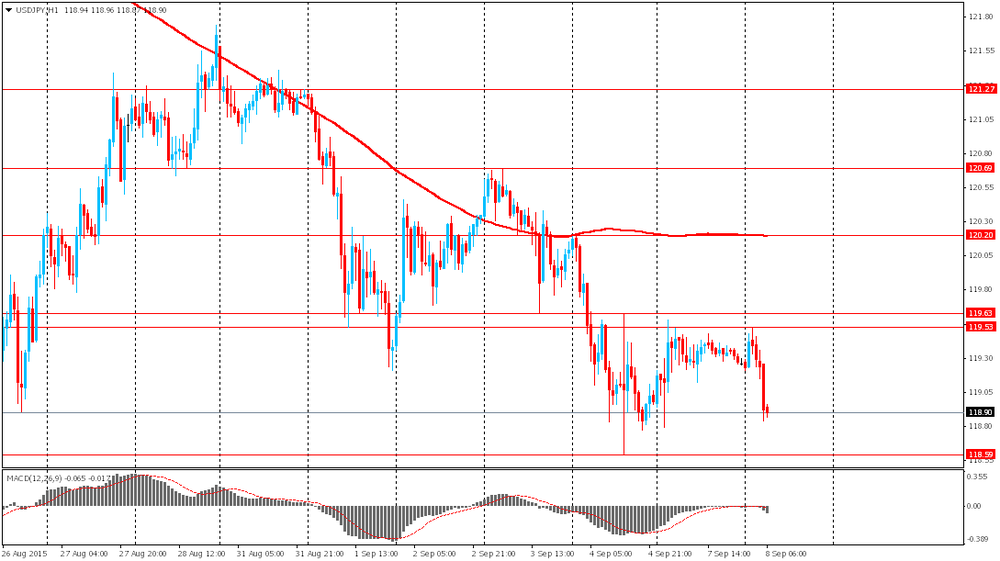

USD/JPY: the currency pair increased to Y120.22

The most important news that are expected (GMT0):

14:00 U.S. Labor Market Conditions Index August 1.1

19:00 U.S. Consumer Credit July 20.74 18.5

-

11:43

Germany’s labour costs per hour worked rise 0.9% in the second quarter

The German statistical office Destatis relased its labour costs data for the second quarter on Tuesday. Labour costs per hour worked rose 0.9% in the second quarter on a seasonally and calendar adjusted basis, after a 0.8% increase in the first quarter.

On a yearly basis, labour costs per hour worked increased 3.1% in the second quarter on a calendar adjusted basis, after a 2.8% gain in the first quarter.

The costs of gross earnings climbed 3.4% year-on-year in the second quarter, while non-wage costs were up 2.0% in calendar adjusted terms.

-

11:34

Germany’s manufacturing turnover climbs by 1.9% in July

Destatis released its manufacturing turnover data for Germany on Tuesday. Manufacturing turnover rose on seasonally adjusted and on adjusted for working days basis by 1.9% in July, after a 1.9% drop in June.

Meanwhile, domestic turnover increased slightly by 0.2% in July, while the business with foreign customers jumped 3.7%.

Sales to euro area countries rose 2.4% in July, while sales to other countries climbed 4.7%.

On a yearly basis, manufacturing turnover in Germany was up on seasonally adjusted and on adjusted for working days basis by 2.5% in July, after a 1.6% gain in June.

-

11:24

Eurozone's revised GDP climbs 0.4% in second quarter

Eurozone's revised gross domestic product (GDP) rose 0.4% in second quarter, up from the preliminary reading of a 0.3% increase, after a 0.5% gain in the first quarter. The first quarter's reading was revised up from a 0.4% rise.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in second quarter, up from the preliminary reading of a 1.2% gain, after a 1.0% rise in the first quarter.

Household spending gained 0.4% in the second quarter, while gross fixed capital formation was down 0.5%.

Exports climbed to 1.6% in the second quarter, while imports rose to 1.0%.

-

11:11

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1100(E962mn), $1.1245-50(E360mn)

USD/JPY: Y119.00($544mn), Y120.15($350mn), Y120.40-45($1.1bn), Y121.50($502mn)

EUR/GBP: Gbp0.7300(E1.01bn)

-

11:09

Swiss unemployment rate remains unchanged at a seasonally adjusted 3.3% in August

The Swiss State Secretariat for Economic Affairs released its unemployment data for Switzerland on Tuesday. The Swiss unemployment rate remained unchanged at a seasonally adjusted 3.3% in August.

On a seasonally unadjusted basis, the unemployment rate in Switzerland increased to 3.2% in August from 3.1% in July.

The number of unemployed people in Switzerland rose to 136,983 in August from 133,754 in July.

The youth unemployment rate was up to 3.6% in August from 3.0% in July.

-

11:00

Eurozone: GDP (QoQ), Quarter II 0.4% (forecast 0.3%)

-

11:00

Eurozone: GDP (YoY), Quarter II 1.5% (forecast 1.2%)

-

10:59

France's trade deficit widens to €3.3 billion in July

According to the French Customs, France's trade deficit widened to €3.3 billion in July from €2.76 billion in June.

The rise in deficit was driven by lower exports and imports.

-

10:53

Germany's seasonally adjusted trade surplus climbs to €22.8 billion in July

Destatis released its trade data for Germany on Tuesday. Germany's seasonally adjusted trade surplus climbed to €22.8 billion in July from 22.1 in June.

Exports increased at a seasonally and calendar-adjusted 2.4% in July, while imports rose 2.2%. These were the highest seasonally adjusted monthly readings ever calculated both for exports and for imports, according to Destatis.

Germany's current account surplus was at €23.4 billion in July, down from €24.4 billion in June.

-

10:44

China's trade surplus rises to $60.24 billion in August

The Chinese Customs Office released its trade data on Tuesday. China's trade surplus rose to $60.24 billion in August from $43.03 billion in July, beating expectations for a rise to a surplus of $48.20 billion.

Exports fell at an annual rate of 5.5% in August, while Imports slid at an annual rate of 13.8%, the tenth consecutive decline.

-

10:40

Japan’s final GDP declines 0.3% in the second quarter

Japan's Cabinet Office released its final gross domestic product (GDP) data for Japan late Monday evening. Japan's GDP decreased by 0.3% in the second quarter, up from the preliminary reading of a 0.4% fall, after a 1.0% rise in the first quarter.

Business investment declined 0.9% in the second quarter, while inventories increased 0.3%. Household spending fell 0.7% in the second quarter.

On a yearly basis, Japan's economy contracted by 1.2% in the second quarter, up from the preliminary reading of a 1.8% rise, after a 4.5% increase in the first quarter. The first quarter's figure was revised up from a 3.9% gain.

-

10:27

OECD Deputy Secretary-General Rintaro Tamaki: it is too early to say that the yuan devaluation was an attempt to boost exports

The Organisation for Economic Cooperation and Development (OECD) Deputy Secretary-General Rintaro Tamaki said at a news conference in Tokyo on Monday that it is too early to say that the yuan devaluation was an attempt to boost exports.

"It's premature to think that action, taken to let the yuan move more in line with the market, was aimed at bringing China back to being an export-driven economy," he said.

Tamaki noted that it is important to monitor whether China can implement reforms to achieve stable and sustainable economic growth.

-

10:18

Head of the European Stability Mechanism (ESM) Klaus Regling is confident the International Monetary Fund (IMF) would participate in the third Greek bailout program

The head of the European Stability Mechanism (ESM) Klaus Regling said on Monday that he was confident the International Monetary Fund (IMF) would participate in the third Greek bailout program.

"It has not been defined to what extent the IMF will contribute but I'm confident that they will participate later this year," he said.

Regling also said that he was confident that there is no need for the full fiscal union.

"I don't think we need to go a lot further for a good functioning of the euro zone area," he said.

-

10:11

International Monetary Fund (IMF) Managing Director Christine Lagarde urges the world’s largest economies to implement structural reforms

The International Monetary Fund (IMF) Managing Director Christine Lagarde urged the world's largest economies to implement structural reforms at the G20 summit on Saturday.

"Downside risks to the outlook have increased, particularly for emerging market economies. Against this backdrop, policy priorities have taken on even more urgency since we last met in April," she said.

Lagarde pointed out that growth remains too low, trade is too low, investment is too low and unemployment is too high.

The IMF managing director also said that the Fed should delay its interest rate hike until 2016 due to the global implications.

-

08:45

France: Trade Balance, bln, July -3.3

-

08:36

Foreign exchange market. Asian session: the euro advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia National Australia Bank's Business Confidence August 4 1

02:00 China Trade Balance, bln August 43.03 48.2 60.24

05:00 Japan Eco Watchers Survey: Current August 51.6 49.3

05:00 Japan Eco Watchers Survey: Outlook August 51.9 48.2

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1% 3.2%

06:00 Germany Current Account July 24.4 23.4

06:00 Germany Trade Balance July 24.1 Revised From 24.0 25.0

The euro climbed ahead of today's eurozone GDP data. A median forecast suggests a revised reading of 1.2% y/y compared to 1.0% reported earlier.

The pound climbed ahead of Thursday's Bank of England meeting. Most analysts expect the BOE to keep interest rates unchanged. Minutes of the meeting might show whether policymakers are concerned about China's economic slowdown.

The yen advanced against the greenback amid revised GDP data. Japan GDP contracted by 1.2% in Q2 compared to a 1.6% contraction stated in a preliminary report published on August 17. Weaker exports resulted in slower economic activity.

The Australian dollar felt pressure as investors assessed National Australia Bank's Business Confidence index. The index fell to 1 in August from 4 reported previously. Meanwhile China's trade balance report supported the AUD. The country's trade surplus came in at $60.24 billion beating expectations for $48.2 billion. Exports fell by 5.5% y/y compared to -8.3% reported previously and -6.0% expected. At the same time imports fell by 14.3% in August compared to -8.1% in July. Imports missed expectations too.

EUR/USD: the pair rose beyond $1.1200 in Asian trade

USD/JPY: the pair fell to Y118.85

GBP/USD: the pair rose beyond $1.5300

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

06:45 France Trade Balance, bln July -2.7

14:00 U.S. Labor Market Conditions Index August 1.1

19:00 U.S. Consumer Credit July 20.74 18.5

20:30 U.S. API Crude Oil Inventories August 7.6

-

08:23

Options levels on tuesday, September 8, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1347 (1342)

$1.1300 (662)

$1.1247 (560)

Price at time of writing this review: $1.1215

Support levels (open interest**, contracts):

$1.1135 (277)

$1.1063 (942)

$1.1021 (2587)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 40777 contracts, with the maximum number of contracts with strike price $1,1500 (3650);

- Overall open interest on the PUT options with the expiration date October, 9 is 54459 contracts, with the maximum number of contracts with strike price $1,0700 (5751);

- The ratio of PUT/CALL was 1.34 versus 1.47 from the previous trading day according to data from September, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5602 (935)

$1.5504 (1294)

$1.5406 (583)

Price at time of writing this review: $1.5376

Support levels (open interest**, contracts):

$1.5279 (498)

$1.5185 (1790)

$1.5089 (1177)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 15297 contracts, with the maximum number of contracts with strike price $1,5500 (1294);

- Overall open interest on the PUT options with the expiration date October, 9 is 14774 contracts, with the maximum number of contracts with strike price $1,5200 (1790);

- The ratio of PUT/CALL was 0.97 versus 1.10 from the previous trading day according to data from September, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Trade Balance, July 25.0

-

08:01

Germany: Current Account , July 23.4

-

07:45

Switzerland: Unemployment Rate (non s.a.), August 3.3% (forecast 3.1%)

-

07:16

Japan: Eco Watchers Survey: Outlook, August 48.2

-

07:02

Japan: Eco Watchers Survey: Current , August 49.3

-

04:38

China: Trade Balance, bln, August 60.24 (forecast 48.2)

-

03:30

Australia: National Australia Bank's Business Confidence, August 1

-

01:58

Japan: GDP, y/y, Quarter II -1.2% (forecast -1.8%)

-

01:51

Japan: Current Account, bln, July 1808.6 (forecast 1715)

-

01:51

Japan: GDP, q/q, Quarter II -0.3% (forecast -0.4%)

-

00:28

Currencies. Daily history for Sep 7’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1167 +0,16%

GBP/USD $1,5274 +0,70%

USD/CHF Chf0,975 +0,36%

USD/JPY Y119,26 +0,23%

EUR/JPY Y133,19 +0,40%

GBP/JPY Y182,15 +0,91%

AUD/USD $0,6928 +0,30%

NZD/USD $0,6269 -0,10%

USD/CAD C$1,3304 +0,20%

-

00:01

Schedule for today, Tuesday, Sep 8’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence August 4

02:00 China Trade Balance, bln August 43.03 48.2

05:00 Japan Eco Watchers Survey: Current August 51.6

05:00 Japan Eco Watchers Survey: Outlook August 51.9

05:45 Switzerland Unemployment Rate (non s.a.) August 3.1% 3.1%

06:00 Germany Current Account July 24.4

06:00 Germany Trade Balance July 24.0

06:45 France Trade Balance, bln July -2.7

14:00 U.S. Labor Market Conditions Index August 1.1

19:00 U.S. Consumer Credit July 20.74 18.5

20:30 U.S. API Crude Oil Inventories August 7.6

-