Noticias del mercado

-

17:11

French President Francois Hollande: the French economy is expected to grow 1% this year and 1.5% next year

French President Francois Hollande said on Monday that the French economy is expected to grow 1% this year and 1.5% next year. But he added that this year's growth would not be enough to reduce unemployment.

Hollande noted that the country's budget deficit is expected to be 3.8% of gross domestic product (GDP) this year and 3.3% in 2016.

The French president also said that he expects the Chinese economy to expand in the long-term period.

-

16:52

European Central Bank purchases €51.6 billion of public and private debt in August

The European Central Bank (ECB) purchased €51.6 billion of public and private debt under its quantitative-easing program in August, compared to €61.3 billion in July.

ECB'S asset buying programme is intended to run to September 2016.

The ECB bought €42.8 billion of government and agency bonds in July, €7.5 billion of covered bonds, and €1.3 billion of asset-backed securities.

The central purchased €11.9 billion of government and agency bonds, €1.0 billion of covered bonds, and €382 million of asset-backed securities last week.

-

16:15

China’s foreign-exchange reserves drop by $93.9 billion in August

According to data released by the People's Bank of China PBoC), China's foreign-exchange reserves declined by $93.9 billion to $3.56 trillion at the end of August, compared with $3.65 trillion in July. Currency reserves have been falling from $3.99 trillion in June 2014.

The recent decline is the result of the central bank's intervention to stop to stop the yuan fall and to limit capital outflows from the country.

-

15:40

Option expiries for today's 10:00 ET NY cut

EURUSD 1.0900 (734m), 1.0985, 1.1000, 1.1050, 1.1075 (701m), 1.1100 (1.37bn), 1.1115, 1.1130 (599m), 1.1160, 1.1250, 1.1300

USDJPY 118.70, 119.40, 119.55, 120.00, 120.40, 120.75, 121.00, 121.25

AUDUSD 0.6900, 0.7000

NZDUSD 0.6240

AUDNZD 1.1000 (400m), 1.1300 (1.2bn)

EURJPY 132.00

-

14:38

Bundesbank President Jens Weidmann is elected as board chairman of the Bank for International Settlements (BIS)

The Bundesbank President Jens Weidmann has been elected on Sunday as board chairman of the Bank for International Settlements (BIS).

The BIS is based in Basel, Switzerland. The BIS Board is responsible for determining the strategic and policy direction of the BIS. The board includes the Bank of England Governor Mark Carney, the European Central Bank President Mario Draghi, the People's Bank of China (PBoC) Governor Zhou Xiaochuan and the Federal Reserve Chairwoman Janet Yellen

Weidmann will replace the Bank of France Governor Christian Noyer, who will retire as the Bank of France Governor on October 31.

Weidmann's term will be for three years and begins on November 1.

-

14:12

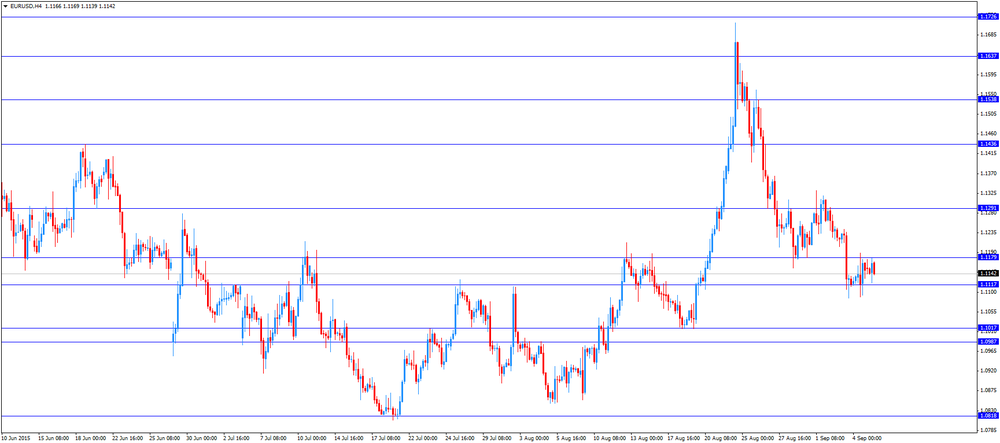

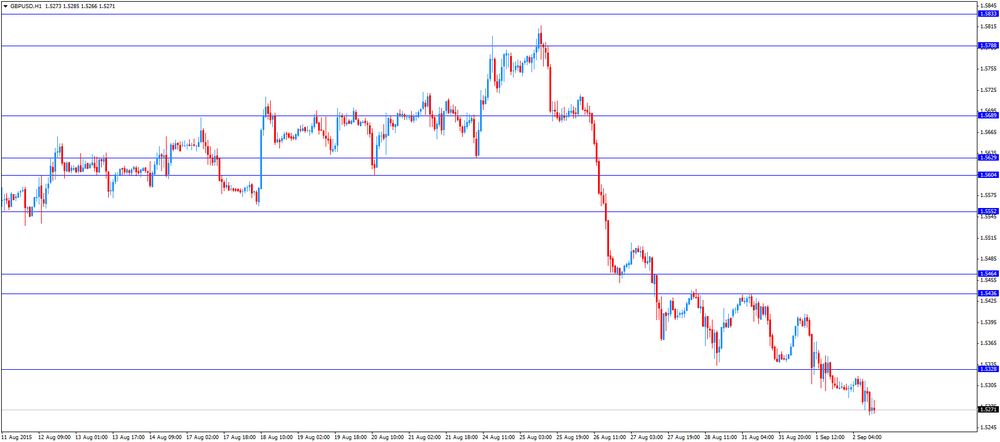

Foreign exchange market. European session: the British pound showed a correction against the U.S. dollar after the last week’s significant decline

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia ANZ Job Advertisements (MoM) August -0.4% 1.0%

05:00 Japan Coincident Index (Preliminary) July 112.3 112.2

05:00 Japan Leading Economic Index (Preliminary) July 106.5 104.9

06:00 Germany Industrial Production s.a. (MoM) July -0.9% Revised From -1.4% 1% 0.7%

06:00 Germany Industrial Production (YoY) July 0.9% Revised From 1.0% 0.5%

07:00 Switzerland Foreign Currency Reserves August 531 Revised From 532 540

08:30 Eurozone Sentix Investor Confidence September 18.4 13.6

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Markets in the U.S. are closed for a public holiday on Monday.

The situation regarding the interest rate hike by the Fed remained unclear. The U.S. Labor Department released the labour market data on Friday. The U.S. economy added 173,000 jobs in August, missing expectations for a rise of 220,000 jobs, after a gain of 245,000 jobs in July. July's figure was revised up from a rise of 215,000 jobs.

The U.S. unemployment rate dropped to 5.1% in August from 5.3% in July, exceeding expectations for a decline to 5.2%. It was the lowest level since April 2008.

Average hourly earnings rose 0.3% in August, beating forecasts of a 0.2% gain, after a 0.2% increase in July.

The euro traded mixed against the U.S. dollar after the mixed economic data from the Eurozone. Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 13.6 in September from 18.4 in August. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The decline was driven by a slowdown in the Chinese economy.

"Investors now see the slowdown in China as well as in other emerging markets as a significant burden for the euro zone's economy, which can no longer be compensated by good developments in the domestic euro zone economy or the United States," Sentix said.

Destatis released its industrial production data for Germany on Monday. German industrial production rose 0.7% in July, missing expectations for a 1.0% gain, after a 0.9% decline in June. June's figure was revised up from a 1.4% drop.

The output of capital goods increased 2.8% in July, energy output climbed 1.9%, and the production in the construction sector was up 3.2%, while the production of intermediate goods fell 0.8%.

The output of consumer goods decreased 3.7%.

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

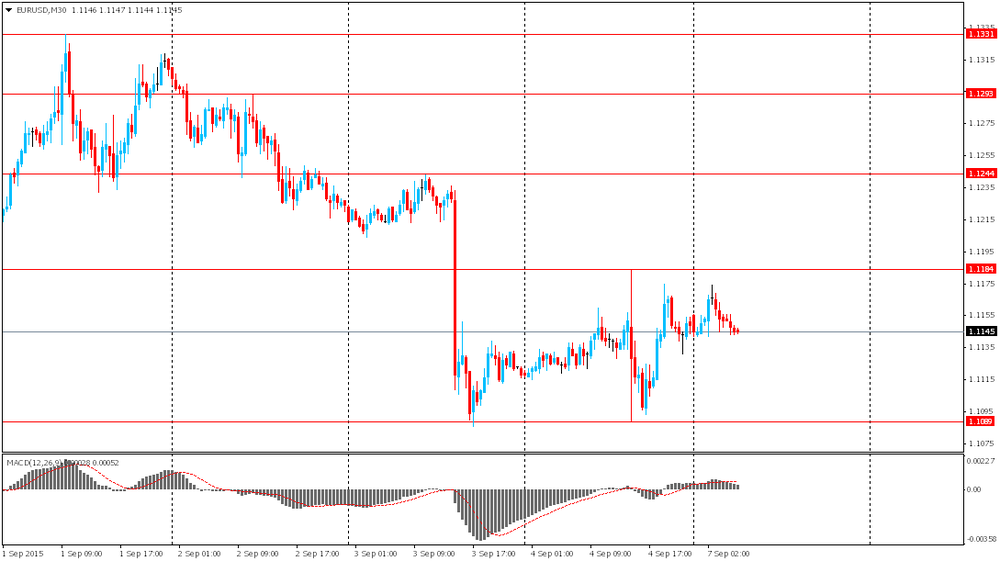

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair rose to $1.5278

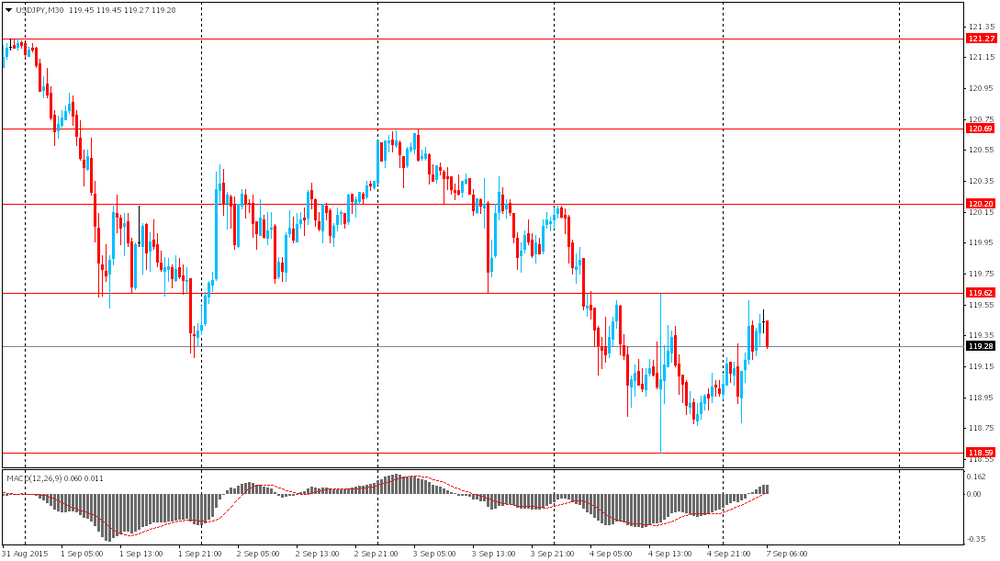

USD/JPY: the currency pair traded mixed

The most important news that are expected (GMT0):

23:50 Japan GDP, q/q (Finally) Quarter II 1% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter II 3.9% -1.8%

-

14:01

Orders

EUR/USD

Offers1.1225 1.1190/00

Bids 1.1100 1.1060-50

GBP/USD

Offers 1.5315/25 1.5300

Bids 1.5120/15 1.5055/50 1.5035/30

EUR/GBP

Offers 0.7395/00

Bids

EUR/JPY

Offers 134.50 134.00 133.45/50

Bids 132.50 132.00

USD/JPY

Offers 120.50 119.95/00 119.70

Bids 119.05/00 118.50

AUD/USD

Offers 0.7100 0.7045/50 0.7000 0.6950

Bids 0.6850 0.6800 0.6750

-

11:38

People’s Bank of China (PBoC) Governor Zhou Xiaochuan: there is no reason for the yuan to fall further

The People's Bank of China (PBoC) Governor Zhou Xiaochuan said at G20 summit on Friday that there is no reason for the yuan to fall further.

Zhu Jun, head of the international department at the PBoC, noted that the yuan devaluation was not an attempt to gain an advantage over other exporters. He added that the Chinese government expected the market turbulence in China to be "pretty close to the end".

Chinese Finance Minister Lou Jiwei said on Friday that he expects China's economy to expand about 7% for the next four or five years.

-

11:31

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1050(E478mn), $1.1075(E701mn), $1.1100(E1.37bn), $1.1115(E321mn), $1.1130(E599mn), $1.1250(E270mn)

USD/JPY: Y121.25($400mn)

AUD/NZD: NZ$1.1000(A$399mn), NZ$1.1300(A$1.2bn)

-

11:27

U.S. Treasury Secretary Jacob Lew: China should refrain from competitive devaluation

The U.S. Treasury Secretary Jacob Lew said at G20 summit on Friday that China should refrain from competitive devaluation.

"China should allow its exchange rate to reflect underlying fundamentals, avoid persistent exchange rate misalignments, and refrain from competitive devaluation," he said.

-

11:14

Job advertisements in Australia climb 1.0% in August

The Australian and New Zealand Banking Group (ANZ) released its job advertisements for Australia on Monday. Job advertisements in Australia climbed 1.0% in August, after a 0.5% decline in July. July's figure was revised down from a 0.4% fall.

Internet job advertisements increased 1.0% in August, while newspaper advertisements gained 0.8%.

On a yearly basis, job advertisement rose 8.7% in August, after a 9.2% in July.

"The recent strength in employment growth has been concentrated in a range of labour intensive services industries, however job losses in mining, mining-related construction and manufacturing are likely to weigh on employment growth over the next year,'' ANZ Chief Economist Warren Hogan said.

-

11:02

Sentix investor confidence index for the Eurozone is down to 13.6 in September

Market research group Sentix released its investor confidence index for the Eurozone on Monday. The index dropped to 13.6 in September from 18.4 in August. It was the lowest level since February.

A reading above 0.0 indicates optimism, below indicates pessimism.

The decline was driven by a slowdown in the Chinese economy.

"Investors now see the slowdown in China as well as in other emerging markets as a significant burden for the euro zone's economy, which can no longer be compensated by good developments in the domestic euro zone economy or the United States," Sentix said.

The current conditions index fell to 15.0 in September from 15.3 in August.

The expectations index plunged to 12.3 in September from 21.5 in August, the lowest level since December 2014

German investor confidence index declined to 20.6 from 25.7

-

10:33

Eurozone: Sentix Investor Confidence, September 13.6

-

10:12

Ai Group/HIA Australian Performance of Construction Index is up to 53.8 in August

The Australian Industry Group (AiG) released its construction data for Australia on late Sunday evening. The Ai Group/HIA Australian Performance of Construction Index rose to 53.8 in August from 47.1 in July.

A reading above 50 indicates expansion in the sector.

The increase was driven by a rise in new orders, which jumped to 57.6 in August from 45.4 in July.

"A healthy August update for commercial construction is encouraging, but needs to be sustained. As new housing activity remains strong rather than achieving further growth, commercial construction and infrastructure investment needs to pick up the baton," HIA Chief Economist, Harley Dale, said.

-

09:44

Japan's leading index declines to 104.9 in July

Japan's Cabinet Office released its preliminary leading index data on Monday. The leading index declined to 104.9 in July from 106.5 in June. It was the lowest level since March.

Japan's coincident index was down to 112.2 in July from 112.3 in June.

-

09:33

Swiss National Bank's foreign exchange reserves increase to 540.460 billion Swiss francs in August

The Swiss National Bank's foreign exchange reserves increased to 540.416 billion Swiss francs in August from 531.201 billion francs in July.

July's figure was revised down from 531.820 billion francs.

-

09:22

German industrial production rises 0.7% in July

Destatis released its industrial production data for Germany on Monday. German industrial production rose 0.7% in July, missing expectations for a 1.0% gain, after a 0.9% decline in June. June's figure was revised up from a 1.4% drop.

The output of capital goods increased 2.8% in July, energy output climbed 1.9%, and the production in the construction sector was up 3.2%, while the production of intermediate goods fell 0.8%.

The output of consumer goods decreased 3.7%.

-

09:11

China lowers its GDP for 2014 to 7.3% from 7.4%

China's National Bureau of Statistics (NBS) revised its gross domestic product (GDP) on Monday. The Chinese economy expanded 7.3% in 2014, down from a 7.4% growth reported earlier. It was the lowest growth since 1990.

The downward revision was driven by a weaker rise in the services sector than previously reported. The services sector rose by 7.8% in 2014, down from the previous estimate of a 8.1% increase.

The agriculture sector grew 4.1% in 2014, while the secondary sector increased by 7.3%.

China's economy expanded 7% in the first half of 2015.

-

09:01

Switzerland: Foreign Currency Reserves, August 540

-

08:20

Foreign exchange market. Asian session: the yen declined

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:30 Australia ANZ Job Advertisements (MoM) August -0.4% 1.0%

05:00 Japan Coincident Index (Preliminary) July 112.3 112.2

05:00 Japan Leading Economic Index (Preliminary) July 106.5 104.9

06:00 Germany Industrial Production s.a. (MoM) July -0.9% Revised From -1.4% 1% 0.7%

06:00 Germany Industrial Production (YoY) July 0.6% 0.4%

Volatility of the U.S. dollar was low after it rose moderately amid jobs data on Friday. The U.S. economy created 173,000 jobs in August vs 220,000 expected. Meanwhile the unemployment rate fell to 5.1% from 5.3% reported previously. Average hourly earnings rose 2.2% beating expectations.

The yen fell against the greenback amid growth in stock indices in Shanghai and Tokyo. Demand for this safe-haven currency declined amid investors' optimism.

The pound little changed ahead of Thursday's Bank of England meeting. Most experts expect the bank to leave its interest rates unchanged. Minutes of the meeting are likely to show whether policymakers are concerned about China's slowing economy.

The Australian dollar slightly rose after data showed that the AiG Performance of Construction Index rose to 53.8 in August from 47.1 reported previously. A high reading of the index is positive for the AUD.

EUR/USD: the pair fluctuated within $1.1140-75 in Asian trade

USD/JPY: the pair rose to Y119.60

GBP/USD: the pair traded within $1.5185-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:00 Switzerland Foreign Currency Reserves August 532

08:30 Eurozone Sentix Investor Confidence September 18.4

23:50 Japan Current Account, bln July 558.6 1715

23:50 Japan GDP, q/q (Finally) Quarter II 1% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter II 3.9% -1.8%

-

08:16

Germany: Industrial Production (YoY), July 0.4%

-

08:00

Germany: Industrial Production s.a. (MoM), July 0.7% (forecast 1%)

-

07:06

Japan: Leading Economic Index , July 104.9

-

07:06

Japan: Coincident Index, July 112.2

-

07:03

Options levels on monday, September 7, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1347 (1342)

$1.1300 (662)

$1.1247 (560)

Price at time of writing this review: $1.1141

Support levels (open interest**, contracts):

$1.1063 (942)

$1.1021 (2587)

$1.0968 (2178)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 40777 contracts, with the maximum number of contracts with strike price $1,1500 (3650);

- Overall open interest on the PUT options with the expiration date October, 9 is 54459 contracts, with the maximum number of contracts with strike price $1,0700 (5751);

- The ratio of PUT/CALL was 1.34 versus 1.47 from the previous trading day according to data from September, 4

GBP/USD

Resistance levels (open interest**, contracts)

$1.5406 (583)

$1.5309 (504)

$1.5213 (1188)

Price at time of writing this review: $1.5186

Support levels (open interest**, contracts):

$1.5089 (1177)

$1.4993 (1612)

$1.4895 (878)

Comments:

- Overall open interest on the CALL options with the expiration date October, 9 is 15297 contracts, with the maximum number of contracts with strike price $1,5500 (1294);

- Overall open interest on the PUT options with the expiration date October, 9 is 14774 contracts, with the maximum number of contracts with strike price $1,5200 (1790);

- The ratio of PUT/CALL was 0.97 versus 1.10 from the previous trading day according to data from September, 4

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:31

Australia: ANZ Job Advertisements (MoM), August 1.0%

-

02:31

Currencies. Daily history for Sep 4’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1149 +0,28%

GBP/USD $1,5167 -0,55%

USD/CHF Chf0,9715 -0,20%

USD/JPY Y118,98 -0,93%

EUR/JPY Y132,66 -0,64%

GBP/JPY Y180,49 -1,47%

AUD/USD $0,6907 -1,49%

NZD/USD $0,6275 -1,74%

USD/CAD C$1,3277 +0,71%

-

02:01

Schedule for today, Monday, Sep 7’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia ANZ Job Advertisements (MoM) August -0.4%

05:00 Japan Coincident Index (Preliminary) July 112.3

05:00 Japan Leading Economic Index (Preliminary) July 106.5

06:00 Germany Industrial Production s.a. (MoM) July -1.4% 1%

06:00 Germany Industrial Production (YoY) July 0.6%

07:00 Switzerland Foreign Currency Reserves August 532

08:30 Eurozone Sentix Investor Confidence September 18.4

12:00 Canada Bank holiday

12:00 U.S. Bank holiday

23:50 Japan Current Account, bln July 558.6 1715

23:50 Japan GDP, q/q (Finally) Quarter II 1% -0.4%

23:50 Japan GDP, y/y (Finally) Quarter II 3.9% -1.8%

-