Noticias del mercado

-

20:21

American focus: Dollar bulls seeking shelter amid European bond-market selloff

Dollar bulls are running scared as a global bond-market rout gains momentum in Europe.

The greenback weakened against most of its 16 major peers and snapped a three-day rise against the euro as debt from Germany to Italy and Spain tumbled. The surge in European yields that began last month has outpaced increases in the U.S., spurring appetite for euros.

"It's like a mini taper-tantrum out of the euro zone," Mark McCormick, a foreign-exchange strategist at Credit Agricole SA, said by phone. "The relative interest-rate spreads are driving short-term movements. You can see the euro has a stronger bid."

The dollar fell 0.8 percent against the euro to $1.1241. The euro rallied versus most of its 16 major peers, adding 0.6 percent to 134.79 yen. The greenback was little changed at 119.83 yen.

Bonds dropped on Tuesday amid what Goldman Sachs Group Inc. termed a "large and vicious" selloff in euro-area securities. Germany's 10-year yield increased seven basis points to 0.68 percent, Spain's rose eight basis points to 1.82 percent and yields on similar-maturity Italian debt added eight basis points to 1.84 percent.

"We've seen the dollar, which was one of the more popular long positions against the euro, come off on the back of some higher yields" in Europe, Brian Daingerfield, a currency strategist at Royal Bank of Scotland Group Plc's RBS Securities unit in Stamford, Connecticut, said by phone. A long position is a bet on an asset rising in value. "A continued selloff in European fixed income markets with higher rates could keep upward pressure on the euro."

The euro is forecast to resume its decline by year-end, as Europe maintains its unprecedented program of monetary stimulus while the U.S. moves toward raising rates for the first time since 2006. The currency will slip against 13 of its 16 major counterparts by Dec. 31, according to predictions.

Markets will be able to anticipate the first increase in U.S. interest rates by monitoring incoming data, which ought to "help mitigate the degree of market turbulence" when the Fed does move, New York Federal Reserve President William C. Dudley said on Tuesday. Any increase is likely to "signal a regime shift" that will stir financial markets when it occurs, he said.

U.S. retail sales data due Wednesday may offer clues on the timing of when the Fed will start to tighten policy. They'll show a 0.2 percent increase in April from the previous month, down from a 0.9 percent jump in March, according to the median estimate of economists.

"There is some ongoing uncertainty on when the first Fed interest-rate hike is going to come," said Neil Mellor, a currency strategist at Bank of New York Mellon Corp. in London. "But underneath it all is the simple fact the Fed is more likely than not going to be the first major central bank to start hiking rates, so the cap on the dollar is going to be fairly limited."

-

20:00

U.S.: Federal budget , April 157 (forecast 146.5)

-

16:54

OECD’s leading indicator falls to 100.1 in March

The Organization for Economic Cooperation and Development (OECD) released its leading indicators on Tuesday. The composite leading indicator decreased to 100.1 in March from 100.2 in February. It signalled stable growth in the United Kingdom, Germany, Japan and India.

The index for the U.S. and China pointed to an easing in growth momentum.

The index for Russia continues to point to a loss in growth momentum.

-

16:44

NIESR’s gross domestic product rises by 0.4% in three months to April

The National Institute of Economic and Social Research (NIESR) released its estimate of gross domestic product (GDP) for the U.K. on Tuesday. The GDP estimate rose by 0.4% in three months to April, after a 0.3% growth in three months to March.

The NIESR said that the weak economic growth in the first quarter was temporary, and it expects the U.K. economy to expand at 2.5% this year.

-

16:23

Job openings decline to 4.994 million in March

The U.S. Bureau of Labor Statistics released its Job Openings and Labor Turnover Survey (JOLTS) report on Tuesday. Job openings fell to 4.994 million in March from 5.144 million in February.

February's figure was revised up from 5.133 million.

Analysts had expected job openings to decline to 5.085 million.

The number of job openings decreased for total private (4.506 million), while remained unchanged for government (488,000) in March.

The hires rate was 3.6% in March.

Total separations rose to 4.983 million in March from 4.793 million in February.

The JOLTS report is one of the Federal Reserve Chair Janet Yellen's favourite labour market indicators.

-

16:02

U.S.: JOLTs Job Openings, March 4.994 (forecast 5.085)

-

16:00

United Kingdom: NIESR GDP Estimate, April 0.4%

-

15:51

Option expiries for today's 10:00 ET NY cut

USDJPY 120.00 (USD 1.2bln)

EURUSD 1.1000 EUR 776m) 1.1100 ( 584m)

GBPUSD 1.5500 (GBP 628m)

USDCAD 1.2065 (USD 375m)

-

15:35

Bank of France expects the French economy to grow 0.3% in the second quarter

The Bank of France expects the French economy to grow 0.3% in the second quarter.

The confidence index for the manufacturing sector climbed to 98 in April from 97 in March. Factory output is expected to increase in May.

The services confidence index rose to 95 in April from 94 in March. Services activity is also expected to expand.

The confidence index for the construction sector was up to 92 in April from 91 in March. A slight decline in activity is expected in May.

-

15:08

New York Fed President William C. Dudley does not know when the Fed will start to hike its interest rates

New York Fed President William C. Dudley said in Zurich in Tuesday that he does not know when the Fed will start to hike its interest rates. He noted that when the interest rate hike by the Fed will have impact on global capital flows, foreign exchange valuation and financial asset prices. But Dudley added that market participants should be prepared for the interest rate hike if they monitor incoming data.

The New York Fed president also said that important emerging-market economies could be hurt by higher U.S. interest rates.

Dudley is a voting member of the Federal Open Market Committee this year.

-

14:45

Release of the Australian annaul budget

- The Australian Government forecasts a budget deficit for the 2015-16 financial year of A$35.1 billion;

- The Australian Government expects that the mining investment in 2015-16 will be 25.5%;

- The Australian Government expects that iron ore price will be $48 per ton in 2015-16;

- The Australian government forecasts that consumer price inflation will be 2.5% in 2015-16;

- The Australian Government expects the unemployment to reach 6.5% in the 2015-16;

- Net debt in Australia is expected to peak at 18% of GDP in 2016-17;

- The Australian Government expects the real GDP to grow 2.75% in 2015-16;

- The Australian government forecasts that a budget deficit will turn into surplus in 2019-20.

- The Australian Government forecasts a budget deficit for the 2015-16 financial year of A$35.1 billion;

-

14:25

Foreign exchange market. European session: the British pound climbed against the U.S. dollar after the better-than-expected U.K. manufacturing production data

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans March 1.1% Revised From 1.2% 1.0% 1.6%

05:00 Japan Leading Economic Index (Preliminary) March 104.7 Revised From 104.8 105.5 105.5

05:00 Japan Coincident Index (Preliminary) March 110.7 109.5

08:00 China New Loans April 1180 903

08:30 United Kingdom Manufacturing Production (YoY) March 1.2% Revised From 1.1% 1.0% 1.1%

08:30 United Kingdom Manufacturing Production (MoM) March 0.5% Revised From 0.4% 0.3% 0.4%

08:30 United Kingdom Industrial Production (YoY) March 0.1% 0.2% 0.7%

08:30 United Kingdom Industrial Production (MoM) March 0.1% 0.0% 0.5%

The U.S. dollar traded lower against the most major currencies ahead of the U.S. job openings figures. Job openings are expected to decline to 5.085 million in March from 5.133 million in February.

The euro traded higher against the U.S. dollar in the absence of any major economic data from the Eurozone. A government bonds selloff on the European markets supported the euro.

Greece yesterday began the transfer of €750 million in loans to the International Monetary Fund (IMF). A payment deadline is today.

According to Reuters, the Greek government used emergency reserves in its holding account with the IMF to repay loans.

Greece has averted a possible default, but there are no reasons for optimism yet. Eurogroup said after yesterday's meeting that it will not unlock the €7.2 billion tranche of loans until the Greek government begins reforms agreed with its creditors. Athens is struggling to meet its payment obligations.

The British pound climbed against the U.S. dollar after the better-than-expected U.K. manufacturing production data. Manufacturing production in the U.K. rose 0.4% in March, exceeding expectations for a 0.3% gain, after a 0.5% increase in February. February's figure was revised up from a 0.4% rise.

Manufacturing output was driven by oil and gas extraction, which jumped 4.9% in March, the biggest rise since February 2014.

On a yearly basis, manufacturing production in the U.K. increased 1.1% in March, after a 1.2% rise in February. It was the largest increase since September 2014. February's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.5% in March, beating forecasts of a flat reading, after a 0.1% rise in February.

On a yearly basis, industrial production in the U.K. gained 0.7% in March, exceeding expectations for a 0.2% rise, after a 0.1% increase in February.

For the first quarter as a whole, industrial output was up 0.1%, driven by a 2.7% gain in the utilities sector, while manufacturing output rose 0.1%.

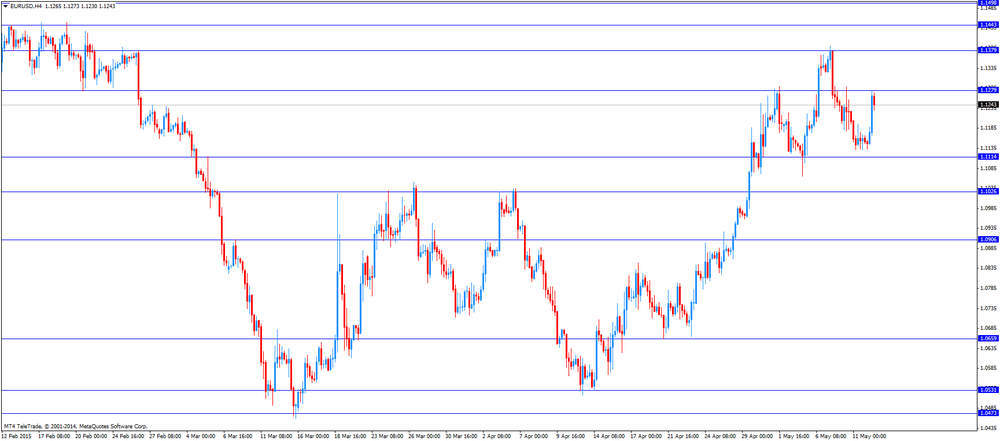

EUR/USD: the currency pair rose to $1.1278

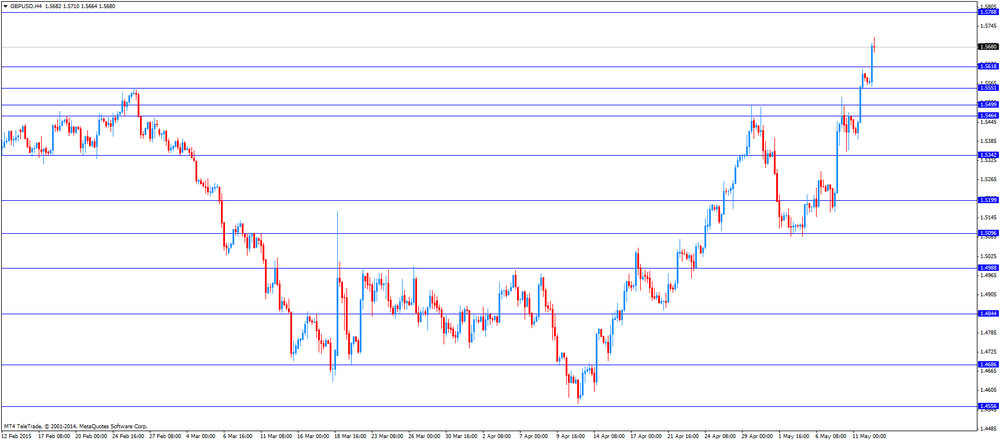

GBP/USD: the currency pair increased to $1.5710

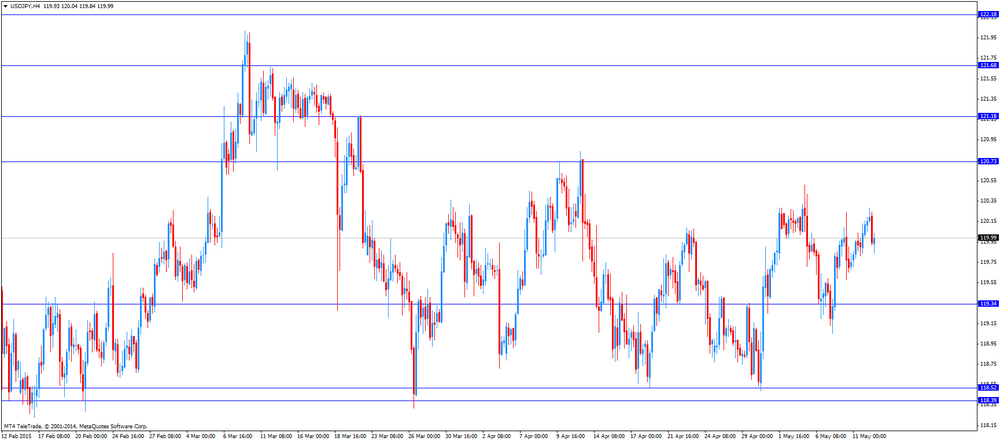

USD/JPY: the currency pair fell to Y119.84

The most important news that are expected (GMT0):

14:00 United Kingdom NIESR GDP Estimate April 0.6%

14:00 U.S. JOLTs Job Openings March 5.133 5.085

16:45 U.S. FOMC Member Williams Speaks

21:00 New Zealand RBNZ Financial Stability Report

21:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

-

14:00

Orders

EUR/USD

Offers 1.1250 1.1280 1.1300 1.1330 1.1360-65 1.1385 1.1400

Bids 1.1200 1.1180 1.1160 1.1135 1.1120 1.1100 1.1085 1.1050-60

GBP/USD

Offers 1.5600 1.5620-25 1.5650 1.5665 1.5580 1.5700

Bids 1.5570 1.5550 1.5250 1.5500 1.5485 1.5465 1.5450 1.5430 1.5400

EUR/GBP

Offers 0.7225-30 0.7255-60 0.7280 0.7300 0.7320-25 0.7350

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100

EUR/JPY

Offers 135.00 135.30 135.50 135.85 136.00 136.50

Bids 134.50 134.20 134.00 133.70 133.50

USD/JPY

Offers 120.25-30 120.50 120.80 121.00

Bids 119.80-85 119.60 119.40 119.25 119.00

AUD/USD

Offers 0.7960 0.7980 0.8000 0.8025 0.8050-60 0.8085 0.8100

Bids 0.7900-10 0.7885-90 0.7850-55 0.7820-25 0.7800 0.7780

-

13:16

United Kingdom: Manufacturing Production (YoY), March 1.1% (forecast 1.0%)

-

11:31

U.K. manufacturing production is up 0.4% in March

The Office for National Statistics (ONS) released its manufacturing industrial production figures for the U.K. on Tuesday. Manufacturing production in the U.K. rose 0.4% in March, exceeding expectations for a 0.3% gain, after a 0.5% increase in February. February's figure was revised up from a 0.4% rise.

Manufacturing output was driven by oil and gas extraction, which jumped 4.9% in March, the biggest rise since February 2014.

On a yearly basis, manufacturing production in the U.K. increased 1.1% in March, after a 1.2% rise in February. It was the largest increase since September 2014. February's figure was revised up from a 1.1% gain.

Industrial production in the U.K. climbed 0.5% in March, beating forecasts of a flat reading, after a 0.1% rise in February.

On a yearly basis, industrial production in the U.K. gained 0.7% in March, exceeding expectations for a 0.2% rise, after a 0.1% increase in February.

For the first quarter as a whole, industrial output was up 0.1%, driven by a 2.7% gain in the utilities sector, while manufacturing output rose 0.1%.

-

11:01

BRC: U.K. total retail sales are down 1.3% in April

According to the British Retail Consortium (BRC), the U.K. total retail sales declined by 1.3% in April, after a 4.7% rise in March. It was the biggest decline since March 2011.

Retail spending excluding changes in floor space fell by 2.4% in April, after a 3.2 increase in March.

The director-general at the BRC Helen Dickinson said that "confidence among consumers is slowly improving".

-

10:41

U.S. one-year ahead inflation expectations are 2.7% in April

According to the New York Fed's survey of consumer expectations, released on Monday, the U.S. one-year ahead inflation expectations were 2.7% in April, down from 2.9% in March. It was the lowest level since mid-2013.

The U.S. three-year ahead inflation expectations rose to 3.0% in April from 2.9% in March.

The Fed wants to hike its interest rate later this year but wants to be sure that the consumer price inflation is on track to reach its 2% target.

-

10:30

United Kingdom: Industrial Production (MoM), March 0.5% (forecast 0.0%)

-

10:30

United Kingdom: Manufacturing Production (MoM) , March 0.4% (forecast 0.3%)

-

10:30

United Kingdom: Industrial Production (YoY), March 0.7% (forecast 0.2%)

-

10:19

Wages in the U.K. are expected to rise by 1.8% in the next 12 months

According to the Chartered Institute of Personnel and Development's (CIPD) survey, British employers expect to raise pay by 1.8% in the next 12 months, down from their previous expectations for a rise of 2.0% three months ago.

The labour market analyst at CIPD Gerwyn Davies said that there are only "very modest improvements" in wages in the U.K. despite the strong labour market.

"Word has spread that inflation is expected to remain very low this year so it's no surprise that many employers are hitting the pause button on pay," Davies noted.

-

08:20

Foreign exchange market. Asian session

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia Home Loans March 1.1% Revised From 1.2% 1.0% 1.6%

The euro was little changed and a gauge of Asian developing-nation currencies fell to a four-week low. Greece persuaded a German-led bloc of creditors that it is serious about delivering the tight budget policies needed to escape a default. A transfer order for the IMF repayment was put in Monday, two Greek officials said. The European Central Bank will reassess the emergency liquidity lines keeping the Greek banking system in business Wednesday. Overblown expectations for the European Central Bank's quantitative easing plan pushed global debt valuations to extreme levels, triggering a "large and vicious" selloff in European bonds that's infected other markets, according to Goldman Sachs Group Inc. Greece has readied a repayment to the International Monetary Fund, officials said, as the ECB prepared to reassess emergency funding for the country's banks.

EUR / USD: during the Asian session, the pair was trading around $ 1.1150

GBP / USD: during the Asian session, the pair was trading around $ 1.5570

USD / JPY: during the Asian session, the pair was trading around Y120.15

-

08:15

Options levels on tuesday, May 12, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1376 (4794)

$1.1317 (5014)

$1.1251 (2068)

Price at time of writing this review: $1.1183

Support levels (open interest**, contracts):

$1.1113 (1015)

$1.1066 (1442)

$1.1019 (2800)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 99658 contracts, with the maximum number of contracts with strike price $1,1200 (5014);

- Overall open interest on the PUT options with the expiration date June, 5 is 117794 contracts, with the maximum number of contracts with strike price $1,0800 (7493);

- The ratio of PUT/CALL was 1.18 versus 1.20 from the previous trading day according to data from May, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5806 (1018)

$1.5708 (2566)

$1.5613 (2506)

Price at time of writing this review: $1.5584

Support levels (open interest**, contracts):

$1.5490 (1159)

$1.5393 (2388)

$1.5295 (1063)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 33044 contracts, with the maximum number of contracts with strike price $1,5700 (2566);

- Overall open interest on the PUT options with the expiration date June, 5 is 45373 contracts, with the maximum number of contracts with strike price $1,5000 (3311);

- The ratio of PUT/CALL was 1.37 versus 1.36 from the previous trading day according to data from May, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:02

Japan: Coincident Index, March 109.5

-

07:01

Japan: Leading Economic Index , March 105.5 (forecast 105.5)

-

03:30

Australia: Home Loans , March 1.6% (forecast 1.0%)

-

00:29

Currencies. Daily history for May 11’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1151 -0,46%

GBP/USD $1,5584 +0,85%

USD/CHF Chf0,9341 +0,42%

USD/JPY Y120,12 +0,31%

EUR/JPY Y133,94 -0,15%

GBP/JPY Y187,18 +1,16%

AUD/USD $0,7892 -0,48%

NZD/USD $0,7341 -2,00%

USD/CAD C$1,2096 +0,21%

-

00:01

Schedule for today, Tuesday, May 12’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia Home Loans March 1.2% 1.0%

05:00 Japan Leading Economic Index(Preliminary) March 104.8 105.5

05:00 Japan Coincident Index (Preliminary) March 110.7

08:00 China New Loans April 1180 903

08:30 United Kingdom Manufacturing Production (YoY) March 1.1% 1.0%

08:30 United Kingdom Manufacturing Production (MoM) March 0.4% 0.3%

08:30 United Kingdom Industrial Production (YoY) March 0.1% 0.2%

08:30 United Kingdom Industrial Production (MoM) March 0.1% 0.0%

09:00 Eurozone ECOFIN Meetings

09:30 Australia Annual Budget Release

14:00 United Kingdom NIESR GDP Estimate April 0.6%

14:00 U.S. JOLTs Job Openings March 5.133 5.085

16:45 U.S. FOMC Member Williams Speaks

18:00 U.S. Federal budget April -53 146.5

20:30 U.S. API Crude Oil Inventories May -1.5

21:00 New Zealand RBNZ Financial Stability Report

21:05 New Zealand RBNZ Governor Graeme Wheeler Speaks

22:45 New Zealand Food Prices Index, m/m April 0.1%

22:45 New Zealand Food Prices Index, y/y April 1.9%

23:50 Japan Current Account, bln March 1440.1 2060

-