Noticias del mercado

-

20:20

American focus: Dollar strengthens as Greek talks stretch on

The dollar strengthened Monday as discussions between Greece's leaders and eurozone finance ministers appeared to yield little progress, stoking worries about a Greek exit from the eurozone, which supported the buck against its main rival.

The ICE U.S. dollar index DXY, +0.10% , a measure of the dollar's strength against a basket of six rivals, was up 0.2% at 94.9850.

After finishing last week lower against the currencies of every industrialized country except for New Zealand, the dollar was broadly higher against Group of 10 and emerging-market currencies.

One notable exception was the pound, which rose to its highest level of the year against the dollar in mid-morning trade as it continued to benefit from the Conservative party's victory in last week's U.K. general election.

Greece has begun processing a payment of about €750 million ($836.8 million) to the International Monetary Fund Tuesday, according to media reports citing Greek government officials. But talks between Greek officials and European Union finance ministers haven't pushed the two sides closer to a deal.

The euro was drifting lower against the greenback with options-related stop-loss selling orders giving the pair an extra downward push with many investors skeptical about any agreement emerging from the meeting of eurozone finance ministers.

The U.S. labor market conditions index for April came in below expectations, but did little to move the market. With no other important data expected Monday, investors looked ahead to the job openings and labor turnover survey, an important reading on the state of the U.S. labor market, as well as retail sales and the producer price index, expected later in the week.

Friday's jobs report was strong enough to briefly relieve the pressure on the dollar, but didn't stop it from finishing lower against the euro for the fourth straight week.

"At this stage we're going to have to see further signs of strength in the economy to really move the needle in terms of when the Fed might raise interest rates," said Joe Manimbo, senior market analyst at Western Union Business Solutions.

Higher interest rates would increase the yield on dollar-denominated deposits, making the U.S. currency more attractive to foreign investors, analysts said.

-

17:14

San Francisco Federal Reserve President John Williams: the interest rate hike by the Fed will depend on the economic data

San Francisco Federal Reserve President John Williams told in an interview to CNBC on Monday that there are improvements in the labour market, but inflation is still low due to a stronger U.S. dollar.

Williams noted that the interest rate hike by the Fed will depend on the economic data, and he added that the Fed may raise its interest rate at every monetary policy meeting.

He expects the economy to bounce back in the second quarter.

The San Francisco Federal Reserve president pointed out that equities valuations are high, but he is not worried about financial stability. Williams added that the Fed should monitor developments in financial markets around the world.

Williams is a voting member of the Federal Open Market Committee this year.

-

16:27

Pace of asset buying by the ECB rises last week

The European Central Bank (ECB) purchased €13.65 billion of government bonds last week. The central bank said on Monday it had settled a total of €108.709 billion of purchases of government bonds as of May 8, up from €95.056 billion the previous week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB also said that it bought €2.9 billion of covered bonds last week, and €42 million of asset-backed securities. Covered bonds programmes totalled €77.976 billion, while asset-backed securities programmes totalled €5.827 billion.

-

15:58

European Central Bank Governing Council Member Ewald Nowotny: the Greek debt crisis "is much more a political question than an economic question"

European Central Bank Governing Council Member Ewald Nowotny said on Monday that the Greek debt crisis "is much more a political question than an economic question."

Nowotny offered no solution for the problem. He pointed out that the ECB's role was to ensure price and financial stability.

"We cannot substitute the political sphere," Nowotny said.

-

15:40

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.8bn), $1.1050(E1.7bn), $1.1100(E1.7bn), $1.1150(E1.0bn), 1.1200(E1.73bn)

USD/JPY: Y119.50($394mn), Y120.00($2.14bn), Y120.50($510mn), Y121.00($1.73bn)

EUR/JPY: Y132.00(E462mn)

GBP/USD: $1.5400(Gbp236mn).

EUR/GBP: Gbp0.7270(E212mn)

AUD/USD: $0.7800(A$2.7bn).

NZD/USD: $0.7525-30(NZ$1.0bn)

-

15:24

German Finance Minister Wolfgang Schaeuble: a referendum on the Greek bailout in Greece may be helpful

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

-

14:58

European Central Bank Vice President Vitor Constancio does not expect the worst case for Greece

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that he did not the worst case for Greece. He added that the ECB is providing liquidity to the banks.

Constancio also said that he did not expect "excessive volatility in the bond market to continue".

-

14:28

Foreign exchange market. European session: the British pound traded higher against the U.S. dollar after the Bank of England’s interest rate decision

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:30 Australia National Australia Bank's Business Confidence April 3 3

09:00 Eurozone Eurogroup Meetings

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375 375

11:00 United Kingdom MPC Rate Statement

The U.S. dollar traded higher against the most major currencies in the absence of any major economic reports from the U.S. The greenback remained supported by Friday's U.S. labour market data. The U.S. economy added 223,000 jobs in April, missing expectations for a rise of 224,000 jobs, after a gain of 85,000 jobs in March. March's figure was revised down from a rise of 126,000 jobs.

The U.S. unemployment rate fell to 5.4% in April from 5.5% in March, in line with expectations. It was lowest level since May 2008.

The euro traded mixed against the U.S. dollar as the Greek debt crisis weighed on the euro. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

German finance minister Wolfgang Schaeuble warned over the weekend that Greece can slide into insolvency.

The British pound traded higher against the U.S. dollar after the Bank of England's (BoE) interest rate decision. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The interest rate decision was delayed because of last Thursday's parliamentary election in the U.K. The Conservative Party won enough seats to take a majority in parliament.

Low inflation and weak wages weighed on the BoE's interest rate decision.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

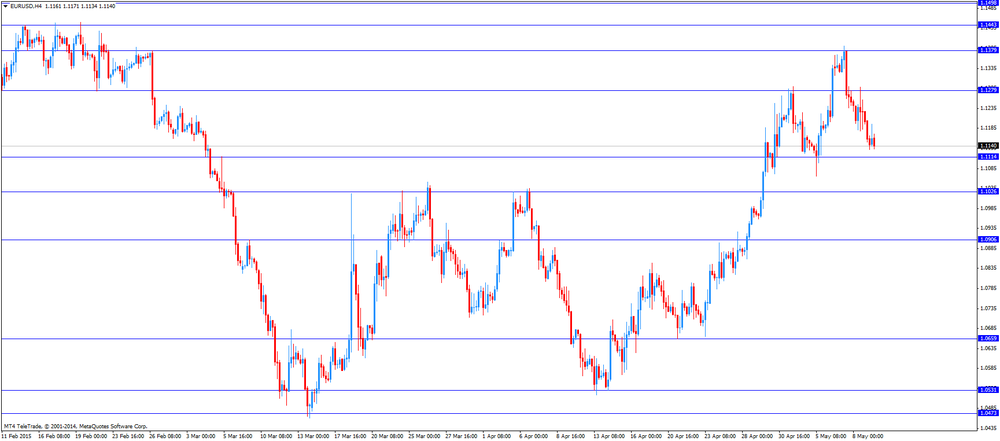

EUR/USD: the currency pair traded mixed

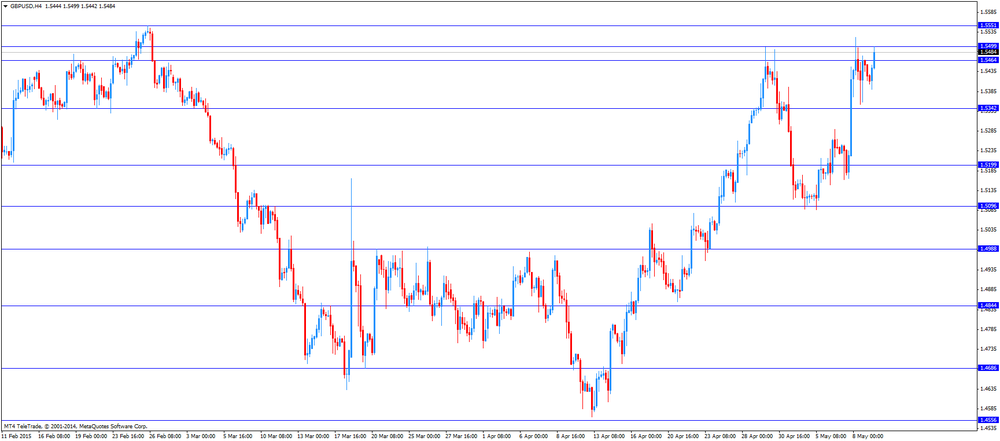

GBP/USD: the currency pair rose to $1.5499

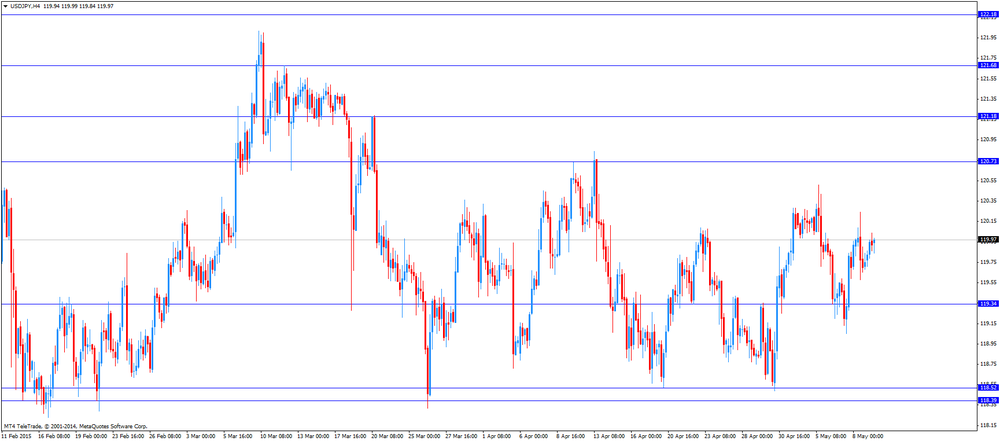

USD/JPY: the currency pair traded mixed

-

14:14

Bank of England keeps its interest rate on hold at 0.5% in May

The Bank of England (BoE) released its interest rate decision on Monday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The interest rate decision was delayed because of last Thursday's parliamentary election in the U.K. The Conservative Party won enough seats to take a majority in parliament.

Low inflation and weak wages weighed on the BoE's interest rate decision.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

Investors are awaiting the BoE Governor Mark Carney's inflation report on Wednesday and the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on May 20.

All members voted in April to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

-

14:00

Orders

EUR/USD

Offers 1.1200 1.1230 1.1250 1.1280 1.1300 1.1330 1.1360-65 1.1385 1.1400

Bids 1.1180 1.1160 1.1135 1.1120 1.1100 1.1085 1.1050-60

GBP/USD

Offers 1.5500 1.5525 1.5545-50 1.5570 1.5585 1.5600 1.5630 1.5650

Bids 1.5380 1.5365 1.5350 1.5330 1.5300

EUR/GBP

Offers 0.7255-60 0.7280 0.7300 0.7320-25 0.7350

Bids 0.7220-25 0.7200 0.7185 0.7165 0.7150

EUR/JPY

Offers 134.20 134.50 134.80 135.00 135.30 135.50 135.85 136.00

Bids 133.70 133.50 133.00 132.80 132.50

USD/JPY

Ордера на продажу 120.00 120.25-30 120.50 120.80 121.00

Bids 119.75-80 119.60 119.40 119.25 119.00 118.85 118.65 118.50

AUD/USD

Offers 0.7920 0.7940 0.7960 0.7980 0.8000 0.8025 0.8050-60 0.8085 0.8100

Bids 0.7875-80 0.7850-55 0.7820-25 0.7800 0.7780

-

13:00

United Kingdom: Asset Purchase Facility, 375

-

13:00

United Kingdom: BoE Interest Rate Decision, 0.5% (forecast 0.5%)

-

11:37

National Australia Bank's business confidence index remains unchanged at 3 in April

The National Australia Bank (NAB) released its business consumer index for Australia on Monday. The business confidence index remained unchanged at 3 in April.

"Recent signs of improvement in the economic partials are encouraging but the non mining sector needs to lift more to offset the impact on domestic demand of sharply lower mining investment and the hit to income from commodity prices," the Chief Economist at NAB Alan Oster said.

National Australia Bank's index of business conditions fell to +4 in April from +6 in March.

The business sales was at +10 in April, while the index of employment declined to -2 in April from 0 in March.

The capital expenditure index decreased to +6 in April from +9 in March.

-

11:12

European Central Bank Governing Council Member Ewald Nowotny: that controls on the movement of capital may be helpful in some extreme situations

European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Friday that controls on the movement of capital may be helpful for countries in an emergency.

"They might be helpful as a temporary measure in some extreme situations," he noted.

Nowotny added that such measures proved to be efficient in the case of Cyprus.

-

11:09

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E1.8bn), $1.1050(E1.7bn), $1.1100(E1.7bn), $1.1150(E1.0bn), 1.1200(E1.73bn)

USD/JPY: Y119.50($394mn), Y120.00($2.14bn), Y120.50($510mn), Y121.00($1.73bn)

EUR/JPY: Y132.00(E462mn)

GBP/USD: $1.5400(Gbp236mn).

EUR/GBP: Gbp0.7270(E212mn)

AUD/USD: $0.7800(A$2.7bn).

NZD/USD: $0.7525-30(NZ$1.0bn)

-

10:33

China’s central bank cuts its interest rate

The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

-

08:10

Options levels on monday, May 11, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1399 (4302)

$1.1324 (1537)

$1.1252 (3118)

Price at time of writing this review: $1.1153

Support levels (open interest**, contracts):

$1.1064 (6046)

$1.1005 (4159)

$1.0936 (5591)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 96705 contracts, with the maximum number of contracts with strike price $1,1200 (4959);

- Overall open interest on the PUT options with the expiration date June, 5 is 116459 contracts, with the maximum number of contracts with strike price $1,0800 (8244);

- The ratio of PUT/CALL was 1.20 versus 1.53 from the previous trading day according to data from May, 8

GBP/USD

Resistance levels (open interest**, contracts)

$1.5705 (2149)

$1.5608 (2067)

$1.5512 (1390)

Price at time of writing this review: $1.5421

Support levels (open interest**, contracts):

$1.5387 (1874)

$1.5291 (470)

$1.5196 (1959)

Comments:

- Overall open interest on the CALL options with the expiration date June, 5 is 31183 contracts, with the maximum number of contracts with strike price $1,5700 (2149);

- Overall open interest on the PUT options with the expiration date June, 5 is 42480 contracts, with the maximum number of contracts with strike price $1,4800 (3035);

- The ratio of PUT/CALL was 1.36 versus 1.37 from the previous trading day according to data from May, 8

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

03:31

Australia: National Australia Bank's Business Confidence, April 3

-

00:59

Currencies. Daily history for May 8’2015:

(pare/closed(GMT +3)/change, %)

EUR/JPY $1,1202 -0,44%

GBP/USD $1,5451 +0,23%

USD/CHF Chf0,9302 +0,87%

USD/JPY Y119,75 +0,05%

EUR/JPY Y134,14 -0,40%

GBP/JPY Y185,01 +0,27%

AUD/USD $0,7930 +0,25%

NZD/USD $0,7488 +0,52%

USD/CAD C$1,2071 -0,32%

-

00:00

Schedule for today, Monday, May 11’2015:

(time / country / index / period / previous value / forecast)

01:30 Australia National Australia Bank's Business Confidence April 3

09:00 Eurozone Eurogroup Meetings

11:00 United Kingdom BoE Interest Rate Decision 0.5% 0.5%

11:00 United Kingdom Asset Purchase Facility 375

11:00 United Kingdom MPC Rate Statement

-