Noticias del mercado

-

17:44

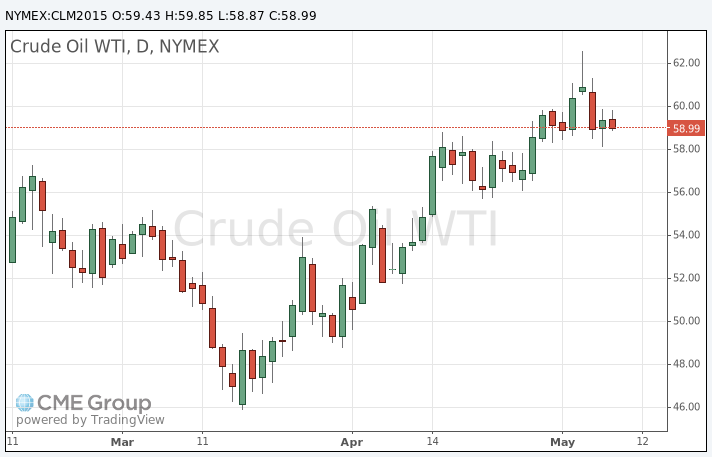

Oil prices decline on concerns about the global glut of oil

Oil prices traded lower on concerns about the global glut of oil. Investors are focusing on the release of the number of oil rigs in the U.S. The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 11 rigs to 668 last week, the lowest weekly level since September 2010.

Combined oil and gas rigs fell by 11 to 894, the lowest level since June 2009.

Investors are also cautious that U.S. oil producers could increase its oil production due to higher oil prices.

The Wall Street Journal reported today that the Organization of the Petroleum Exporting Countries (OPEC) forecasts that oil prices will be about $76 a barrel in 2025. OPEC doesn't see oil prices trading at $100 a barrel in the next decade, according to its latest strategy report, seen by The Wall Street Journal.

The Wall Street Journal also said that the report recommends that OPEC reintroduce the production quota system it abandoned in 2011.

WTI crude oil for June delivery fell to $58.87 a barrel on the New York Mercantile Exchange. Brent crude oil for June declined to $64.83 a barrel on ICE Futures Europe.

-

17:27

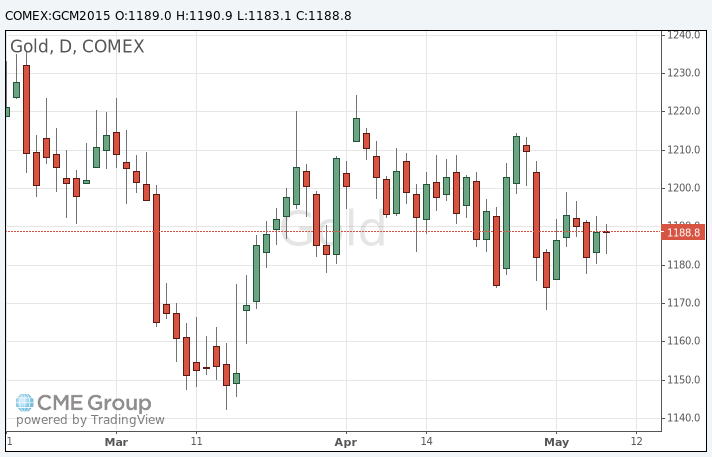

Gold price traded lower despite further stimulus measures from China

Gold price traded lower despite further stimulus measures from China. The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

The Greek debt crisis remains in focus. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

June futures for gold on the COMEX today fell to 1183.10 dollars per ounce.

-

10:54

Number of oil rigs in the U.S. declines again

The oil driller Baker Hughes reported that the number of active U.S. rigs declined by 11 rigs to 668 last week, the lowest weekly level since September 2010.

Combined oil and gas rigs fell by 11 to 894, the lowest level since June 2009.

-

10:33

China’s central bank cuts its interest rate

The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

-

01:01

Commodities. Daily history for May 8’2015:

(raw materials / closing price /% change)

Oil 59.39 +0.76%

Gold 1,187.90 -0.08%

-