Noticias del mercado

-

21:00

S&P 500 2,109.6 -6.50 -0.3 %, NASDAQ 5,006.13 +2.58 +0.1 %, Dow 18,121.58 -69.53 -0.4 %

-

20:56

WSE: Session Results

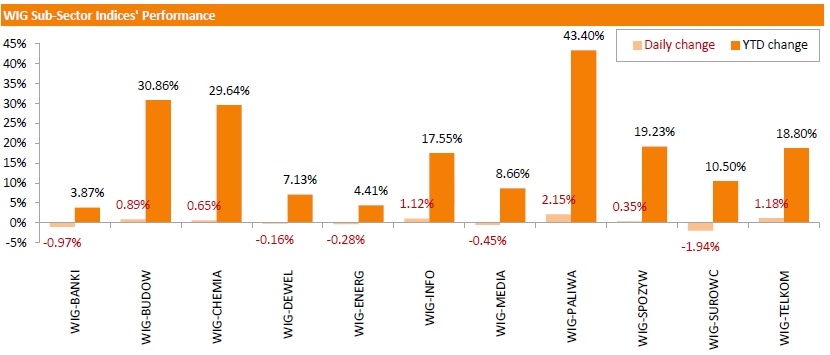

Polish equity market posted losses on Monday. The broad market measure - the WIG index fell by 0.2%, while the large liquid companies' indicator - the WIG30 index lost 0.35%.

Besides LPP (WSE: LPP) that lost 3.57%, the shares of KGHM (WSE: KGH) also went down significantly - by 2.16% as consolidated 1QFY2015 financials posted by KGHM International frustrated the market participants. In addition BZ WBK (WSE: BZW) dropped down rather significantly - by 1.92%. At the same time PKN ORLEN (WSE: PKN) recorded the highest growth among the WIG30 index components - 2.65%. It was followed by GRUPA AZOTY (WSE: ATT) and PGNIG (WSE: PGN), adding 1.81% each.

Among the WIG sub-sector indices the oil&gas names' indicator added the most (+2.15%). In the mean time, the indicators related to basic material producers (-1.94%) and the banks (-0.97%) underperformed.

-

19:12

Wall Street. Major U.S. stock-indexes growth

Major U.S. stock-indexes mixed on Monday amid worries about Greece's precarious financial condition and slowing growth in China, while energy stocks fell on weaker oil prices.

Almost of the Dow stocks are trading in negative area (23 of 30). Top looser - Exxon Mobil Corporation (XOM, -2.11%). Top gainer - Caterpillar Inc. (CAT, +2.27%).

Almost all S&P index sectors also in negative area. Top gainer - Healthcare (+0,2%). Top looser - Basic materials (-1.0%).

At the moment:

Dow 18091.00 -30.00 -0.17%

S&P 500 2106.25 -2.25 -0.11%

Nasdaq 100 4446.50 -2.25 -0.05%

10-year yield 2.22% +0.07

Oil 59.12 -0.27 -0.45%

Gold 1182.90 -6.00 -0.50%

-

18:07

European stocks close: stocks closed lower on the Greek debt problem

Stock indices closed lower on the Greek debt problem. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

European Central Bank Governing Council Member Ewald Nowotny said on Monday that the Greek debt crisis "is much more a political question than an economic question."

The Bank of England (BoE) released its interest rate decision on Monday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The interest rate decision was delayed because of last Thursday's parliamentary election in the U.K. The Conservative Party won enough seats to take a majority in parliament.

Low inflation and weak wages weighed on the BoE's interest rate decision.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

Indexes on the close:

Name Price Change Change %

FTSE 100 7,029.85 -16.97 -0.24 %

DAX 11,673.35 -36.38 -0.31 %

CAC 40 5,027.87 -62.52 -1.23 %

-

18:00

European stocks closed: FTSE 100 7,034.59 -12.23 -0.2 %, CAC 40 5,027.87 -62.52 -1.2 %, DAX 11,674.73 -35.00 -0.3 %

-

17:14

San Francisco Federal Reserve President John Williams: the interest rate hike by the Fed will depend on the economic data

San Francisco Federal Reserve President John Williams told in an interview to CNBC on Monday that there are improvements in the labour market, but inflation is still low due to a stronger U.S. dollar.

Williams noted that the interest rate hike by the Fed will depend on the economic data, and he added that the Fed may raise its interest rate at every monetary policy meeting.

He expects the economy to bounce back in the second quarter.

The San Francisco Federal Reserve president pointed out that equities valuations are high, but he is not worried about financial stability. Williams added that the Fed should monitor developments in financial markets around the world.

Williams is a voting member of the Federal Open Market Committee this year.

-

16:27

Pace of asset buying by the ECB rises last week

The European Central Bank (ECB) purchased €13.65 billion of government bonds last week. The central bank said on Monday it had settled a total of €108.709 billion of purchases of government bonds as of May 8, up from €95.056 billion the previous week.

ECB'S asset buying programme is intended to run to September 2016.

The ECB also said that it bought €2.9 billion of covered bonds last week, and €42 million of asset-backed securities. Covered bonds programmes totalled €77.976 billion, while asset-backed securities programmes totalled €5.827 billion.

-

15:58

European Central Bank Governing Council Member Ewald Nowotny: the Greek debt crisis "is much more a political question than an economic question"

European Central Bank Governing Council Member Ewald Nowotny said on Monday that the Greek debt crisis "is much more a political question than an economic question."

Nowotny offered no solution for the problem. He pointed out that the ECB's role was to ensure price and financial stability.

"We cannot substitute the political sphere," Nowotny said.

-

15:41

U.S. Stocks open: Dow +0.00%, Nasdaq +0.13%, S&P +0.01%

-

15:27

Before the bell: S&P futures +0.04%, NASDAQ futures +0.11%

U.S. stock-index futures were little changed.

Global markets:

Nikkei 19,620.91 +241.72 +1.2%

Hang Seng 27,718.2 +140.86 +0.5%

Shanghai Composite 4,334.02 +128.10 +3.0%

FTSE 7,050.55 +3.73 +0.1%

CAC 5,034.21 -56.18 -1.1%

DAX 11,667.78 -41.95 -0.4%

Crude oil $59.53 (+0.22%)

Gold $1184.60 (-0.02%)

-

15:24

German Finance Minister Wolfgang Schaeuble: a referendum on the Greek bailout in Greece may be helpful

German Finance Minister Wolfgang Schaeuble said on Monday that a referendum on the Greek bailout in Greece may be helpful. "If the Greek government thinks it should have a referendum, then it should organize a referendum," he noted.

Schaeuble ruled out any deal between Greece and its creditors at today's Eurogroup meeting as "there is not sufficient progress".

-

15:13

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

81.00

+0.05%

0.5K

Barrick Gold Corporation, NYSE

ABX

12.76

+0.08%

12.6K

Exxon Mobil Corp

XOM

88.38

+0.14%

8.2K

Twitter, Inc., NYSE

TWTR

37.65

+0.16%

11.9K

UnitedHealth Group Inc

UNH

115.90

+0.19%

3.4K

Wal-Mart Stores Inc

WMT

78.71

+0.23%

22.8K

Boeing Co

BA

145.87

+0.28%

4.7K

Deere & Company, NYSE

DE

90.15

+0.29%

0.1K

General Motors Company, NYSE

GM

35.43

+0.31%

2.1K

Walt Disney Co

DIS

110.49

+0.35%

0.3K

Caterpillar Inc

CAT

88.00

+0.79%

3.2K

HONEYWELL INTERNATIONAL INC.

HON

103.00

+0.86%

0.3K

Cisco Systems Inc

CSCO

29.57

+1.16%

41.0K

AT&T Inc

T

33.69

0.00%

0.1K

United Technologies Corp

UTX

118.43

0.00%

0.8K

ALCOA INC.

AA

13.82

0.00%

3.2K

International Business Machines Co...

IBM

172.66

-0.01%

0.2K

Chevron Corp

CVX

108.63

-0.02%

0.8K

Johnson & Johnson

JNJ

101.45

-0.02%

0.1K

3M Co

MMM

160.55

-0.03%

0.5K

Starbucks Corporation, NASDAQ

SBUX

49.75

-0.06%

1.3K

General Electric Co

GE

27.34

-0.08%

23.5K

Facebook, Inc.

FB

78.44

-0.09%

5.4K

Goldman Sachs

GS

200.30

-0.10%

0.3K

Tesla Motors, Inc., NASDAQ

TSLA

236.31

-0.13%

7.7K

Amazon.com Inc., NASDAQ

AMZN

433.01

-0.16%

0.7K

Verizon Communications Inc

VZ

50.05

-0.18%

4.9K

Microsoft Corp

MSFT

47.66

-0.19%

3.0K

McDonald's Corp

MCD

98.00

-0.23%

1.9K

E. I. du Pont de Nemours and Co

DD

75.10

-0.24%

12.8K

Apple Inc.

AAPL

127.32

-0.24%

131.8K

Ford Motor Co.

F

15.63

-0.26%

6.9K

Citigroup Inc., NYSE

C

53.87

-0.28%

4.7K

JPMorgan Chase and Co

JPM

65.30

-0.29%

15.8K

Yahoo! Inc., NASDAQ

YHOO

43.92

-0.39%

1.6K

Merck & Co Inc

MRK

60.50

-0.40%

0.1K

Visa

V

69.16

-0.45%

5.2K

Intel Corp

INTC

32.65

-0.46%

62.2K

-

14:58

European Central Bank Vice President Vitor Constancio does not expect the worst case for Greece

European Central Bank (ECB) Vice President Vitor Constancio said on Friday that he did not the worst case for Greece. He added that the ECB is providing liquidity to the banks.

Constancio also said that he did not expect "excessive volatility in the bond market to continue".

-

14:48

Upgrades and downgrades before the market open

Upgrades:

Caterpillar (CAT) upgraded from Neutral to Outperform at Robert W. Baird, target raised from $80 to $101

Downgrades:

Other:

-

14:14

Bank of England keeps its interest rate on hold at 0.5% in May

The Bank of England (BoE) released its interest rate decision on Monday. The BoE kept its interest rates unchanged at 0.5% and its asset purchase program unchanged at £375 billion. This decision was widely expected.

The interest rate decision was delayed because of last Thursday's parliamentary election in the U.K. The Conservative Party won enough seats to take a majority in parliament.

Low inflation and weak wages weighed on the BoE's interest rate decision.

Analysts expect that the BoE will start to raise its interest rate in early 2016.

Investors are awaiting the BoE Governor Mark Carney's inflation report on Wednesday and the minutes of the monetary policy committee (MPC). The minutes of the meeting will be released on May 20.

All members voted in April to keep the central bank's monetary policy unchanged, according to MPC's meeting minutes.

-

12:05

European stock markets mid session: most stocks traded lower on the Greek debt crisis

Most stock indices traded lower on the Greek debt crisis. The Eurogroup meeting is scheduled to be today. It is unlikely that the €7.2 billion tranche of loans will be unlocked at this meeting because there are still differences despite the progress of negotiations.

Greece must repay the IMF €750 million loan on May 12. Athens said that it has enough money to pay the IMF this week.

German finance minister Wolfgang Schaeuble warned over the weekend that Greece can slide into insolvency.

Current figures:

Name Price Change Change %

FTSE 100 7,063.99 +17.17 +0.2 %

DAX 11,646.11 -63.62 -0.5 %

CAC 40 5,016.06 -74.33 -1.5 %

-

11:37

National Australia Bank's business confidence index remains unchanged at 3 in April

The National Australia Bank (NAB) released its business consumer index for Australia on Monday. The business confidence index remained unchanged at 3 in April.

"Recent signs of improvement in the economic partials are encouraging but the non mining sector needs to lift more to offset the impact on domestic demand of sharply lower mining investment and the hit to income from commodity prices," the Chief Economist at NAB Alan Oster said.

National Australia Bank's index of business conditions fell to +4 in April from +6 in March.

The business sales was at +10 in April, while the index of employment declined to -2 in April from 0 in March.

The capital expenditure index decreased to +6 in April from +9 in March.

-

11:12

European Central Bank Governing Council Member Ewald Nowotny: that controls on the movement of capital may be helpful in some extreme situations

European Central Bank (ECB) Governing Council Member Ewald Nowotny said on Friday that controls on the movement of capital may be helpful for countries in an emergency.

"They might be helpful as a temporary measure in some extreme situations," he noted.

Nowotny added that such measures proved to be efficient in the case of Cyprus.

-

10:33

China’s central bank cuts its interest rate

The People's Bank of China (PBOC) cut its one-year lending rate by 25 basis points to 5.1% on Sunday. It lowered the benchmark deposit rate by 25 basis points to 2.25%. It was third interest rate cut in six months.

China's central bank noted that the country's economy is still facing "relatively big downward pressure".

"At the same time, the overall level of domestic prices remains low, and real interest rates are still higher than the historical average," the central bank added.

-

01:00

Stocks. Daily history for Apr May 8’2015:

(index / closing price / change items /% change)

Nikkei 225 19,379.19 +87.20 +0.45 %

Hang Seng 27,577.34 +287.37 +1.05 %

S&P/ASX 200 5,634.6 -11.13 -0.20 %

Shanghai Composite 4,206.76 +94.55 +2.30 %

FTSE 100 7,046.82 +159.87 +2.32 %

CAC 40 5,090.39 +123.17 +2.48 %

Xetra DAX 11,709.73 +301.76 +2.65 %

S&P 500 2,116.1 +28.10 +1.35 %

NASDAQ Composite 5,003.55 +58.00 +1.17 %

Dow Jones 18,191.11 +267.05 +1.49 %

-