Noticias del mercado

-

20:20

American focus: the US dollar appreciated strongly against most major currencies

The US dollar strengthened significantly against the euro, reaching a peak on 27 April. The reason for such dynamics were weak GDP data in the euro zone and US indicators optimistic. Revised Eurostat estimates showed that the euro zone economy expanded less than previously estimated. Gross domestic product grew by 0.5 percent in the first quarter compared with the previous quarter, when it grew by 0.3 per cent. Eurostat previously estimated 0.6 percent growth in the first three months of 2016. In annual terms, GDP growth fell to 1.5 percent from 1.6 percent. The annual growth rate for the first quarter was revised down to 1.6 percent. At the same time, the economy of the EU 29 countries registered an increase of 0.5 percent in quarterly terms and by 1.7 percent per annum.

With regard to the statistics on the US, the Commerce Department reported that retail sales in April recorded their biggest gain in a year, as the Americans have stepped up purchases of cars and a number of other goods. Retail sales rose 1.3 percent last month. The figure for March was revised down to -0.3 percent from -0.4 percent. Excluding cars, gasoline and building materials and services to the food, retail sales jumped 0.9 percent after rising 0.2 percent in March. Economists had forecast an increase total sales by 0.7 percent and core sales by 0.3 percent. In April, car sales rose by 3.2 percent, the biggest increase since March 2015, after being shown a sharp decline of 3.2 percent in March. Sales at service stations increased by 2.2 percent, reflecting the recent rise in gasoline prices. Sales in clothing stores increased by 1.0 percent, the biggest increase since May 2015. Online retail sales rose 2.1 percent, the biggest gain since June 2014.

Meanwhile, the final results of the studies submitted by Thomson-Reuters and Institute of Michigan, revealed in May consumer sentiment index rose to 95.8 points compared with a final reading of 89.0 points in April. According to average estimates, the index was up 91.0 points.

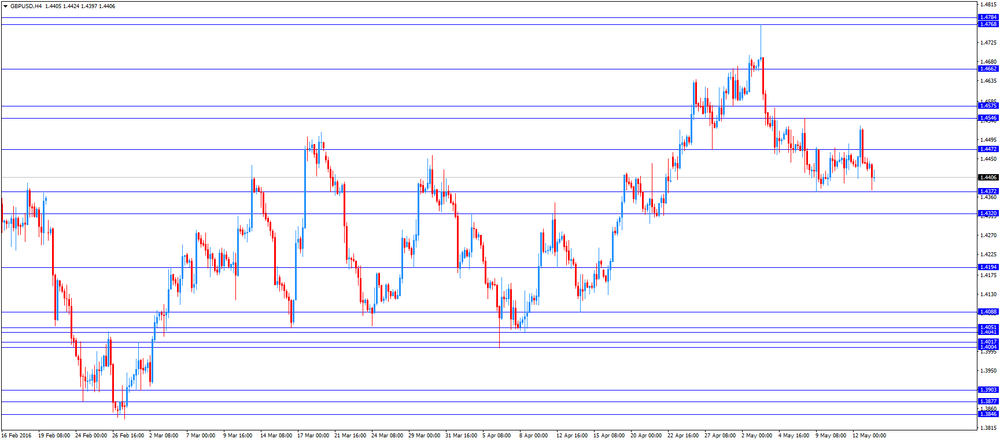

The pound depreciated moderately against the dollar, updating at least May, which was mainly due to the widespread growth of the US currency in response to the data on retail sales. Pressure on the pound have also had statements by the International Monetary Fund that the decision to withdraw Britain from the EU on the basis of a referendum on June 23 may have a negative impact on the economy. In this case, the UK GDP in the long run may be lower than 1% -9%, what will be, if it is to remain in the union. Exit from the EU can "provoke uncertainty growth, increased volatility in the financial market, as well as a negative impact on production", - says the IMF report. Statement by the IMF follows the Bank of England warning, who noted that the vote for the exit from the EU will slow down economic growth, will cause unemployment and inflation due to a sharp drop in the pound.

The Canadian dollar dropped more than 100 pips against the US dollar, updating the minimum on 11 May. In addition to the general strengthening of the US currency, affected the course of trading in the oil market situation. Today, oil futures are down again, ending a three-day rally, due to the partial profit-taking by investors before the long weekend. Recall on Monday, markets in many European countries, including Germany and France, will be closed for a public holiday. Further reduction of prices holding back the news from Nigeria, where, due to supply disruptions of oil production fell to 22-year low. Minister of Finance of Nigeria said that the country's oil production fell to 1.65 million barrels per day from 2.2 million barrels per day before the failure. Little influenced by a report from the Organization of Petroleum Exporting Countries (OPEC). As it became known, OPEC kept its forecast for global oil demand in 2016, which is expected to grow by 1.2 million barrels per day to 94.18 million barrels per day. In 2016, as the experts expect production in countries outside OPEC will decline by 0.74 million barrels per day (figure revised to 10 th. Barrels per day downward) to 56.4 million barrels a day.

-

18:47

WEEKLY REVIEW: Waiting for hints for further interest rate hikes by the Fed

This week was fairly quiet. The U.S. economic market data was mixed again. The initial jobless claims in the U.S. surprisingly increased last week. Are that signs of the slowdown in the U.S. labour market? The pace of the job creation also slowed in April.

Market participants are awaiting the U.S. labour market for May. The weaker-than-expected U.S. labour market could mean that the Fed would not raise its interest rate in June. The referendum on Britain's membership in the European Union (EU) on June 23 is also likely to weigh on the Fed's interest rate decision as Britain's exit from the EU would have a negative impact on the U.S. economy.

Oil prices rose this week, mainly supported by the wildfire in Canada. It is likely that we will see some correction in the coming days and weeks as the global oil oversupply still remained.

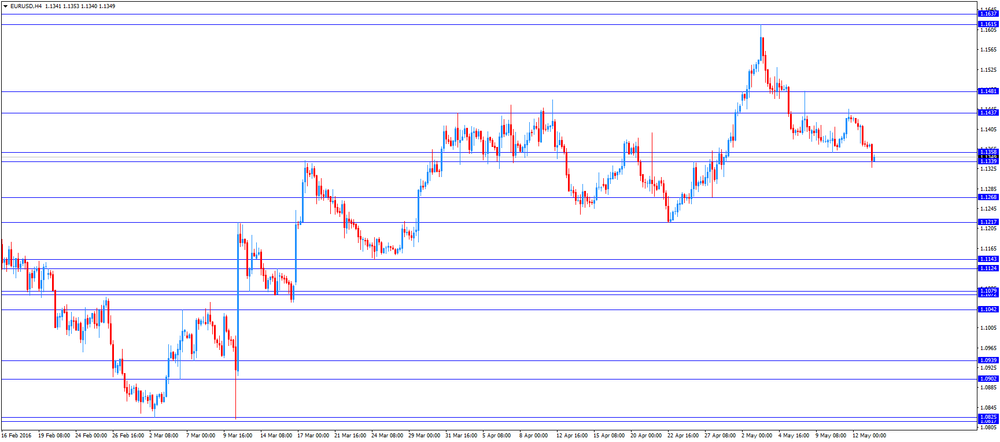

It is likely that the currency pair EURUSD will rise toward the high of May 11 at $1.1445, if there are negative news from the U.S. and there are no negative economic data from the Eurozone.

If the U.S. economic data is better than expected and in case of the negative economic data from the Eurozone, the currency pair EURUSD may test the low of April 22 at $1.1217.

-

18:28

The Bank of Japan Governor Haruhiko Kuroda: the BoJ is ready to add further stimulus measures to boost inflation

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Friday that the central bank was ready to add further stimulus measures to boost inflation.

"It [the BoJ] will carefully consider how to make the best use of the policy scheme in order to achieve the price stability target of 2 percent, and will act decisively as we move on," he said.

Kuroda added that there were still tools to boost inflation.

"There is no doubt that ample space for additional easing," the BoJ governor noted.

-

18:23

International Monetary Fund Managing Director Christine Lagarde: Britain’s exit from the European Union (EU) would be “very bad”

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Friday that Britain's exit from the European Union (EU) would be "very bad".

The IMF released its report on the U.K. economy. The lender said that the biggest risk to the U.K. economy was the referendum on Britain's membership in the EU.

"The long-run effects on UK output and incomes would also likely be negative and substantial," the IMF said.

-

17:16

New loans in China decline to 555.6 billion yuan in April

The People's Bank of China (PBoC) released its new loans data on Friday. New loans in local currency in China were 555.6 billion yuan in April, down from March's 1,370.0 billion yuan.

M2 money supply jumped by 12.8% year-on-year in April.

Total social financing decreased to 751 billion yuan in April from 2.34 trillion yuan in March.

-

17:10

Retail sales in New Zealand rose 0.8% in the first quarter

Statistics New Zealand released retail sales data on late Thursday evening. Retail sales in New Zealand climbed 0.8% in the first quarter, missing expectations for a 1.0% rise, after a 1.1% gain in the fourth quarter. The fourth quarter's figure was revised down from a 1.2% increase.

The increase was mainly driven by a rise in electrical and electronic goods sales, which jumped 3.8% in the first quarter.

"Consumers continued to spend-up on electrical and electronic goods this quarter. There has been sustained growth in this industry for some time, with the trend rising over the past eight years," business indicators senior manager Neil Kelly said

On a yearly basis, retail sales rose 4.8% in the first quarter, after a 5.3% increase in the fourth quarter.

-

17:02

Japan's tertiary industry activity index decreases 0.7% in March

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Friday. The index decreased 0.7% in March, missing expectations for a 0.2% decline, after a 0.1% fall in February.

The fall was driven by declines in finance and Insurance, wholesale trade, information and communications, real estate, living and amusement-related services.

On a yearly basis, the tertiary industry activity index fell 0.1% in March, after a 2.5% rise in February.

-

16:22

U.S. business inventories increase 0.4% in March

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.4% in March, beating expectations for a 0.2% gain, after a 0.1% decrease in February.

Retail inventories climbed 1.0% in March, wholesale inventories were up 0.1%, while manufacturing inventories increased 0.2%.

Retail sales declined 0.3% in March, while total business sales were up 0.3%.

The business inventories/sales ratio remained unchanged at 1.41 months in March. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:15

Thomson Reuters/University of Michigan preliminary consumer sentiment index jumps to 95.8 in May

The Thomson Reuters/University of Michigan preliminary consumer sentiment index jumped to 95.8 in May from a final reading of 89.0 in March. Analysts had expected the index to rise to 91.0.

"Consumer sentiment rebounded in early May due to more frequent income gains, an improved jobs outlook, and the expectation of lower inflation and interest rates. The largest gains were recorded among lower income and younger households, although the gains were recorded among all income and age subgroups as well as across all regions," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The index of current economic conditions climbed to 108.6 in May from 106.7 in April, while the index of consumer expectations increased to 87.5 from 77.6.

The one-year inflation expectations declined to 2.5% in May from 2.8% in April.

-

16:00

U.S.: Business inventories , March 0.4% (forecast 0.2%)

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, May 95.8 (forecast 91)

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 106.00 (USD 503m) 107.25 (521m) 107.75 (410m) 108.18-20 (1.61bln) 109.50 (350m)

EUR/USD: 1.1200 (EUR 463m) 1.1350 (764m) 1.1500 (901m)

AUD/USD 0.7300 (AUD 618m) 0.7410 (275m)

USD/CAD 1.2800-05 (USD 726m) 1.2835-45 (538m) 1.2900 (370m) 1.3000 (320m) 1.3220 (1.13bln)

NZD/USD 0.6850 (NZD 216m)

AUD/NZD 1.0850 (AUD 202m)

-

15:35

Final consumer prices in Italy decrease 0.1% in April

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Final consumer prices in Italy decreased 0.1% in April, down from the preliminary reading of 0.0%, after a 0.2% increase in March.

The monthly decrease was driven by a drop in prices of non-regulated energy products.

On a yearly basis, consumer prices declined 0.5% in April, down with preliminary reading of -0.4%, after a 0.2% decline in March.

The declines was mainly driven by a faster decline of prices of non-regulated energy products and electricity. Prices of non-regulated energy products slid 6.4% year-on-year in April, while prices for electricity declined 1.9%.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in April from 0.6% in March.

-

15:23

Italian economy increases 0.3% in the first quarter

The Italian statistical office Istat released its preliminary gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.3% in the first quarter, after a 0.2% rise in the fourth quarter. The fourth quarter's figure was revised up from a 0.1% gain.

On a yearly basis, Italy's GDP declined to 1.0% in the first quarter from 1.1% in the fourth quarter. The fourth quarter's figure was revised up from a 1.0% rise.

-

15:18

U.S. producer prices rise 0.2% in April

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index rose 0.2% in April, missing expectations for a 0.3% rise, after a 0.1% drop in March.

The increase was mainly driven by a rise in services prices.

Energy prices increased 0.2% in April, wholesale food prices decreased 0.3%.

Services prices were up 0.1% in April, while prices for goods rose 0.2%.

On a yearly basis, the producer price index was flat in April, after a 0.1% decline in March.

The producer price index excluding food and energy increased 0.1% in April, in line with expectations, after a 0.1% fall in March.

On a yearly basis, the producer price index excluding food and energy climbed 0.9% in April, after a 1.0% rise in March.

These figures could mean that the Fed will raise its interest rate cautiously and gradually.

-

15:08

U.S. retail sales climb 1.3% in April

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 1.3% in April, exceeding expectations for a 0.7% rise, after a 0.3% fall in March. It was the biggest rise since March 2015.

March's figure was revised up from a 0.4% decline.

The increase was mainly driven by a rise in sales at auto dealerships.

Sales at clothing retailers were up 1.0% in April, sales at building material and garden equipment stores decreased 1.0%, while sales at auto dealerships jumped 3.2%.

Retail sales excluding automobiles rose 0.8% in April, beating expectations for a 0.3% increase, after a 0.4% gain in March. March's figure was revised up from a 0.1% rise.

Sales at service stations climbed 2.2% in April, while sales at furniture stores rose 0.7%.

These figures indicates that the U.S. economy could rebound in the second quarter after the weak growth in the first quarter.

-

14:31

U.S.: Retail sales excluding auto, April 0.8% (forecast 0.3%)

-

14:31

U.S.: PPI excluding food and energy, Y/Y, April 0.9%

-

14:31

U.S.: PPI, y/y, April 0%

-

14:30

U.S.: PPI excluding food and energy, m/m, April 0.1% (forecast 0.1%)

-

14:30

U.S.: PPI, m/m, April 0.2% (forecast 0.3%)

-

14:30

U.S.: Retail Sales YoY, April 3%

-

14:30

U.S.: Retail sales, April 1.3% (forecast 0.7%)

-

14:23

Greek GDP declines 0.4% in the first quarter

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.4% in the first quarter, after a 0.1% rise in the fourth quarter.

On a yearly basis, Greek preliminary GDP fell 1.3% in the first quarter, after a revised 0.8% decrease in the fourth quarter.

-

14:09

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Tertiary Industry Index March -0.1% -0.2% -0.7%

06:00 Germany CPI, m/m (Finally) April 0.8% -0.4% -0.4%

06:00 Germany CPI, y/y (Finally) April 0.3% -0.1% -0.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter I 0.3% 0.6% 0.7%

06:00 Germany GDP (YoY) (Preliminary) Quarter I 2.1% 1.5% 1.3%

06:45 France Non-Farm Payrolls (Preliminary) Quarter I 0.2% 0.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I 0.3% 0.6% 0.5%

09:00 Eurozone GDP (YoY) (Revised) Quarter I 1.6% 1.6% 1.5%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data from the U.S. The U.S. retail sales are expected to rise 0.7% in April, after a 0.7% decline in March.

The U.S. PPI is expected to increase 0.3% in April, after a 0.1% drop in March.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in April, after a 0.1% fall in March.

The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to increase to 91.0 in May from 89.0 in April.

The euro traded mixed against the U.S. dollar on the GDP data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

The British pound traded mixed against the U.S. dollar on the weak construction output data from the U.K. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

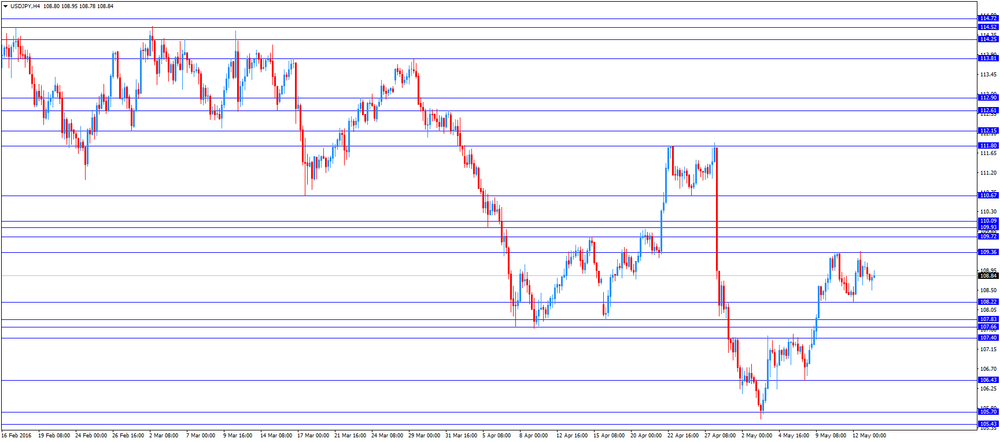

USD/JPY: the currency pair climbed to Y108.95

The most important news that are expected (GMT0):

12:30 U.S. Retail sales April -0.4% 0.7%

12:30 U.S. Retail Sales YoY April 1.7%

12:30 U.S. Retail sales excluding auto April 0.1% 0.3%

12:30 U.S. PPI, m/m April -0.1% 0.3%

12:30 U.S. PPI, y/y April -0.1%

12:30 U.S. PPI excluding food and energy, m/m April -0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y April 1%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) May 89 91

14:00 U.S. Business inventories March -0.1% 0.2%

-

13:50

Orders

EUR/GBP

Offers : 0.7880-85 0.7900 0.7920 0.7930 0.7950 0.7980 0.8000 0.8020 0.8050

Bids: 0.7845-50 0.7830 0.7820 0.7800 0.7780 0.7760 0.7735 0.7700

EUR/USD

Offers : 1.1350 1.1380 1.1400 1.1430 1.1450-60 1.1475-80 1.1500

Bids: 1.1330 1.1315 1.1300 1.1285 1.1270 1.1250 1.1230 1.1200

GBP/USD

Offers : 1.4420 1.4435 1.4450 1.4460 1.4480 1.4500 1.4530 1.4550

Bids: 1.4375 1.4350-55 1.4330 1.4300-10 1.4275-80 1.4250 1.4230 1.4200

EUR/JPY

Offers : 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50 126.00

Bids: 123.00 122.80 122.50 122.00 121.70 121.50 121.00

USD/JPY

Offers : 108.85 109.00 109.20 109.50 109.80 110.00 110.30 110.50

Bids: 108.50 108.30 108.20 108.00 107.85 107.60 107.20-25 107.00

AUD/USD

Offers : 0.7300-10 0.7325 0.7350 0.7380 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids: 0.7275-80 0.7265 0.7250 0.7200 0.7185 0.7165 0.7150

-

12:11

UK’s construction output declines 3.6% in March

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

-

12:02

French final non-farm employment increases 0.2% in the first quarter

The French statistical office Insee released its preliminary non-farm employment data on Friday. French non-farm employment increased 0.2% in the first quarter, after a 0.2% increase in the fourth quarter.

Employment excluding temporary work rose by 48,500 jobs in the first quarter.

Temporary employment rose by 0.3% in the first quarter.

Employment in the industry was down by 0.4% in the first quarter, while employment in construction declined by 0.3%.

Overall, job creation in the market services sector climbed by 0.4% in the first quarter.

-

11:49

Final consumer price inflation in Spain rises 0.7% in April

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.7% in April, in line with the preliminary reading, after a 0.6% rise in March.

The monthly rise was mainly driven by an increase in clothing and footwear, which climbed 10.6% in April.

On a yearly basis, consumer prices fell by 1.1% in April from a year ago, in line with preliminary reading, after a 0.8% decline in March.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:42

German economy grows 0.7% in the first quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

-

11:33

German final consumer price inflation falls 0.4% in April

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.4% in April, in line with the preliminary estimate, after a 0.8% rise in March.

On a yearly basis, German final consumer price index decreased to -0.1% in April from 0.3% in March, in line with the preliminary estimate.

Energy prices dropped 8.5% year-on-year in April, while food prices climbed 0.5%.

Consumer prices excluding energy increased 0.9% year-on-year in April.

-

11:22

Eurozone's revised GDP climbs 0.5% in first quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

-

11:00

Eurozone: GDP (QoQ), Quarter I 0.5% (forecast 0.6%)

-

11:00

Eurozone: GDP (YoY), Quarter I 1.5% (forecast 1.6%)

-

10:56

Boston Fed President Eric Rosengren: the U.S. economy will expand faster in the second quarter

Boston Fed President Eric Rosengren said in a speech on Thursday that the U.S. economy would expand faster in the second quarter after a weak growth in the first quarter. He noted that headwinds from abroad diminished.

Rosengren pointed out that it was appropriate to continue to hike interest rates if the U.S. economy continued to improve.

"In my view, the market remains too pessimistic about the fundamental strength of the U.S. economy, and the likelihood of removing monetary accommodation is higher than is currently priced into financial markets based on current data," Boston Fed president said.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:47

Kansas City Fed President Esther George: interest rates in the U.S. are too low

Kansas City Fed President Esther George said in a speech on Thursday that interest rates in the U.S. were too low.

"I support a gradual adjustment of short-term interest rates toward a more normal level, but I view the current level as too low for today's economic conditions," she said.

"The economy is at or near full employment and inflation is close to the FOMC's target of 2 percent, yet short-term interest rates remain near historic low," George added.

George is a voting member of the Federal Open Market Committee (FOMC) this year. She voted for an interest rate hike in March and April.

-

10:38

Fed Chairwoman Janet Yellen does not completely rule out negative interest rates

Fed Chairwoman Janet Yellen wrote in a letter to Representative Brad Sherman on Thursday that she would not completely rule out negative interest rates, adding that "policymakers would need to consider a wide range of issues" before implementing this tool in the U.S.

She noted that the Fed would analyse the effect of negative interest rates as this tool provided additional monetary policy accommodation.

-

10:11

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 41.7 in in the week ended May 08

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 41.7 in in the week ended May 08 from 42.0 the prior week. It was the lowest reading since mid-December 2015.

The decrease was mainly driven by a less favourable assessment of the U.S. economy. The measure of views of the economy was down to 30.6 from 32.6, the buying climate index increased to 39.1 from 38.2, while the personal finances index rose to 55.4 from 55.3.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 106.00 (USD 503m) 107.25 (521m) 107.75 (410m) 108.18-20 (1.61bln) 109.50 (350m)

EUR/USD: 1.1200 (EUR 463m) 1.1350 (764m) 1.1500 (901m)

AUD/USD 0.7300 (AUD 618m) 0.7410 (275m)

USD/CAD 1.2800-05 (USD 726m) 1.2835-45 (538m) 1.2900 (370m) 1.3000 (320m) 1.3220 (1.13bln)

NZD/USD 0.6850 (NZD 216m)

AUD/NZD 1.0850 (AUD 202m)

-

09:01

France: Non-Farm Payrolls, Quarter I 0.2%

-

08:28

Options levels on friday, May 13, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1544 (4311)

$1.1482 (4521)

$1.1437 (2086)

Price at time of writing this review: $1.1358

Support levels (open interest**, contracts):

$1.1324 (2236)

$1.1277 (2549)

$1.1247 (5658)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 63453 contracts, with the maximum number of contracts with strike price $1,1600 (5252);

- Overall open interest on the PUT options with the expiration date June, 3 is 87751 contracts, with the maximum number of contracts with strike price $1,1200 (8906);

- The ratio of PUT/CALL was 1.38 versus 1.37 from the previous trading day according to data from May, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.4705 (1709)

$1.4607 (2227)

$1.4511 (2110)

Price at time of writing this review: $1.4415

Support levels (open interest**, contracts):

$1.4389 (1397)

$1.4292 (2357)

$1.4195 (2842)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 29287 contracts, with the maximum number of contracts with strike price $1,4600 (2227);

- Overall open interest on the PUT options with the expiration date June, 3 is 32594 contracts, with the maximum number of contracts with strike price $1,4200 (2842);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from May, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:18

Asian session: The yen has weakened

The yen has weakened in most recent sessions as investors pared long positions and Japanese officials explicitly warned about currency intervention.

Also undermining the yen, a prominent academic with close ties to BOJ Governor Haruhiko Kuroda said on Thursday that the Bank of Japan is likely to expand monetary stimulus either in June or July with an eye on first-quarter gross domestic product data and the outcome of this month's G7 summit.

Cleveland Fed President Loretta Mester, who has been less cautious about future rate increases than many of her colleagues, said that inflation measures have moved higher. She said any uncertainty in the Fed's economic forecasting should not stop the central bank from taking monetary policy decisions.

Boston Fed President Eric Rosengren, a voting member this year on the Fed's rate-setting committee, said the central bank should raise rates again if second-quarter data confirms that the U.S. labor market is near full strength and inflation is on track to accelerate.

Later on Friday, investors await a fresh set of U.S. economic readings, including retail sales data and the April producer price index.

EUR/USD: during the Asian session the pair traded in the range of $1.1365-80

GBP/USD: during the Asian session the pair traded in the range of $1.4420-50

USD/JPY: during the Asian session the pair fell to Y108.70

Based on Reuters materials

-

08:01

Germany: CPI, m/m, April -0.4% (forecast -0.4%)

-

08:01

Germany: CPI, y/y , April -0.1% (forecast -0.1%)

-

08:00

Germany: GDP (QoQ), Quarter I 0.7% (forecast 0.6%)

-

08:00

Germany: GDP (YoY), Quarter I 1.3% (forecast 1.5%)

-

06:31

Japan: Tertiary Industry Index , March -0.7% (forecast -0.2%)

-

01:03

Currencies. Daily history for May 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1375 -0,43%

GBP/USD $1,4441 -0,02%

USD/CHF Chf0,9705 -0,02%

USD/JPY Y109,03 +0,53%

EUR/JPY Y124,02 +0,10%

GBP/JPY Y157,45 +0,51%

AUD/USD $0,7318 -0,77%

NZD/USD $0,6816 0,00%

USD/CAD C$1,284 -0,09%

-

00:46

New Zealand: Retail Sales, q/q, Quarter I 0.8% (forecast 1.0%)

-

00:46

New Zealand: Retail Sales YoY, Quarter I 4.8%

-

00:01

Schedule for today, Friday, May 13’2016:

(time / country / index / period / previous value / forecast)

04:30 Japan Tertiary Industry Index March -0.1% -0.2%

06:00 Germany CPI, m/m (Finally) April 0.8% -0.4%

06:00 Germany CPI, y/y (Finally) April 0.3% -0.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter I 0.3% 0.6%

06:00 Germany GDP (YoY) (Preliminary) Quarter I 2.1% 1.5%

06:45 France Non-Farm Payrolls (Preliminary) Quarter I 0.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I 0.3% 0.6%

09:00 Eurozone GDP (YoY) (Revised) Quarter I 1.6% 1.6%

12:30 U.S. Retail sales April -0.4% 0.7%

12:30 U.S. Retail Sales YoY April 1.7%

12:30 U.S. Retail sales excluding auto April 0.1% 0.3%

12:30 U.S. PPI, m/m April -0.1% 0.3%

12:30 U.S. PPI, y/y April -0.1%

12:30 U.S. PPI excluding food and energy, m/m April -0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y April 1%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) May 89 91

14:00 U.S. Business inventories March -0.1% 0.2%

-