Noticias del mercado

-

21:00

Dow -1.01% 17,541.04 -179.46 Nasdaq -0.49% 4,713.93 -23.40 S&P -0.87% 2,046.08 -18.03

-

20:20

American focus: the US dollar appreciated strongly against most major currencies

The US dollar strengthened significantly against the euro, reaching a peak on 27 April. The reason for such dynamics were weak GDP data in the euro zone and US indicators optimistic. Revised Eurostat estimates showed that the euro zone economy expanded less than previously estimated. Gross domestic product grew by 0.5 percent in the first quarter compared with the previous quarter, when it grew by 0.3 per cent. Eurostat previously estimated 0.6 percent growth in the first three months of 2016. In annual terms, GDP growth fell to 1.5 percent from 1.6 percent. The annual growth rate for the first quarter was revised down to 1.6 percent. At the same time, the economy of the EU 29 countries registered an increase of 0.5 percent in quarterly terms and by 1.7 percent per annum.

With regard to the statistics on the US, the Commerce Department reported that retail sales in April recorded their biggest gain in a year, as the Americans have stepped up purchases of cars and a number of other goods. Retail sales rose 1.3 percent last month. The figure for March was revised down to -0.3 percent from -0.4 percent. Excluding cars, gasoline and building materials and services to the food, retail sales jumped 0.9 percent after rising 0.2 percent in March. Economists had forecast an increase total sales by 0.7 percent and core sales by 0.3 percent. In April, car sales rose by 3.2 percent, the biggest increase since March 2015, after being shown a sharp decline of 3.2 percent in March. Sales at service stations increased by 2.2 percent, reflecting the recent rise in gasoline prices. Sales in clothing stores increased by 1.0 percent, the biggest increase since May 2015. Online retail sales rose 2.1 percent, the biggest gain since June 2014.

Meanwhile, the final results of the studies submitted by Thomson-Reuters and Institute of Michigan, revealed in May consumer sentiment index rose to 95.8 points compared with a final reading of 89.0 points in April. According to average estimates, the index was up 91.0 points.

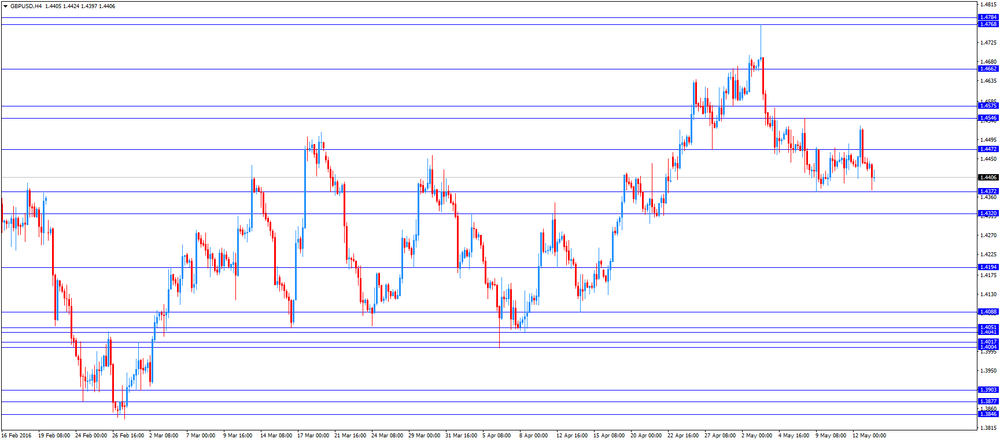

The pound depreciated moderately against the dollar, updating at least May, which was mainly due to the widespread growth of the US currency in response to the data on retail sales. Pressure on the pound have also had statements by the International Monetary Fund that the decision to withdraw Britain from the EU on the basis of a referendum on June 23 may have a negative impact on the economy. In this case, the UK GDP in the long run may be lower than 1% -9%, what will be, if it is to remain in the union. Exit from the EU can "provoke uncertainty growth, increased volatility in the financial market, as well as a negative impact on production", - says the IMF report. Statement by the IMF follows the Bank of England warning, who noted that the vote for the exit from the EU will slow down economic growth, will cause unemployment and inflation due to a sharp drop in the pound.

The Canadian dollar dropped more than 100 pips against the US dollar, updating the minimum on 11 May. In addition to the general strengthening of the US currency, affected the course of trading in the oil market situation. Today, oil futures are down again, ending a three-day rally, due to the partial profit-taking by investors before the long weekend. Recall on Monday, markets in many European countries, including Germany and France, will be closed for a public holiday. Further reduction of prices holding back the news from Nigeria, where, due to supply disruptions of oil production fell to 22-year low. Minister of Finance of Nigeria said that the country's oil production fell to 1.65 million barrels per day from 2.2 million barrels per day before the failure. Little influenced by a report from the Organization of Petroleum Exporting Countries (OPEC). As it became known, OPEC kept its forecast for global oil demand in 2016, which is expected to grow by 1.2 million barrels per day to 94.18 million barrels per day. In 2016, as the experts expect production in countries outside OPEC will decline by 0.74 million barrels per day (figure revised to 10 th. Barrels per day downward) to 56.4 million barrels a day.

-

18:47

WEEKLY REVIEW: Waiting for hints for further interest rate hikes by the Fed

This week was fairly quiet. The U.S. economic market data was mixed again. The initial jobless claims in the U.S. surprisingly increased last week. Are that signs of the slowdown in the U.S. labour market? The pace of the job creation also slowed in April.

Market participants are awaiting the U.S. labour market for May. The weaker-than-expected U.S. labour market could mean that the Fed would not raise its interest rate in June. The referendum on Britain's membership in the European Union (EU) on June 23 is also likely to weigh on the Fed's interest rate decision as Britain's exit from the EU would have a negative impact on the U.S. economy.

Oil prices rose this week, mainly supported by the wildfire in Canada. It is likely that we will see some correction in the coming days and weeks as the global oil oversupply still remained.

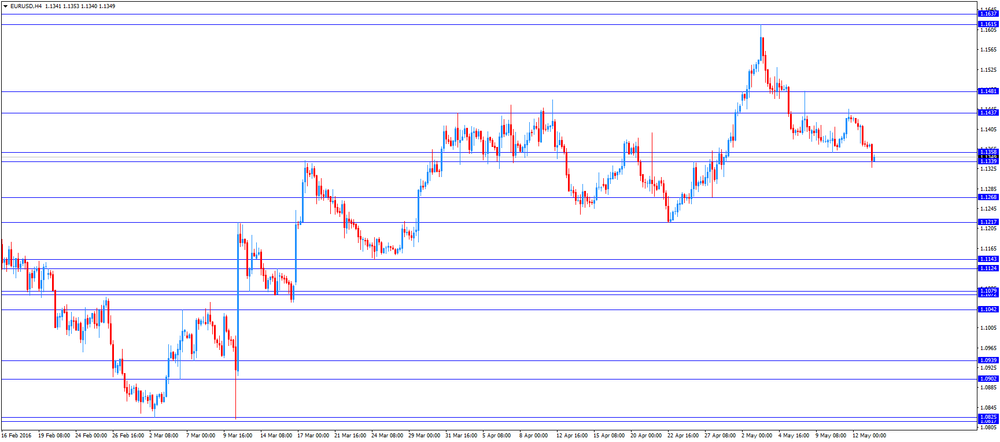

It is likely that the currency pair EURUSD will rise toward the high of May 11 at $1.1445, if there are negative news from the U.S. and there are no negative economic data from the Eurozone.

If the U.S. economic data is better than expected and in case of the negative economic data from the Eurozone, the currency pair EURUSD may test the low of April 22 at $1.1217.

-

18:28

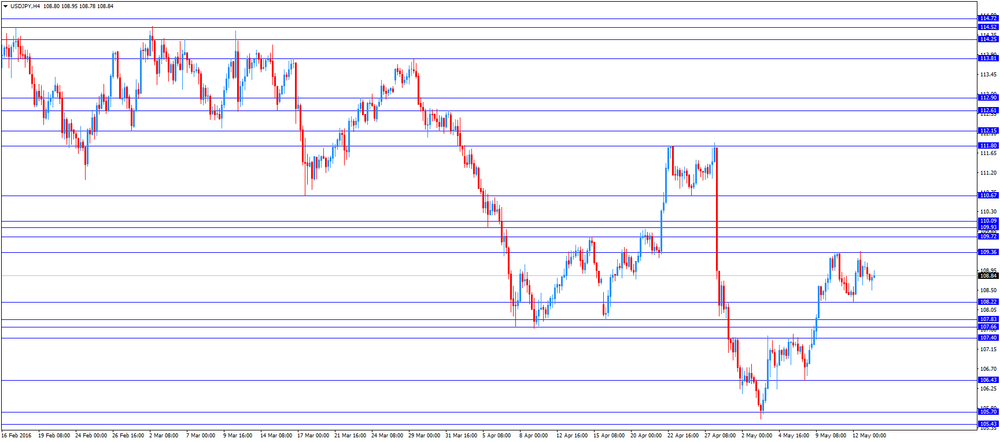

The Bank of Japan Governor Haruhiko Kuroda: the BoJ is ready to add further stimulus measures to boost inflation

The Bank of Japan (BoJ) Governor Haruhiko Kuroda said in a speech on Friday that the central bank was ready to add further stimulus measures to boost inflation.

"It [the BoJ] will carefully consider how to make the best use of the policy scheme in order to achieve the price stability target of 2 percent, and will act decisively as we move on," he said.

Kuroda added that there were still tools to boost inflation.

"There is no doubt that ample space for additional easing," the BoJ governor noted.

-

18:23

International Monetary Fund Managing Director Christine Lagarde: Britain’s exit from the European Union (EU) would be “very bad”

International Monetary Fund (IMF) Managing Director Christine Lagarde said on Friday that Britain's exit from the European Union (EU) would be "very bad".

The IMF released its report on the U.K. economy. The lender said that the biggest risk to the U.K. economy was the referendum on Britain's membership in the EU.

"The long-run effects on UK output and incomes would also likely be negative and substantial," the IMF said.

-

18:18

European stocks close: stocks traded higher despite the weak GDP data from the Eurozone

Stock closed higher despite the weak gross domestic product (GDP) data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,138.5 +34.31 +0.56 %

DAX 9,952.9 +90.78 +0.92 %

CAC 40 4,319.99 +26.72 +0.62 %

-

18:00

European stocks closed: FTSE 100 6,138.5 +34.31 +0.56% CAC 40 4,319.99 +26.72 +0.62% DAX 9,952.9 +90.78 +0.92%

-

17:50

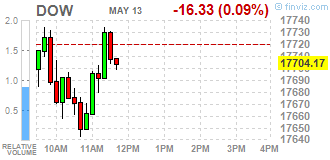

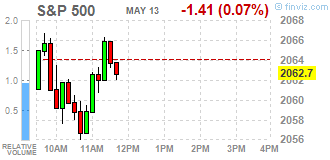

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes little changed on Friday as a drop in consumer stocks after another set of weak retail reports was offset by a bounce in Apple shares and strong retails sales data that suggested the economy recovery was gaining traction. The U.S. Commerce Department said retail sales jumped 1,3% last month, the largest gain since March 2015 and a bigger rise than the 0,8% economists were expecting.

Dow stocks mixed (15 in positive area vs 15 in negative). Top looser - Wal-Mart Stores Inc. (WMT, -2,27). Top gainer - Apple Inc. (AAPL, +1,37%).

S&P sectors also mixed. Top looser - Financial (-0,4%). Top gainer - Conglomerates (+0,7%).

At the moment:

Dow 17657.00 -11.00 -0.06%

S&P 500 2059.50 +0.75 +0.04%

Nasdaq 100 4353.00 +18.25 +0.42%

Oil 46.22 -0.48 -1.03%

Gold 1271.20 0.00 0.00%

U.S. 10yr 1.74 -0.02

-

17:42

Oil prices fell slightly

Quotes oil futures are down again, ending a three-day rally, due to the rise in price of the dollar and partial profit-taking by some investors.

"I would like to mention last fall to lock in profits after three days of strong growth In addition, investors are gradually preparing for a long weekend.", - Said Carsten Fritsch, analyst at Commerzbank. On Monday, markets in many European countries, including Germany and France, will be closed for a public holiday.

Further reduction of prices holding back the news from Nigeria, where, due to supply disruptions of oil production fell to 22-year low. Minister of Finance of Nigeria said that the country's oil production fell to 1.65 million barrels per day from 2.2 million barrels per day before the failure.

The decline in production in Nigeria added to ongoing problems in Canada, where forest fires have led to the closure of a number of oil facilities. "Forest fires have led to the temporary reduction of production by 1.4 million barrels per day, but the facilities do not seem to have suffered Activity is starting to recover, but we believe that in order to restore production take weeks.", - The experts at Jefferies.

Little influenced by a report from the Organization of Petroleum Exporting Countries (OPEC). As it became known, OPEC kept its forecast for global oil demand in 2016, which is expected to grow by 1.2 million barrels per day to 94.18 million barrels per day. In 2015, according to estimates, the demand for oil in the world increased by 1.54 million barrels per day to 92.98 million barrels. In particular, demand for oil in China in 2015 increased by 0.37 million barrels per day in 2016 is expected to increase by 0.28 million barrels per day. In 2016, as the experts expect production in countries outside OPEC will decline by 0.74 million barrels per day (figure revised to 10 th. Barrels per day downward) to 56.4 million barrels a day.

WTI for delivery in June fell to $46.31 a barrel. Brent for June fell to $47.81 a barrel.

-

17:41

WSE: Session Results

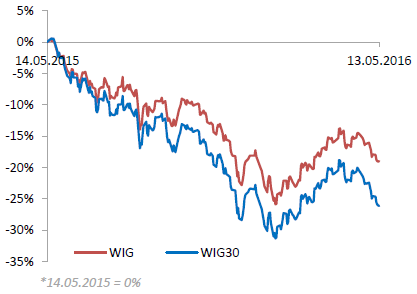

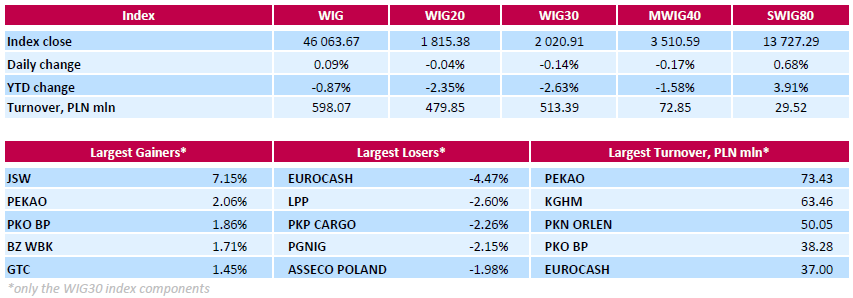

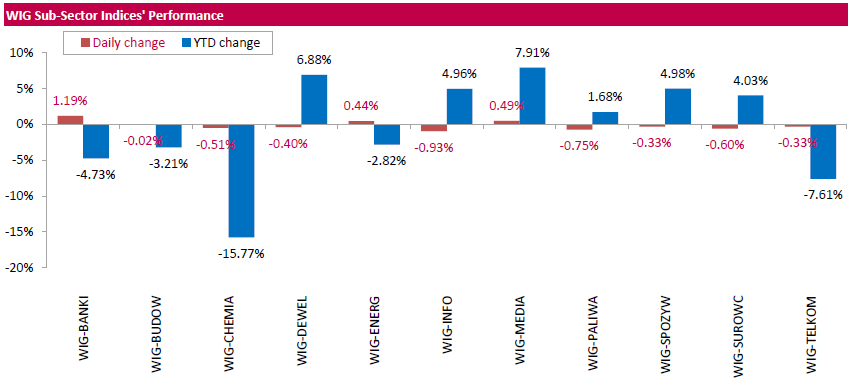

Polish equity market closed slightly higher on Friday. The broad market measure, the WIG Index, edged up 0.09%. From a sector perspective, information technology (-0.93%) fared the worst, while banking sector (+1.19%) was best-performer.

The large-cap stocks' measure, the WIG30 Index, fell by 0.14%. In the index basket, FMCG-wholesaler EUROCASH (WSE: EUR) was hit the hardest, down 4.47%, as the company announced its Q1 net profit was PLN 1.2 mln ($309 ths), below analysts' consensus estimate of PLN 1.9 mln. It was followed by clothing retailer LPP (WSE: LPP), railway freight transport operator PKP CARGO (WSE: PKP) and oil and gas producer PGNIG (WSE: PGN), plunging by 2.6%, 2.26% and 2.15% respectively. Elsewhere, IT-company ASSECO POLAND (WSE: ACP) and bank MILLENNIUM (WSE: MIL) fell by 1.98% and 1.89% respectively as their Q1 earnings didn't meet the analysts' expectations. On the other side of the ledger, coking coal producer JSW (WSE: JSW) recorded the strongest daily performance, jumping by 7.15%, after the company reported a significant decrease in net loss to PLN 59.8 mln in Q1 compared to net loss of PLN 198.1 mln in the corresponding period of the previous year. Other major outperformers were three banking sector names PEKAO (WSE: PEO), PKO BP (WSE: PKO) and BZ WBK (WSE: BZW), soaring by 2.06%, 1.86% and 1.71% respectively.

-

17:21

Gold shows a slight increase

Gold has risen in price by a percentage amid falling European shares, but then lost almost all positions due to the significant strengthening of the US dollar.

The dollar had on the US data pointed to the improvement of the economic situation in the country. The Commerce Department reported that retail sales in April recorded their biggest gain in a year, as the Americans have stepped up purchases of cars and a number of other goods. Retail sales rose 1.3 percent last month. The data for March were revised, and showed a decline of 0.3 percent instead of falling 0.4 percent previously reported. Excluding cars, gasoline and building materials and services to the food, retail sales jumped 0.9 percent last month after a revised towards strengthening 0.2 percent in March. Economists had forecast retail sales growth of 0.7 percent and core retail sales by 0.3 percent last month. Recall, the economy grew by 1.4 percent in the fourth quarter.

The decline in gold prices is also due to the recent statements by the Fed that the Fed should raise rates if the data point to an improving economy. Boston Fed President Eric Rosengren said that he expects the US economy to accelerate growth in the 2nd quarter of this year, which should provide conditions for new Fed raises interest rates. However, Rosengren did not comment on their expected timing of the next rate hike. He again warned that financial markets are likely to underestimate the number of probable interest rate hikes by the central bank.

Meanwhile, the president of the Federal Reserve Bank of Kansas City, Esther George said that interest rates are at very low levels, given that the economy is close to full employment, and inflation close to the target level of the Central Bank is 2%. George also said that maintaining interest rates at extremely low levels creates negative conditions in the economy.

In addition, it became known that the gold reserves in the largest gold ETF-SPDR Gold Trust fund amounted to 27.17 million on Thursday. Ounces, which is the highest value since November 2013.

Since the beginning of the year the price of gold has increased by 20 per cent against the backdrop of the US series of weak economic data, and other countries, which have reduced the likelihood of the Fed raising interest rates in the short term. Recall, higher interest rates have a downward pressure on the price of gold, which brings its holders to interest income and that is difficult to compete with the assets, bringing that income against the background of increasing interest rates.

The cost of the June gold futures on the COMEX rose to $ 1272.7 per ounce.

-

17:16

New loans in China decline to 555.6 billion yuan in April

The People's Bank of China (PBoC) released its new loans data on Friday. New loans in local currency in China were 555.6 billion yuan in April, down from March's 1,370.0 billion yuan.

M2 money supply jumped by 12.8% year-on-year in April.

Total social financing decreased to 751 billion yuan in April from 2.34 trillion yuan in March.

-

17:10

Retail sales in New Zealand rose 0.8% in the first quarter

Statistics New Zealand released retail sales data on late Thursday evening. Retail sales in New Zealand climbed 0.8% in the first quarter, missing expectations for a 1.0% rise, after a 1.1% gain in the fourth quarter. The fourth quarter's figure was revised down from a 1.2% increase.

The increase was mainly driven by a rise in electrical and electronic goods sales, which jumped 3.8% in the first quarter.

"Consumers continued to spend-up on electrical and electronic goods this quarter. There has been sustained growth in this industry for some time, with the trend rising over the past eight years," business indicators senior manager Neil Kelly said

On a yearly basis, retail sales rose 4.8% in the first quarter, after a 5.3% increase in the fourth quarter.

-

17:02

Japan's tertiary industry activity index decreases 0.7% in March

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Friday. The index decreased 0.7% in March, missing expectations for a 0.2% decline, after a 0.1% fall in February.

The fall was driven by declines in finance and Insurance, wholesale trade, information and communications, real estate, living and amusement-related services.

On a yearly basis, the tertiary industry activity index fell 0.1% in March, after a 2.5% rise in February.

-

16:51

OPEC’s monthly report: OPEC’s output climbs in April

The Organization of the Petroleum Exporting Countries (OPEC) released its monthly report on Friday. OPEC's output climbed by 188,000 barrels per day (bpd) to 32.44 million bpd in April, according to the report. The increase was driven by higher output from Iran.

Iran's oil production rose by 198,000 bpd to 3.45 million bpd in April.

Supply from non-OPEC members is expected to fall by 745,000 bpd in 2016 compared to the last year, while the U.S. oil output is expected to decline by 431,000 bpd.

Global oil demand is expected to climb by 1.20 million bpd in 2016, unchanged from March, OPEC noted.

OPEC noted that investments in exploration and production between 2016 and 2018 would be less than half of investments during 2012 to 2014.

OPEC also said that the global oil oversupply remained.

"Not much has fundamentally changed as the oversupply remains and global oil inventories are at record highs. But investors hope strong demand, particularly for gasoline, ahead of the US driving season and weaker non-OPEC production will help work down excess supply," OPEC noted.

-

16:22

U.S. business inventories increase 0.4% in March

The U.S. Commerce Department released the business inventories data on Friday. The U.S. business inventories rose 0.4% in March, beating expectations for a 0.2% gain, after a 0.1% decrease in February.

Retail inventories climbed 1.0% in March, wholesale inventories were up 0.1%, while manufacturing inventories increased 0.2%.

Retail sales declined 0.3% in March, while total business sales were up 0.3%.

The business inventories/sales ratio remained unchanged at 1.41 months in March. The business inventories /sales ratio is a measure of how long it would take to clear shelves.

-

16:15

Thomson Reuters/University of Michigan preliminary consumer sentiment index jumps to 95.8 in May

The Thomson Reuters/University of Michigan preliminary consumer sentiment index jumped to 95.8 in May from a final reading of 89.0 in March. Analysts had expected the index to rise to 91.0.

"Consumer sentiment rebounded in early May due to more frequent income gains, an improved jobs outlook, and the expectation of lower inflation and interest rates. The largest gains were recorded among lower income and younger households, although the gains were recorded among all income and age subgroups as well as across all regions," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The index of current economic conditions climbed to 108.6 in May from 106.7 in April, while the index of consumer expectations increased to 87.5 from 77.6.

The one-year inflation expectations declined to 2.5% in May from 2.8% in April.

-

16:00

U.S.: Business inventories , March 0.4% (forecast 0.2%)

-

16:00

U.S.: Reuters/Michigan Consumer Sentiment Index, May 95.8 (forecast 91)

-

15:46

WSE: After start on Wall Street

U.S. Stocks open: Dow -0.11%, Nasdaq -0.06%, S&P -0.13%

Wall Street started the session due to indication of derivatives. Changes of indices are modest and may not be a surprise for European markets. They do not threaten the WSE as well - at least until there will be some serious movement. If we do not happen to have anything to change the mood, the WIG20 will have a chance to bring a good result to the final.

-

15:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 106.00 (USD 503m) 107.25 (521m) 107.75 (410m) 108.18-20 (1.61bln) 109.50 (350m)

EUR/USD: 1.1200 (EUR 463m) 1.1350 (764m) 1.1500 (901m)

AUD/USD 0.7300 (AUD 618m) 0.7410 (275m)

USD/CAD 1.2800-05 (USD 726m) 1.2835-45 (538m) 1.2900 (370m) 1.3000 (320m) 1.3220 (1.13bln)

NZD/USD 0.6850 (NZD 216m)

AUD/NZD 1.0850 (AUD 202m)

-

15:35

Final consumer prices in Italy decrease 0.1% in April

The Italian statistical office Istat released its final consumer price inflation data for Italy on Friday. Final consumer prices in Italy decreased 0.1% in April, down from the preliminary reading of 0.0%, after a 0.2% increase in March.

The monthly decrease was driven by a drop in prices of non-regulated energy products.

On a yearly basis, consumer prices declined 0.5% in April, down with preliminary reading of -0.4%, after a 0.2% decline in March.

The declines was mainly driven by a faster decline of prices of non-regulated energy products and electricity. Prices of non-regulated energy products slid 6.4% year-on-year in April, while prices for electricity declined 1.9%.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.5% year-on-year in April from 0.6% in March.

-

15:32

U.S. Stocks open: Dow -0.11%, Nasdaq -0.06%, S&P -0.13%

-

15:26

Before the bell: S&P futures -0.21%, NASDAQ futures -0.10%

U.S. stock-index futures fluctuated.

Global Stocks:

Nikkei 16,412.21 -234.13 -1.41%

Hang Seng 19,719.29 -196.17 -0.99%

Shanghai Composite 2,827.37 -8.49 -0.30%

FTSE 6,091.39 -12.80 -0.21%

CAC 4,300.31 +7.04 +0.16%

DAX 9,903.57 +41.45 +0.42%

Crude $46.06 (-1.35%)

Gold $1267.00 (-0.33%)

-

15:23

Italian economy increases 0.3% in the first quarter

The Italian statistical office Istat released its preliminary gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.3% in the first quarter, after a 0.2% rise in the fourth quarter. The fourth quarter's figure was revised up from a 0.1% gain.

On a yearly basis, Italy's GDP declined to 1.0% in the first quarter from 1.1% in the fourth quarter. The fourth quarter's figure was revised up from a 1.0% rise.

-

15:18

U.S. producer prices rise 0.2% in April

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index rose 0.2% in April, missing expectations for a 0.3% rise, after a 0.1% drop in March.

The increase was mainly driven by a rise in services prices.

Energy prices increased 0.2% in April, wholesale food prices decreased 0.3%.

Services prices were up 0.1% in April, while prices for goods rose 0.2%.

On a yearly basis, the producer price index was flat in April, after a 0.1% decline in March.

The producer price index excluding food and energy increased 0.1% in April, in line with expectations, after a 0.1% fall in March.

On a yearly basis, the producer price index excluding food and energy climbed 0.9% in April, after a 1.0% rise in March.

These figures could mean that the Fed will raise its interest rate cautiously and gradually.

-

15:08

U.S. retail sales climb 1.3% in April

The U.S. Commerce Department released the retail sales data on Friday. The U.S. retail sales climbed 1.3% in April, exceeding expectations for a 0.7% rise, after a 0.3% fall in March. It was the biggest rise since March 2015.

March's figure was revised up from a 0.4% decline.

The increase was mainly driven by a rise in sales at auto dealerships.

Sales at clothing retailers were up 1.0% in April, sales at building material and garden equipment stores decreased 1.0%, while sales at auto dealerships jumped 3.2%.

Retail sales excluding automobiles rose 0.8% in April, beating expectations for a 0.3% increase, after a 0.4% gain in March. March's figure was revised up from a 0.1% rise.

Sales at service stations climbed 2.2% in April, while sales at furniture stores rose 0.7%.

These figures indicates that the U.S. economy could rebound in the second quarter after the weak growth in the first quarter.

-

14:53

Wall Street. Stocks before the bell

(company / ticker / price / change ($/%) / volume)

3M Co

MMM

169.95

-0.20(-0.1175%)

2258

ALCOA INC.

AA

9.4

-0.04(-0.4237%)

15163

Amazon.com Inc., NASDAQ

AMZN

717.05

-0.88(-0.1226%)

39550

Apple Inc.

AAPL

90.07

-0.27(-0.2989%)

183615

AT&T Inc

T

39.46

-0.09(-0.2276%)

3574

Barrick Gold Corporation, NYSE

ABX

18.07

-0.05(-0.2759%)

104630

Boeing Co

BA

134.37

-0.05(-0.0372%)

1454

Caterpillar Inc

CAT

71.28

-0.42(-0.5858%)

975

Chevron Corp

CVX

101.85

-0.27(-0.2644%)

7540

Cisco Systems Inc

CSCO

26.6

-0.07(-0.2625%)

102

Citigroup Inc., NYSE

C

43.95

-0.05(-0.1136%)

9680

Deere & Company, NYSE

DE

83.41

-0.74(-0.8794%)

330

E. I. du Pont de Nemours and Co

DD

64.3

0.02(0.0311%)

685

Exxon Mobil Corp

XOM

89.38

-0.29(-0.3234%)

7466

Facebook, Inc.

FB

120.2

-0.08(-0.0665%)

89987

Ford Motor Co.

F

13.35

0.00(0.00%)

10809

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

11

-0.03(-0.272%)

125464

General Electric Co

GE

30.05

-0.04(-0.1329%)

6060

General Motors Company, NYSE

GM

30.9

-0.28(-0.898%)

33363

Home Depot Inc

HD

133.38

-0.81(-0.6036%)

10015

Intel Corp

INTC

29.7

-0.06(-0.2016%)

1202

Johnson & Johnson

JNJ

113.5

-0.73(-0.6391%)

3748

McDonald's Corp

MCD

129.74

-0.38(-0.292%)

6009

Nike

NKE

57.79

-0.20(-0.3449%)

1700

Pfizer Inc

PFE

33.14

-0.05(-0.1506%)

1451

Tesla Motors, Inc., NASDAQ

TSLA

207.3

0.02(0.0097%)

5526

The Coca-Cola Co

KO

45.69

-0.14(-0.3055%)

6198

Twitter, Inc., NYSE

TWTR

14.09

0.01(0.071%)

31490

UnitedHealth Group Inc

UNH

129.64

-0.10(-0.0771%)

4213

Verizon Communications Inc

VZ

51

-0.47(-0.9132%)

5350

Visa

V

77.45

-0.44(-0.5649%)

5519

Wal-Mart Stores Inc

WMT

66.47

-0.38(-0.5684%)

4240

Walt Disney Co

DIS

101.1

-0.61(-0.5997%)

5943

Yahoo! Inc., NASDAQ

YHOO

36.95

-0.08(-0.216%)

2320

Yandex N.V., NASDAQ

YNDX

19.25

-0.33(-1.6854%)

351

-

14:50

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Johnson & Johnson (JNJ) downgraded to Neutral from Buy at BTIG Research

Other:

-

14:31

U.S.: Retail sales excluding auto, April 0.8% (forecast 0.3%)

-

14:31

U.S.: PPI excluding food and energy, Y/Y, April 0.9%

-

14:31

U.S.: PPI, y/y, April 0%

-

14:30

U.S.: PPI excluding food and energy, m/m, April 0.1% (forecast 0.1%)

-

14:30

U.S.: PPI, m/m, April 0.2% (forecast 0.3%)

-

14:30

U.S.: Retail Sales YoY, April 3%

-

14:30

U.S.: Retail sales, April 1.3% (forecast 0.7%)

-

14:23

Greek GDP declines 0.4% in the first quarter

The Hellenic Statistical Authority released its preliminary gross domestic product (GDP) data for Greece on Friday. The Greek preliminary GDP declined 0.4% in the first quarter, after a 0.1% rise in the fourth quarter.

On a yearly basis, Greek preliminary GDP fell 1.3% in the first quarter, after a revised 0.8% decrease in the fourth quarter.

-

14:09

Foreign exchange market. European session: the euro traded mixed against the U.S. dollar on the GDP data from the Eurozone

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Tertiary Industry Index March -0.1% -0.2% -0.7%

06:00 Germany CPI, m/m (Finally) April 0.8% -0.4% -0.4%

06:00 Germany CPI, y/y (Finally) April 0.3% -0.1% -0.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter I 0.3% 0.6% 0.7%

06:00 Germany GDP (YoY) (Preliminary) Quarter I 2.1% 1.5% 1.3%

06:45 France Non-Farm Payrolls (Preliminary) Quarter I 0.2% 0.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I 0.3% 0.6% 0.5%

09:00 Eurozone GDP (YoY) (Revised) Quarter I 1.6% 1.6% 1.5%

The U.S. dollar traded mixed against the most major currencies ahead of the release of the U.S. economic data from the U.S. The U.S. retail sales are expected to rise 0.7% in April, after a 0.7% decline in March.

The U.S. PPI is expected to increase 0.3% in April, after a 0.1% drop in March.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in April, after a 0.1% fall in March.

The preliminary Thomson Reuters/University of Michigan consumer sentiment index is expected to increase to 91.0 in May from 89.0 in April.

The euro traded mixed against the U.S. dollar on the GDP data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

The British pound traded mixed against the U.S. dollar on the weak construction output data from the U.K. The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

EUR/USD: the currency pair traded mixed

GBP/USD: the currency pair traded mixed

USD/JPY: the currency pair climbed to Y108.95

The most important news that are expected (GMT0):

12:30 U.S. Retail sales April -0.4% 0.7%

12:30 U.S. Retail Sales YoY April 1.7%

12:30 U.S. Retail sales excluding auto April 0.1% 0.3%

12:30 U.S. PPI, m/m April -0.1% 0.3%

12:30 U.S. PPI, y/y April -0.1%

12:30 U.S. PPI excluding food and energy, m/m April -0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y April 1%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) May 89 91

14:00 U.S. Business inventories March -0.1% 0.2%

-

13:50

Orders

EUR/GBP

Offers : 0.7880-85 0.7900 0.7920 0.7930 0.7950 0.7980 0.8000 0.8020 0.8050

Bids: 0.7845-50 0.7830 0.7820 0.7800 0.7780 0.7760 0.7735 0.7700

EUR/USD

Offers : 1.1350 1.1380 1.1400 1.1430 1.1450-60 1.1475-80 1.1500

Bids: 1.1330 1.1315 1.1300 1.1285 1.1270 1.1250 1.1230 1.1200

GBP/USD

Offers : 1.4420 1.4435 1.4450 1.4460 1.4480 1.4500 1.4530 1.4550

Bids: 1.4375 1.4350-55 1.4330 1.4300-10 1.4275-80 1.4250 1.4230 1.4200

EUR/JPY

Offers : 123.80 124.00 124.30 124.50 124.70-75 125.00 125.30 125.50 126.00

Bids: 123.00 122.80 122.50 122.00 121.70 121.50 121.00

USD/JPY

Offers : 108.85 109.00 109.20 109.50 109.80 110.00 110.30 110.50

Bids: 108.50 108.30 108.20 108.00 107.85 107.60 107.20-25 107.00

AUD/USD

Offers : 0.7300-10 0.7325 0.7350 0.7380 0.7400 0.7420-25 0.7450 0.7475 0.7500

Bids: 0.7275-80 0.7265 0.7250 0.7200 0.7185 0.7165 0.7150

-

13:35

WSE: Mid session comment

The fact that the possible downgrading or rating by Moody's should not meet with violent negative reaction of the market is evidenced by the fact that in anticipation of this information the WIG20 without complexes overlooks consecutive daily maxima, and we may see green colour among the blue chips. Thus, our market goes up in the same rhythm as the German market. There is no case, if we look further on the zloty - EURPLN descends to the daily minimum falling below the 4.40 level.

Strengthening of the zloty and boosters of the DAX hit on vulnerable ground in a market that was looking for the pulse to rebound from 1,800 points. As a result, at halfway of the session, the value of the WIG20 index is rising by 0.6 percent. The problem, however, is turnover, which barely exceeded PLN 200 mln. With such a technical credibility of today's activity is still low.

-

12:15

European stock markets mid session: stocks traded lower on the GDP data from the Eurozone

Stock indices traded lower on the gross domestic product (GDP) data from the Eurozone. Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

Current figures:

Name Price Change Change %

FTSE 100 6,065.87 -38.32 -0.63 %

DAX 9,829.76 -32.36 -0.33 %

CAC 40 4,269.07 -24.20 -0.56 %

-

12:11

UK’s construction output declines 3.6% in March

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. declined 3.6% in March. It was the biggest drop since December 2012.

The decline was driven by a drop in all new work and repair and maintenance, which both plunged 3.6% in March.

On a yearly basis, construction output decreased 4.5% in March. It was the biggest decline since March 2013.

-

12:02

French final non-farm employment increases 0.2% in the first quarter

The French statistical office Insee released its preliminary non-farm employment data on Friday. French non-farm employment increased 0.2% in the first quarter, after a 0.2% increase in the fourth quarter.

Employment excluding temporary work rose by 48,500 jobs in the first quarter.

Temporary employment rose by 0.3% in the first quarter.

Employment in the industry was down by 0.4% in the first quarter, while employment in construction declined by 0.3%.

Overall, job creation in the market services sector climbed by 0.4% in the first quarter.

-

11:49

Final consumer price inflation in Spain rises 0.7% in April

The Spanish statistical office INE released its final consumer price inflation data on Friday. Consumer price inflation in Spain was up 0.7% in April, in line with the preliminary reading, after a 0.6% rise in March.

The monthly rise was mainly driven by an increase in clothing and footwear, which climbed 10.6% in April.

On a yearly basis, consumer prices fell by 1.1% in April from a year ago, in line with preliminary reading, after a 0.8% decline in March.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

11:42

German economy grows 0.7% in the first quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.7% in the first quarter, exceeding expectations for a 0.6% growth, after a 0.3% increase in the fourth quarter.

The increase was driven by domestic demand and capital formation. Both general government final consumption expenditure and household final consumption expenditure increased in the first quarter.

The trade effect was negative as imports climbed faster than exports.

On a yearly basis, Germany's GDP fell to 1.3% in the first quarter from 2.1% in the fourth quarter, missing expectations for a 1.5% growth.

-

11:33

German final consumer price inflation falls 0.4% in April

Destatis released its final consumer price data for Germany on Friday. German final consumer price index were down 0.4% in April, in line with the preliminary estimate, after a 0.8% rise in March.

On a yearly basis, German final consumer price index decreased to -0.1% in April from 0.3% in March, in line with the preliminary estimate.

Energy prices dropped 8.5% year-on-year in April, while food prices climbed 0.5%.

Consumer prices excluding energy increased 0.9% year-on-year in April.

-

11:22

Eurozone's revised GDP climbs 0.5% in first quarter

Eurostat released its revised gross domestic product (GDP) data for the Eurozone on Friday. Eurozone's revised GDP rose 0.5% in first quarter, down from the preliminary reading of a 0.6% increase, after a 0.3% gain in the fourth quarter.

On a yearly basis, Eurozone's revised gross domestic product (GDP) increased 1.5% in fourth quarter, down from the preliminary reading of a 1.6% growth, after a 1.6% rise in the fourth quarter.

-

11:00

Eurozone: GDP (QoQ), Quarter I 0.5% (forecast 0.6%)

-

11:00

Eurozone: GDP (YoY), Quarter I 1.5% (forecast 1.6%)

-

10:56

Boston Fed President Eric Rosengren: the U.S. economy will expand faster in the second quarter

Boston Fed President Eric Rosengren said in a speech on Thursday that the U.S. economy would expand faster in the second quarter after a weak growth in the first quarter. He noted that headwinds from abroad diminished.

Rosengren pointed out that it was appropriate to continue to hike interest rates if the U.S. economy continued to improve.

"In my view, the market remains too pessimistic about the fundamental strength of the U.S. economy, and the likelihood of removing monetary accommodation is higher than is currently priced into financial markets based on current data," Boston Fed president said.

Rosengren is a voting member of the Federal Open Market Committee (FOMC) this year.

-

10:47

Kansas City Fed President Esther George: interest rates in the U.S. are too low

Kansas City Fed President Esther George said in a speech on Thursday that interest rates in the U.S. were too low.

"I support a gradual adjustment of short-term interest rates toward a more normal level, but I view the current level as too low for today's economic conditions," she said.

"The economy is at or near full employment and inflation is close to the FOMC's target of 2 percent, yet short-term interest rates remain near historic low," George added.

George is a voting member of the Federal Open Market Committee (FOMC) this year. She voted for an interest rate hike in March and April.

-

10:38

Fed Chairwoman Janet Yellen does not completely rule out negative interest rates

Fed Chairwoman Janet Yellen wrote in a letter to Representative Brad Sherman on Thursday that she would not completely rule out negative interest rates, adding that "policymakers would need to consider a wide range of issues" before implementing this tool in the U.S.

She noted that the Fed would analyse the effect of negative interest rates as this tool provided additional monetary policy accommodation.

-

10:24

Global gold demand totals 1,290 tonnes in the first quarter of 2016

World Gold Council (WGC) said on Thursday that global gold demand totalled 1,290 tonnes in the first quarter of 2016, up by 21% compared to the same period last year. According to WGC, the rise was mainly driven by higher inflows into exchange traded funds (ETFs). Global demand for jewellery dropped by 19% year-on-year in the first quarter, total bar and coin demand rose by 1%, while central banks' and other institutions' demand fell by 3%. Total supply rose by 5% to 1,135 tonnes in the first quarter.

-

10:11

Bloomberg Consumer Comfort Index: consumers’ expectations for U.S. economy decline to 41.7 in in the week ended May 08

According to data from the Bloomberg Consumer Comfort Index, consumers' expectations for U.S. economy declined to 41.7 in in the week ended May 08 from 42.0 the prior week. It was the lowest reading since mid-December 2015.

The decrease was mainly driven by a less favourable assessment of the U.S. economy. The measure of views of the economy was down to 30.6 from 32.6, the buying climate index increased to 39.1 from 38.2, while the personal finances index rose to 55.4 from 55.3.

-

10:00

Option expiries for today's 10:00 ET NY cut

USD/JPY 106.00 (USD 503m) 107.25 (521m) 107.75 (410m) 108.18-20 (1.61bln) 109.50 (350m)

EUR/USD: 1.1200 (EUR 463m) 1.1350 (764m) 1.1500 (901m)

AUD/USD 0.7300 (AUD 618m) 0.7410 (275m)

USD/CAD 1.2800-05 (USD 726m) 1.2835-45 (538m) 1.2900 (370m) 1.3000 (320m) 1.3220 (1.13bln)

NZD/USD 0.6850 (NZD 216m)

AUD/NZD 1.0850 (AUD 202m)

-

09:16

WSE: After opening

The WIG20 futures (WSE: FW20M16), as expected, started Friday in the red, although the drop immediately by 11 points below yesterday's closing must be regarded as considerable. In this way, we have adjusted to changes in contracts for other European indices.

WIG20 index opened at 1812.82 points (-0.18%)*

WIG 46020.87 0.00%

WIG30 2018.93 -0.24%

*/ - change to previous close

The first bars on the cash market fully confirm the scale of pessimism from the futures market in early trading. Going below yesterday's minimum by the WIG20 is a fact and it means the continuation of decline started at the end of March. Among blue chips more negative distinction indicates Eurocash (WSE: EUR) after the release of weaker-than-expected first-quarter results.

-

09:01

France: Non-Farm Payrolls, Quarter I 0.2%

-

08:29

WSE: Before opening

Yesterday's behavior of US stock indices allows to assess that after the best session in two months on Tuesday and worst one for about a month, quotations on Wednesday brought calm to the market.

Quotations on Wall Street ended better than expected in Europe and in the morning we would think about any attempt to rebound drop in the German DAX.

Unfortunately, the night brought decline of contracts on the S&P500, which weakens the positive note of better-than-expected completion of session in the US.

The decline is also recorded by contract for the DAX and maintain the current atmosphere will lead to rather modest changes in the openings session on European markets.

The macro calendar will announced today the dynamics of PPI and retail sales in the US and readings of GDP in Germany and the euro zone, as well as the dynamics of Polish GDP. Investors are waiting today for the publication of the rating for the Polish debt by Moody's, which may isolate the Warsaw Stock Exchange from the environment.

From the technical analysis, the area of 1,800 points on the WIG20 encouraged to play assuming some recovery of six weeks sell-off. Breaking 1,800 points will start speculating about returning to the area of 1,650 points on the WIG20.

-

08:28

Options levels on friday, May 13, 2016:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1544 (4311)

$1.1482 (4521)

$1.1437 (2086)

Price at time of writing this review: $1.1358

Support levels (open interest**, contracts):

$1.1324 (2236)

$1.1277 (2549)

$1.1247 (5658)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 63453 contracts, with the maximum number of contracts with strike price $1,1600 (5252);

- Overall open interest on the PUT options with the expiration date June, 3 is 87751 contracts, with the maximum number of contracts with strike price $1,1200 (8906);

- The ratio of PUT/CALL was 1.38 versus 1.37 from the previous trading day according to data from May, 12

GBP/USD

Resistance levels (open interest**, contracts)

$1.4705 (1709)

$1.4607 (2227)

$1.4511 (2110)

Price at time of writing this review: $1.4415

Support levels (open interest**, contracts):

$1.4389 (1397)

$1.4292 (2357)

$1.4195 (2842)

Comments:

- Overall open interest on the CALL options with the expiration date June, 3 is 29287 contracts, with the maximum number of contracts with strike price $1,4600 (2227);

- Overall open interest on the PUT options with the expiration date June, 3 is 32594 contracts, with the maximum number of contracts with strike price $1,4200 (2842);

- The ratio of PUT/CALL was 1.11 versus 1.12 from the previous trading day according to data from May, 12

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:18

Asian session: The yen has weakened

The yen has weakened in most recent sessions as investors pared long positions and Japanese officials explicitly warned about currency intervention.

Also undermining the yen, a prominent academic with close ties to BOJ Governor Haruhiko Kuroda said on Thursday that the Bank of Japan is likely to expand monetary stimulus either in June or July with an eye on first-quarter gross domestic product data and the outcome of this month's G7 summit.

Cleveland Fed President Loretta Mester, who has been less cautious about future rate increases than many of her colleagues, said that inflation measures have moved higher. She said any uncertainty in the Fed's economic forecasting should not stop the central bank from taking monetary policy decisions.

Boston Fed President Eric Rosengren, a voting member this year on the Fed's rate-setting committee, said the central bank should raise rates again if second-quarter data confirms that the U.S. labor market is near full strength and inflation is on track to accelerate.

Later on Friday, investors await a fresh set of U.S. economic readings, including retail sales data and the April producer price index.

EUR/USD: during the Asian session the pair traded in the range of $1.1365-80

GBP/USD: during the Asian session the pair traded in the range of $1.4420-50

USD/JPY: during the Asian session the pair fell to Y108.70

Based on Reuters materials

-

08:01

Germany: CPI, m/m, April -0.4% (forecast -0.4%)

-

08:01

Germany: CPI, y/y , April -0.1% (forecast -0.1%)

-

08:00

Germany: GDP (QoQ), Quarter I 0.7% (forecast 0.6%)

-

08:00

Germany: GDP (YoY), Quarter I 1.3% (forecast 1.5%)

-

07:05

Global Stocks

European stocks posted firm losses on Thursday with a crop of lackluster financial results and a slump in oil prices sapped investment appetite. Oil futures, however, slipped into negative territory in the afternoon, dragging European markets down with them.

U.S. stocks finished flat Thursday as an afternoon rebound in oil prices helped shares rise off their session lows. However, a sharp drop in Apple Inc.

Asian stocks dropped as crude oil retreated and technology shares declined after Apple Inc. sank to the lowest since June 2014. Bullish momentum in equities from a February low faltered over the past month, as signs of weakness in the global economy and disappointing corporate earnings heightened concerns over whether central bank officials will be able to effectively boost growth.

Based on MarketWatch materials

-

06:31

Japan: Tertiary Industry Index , March -0.7% (forecast -0.2%)

-

04:11

Nikkei 225 16,474.96 -171.38 -1.03 %, Hang Seng 19,824.78 -90.68 -0.46 %, Shanghai Composite 2,834.31 -1.55 -0.05 %

-

01:05

Commodities. Daily history for May 12’2016:

(raw materials / closing price /% change)

Oil 46.39 -0.66%

Gold 1,264.70 -0.51%

-

01:04

Stocks. Daily history for Sep Apr May 12’2016:

(index / closing price / change items /% change)

Nikkei 225 16,646.34 +67.33 +0.41 %

Hang Seng 19,915.46 -139.83 -0.70 %

S&P/ASX 200 5,359.3 -12.99 -0.24 %

Shanghai Composite 2,836.74 -0.30 -0.01 %

FTSE 100 6,104.19 -58.30 -0.95 %

CAC 40 4,293.27 -23.40 -0.54 %

Xetra DAX 9,862.12 -113.20 -1.13 %

S&P 500 2,064.11 -0.35 -0.02 %

NASDAQ Composite 4,737.33 -23.35 -0.49 %

Dow Jones Industrial Average 17,720.5 +9.38 +0.05 %

-

01:03

Currencies. Daily history for May 12’2016:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1375 -0,43%

GBP/USD $1,4441 -0,02%

USD/CHF Chf0,9705 -0,02%

USD/JPY Y109,03 +0,53%

EUR/JPY Y124,02 +0,10%

GBP/JPY Y157,45 +0,51%

AUD/USD $0,7318 -0,77%

NZD/USD $0,6816 0,00%

USD/CAD C$1,284 -0,09%

-

00:46

New Zealand: Retail Sales, q/q, Quarter I 0.8% (forecast 1.0%)

-

00:46

New Zealand: Retail Sales YoY, Quarter I 4.8%

-

00:01

Schedule for today, Friday, May 13’2016:

(time / country / index / period / previous value / forecast)

04:30 Japan Tertiary Industry Index March -0.1% -0.2%

06:00 Germany CPI, m/m (Finally) April 0.8% -0.4%

06:00 Germany CPI, y/y (Finally) April 0.3% -0.1%

06:00 Germany GDP (QoQ) (Preliminary) Quarter I 0.3% 0.6%

06:00 Germany GDP (YoY) (Preliminary) Quarter I 2.1% 1.5%

06:45 France Non-Farm Payrolls (Preliminary) Quarter I 0.2%

09:00 Eurozone GDP (QoQ) (Revised) Quarter I 0.3% 0.6%

09:00 Eurozone GDP (YoY) (Revised) Quarter I 1.6% 1.6%

12:30 U.S. Retail sales April -0.4% 0.7%

12:30 U.S. Retail Sales YoY April 1.7%

12:30 U.S. Retail sales excluding auto April 0.1% 0.3%

12:30 U.S. PPI, m/m April -0.1% 0.3%

12:30 U.S. PPI, y/y April -0.1%

12:30 U.S. PPI excluding food and energy, m/m April -0.1% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y April 1%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) May 89 91

14:00 U.S. Business inventories March -0.1% 0.2%

-