Noticias del mercado

-

17:50

Greece gets €23 billion in the first tranche

A Greek official said on Friday that the Greece will get €23 billion in the first tranche from the third bailout programme. €13 billion will be used to cover the debt repayment and an additional €10 billion will be used to bolster capitalisation levels of Greek banks.

-

16:23

Thomson Reuters/University of Michigan preliminary consumer sentiment index drops to 92.9 in August

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 92.9 in August from a final reading of 93.1 in July, missing expectations for an increase to 93.5.

"Consumer confidence was virtually unchanged in early August from the July reading, marking its highest nine month average since 2004. Renewed strength in personal finances largely offset slight declines in prospects for the national economy and buying conditions," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The decline in the index was mainly driven by falls in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions declined to 107.1 in August from 107.2 in July, while the index of consumer expectations decreased to 83.8 from 84.1.

The one-year inflation expectations remained unchanged at to 2.8% in August.

-

16:01

U.S.: Reuters/Michigan Consumer Sentiment Index, August 92.9 (forecast 93.5)

-

15:45

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E501mn), $1.1065(E626mn)

USD/JPY: Y124.00($1.41bn), Y124.50($1.11bn)

GBP/USD: $1.5500(Gbp307), $1.5625(Gbp102mn)

AUD/USD: $0.7300(A$101mn)

NZD/USD: $0.6625(NZ$329mn)

USD/CAD: C$1.3025($500mn)

-

15:41

U.S. industrial production rises 0.6% in July

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.1% gain in June. June's figure was revised down from a 0.2% rise.

The increase was driven by higher factory output. Factory output climbed by 0.8% in July.

Mining output climbed 0.2% in July, while utilities production declined 1.0%.

Capacity utilisation rate increased to 78.8% in July from 77.7% in June, in line with expectations. June's figure was revised down 77.8%.

-

15:15

U.S.: Capacity Utilization, July 78 (forecast 78%)

-

15:15

U.S.: Industrial Production (MoM), July 0.8% (forecast 0.3%)

-

15:15

U.S.: Industrial Production YoY , July 1.3%

-

14:53

U.S. producer price index rises 0.2% in June

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index increased 0.2% in July, exceeding expectations for a 0.1% gain, after a 0.4% rise in June.

On a yearly basis, the producer price index decreased 0.8% in July, beating forecasts of a 0.9% decline, after a 0.7% fall in June.

The rise was partly driven by higher services prices, which were up 0.4%.

Food prices fell by 0.1% in July, driven by a drop in wholesale egg prices, which slid 24.2%.

Energy sales declined 0.6% in July.

The producer price index excluding food and energy climbed 0.3% in July, exceeding expectations for a 0.1% gain, after a 0.3% increase in June.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in July, beating forecasts of a 0.5% increase, after a 0.8% rise in June.

A stronger U.S. dollar and low oil prices still weigh on inflation. Producer prices may drop in August due to a recent decline in oil prices.

-

14:39

Canadian manufacturing shipments are up 1.2% in June

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments rose 1.2% in June, missing forecasts of a 2.1% increase, after a 0.2% gain in May. May's figure was revised up from a 0.1% rise.

The rise was partly driven by higher sales of chemical products and motor vehicles. Sales of chemical products climbed 5.4% in June, while sales of motor vehicles rose 4.2%.

Sales increased in 18 of 21 categories.

-

14:30

U.S.: PPI excluding food and energy, m/m, July 0.3% (forecast 0.1%)

-

14:30

U.S.: PPI excluding food and energy, Y/Y, July 0.6% (forecast 0.5%)

-

14:30

U.S.: PPI, y/y, July -0.8% (forecast -0.9%)

-

14:30

Canada: Manufacturing Shipments (MoM), June 1.2% (forecast 2.1%)

-

14:30

U.S.: PPI, m/m, July 0.2% (forecast 0.1%)

-

14:25

UK’s construction output rises 0.9% in June

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. gained 0.9% in June, after a 1.0% drop in May.

The increase was driven by new housing, infrastructure and public works projects.

On a yearly basis, construction output climbed 2.6% in June, after a 2.1% rise in May.

Construction makes up 6% of UK's economy.

-

14:13

Italian economy increases 0.2% in the second quarter

Italian economy increases 0.2% in the second quarter

The Italian statistical office Istat released its gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.2% in the second quarter, after a 0.3% rise in the first quarter.

The growth was driven by an increase in domestic demand.

On a yearly basis, Italy's GDP rose to 0.5% in the second quarter from 0.1% in the first quarter.

-

14:04

Foreign exchange market. European session: the euro traded higher against the U.S. dollar as the Greek parliament approved the draft deal on the third bailout programme

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

02:15 Australia RBA Assist Gov Kent Speaks

05:30 France GDP, q/q (Preliminary) Quarter II 0.7% Revised From 0.6% 0.2% 0.0%

05:30 France GDP, Y/Y (Preliminary) Quarter II 0.8% 1.0%

06:00 Germany GDP (YoY) (Preliminary) Quarter II 1.1% 1.5% 1.6%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II 0.3% 0.5% 0.4%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 0.8% 1% 1%

09:00 Eurozone Harmonized CPI July 0.0% -0.6% -0.6%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II 1.0% 1.3% 1.2%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II 0.4% 0.4% 0.3%

The U.S. dollar traded lower against the most major currencies ahead of the release of the U.S. economic data. The U.S. PPI is expected to increase 0.1% in July, after a 0.4% rise in June.

The U.S. producer price inflation excluding food and energy is expected to rise 0.1% in July, after a 0.3 gain in June.

The U.S. industrial production is expected to climb 0.3% in July, after a 0.2% rise in June.

The preliminary Thomson Reuters/University of Michigan preliminary consumer sentiment index is expected to climb to 93.5 in August from a final reading of 93.1 in July.

The euro traded higher against the U.S. dollar as the Greek parliament approved the draft deal on the third bailout programme on Friday. Out of 300 Greek MPs 222 voted for the deal, 64 voted against the deal, 11 abstained and three were absent.

Out of 149 Syriza MPs 43 voted against the deal.

News reported that the Greek Prime Minister Alexis Tsipras will ask for a confidence vote before parliament in the next week.

Eurozone finance ministers are expected to approve the deal later on Friday.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

Eurostat released no details of the component breakdown of GDP.

Eurozone's final harmonized consumer price index dropped 0.6% in July, in line with the previous estimate, after a flat reading in June.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in July, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 1.0% in June from 0.8% in June, in line with the previous estimate.

Germany's preliminary GDP gained by 0.4% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's GDP rose to 1.6% in the second quarter from 1.1% in the first quarter, exceeding expectations for a gain to 1.5%.

France's preliminary GDP was flat in the second quarter, missing expectations for a 0.2% rise, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% gain.

On a yearly basis, Germany's GDP rose to 1.0% in the second quarter from 0.8% in the first quarter.

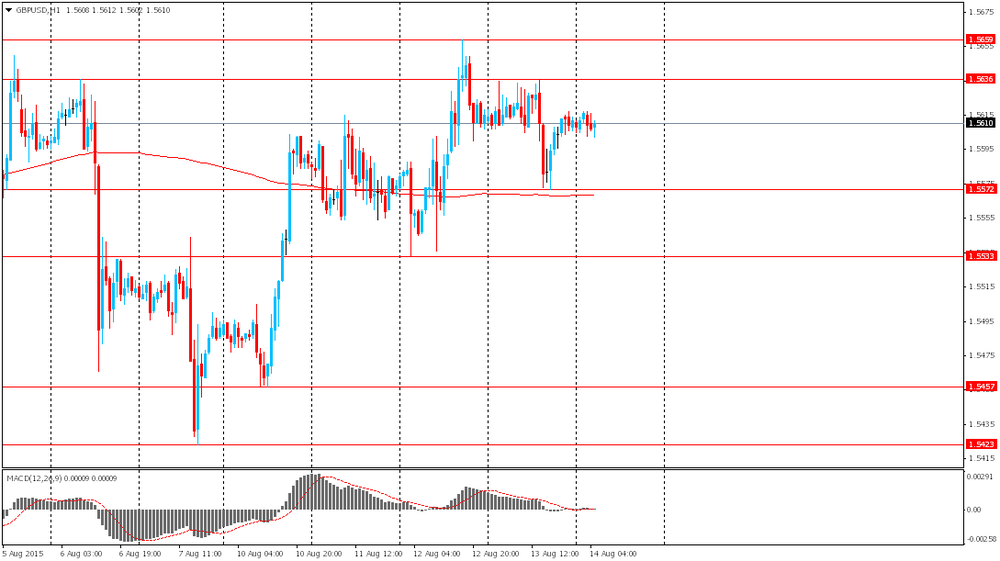

The British pound traded higher against the U.S. dollar in the absence of any major economic reports from the U.K.

The Canadian dollar traded higher against the U.S. dollar ahead of Canadian economic data. Canada's manufacturing shipments are expected to increase 2.1% in June, after a 0.1% gain in May.

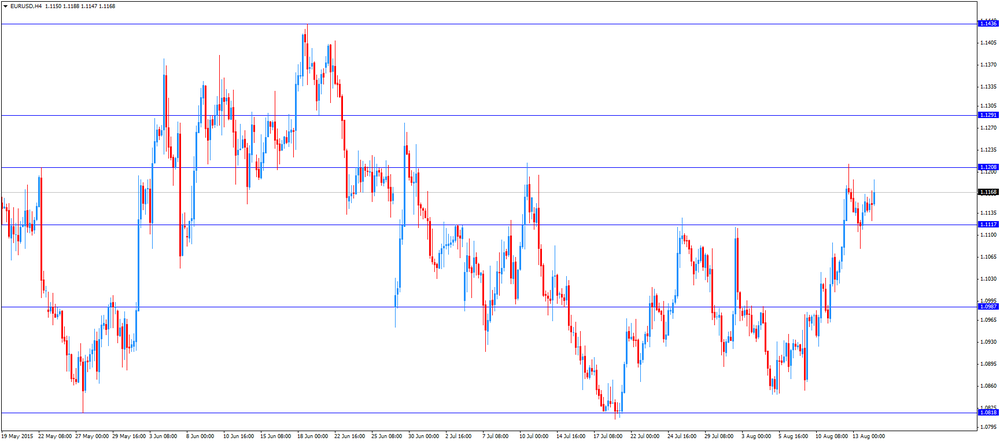

EUR/USD: the currency pair rose to $1.1188

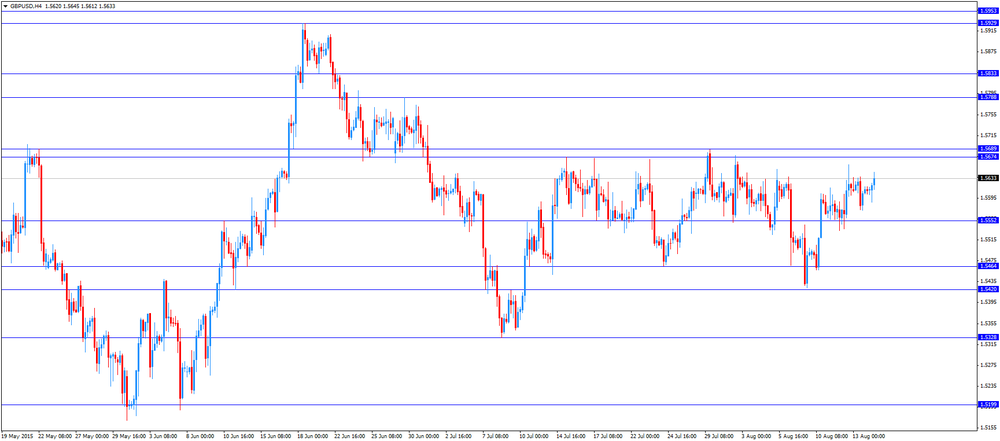

GBP/USD: the currency pair increased to $1.5645

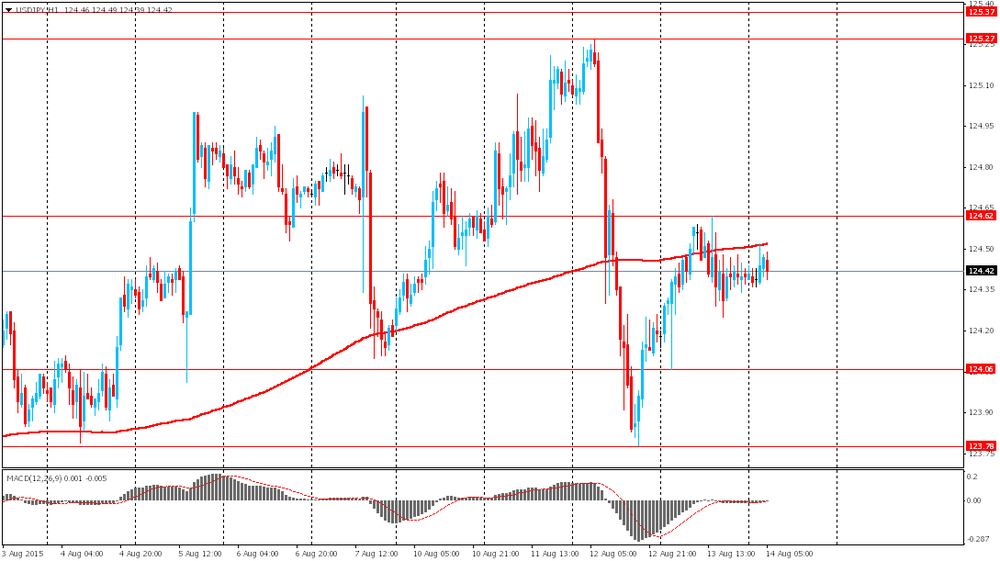

USD/JPY: the currency pair fell to Y124.04

The most important news that are expected (GMT0):

12:30 Canada Manufacturing Shipments (MoM) June 0.1% 2.1%

12:30 U.S. PPI excluding food and energy, m/m July 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y July 0.8% 0.5%

12:30 U.S. PPI, m/m July 0.4% 0.1%

12:30 U.S. PPI, y/y July -0.7% -0.9%

13:15 U.S. Capacity Utilization July 77.8% 78%

13:15 U.S. Industrial Production (MoM) July 0.2% 0.3%

13:15 U.S. Industrial Production YoY July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) August 93.1 93.5

-

13:57

Orders

EUR/USD

Offers 1.1180 1.1200 1.2220 1.1245 11265 1.1285 1.1300

Bids 1.1125 1.1100 1.1085 1.1050 1.1020 1.1000 1.0985 1.0965 1.0950

GBP/USD

Offers 1.5630 1.5650 1.5680 1.5700-10 1.5730 1.5750

Bids 1.5585 1.5550 1.5525 -30 1.5500 1.5485 1.5465 1.5450

EUR/GBP

Offers 0.7155 0.7180-85 0.7200 0.7230 0.7250

Bids 0.7125 0.7100 0.7085 0.7075 0.7050 0.7030-35 0.7020 0.7000

EUR/JPY

Offers 138.80 139.00 139.30 139.50 139.75 140.00

Bids 138.30 138.00 137.80 137.60 137.45 137.25 137.00

USD/JPY

Offers 124.65 124.80 125.00 125.20-25 125.50 125.75 126.00

Bids 124.20 124.00 123.75-80 1 123.45-50 123.25-30 123.00

AUD/USD

Offers 0.7400 0.7425 0.7450 0.7480 0.7500

Bids 0.7350 0.7335 0.7320 0.7300 0.7285 0.7260 0.7300 0.7280 0.7250

-

11:49

Greek parliament approves the draft deal on the third bailout programme

The Greek parliament approved the draft deal on the third bailout programme on Friday. Out of 300 Greek MPs 222 voted for the deal, 64 voted against the deal, 11 abstained and three were absent.

Out of 149 Syriza MPs 43 voted against the deal.

News reported that the Greek Prime Minister Alexis Tsipras will ask for a confidence vote before parliament in the next week.

Eurozone finance ministers are expected to approve the deal later on Friday.

-

11:39

Eurozone's final harmonized consumer price index plunges 0.6% in July

Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index dropped 0.6% in July, in line with the previous estimate, after a flat reading in June.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in July, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 1.0% in June from 0.8% in June, in line with the previous estimate.

-

11:27

Eurozone’s economy expands at 0.3% in the second quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.6% in the second quarter, after a 0.2% growth in first quarter. On a yearly basis, the U.S. economy expanded at 2.3% in second quarter, after a 2.9% increase in the first quarter.

-

11:17

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1000(E501mn), $1.1065(E626mn)

USD/JPY: Y124.00($1.41bn), Y124.50($1.11bn)

GBP/USD: $1.5500(Gbp307), $1.5625(Gbp102mn)

AUD/USD: $0.7300(A$101mn)

NZD/USD: $0.6625(NZ$329mn)

USD/CAD: C$1.3025($500mn)

-

11:15

French economy was flat in the second quarter

The French statistical office Insee released its gross domestic product (GDP) growth for France on Friday. France's preliminary GDP was flat in the second quarter, missing expectations for a 0.2% rise, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% gain.

Total production in goods and services fell 0.1% in the second quarter, after a 0.8% increase in the first quarter as output in the manufactured goods dropped.

Households' spending declined strongly.

Export climbed 1.7% in the second quarter, after a 1.3% in the first quarter, while imports rose at a slower pace.

On a yearly basis, France's GDP rose to 1.0% in the second quarter from 0.8% in the first quarter.

-

11:05

German economy grows 0.4% in the second quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.4% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's GDP rose to 1.6% in the second quarter from 1.1% in the first quarter, exceeding expectations for a gain to 1.5%.

-

11:00

Eurozone: GDP (QoQ), Quarter II 0.3% (forecast 0.4%)

-

11:00

Eurozone: Harmonized CPI, July -0.6% (forecast -0.6%)

-

11:00

Eurozone: GDP (YoY), Quarter II 1.2% (forecast 1.3%)

-

11:00

Eurozone: Harmonized CPI ex EFAT, Y/Y, July 1% (forecast 1%)

-

10:35

International Monetary Fund: Europe should discuss debt relief for Greece

The International Monetary Fund (IMF) said that Europe should discuss debt relief for Greece.

"We look forward to working with the authorities to develop their (economic) program in more detail and for Greece's European partners to make decisions on debt relief that will allow Greece's debt to become sustainable," IMF Greece Mission Chief Delia Velculescu said.

She added that the IMF will provide financial help for Greece if the plan regarding debt relief is ready.

-

10:31

Germany's deputy Finance Minister Jens Spahn: the German government was ready to talk about debt relief for Greece

Germany's deputy Finance Minister Jens Spahn said on Thursday that the German government was ready to talk about debt relief for Greece.

"A so-called haircut is not legal, where you give up some debt ... but under the term debt relief you can also talk about extending maturities, having a period without making interest payments or redemption payments and we can talk about that, we have always said that," he said.

Spahn pointed out that some outstanding questions, such as on privatizations and banking recapitalization, had to be addressed this week.

He added that the German government wants that the International Monetary Fund (IMF) stayed involved in the process.

-

10:17

Foreign direct investment inflows in China rise by 5.2% in July

Foreign direct investment inflows in China rose by 50.6 billion yuan in July, up 5.2% from a year earlier.

Foreign direct investment inflows in June increased by an annual rate of 0.7%.

In the first seven months, foreign direct investment inflows climbed by 7.9% to 471.1 billion yuan.

The biggest contributor was the services sector, up 19.6% from a year earlier.

The most investment came from France.

-

10:10

The Wall Street Journal survey: about 82% of economists expect the Fed to start raising its interest rate in September

According to The Wall Street Journal survey, about 82% of economists expect the Fed to start raising its interest rate in September. 13% expect that the Fed would wait until December.

82% of economists expected last month that the Fed to start raising its interest rate in September, while 15% expected the first interest rate hike in December.

Only one of the 60 economists surveyed this month said that the Fed would wait until 2016 to start hiking its interest rates.

-

08:19

Options levels on friday, August 14, 2015:

EUR / USD

Resistance levels (open interest**, contracts)07

$1.1237 (4859)

$1.1217 (3565)

$1.1188 (1675)

Price at time of writing this review: $1.1142

Support levels (open interest**, contracts):

$1.1107 (1246)

$1.1079 (1548)

$1.1036 (2012)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 84493 contracts, with the maximum number of contracts with strike price $1,1300 (7072);

- Overall open interest on the PUT options with the expiration date September, 4 is 116184 contracts, with the maximum number of contracts with strike price $1,0500 (7875);

- The ratio of PUT/CALL was 1.38 versus 1.39 from the previous trading day according to data from August, 13

GBP/USD

Resistance levels (open interest**, contracts)

$1.5902 (2027)

$1.5804 (1944)

$1.5706 (1913)

Price at time of writing this review: $1.5604

Support levels (open interest**, contracts):

$1.5494 (2553)

$1.5397 (1727)

$1.5298 (2285)

Comments:

- Overall open interest on the CALL options with the expiration date September, 4 is 27486 contracts, with the maximum number of contracts with strike price $1,5600 (2823);

- Overall open interest on the PUT options with the expiration date September, 4 is 33552 contracts, with the maximum number of contracts with strike price $1,5500 (2553);

- The ratio of PUT/CALL was 1.22 versus 1.23 from the previous trading day according to data from August, 13

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:17

Foreign exchange market. Asian session: the euro little changed

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

02:15 Australia RBA Assist Gov Kent Speaks

05:30 France GDP, q/q (Preliminary) Quarter II 0.7% Revised From 0.6% 0.2% 0.0%

05:30 France GDP, Y/Y (Preliminary) Quarter II 0.8% 1.0%

06:00 Germany GDP (YoY) (Preliminary) Quarter II 1.1% 1.5% 1.6%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II 0.3% 0.5% 0.4%

The euro was quite stable this morning. Market participants are waiting for the euro zone GDP statistics. Data are likely to show that modest growth persisted. A median forecast suggests a 0.4% growth rate in the second quarter just like in the first quarter. Analysts also say that France and Italy are likely to report slower growth. This would underline uneven recovery in the single currency area, where Germany leads compared to other key economies.

The yen fluctuated mildly after the central Bank of China strengthened the yuan by 0.06%. Friday fix is slightly above Thursday's median level, which suggests a reversal of dynamics of the past three days.

The New Zealand dollar fell amid retail sales data. The corresponding index rose by 0.1% in the second quarter of the current year missing expectations for a 0.5% increase. First quarter reading was revised to 2.3% from 2.7%. Nevertheless on an annualized basis retail sales rose by 5.9% vs 5.2% expected.

EUR/USD: the pair fluctuated within $1.1135-60 in Asian trade

USD/JPY: the pair traded within Y124.35-50

GBP/USD: the pair traded within $1.5600-15

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 0.8% 1%

09:00 Eurozone Harmonized CPI July 0.0% -0.6%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II 1.0% 1.3%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II 0.4% 0.4%

12:30 Canada Manufacturing Shipments (MoM) June 0.1% 2.1%

12:30 U.S. PPI excluding food and energy, m/m July 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y July 0.8% 0.5%

12:30 U.S. PPI, m/m July 0.4% 0.1%

12:30 U.S. PPI, y/y July -0.7% -0.9%

13:15 U.S. Capacity Utilization July 77.8% 78%

13:15 U.S. Industrial Production (MoM) July 0.2% 0.3%

13:15 U.S. Industrial Production YoY July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) August 93.1 93.5

-

08:00

Germany: GDP (QoQ), Quarter II 0.4% (forecast 0.5%)

-

08:00

Germany: GDP (YoY), Quarter II 1.6% (forecast 1.5%)

-

07:31

France: GDP, Y/Y, Quarter II 1.0%

-

07:30

France: GDP, q/q, Quarter II 0.0% (forecast 0.2%)

-

01:00

Currencies. Daily history for Aug 13’2015:

(pare/closed(GMT +3)/change, %)

EUR/USD $1,1153 -0,04%

GBP/USD $1,5612 -0,02%

USD/CHF Chf0,9759 +0,08%

USD/JPY Y124,40 +0,17%

EUR/JPY Y138,74 +0,14%

GBP/JPY Y194,2 +0,15%

AUD/USD $0,7360 -0,29%

NZD/USD $0,6565-0,76%

USD/CAD C$1,3061 +0,66%

-

00:46

New Zealand: Retail Sales YoY, Quarter II 5.9% (forecast 5.2%)

-

00:45

New Zealand: Retail Sales, q/q, Quarter II 0.1% (forecast 0.5%)

-

00:00

Schedule for today, Friday, Aug 14’2015:

(time / country / index / period / previous value / forecast)

02:15 Australia RBA Assist Gov Kent Speaks

05:30 France GDP, q/q (Preliminary) Quarter II 0.6% 0.2%

05:30 France GDP, Y/Y (Preliminary) Quarter II 0.8%

06:00 Germany GDP (YoY) (Preliminary) Quarter II 1.1% 1.5%

06:00 Germany GDP (QoQ) (Preliminary) Quarter II 0.3% 0.5%

09:00 Eurozone Harmonized CPI ex EFAT, Y/Y (Finally) July 0.8% 1%

09:00 Harmonized CPI July 0.0% -0.6%

09:00 Eurozone GDP (YoY) (Preliminary) Quarter II 1.0% 1.3%

09:00 Eurozone GDP (QoQ) (Preliminary) Quarter II 0.4% 0.4%

12:30 Canada Manufacturing Shipments (MoM) June 0.1% 2.1%

12:30 U.S. PPI excluding food and energy, m/m July 0.3% 0.1%

12:30 U.S. PPI excluding food and energy, Y/Y July 0.8% 0.5%

12:30 U.S. PPI, m/m July 0.4% 0.1%

12:30 U.S. PPI, y/y July -0.7% -0.9%

13:15 U.S. Capacity Utilization July 77.8% 78%

13:15 U.S. Industrial Production (MoM) July 0.2% 0.3%

13:15 U.S. Industrial Production YoY July 1.3%

14:00 U.S. Reuters/Michigan Consumer Sentiment Index (Preliminary) August 93.1 93.5

-