Noticias del mercado

-

21:00

Dow +0.28% 17,457.23 +48.98 Nasdaq +0.15% 5,041.10 +7.54 S&P +0.26% 2,088.85 +5.46

-

18:35

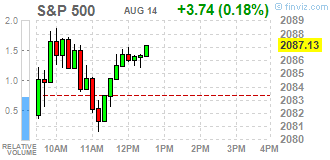

Wall Street. Major U.S. stock-indexes little changed

Major U.S. stock-indexes are little changed on Friday as a raft of positive economic data indicated a healthy start to the third quarter. The Dow and the S&P 500 were on track to post slight gains for the week, but the Nasdaq was set to close flat in a choppy week during which China devalued its currency, hitting markets and derailing predictions of a rate hike. U.S. producer prices rose for a third straight month in July, suggesting the drag on inflation from weaker oil prices was easing, while industrial output advanced at its strongest pace in eight months in July. Inflation has been persistently running below the Fed's 2 percent target.

Most of Dow stocks in positive area (23 of 30). Top looser - Pfizer Inc. (PFE, -0.42%). Top gainer - E. I. du Pont de Nemours and Company (DD, +1.30).

Most of all S&P index sectors also in positive area. Top looser - Healthcare (-0.2%). Top gainer - Conglomerates (+0,4%).

At the moment:

Dow 17392.00 +23.00 +0.13%

S&P 500 2081.25 +0.75 +0.04%

Nasdaq 100 4510.25 -7.00 -0.15%

10 Year yield 2,19% +0,00

Oil 42.61 +0.38 +0.90%

Gold 1112.90 -2.70 -0.24%

-

18:00

European stocks closed: FTSE 100 6,550.74 -17.59 -0.27% CAC 40 4,956.47 -30.38 -0.61% DAX 10,985.14 -29.49 -0.27%

-

18:00

European stocks close: stocks closed lower ahead of the results of the Eurogroup’s meeting today

Stock indices closed lower ahead of the results of the Eurogroup's meeting today. The Greek parliament approved the draft deal on the third bailout programme on Friday. Out of 300 Greek MPs 222 voted for the deal, 64 voted against the deal, 11 abstained and three were absent.

Out of 149 Syriza MPs 43 voted against the deal.

News reported that the Greek Prime Minister Alexis Tsipras will ask for a confidence vote before parliament in the next week.

Eurozone finance ministers are expected to approve the deal later on Friday.

A Greek official said on Friday that the Greece will get €23 billion in the first tranche from the third bailout programme. €13 billion will be used to cover the debt repayment and an additional €10 billion will be used to bolster capitalisation levels of Greek banks.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

Eurostat released no details of the component breakdown of GDP.

Eurozone's final harmonized consumer price index dropped 0.6% in July, in line with the previous estimate, after a flat reading in June.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in July, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 1.0% in June from 0.8% in June, in line with the previous estimate.

Germany's preliminary GDP gained by 0.4% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's GDP rose to 1.6% in the second quarter from 1.1% in the first quarter, exceeding expectations for a gain to 1.5%.

France's preliminary GDP was flat in the second quarter, missing expectations for a 0.2% rise, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% gain.

On a yearly basis, Germany's GDP rose to 1.0% in the second quarter from 0.8% in the first quarter.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,550.74 -17.59 -0.27 %

DAX 10,985.14 -29.49 -0.27 %

CAC 40 4,956.47 -30.38 -0.61 %

-

17:50

Greece gets €23 billion in the first tranche

A Greek official said on Friday that the Greece will get €23 billion in the first tranche from the third bailout programme. €13 billion will be used to cover the debt repayment and an additional €10 billion will be used to bolster capitalisation levels of Greek banks.

-

17:41

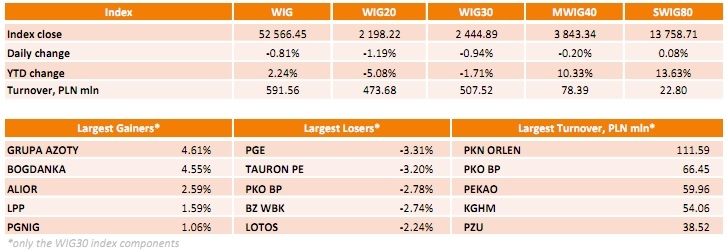

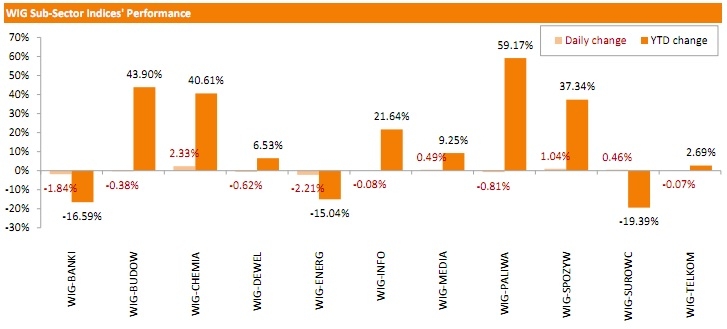

WSE: Session Results

The Polish equity market finished lower Friday. The broad-market measure, the WIG Index, fell by 0.81%. Sector performance in the WIG Index was mixed. Utilities names (-2.21%) fared the worst, while chemicals stocks (+2.33%) outperformed.

The large-cap stocks' measure, the WIG30 Index, lost 0.94%. Within the index components, PGE (WSE: PGE) and TAURON PE (WSE: TPE) recorded the biggest declines, slumping 3.31% and 3.2% respectively. They were followed by PKO BP (WSE: PKO), BZ WBK (WSE: BZW) and LOTOS (WSE: LTS), losing 2.24%-2.78%. On the other side of the ledger, the biggest advancers were GRUPA AZOTY (WSE: ATT), BOGDANKA (WSE: LWB) and ALIOR (WSE: ALR), climbing 2.59%-4.61%.

-

16:23

Thomson Reuters/University of Michigan preliminary consumer sentiment index drops to 92.9 in August

The Thomson Reuters/University of Michigan preliminary consumer sentiment index fell to 92.9 in August from a final reading of 93.1 in July, missing expectations for an increase to 93.5.

"Consumer confidence was virtually unchanged in early August from the July reading, marking its highest nine month average since 2004. Renewed strength in personal finances largely offset slight declines in prospects for the national economy and buying conditions," the Surveys of Consumers chief economist at the University of Michigan Richard Curtin said.

The decline in the index was mainly driven by falls in the index of current economic conditions and the index of consumer expectations.

The index of current economic conditions declined to 107.1 in August from 107.2 in July, while the index of consumer expectations decreased to 83.8 from 84.1.

The one-year inflation expectations remained unchanged at to 2.8% in August.

-

15:41

U.S. industrial production rises 0.6% in July

The Federal Reserve released its industrial production report on Friday. The U.S. industrial production rose 0.6% in July, exceeding expectations for a 0.3% increase, after a 0.1% gain in June. June's figure was revised down from a 0.2% rise.

The increase was driven by higher factory output. Factory output climbed by 0.8% in July.

Mining output climbed 0.2% in July, while utilities production declined 1.0%.

Capacity utilisation rate increased to 78.8% in July from 77.7% in June, in line with expectations. June's figure was revised down 77.8%.

-

15:31

U.S. Stocks open: Dow -0.04%, Nasdaq -0.15%, S&P -0.05%

-

15:22

Before the bell: S&P futures -0.19%, NASDAQ futures -0.18%

U.S. stock-index futures fell as investors turn their attention to economic reports amid the Federal Reserve's intentions to raise interest rates.

Global Stocks:

Nikkei 20,519.45 -76.10 -0.37%

Hang Seng 23,991.03 -27.77 -0.12%

Shanghai Composite 3,965.64 +11.08 +0.28%

FTSE 6,551.16 -17.17 -0.26%

CAC 4,952.31 -34.54 -0.69%

DAX 10,963.38 -51.25 -0.47%

Crude oil $42.13 (-0.21%)

Gold $1116.50 (+0.08%)

-

15:09

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

Walt Disney Co

DIS

107.53

+0.01%

2.1K

AMERICAN INTERNATIONAL GROUP

AIG

63.25

+0.02%

0.3K

Visa

V

73.98

+0.07%

0.4K

JPMorgan Chase and Co

JPM

67.60

+0.07%

1.2K

ALCOA INC.

AA

9.32

+0.11%

7.1K

Exxon Mobil Corp

XOM

78.75

+0.13%

2.5K

General Motors Company, NYSE

GM

31.15

+0.28%

2.0K

American Express Co

AXP

81.00

+0.30%

0.1K

Yandex N.V., NASDAQ

YNDX

12.87

+0.78%

6.0K

Barrick Gold Corporation, NYSE

ABX

7.88

+1.42%

79.9K

Tesla Motors, Inc., NASDAQ

TSLA

246.50

+1.65%

81.9K

E. I. du Pont de Nemours and Co

DD

54.00

+1.83%

2.8K

Verizon Communications Inc

VZ

47.66

0.00%

0.2K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

10.07

0.00%

17.1K

Merck & Co Inc

MRK

58.97

-0.02%

0.3K

Pfizer Inc

PFE

35.35

-0.03%

16.8K

Nike

NKE

113.55

-0.04%

4.0K

Procter & Gamble Co

PG

75.75

-0.04%

0.4K

AT&T Inc

T

33.79

-0.06%

3.1K

Wal-Mart Stores Inc

WMT

72.07

-0.06%

1.4K

Cisco Systems Inc

CSCO

28.68

-0.07%

2.6K

Ford Motor Co.

F

14.70

-0.07%

1.2K

Johnson & Johnson

JNJ

98.40

-0.08%

0.2K

Facebook, Inc.

FB

93.35

-0.09%

30.6K

Home Depot Inc

HD

118.90

-0.10%

0.7K

Chevron Corp

CVX

85.75

-0.12%

0.5K

McDonald's Corp

MCD

99.22

-0.15%

4.5K

General Electric Co

GE

25.75

-0.16%

1.6K

Amazon.com Inc., NASDAQ

AMZN

528.70

-0.18%

1.1K

Intel Corp

INTC

28.81

-0.21%

1K

Starbucks Corporation, NASDAQ

SBUX

56.70

-0.26%

0.7K

Microsoft Corp

MSFT

46.60

-0.28%

0.8K

Apple Inc.

AAPL

114.59

-0.49%

139.6K

Twitter, Inc., NYSE

TWTR

28.40

-0.49%

34.8K

Yahoo! Inc., NASDAQ

YHOO

35.68

-0.70%

1.3K

Hewlett-Packard Co.

HPQ

28.20

-0.88%

2.7K

-

14:53

U.S. producer price index rises 0.2% in June

The U.S. Commerce Department released the producer price index figures on Friday. The U.S. producer price index increased 0.2% in July, exceeding expectations for a 0.1% gain, after a 0.4% rise in June.

On a yearly basis, the producer price index decreased 0.8% in July, beating forecasts of a 0.9% decline, after a 0.7% fall in June.

The rise was partly driven by higher services prices, which were up 0.4%.

Food prices fell by 0.1% in July, driven by a drop in wholesale egg prices, which slid 24.2%.

Energy sales declined 0.6% in July.

The producer price index excluding food and energy climbed 0.3% in July, exceeding expectations for a 0.1% gain, after a 0.3% increase in June.

On a yearly basis, the producer price index excluding food and energy climbed 0.6% in July, beating forecasts of a 0.5% increase, after a 0.8% rise in June.

A stronger U.S. dollar and low oil prices still weigh on inflation. Producer prices may drop in August due to a recent decline in oil prices.

-

14:46

Upgrades and downgrades before the market open

Upgrades:

DuPont (DD) upgraded to Overweight from Neutral at JP Morgan

Downgrades:

Other:

-

14:39

Canadian manufacturing shipments are up 1.2% in June

Statistics Canada released manufacturing shipments on Friday. Canadian manufacturing shipments rose 1.2% in June, missing forecasts of a 2.1% increase, after a 0.2% gain in May. May's figure was revised up from a 0.1% rise.

The rise was partly driven by higher sales of chemical products and motor vehicles. Sales of chemical products climbed 5.4% in June, while sales of motor vehicles rose 4.2%.

Sales increased in 18 of 21 categories.

-

14:25

UK’s construction output rises 0.9% in June

The Office for National Statistics (ONS) released its construction output data for the U.K. on Friday. Construction output in the U.K. gained 0.9% in June, after a 1.0% drop in May.

The increase was driven by new housing, infrastructure and public works projects.

On a yearly basis, construction output climbed 2.6% in June, after a 2.1% rise in May.

Construction makes up 6% of UK's economy.

-

14:13

Italian economy increases 0.2% in the second quarter

Italian economy increases 0.2% in the second quarter

The Italian statistical office Istat released its gross domestic product (GDP) growth for Italy on Friday. Italy's preliminary GDP increased 0.2% in the second quarter, after a 0.3% rise in the first quarter.

The growth was driven by an increase in domestic demand.

On a yearly basis, Italy's GDP rose to 0.5% in the second quarter from 0.1% in the first quarter.

-

12:00

European stock markets mid session: stocks slightly higher as the Greek parliament approved the draft deal on the third bailout programme

Stock indices traded slightly higher as the Greek parliament approved the draft deal on the third bailout programme on Friday. Out of 300 Greek MPs 222 voted for the deal, 64 voted against the deal, 11 abstained and three were absent.

Out of 149 Syriza MPs 43 voted against the deal.

News reported that the Greek Prime Minister Alexis Tsipras will ask for a confidence vote before parliament in the next week.

Eurozone finance ministers are expected to approve the deal later on Friday.

Meanwhile, the economic data from the Eurozone was mixed. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

Eurostat released no details of the component breakdown of GDP.

Eurozone's final harmonized consumer price index dropped 0.6% in July, in line with the previous estimate, after a flat reading in June.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in July, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 1.0% in June from 0.8% in June, in line with the previous estimate.

Germany's preliminary GDP gained by 0.4% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's GDP rose to 1.6% in the second quarter from 1.1% in the first quarter, exceeding expectations for a gain to 1.5%.

France's preliminary GDP was flat in the second quarter, missing expectations for a 0.2% rise, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% gain.

On a yearly basis, Germany's GDP rose to 1.0% in the second quarter from 0.8% in the first quarter.

Current figures:

Name Price Change Change %

FTSE 100 6,577.61 +9.28 +0.14 %

DAX 11,034.7 +20.07 +0.18 %

CAC 40 4,991.05 +4.20 +0.08 %

-

11:49

Greek parliament approves the draft deal on the third bailout programme

The Greek parliament approved the draft deal on the third bailout programme on Friday. Out of 300 Greek MPs 222 voted for the deal, 64 voted against the deal, 11 abstained and three were absent.

Out of 149 Syriza MPs 43 voted against the deal.

News reported that the Greek Prime Minister Alexis Tsipras will ask for a confidence vote before parliament in the next week.

Eurozone finance ministers are expected to approve the deal later on Friday.

-

11:39

Eurozone's final harmonized consumer price index plunges 0.6% in July

Eurostat released its final consumer price inflation data for the Eurozone on Friday. Eurozone's final harmonized consumer price index dropped 0.6% in July, in line with the previous estimate, after a flat reading in June.

On a yearly basis, Eurozone's final consumer price inflation remained unchanged at 0.2% in July, in line with the previous estimate.

Eurozone's consumer price inflation excluding food, energy, alcohol and tobacco rose to an annual rate of 1.0% in June from 0.8% in June, in line with the previous estimate.

-

11:27

Eurozone’s economy expands at 0.3% in the second quarter

Eurostat released its GDP growth figures for the Eurozone on Friday. Eurozone's preliminary gross domestic product (GDP) increased by 0.3% in the second quarter, missing expectations for a 0.4% rise, after a 0.4% gain in the first quarter.

On a yearly basis, Eurozone's preliminary GDP rose by 1.2% in the second quarter, missing expectations for a 1.3% increase, after a 1.0% gain in the first quarter.

Eurostat released no details of the component breakdown of GDP.

The U.S. economy grew 0.6% in the second quarter, after a 0.2% growth in first quarter. On a yearly basis, the U.S. economy expanded at 2.3% in second quarter, after a 2.9% increase in the first quarter.

-

11:15

French economy was flat in the second quarter

The French statistical office Insee released its gross domestic product (GDP) growth for France on Friday. France's preliminary GDP was flat in the second quarter, missing expectations for a 0.2% rise, after a 0.7% increase in the first quarter. The first quarter's figure was revised up from a 0.6% gain.

Total production in goods and services fell 0.1% in the second quarter, after a 0.8% increase in the first quarter as output in the manufactured goods dropped.

Households' spending declined strongly.

Export climbed 1.7% in the second quarter, after a 1.3% in the first quarter, while imports rose at a slower pace.

On a yearly basis, France's GDP rose to 1.0% in the second quarter from 0.8% in the first quarter.

-

11:05

German economy grows 0.4% in the second quarter

Destatis released its gross domestic product (GDP) growth for Germany on Friday. Germany's preliminary GDP gained by 0.4% in the second quarter, missing expectations for a 0.5% rise, after a 0.3% increase in the first quarter.

The increase was driven by higher exports as the euro remained weak. Exports increased much more than imports.

Household and government consumption expenditure continued to develop positively.

On a yearly basis, Germany's GDP rose to 1.6% in the second quarter from 1.1% in the first quarter, exceeding expectations for a gain to 1.5%.

-

10:35

International Monetary Fund: Europe should discuss debt relief for Greece

The International Monetary Fund (IMF) said that Europe should discuss debt relief for Greece.

"We look forward to working with the authorities to develop their (economic) program in more detail and for Greece's European partners to make decisions on debt relief that will allow Greece's debt to become sustainable," IMF Greece Mission Chief Delia Velculescu said.

She added that the IMF will provide financial help for Greece if the plan regarding debt relief is ready.

-

10:31

Germany's deputy Finance Minister Jens Spahn: the German government was ready to talk about debt relief for Greece

Germany's deputy Finance Minister Jens Spahn said on Thursday that the German government was ready to talk about debt relief for Greece.

"A so-called haircut is not legal, where you give up some debt ... but under the term debt relief you can also talk about extending maturities, having a period without making interest payments or redemption payments and we can talk about that, we have always said that," he said.

Spahn pointed out that some outstanding questions, such as on privatizations and banking recapitalization, had to be addressed this week.

He added that the German government wants that the International Monetary Fund (IMF) stayed involved in the process.

-

10:17

Foreign direct investment inflows in China rise by 5.2% in July

Foreign direct investment inflows in China rose by 50.6 billion yuan in July, up 5.2% from a year earlier.

Foreign direct investment inflows in June increased by an annual rate of 0.7%.

In the first seven months, foreign direct investment inflows climbed by 7.9% to 471.1 billion yuan.

The biggest contributor was the services sector, up 19.6% from a year earlier.

The most investment came from France.

-

10:10

The Wall Street Journal survey: about 82% of economists expect the Fed to start raising its interest rate in September

According to The Wall Street Journal survey, about 82% of economists expect the Fed to start raising its interest rate in September. 13% expect that the Fed would wait until December.

82% of economists expected last month that the Fed to start raising its interest rate in September, while 15% expected the first interest rate hike in December.

Only one of the 60 economists surveyed this month said that the Fed would wait until 2016 to start hiking its interest rates.

-

08:23

Global Stocks: U.S. indices changed mildly

Major U.S. stock indices took a breath on Thursday and posted only slight changes. Investors assessed U.S. retail sales data paying little attention to further devaluation of the yuan.

U.S. Department of Commerce reported that seasonally adjusted retail sales rose by 0.6% m/m in July (instead of +0.5% expected) giving the U.S. economy the right push at the beginning of the second half of the year. In June sales were unchanged after a surge in May. Sales excluding automobiles rose by 0.4% in July marking the third straight month of solid growth. A better-than-expected report suggests that the U.S. economy remains strong despite turmoils around the globe.

The Dow Jones industrial average climbed 5.74 points, or less than 0.1%, to 17408.25. The S&P 500 slid 2.66 points, or 0.1%, to 2083.39. The Nasdaq Composite Index lost 10.83 points, or 0.2%, to 5033.56.

Energy companies' 1.4% drop led declines in the S&P 500 index.

This morning in Asia Hong Kong Hang Seng rose 0.08%, or 18.87 points, to 24,037.67. China Shanghai Composite Index gained 0.89%, or 35.19 points, to 3,989.75. The Nikkei lost 0.26%, or 54.21 points, to 20,541.34.

On Friday the People's Bank of China raised exchange rate of the yuan by 0.06% after three days of cuts.

Japanese stocks declined amid concerns over Chinese economy.

-

04:04

Nikkei 225 20,560.61 -34.94 -0.17 %, Hang Seng 24,077.21 +58.41 +0.24 %, Shanghai Composite 3,976 +21.45 +0.54 %

-