Noticias del mercado

-

18:00

European stocks closed: FTSE 100 5,874.06 -78.72 -1.32% CAC 40 4,473.07 -76.49 -1.68% DAX 10,139.34 -200.72 -1.94%

-

17:05

Fitch Ratings affirms UK’s sovereign debt rating at 'AA+'

Fitch Ratings has affirmed UK's sovereign debt rating at 'AA+' on Friday. The outlook is stable.

"The UK's ratings benefit from a high-income, diversified and flexible economy. The credible monetary and fiscal policy framework and sterling's international reserve currency status further support the ratings," Fitch said in its statement.

The agency expects the French economy to expand 2.5% in 2015, 2.3% in 2016 and 2.1% in 2017.

"The mild growth slowdown has continued since the last rating review in June 2015," the agency noted.

-

16:59

Fitch Ratings affirms France’s sovereign debt rating at 'AA+'

Fitch Ratings has affirmed France's sovereign debt rating at 'AA+' on Friday. The outlook is stable.

"France's ratings balance a wealthy and diversified economy, track record of relative macro-financial stability, strong and effective civil and social institutions with a high general government debt/GDP ratio and fiscal deficit," Fitch said in its statement.

The agency expects the French economy to expand 1.1% in 2015, 1.5% in 2016 and 2017.

"France's economic recovery is proceeding with growth this year supported by low oil prices and favourable monetary and tax policies boosting private consumption, and the euro depreciation bolstering exports," the agency noted.

Inflation is expected to climb from 0.1% this year to 1.3% by 2017, while unemployment rate is expected to be 10.5% in 2015, falling to just below 10% by 2017.

Fitch expects France's government deficit to decline to 3.4% of GDP in 2016 and 2.8% in 2017 from 3.8% in 2015.

-

16:50

Bank of England Deputy Governor Minouche Shafik: wages should grow faster before the central bank will start raising its interest rate

Bank of England (BoE) Deputy Governor Minouche Shafik said in a speech on Monday that wages should grow faster before the central bank will start raising its interest rate.

"I will wait until I am convinced that wage growth will be sustained at a level consistent with inflation returning to target before voting for an increase in Bank Rate," she said.

Shafik added that interest rate could rise faster than expected by markets once the BoE starts raising its interest rate.

"I can see Bank Rate rising more quickly than the path implied by the market curve at the time of the last Inflation Report," the BoE deputy governor noted.

-

16:16

European Central Bank purchases €13.60 billion of government and agency bonds last week

The European Central Bank (ECB) purchased €13.60 billion of government and agency bonds under its quantitative-easing program last week.

The ECB bought €1.90 billion of covered bonds, and €98 million of asset-backed securities.

The ECB will pause its asset-buying programme between December 22 and January 1. The central bank will resume its purchases on January 04.

The ECB kept its interest rate unchanged at 0.05% on December 04, but lowered its deposit rate to -0.3% from -0.2%. The asset-buying programme will be extended until the end of March 2017. The volume of the monthly purchases remained unchanged.

-

15:53

Japan's tertiary industry activity index increases 0.9% in October

Japan's Ministry of Economy, Trade and Industry released its tertiary industry activity index on Monday. The index rose 0.9% in October, after a 0.4% decline in September.

The increase was driven by rises in wholesale trade, real estate, finance and insurance, information and communications, living and amusement-related services, retail trade, and electricity, gas, heat supply and water industries.

-

14:53

Greek import prices rise 0.2% in November

The Hellenic Statistical Authority released its import prices data for Greece on Monday. Greek import prices climbed 0.2% in November, after a 0.8% fall in October.

On a yearly basis, import prices dropped 10.4% in November, after a 12.6% decline in October.

Import prices for energy plunged by 35.5% year-on-year in November, price for durable consumer goods fell by 0.3%, while price for non-durable consumer goods increased by 0.6%.

Prices of capital goods rose 0.2% year-on-year in November, while intermediate goods prices decreased 0.9%.

-

14:50

Option expiries for today's 10:00 ET NY cut

USD/JPY: 120.00 (USD 381m) 121.50 (280m) 122.00 (465m)

EUR/USD: 1.0900 (EUR 402m) 1.1000 (665m)

GBP/USD: 1.5135 (310m) 1.5200 (636m)

USD/CAD: 1.3760 (USD 312m)

AUD/USD: 0.7125-30 (AUD 603m) 0.7200 (586m) 0.7400 (450m)

AUD/NZD: 1.0900 (AUD 983m)

-

14:27

European Central Bank Chief Economist Peter Praet: the ECB is ready to face the Fed’s interest rate hike

The European Central Bank (ECB) Chief Economist Peter Praet said in an interview with the Financial Times on Sunday that the ECB is ready to face the Fed's interest rate hike.

"We are ready to face any situation there," he said.

The Fed will release its monetary policy meeting results on Wednesday. Analysts expect the Fed to raise its interest rate.

-

14:20

European Central Bank President Mario Draghi: inflation in the Eurozone will reach 2% target "without undue delay"

The European Central Bank (ECB) President Mario Draghi said in a speech on Monday that inflation in the Eurozone will reach 2% target "without undue delay".

"After the recalculation of our tools carried out by the Governing Council earlier this month, we expect inflation to reach our target without undue delay," he said.

Draghi added that there are no restrictions in usage of tolls to boost inflation toward 2% target.

The ECB president pointed out that the central bank is ready to add further stimulus measures to reach 2% inflation target if needed.

-

14:13

Foreign exchange market. European session: the euro traded higher against the U.S. dollar on comments by the European Central Bank President Mario Draghi

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

04:30 Japan Industrial Production (MoM) (Finally) October 1.4% Revised From 1.1% 1.4% 1.4%

04:30 Japan Industrial Production (YoY) (Finally) October -0.8% -1.4% -1.4%

04:30 Japan Tertiary Industry Index October -0.4% 0.9%

10:00 Eurozone Industrial production, (MoM) October -0.3% 0.3% 0.6%

10:00 Eurozone Industrial Production (YoY) October 1.3% Revised From 1.7% 1.3% 1.9%

11:00 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom MPC Member Shafik Speaks

The U.S. dollar traded mixed against the most major currencies in the absence of any major economic reports from the U.S. Market participants are awaiting the release of the Fed's monetary policy meeting results on Wednesday. Analysts expect the Fed to raise its interest rate.

The euro traded higher against the U.S. dollar on comments by the European Central Bank (ECB) President Mario Draghi. He said on Monday that inflation in the Eurozone will reach 2% target "without undue delay".

Meanwhile, the economic data from Eurozone was positive. Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in October, exceeding expectations for a 0.3% increase, after a 0.3% fall in September.

The increase was driven by rises in durable consumer goods, non-durable consumer goods, energy and capital output. Durable consumer goods output jumped 1.8% in October, non-durable consumer goods were up 0.4%, capital goods output climbed 1.4%, while energy output rose 0.6%.

Intermediate goods output declined 0.1% in October.

On a yearly basis, Eurozone's industrial production gained 1.9% in October, exceeding expectations for a 1.3% rise, after a 1.3% increase in September. September's figure was revised down from a 1.7% gain.

The increase was mainly driven by rises in durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 4.2% in October from a year ago, capital goods rose by 3.5%, while intermediate goods output increased by 1.5%.

Energy output was up by 0.2% in October from a year ago, while non-durable consumer goods gained by 0.7%.

The British pound traded lower against the U.S. dollar. According to property tracking website Rightmove, U.K. house prices declined 1.1% in December, after a 1.3% drop in November. The latest decline was the smallest fall since 2006.

The decline was mainly driven by falls in prices in the East of England, the South West, Wales, the East Midlands and the North East.

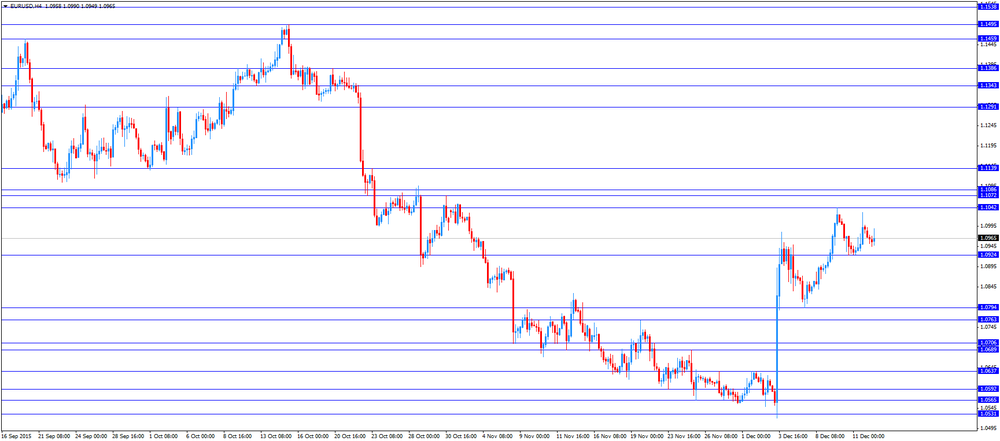

EUR/USD: the currency pair rose to $1.0990

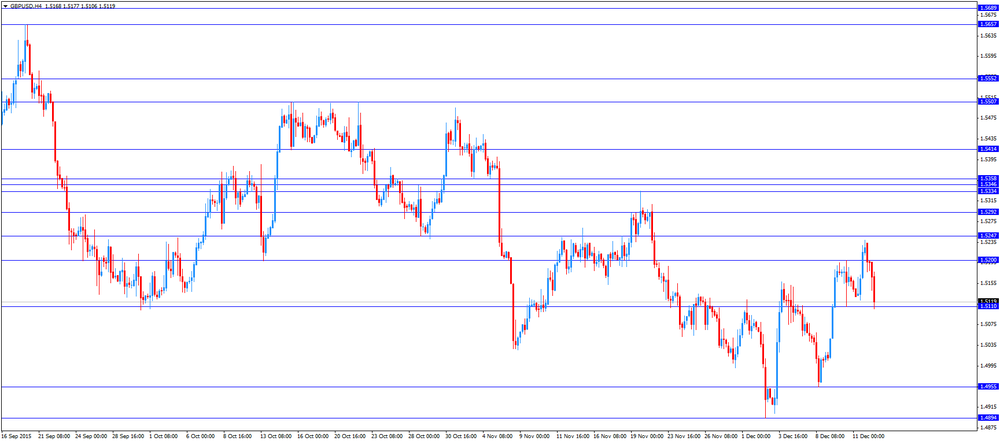

GBP/USD: the currency pair declined to $1.5106

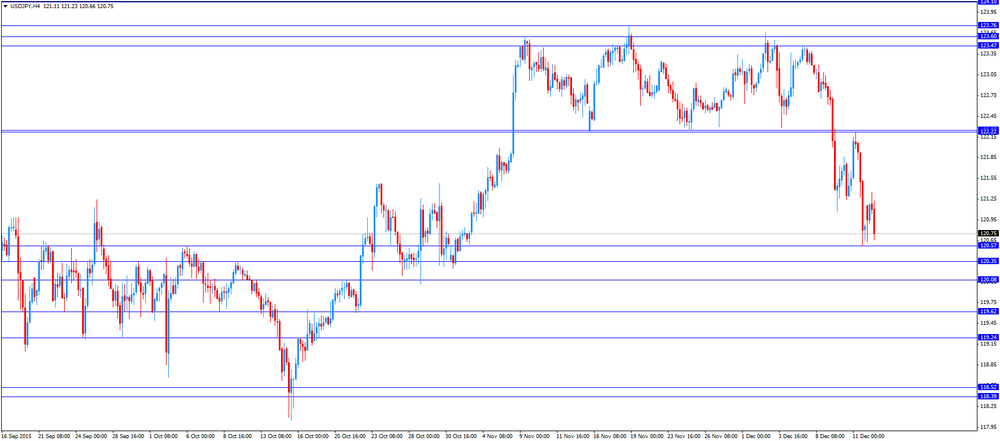

USD/JPY: the currency pair decreased to Y120.66

-

13:50

Orders

EUR/USD

Offers 1.0985 1.1000 1.1025-30 1.1050 1.1080 1.1100 1.1130 1.1150

Bids 1.0950 1.0925-30 1.0900 1.0880 1.0865 1.0850 1.0825-30 1.0800

GBP/USD

Offers 1.5200 1.5225 1.5240-50 1.5270 1.5285 1.5300 1.5330 1.5350 1.5380 1.5400

Bids 1.5165 1.5150 1.5125-30 1.51101.5100 1.5080 1.5065 1.5050 1.5030 1.5000

EUR/GBP

Offers 0.7230-35 0.7250 0.7275-80 0.7300 0.7320 0.7350 0.7375 0.7400

Bids 0.7200 0.7180 0.7165 0.7150 0.7130 0.7100

EUR/JPY

Offers 133.00 133.25 133.50 133.85 134.00 134.20-25 134.50

Bids 132.50 132.00 131.50 131.00 130.80 130.50

USD/JPY

Offers 121.50 121.70 121.85 122.00 122.20-25 122.50122.85 123.00

Bids 121.20 121.00 120.85 120.60-65 120.50 120.30 120.00

AUD/USD

Offers 0.7220 0.7250 0.7285 0.7300 0.7320-25 0.7345-50 0.7375 0.7400

Bids 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100

-

11:38

Rightmove: U.K. house prices drop 1.3% in December

According to property tracking website Rightmove, U.K. house prices declined 1.1% in December, after a 1.3% drop in November. The latest decline was the smallest fall since 2006.

The decline was mainly driven by falls in prices in the East of England, the South West, Wales, the East Midlands and the North East.

"Whilst a fall is the norm at this time of year, this is December's best post-financial-crash performance, signalling another round of price rises in 2016. Despite the shortage of suitable stock in many parts of the market, demand for housing is on the up," Rightmove director and housing market analyst, Miles Shipside, said.

On a yearly basis, house prices in the U.K. climbed 7.4% in December, after a 6.2% increase in November.

-

11:12

Eurozone’s industrial production rises 0.6% in October

Eurostat released its industrial production data for the Eurozone on Monday. Industrial production in the Eurozone rose 0.6% in October, exceeding expectations for a 0.3% increase, after a 0.3% fall in September.

The increase was driven by rises in durable consumer goods, non-durable consumer goods, energy and capital output. Durable consumer goods output jumped 1.8% in October, non-durable consumer goods were up 0.4%, capital goods output climbed 1.4%, while energy output rose 0.6%.

Intermediate goods output declined 0.1% in October.

On a yearly basis, Eurozone's industrial production gained 1.9% in October, exceeding expectations for a 1.3% rise, after a 1.3% increase in September. September's figure was revised down from a 1.7% gain.

The increase was mainly driven by rises in durable consumer goods, intermediate goods output and capital goods. Durable consumer goods climbed by 4.2% in October from a year ago, capital goods rose by 3.5%, while intermediate goods output increased by 1.5%.

Energy output was up by 0.2% in October from a year ago, while non-durable consumer goods gained by 0.7%.

-

11:00

Eurozone: Industrial production, (MoM), October 0.6% (forecast 0.3%)

-

11:00

Eurozone: Industrial Production (YoY), October 1.9% (forecast 1.3%)

-

10:58

Final industrial production in Japan drops 1.4% in October

Japan's Ministry of Economy, Trade and Industry released its final industrial production data on Monday. Final industrial production in Japan rose 1.4% in October, in line with the preliminary estimate, after a 1.4% increase in September. September's figure was revised up from a 1.1% gain.

Industrial shipments climbed 2.1% in October, in line with the preliminary estimate, while inventories dropped 1.9%, in line with the preliminary estimate.

On a yearly basis, Japan's industrial production was down 1.4% in October, in line with the preliminary estimate, after a 0.8% decline in September.

-

10:45

Final consumer prices in Italy decrease 0.4% in November

The Italian statistical office Istat released its final consumer price inflation data for Italy on Monday. Final consumer prices in Italy decreased 0.4% in November, in line with preliminary reading, after a 0.2% rise in October.

The decrease was mainly driven by a drop in prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care plunged 1.6% in November.

On a yearly basis, consumer prices climbed 0.1% in November, in line with preliminary reading, after a 0.3% increase in October.

The slower increase was mainly driven by lower prices for services related to recreation including repair and personal care. Prices for services related to recreation including repair and personal care rose 0.6% year-on-year, after a 1.4% gain in October.

Final consumer price inflation excluding unprocessed food and energy prices fell to 0.7% year-on-year in November from 0.8% in October.

-

10:22

Tankan Survey: the large manufacturers’ index remains unchanged at +12 in the fourth quarter

The Bank of Japan released its quarterly Tankan business survey on late Sunday evening. The large manufacturers' index remained unchanged at +12 in the fourth quarter, beating expectations for a fall to +11. Confidence was driven by record-high profits of companies.

The outlook fell to +7 in the fourth quarter from +10 in the third quarter.

The large non-manufacturers' index remained unchanged at +25 in the fourth quarter, beating expectations for a decline to +23.

The outlook decreased to +18 from +19.

-

10:10

China’s industrial production increases 6.2% year-on-year in November

The National Bureau of Statistics said on Saturday that China's industrial production increased 6.2% year-on-year in November, exceeding expectations for a 5.6% rise, down from a 5.6% gain in October.

Fixed-asset investment in China climbed 10.2% year-on-year in the January-November period, beating expectations for a 10.1% increase, after a 10.2% rise in the January-October period.

Retail sales in China increased 11.2% year-on-year in November, exceeding expectations for a 11.1% gain, after a 11.0% rise in October.

These data indicates that the Chinese economy was recovering in the fourth quarter.

-

09:02

Option expiries for today's 10:00 ET NY cut

USD/JPY: 120.00 (USD 381m) 121.50 (280m) 122.00 (465m)

EUR/USD: 1.0900 (EUR 402m) 1.1000 (665m)

GBP/USD: 1.5135 (310m) 1.5200 (636m)

USD/CAD: 1.3760 (USD 312m)

AUD/USD: 0.7125-30 (AUD 603m) 0.7200 (586m) 0.7400 (450m)

AUD/NZD: 1.0900 (AUD 983m)

-

07:46

Foreign exchange market. Asian session: the U.S. dollar advanced

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

04:30 Japan Industrial Production (MoM) (Finally) October 1.4% Revised From 1.1% 1.4% 1.4%

04:30 Japan Industrial Production (YoY) (Finally) October -0.8% -1.4% -1.4%

04:30 Japan Tertiary Industry Index October -0.4% 0.9%

The U.S. dollar rose amid expectations of a Fed rate hike this week. Several times Fed Chair Janet Yellen pointed to a possibility of a liftoff in interest rates at December meeting in case of sustained economic growth and lower unemployment rate. Last week data showed that the unemployment rate remained at record-low 5% in November, while the number of employed outside the farming sector rose by 211,000. Higher rates would boost the dollar.

The euro traded range-bound ahead of today's industrial production data. A median forecast suggests the industrial production rose by 0.3% in October after a flat reading in September. Analysts believe that European producers and exporters took advantage of the euro's weakness and increased sales.

The yen declined after the Bank of Japan released mixed Tankan report. The Tankan index for large producers came in at 12 in the fourth quarter exceeding expectations for 12 points and matching its previous reading. However the outlook for business activity of large manufacturers declined to 7 from 10 reported previously. Thus the updated reading was better than the one before it, but prospects disappoint.

EUR/USD: the pair fluctuated within $1.0950-85 in Asian trade

USD/JPY: the pair rose to Y121.20

GBP/USD: the pair traded within $1.5180-00

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

10:00 Eurozone Industrial production, (MoM) October -0.3% 0.3%

10:00 Eurozone Industrial Production (YoY) October 1.7% 1.3%

11:00 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom MPC Member Shafik Speaks

-

07:04

Options levels on monday, December 14, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1134 (4222)

$1.1094 (5104)

$1.1066 (2773)

Price at time of writing this review: $1.0963

Support levels (open interest**, contracts):

$1.0911 (638)

$1.0857 (1560)

$1.0791 (2252)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 52913 contracts, with the maximum number of contracts with strike price $1,1100 (6884);

- Overall open interest on the PUT options with the expiration date January, 8 is 65640 contracts, with the maximum number of contracts with strike price $1,0450 (7952);

- The ratio of PUT/CALL was 1.24 versus 1.25 from the previous trading day according to data from December, 11

GBP/USD

Resistance levels (open interest**, contracts)

$1.5503 (1003)

$1.5405 (957)

$1.5308 (1025)

Price at time of writing this review: $1.5192

Support levels (open interest**, contracts):

$1.5093 (3087)

$1.4996 (1821)

$1.4897 (1967)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 16474 contracts, with the maximum number of contracts with strike price $1,5100 (2483);

- Overall open interest on the PUT options with the expiration date January, 8 is 17511 contracts, with the maximum number of contracts with strike price $1,5100 (3087);

- The ratio of PUT/CALL was 1.06 versus 1.06 from the previous trading day according to data from December, 11

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

05:41

Japan: Industrial Production (YoY), October -1.4% (forecast -1.4%)

-

05:38

Japan: Tertiary Industry Index , October 0.9%

-

05:36

Japan: Industrial Production (MoM) , October 1.4% (forecast 1.4%)

-

01:02

Currencies. Daily history for Dec 11’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0988 +0,44%

GBP/USD $1,5224 +0,43%

USD/CHF Chf0,9835 -0,42%

USD/JPY Y120,86 -0,57%

EUR/JPY Y132,81 -0,14%

GBP/JPY Y184,00 -0,13%

AUD/USD $0,7185 -1,31%

NZD/USD $0,6711 -0,61%

USD/CAD C$1,3740 +0,85%

-

00:51

Japan: BoJ Tankan. Non-Manufacturing Index, December 25 (forecast 23)

-

00:50

Japan: BoJ Tankan. Manufacturing Index, Quarter IV 12 (forecast 11)

-

00:08

Schedule for today, Monday, Dec 14’2015:

(time / country / index / period / previous value / forecast)

04:30 Japan Industrial Production (MoM) (Finally) October 1.1% 1.4%

04:30 Japan Industrial Production (YoY) (Finally) October -0.8% -1.4%

04:30 Japan Tertiary Industry Index October -0.4%

10:00 Eurozone Industrial production, (MoM) October -0.3% 0.3%

10:00 Eurozone Industrial Production (YoY) October 1.7% 1.3%

11:00 Eurozone ECB President Mario Draghi Speaks

12:00 United Kingdom MPC Member Shafik Speaks

-