Noticias del mercado

-

22:46

New Zealand: Current Account , Quarter III -4.75 (forecast -4.901)

-

22:00

U.S.: Net Long-term TIC Flows , October -16.6

-

22:00

U.S.: Total Net TIC Flows, October 68.9

-

18:00

European stocks closed: FTSE 100 6,017.79 +143.73 +2.4% CAC 40 4,614.4 +141.33 +3.2% DAX 10,450.38 +311.04 +3.1%

-

17:25

Bank of England’s quarterly bulletin: households are better prepared for an interest rate hike than a year ago

The Bank of England (BOE) released its quarterly bulletin on Tuesday. The central bank said that households are better prepared for an interest rate hike than a year ago.

"Households appear a little better placed to cope with a rise in interest rates than a year ago and survey responses do not imply that a rise in rates would have an unusually large impact on spending," the central bank said.

"The Government's plans for fiscal consolidation are likely to continue to weigh on household spending," the BoE added.

-

17:09

New Zealand’s Treasury Ministry downgrades its growth forecasts

New Zealand's Treasury Ministry released its Half Year Economic and Fiscal Update on Tuesday. New Zealand's economy is expected to grow at 2.1% in 2015-16, down from the previous estimate of 3.1% rise, and 2.4% in 2016-17, down from the previous estimate of 2.8% increase.

Inflation is expected to be 1.4 in 2015-16 and 2.1% in 2016-17.

-

17:01

Australian house price index rises 2.0% in the third quarter

The Australian Bureau of Statistics released its house price index on Tuesday. The Australian house price index rose 2.0% in the third quarter, in line with expectations, after a 4.7% gain in the second quarter.

Main contributors were Melbourne (+2.9%), Brisbane (+1.3%), Adelaide (+1.2%), and Canberra (+1.3%).

On a yearly basis, house prices climbed 10.7% in the third quarter, after a 9.8% rise in the second quarter.

The total value of residential dwellings in Australia rose by A$137.1 billion to A$5.9 trillion in the third quarter.

-

16:40

U.S. weekly earnings fall 0.2% in November

The U.S. Labor Department released its real earnings data on Tuesday. Average weekly earnings fell 0.2% in November, after a 0.4% increase in October.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.1% in November, after a 0.2% rise in October.

On a yearly basis, real average weekly earnings increased 1.6% in November, while hourly earnings rose 1.8%.

-

16:11

NAHB housing market index declines to 61 in December

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index fell to 61 in December from 62 in November, missing expectations for an increase to 63.

A level above 50.0 is considered positive, below indicates a negative outlook.

The fall was driven by a decline in all three components of the index. The buyer traffic sub-index decreased to 46 in December from 48 in November, the current sales conditions sub-index fell to 66 from 67, while the sub-index measuring sales expectations in the next six months dropped to 67 from 69.

"Overall, builders are optimistic about the housing market, although they are reporting concerns with the high price of lots and labour," the NAHB Chairman Tom Woods said.

"With job creation, economic growth and growing household formations, we anticipate the housing market to continue to pick up traction as we head into 2016," the NAHB Chief Economist David Crowe said.

-

16:00

U.S.: NAHB Housing Market Index, December 61 (forecast 63)

-

15:51

U.K. leading economic index falls 0.1% in October

The Conference Board (CB) released its leading economic index for the U.K. on Tuesday. The leading economic index (LEI) decreased 0.1% in October, after a 0.4% fall in September.

The coincident index was up 0.1% in October, after a 0.3% gain in September.

"The recent deceleration in the growth of the LEI suggests that the economic expansion is likely to moderate in early 2016," the CB said.

-

15:03

U.S. consumer price inflation is flat in November

The U.S. Labor Department released consumer price inflation data on Tuesday. The U.S. consumer price inflation was flat in November, in line with expectations, after a 0.2% rise in October.

Shelter costs climbed 0.2% in November, while medical care costs rose 0.4%.

Gasoline prices fell 2.4% in November, while food prices decreased 0.1%.

On a yearly basis, the U.S. consumer price index increased to 0.5% in November from 0.2% in October, beating expectations for a rise to 0.4%.

The inflation remains low due to low oil prices.

The U.S. consumer price inflation excluding food and energy gained 0.2% in November, in line with expectations, after a 0.2% increase in October.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.0% in November from 1.9% in October, in line with expectations.

The increase of the consumer price index excluding food and energy was driven by higher prices of rents, airline fares, new motor vehicles and medical care.

The consumer price index is not preferred Fed's inflation measure.

-

14:48

NY Fed Empire State manufacturing index rises to -4.59 in December

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose to -4.59 in December from -10.74 in November, exceeding expectations for an increase to -6.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The December 2015 Empire State Manufacturing Survey indicates that business activity declined for a fifth consecutive month for New York manufacturers. However, the pace of decline slowed somewhat," the New York Federal Reserve said in its report.

The new orders index increased to -5.07 in December from-11.82 in November, while the shipments index climbed to 5.51 from -4.10.

The general business conditions expectations index for the next six months increased to 38.51 in December from 20.33 in November.

The price-paid index decreased to 4.04 in December from 4.55 in November.

The index for the number of employees dropped to -16.16 in December from -7.27 in November.

-

14:45

Option expiries for today's 10:00 ET NY cut

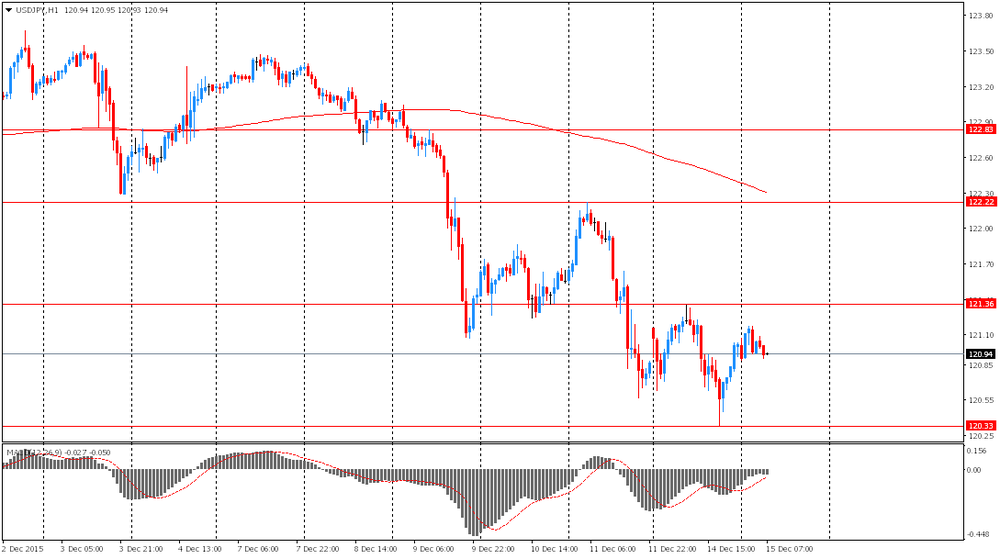

USD/JPY:120.00 (USD 382m) 121.85 (300m) 122.00 (532m)

EUR/USD:1.0895-1.0900 (EUR 500m) 1.1000 (796m) 1.1050 (600m)

GBP/USD:1.5350 (GBP 264m)

EUR/GBP:0.7300 (EUR241m)

AUD/USD:0.7215 (AUD 246m)

-

14:38

Canadian manufacturing shipments drop 1.1% in October

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments fell 1.1% in October, missing expectations for a 0.5% decrease, after a 1.5% decline in September.

The decline was driven by falls in the petroleum and coal product, aerospace product and parts, and machinery industries.

Sales of petroleum and coal products dropped 5.7% in October, aerospace product and parts sales slid 10.3%, while sales in in the machinery industry declined 4.6%.

Inventories increased 0.5% in October.

-

14:30

U.S.: CPI excluding food and energy, Y/Y, November 2% (forecast 2.0%)

-

14:30

U.S.: NY Fed Empire State manufacturing index , December -4.59 (forecast -6)

-

14:30

Canada: Manufacturing Shipments (MoM), October -1.1% (forecast -0.5%)

-

14:30

U.S.: CPI, Y/Y, November 0.5% (forecast 0.4%)

-

14:30

U.S.: CPI excluding food and energy, m/m, November 0.2% (forecast 0.2%)

-

14:30

U.S.: CPI, m/m , November 0.0% (forecast 0%)

-

14:25

UK house price inflation rises 0.8% in October

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.8% in October, after a 0.8% increase in September.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.0% in October, after a 6.1% in September. It was the highest rise since March.

The higher house price inflation was mainly driven by an increase in prices in the East and the South East.

The average mix-adjusted house price was £287,000 in October, up from £286,000 in September.

-

14:15

Foreign exchange market. European session: the euro traded lower against the U.S. dollar despite the positive data from the Eurozone as market participants are awaiting the release of the Fed's monetary policy meeting results on Wednesday

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:30 Australia New Motor Vehicle Sales (YoY) November 4.2% 6.0%

00:30 Australia New Motor Vehicle Sales (MoM) November -3.6% 1.0%

00:30 Australia House Price Index (QoQ) Quarter III 4.7% 2% 2.0%

00:30 Australia RBA Meeting's Minutes

08:15 Switzerland Producer & Import Prices, m/m November 0.2% 0.1% 0.4%

08:15 Switzerland Producer & Import Prices, y/y November -6.6% -5.5%

09:30 United Kingdom Retail Price Index, m/m November 0% -0.1% 0.1%

09:30 United Kingdom Retail prices, Y/Y November 0.7% 0.9% 1.1%

09:30 United Kingdom Producer Price Index - Input (MoM) November 0.2% -1.1% -1.6%

09:30 United Kingdom Producer Price Index - Input (YoY) November -12.3% Revised From -12.1% -12.5% -13.1%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0% -0.1% -0.2%

09:30 United Kingdom Producer Price Index - Output (YoY) November -1.4% Revised From -1.3% -1.3% -1.5%

09:30 United Kingdom HICP, m/m November 0.1% -0.1% 0.0%

09:30 United Kingdom HICP, Y/Y November -0.1% 0.1% 0.1%

09:30 United Kingdom HICP ex EFAT, Y/Y November 1.1% 1.2% 1.2%

10:00 Eurozone ZEW Economic Sentiment December 28.3 34.4 33.9

10:00 Eurozone Employment Change Quarter III 0.4% Revised From 0.3% 0.2% 0.3%

10:00 Germany ZEW Survey - Economic Sentiment December 10.4 15 16.1

The U.S. dollar traded higher against the most major currencies ahead of the release of the U.S. economic data. The U.S. consumer price inflation is expected to rise to 0.4% year-on-year in November from 0.2% in October.

The U.S. consumer price index excluding food and energy is expected to climb to 2.0% year-on-year in November from 1.9% in October.

The U.S. industrial production is expected to increase 0.1% in October, after a 0.2% fall in September.

The NY Fed Empire State manufacturing index is expected to rise to -6.0 in December from -10.74 in November.

The NAHB housing market index is expected to rise to 63 in December from 62 in November.

The euro traded lower against the U.S. dollar despite the positive data from the Eurozone as market participants are awaiting the release of the Fed's monetary policy meeting results on Wednesday.

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 16.1 in December from 10.4 in November, exceeding expectations for a rise to 15.0.

"While the large influx of refugees is above all a major challenge facing policy-makers and civil society in Germany, the economic slowdown in emerging markets is exerting pressure on the German export industry. Overall, however, confidence is growing that the German economy is sufficiently robust to meet these challenges in the coming year," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 33.9 in December from 28.3 in November, missing expectations for a rise to 34.4.

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the third quarter, exceeding expectations for a 0.2% gain, after a 0.4% rise in the second quarter. The second quarter's figure was revised up from a 0.3% gain.

Main contributors were Estonia (+2.1%), Ireland, Spain, Luxembourg and the United Kingdom (all +0.6%).

The British pound traded lower against the U.S. dollar after the release of the U.K. inflation data. The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% year-on-year in November from -0.1% in October, in line with expectations.

The rise was driven by a smaller drop in petrol and diesel prices.

On a monthly basis, U.K. consumer prices were flat in November, beating expectations for a 0.1% decline, after a 0.1% increase in October.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% year-on-year in November from 1.1% in October, in line with expectations.

The Retail Prices Index climbed to 1.1% year-on-year in November from 0.7% in October, exceeding expectations for an increase to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

The Canadian dollar traded lower against the U.S. dollar ahead of the release of Canadian manufacturing shipments data. Canadian manufacturing shipments are expected to fall 0.5% in October, after a 1.5% decline in September.

The Bank of Canada Governor Stephen Poloz will speak at 16:45 GMT.

The Swiss franc traded lower against the U.S. dollar. The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in November, exceeding expectations for a 0.1% gain, after a 0.2% increase in October.

The increase was mainly driven by higher prices for mineral oil products.

On a yearly basis, producer and import prices plunged 5.5% in November, after a 6.6% drop in October.

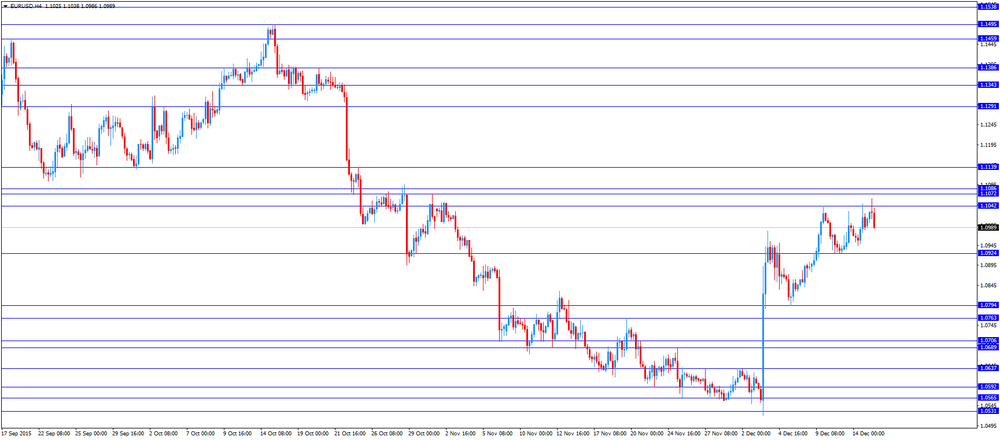

EUR/USD: the currency pair declined to $1.0986

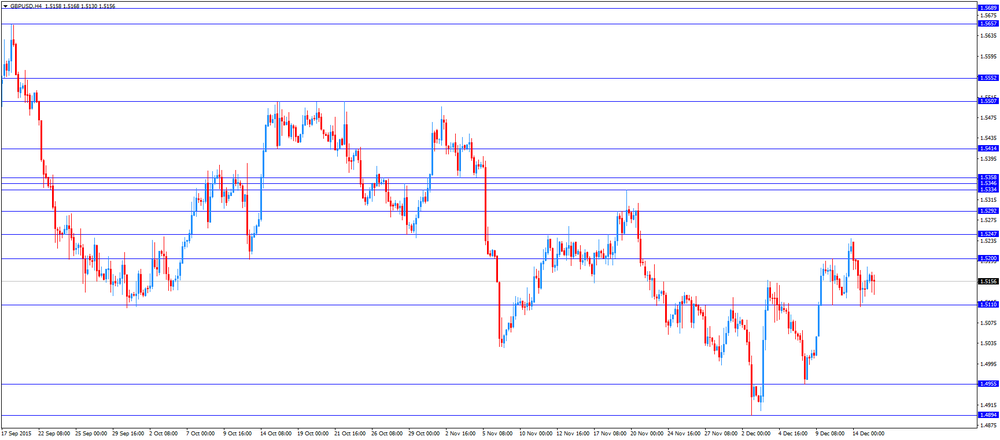

GBP/USD: the currency pair fell to $1.5130

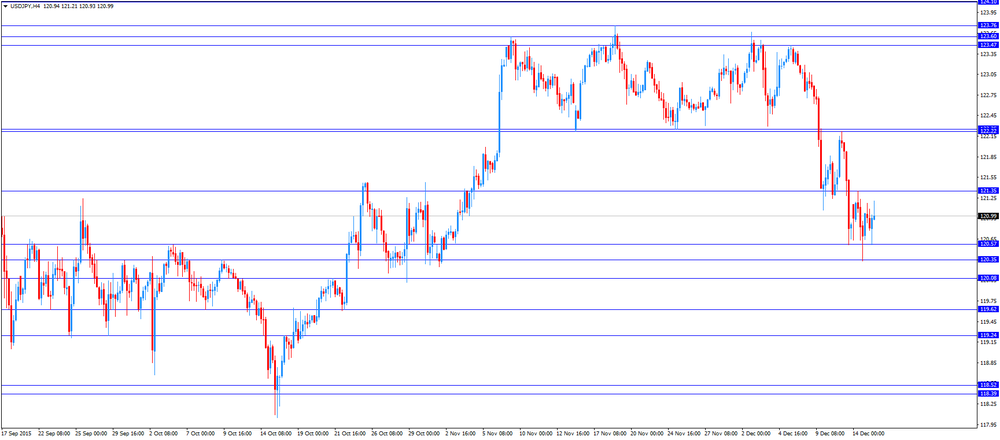

USD/JPY: the currency pair increased to Y121.21

The most important news that are expected (GMT0):

13:30 Canada Manufacturing Shipments (MoM) October -1.5% -0.5%

13:30 U.S. NY Fed Empire State manufacturing index December -10.74 -6

13:30 U.S. CPI, m/m November 0.2% 0%

13:30 U.S. CPI, Y/Y November 0.2% 0.4%

13:30 U.S. CPI excluding food and energy, m/m November 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y November 1.9% 2.0%

15:00 U.S. NAHB Housing Market Index December 62 63

16:45 Canada BOC Gov Stephen Poloz Speaks

-

14:00

Orders

EUR/USD

Offers 1.1065 1.1080-85 1.1100 1.1130 1.1150 1.1175 1.1200

Bids 1.1025-30 1.1000 1.0985 1.0965 1.0950 1.0925-30 1.0900

GBP/USD

Offers 1.5175-80 1.5200 1.5225 1.5240-50 1.5270 1.5285 1.5300

Bids 1.5125-30 1.5110 1.5100 1.5080 1.5065 1.5050 1.5030 1.5000

EUR/GBP

Offers 0.7300 0.7320 0.7350 0.7375 0.7400 0.7420 0.7450

Bids 0.7265 0.7250 0.7225-30 0.7200 0.7180 0.7165 0.7150

EUR/JPY

Offers 133.50 133.85 134.00 134.20-25 134.50 13475 135.00

Bids 133.00 132.80 132.50 132.00 131.50 131.00 130.80 130.50

USD/JPY

Offers 120.85 121.00 121.20 121.50 121.70 121.85 122.00 122.20-25 122.50

Bids 120.60-65 120.50 120.30 120.00 119.85 119.60 119.50 119.30 119.00

AUD/USD

Offers 0.7265 0.7285 0.7300 0.7320-25 0.7345-50 0.7375 0.7400

Bids 0.7220-25 0.7200 0.7185 0.7165 0.7150 0.7130 0.7100

-

13:20

Final consumer price inflation in Spain rises 0.4% in November

The Spanish statistical office INE released its final consumer price inflation data on Tuesday. Consumer price inflation in Spain was up 0.4% in November, up from the preliminary reading of a 0.3% rise, after a 0.6% increase in October.

On a yearly basis, consumer prices fell by 0.3% in November from a year ago, in line with preliminary reading, after a 0.7% decline in October.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

12:53

Eurozone's employment increases by 0.3% in the third quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the third quarter, exceeding expectations for a 0.2% gain, after a 0.4% rise in the second quarter. The second quarter's figure was revised up from a 0.3% gain.

Main contributors were Estonia (+2.1%), Ireland, Spain, Luxembourg and the United Kingdom (all +0.6%).

On a yearly basis, employment in the Eurozone increased by 1.1% in the third quarter, after a 1.0% gain in the second quarter. The second quarter's figure was revised up from a 0.8% rise.

-

12:48

UK consumer price inflation rises rose to 0.1% year-on-year in November

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% year-on-year in November from -0.1% in October, in line with expectations.

The rise was driven by a smaller drop in petrol and diesel prices.

On a monthly basis, U.K. consumer prices were flat in November, beating expectations for a 0.1% decline, after a 0.1% increase in October.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% year-on-year in November from 1.1% in October, in line with expectations.

The Retail Prices Index climbed to 1.1% year-on-year in November from 0.7% in October, exceeding expectations for an increase to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

-

12:39

Germany's ZEW economic sentiment index rises to 16.1 in December

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 16.1 in December from 10.4 in November, exceeding expectations for a rise to 15.0.

The assessment of the current situation in Germany rose by 0.6 points to 55.0 points.

"While the large influx of refugees is above all a major challenge facing policy-makers and civil society in Germany, the economic slowdown in emerging markets is exerting pressure on the German export industry. Overall, however, confidence is growing that the German economy is sufficiently robust to meet these challenges in the coming year," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 33.9 in December from 28.3 in November, missing expectations for a rise to 34.4.

The assessment of the current situation in the Eurozone rose by 0.4 points to -9.6 points.

-

12:34

Switzerland's producer and import prices are up 0.4% in November

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in November, exceeding expectations for a 0.1% gain, after a 0.2% increase in October.

The increase was mainly driven by higher prices for mineral oil products.

The Import Price Index increased by 0.8% in November, while producer prices climbed 0.3%.

On a yearly basis, producer and import prices plunged 5.5% in November, after a 6.6% drop in October.

The Import Price Index fell by 9.7% year-on year in November, while producer prices dropped 3.6%.

-

11:00

Eurozone: Employment Change, Quarter III 0.3% (forecast 0.2%)

-

11:00

Germany: ZEW Survey - Economic Sentiment, December 16.1 (forecast 15)

-

11:00

Eurozone: ZEW Economic Sentiment, December 33.9 (forecast 34.4)

-

10:31

United Kingdom: Producer Price Index - Input (MoM), November -1.6% (forecast -1.1%)

-

10:31

United Kingdom: Producer Price Index - Input (YoY) , November -13.1% (forecast -12.5%)

-

10:30

United Kingdom: Retail Price Index, m/m, November 0.1% (forecast -0.1%)

-

10:30

United Kingdom: Producer Price Index - Output (YoY) , November -1.5% (forecast -1.3%)

-

10:30

United Kingdom: HICP, m/m, November 0.0% (forecast -0.1%)

-

10:30

United Kingdom: Producer Price Index - Output (MoM), November -0.2% (forecast -0.1%)

-

10:30

United Kingdom: Retail prices, Y/Y, November 1.1% (forecast 0.9%)

-

10:30

United Kingdom: HICP, Y/Y, November 0.1% (forecast 0.1%)

-

10:30

United Kingdom: HICP ex EFAT, Y/Y, November 1.2% (forecast 1.2%)

-

10:13

Preliminary real GDP of 20 OECD member countries remains unchanged at 0.7% in the third quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Monday. Real GDP of 20 OECD member countries remained unchanged at 0.7% in the third quarter.

Real GDP of the United States was down to 0.5% from 1.0%, real GDP of Germany fell to 0.3% from 0.4%, while Britain's economy decreased to 0.5% from 0.7%.

GDP of China remained unchanged at 1.8% in the third quarter.

GDP of France increased to 0.3% from 0.0%, India's economy climbed to 1.9% from 1.7%, while Japan's GDP rose to 0.2% from -0.1%.

Eurozone's economy expanded at 0.3% in the third quarter, after a 0.4% rise in the second quarter.

On a yearly basis, GDP of 20 OECD member countries was up 2.9% in the third quarter, after a 3.1% gain in the previous quarter.

-

09:54

Household debt in Canada rises in the third quarter

Statistics Canada released its household debt data on Monday. The ratio of household credit-market debt to disposable income in Canada increased to 163.7% in the third quarter, up from 162.7% in the second quarter. This data means that average Canadian household has C$1.64 in debt for every Canadian dollar of disposable income.

Credit-market debt climbed 1.4% in the third quarter, while disposable income rose only 0.8%.

The interest-only debt service ratio to disposable income was at a record low 6.1%.

-

09:46

The Australian budget deficit will be higher than previously estimated

The Australian Treasury Ministry released its Mid-Year Economic and Fiscal Outlook on Tuesday. The Australian budget deficit is expected to expand to A$37.4 billion in 2015-16, up from a deficit of A$35.1 billion estimated in May. The rise was driven by a drop in commodity prices, weak wage growth and subdued economic outlook.

The Australian economy is expected to grow at 2.5% in 2015-16, down from a 2.75% rise estimated in May.

-

09:32

December’s Reserve Bank of Australia monetary policy meeting: low interest rates supported growth in household consumption and dwelling investment

The Reserve Bank of Australia (RBA) released its minutes from December monetary policy meeting on Tuesday. The RBA said that low interest rates supported growth in household consumption and dwelling investment, while the exchange rate was adjusting to the significant drop in key commodity prices.

The Australian output growth should strengthen gradually over the next two years, the RBA said.

Members said that there is spare capacity in the economy, including in the labour market.

Members also said that further interest rate cut may be needed.

"Members judged that the outlook for inflation may afford some scope for a further easing of monetary policy should that be appropriate to lend support to demand. The Board would continue to assess the outlook, and hence whether the current stance of policy would most effectively foster sustainable growth and inflation consistent with the target," the minutes said.

The RBA kept unchanged its interest rate at 2.00% in December.

-

09:15

Switzerland: Producer & Import Prices, m/m, November 0.4% (forecast 0.1%)

-

09:15

Switzerland: Producer & Import Prices, y/y, November -5.5%

-

09:13

Chinese Xinhua news agency: Chinese leaders said that the country’s economy should expand in a "reasonable range" in 2016

According to the Chinese Xinhua news agency on Monday, Chinese leaders said that the country's economy should expand in a "reasonable range" in 2016, driven by higher domestic demand and supply-side improvements.

"While appropriately expanding aggregate demand, more efforts will be made to improve the quality of efficiency of the supply system," the news agency said.

-

08:59

Option expiries for today's 10:00 ET NY cut

USD/JPY:120.00 (USD 382m) 121.85 (300m) 122.00 (532m)

EUR/USD:1.0895-1.0900 (EUR 500m) 1.1000 (796m) 1.1050 (600m)

GBP/USD:1.5350 (GBP 264m)

EUR/GBP:0.7300 (EUR241m)

AUD/USD:0.7215 (AUD 246m)

-

08:25

Options levels on tuesday, December 15, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1135 (4328)

$1.1096 (5130)

$1.1069 (2772)

Price at time of writing this review: $1.1037

Support levels (open interest**, contracts):

$1.0957 (287)

$1.0917 (766)

$1.0863 (1638)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 53816 contracts, with the maximum number of contracts with strike price $1,1100 (7412);

- Overall open interest on the PUT options with the expiration date January, 8 is 66146 contracts, with the maximum number of contracts with strike price $1,0450 (8182);

- The ratio of PUT/CALL was 1.23 versus 1.24 from the previous trading day according to data from December, 14

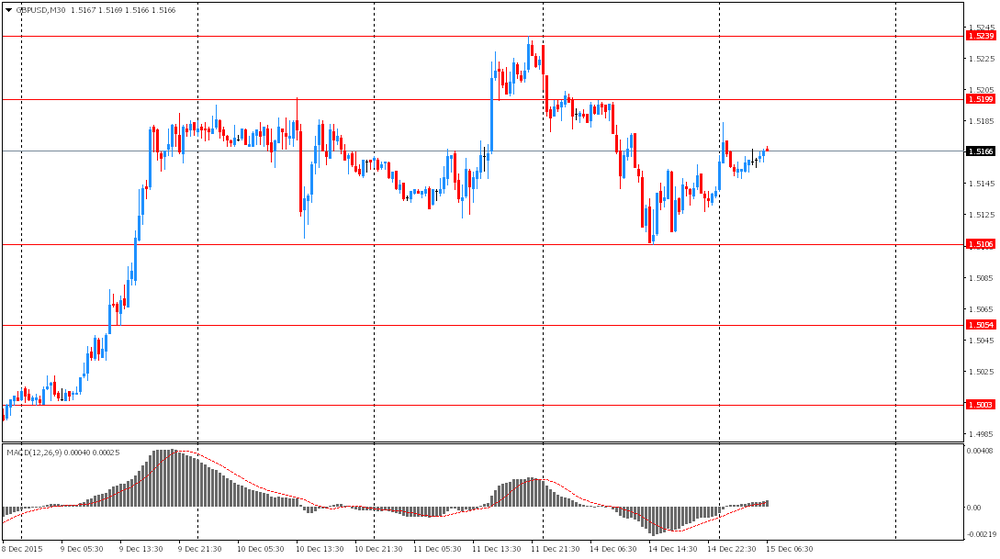

GBP/USD

Resistance levels (open interest**, contracts)

$1.5403 (974)

$1.5305 (1025)

$1.5208 (1179)

Price at time of writing this review: $1.5162

Support levels (open interest**, contracts):

$1.5091 (3096)

$1.4994 (1814)

$1.4897 (1973)

Comments:

- Overall open interest on the CALL options with the expiration date January, 8 is 17392 contracts, with the maximum number of contracts with strike price $1,5100 (2483);

- Overall open interest on the PUT options with the expiration date January, 8 is 17465 contracts, with the maximum number of contracts with strike price $1,5100 (3096);

- The ratio of PUT/CALL was 1.00 versus 1.06 from the previous trading day according to data from December, 14

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:02

Foreign exchange market. Asian session: the U.S. dollar retreated slightly

Economic calendar (GMT0):

Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:30 Australia New Motor Vehicle Sales (YoY) November 4.2% 6.0%

00:30 Australia New Motor Vehicle Sales (MoM) November -3.6% 1.0%

00:30 Australia House Price Index (QoQ) Quarter III 4.7% 2% 2.0%

00:30 Australia RBA Meeting's Minutes

The U.S. dollar declined slightly against most major currencies ahead of Fed's interest rate decision this week. Investors expect the central bank of the U.S. to raise its interest rates for the first time since 2006. Several times Fed Chair Janet Yellen pointed to a possibility of a liftoff in interest rates at December meeting in case of sustained economic growth and lower unemployment rate. Last week data showed that the unemployment rate remained at record-low 5% in November, while the number of employed outside the farming sector rose by 211,000.

The pound climbed ahead of inflation data. Economists believe that prices rose on an annualized basis in November after staying flat for two previous months. This raises a probability of BOE rate increase in 2016. BOE officials signaled they are ready to raise rates in the first half of 2016 in case of sustained inflation growth.

The Australian dollar rose on economic data and RBA meeting minutes. The Australian Bureau of Statistics released new motor vehicle sales statistics. The corresponding index came in at 1.0% m/m in November compared to -3.6% reported previously. Sales rose by 6.0% on an annualized basis. Earlier this month the Reserve Bank of Australia left its benchmark interest rate unchanged at 2.0% amid signs of improvement in non-mining sectors.

EUR/USD: the pair rose to $1.1030 in Asian trade

USD/JPY: the pair traded within Y120.75-20

GBP/USD: the pair rose to $1.5185

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:15 Switzerland Producer & Import Prices, m/m November 0.2% 0.1%

08:15 Switzerland Producer & Import Prices, y/y November -6.6%

09:30 United Kingdom Retail Price Index, m/m November 0% -0.1%

09:30 United Kingdom Retail prices, Y/Y November 0.7% 0.9%

09:30 United Kingdom Producer Price Index - Input (MoM) November 0.2% -1.1%

09:30 United Kingdom Producer Price Index - Input (YoY) November -12.1% -12.5%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0% -0.1%

09:30 United Kingdom Producer Price Index - Output (YoY) November -1.3% -1.3%

09:30 United Kingdom HICP, m/m November 0.1% -0.1%

09:30 United Kingdom HICP, Y/Y November -0.1% 0.1%

09:30 United Kingdom HICP ex EFAT, Y/Y November 1.1% 1.2%

10:00 Eurozone ZEW Economic Sentiment December 28.3 34.4

10:00 Eurozone Employment Change Quarter III 0.3% 0.2%

10:00 Germany ZEW Survey - Economic Sentiment December 10.4 15

13:30 Canada Manufacturing Shipments (MoM) October -1.5% -0.5%

13:30 U.S. NY Fed Empire State manufacturing index December -10.74 -6

13:30 U.S. CPI, m/m November 0.2% 0%

13:30 U.S. CPI, Y/Y November 0.2% 0.4%

13:30 U.S. CPI excluding food and energy, m/m November 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y November 1.9% 2.0%

15:00 U.S. NAHB Housing Market Index December 62 63

16:45 Canada BOC Gov Stephen Poloz Speaks

21:00 U.S. Net Long-term TIC Flows October 33.6

21:00 U.S. Total Net TIC Flows October -175.1

21:45 New Zealand Current Account Quarter III -1.22 -4.901

23:30 Australia Leading Index November 0.1%

-

01:31

Australia: New Motor Vehicle Sales (MoM) , November 1.0%

-

01:31

Australia: New Motor Vehicle Sales (YoY) , November 6.0%

-

01:30

Australia: House Price Index (QoQ), Quarter III 2.0% (forecast 2%)

-

00:34

Currencies. Daily history for Dec 14’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,0991 +0,03%

GBP/USD $1,5140 -0,55%

USD/CHF Chf0,9847 +0,12%

USD/JPY Y121,02 +0,13%

EUR/JPY Y133,02 +0,16%

GBP/JPY Y183,23 -0,42%

AUD/USD $0,7242 +0,79%

NZD/USD $0,6756 +0,67%

USD/CAD C$1,3732 -0,06%

-

00:00

Schedule for today, Tuesday, Dec 15’2015:

(time / country / index / period / previous value / forecast)

00:30 Australia New Motor Vehicle Sales (YoY) November 4.2%

00:30 Australia New Motor Vehicle Sales (MoM) November -3.6%

00:30 Australia House Price Index (QoQ) Quarter III 4.7% 2%

00:30 Australia RBA Meeting's Minutes

08:15 Switzerland Producer & Import Prices, m/m November 0.2%

08:15 Switzerland Producer & Import Prices, y/y November -6.6%

09:30 United Kingdom Retail Price Index, m/m November 0% -0.1%

09:30 United Kingdom Retail prices, Y/Y November 0.7% 0.9%

09:30 United Kingdom Producer Price Index - Input (MoM) November 0.2% -1.1%

09:30 United Kingdom Producer Price Index - Input (YoY) November -12.1% -12.5%

09:30 United Kingdom Producer Price Index - Output (MoM) November 0% -0.1%

09:30 United Kingdom Producer Price Index - Output (YoY) November -1.3% -1.3%

09:30 United Kingdom HICP, m/m November 0.1% -0.1%

09:30 United Kingdom HICP, Y/Y November -0.1% 0.1%

09:30 United Kingdom HICP ex EFAT, Y/Y November 1.1% 1.2%

10:00 Eurozone ZEW Economic Sentiment December 28.3

10:00 Eurozone Employment Change Quarter III 0.3%

10:00 Germany ZEW Survey - Economic Sentiment December 10.4 15

13:30 Canada Manufacturing Shipments (MoM) October -1.5% -0.5%

13:30 U.S. NY Fed Empire State manufacturing index December -10.74 -6

13:30 U.S. CPI, m/m November 0.2% 0%

13:30 U.S. CPI, Y/Y November 0.2% 0.5%

13:30 U.S. CPI excluding food and energy, m/m November 0.2% 0.2%

13:30 U.S. CPI excluding food and energy, Y/Y November 1.9% 2.0%

15:00 U.S. NAHB Housing Market Index December 62 63

16:45 Canada BOC Gov Stephen Poloz Speaks

21:00 U.S. Net Long-term TIC Flows October 33.6

21:00 U.S. Total Net TIC Flows October -175.1

21:45 New Zealand Current Account Quarter III -1.22 -4.901

23:30 Australia Leading Index November 0.1%

-