Noticias del mercado

-

21:00

Dow +1.18% 17,573.18 +204.68 Nasdaq +1.23% 5,013.08 +60.85 S&P +1.36% 2,049.39 +27.45

-

18:26

Wall Street. Major U.S. stock-indexes rose

Major U.S. in positive area on Tuesday as energy stocks rose in tandem with recovering oil prices, and a day before a widely expected interest-rate hike by the Federal Reserve in nearly a decade. Nine of the 10 major S&P sectors were higher, with the energy sector's 2.2 percent rise leading the advancers.

Most of Dow stocks in positive area (25 of 30). Top looser - 3M Company (MMM, -4.94%). Top gainer - Exxon Mobil Corporation (XOM, +4.06%).

Almost all S&P index sectors also in positive area. Top looser - Conglomerates (-0.6%). Top gainer - Basic Materials (+2,0%).

At the moment:

Dow 17482.00 +228.00 +1.32%

S&P 500 2036.75 +27.25 +1.36%

Nasdaq 100 4611.75 +51.25 +1.12%

Oil 37.44 +1.13 +3.11%

Gold 1061.00 -2.40 -0.23%

U.S. 10yr 2.26 +0.04

-

18:17

WSE: Session Results

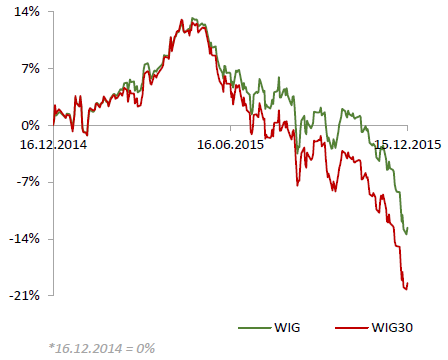

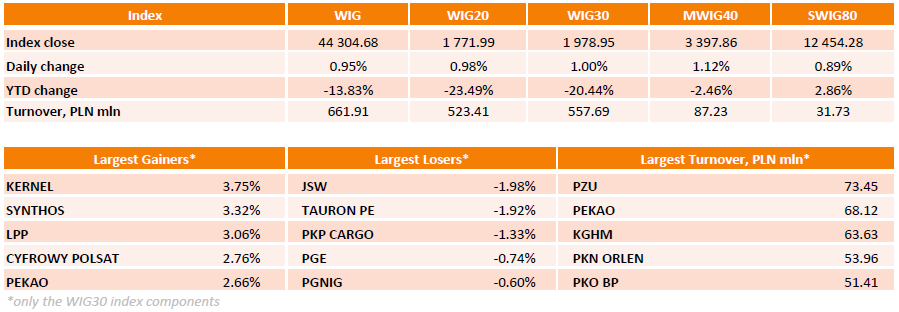

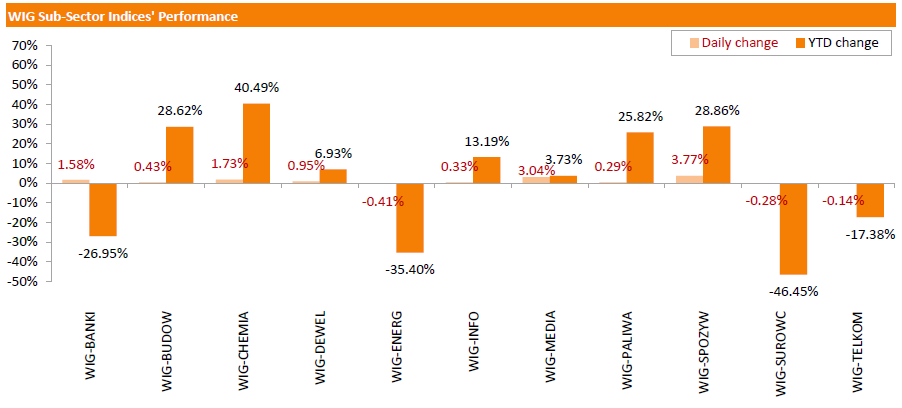

Polish equity market closed higher Tuesday. The broad market measure, the WIG Index, added 0.95%. Sector performance within the WIG Index was mixed. Food sector (+3.77%) was the strongest group, while utilities (-0.41%) lagged behind.

Large-cap stocks' measure, the WIG30 index, advanced 1%. Within the indicator's components, agricultural holding KERNEL (WSE: KER), chemical producer SYNTHOS (WSE: SNS) and clothing retailer LPP (WSE: LPP) were the biggest gainers, adding 3.75%, 3.32 and 3.06% respectively. On the contrary, coking coal miner JSW (WSE: JSW) and genco TAURON PE (WSE: TPE) led the decliners, slumping by 1.98% and 1.92% respectively. They were followed by railway freight transport operator PKP CARGO (WSE: PKP), losing 1.33%.

-

18:00

European stocks close: stocks closed higher as oil prices rebounded

Stock indices closed higher as oil prices rebounded.

Market participants are awaiting the release of the Fed's monetary policy meeting results on Wednesday. Analysts expect the Fed to raise its interest rate.

Meanwhile, the economic data from Eurozone was positive. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 16.1 in December from 10.4 in November, exceeding expectations for a rise to 15.0.

"While the large influx of refugees is above all a major challenge facing policy-makers and civil society in Germany, the economic slowdown in emerging markets is exerting pressure on the German export industry. Overall, however, confidence is growing that the German economy is sufficiently robust to meet these challenges in the coming year," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 33.9 in December from 28.3 in November, missing expectations for a rise to 34.4.

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the third quarter, exceeding expectations for a 0.2% gain, after a 0.4% rise in the second quarter. The second quarter's figure was revised up from a 0.3% gain.

Main contributors were Estonia (+2.1%), Ireland, Spain, Luxembourg and the United Kingdom (all +0.6%).

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% year-on-year in November from -0.1% in October, in line with expectations.

The rise was driven by a smaller drop in petrol and diesel prices.

On a monthly basis, U.K. consumer prices were flat in November, beating expectations for a 0.1% decline, after a 0.1% increase in October.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% year-on-year in November from 1.1% in October, in line with expectations.

The Retail Prices Index climbed to 1.1% year-on-year in November from 0.7% in October, exceeding expectations for an increase to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,017.79 +143.73 +2.45 %

DAX 10,450.38 +311.04 +3.07 %

CAC 40 4,614.4 +141.33 +3.16 %

-

17:25

Bank of England’s quarterly bulletin: households are better prepared for an interest rate hike than a year ago

The Bank of England (BOE) released its quarterly bulletin on Tuesday. The central bank said that households are better prepared for an interest rate hike than a year ago.

"Households appear a little better placed to cope with a rise in interest rates than a year ago and survey responses do not imply that a rise in rates would have an unusually large impact on spending," the central bank said.

"The Government's plans for fiscal consolidation are likely to continue to weigh on household spending," the BoE added.

-

17:09

New Zealand’s Treasury Ministry downgrades its growth forecasts

New Zealand's Treasury Ministry released its Half Year Economic and Fiscal Update on Tuesday. New Zealand's economy is expected to grow at 2.1% in 2015-16, down from the previous estimate of 3.1% rise, and 2.4% in 2016-17, down from the previous estimate of 2.8% increase.

Inflation is expected to be 1.4 in 2015-16 and 2.1% in 2016-17.

-

17:01

Australian house price index rises 2.0% in the third quarter

The Australian Bureau of Statistics released its house price index on Tuesday. The Australian house price index rose 2.0% in the third quarter, in line with expectations, after a 4.7% gain in the second quarter.

Main contributors were Melbourne (+2.9%), Brisbane (+1.3%), Adelaide (+1.2%), and Canberra (+1.3%).

On a yearly basis, house prices climbed 10.7% in the third quarter, after a 9.8% rise in the second quarter.

The total value of residential dwellings in Australia rose by A$137.1 billion to A$5.9 trillion in the third quarter.

-

16:40

U.S. weekly earnings fall 0.2% in November

The U.S. Labor Department released its real earnings data on Tuesday. Average weekly earnings fell 0.2% in November, after a 0.4% increase in October.

The increase was driven by rises in in average hourly earnings.

Average hourly earnings climbed 0.1% in November, after a 0.2% rise in October.

On a yearly basis, real average weekly earnings increased 1.6% in November, while hourly earnings rose 1.8%.

-

16:11

NAHB housing market index declines to 61 in December

The National Association of Home Builders (NAHB) released its housing market index for the U.S. on Tuesday. The NAHB housing market index fell to 61 in December from 62 in November, missing expectations for an increase to 63.

A level above 50.0 is considered positive, below indicates a negative outlook.

The fall was driven by a decline in all three components of the index. The buyer traffic sub-index decreased to 46 in December from 48 in November, the current sales conditions sub-index fell to 66 from 67, while the sub-index measuring sales expectations in the next six months dropped to 67 from 69.

"Overall, builders are optimistic about the housing market, although they are reporting concerns with the high price of lots and labour," the NAHB Chairman Tom Woods said.

"With job creation, economic growth and growing household formations, we anticipate the housing market to continue to pick up traction as we head into 2016," the NAHB Chief Economist David Crowe said.

-

15:51

U.K. leading economic index falls 0.1% in October

The Conference Board (CB) released its leading economic index for the U.K. on Tuesday. The leading economic index (LEI) decreased 0.1% in October, after a 0.4% fall in September.

The coincident index was up 0.1% in October, after a 0.3% gain in September.

"The recent deceleration in the growth of the LEI suggests that the economic expansion is likely to moderate in early 2016," the CB said.

-

15:36

U.S. Stocks open: Dow +0.93%, Nasdaq +0.89%, S&P +1.06%

-

15:29

Before the bell: S&P futures +1.09%, NASDAQ futures +1.00%

U.S. stock-index futures rose.

Global Stocks:

Nikkei 18,565.9 -317.52 -1.68%

Hang Seng 21,274.37 -35.48 -0.17%

Shanghai Composite 3,510.9 -9.76 -0.28%

FTSE 5,974.75 +100.69 +1.71%

CAC 4,573.07 +100.00 +2.24%

DAX 10,395.86 +256.52 +2.53%

Crude oil $36.55 (+0.66%)

Gold $1061.60 (-0.17%)

-

15:03

U.S. consumer price inflation is flat in November

The U.S. Labor Department released consumer price inflation data on Tuesday. The U.S. consumer price inflation was flat in November, in line with expectations, after a 0.2% rise in October.

Shelter costs climbed 0.2% in November, while medical care costs rose 0.4%.

Gasoline prices fell 2.4% in November, while food prices decreased 0.1%.

On a yearly basis, the U.S. consumer price index increased to 0.5% in November from 0.2% in October, beating expectations for a rise to 0.4%.

The inflation remains low due to low oil prices.

The U.S. consumer price inflation excluding food and energy gained 0.2% in November, in line with expectations, after a 0.2% increase in October.

On a yearly basis, the U.S. consumer price index excluding food and energy increased to 2.0% in November from 1.9% in October, in line with expectations.

The increase of the consumer price index excluding food and energy was driven by higher prices of rents, airline fares, new motor vehicles and medical care.

The consumer price index is not preferred Fed's inflation measure.

-

14:57

Wall Street. Stocks before the bell

(company / ticker / price / change, % / volume)

AMERICAN INTERNATIONAL GROUP

AIG

59.84

2.43%

2.7K

Walt Disney Co

DIS

111.33

1.81%

11.1K

Boeing Co

BA

145.30

1.61%

3.7K

Visa

V

78.10

1.60%

9.2K

ALCOA INC.

AA

9.13

1.44%

39.8K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

6.55

1.39%

93.7K

Barrick Gold Corporation, NYSE

ABX

7.14

1.28%

27.9K

Citigroup Inc., NYSE

C

51.70

1.17%

14.6K

Tesla Motors, Inc., NASDAQ

TSLA

220.90

1.06%

12.7K

Chevron Corp

CVX

90.24

1.02%

8.9K

Amazon.com Inc., NASDAQ

AMZN

664.50

1.00%

13.0K

Nike

NKE

129.00

0.89%

0.2K

JPMorgan Chase and Co

JPM

64.83

0.87%

0.9K

Microsoft Corp

MSFT

55.62

0.87%

42.6K

Goldman Sachs

GS

177.90

0.85%

1.6K

American Express Co

AXP

69.41

0.84%

0.7K

Pfizer Inc

PFE

32.44

0.81%

15.2K

Cisco Systems Inc

CSCO

26.67

0.68%

24.6K

Procter & Gamble Co

PG

78.80

0.65%

0.3K

Exxon Mobil Corp

XOM

76.50

0.62%

3.7K

Google Inc.

GOOG

752.40

0.62%

1.8K

Home Depot Inc

HD

132.81

0.61%

1.1K

Ford Motor Co.

F

13.70

0.59%

5.6K

Starbucks Corporation, NASDAQ

SBUX

60.27

0.58%

0.2K

UnitedHealth Group Inc

UNH

116.50

0.56%

0.8K

Facebook, Inc.

FB

105.24

0.55%

16.0K

Intel Corp

INTC

34.64

0.49%

10.2K

Wal-Mart Stores Inc

WMT

60.64

0.41%

2.2K

Yandex N.V., NASDAQ

YNDX

14.52

0.41%

1.1K

AT&T Inc

T

33.73

0.39%

31.5K

The Coca-Cola Co

KO

42.61

0.38%

3.4K

ALTRIA GROUP INC.

MO

57.70

0.31%

21.6K

Yahoo! Inc., NASDAQ

YHOO

32.68

0.28%

0.7K

General Electric Co

GE

30.31

0.17%

14.2K

E. I. du Pont de Nemours and Co

DD

68.00

0.12%

31.4K

HONEYWELL INTERNATIONAL INC.

HON

98.98

0.00%

1.3K

United Technologies Corp

UTX

93.00

-0.03%

1.2K

International Business Machines Co...

IBM

135.85

-0.06%

0.2K

Verizon Communications Inc

VZ

45.40

-0.12%

8.3K

Apple Inc.

AAPL

111.36

-1.00%

546.3K

Caterpillar Inc

CAT

65.31

-1.23%

3.4K

Twitter, Inc., NYSE

TWTR

24.60

-1.28%

133.6K

3M Co

MMM

150.00

-4.84%

17.5K

-

14:53

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Dow Chemical (DOW) downgraded to Neutral from Buy at UBS

Other:

Chevron (CVX) target raised to $122 from $95 at Cowen

-

14:48

NY Fed Empire State manufacturing index rises to -4.59 in December

The New York Federal Reserve released its survey on Tuesday. The NY Fed Empire State manufacturing index rose to -4.59 in December from -10.74 in November, exceeding expectations for an increase to -6.00.

A reading above zero indicates expansion, while a reading below zero indicates contraction.

"The December 2015 Empire State Manufacturing Survey indicates that business activity declined for a fifth consecutive month for New York manufacturers. However, the pace of decline slowed somewhat," the New York Federal Reserve said in its report.

The new orders index increased to -5.07 in December from-11.82 in November, while the shipments index climbed to 5.51 from -4.10.

The general business conditions expectations index for the next six months increased to 38.51 in December from 20.33 in November.

The price-paid index decreased to 4.04 in December from 4.55 in November.

The index for the number of employees dropped to -16.16 in December from -7.27 in November.

-

14:38

Canadian manufacturing shipments drop 1.1% in October

Statistics Canada released manufacturing shipments on Tuesday. Canadian manufacturing shipments fell 1.1% in October, missing expectations for a 0.5% decrease, after a 1.5% decline in September.

The decline was driven by falls in the petroleum and coal product, aerospace product and parts, and machinery industries.

Sales of petroleum and coal products dropped 5.7% in October, aerospace product and parts sales slid 10.3%, while sales in in the machinery industry declined 4.6%.

Inventories increased 0.5% in October.

-

14:25

UK house price inflation rises 0.8% in October

The Office for National Statistics (ONS) released its house inflation data for the U.K. on Tuesday. The U.K. house price index rose at a seasonally adjusted rate of 0.8% in October, after a 0.8% increase in September.

On a yearly basis, the U.K. house price index increased at a seasonally adjusted rate of 7.0% in October, after a 6.1% in September. It was the highest rise since March.

The higher house price inflation was mainly driven by an increase in prices in the East and the South East.

The average mix-adjusted house price was £287,000 in October, up from £286,000 in September.

-

13:20

Final consumer price inflation in Spain rises 0.4% in November

The Spanish statistical office INE released its final consumer price inflation data on Tuesday. Consumer price inflation in Spain was up 0.4% in November, up from the preliminary reading of a 0.3% rise, after a 0.6% increase in October.

On a yearly basis, consumer prices fell by 0.3% in November from a year ago, in line with preliminary reading, after a 0.7% decline in October.

The annual decline was mainly driven by a drop in the prices of housing and transport.

-

12:59

European stock markets mid session: stocks traded higher as oil prices rebounded

Stock indices traded higher as oil prices rebounded.

Market participants are awaiting the release of the Fed's monetary policy meeting results on Wednesday. Analysts expect the Fed to raise its interest rate.

Meanwhile, the economic data from Eurozone was positive. The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 16.1 in December from 10.4 in November, exceeding expectations for a rise to 15.0.

"While the large influx of refugees is above all a major challenge facing policy-makers and civil society in Germany, the economic slowdown in emerging markets is exerting pressure on the German export industry. Overall, however, confidence is growing that the German economy is sufficiently robust to meet these challenges in the coming year," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 33.9 in December from 28.3 in November, missing expectations for a rise to 34.4.

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the third quarter, exceeding expectations for a 0.2% gain, after a 0.4% rise in the second quarter. The second quarter's figure was revised up from a 0.3% gain.

Main contributors were Estonia (+2.1%), Ireland, Spain, Luxembourg and the United Kingdom (all +0.6%).

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% year-on-year in November from -0.1% in October, in line with expectations.

The rise was driven by a smaller drop in petrol and diesel prices.

On a monthly basis, U.K. consumer prices were flat in November, beating expectations for a 0.1% decline, after a 0.1% increase in October.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% year-on-year in November from 1.1% in October, in line with expectations.

The Retail Prices Index climbed to 1.1% year-on-year in November from 0.7% in October, exceeding expectations for an increase to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

Current figures:

Name Price Change Change %

FTSE 100 5,974.01 +99.95 +1.70 %

DAX 10,358.23 +218.89 +2.16 %

CAC 40 4,577.93 +104.86 +2.34 %

-

12:53

Eurozone's employment increases by 0.3% in the third quarter

Eurostat released its employment growth data for the Eurozone on Tuesday. Eurozone's employment increased by 0.3% in the third quarter, exceeding expectations for a 0.2% gain, after a 0.4% rise in the second quarter. The second quarter's figure was revised up from a 0.3% gain.

Main contributors were Estonia (+2.1%), Ireland, Spain, Luxembourg and the United Kingdom (all +0.6%).

On a yearly basis, employment in the Eurozone increased by 1.1% in the third quarter, after a 1.0% gain in the second quarter. The second quarter's figure was revised up from a 0.8% rise.

-

12:48

UK consumer price inflation rises rose to 0.1% year-on-year in November

The Office for National Statistics (ONS) released the consumer price inflation data for the U.K. on Tuesday. The U.K. consumer price index rose to 0.1% year-on-year in November from -0.1% in October, in line with expectations.

The rise was driven by a smaller drop in petrol and diesel prices.

On a monthly basis, U.K. consumer prices were flat in November, beating expectations for a 0.1% decline, after a 0.1% increase in October.

Consumer price inflation excluding food, energy, alcohol and tobacco prices climbed to 1.2% year-on-year in November from 1.1% in October, in line with expectations.

The Retail Prices Index climbed to 1.1% year-on-year in November from 0.7% in October, exceeding expectations for an increase to 0.9%.

The consumer price inflation is below the Bank of England's 2% target.

-

12:39

Germany's ZEW economic sentiment index rises to 16.1 in December

The ZEW Center for European Economic Research released its economic sentiment index for Germany and the Eurozone on Tuesday. Germany's ZEW economic sentiment index climbed to 16.1 in December from 10.4 in November, exceeding expectations for a rise to 15.0.

The assessment of the current situation in Germany rose by 0.6 points to 55.0 points.

"While the large influx of refugees is above all a major challenge facing policy-makers and civil society in Germany, the economic slowdown in emerging markets is exerting pressure on the German export industry. Overall, however, confidence is growing that the German economy is sufficiently robust to meet these challenges in the coming year," the ZEW President Clemens Fuest.

Eurozone's ZEW economic sentiment index increased to 33.9 in December from 28.3 in November, missing expectations for a rise to 34.4.

The assessment of the current situation in the Eurozone rose by 0.4 points to -9.6 points.

-

12:34

Switzerland's producer and import prices are up 0.4% in November

The Federal Statistical Office released its producer and import prices data on Tuesday. Switzerland's producer and import prices rose 0.4% in November, exceeding expectations for a 0.1% gain, after a 0.2% increase in October.

The increase was mainly driven by higher prices for mineral oil products.

The Import Price Index increased by 0.8% in November, while producer prices climbed 0.3%.

On a yearly basis, producer and import prices plunged 5.5% in November, after a 6.6% drop in October.

The Import Price Index fell by 9.7% year-on year in November, while producer prices dropped 3.6%.

-

10:13

Preliminary real GDP of 20 OECD member countries remains unchanged at 0.7% in the third quarter

The Organization for Economic Cooperation and Development (OECD) released its preliminary real gross domestic product (GDP) growth figures on Monday. Real GDP of 20 OECD member countries remained unchanged at 0.7% in the third quarter.

Real GDP of the United States was down to 0.5% from 1.0%, real GDP of Germany fell to 0.3% from 0.4%, while Britain's economy decreased to 0.5% from 0.7%.

GDP of China remained unchanged at 1.8% in the third quarter.

GDP of France increased to 0.3% from 0.0%, India's economy climbed to 1.9% from 1.7%, while Japan's GDP rose to 0.2% from -0.1%.

Eurozone's economy expanded at 0.3% in the third quarter, after a 0.4% rise in the second quarter.

On a yearly basis, GDP of 20 OECD member countries was up 2.9% in the third quarter, after a 3.1% gain in the previous quarter.

-

09:54

Household debt in Canada rises in the third quarter

Statistics Canada released its household debt data on Monday. The ratio of household credit-market debt to disposable income in Canada increased to 163.7% in the third quarter, up from 162.7% in the second quarter. This data means that average Canadian household has C$1.64 in debt for every Canadian dollar of disposable income.

Credit-market debt climbed 1.4% in the third quarter, while disposable income rose only 0.8%.

The interest-only debt service ratio to disposable income was at a record low 6.1%.

-

09:46

The Australian budget deficit will be higher than previously estimated

The Australian Treasury Ministry released its Mid-Year Economic and Fiscal Outlook on Tuesday. The Australian budget deficit is expected to expand to A$37.4 billion in 2015-16, up from a deficit of A$35.1 billion estimated in May. The rise was driven by a drop in commodity prices, weak wage growth and subdued economic outlook.

The Australian economy is expected to grow at 2.5% in 2015-16, down from a 2.75% rise estimated in May.

-

09:32

December’s Reserve Bank of Australia monetary policy meeting: low interest rates supported growth in household consumption and dwelling investment

The Reserve Bank of Australia (RBA) released its minutes from December monetary policy meeting on Tuesday. The RBA said that low interest rates supported growth in household consumption and dwelling investment, while the exchange rate was adjusting to the significant drop in key commodity prices.

The Australian output growth should strengthen gradually over the next two years, the RBA said.

Members said that there is spare capacity in the economy, including in the labour market.

Members also said that further interest rate cut may be needed.

"Members judged that the outlook for inflation may afford some scope for a further easing of monetary policy should that be appropriate to lend support to demand. The Board would continue to assess the outlook, and hence whether the current stance of policy would most effectively foster sustainable growth and inflation consistent with the target," the minutes said.

The RBA kept unchanged its interest rate at 2.00% in December.

-

09:13

Chinese Xinhua news agency: Chinese leaders said that the country’s economy should expand in a "reasonable range" in 2016

According to the Chinese Xinhua news agency on Monday, Chinese leaders said that the country's economy should expand in a "reasonable range" in 2016, driven by higher domestic demand and supply-side improvements.

"While appropriately expanding aggregate demand, more efforts will be made to improve the quality of efficiency of the supply system," the news agency said.

-

07:00

Global Stocks: U.S. stock indices gained

U.S. stock indices edged up on Monday as oil prices climbed despite global supply glut concerns.

The Dow Jones Industrial Average added 103.29 points, or 0.6%, to 17,368.50. The S&P 500 climbed 9.57 points, or 0.5%, to 2,021.94 (9 out of its 10 sectors closed higher). The Nasdaq Composite rose 18.76 points, or 0.4% to 4,952.23.

Investors are waiting for the FOMC meeting. The two-day policy meeting will start later today. According to FedWatch CME Group traders see an 83% probability of a rate hike, which would bring the range to 0.25%-0.50% from 0%-0.25%. Investors are quite sure that the Fed will raise rates this week, that's why they will focus on comments related to the pace of further increases.

This morning in Asia Hong Kong Hang Seng rose 0.27%, or 57.40, to 21,367.25. China Shanghai Composite Index climbed 0.01%, or 0.20, to 3.520.87. The Nikkei fell 1.52%, or 287.41, to 18,596.01.

Asian indices traded mixed. Investors are waiting for Fed interest rate decision.

Japanese stocks fell amid a stronger yen.

-

03:06

Nikkei 225 18,758.34 -125.08 -0.7 %, Hang Seng 21,329.41 +19.56 +0.1 %, Shanghai Composite 3,519.82 -0.85 0.0%

-

00:34

Stocks. Daily history for Sep Dec 14’2015:

(index / closing price / change items /% change)

Nikkei 225 18,883.42 -347.06 -1.80 %

Hang Seng 21,309.85 -154.20 -0.72 %

Shanghai Composite 3,521.12 +86.54 +2.52 %

FTSE 100 5,874.06 -78.72 -1.32 %

CAC 40 4,473.07 -76.49 -1.68 %

Xetra DAX 10,139.34 -200.72 -1.94 %

S&P 500 2,021.94 +9.57 +0.48 %

NASDAQ Composite 4,952.23 +18.76 +0.38 %

Dow Jones 17,368.5 +103.29 +0.60 %

-