Noticias del mercado

-

18:17

Swiss National Bank President Thomas Jordan: the Swiss franc remains overvalued

The Swiss National Bank President Thomas Jordan said in Brussels on late Tuesday that the Swiss franc remains overvalued. He added that the central bank might intervene in in the foreign exchange market if needed.

-

18:11

Bank of Japan kept its monetary policy unchanged, revised up its view on exports and factory output

The Bank of Japan (BoJ) released its interest rate decision on Wednesday. The BoJ kept its monetary policy unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen.

The BoJ revised up its view on exports and factory output.

The BoJ Governor Haruhiko Kuroda said at the press conference that the central bank is on course to achieve its 2% target by around the middle of next year. He also said that inflation was slowing due to falling energy costs.

The BoJ governor noted that he wishes a stable yen.

Kuroda pointed out that there no need for additional easing.

-

17:32

Foreign exchange market. American session: the U.S. dollar traded mixed against the most major currencies ahead the Fed’s minutes

The U.S. dollar traded mixed against the most major currencies ahead the Fed's minutes. Investors expect signs when the Fed will start to hike its interest rate.

The U.S. producer price index dropped 0.8% in January, missing forecasts of a 0.4% decline, after a 0.2% decrease in December. December's figure was revised up from a 0.3% fall.

That was the biggest decline since November 2009.

The decline was driven by lower energy prices and a stronger U.S. dollar.

The producer price index excluding food and energy fell 0.1% in January, missing forecasts of a 0.2% increase, after a 0.3% gain in December.

The U.S. industrial production increased 0.2% in January, missing expectations for a 0.5% rise, after a 0.3% drop in December. December's figure was revised down from a 0.1% decline

The increase was driven by higher output of utilities. Mining output dropped by 1% in January, while utility output climbed by 2.3%.

Capacity utilisation rate remained unchanged at 79.4% in January. December's figure was revised up from 79.7%.

Housing starts in the U.S. fell 2.0% to 1.065 million annualized rate in January from a 1.087 million pace in December, missing expectations for a decrease to 1.070 million. December's figure was revised down from 1.089 million units.

Building permits in the U.S. decreased 0.7% to 1.053 million annualized rate in January from a 1.06 million pace in December. Analysts had expected the pace to remain unchanged at 1.06 million units.

The euro traded lower against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

The British pound traded higher against the U.S. dollar. The U.K. unemployment rate fell to 5.7% in the October to December quarter from 5.8% in the three months to September. Analysts had expected the unemployment rate to remain unchanged.

That was the lowest level since August 2008.

The claimant count decreased by 38,600 people in January, exceeding expectations for a drop of 25,200 people, after a decrease of 35,800 people in December. December's figure was revised from a decline of 29,700.

Average weekly earnings, excluding bonuses, climbed by 2.1%.

Average weekly earnings, including bonuses, rose by 1.7%.

Wage growth outpaced inflation for the first time since 2009. Inflation was 0.3% last month.

The Bank of England (BoE) released its last meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

The Swiss franc traded lower against the U.S. dollar. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index dropped to -73.0 points in February from -10.8 points in January.

The Canadian dollar traded mixed against the U.S. dollar after the better-than-expected Canadian wholesales data. Wholesale sales jumped 2.5% in December, exceeding expectations for a 0.4% gain, after a 0.3% drop in November. That was the highest increase since January 2011.

The increase was driven by a rise in six of the seven sectors.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded mixed against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie increased against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback after the Bank of Japan's (BoJ) interest decision. The BoJ kept its monetary policy unchanged.

The BoJ Governor Haruhiko Kuroda said at the press conference that the central bank is on course to achieve its 2% target by around the middle of next year. He noted that he wishes a stable yen.

Kuroda pointed out that there no need for additional easing.

-

16:57

Canada’s wholesale sales jumped 2.5% in December

Statistics Canada released wholesale sales figures on Wednesday. Wholesale sales jumped 2.5% in December, exceeding expectations for a 0.4% gain, after a 0.3% drop in November. That was the highest increase since January 2011.

The increase was driven by a rise in six of the seven sectors. Sales of automobiles climbed 9.0% in December.

-

16:23

U.S. industrial production rises 0.2% in January

The Federal Reserve released its industrial production report on Wednesday. The U.S. industrial production increased 0.2% in January, missing expectations for a 0.5% rise, after a 0.3% drop in December. December's figure was revised down from a 0.1% decline

The increase was driven by higher output of utilities. Mining output dropped by 1% in January, while utility output climbed by 2.3%.

Capacity utilisation rate remained unchanged at 79.4% in January. December's figure was revised up from 79.7%.

Analysts had expected a capacity utilisation rate of 79.9%.

-

15:57

U.S. producer price index plunges by 0.8% in January

The U.S. Commerce Department released the producer price index figures on Wednesday. The U.S. producer price index dropped 0.8% in January, missing forecasts of a 0.4% decline, after a 0.2% decrease in December. December's figure was revised up from a 0.3% fall.

That was the biggest decline since November 2009.

On a yearly basis, the producer price index was flat in January, after a 1.1% rise in December.

The decline was driven by lower energy prices and a stronger U.S. dollar. Wholesale energy prices dropped 10.3% in January, while food prices fell 1.1%, the largest decrease since April 2013.

The producer price index excluding food and energy fell 0.1% in January, missing forecasts of a 0.2% increase, after a 0.3% gain in December.

On a yearly basis, the producer price index excluding food and energy climbed 1.6% in January, after a 2.1% rise in December.

-

15:25

U.S. housing market data was weaker than expected in January

The U.S. Commerce Department released the housing market data on Wednesday. Housing starts in the U.S. fell 2.0% to 1.065 million annualized rate in January from a 1.087 million pace in December, missing expectations for a decrease to 1.070 million. December's figure was revised down from 1.089 million units.

Building permits in the U.S. decreased 0.7% to 1.053 million annualized rate in January from a 1.06 million pace in December. Analysts had expected the pace to remain unchanged at 1.06 million units.

Starts of single-family homes dropped 6.7% to 678,000 units in January. Building permits for single-family homes declined 3.1%.

Starts of multifamily buildings rose 7.5% to 360,000 units in January. Permits for multi-family housing increased 3.6%.

-

15:15

U.S.: Capacity Utilization, January 79.4% (forecast 79.9%)

-

15:15

U.S.: Industrial Production (MoM), January +0.2% (forecast +0.5%)

-

14:55

Bank of England's Monetary Policy Committee minutes: all members voted to keep the central bank's monetary policy unchanged

The Bank of England's Monetary Policy Committee (MPC) released its latest minutes on Wednesday. All members voted to keep the central bank's monetary policy unchanged.

Two members of the nine MPC said that "there could well be a case for an increase in Bank Rate later in the year". These members were not named.

One member said that "the next change in the stance of monetary policy was roughly as likely to be a loosening as a tightening".

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 117.90-118.00 (USD 1.9bln) 118.50 (USD 1.4bln) 119.00 (USD 828m) 119.50 (USD 2.2bln)

EURUSD 1.1300 (EUR 2bln 1.1350 (EUR 500m) 1.1400 (EUR 1.95bln) 1.1430 ( EUR 471m)

GBPUSD 1.5350 (GBP 200m)

USDCHF 0.9385 (USD 200m) 0.9500 (USD 463m)

AUDUSD 0.7715 (AUD 557m) 0.7815 (AUD 240m)

AUDJPY 91.15 (AUD 350m)

EURJPY 135.25 (EUR 200m) 136.40 (EUR 412m)

EURGBP 0.7500 (EUR 412m)

-

14:32

U.S.: PPI, y/y, January 0.0%

-

14:32

U.S.: PPI excluding food and energy, Y/Y, January +1.6%

-

14:31

U.S.: PPI excluding food and energy, m/m, January -0.1% (forecast +0.2%)

-

14:31

U.S.: Building Permits, mln, January 1053 (forecast 1060)

-

14:31

U.S.: Housing Starts, mln, January 1065 (forecast 1070)

-

14:30

Canada: Wholesale Sales, m/m, December +2.5% (forecast +0.4%)

-

14:30

U.S.: PPI, m/m, January -0.8% (forecast -0.4%)

-

14:01

Foreign exchange market. European session: the British pound rose against the U.S. dollar after the better-than-expected labour market data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:30 United Kingdom Average Earnings, 3m/y December +1.8% Revised From +1.7% +1.7% +2.1%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December +1.8% +1.7%

09:30 United Kingdom Bank of England Minutes

09:30 United Kingdom Claimant count January -35.8 Revised From -29.7 -25.2 -38.6

09:30 United Kingdom Claimant Count Rate January 2.6% 2.5%

09:30 United Kingdom ILO Unemployment Rate December 5.8% 5.8% 5.7%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -10.8 -73.0

The U.S. dollar traded mixed against the most major currencies ahead the U.S. economic data. Housing starts in the U.S. are expected to decline to 1.070 million units in January from 1.089 million units in December.

The number of building permits is expected to remain unchanged at 1.060 million units in January.

The U.S. PPI is expected to decline 0.4% in January, after a 0.3% decrease in December.

The U.S. industrial production is expected to rise 0.5% in January, after a 0.1% fall in December.

The Fed will release minutes of its last meeting. Investors expect signs when the Fed will start to hike its interest rate.

The euro fell against the U.S. dollar in the absence of any major economic reports from the Eurozone.

Investors remained cautious due to new debt deal talks between the European Union and Greece.

The British pound rose against the U.S. dollar after the better-than-expected labour market data from the U.K. The U.K. unemployment rate fell to 5.7% in the October to December quarter from 5.8% in the three months to September. Analysts had expected the unemployment rate to remain unchanged.

That was the lowest level since August 2008.

The claimant count decreased by 38,600 people in January, exceeding expectations for a drop of 25,200 people, after a decrease of 35,800 people in December. December's figure was revised from a decline of 29,700.

Average weekly earnings, excluding bonuses, climbed by 2.1%.

Average weekly earnings, including bonuses, rose by 1.7%.

Wage growth outpaced inflation for the first time since 2009. Inflation was 0.3% last month.

The Bank of England (BoE) released its last meeting minutes. All members voted to keep the central bank's monetary policy unchanged.

The Swiss franc traded lower against the U.S. dollar after the weak survey by the ZEW Institute and Credit Suisse Group. A survey by the ZEW Institute and Credit Suisse Group showed today that Switzerland's economic sentiment index dropped to -73.0 points in February from -10.8 points in January.

The Canadian dollar traded lower against the U.S. dollar ahead of Canadian wholesales data. Wholesale sales in Canada are expected to climb 0.4% in December, after a 0.3% drop in November.

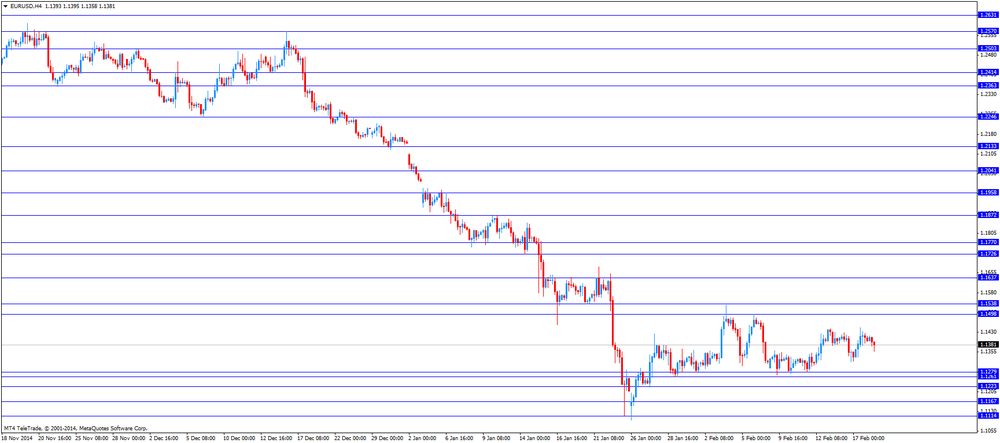

EUR/USD: the currency pair declined to 1.1377

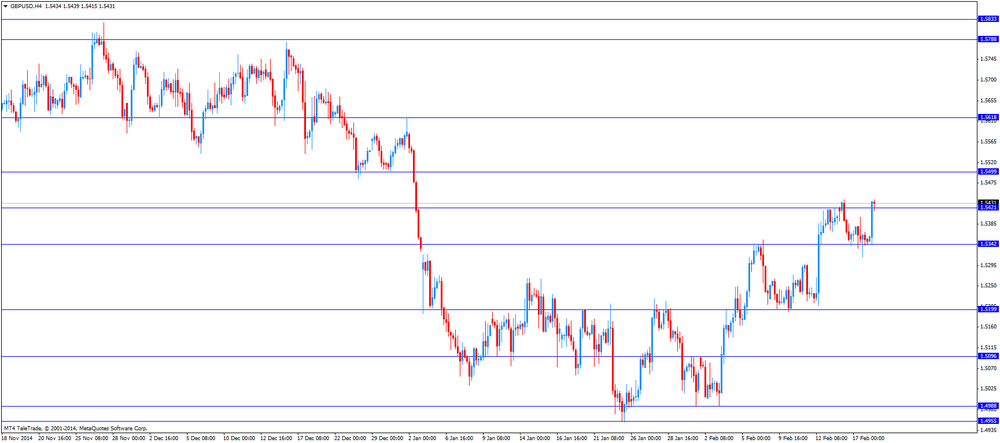

GBP/USD: the currency pair rose to $1.5439

USD/JPY: the currency pair climbed to Y119.41

The most important news that are expected (GMT0):

13:30 Canada Wholesale Sales, m/m December -0.3% +0.4%

13:30 U.S. Building Permits, mln January 1060 Revised From 1032 1060

13:30 U.S. Housing Starts, mln January 1089 1070

13:30 U.S. PPI, m/m January -0.3% -0.4%

13:30 U.S. PPI, y/y January +1.1%

13:30 U.S. PPI excluding food and energy, m/m January +0.3% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y January +2.1%

14:15 U.S. Industrial Production (MoM) January -0.1% +0.5%

14:15 U.S. Capacity Utilization January 79.7% 79.9%

19:00 U.S. FOMC meeting minutes

21:45 New Zealand PPI Input (QoQ) Quarter IV -1.5% -0.2%

21:45 New Zealand PPI Output (QoQ) Quarter IV -1.1% -0.3%

22:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Adjusted Merchandise Trade Balance, bln January -712.1 -600.0

-

14:00

Orders

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1350 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5465 1.5480 1.5500

Bids 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.20 136.50 136.80 137.00

Bids 135.15 134.95-00 133.90 133.60 133.00 132.50-55

USD/JPY

Offers 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7370-75 0.7350 0.7325 0.7300

AUD/USD

Offers 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:31

UK unemployment rate declines to 5.7% in the October to December quarter

The Office for National Statistics released the labour market data on Wednesday. The U.K. unemployment rate fell to 5.7% in the October to December quarter from 5.8% in the three months to September. Analysts had expected the unemployment rate to remain unchanged.

That was the lowest level since August 2008.

The claimant count decreased by 38,600 people in January, exceeding expectations for a drop of 25,200 people, after a decrease of 35,800 people in December. December's figure was revised from a decline of 29,700.

The employment rate rose to 73.2% in the October to December quarter from 73% in the three months to September, the highest rate since the three months to February 2005.

Average weekly earnings, excluding bonuses, climbed by 2.1%.

Average weekly earnings, including bonuses, rose by 1.7%.

Wage growth outpaced inflation for the first time since 2009. Inflation was 0.3% last month.

-

11:29

Option expiries for today's 10:00 ET NY cut

USDJPY 117.90-118.00 (USD 1.9bln) 118.50 (USD 1.4bln) 119.00 (USD 828m) 119.50 (USD 2.2bln)

EURUSD 1.1300 (EUR 2bln 1.1350 (EUR 500m) 1.1400 (EUR 1.95bln) 1.1430 ( EUR 471m)

GBPUSD 1.5350 (GBP 200m)

USDCHF 0.9385 (USD 200m) 0.9500 (USD 463m)

AUDUSD 0.7715 (AUD 557m) 0.7815 (AUD 240m)

AUDJPY 91.15 (AUD 350m)

EURJPY 135.25 (EUR 200m) 136.40 (EUR 412m)

EURGBP 0.7500 (EUR 412m)

-

11:02

Switzerland: Credit Suisse ZEW Survey (Expectations), February -73.0

-

10:31

United Kingdom: Average earnings ex bonuses, 3 m/y, December +1.7%

-

10:30

United Kingdom: Claimant count , January -38.6 (forecast -25.2)

-

10:30

United Kingdom: ILO Unemployment Rate, December 5.7% (forecast 5.8%)

-

10:30

United Kingdom: Average Earnings, 3m/y , December +2.1% (forecast +1.7%)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded moderately higher against most major peers

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

The U.S. dollar traded moderately higher trimming early losses against the most major currencies after yesterday's weaker-than-expected U.S. economic data. The NAHB housing market index declined to 55 in February from 57 in January. Analysts had expected the index to rise at 58. The NY Fed Empire State manufacturing index declined to 7.78 in February from 9.95 in January, missing expectations for a fall to 9.1. Today market participants await a set of important U.S. data including Building Permits, Housing Starts, the PPI, Industrial Production and the minutes of the last Federal Open Market Committee meeting.

The Australian dollar traded almost flat on Wednesday after the minutes of the RBA meeting were published yesterday. The bank named a lower growth and inflation outlook and Chinese demand for commodities as reasons for this month's decision to lower interest rates after a 17-month pause to support demand and to achieve balanced growth. On late Tuesday data on the Conference Board Australia Leading Index came in for the month of December with an upbeat reading of +0.4% compared to +0.1% in the previous month. Australia's Leading Index climbed +0.1% in January.

Chinese markets are closed today for the Lunar New Year holiday.

New Zealand's dollar halted its advance after adding gains for four days against the greenback and declined moderately. Late in the day data on New Zealand's PPI In- and Output for the fourth quarter are due at 21:45 GTM.

The Japanese yen traded moderately stronger against the greenback on Wednesday after the Bank of Japan held its unprecedented monetary policy steady after an 8 to 1 vote. Interest rates were not changed and remain at 0.10% and the Monetary Base Target was left at 275. The outlook for exports and factory output was upgraded and consumption remains firm according to BOJ Governor Kuroda. Inflation is slowing due to falling energy costs. He stated that the BoJ won't hesitate to achieve the price target and change policy if necessary.

Asia's second largest economy exited recession in the final quarter of last year according to data published over the weekend

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar traded lower against the yen

GPB/USD: Sterling traded lower against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:30 United Kingdom Average Earnings, 3m/y December +1.7% +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December +1.8%

09:30 United Kingdom Bank of England Minutes

09:30 United Kingdom Claimant count January -29.7 -25.2

09:30 United Kingdom Claimant Count Rate January 2.6%

09:30 United Kingdom ILO Unemployment Rate December 5.8% 5.8%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -10.8

13:30 Canada Wholesale Sales, m/m December -0.3% +0.4%

13:30 U.S. Building Permits, mln January 1060 Revised From 1032 1060

13:30 U.S. Housing Starts, mln January 1089 1070

13:30 U.S. PPI, m/m January -0.3% -0.4%

13:30 U.S. PPI, y/y January +1.1%

13:30 U.S. PPI excluding food and energy, m/m January +0.3% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y January +2.1%

14:15 U.S. Industrial Production (MoM) January -0.1% +0.5%

14:15 U.S. Capacity Utilization January 79.7% 79.9%

19:00 U.S. FOMC meeting minutes

21:30 U.S. API Crude Oil Inventories February +1.6

21:45 New Zealand PPI Input (QoQ) Quarter IV -1.5% -0.2%

21:45 New Zealand PPI Output (QoQ) Quarter IV -1.1% -0.3%

22:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Adjusted Merchandise Trade Balance, bln January -712.1 -600.0

-

07:26

Options levels on wednesday, February 18, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1579 (5294)

$1.1508 (1579)

$1.1447 (429)

Price at time of writing this review: $1.1407

Support levels (open interest**, contracts):

$1.1338 (3701)

$1.1289 (4146)

$1.1226 (3992)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 103414 contracts, with the maximum number of contracts with strike price $1,1500 (5294);

- Overall open interest on the PUT options with the expiration date March, 6 is 107182 contracts, with the maximum number of contracts with strike price $1,1200 (5529);

- The ratio of PUT/CALL was 1.04 versus 1.03 from the previous trading day according to data from February, 17

GBP/USD

Resistance levels (open interest**, contracts)

$1.5603 (2078)

$1.5506 (2883)

$1.5410 (2124)

Price at time of writing this review: $1.5354

Support levels (open interest**, contracts):

$1.5291 (1728)

$1.5194 (2076)

$1.5097 (1796)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28263 contracts, with the maximum number of contracts with strike price $1,5500 (2883);

- Overall open interest on the PUT options with the expiration date March, 6 is 33373 contracts, with the maximum number of contracts with strike price $1,5200 (2076);

- The ratio of PUT/CALL was 1.18 versus 1.22 from the previous trading day according to data from February, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

07:16

-

04:04

Japan: BoJ Interest Rate Decision, 0.10% (forecast 0.10%)

-

04:03

Japan: Bank of Japan Monetary Base Target, 275

-

01:00

Currencies. Daily history for Feb 17’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1410 +0,49%

GBP/USD $1,5351 -0,08%

USD/CHF Chf0,9367 +0,54%

USD/JPY Y119,24 +0,65%

EUR/JPY Y136,05 +1,13%

GBP/JPY Y183,02 +0,56%

AUD/USD $0,7817 +0,59%

NZD/USD $0,7538 +0,50%

USD/CAD C$1,2387 -0,63%

-

00:30

Australia: Leading Index, January 0.1%

-

00:00

Australia: Conference Board Australia Leading Index, December +0.4%

-

00:00

Schedule for today, Wednesday, Feb 18’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

03:00 Japan BoJ Interest Rate Decision 0.10% 0.10%

03:00 Japan Bank of Japan Monetary Base Target 275

03:00 Japan BoJ Monetary Policy Statement

06:30 Japan BOJ Press Conference

09:30 United Kingdom Average Earnings, 3m/y December +1.7% +1.7%

09:30 United Kingdom Average earnings ex bonuses, 3 m/y December +1.8%

09:30 United Kingdom Bank of England Minutes

09:30 United Kingdom Claimant count January -29.7 -25.2

09:30 United Kingdom Claimant Count Rate January 2.6%

09:30 United Kingdom ILO Unemployment Rate December 5.8% 5.8%

10:00 Switzerland Credit Suisse ZEW Survey (Expectations) February -10.8

13:30 Canada Wholesale Sales, m/m December -0.3% +0.4%

13:30 U.S. Building Permits, mln January 1060 Revised From 1032 1060

13:30 U.S. Housing Starts, mln January 1089 1070

13:30 U.S. PPI, m/m January -0.3% -0.4%

13:30 U.S. PPI, y/y January +1.1%

13:30 U.S. PPI excluding food and energy, m/m January +0.3% +0.2%

13:30 U.S. PPI excluding food and energy, Y/Y January +2.1%

14:15 U.S. Industrial Production (MoM) January -0.1% +0.5%

14:15 U.S. Capacity Utilization January 79.7% 79.9%

19:00 U.S. FOMC meeting minutes

21:30 U.S. API Crude Oil Inventories February +1.6

21:45 New Zealand PPI Input (QoQ) Quarter IV -1.5% -0.2%

21:45 New Zealand PPI Output (QoQ) Quarter IV -1.1% -0.3%

22:00 U.S. FOMC Member Jerome Powell Speaks

23:50 Japan Adjusted Merchandise Trade Balance, bln January -712.1 -600.0

-