Noticias del mercado

-

18:34

Bank of Japan expects the country’s inflation of about 0.5%

The Bank of Japan (BoJ) released its monthly economic report on Thursday. The BoJ said that Japan's economy has continued to recover moderately.

The BoJ noted that recovery in private consumption remained sluggish and private consumption as a whole has remained resilient.

The central bank also said that exports and production have been picking up.

The BoJ downgraded its view on inflation. It said consumer price inflation rose at an annual pace of about 0.5%. In the previous statement, the central bank said that inflation in Japan was in the range of 0.5% to 1%.

-

18:17

FOMC’s January minutes: the Fed expresses concerns over hiking its interest rates too soon

The Fed released minutes of its January 27-28 meeting on Wednesday. The Fed expressed concern that hiking interest rates too soon could have a negative impact on the U.S. economic recovery.

The Fed's minutes said that "many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time".

The Fed policymakers are worried about falling inflation expectations in the U.S.

The Fed policymakers indicated that the Fed is likely to hike its interest rate in June.

The Fed noted that it would take "financial and international developments" into account.

-

17:34

Foreign exchange market. American session: the U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data

The U.S. dollar traded lower against the most major currencies after the mixed U.S. economic data. The index declined to 5.2 in February from 6. 3 in January, missing expectations for a rise to 8.8. That was the lowest reading since February 2014.

A reading above zero indicates expansion.

The number of initial jobless claims in the week ending February 14 in the U.S. fell by 21,000 to 283,000 from 304,000 in the previous week, beating expectations for a rise by 1,000.

The U.S. leading economic index climbed by 0.2% in January, after a 0.4% increase in December. December's figure was revised down from a 0.6% gain.

The euro traded higher against the U.S. dollar. The rejection of Greek loan proposal by Germany weighed on the euro. Greece submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

The European Central Bank (ECB) released its minutes of January meeting, for the first time. According to the minutes, the most Governing Council members voted a EUR60 billion a month bond-purchase programme, mostly government bonds, to increase inflation and to spur economic growth in the Eurozone.

One member wants to consider buying corporate bonds.

Eurozone's adjusted current account surplus fell to €17.8 billion in December from €19.9 billion in November. November's figure was revised up from a surplus of €18.1 billion. Analysts had expected a surplus of €23.3 billion.

Eurozone's consumer confidence index rose to -6.7 in February from -8.5 in January. Analysts had expected the index to decrease to -8.0.

The British pound traded higher against the U.S. dollar. The CBI industrial order books balance climbed to +10% in February from +4% in January.

Analysts expected the CBI industrial order books balance to increase to +7%.

Volume of output for the next three months climbed to +25 in February, the highest level since September 2014, up from +13 in January.

The Swiss franc traded higher against the U.S. dollar. Switzerland's trade surplus widened to CHF3.43 billion in January from CHF1.51 billion in December. December's figure was revised down from CHF1.52 billion.

Analysts had expected the trade surplus to narrow to CHF1.23 billion.

Exports rose 2.9% in January, while imports declined 2.2%.

The New Zealand dollar traded higher against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback after the mixed economic data from New Zealand. Producer price index input in New Zealand fell by 0.4% in the fourth quarter, missing expectations for a 0.2% decline, after a 1.5% drop in the third quarter.

Producer price index output in New Zealand declined by 0.1% in the fourth quarter, beating expectations for a 0.3% decrease, after a 1.1% fall in the third quarter.

The Australian dollar traded higher against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded mixed against the greenback despite the better-than-expected trade data from Japan. Japan's adjusted trade deficit narrowed to ¥406.1 billion in January from a deficit of ¥620.7 billion in December. December's figure was revised up from a deficit of ¥712.10 billion.

Analysts had expected a deficit of ¥600.00 billion.

The Bank of Japan (BoJ) released its monthly economic report on Thursday. The BoJ said that Japan's economy has continued to recover moderately.

-

17:00

U.S.: Crude Oil Inventories, February +7.7

-

16:57

U.S. leading economic index increased 0.2% in January

The Conference Board released its leading economic index for the U.S. on Thursday. The leading economic index climbed by 0.2% in January, after a 0.4% increase in December.

December's figure was revised down from a 0.6% gain.

The Conference Board economist Ataman Ozyildirim said that "the lack of strong momentum in residential construction, along with a weak outlook for new orders in manufacturing, poses a downside risk for the U.S. economy".

He noted that the index grew moderately in recent months.

-

16:32

Philadelphia Federal Reserve Bank’s manufacturing index dropped to 5.2 in February

The Philadelphia Federal Reserve Bank released its manufacturing index on Thursday. The index declined to 5.2 in February from 6. 3 in January, missing expectations for a rise to 8.8. That was the lowest reading since February 2014.

The index fell the third consecutive month.

A reading above zero indicates expansion.

The survey's future activity index declined from a reading of 50.9 in January to 29.7 in February, but continues to reflect general optimism about manufacturing growth in the region over the next six months.

-

16:00

Eurozone: Consumer Confidence, February -7 (forecast -8)

-

16:00

U.S.: Philadelphia Fed Manufacturing Survey, February 5.2 (forecast 8.8)

-

16:00

U.S.: Leading Indicators , January +0.2% (forecast +0.4%)

-

15:52

ECB Monetary Policy Meeting Account: most Governing Council members voted for quantitative easing

The European Central Bank's (ECB) its minutes of January meeting on Thursday, for the first time. The ECB named its minutes the account. According to the minutes, the most Governing Council members voted a EUR60 billion a month bond-purchase programme, mostly government bonds, to increase inflation and to spur economic growth in the Eurozone.

One member wants to consider buying corporate bonds.

The central bank decided to launch its quantitative easing because earlier stimulus measures were "more limited" than expected.

The ECB decided on January 22 to launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

-

14:45

Option expiries for today's 10:00 ET NY cut

USDJPY 118.50 (USD 695m) 119.00 (USD 2.3bln) 119.40 (USD 400m) 120.00 (USD 1.2bln)

EURUSD 1.1200 (EUR 2.1bln) 1.1250-60 (EUR 850m) 1.1350 (EUR 715m) 1.1400 (EUR 2bln)

GBPUSD 1.5385-1.5400 (GBP 450m)

USDCAD 1.2275-80 (USD 800m)

AUDUSD 0.7750 (AUD 534m) 0.7775 (AUD 542m)

NZDUSD 0.7500 (NZD 732m)

-

14:30

U.S.: Initial Jobless Claims, February 283 (forecast 305)

-

14:14

Foreign exchange market. European session: the euro fell against the U.S. dollar after the release of the European Central Bank’s (ECB) minutes

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

04:30 Japan All Industry Activity Index, m/m December +0.1% -0.2% -0.3%

05:00 Japan BoJ monthly economic report

07:00 Switzerland Trade Balance January 1.52 1.23 3.43

07:45 France CPI, m/m January +0.1% -0.9% -1.1%

07:45 France CPI, y/y January +0.1% -0.4%

09:00 Eurozone Current account, adjusted, bln December 19.9 Revised From 18.1 23.3 17.8

11:00 United Kingdom CBI industrial order books balance February 4 7 10

12:30 Eurozone ECB Monetary Policy Meeting Accounts

The U.S. dollar traded higher against the most major currencies ahead the U.S. economic data. The number of initial jobless claims in the U.S. is expected to increase by 1,000 to 305,000.

The Philadelphia Federal Reserve Bank' manufacturing index is expected to rise to 8.8 in February from 26.3 in January.

The Fed released its minutes of last meeting. The Fed is concerned about to increase its interest rate too soon.

The euro fell against the U.S. dollar after the release of the European Central Bank's (ECB) minutes. The ECB released its minutes of January meeting, for the first time. According to the minutes, the most Governing Council members voted a EUR60 billion a month bond-purchase programme, mostly government bonds, to increase inflation and to spur economic growth in the Eurozone.

One member wants to consider buying corporate bonds.

The rejection of Greek loan proposal by Germany weighed on the euro. Greece submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Eurozone's adjusted current account surplus fell to €17.8 billion in December from €19.9 billion in November. November's figure was revised up from a surplus of €18.1 billion. Analysts had expected a surplus of €23.3 billion.

The British pound traded slightly lower against the U.S. dollar despite the better-than-expected CBI industrial order books balance data from the U.K. The CBI industrial order books balance climbed to +10% in February from +4% in January.

Analysts expected the CBI industrial order books balance to increase to +7%.

Volume of output for the next three months climbed to +25 in February, the highest level since September 2014, up from +13 in January.

The Swiss franc traded lower against the U.S. dollar despite the better-than-expected trade data from Switzerland. Switzerland's trade surplus widened to CHF3.43 billion in January from CHF1.51 billion in December. December's figure was revised down from CHF1.52 billion.

Analysts had expected the trade surplus to narrow to CHF1.23 billion.

Exports rose 2.9% in January, while imports declined 2.2%.

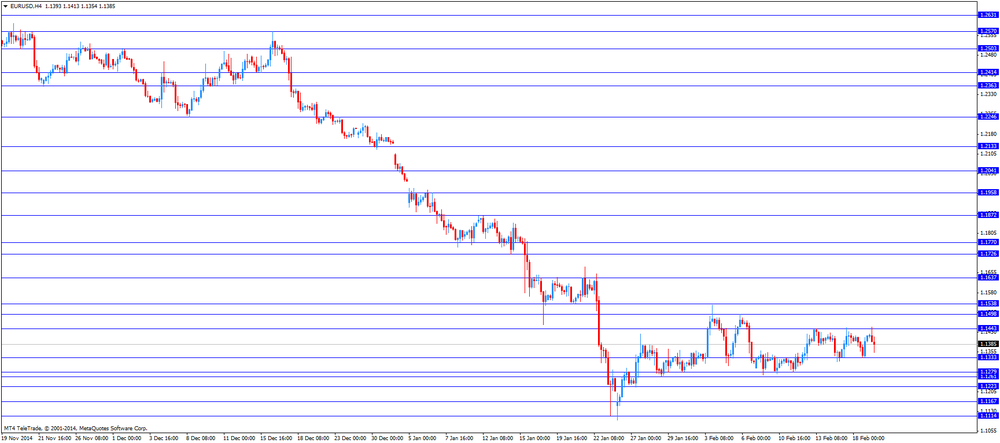

EUR/USD: the currency pair declined to 1.1354

GBP/USD: the currency pair fell to $1.5416

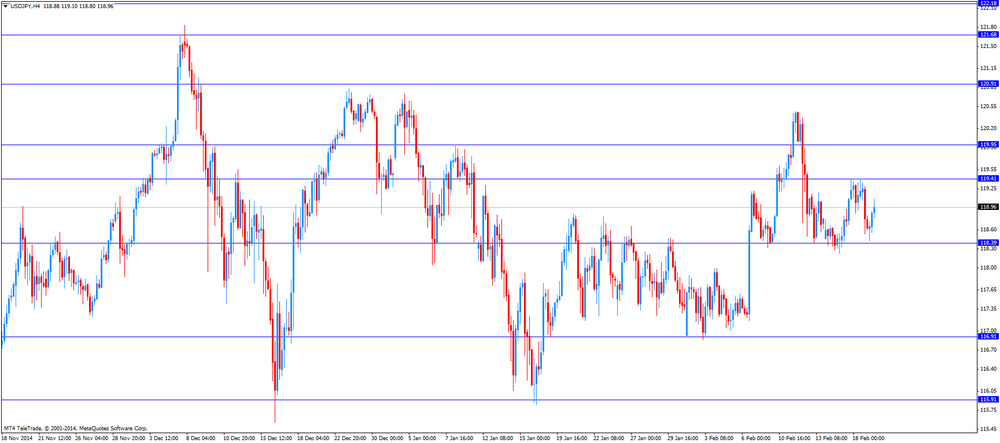

USD/JPY: the currency pair climbed to Y119.10

The most important news that are expected (GMT0):

13:30 U.S. Initial Jobless Claims February 304 305

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Philadelphia Fed Manufacturing Survey February 6.3 8.8

-

14:00

Orders

EUR/USD

Offers 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1320 1.1300 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5480 1.5500 1.5540 1.5620

Bids 1.5390 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 136.20 136.50 136.80 137.00

Bids 134.95-00 133.90 133.60 133.00 132.50-55

USD/JPY

Offers 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7345 0.7325 0.7300

AUD/USD

Offers 0.7840 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:37

Switzerland's trade surplus widened to CHF3.43 billion in January

The Swiss Federal Customs Administration released its trade data figures for Switzerland on Thursday. Switzerland's trade surplus widened to CHF3.43 billion in January from CHF1.51 billion in December. December's figure was revised down from CHF1.52 billion.

Analysts had expected the trade surplus to narrow to CHF1.23 billion.

Exports rose 2.9% in January, while imports declined 2.2%.

-

13:17

CBI industrial order books balance climbs to +10% in February

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance climbed to +10% in February from +4% in January.

Analysts expected the CBI industrial order books balance to increase to +7%.

The CBI's director for economics Rain Newton-Smith said that export orders increased, "but uncertainty over prospects in the Eurozone will continue to weigh on export demand".

He noted that lower oil prices were positive for the manufacturing sector in the UK, "but North Sea producers are clearly suffering".

Volume of output for the next three months climbed to +25 in February, the highest level since September 2014, up from +13 in January.

-

12:00

United Kingdom: CBI industrial order books balance, February 10 (forecast 7)

-

11:26

Option expiries for today's 10:00 ET NY cut

USDJPY 118.50 (USD 695m) 119.00 (USD 2.3bln) 119.40 (USD 400m) 120.00 (USD 1.2bln)

EURUSD 1.1200 (EUR 2.1bln) 1.1250-60 (EUR 850m) 1.1350 (EUR 715m) 1.1400 (EUR 2bln)

GBPUSD 1.5385-1.5400 (GBP 450m)

USDCAD 1.2275-80 (USD 800m)

AUDUSD 0.7750 (AUD 534m) 0.7775 (AUD 542m)

NZDUSD 0.7500 (NZD 732m)

-

10:00

Eurozone: Current account, adjusted, bln , December 17.8 (forecast 23.3)

-

08:45

France: CPI, m/m, January -1.1% (forecast -0.9%)

-

08:45

France: CPI, y/y, January -0.4%

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded lower against most major peers, adding gains against the aussie

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Bank holiday

04:30 Japan All Industry Activity Index, m/m December +0.1% -0.2% -0.3%

05:00 Japan BoJ monthly economic report

07:00 Switzerland Trade Balance January 1.52 1.23 3.43

The U.S. dollar traded lower against most major peers after weak U.S. economic data and the Federal Reserve policy meeting minutes release. The dovish minutes showed that the FED is concerned about raising benchmark interest rates too soon might harm the economic recovery. Slow growth in wages could become a restraining factor for household spending and could keep inflation below the targeted level. Low oil prices could have a negative influence on employment and investments in the sector. An increasingly stronger dollar hurts the export industry.

Today the negotiations about a Greek debt deal will remain in the focus. As time runs out for Greece markets were supported yesterday as Athens stated it will seek an extension of the loan agreement and German Finance Minister Wolfgang Schäuble said that a compromise could be reached.

The Australian dollar declined on Thursday with no important data in the region published.

Chinese markets are closed today for the Lunar New Year holiday celebrations.

New Zealand's dollar advanced against the greenback. The PPI Input for the fourth quarter declined by -0.4%, more than the forecasted -0.2%. The PPI Output came in at -0.1% declining less than the -0.3% predicted.

The Japanese yen traded moderately stronger against the greenback on Thursday after better-than-expected export figures. Many markets are closed for the Lunar New Year celebrations Yesterday the Bank of Japan held its unprecedented monetary policy steady. The outlook for exports and factory output was upgraded and consumption remains firm according to BOJ Governor Kuroda. The Japanese Adjusted Merchandise Trade Balance came in at -406.1 billion for January. Economists expected a reading of -600 billion. The All Industry Activity Index declined by -0.3% in December compared to an increase of +0.1% in November. Analyst forecasted a decline by -0.2%.

EUR/USD: the euro traded stronger against the greenback

USD/JPY: the U.S. dollar traded moderately lower against the yen

GPB/USD: Sterling added gains against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:45 France CPI, m/m January +0.1% -0.9%

07:45 France CPI, y/y January +0.1%

09:00 Eurozone Current account, adjusted, bln December 18.1 23.3

09:00 Eurozone ECB Monetary Policy Meeting Accounts

11:00 United Kingdom CBI industrial order books balance February 4 7

13:30 U.S. Initial Jobless Claims February 304 305

15:00 Eurozone Consumer Confidence February -9 -8

15:00 U.S. Leading Indicators January +0.5% +0.4%

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Philadelphia Fed Manufacturing Survey February 6.3 8.8

16:00 U.S. Crude Oil Inventories February +4.9

-

08:27

Options levels on thursday, February 19, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1560 (5524)

$1.1504 (2945)

$1.1463 (1812)

Price at time of writing this review: $1.1417

Support levels (open interest**, contracts):

$1.1352 (2227)

$1.1304 (2236)

$1.1252 (2155)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 103946 contracts, with the maximum number of contracts with strike price $1,1500 (5524);

- Overall open interest on the PUT options with the expiration date March, 6 is 108654 contracts, with the maximum number of contracts with strike price $1,1200 (5633);

- The ratio of PUT/CALL was 1.05 versus 1.04 from the previous trading day according to data from February, 18

GBP/USD

Resistance levels (open interest**, contracts)

$1.5702 (1059)

$1.5604 (2270)

$1.5508 (3027)

Price at time of writing this review: $1.5457

Support levels (open interest**, contracts):

$1.5391 (442)

$1.5294 (1747)

$1.5196 (2077)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 28792 contracts, with the maximum number of contracts with strike price $1,5500 (3027);

- Overall open interest on the PUT options with the expiration date March, 6 is 33122 contracts, with the maximum number of contracts with strike price $1,5200 (2077);

- The ratio of PUT/CALL was 1.15 versus 1.18 from the previous trading day according to data from February, 18

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:00

Switzerland: Trade Balance, January 3.43 (forecast 1.23)

-

05:32

Japan: All Industry Activity Index, m/m, December -0.3% (forecast -0.2%)

-

01:00

Currencies. Daily history for Feb 18’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1396 -0,12%

GBP/USD $1,5434 +0,54%

USD/CHF Chf0,9420 +0,56%

USD/JPY Y118,77 -0,40%

EUR/JPY Y135,37 -0,50%

GBP/JPY Y183,35 +0,18%

AUD/USD $0,7807 -0,13%

NZD/USD $0,7543 +0,07%

USD/CAD C$1,2425 +0,31%

-

00:54

Japan: Adjusted Merchandise Trade Balance, bln, January -406.12 (forecast -600.0)

-

00:00

Schedule for today, Thursday, Feb 19’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

04:30 Japan All Industry Activity Index, m/m December +0.1% -0.2%

05:00 Japan BoJ monthly economic report

07:00 Switzerland Trade Balance January 1.52 1.23

07:45 France CPI, m/m January +0.1% -0.9%

07:45 France CPI, y/y January +0.1%

09:00 Eurozone Current account, adjusted, bln December 18.1 23.3

09:00 Eurozone ECB Monetary Policy Meeting Accounts

11:00 United Kingdom CBI industrial order books balance February 4 7

13:30 U.S. Initial Jobless Claims February 304 305

15:00 Eurozone Consumer Confidence February -9 -8

15:00 U.S. Leading Indicators January +0.5% +0.4%

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

15:00 U.S. Philadelphia Fed Manufacturing Survey February 6.3 8.8

16:00 U.S. Crude Oil Inventories February +4.9

-