Noticias del mercado

-

17:32

Foreign exchange market. American session: the Canadian dollar declined against the U.S. dollar after the weaker-than-expected Canadian retail sales data

The U.S. dollar traded mixed against the most major currencies after the better-than-expected U.S. preliminary manufacturing purchasing managers' index. The index rose to 54.3 in February from 53.9 in January, beating expectations for a decline to 53.7.

The euro traded higher against the U.S. dollar. Concerns over new debt talks between Greece and the European Union continue to weigh on the euro. Greece yesterday submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Another round of talks between Greece and the European Union was scheduled to take place on Friday.

Eurozone's preliminary manufacturing PMI increased to 51.1 in February from 51.0 in January, missing expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 53.9 in February from 52.7 in January. Analysts had expected the index to climb to 53.2.

Germany's preliminary manufacturing PMI remained unchanged at 50.9 in February from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 55.5 in February from 54.0 in January, beating expectations for a gain to 54.3.

France's preliminary manufacturing PMI fell to 47.7 in February from 49.2 in January, missing forecasts of a rise to 49.7.

France's preliminary services PMI rose to 53.4 in February from 49.4 in January, exceeding expectations for a gain to 49.9.

The British pound traded higher against the U.S. dollar. Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

The Canadian dollar declined against the U.S. dollar after the weaker-than-expected Canadian retail sales data. Canadian retail sales plunged by 2.0% in December, missing expectations for a 0.3% decline, after a 0.4% rise in November.

That was the biggest fall since April 2010.

The drop was driven by lower sales in 9 of 11 subsectors.

Canadian retail sales excluding automobiles dropped 2.3% in December, missing expectations for a 0.7% decrease, after a 0.6% gain in November. November's figure was revised down from a 0.7% increase.

That was the largest drop since December 2008.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded higher against the greenback in the absence of any major economic reports from New Zealand.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded higher against the greenback in the absence of any major economic reports from Australia.

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback after comments by the Bank of Japan Governor Haruhiko Kuroda. He said in parliament on Friday that there are a lot of policy options, and it is possible to achieve the 2% inflation target.

Japan's preliminary manufacturing PMI decreased to 51.5 in February from 52.2 in January, missing expectations for a rise to 52.6.

-

16:42

U.S. preliminary manufacturing purchasing managers' index (PMI) rises to 54.3 in February

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) rose to 54.3 in February from 53.9 in January, beating expectations for a decline to 53.7.

A reading above 50 indicates expansion in economic activity.

The Markit Chief Economist Chris Williamson said that "the U.S. economy has entered a slower growth phase".

-

15:45

U.S.: Manufacturing PMI, February 54.3 (forecast 53.7)

-

15:17

Canadian retail sales drops at the fastest pace since April 2010

Statistics Canada released retail sales data on Friday. Canadian retail sales plunged by 2.0% in December, missing expectations for a 0.3% decline, after a 0.4% rise in November.

That was the biggest fall since April 2010.

The drop was driven by lower sales in 9 of 11 subsectors. Clothing and clothing accessories sales fell 5.6% in December, while electronic sales decreased 9.2%.

Gasoline sales dropped by 7.4% in December.

Motor vehicles and parts sales fell 1.0% in December.

Canadian retail sales excluding automobiles dropped 2.3% in December, missing expectations for a 0.7% decrease, after a 0.6% gain in November. November's figure was revised down from a 0.7% increase.

That was the largest drop since December 2008.

-

14:45

Option expiries for today's 10:00 ET NY cut

USD/JPY 114.00 (1.99bn), 117.10-15 (1bn), 118.35, 119.55 (1.46bn), 120.00, 120.30, 120.50 (1bn), 121.00/05 (2.3bn)

EUR/USD 1.1350 (517m), 1.1460 (721m), 1.1500 (582m)

GBP/USD 1.5500 (661m), 1.5600

USD/CAD 1.2350/55 (521m), 1.2365/75 (1.26bn), 1.2400 (900m), 1.2500, 1.2575, 1.2600

AUD/USD 0.7635 (795m) , 0.7650 (780m), 0.7665, 0.7840 (1.77bn), 0.7850 (1.16bn)

USD/CHF 0.9375 (350m), 0.9510 (210m)

AUD/JPY 92.89 (100m)

-

14:30

Canada: Retail Sales ex Autos, m/m, December -2.3% (forecast -0.7%)

-

14:30

Canada: Retail Sales, m/m, December -2.0% (forecast -0.3%)

-

14:03

Foreign exchange market. European session: the euro fell against the U.S. dollar as concerns over new debt talks between Greece and the European Union weighed on the euro

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 China Bank holiday

01:35 Japan Manufacturing PMI (Preliminary) February 52.2 52.6 51.5

07:00 Germany Producer Price Index (MoM) January -0.7% -0.3% -0.6%

07:00 Germany Producer Price Index (YoY) January -1.7% -2.2%

08:00 France Services PMI (Preliminary) February 49.4 49.9 53.4

08:00 France Manufacturing PMI (Preliminary) February 49.2 49.7 47.7

08:30 Germany Manufacturing PMI (Preliminary) February 50.9 51.8 50.9

08:30 Germany Services PMI (Preliminary) February 54.0 54.3 55.5

09:00 Eurozone Manufacturing PMI (Preliminary) February 51.0 51.6 51.1

09:00 Eurozone Services PMI (Preliminary) February 52.7 53.2 53.9

09:30 United Kingdom Retail Sales (MoM) January +0.2% Revised From +0.4% -0.1% -0.3%

09:30 United Kingdom Retail Sales (YoY) January +4.0% Revised From +4.3% +6.0% +5.4%

09:30 United Kingdom PSNB, bln January 9.8 Revised From 12.5 -9.5 -9.4

The U.S. dollar traded mixed against the most major currencies ahead the U.S. preliminary manufacturing purchasing managers' index. The index is expected to decline to 53.7 in February from 53.9 in January.

The euro fell against the U.S. dollar as concerns over new debt talks between Greece and the European Union weighed on the euro. Greece yesterday submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Another round of talks between Greece and the European Union was scheduled to take place on Friday.

Eurozone's preliminary manufacturing PMI increased to 51.1 in February from 51.0 in January, missing expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 53.9 in February from 52.7 in January. Analysts had expected the index to climb to 53.2.

Germany's preliminary manufacturing PMI remained unchanged at 50.9 in February from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 55.5 in February from 54.0 in January, beating expectations for a gain to 54.3.

France's preliminary manufacturing PMI fell to 47.7 in February from 49.2 in January, missing forecasts of a rise to 49.7.

France's preliminary services PMI rose to 53.4 in February from 49.4 in January, exceeding expectations for a gain to 49.9.

The British pound dropped against the U.S. dollar after the weaker-than-expected U.K. economic data. Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

The Canadian dollar traded higher against the U.S. dollar ahead of the Canadian retail sales data. Canadian retail sales are expected to decrease 0.3% in December, after a 0.4% rise in November.

Canadian retail sales excluding automobiles are expected to drop 0.7% in December, after a 0.7% gain in November.

EUR/USD: the currency pair declined to 1.1297

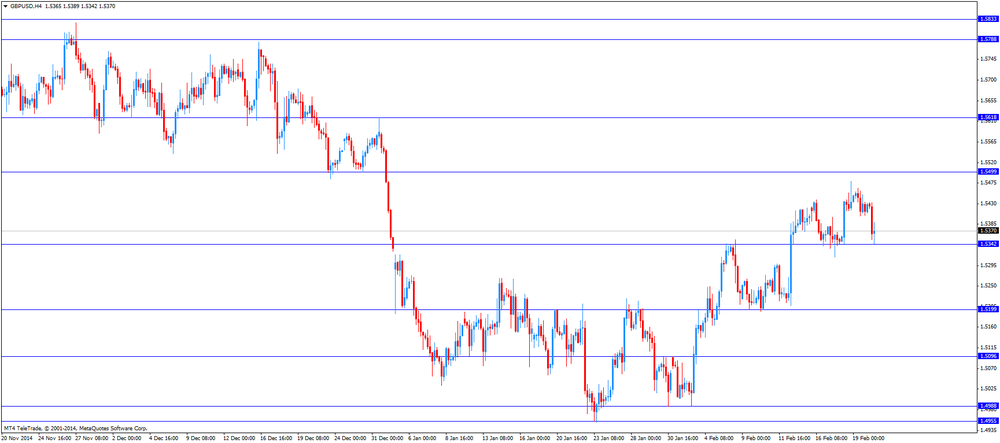

GBP/USD: the currency pair fell to $1.5342

USD/JPY: the currency pair decreased to Y118.53

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m December +0.4% -0.3%

13:30 Canada Retail Sales ex Autos, m/m December +0.7% -0.7%

14:45 U.S. Manufacturing PMI (Preliminary) February 53.9 53.7

-

14:00

Orders

EUR/USD

Offers 1.1380 1.1450-55 1.1485 1.1500 1.1530 1.1550

Bids 1.1290 1.1270-75 1.1240-50 1.1200

GBP/USD

Offers 1.5480 1.5500 1.5540 1.5620

Bids 1.5340 1.5300 1.5280 1.5250 1.5200-10 1.5185

EUR/JPY

Offers 135.40 136.20 136.50 136.80 137.00

Bids 133.90 133.60 133.00 132.50-55

USD/JPY

Offers 119.50 119.80 120.00 120.20-30 120.50

Bids 118.20 118.00 117.80 117.50

EUR/GBP

Offers 0.7410 0.7445-50 0.7470 0.7490-7500 0.7510-20

Bids 0.7325 0.7300 0.7200

AUD/USD

Offers 0.7860 0.7880-85 0.7900 0.7920 0.7950

Bids 0.7755 0.7730 0.7700 0.7650 0.7625 0.7600

-

13:42

Public sector net borrowing in the U.K. plunges by £9.4 billion in January

The Office for National Statistics released public sector net borrowing for the U.K. on Friday. The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

-

13:25

UK retail sales decline 0.3% in January

The Office for National Statistics released the retail sales data for the U.K. on Friday. Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

Average store prices declined 3.1% in January from the year earlier, mostly due to falling petrol prices.

-

11:28

Option expiries for today's 10:00 ET NY cut

USD/JPY 114.00 (1.99bn), 117.10-15 (1bn), 118.35, 119.55 (1.46bn), 120.00, 120.30, 120.50 (1bn), 121.00/05 (2.3bn)

EUR/USD 1.1350 (517m), 1.1460 (721m), 1.1500 (582m)

GBP/USD 1.5500 (661m), 1.5600

USD/CAD 1.2350/55 (521m), 1.2365/75 (1.26bn), 1.2400 (900m), 1.2500, 1.2575, 1.2600

AUD/USD 0.7635 (795m) , 0.7650 (780m), 0.7665, 0.7840 (1.77bn), 0.7850 (1.16bn)

USD/CHF 0.9375 (350m), 0.9510 (210m)

AUD/JPY 92.89 (100m)

-

10:31

United Kingdom: Retail Sales (MoM), January -0.3% (forecast -0.1%)

-

10:31

United Kingdom: Retail Sales (YoY) , January +5.4% (forecast +6.0%)

-

10:30

United Kingdom: PSNB, bln, January -9.4 (forecast -9.5)

-

10:00

Eurozone: Manufacturing PMI, February 51.1 (forecast 51.6)

-

09:30

Germany: Manufacturing PMI, February 50.9 (forecast 51.8)

-

09:30

Germany: Services PMI, February 55.5 (forecast 54.3)

-

09:00

France: Manufacturing PMI, February 47.7 (forecast 49.7)

-

09:00

France: Services PMI, February 53.4 (forecast 49.9)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded lower against most major peers, stronger against the euro as Greece worries weigh

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 China Bank holiday

01:35 Japan Manufacturing PMI (Preliminary) February 52.2 52.6 51.5

07:00 Germany Producer Price Index (MoM) January -0.7% -0.3% -0.6%

07:00 Germany Producer Price Index (YoY) January -1.7% -2.2%

The U.S. dollar traded mostly lower against its major peers but is heading for a winning week as market participants speculate on a mid-year rate hike after reassessing the FED's dovish minutes and despite mixed U.S. economic data. The greenback weakened on Wednesday after the minutes of the FED's January meeting, where the committee expressed concerns that a rate hike might slow down economic recovery. Yesterday data showed that the Philadelphia Fed Manufacturing Survey declined to 5.2 in February from 6. 3 in January, missing expectations for a rise to 8.8. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending February 14 in the U.S. fell by 21,000 to 283,000 from 304,000 in the previous week, beating expectations for a rise by 1,000. The U.S. leading economic index climbed by 0.2% in January, after a 0.4% increase in December. December's figure was revised down from a 0.6% gain.

Today data on U.S. Manufacturing PMI and Mortgage Delinquencies will be published.

The negotiations about a Greek debt deal will remain in the focus. As time runs out for Greece Athens requested an extension of the loan agreement but German Finance Minister Wolfgang Schäuble said it was "not a substantial proposal for a solution". The single currency lost against the U.S. dollar as the situation weighs.

The Australian dollar rose against the dollar on Thursday with no important data in the region published but worries about low commodity prices limited gains and weigh in the currency.

Chinese markets are closed today for the Lunar New Year holiday celebrations.

New Zealand's dollar advanced against the greenback with no major economic data for the region published.

The Japanese yen traded almost unchanged against the greenback on Friday in a light-data day, many Asian markets are closed for the Lunar New Year celebrations. Japans Manufacturing PMI for February declined from a previous reading of 52.2 to 51.5, below estimates of an increase to 52.6. BoJ Governor Haruhiko Kuroda stated yesterday that the bank is watching the bond market closely and said that negative rates are part of the bank's policy to reach the targeted 2% inflation rate.

EUR/USD: the euro traded weaker against the greenback

USD/JPY: the U.S. dollar traded moderately lower against the yen

GPB/USD: Sterling traded higher against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

08:00 France Services PMI (Preliminary) February 49.4 49.9

08:00 France Manufacturing PMI (Preliminary) February 49.2 49.7

08:30 Germany Manufacturing PMI (Preliminary) February 50.9 51.8

08:30 Germany Services PMI (Preliminary) February 54.0 54.3

09:00 Eurozone Manufacturing PMI (Preliminary) February 51.0 51.6

09:00 Eurozone Services PMI (Preliminary) February 52.7 53.2

09:30 United Kingdom Retail Sales (MoM) January -0.4% -0.1%

09:30 United Kingdom Retail Sales (YoY) January +4.3% +6.0%

09:30 United Kingdom PSNB, bln January 12.5 -9.5

13:30 Canada Retail Sales, m/m December +0.4% -0.3%

13:30 Canada Retail Sales ex Autos, m/m December +0.7% -0.7%

14:45 U.S. Manufacturing PMI (Preliminary) February 53.9 53.7

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

-

08:29

Options levels on friday, February 20, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1468 (1627)

$1.1433 (749)

$1.1399 (427)

Price at time of writing this review: $1.1345

Support levels (open interest**, contracts):

$1.1299 (2239)

$1.1250 (2233)

$1.1185 (2725)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 104547 contracts, with the maximum number of contracts with strike price $1,1500 (5644);

- Overall open interest on the PUT options with the expiration date March, 6 is 109420 contracts, with the maximum number of contracts with strike price $1,1200 (5672);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from February, 19

GBP/USD

Resistance levels (open interest**, contracts)

$1.5701 (1156)

$1.5603 (2261)

$1.5506 (3083)

Price at time of writing this review: $1.5422

Support levels (open interest**, contracts):

$1.5391 (1129)

$1.5294 (1777)

$1.5197 (2076)

Comments:

- Overall open interest on the CALL options with the expiration date March, 6 is 29540 contracts, with the maximum number of contracts with strike price $1,5500 (3083);

- Overall open interest on the PUT options with the expiration date March, 6 is 33994 contracts, with the maximum number of contracts with strike price $1,5200 (2076);

- The ratio of PUT/CALL was 1.15 versus 1.15 from the previous trading day according to data from February, 19

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

08:01

Germany: Producer Price Index (MoM), January -0.6% (forecast -0.3%)

-

08:01

Germany: Producer Price Index (YoY), January -2.2%

-

02:35

Japan: Manufacturing PMI, February 51.5 (forecast 52.6)

-

00:30

Currencies. Daily history for Feb 19’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1356 -0,35%

GBP/USD $1,5413 -0,14%

USD/CHF Chf0,9493 +0,77%

USD/JPY Y118,94 +0,14%

EUR/JPY Y135,20 -0,13%

GBP/JPY Y183,3 -0,03%

AUD/USD $0,7790 -0,22%

NZD/USD $0,7515 -0,37%

USD/CAD C$1,2494 +0,55%

-

00:00

Schedule for today, Friday, Feb 20’2015:

(time / country / index / period / previous value / forecast)

00:00 China Bank holiday

01:35 Japan Manufacturing PMI (Preliminary) February 52.2 52.6

07:00 Germany Producer Price Index (MoM) January -0.7% -0.3%

07:00 Germany Producer Price Index (YoY) January -1.7%

08:00 France Services PMI (Preliminary) February 49.4 49.9

08:00 France Manufacturing PMI (Preliminary) February 49.2 49.7

08:30 Germany Manufacturing PMI (Preliminary) February 50.9 51.8

08:30 Germany Services PMI (Preliminary) February 54.0 54.3

09:00 Eurozone Manufacturing PMI (Preliminary) February 51.0 51.6

09:00 Eurozone Services PMI (Preliminary) February 52.7 53.2

09:30 United Kingdom Retail Sales (MoM) January -0.4% -0.1%

09:30 United Kingdom Retail Sales (YoY) January +4.3% +6.0%

09:30 United Kingdom PSNB, bln January 12.5 -9.5

13:30 Canada Retail Sales, m/m December +0.4% -0.3%

13:30 Canada Retail Sales ex Autos, m/m December +0.7% -0.7%

14:45 U.S. Manufacturing PMI (Preliminary) February 53.9 53.7

15:00 U.S. Mortgage Delinquencies Quarter IV 5.85%

-