Noticias del mercado

-

21:00

S&P 500 2,105.38 +7.93 +0.38 %, NASDAQ 4,943.05 +18.35 +0.37 %, Dow 18,095.94 +110.17 +0.61 %

-

18:04

European stocks close: stocks closed mixed ahead of new debt talks between Greece and the European Union on late Friday

Stock indices closed mixed ahead of new debt talks between Greece and the European Union on late Friday. Greece yesterday submitted a request for an extension of its existing loan agreement. But German Finance Minister Wolfgang Schaeuble replied that the Greek loan proposal was "not a substantial proposal for a solution".

Eurozone's preliminary manufacturing PMI increased to 51.1 in February from 51.0 in January, missing expectations for a rise to 51.6.

Eurozone's preliminary services PMI rose to 53.9 in February from 52.7 in January. Analysts had expected the index to climb to 53.2.

Germany's preliminary manufacturing PMI remained unchanged at 50.9 in February from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 55.5 in February from 54.0 in January, beating expectations for a gain to 54.3.

France's preliminary manufacturing PMI fell to 47.7 in February from 49.2 in January, missing forecasts of a rise to 49.7.

France's preliminary services PMI rose to 53.4 in February from 49.4 in January, exceeding expectations for a gain to 49.9.

Retail sales in the U.K. decreased 0.3% in January, missing expectations for a 0.1% drop, after a 0.2% gain in December. December's figure was revised down from a 0.4% rise.

The increase was driven by lower food, clothing and footwear sales.

On a yearly basis, retail sales in the U.K. climbed 5.4% in January, missing expectations for a 6.0% rise, after a 4.0% increase in December. December's figure was revised down from a 4.3% increase.

The public sector net borrowing in the U.K. dropped by £9.4 billion in January, missing expectations for a decline to £9.5 billion, after a rise by£9.9 billion in December. December's figure was revised down from an increase by £12.5 billion.

The decline was driven by a tax receipts of self-employed workers and top rate taxpayers.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,915.2 +26.30 +0.38%

DAX 11,050.64 +48.70 +0.44%

CAC 40 4,830.9 -2.38 -0.05%

-

18:01

European stocks closed: FTSE 100 6,915.2 +26.30 +0.38%, CAC 40 4,830.9 -2.38 -0.05%, DAX 11,050.64 +48.70 +0.44%

-

15:34

U.S. Stocks open: Dow -0.24%, Nasdaq +0.02%, S&P -0.09%

-

15:25

Before the bell: S&P futures -0.18%, Nasdaq futures -0.04%

U.S. stock-index futures fell as creditors raised the pressure on Greece amid efforts to reach a debt agreement.

Global markets:

Nikkei 18,332.3 +67.51 +0.37%

FTSE 6,903.92 +15.02 +0.22%

CAC 4,802.34 -30.94 -0.64%

DAX 10,998.15 -3.79 -0.03%

Crude oil $51.62 (+0.78%)

Gold $1211.80 (+0.35%)

-

15:12

Stocks before the bell

(company / ticker / price / change, % / volume)

Procter & Gamble Co

PG

86.31

+0.06%

2.6K

Amazon.com Inc., NASDAQ

AMZN

373.71

+0.09%

4.7K

FedEx Corporation, NYSE

FDX

180.01

+0.13%

0.1K

American Express Co

AXP

79.90

+0.15%

10.2K

General Electric Co

GE

25.июн

+0.16%

51.7K

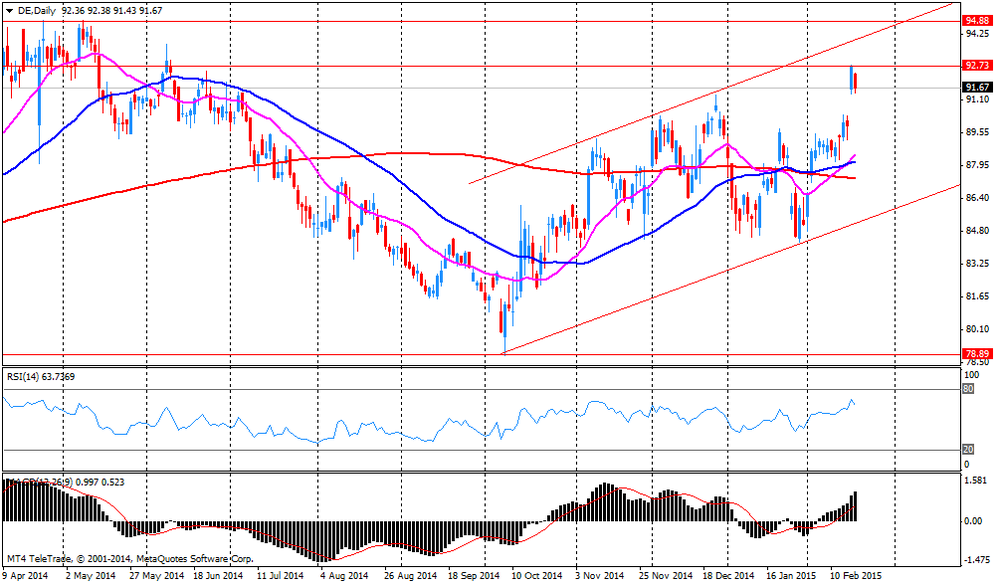

Deere & Company, NYSE

DE

92.98

+0.25%

5.3K

Tesla Motors, Inc., NASDAQ

TSLA

205.50

+0.51%

18.7K

Facebook, Inc.

FB

77.11

+0.52%

204.8K

Starbucks Corporation, NASDAQ

SBUX

93.52

+0.56%

1.8K

Barrick Gold Corporation, NYSE

ABX

дек.65

+3.43%

116.7K

AT&T Inc

T

34.49

0.00%

1.9K

Cisco Systems Inc

CSCO

29.49

0.00%

6.0K

International Business Machines Co...

IBM

162.19

0.00%

0.3K

Travelers Companies Inc

TRV

107.98

0.00%

0.1K

Visa

V

269.03

-0.03%

3.4K

Boeing Co

BA

151.13

-0.03%

4.6K

3M Co

MMM

167.34

-0.04%

0.6K

Twitter, Inc., NYSE

TWTR

47.80

-0.04%

26.0K

Goldman Sachs

GS

188.55

-0.06%

0.1K

Microsoft Corp

MSFT

43.50

-0.07%

5.4K

Verizon Communications Inc

VZ

48.90

-0.08%

0.2K

Yahoo! Inc., NASDAQ

YHOO

43.60

-0.11%

3.3K

Nike

NKE

93.50

-0.13%

2.0K

Pfizer Inc

PFE

34.43

-0.15%

1.5K

Apple Inc.

AAPL

128.51

-0.16%

192.9K

Ford Motor Co.

F

16.18

-0.19%

19.2K

JPMorgan Chase and Co

JPM

59.25

-0.20%

7.6K

Home Depot Inc

HD

111.75

-0.21%

2.1K

Intel Corp

INTC

34.19

-0.22%

8.4K

McDonald's Corp

MCD

94.33

-0.26%

1.1K

General Motors Company, NYSE

GM

37.09

-0.27%

1.6K

Citigroup Inc., NYSE

C

51.26

-0.31%

15.4K

Caterpillar Inc

CAT

84.46

-0.40%

3.0K

Yandex N.V., NASDAQ

YNDX

16.75

-0.59%

13.8K

International Paper Company

IP

56.88

-0.66%

1.3K

ALCOA INC.

AA

15.73

-0.76%

20.9K

Exxon Mobil Corp

XOM

89.72

-1.42%

61.4K

Chevron Corp

CVX

108.80

-1.48%

18.5K

Wal-Mart Stores Inc

WMT

84.94

-1.56%

37.6K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

20.86

-2.02%

17.9K

-

15:03

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Other:

Boeing (BA) target raised from $164 to $196 at Sterne Agee

Apple (AAPL) target raised from $130 to $145 at Goldman

-

14:34

Company News: Deere & Company (DE) reported better than expected first fiscal quarter profits

Deere & Company (DE) earned $1.12 per share in the first fiscal quarter, beating analysts' estimate of $0.82. Revenue in the first fiscal quarter decreased 19.3% year-over-year to $5.61 billion, but beating analysts' estimate of $5.50 billion.

The company announced its forecasts for the second fiscal quarter of 2015. Revenue is expected to be $7.5 billion in the second fiscal quarter of 2015 (analysts' estimate: $7.96 billion).

The company expects revenue of $27.36 billion (-17% y/y) (the previous estimate: -15% y/y) in the full fiscal year 2015 (analysts' estimate: $28.4 billion).

The company downgraded its net income forecast to $1.8 billion from the previous estimate of $1.9 billion.

Deere & Company (DE) shares fell to $91.30 (-0.45%) prior to the opening bell.

-

12:30

European stocks traded at a seven-year high

European stocks traded at a seven-year high as Greek Finance Minister Yanis Varoufakis returns to Brussels to meet his euro-area counterparts seeking an agreement that will let Europe's most-indebted country avoid default.

"Markets expect a solution which keeps Greece in the euro zone, but for the moment all news will increase volatility due to uncertainty," said Guillermo Hernandez Sampere, who helps manage about 150 million euros ($170 million) at MPPM EK in Eppstein, Germany. "We will have another day with a lot of noise, which always has short-term effects on markets."

Varoufakis said on Thursday that he would accept the financial and procedural conditions of the existing bailout deal, while asking for negotiations on other elements. German Finance Minister Wolfgang Schaeuble almost immediately rebuffed the proposal. Later, optimism returned after a "positive" conversation between Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel.

Euro-area manufacturing and services strengthened this month, with Markit Economics' composite purchasing managers' index for both sectors rising to 53.5 from 52.6 in January. That beat the median forecast of economists for a reading of 53 and is the highest in seven months.

Among equities moving on corporate news, Danone fell 1.2 percent. The world's biggest yogurt maker set a lower sales forecast for 2015 than last year's amid deflationary pressure in Europe and weakening currencies in emerging markets.

Gemalto NV slid 7.2 percent, for the biggest decline on the Stoxx 600. The largest maker of mobile-phone cards said it's investigating a report that U.S. and U.K. spies allegedly hacked into its computer network to steal the keys used to encrypt conversations, messages and data traffic.

Standard Life Plc climbed 3.2 percent after reporting better-than-expected full-year profit.

Gauge of energy stocks and commodity producers posted the biggest gains of the 19 industry groups on the Stoxx 600, as oil trimmed its first weekly decline in a month. Tullow Oil Plc and Premier Oil Plc rose at least 2.8 percent, while Glencore Plc added 1.9 percent.

FTSE 100 6,911.95 +23.05 +0.33%

CAC 40 4,825.73 -7.55 -0.16%

DAX 10,983.57 -18.37 -0.17%

-

09:00

Global Stocks: Nikkei at fresh 15-year high and Wall Street moderately lower

U.S. markets moderately declined on Thursday on mixed U.S. data and worries over Greece. Athens requested an extension of the loan agreement but Germany rejected the Greek proposal with German Finance Minister Wolfgang Schäuble stating it was "not a substantial proposal for a solution". The technology, basic material and health care sector added gains while utilities and the energy sector declined. Yesterday data showed that the Philadelphia Fed Manufacturing Survey declined to 5.2 in February from 6. 3 in January, missing expectations for a rise to 8.8. That was the lowest reading since February 2014. The number of initial jobless claims in the week ending February 14 in the U.S. fell by 21,000 to 283,000 from 304,000 in the previous week, beating expectations for a rise by 1,000. The U.S. leading economic index climbed by 0.2% in January, after a 0.4% increase in December. December's figure was revised down from a 0.6% gain.

Today data on U.S. Manufacturing PMI and Mortgage Delinquencies will in the focus.

The DOW JONES index lost -0.24% closing at 17,985.77 points. The S&P 500 closed -0.11% with a final quote of 2,097.45 further declining from a record high hit 2 days ago.

Chinese markets are closed today for a public holiday as the Lunar New year celebrations take place.

Japanese markets rose for a third day and closed at a fresh 15-year high in today's trading. The Nikkei added gains, closing +0.37% with a final quote of 18,332.30 points - the highest level since 2000. Market sentiment was boosted by strong U.S. jobs data.

-

03:00

Nikkei 225 18,348.39 +83.60 +0.46%, Topix 1,499.85 +4.92 +0.33%

-

00:31

Stocks. Daily history for Feb 19’2015:

(index / closing price / change items /% change)

S&P/ASX 200 5,904.23 -11.45 -0.19%

TOPIX 1,494.93 +12.26 +0.83%

FTSE 100 6,888.9 -9.18 -0.13 %

CAC 40 4,833.28 +34.25 +0.71 %

Xetra DAX 11,001.94 +40.94 +0.37 %

S&P 500 2,097.45 -2.23 -0.11 %

NASDAQ Composite 4,924.7 +18.34 +0.37 %

Dow Jones -44.08 -0.24 %

-