Noticias del mercado

-

18:18

Bank of Japan expects the country’s inflation to slow further

The Bank of Japan (BoJ) released its monthly economic report on Thursday. The BoJ said that Japanese consumer inflation will slow further due to falling oil prices.

The central bank noted that Japan's economy has continued to recover moderately as a trend, and it expect that the country's economy will recover moderately.

The Bank of Japan (BoJ) released its interest rate decision on Wednesday. The BoJ kept its monetary policy unchanged. The central bank will expand its monetary base at an annual pace of 80 trillion yen.

The BoJ cut its inflation forecast for the year to March 2016 to 1.0%, down from a previous estimate of 1.7%.

-

17:37

Foreign exchange market. American session: the euro dropped against the U.S. dollar after the European Central Bank's press conference

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims from the U.S. The number of initial jobless claims in the week ending January 17 in the U.S. fell by 10,000 to 307,000 from 317,000 in the previous week, missing expectations for a decline by 16,000. The previous week's figure was revised to 317,000 from 316,000.

The euro dropped against the U.S. dollar after the European Central Bank's (ECB) press conference. The European Central Bank (ECB) President Mario Draghi said at the press conference that the central bank will launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

The ECB released its interest decision today. The central bank kept its interest rate unchanged at 0.05%.

Eurozone's consumer confidence index rose to -8.5 in January from -10.9 in December. Analysts had expected the index to increase to -10.5.

The British pound fell against the U.S. dollar. The public sector net borrowing in the U.K. rose to £13.1 billion in December from £10.3 billion a year earlier, missing expectations for a decline to £9.2 billion.

The CBI industrial order books balance fell to +4% in January from +5% in December. Analysts expected the CBI industrial order books balance to remain unchanged at +5%.

British factories expect a decline in exports orders in the next three months, the CBI said.

The Canadian dollar traded mixed against the U.S. dollar. The loonie dropped against the greenback yesterday as the Bank of Canada cut its interest rate. The BoC lowered its interest rate to 0.75% from 1.0%.

The New Zealand dollar traded lower against the U.S. dollar. In the overnight trading session, the kiwi traded lower against the greenback despite the solid Business NZ performance of manufacturing index (PMI). The Business NZ performance of manufacturing index (PMI) rose to 57.7 in December from 55.6 in November. November's figure was revised up from 55.2.

The Australian dollar traded lower against the U.S. dollar. In the overnight trading session, the Aussie traded lower against the greenback after the weak economic data from Australia. The Melbourne Institute's consumer inflation expectations for Australia decreased to 3.2% in January from 3.4% in December.

Australia's new home sales climbed 2.2% in November, after a 3.0% gain in October.

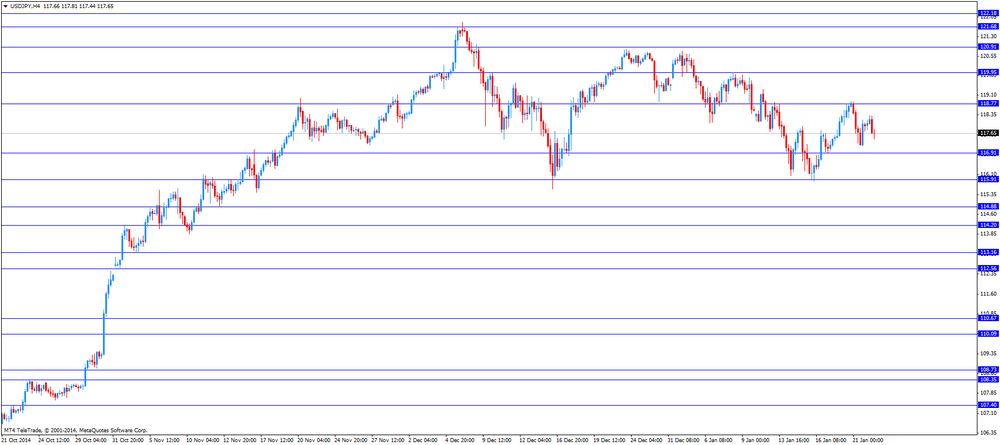

The Japanese yen traded lower against the U.S. dollar. In the overnight trading session, the yen traded lower against the greenback. The Bank of Japan (BoJ) released its monthly economic report on Thursday. The BoJ said that Japanese consumer inflation will slow further due to falling oil prices.

-

17:08

Denmark’s central bank lowered its interest rate after the ECB’s further stimulus decision

Denmark's central bank cut the certificate of deposit rate to a record low of -0.35%, down from -0.2%. That was the second interest rate reduction in four days. The central bank wants to ward off further appreciation of the krone.

The cut came after the European Central Bank announced an asset purchases programme of 60 billion euros a month.

The central bank said that it has intervened before the cut.

The Danish krone is pegged to the euro.

-

17:00

U.S.: Crude Oil Inventories, January +10.1

-

16:43

European Central Bank President Mario Draghi: the central bank will launch an expanded asset purchase programme of 60 billion euro a month

The European Central Bank (ECB) President Mario Draghi said at the press conference on Thursday that the central bank will launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016. In aggregate, the asset purchasing programme will be over 1.1 trillion euro.

Analysts had expected the ECB president to announce an asset purchase programme of 50 billion euro a month.

Draghi pointed out that "some additional eligibility criteria will be applied in the case of countries under an EU/IMF adjustment program".

Main comments by the ECB president:

- purchases of securities of European institutions will be subject to loss sharing;

- 20% of additional purchases will be subject to risk sharing;

- the pricing of the six remaining targeted longer-term refinancing operations (TLTROs) will be changed;

- falling oil prices weighed on inflation, the possible negative impact "on wage and price-setting has increased and could adversely affect medium-term price developments";

- today's decision is expected to "strengthen demand, increase capacity utilisation and support money and credit growth, and thereby contribute to a return of inflation rates towards 2%";

- "the determined implementation of product and labour market reforms as well as actions to improve the business environment for firms needs to gain momentum in several countries";

- "fiscal policies should support the economic recovery".

- purchases of securities of European institutions will be subject to loss sharing;

-

16:00

Eurozone: Consumer Confidence, January -8.5 (forecast -10.5)

-

15:21

Public sector net borrowing in the U.K. climbed to £13.1 billion in December

The Office for National Statistics released public sector net borrowing for the U.K. on Thursday. The public sector net borrowing in the U.K. rose to £13.1 billion in December from £10.3 billion a year earlier, missing expectations for a decline to £9.2 billion.

The increase was driven by a £2.9bn payment to the European Commission budget.

-

15:02

U.S.: Housing Price Index, y/y, November +5.3%

-

15:01

U.S.: Housing Price Index, m/m, November +0.8% (forecast +0.4%)

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1400(E646mn), $1.1500(E400mn), $1.1575(E435mn), $1.1600(E1.1bn), $1.1625(E301mn), $1.1700(E639mn), 1.1750(E419mn), $1.1800(E311mn), $1.1900(E521mn)

EUR/JPY: Y138.00(E238mn)

GBP/USD: $1.5300(stg201mn)

USD/CHF: Chf0.9150($500mn), Chf0.9300($420mn)

AUD/USD: $0.8015(A$727mn), $0.8035(A$378mn)

NZD/USD: $0.7875-85(NZ$1.2bn)

-

14:30

U.S.: Initial Jobless Claims, January 307 (forecast 301)

-

14:00

Orders

EUR/USD

Offers $1.1710, $1.1700, $1.180

Bids $1.1540, $1.1500/490, $1.1450, $1.1400

GBP/USD

Offers $1.5320, $1.5265, $1.5230/35

Bids $1.5055, $1.5030, $1.5000

AUD/USD

Offers $0.8390/00, $0.8350, $0.8300, $0.8230, $0.8155

Bids $0.8055, $0.8030, $0.8000

EUR/JPY

Offers Y139.00, Y137.90/00, Y137.65

Bids Y135.50, Y135.00, Y134.50

USD/JPY

Offers Y119.95, Y119.00, Y118.85

Bids Y116.90, Y116.50, Y116.20/00, Y115.85

EUR/GBP

Offers stg0.7800, stg0.7745, stg0.7715

Bids stg0.7600, stg0.7500

-

14:00

Foreign exchange market. European session: the euro traded higher against the U.S. dollar ahead of the European Central Bank's press conference

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

00:00 Australia HIA New Home Sales, m/m November +3.0% +2.2%

00:30 Australia Consumer Inflation Expectation January +3.4% +3.2%

05:00 Japan BoJ monthly economic report

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom PSNB, bln December 10.3 Revised From 13.4 9.2 13.1

11:00 United Kingdom CBI industrial order books balance January 5 6 4

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05% 0.05%

The U.S. dollar traded lower against the most major currencies ahead of the number of initial jobless claims from the U.S. The number of initial jobless claims in the U.S. is expected to decline by 15,000 to 301,000.

The euro traded higher against the U.S. dollar ahead of the European Central Bank's (ECB) press conference. Analysts expect that the ECB President Mario Draghi will announce a 550 billion-euro bond-buying programme.

The ECB released its interest decision today. The central bank kept its interest rate unchanged at 0.05%.

The British pound rose against the U.S. dollar despite the weaker-than-expected economic data from the U.K. The public sector net borrowing in the U.K. rose to £13.1 billion in December from £10.3 billion a year earlier, missing expectations for a decline to £9.2 billion.

The CBI industrial order books balance fell to +4% in January from +5% in December. Analysts expected the CBI industrial order books balance to remain unchanged at +5%.

British factories expect a decline in exports orders in the next three months, the CBI said.

The Canadian dollar traded higher against the U.S. dollar. The loonie dropped against the greenback yesterday as the Bank of Canada cut its interest rate. The BoC lowered its interest rate to 0.75% from 1.0%.

EUR/USD: the currency pair rose to $1.1651

GBP/USD: the currency pair increased to $1.5211

USD/JPY: the currency pair fell to $117.44

The most important news that are expected (GMT0):

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims January 316 301

-

13:45

Eurozone: ECB Interest Rate Decision, 0.05% (forecast 0.05%)

-

13:27

CBI industrial order books balance fell to +4% in January

The Confederation of British Industry (CBI) released its industrial order books balance on Thursday. The CBI industrial order books balance fell to +4% in January from +5% in December.

Analysts expected the CBI industrial order books balance to remain unchanged at +5%.

British factories expect a decline in exports orders in the next three months, the CBI said.

The CBI's director for economics Rain Newton-Smith said that British manufacturers are on the right track.

-

12:00

United Kingdom: CBI industrial order books balance, January 4 (forecast 6)

-

11:30

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1400(E646mn), $1.1500(E400mn), $1.1575(E435mn), $1.1600(E1.1bn), $1.1625(E301mn), $1.1700(E639mn), 1.1750(E419mn), $1.1800(E311mn), $1.1900(E521mn)

EUR/JPY: Y138.00(E238mn)

GBP/USD: $1.5300(stg201mn)

USD/CHF: Chf0.9150($500mn), Chf0.9300($420mn)

AUD/USD: $0.8015(A$727mn), $0.8035(A$378mn)

NZD/USD: $0.7875-85(NZ$1.2bn)

-

10:30

United Kingdom: PSNB, bln, December 13.1 (forecast 9.2)

-

10:20

Press Review: D-Day for euro as market awaits ECB quantitative easing

BLOOMBERG

Don't Worry About China Slowdown, Premier Li Tells Davos

China will avoid a hard landing and is focused on ensuring long-term medium-to-fast growth, Premier Li Keqiang told global leaders in Davos.

While the economy will still face large downward pressures in 2015, China won't have systemic financial risks and will seek to improve the quality of growth to ensure an "appropriate" pace of expansion, Li said Wednesday in a speech at the World Economic Forum in the Swiss ski town.

A few hours earlier, the central bank governor said on a panel that a slower expansion is "good news" if it's more sustainable. The comments and the first reverse-repurchase agreements in a year on Thursday follow data this week showing 7.4 economic percent growth for 2014, the slowest in 24 years and the first failure to meet government targets this century.

REUTERS

D-Day for euro as market awaits ECB quantitative easing(Reuters) - The euro held fast more than a cent above 11-year lows ahead of a European Central Bank policy meeting on Thursday widely expected to embark on the outright money-printing the bank has steadfastly avoided, in contrast to its peers.

Traders and strategists at the major banks say an extended monthly bond-buying program, outlined by Reuters and other news services on Wednesday, is fully priced-in to the euro.

That argues for a clearing out of many of the bets on the euro weakening against the dollar that have made money for investors over the past six months and the single currency rose almost a cent on Wednesday.

Source: http://www.reuters.com/article/2015/01/22/us-markets-forex-idUSKBN0KT2KA20150122

BLOOMBERG

IMF Says Gulf States Set to Swing Into Deficit as Oil Falls

The oil-rich nations of the Persian Gulf are set to post budget deficits this year after a plunge in crude prices, the International Monetary Fund said.

The six nations of the Gulf Cooperation Council will have a collective fiscal gap of 6.3 percent of gross domestic product, a swing of about 11 percentage points from last year's surplus, the IMF said in a report published in Washington on Wednesday. While many nations have enough savings to avoid steep cuts and "limit the drag on growth," they will need to adjust spending plans in the longer term, it said.

The IMF cut its 2015 growth forecast for the Middle East's oil exporters to 3 percent from the 3.9 percent it projected in October. It kept the prediction for the region's oil importers at 3.9 percent, saying that worse-than-expected demand in export markets in the Gulf and Europe will offset any benefits from cheaper energy.

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers during the Asian ahead of ECB

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

00:00 Australia HIA New Home Sales, m/m November +3.0% +2.2%

00:30 Australia Consumer Inflation Expectation January +3.4% +3.2%

05:00 Japan BoJ monthly economic report

The U.S. dollar traded broadly stronger against its major peers during the Asian session. The euro is trading near 11-year lows ahead of the ECB-meeting today where the large-scale bond-buying program will be discussed. According to insiders the ECB Executive Board has proposed to purchase 50 billion euros in assets a month through the end of 2016 not starting before the 1st of March. The ECB interest Rate Decision is scheduled for 12:45 GMT, the press conference at 13:30.

Market participants are also looking forward to data on U.S. Initial jobless Claims, the House Price index and Consumer Confidence.

The Australian dollar traded weaker against the greenback. New Home Sales for November rose at a slower pace by +2.2% compared to +3.0% in September. The consumer Inflation Expectation was below estimates with a reading of +3.2% in January compared to +3.4% in the previous month.

New Zealand's dollar continued its fall and traded at the weakest since 2012 against the greenback currently trading at USD0.7517. Both, the New Zealand and the Australian dollar were under pressure as the Bank of Canada unexpectedly cut benchmark interest rates from 1% to 0.75% as a reaction to falling oil prices and its negative impact on inflation, fuelling expectations that the south pacific central banks will also have to cut rates.

The Japanese yen traded lower against the greenback after surging the previous day when the Bank of Japan held off on further expanding its massive stimulus program and kept the monetary base target unchanged. Volatile trading was partly a result of China's central bank's move to add liquidity to the market and the upcoming ECB policy meeting today.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded stroger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom PSNB, bln December 13.4 9.2

11:00 United Kingdom CBI industrial order books balance January 5 6

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims January 316 301

14:00 U.S. Housing Price Index, m/m November +0.6% +0.4%

14:00 U.S. Housing Price Index, y/y November +4.5%

15:00 Eurozone Consumer Confidence January -11.5 -10.5

16:00 U.S. Crude Oil Inventories January +5.4

-

07:28

Options levels on thursday, January 22, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1804 (1562)

$1.1750 (1255)

$1.1689 (127)

Price at time of writing this review: $1.1587

Support levels (open interest**, contracts):

$1.1512 (1806)

$1.1447 (5728)

$1.1390 (5093)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 63799 contracts, with the maximum number of contracts with strike price $1,2100 (7862);

- Overall open interest on the PUT options with the expiration date February, 6 is 69593 contracts, with the maximum number of contracts with strike price $1,1700 (6720);

- The ratio of PUT/CALL was 1.11 versus 1.14 from the previous trading day according to data from January, 21

GBP/USD

Resistance levels (open interest**, contracts)

$1.5402 (475)

$1.5304 (421)

$1.5207 (864)

Price at time of writing this review: $1.5129

Support levels (open interest**, contracts):

$1.5090 (1597)

$1.4993 (907)

$1.4896 (1359)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15700 contracts, with the maximum number of contracts with strike price $1,5800 (1105);

- Overall open interest on the PUT options with the expiration date February, 6 is 16516 contracts, with the maximum number of contracts with strike price $1,5100 (1597);

- The ratio of PUT/CALL was 1.05 versus 1.06 from the previous trading day according to data from January, 21

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

01:07

Australia: HIA New Home Sales, m/m, November +2.2%

-

01:03

Australia: Consumer Inflation Expectation, January +3.2%

-

00:30

Currencies. Daily history for Jan 21’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $ 1,1609 +0,53%

GBP/USD $1,5141 -0,02%

USD/CHF Chf0,8597 -1,84%

USD/JPY Y117,95 -0,72%

EUR/JPY Y136,94 -0,20%

GBP/JPY Y178,58 -0,74%

AUD/USD $0,8083 -1,08%

NZD/USD $0,7551 -1,15%

USD/CAD C$1,2338 +1,84%

-

00:01

Schedule for today, Thursday, Jan 22’2015:

(time / country / index / period / previous value / forecast)

00:00 Australia HIA New Home Sales, m/m November +3.0%

00:30 Australia Consumer Inflation Expectation January +3.4%

05:00 Japan BoJ monthly economic report

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom PSNB, bln December 13.4 9.2

11:00 United Kingdom CBI industrial order books balance January 5 6

12:45 Eurozone ECB Interest Rate Decision 0.05% 0.05%

13:30 Eurozone ECB Press Conference

13:30 U.S. Initial Jobless Claims January 316 301

14:00 U.S. Housing Price Index, m/m November +0.6% +0.4%

14:00 U.S. Housing Price Index, y/y November +4.5%

15:00 Eurozone Consumer Confidence January -11.5 -10.5

16:00 U.S. Crude Oil Inventories January +5.4

-