Noticias del mercado

-

17:43

Foreign exchange market. American session: the Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data

The U.S. dollar traded mixed against the most major currencies after the weaker-than-expected U.S. economic data. Sales of existing homes climbed 2.4% to a seasonally adjusted annual rate of 5.04 million in December from 4.92 million in November. November's figure was revised down from 4.93 million units. Analysts had expected an increase to 5.08 million units.

The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in January from 53.9 in December, missing expectations for a rise to 54.1. The decline was driven by slower new business growth.

The Conference Board's leading economic index for the U.S. climbed by 0.5% in December, in line with expectations, after a 0.4% increase in November. November's figure was revised down from a 0.6% gain.

The euro traded higher against the U.S. dollar. The European Central Bank's decision to expand its asset purchase programme to 60 billion euro a month starting from March 2015 until September 2016 still weighed on the euro.

Eurozone's preliminary manufacturing PMI increased to 51.0 in January from 50.6 in November, in line with expectations.

Eurozone's preliminary services PMI rose to 52.3 in January from 51.6 in December. Analysts had expected the index to climb to 52.1.

Germany's preliminary manufacturing PMI decreased to 51.0 in January from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 52.7 in January from 52.1 in December, beating expectations for a gain to 52.6.

France's preliminary manufacturing PMI rose to 49.5 in January from 47.5 in December, exceeding forecasts of a rise to 48.1.

France's preliminary services PMI fell to 49.5 in January from 50.6 in December, missing expectations for a gain to 50.9.

The British pound traded higher against the U.S. dollar. Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

The Canadian dollar traded mixed against the U.S. dollar after the mixed Canadian economic data. Canadian consumer price inflation decreased 0.7% in December, missing expectations for a 0.5% decline, after a 0.4% drop in November.

On a yearly basis, the consumer price index fell to 1.5% December from 2.0% in November, in line with expectations. That was the lowest level since March 2014.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.3% in December, in line with expectations, after a 0.2% decrease in November.

On a yearly basis, core consumer price index in Canada climbed to 2.2% in December from 2.1% in November. Analysts had expected the index to remain unchanged at 2.1%.

Canadian retail sales increased by 0.4% in November, beating expectations for a 0.1% gain, after a flat reading in October.

The increase was driven by promotions such as Black Friday and cold weather. M clothing and clothing accessories sales rose 5.2% in November, while electronic and appliance stores sales gained 4.6%.

The loonie dropped against the greenback on Wednesday as the Bank of Canada (BoC) cut its interest rate. The BoC lowered its interest rate to 0.75% from 1.0%.

The New Zealand dollar traded higher against the U.S. dollar in the absence of any major economic reports from New Zealand. In the overnight trading session, the kiwi traded mixed against the greenback as falling commodity prices weighed on the kiwi.

The better-than-expected Chinese preliminary manufacturing PMI supported the kiwi. Chinese preliminary manufacturing PMI increased to 49.8 in January from 49.6 in December, exceeding expectations for a decline to 49.5.

The Australian dollar traded lower against the U.S. dollar in the absence of any major economic reports from Australia. In the overnight trading session, the Aussie traded lower against the greenback due to falling commodity prices.

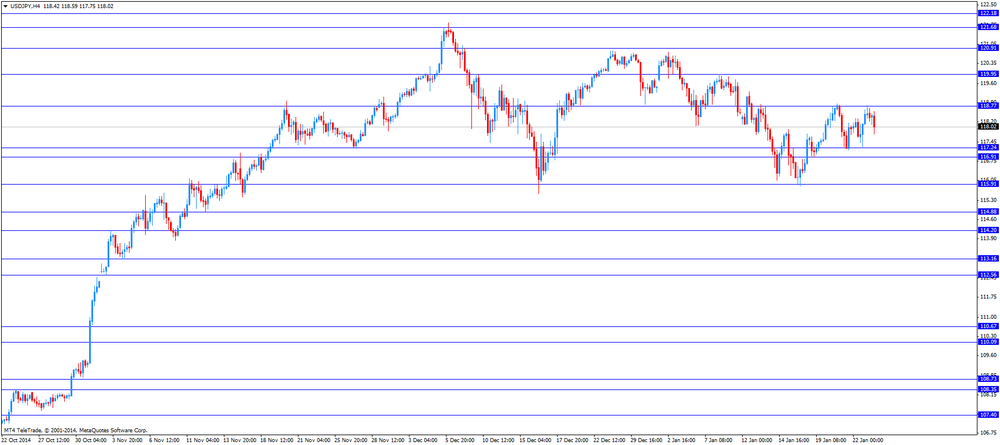

The Japanese yen traded higher against the U.S. dollar. In the overnight trading session, the yen traded higher against the greenback. Japan's preliminary manufacturing PMI increased to 52.1 in January from 52.0 in December.

-

17:28

U.S. leading economic index increased 0.5% in December

The Conference Board released its leading economic index for the U.S. on Friday. The leading economic index climbed by 0.5% in December, in line with expectations, after a 0.4% increase in November.

November's figure was revised down from a 0.6% gain.

The Conference Board economist Ataman Ozyildirim said that the increase of the index was driven by a majority of its components. He added that "a lack of growth in residential construction and average weekly hours in manufacturing remains a concern".

-

17:04

U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in January

Markit Economics released its preliminary manufacturing purchasing managers' index (PMI) for the U.S. on Friday. The U.S. preliminary manufacturing purchasing managers' index (PMI) fell to 53.7 in January from 53.9 in December, missing expectations for a rise to 54.1.

A reading above 50 indicates expansion in economic activity.

The decline was driven by slower new business growth.

The Markit Chief Economist Chris Williamson said that the pace of expansion is slowing.

-

16:55

U.S. existing homes sales rose 2.4% in December

The National Association of Realtors released existing homes sales figures in the U.S. on Friday. Sales of existing homes climbed 2.4% to a seasonally adjusted annual rate of 5.04 million in December from 4.92 million in November.

November's figure was revised down from 4.93 million units.

Analysts had expected an increase to 5.08 million units.

For all of 2014, sales of existing home dropped to 4.93 million sales, a 3.1% decline from 2013, according to the National Association of Realtors (NAR). That was the first drop since 2010.

The NAR chief economist Lawrence Yun said that he expects sales to rebound in 2015.

The share of first-time buyers dropped in 2014.

-

16:08

Canadian consumer price inflation dropped 0.7% in December

Statistics Canada released consumer price inflation data on Friday. Canadian consumer price inflation decreased 0.7% in December, missing expectations for a 0.5% decline, after a 0.4% drop in November.

On a yearly basis, the consumer price index fell to 1.5% December from 2.0% in November, in line with expectations. That was the lowest level since March 2014.

The consumer price index was driven by lower gasoline prices.

Canadian core consumer price index, which excludes some volatile goods, decreased 0.3% in December, in line with expectations, after a 0.2% decrease in November.

On a yearly basis, core consumer price index in Canada climbed to 2.2% in December from 2.1% in November. Analysts had expected the index to remain unchanged at 2.1%.

The Bank of Canada's inflation target is 2.0%.

The Bank of Canada (BoC) lowered its interest rate to 0.75% from 1.0% on Wednesday. Falling oil price was the main reason behind the interest rate cut.

-

16:00

U.S.: Existing Home Sales , December 5.04 (forecast 5.08)

-

16:00

U.S.: Leading Indicators , December +0.5% (forecast +0.5%)

-

15:45

U.S.: Manufacturing PMI, January 53.7 (forecast 54.1)

-

15:44

Canadian retail sales rose by 0.4% in November

Statistics Canada released retail sales data on Friday. Canadian retail sales increased by 0.4% in November, beating expectations for a 0.1% gain, after a flat reading in October.

The increase was driven by promotions such as Black Friday and cold weather. M clothing and clothing accessories sales rose 5.2% in November, while electronic and appliance stores sales gained 4.6%.

Motor vehicles and parts dealers, food and beverage stores and gasoline stations sales fell slightly in November.

Canadian retail sales excluding automobiles increased 0.7% in November, exceeding expectations for a 0.5% rise, after a 0.1% gain in October. October's figure was revised down from a 0.2% increase.

-

15:00

Belgium: Business Climate, January -8.8 (forecast -6.1)

-

14:46

Option expiries for today's 10:00 ET NY cut

EUR/USD: $1.1400(E1.0bn), $1.1450 (E740mn), $1.1500 (E1.0bn), $1.1550(E2.2bn), $1.1600 (E1.1bn), $1.1650 (E822mn), $1.1700(E1.45bn)

USD/JPY: Y117.00($334mn), Y118.00($2.3bn), Y118.25($749mn), Y119.00($565mn)

GBP/USD: $1.5250(stg350mn)

EUR/GBP: Stg0.7500(E660mn), Stg0.7600(E270mn).

AUD/USD: $0.7900(A$456mn)

NZD/USD: $0.7500(N$500mn)

-

14:31

Canada: Consumer Price Index m / m, December -0.7% (forecast -0.5%)

-

14:31

Canada: Consumer price index, y/y, December +1.5% (forecast +1.5%)

-

14:31

Canada: Bank of Canada Consumer Price Index Core, y/y, December +2.2% (forecast +2.1%)

-

14:30

Canada: Retail Sales, m/m, November +0.4% (forecast +0.1%)

-

14:30

Canada: Bank of Canada Consumer Price Index Core, m/m, December -0.3% (forecast -0.3%)

-

14:30

Canada: Retail Sales ex Autos, m/m, November +0.7% (forecast +0.5%)

-

14:07

Foreign exchange market. European session: the British pound declined against the U.S. dollar despite the better-than-expected retail sales data from the U.K.

Economic calendar (GMT0):

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual)

01:35 Japan Manufacturing PMI (Preliminary) January 52.0 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) January 49.6 49.5 49.8

07:58 France Services PMI (Preliminary) January 50.6 50.9 49.5

07:58 France Manufacturing PMI (Preliminary) January 47.5 48.1 49.5

08:28 Germany Manufacturing PMI (Preliminary) January 51.2 51.8 51.0

08:28 Germany Services PMI (Preliminary) January 52.1 52.6 52.7

08:58 Eurozone Manufacturing PMI (Preliminary) January 50.6 51.0 51.0

08:58 Eurozone Services PMI (Preliminary) January 51.6 52.1 52.3

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December +1.6% -0.6% +0.4%

09:30 United Kingdom Retail Sales (YoY) December +6.4% +3.0% +4.3%

The U.S. dollar traded higher against the most major currencies ahead of the U.S. economic data. The U.S. preliminary manufacturing purchasing managers' index is expected to climbs to 54.1 in January from 53.9 in December.

The existing home sales in the U.S. are expected to increase to 5.08 million units in December from 4.93 million units in November.

The euro fell against the U.S. dollar as the European Central Bank's decision to expand its asset purchase programme to 60 billion euro a month starting from March 2015 until September 2016 still weighed on the euro.

Eurozone's preliminary manufacturing PMI increased to 51.0 in January from 50.6 in November, in line with expectations.

Eurozone's preliminary services PMI rose to 52.3 in January from 51.6 in December. Analysts had expected the index to climb to 52.1.

Germany's preliminary manufacturing PMI decreased to 51.0 in January from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 52.7 in January from 52.1 in December, beating expectations for a gain to 52.6.

France's preliminary manufacturing PMI rose to 49.5 in January from 47.5 in December, exceeding forecasts of a rise to 48.1.

France's preliminary services PMI fell to 49.5 in January from 50.6 in December, missing expectations for a gain to 50.9.

The British pound declined against the U.S. dollar despite the better-than-expected retail sales data from the U.K. Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

The Canadian dollar traded lower against the U.S. dollar ahead of the Canadian economic data. The consumer price index in Canada is expected to decline to an annual rate of 1.5% in December from 2.0% in November.

The core consumer price index in Canada is expected to remain unchanged at an annual rate of 2.1% in December.

Canadian retail sales are expected to increase 0.1% in November, after a flat reading in October.

Canadian retail sales excluding automobiles are expected to rise 0.5% in November, after a 0.2% rise in October.

The loonie dropped against the greenback on Wednesday as the Bank of Canada (BoC) cut its interest rate. The BoC lowered its interest rate to 0.75% from 1.0%.

EUR/USD: the currency pair fell to $1.1114

GBP/USD: the currency pair decreased to $1.4952

USD/JPY: the currency pair fell to $117.75

The most important news that are expected (GMT0):

13:30 Canada Retail Sales, m/m November 0.0% +0.1%

13:30 Canada Retail Sales ex Autos, m/m November +0.2% +0.5%

13:30 Canada Consumer Price Index m / m December -0.4% -0.5%

13:30 Canada Consumer price index, y/y December +2.0% +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m December -0.2% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December +2.1% +2.1%

14:45 U.S. Manufacturing PMI (Preliminary) January 53.9 54.1

15:00 U.S. Existing Home Sales December 4.93 5.08

-

14:00

Orders

EUR/USD

Offers $1.1710, $1.1700, $1.1680, $1.1500, $1.1460

Bids $1.1100, $1.1000

GBP/USD

Offers $1.5320, $1.5265, $1.5210, $1.5110/00, $1.5055

Bids $1.4970, $1.4900, $1.4810

AUD/USD

Offers $0.8350, $0.8300, $0.8230, $0.8135, $0.8100, $0.8030

Bids $0.7950, $0.7900

EUR/JPY

Offers Y139.00, Y137.90/00, Y137.65, Y136.60, Y135.00, Y134.00

Bids Y132.00, Y131.00

USD/JPY

Offers Y119.95, Y119.00, Y118.85

Bids Y117.65, Y116.90, Y116.50, Y116.20/00, Y115.85

EUR/GBP

Offers stg0.7800, stg0.7745, stg0.7715, stg0.7670, stg0.7600

Bids stg0.7400, stg0.7300

-

13:27

UK retail sales increased 0.4% in December

The Office for National Statistics released the retail sales data for the U.K. on Fridday. Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

Sales at department stores dropped 4.5% in December, the weakest performance since January 1996.

-

10:30

United Kingdom: Retail Sales (MoM), December +0.4% (forecast -0.6%)

-

10:30

United Kingdom: Retail Sales (YoY) , December +4.3% (forecast +3.0%)

-

10:15

Press Review: ECB’s Quantitative Easing Program Is Open-Ended, Visco Says

BLOOMBERG

ECB's Quantitative Easing Program Is Open-Ended, Visco Says

The European Central Bank's asset-purchase program will continue past September 2016 if it hasn't met its inflation objectives by then, Governing Council member Ignazio Visco said.

"We are open-ended," Visco said on Friday in an interview with Bloomberg Television's Francine Lacqua and Guy Johnson at the World Economic Forum in Davos, Switzerland. "If we see that there are difficulties in achieving this target that we have, we have to continue."

ECB President Mario Draghi pledged on Thursday to buy 60 billion euros ($68 billion) a month of assets including government bonds through September 2016, adding that buying will "in any case be conducted until we see a sustained adjustment in the path of inflation." The quantitative-easing package is designed to stave off a deflationary spiral in the 19-nation currency bloc by flooding the region with liquidity and pushing investors into riskier assets.

REUTERS

Swedish central bank should consider weakening currency: Borg(Reuters) - Sweden's central bank should consider steps to weaken the crown to keep the economy competitive after the European Central Bank launched substantial bond-buying on Thursday, former finance minister Anders Borg told Reuters.

Borg, in government until last year and now chair of the Global Financial System Initiative at the World Economic Forum, said the currency was arguably too strong for the good of the economyand the Riksbank had tools to act.

Source: http://www.reuters.com/article/2015/01/22/us-sweden-currency-borg-idUSKBN0KV2A420150122

BLOOMBERG

Oil Climbs as Saudi King's Death Spurs Policy Speculation

Oil rose after the death of King Abdullah of Saudi Arabia, the biggest producer in the Organization of Petroleum Exporting Countries.

Futures rallied as much as 3.1 percent inNew York and 2.6 percent in London after the Saudi royal court announced the death in a statement. Crown Prince Salman bin Abdulaziz will succeed Abdullah on the throne. The kingdom, the world's largest crude exporter, led OPEC's decision to maintain its oil-production quota at a meeting in November, exacerbating a global glut that's driven prices lower.

-

10:00

Eurozone: Manufacturing PMI, January 51.0 (forecast 51.0)

-

10:00

Eurozone: Services PMI, January 52.3 (forecast 52.1)

-

09:38

French and German Manufacturing / Service PMI mixed

While the French Services PMI for January was below expectations with a reading of 49.5 compared to 50.9 German Services PMI improved from 52.1 to 52.7 beating estimates by 0.1.

The Manufacturing PMI in France improved according to Markit Economics with a reading of 49.5, compared to forecasts of 48.1 and a previous reading of 47.5.Whereas Germany's Manufacturing PMI fell unexpectedly last month. The index declined from 51.2 to 51.0. Economists expected a reading of 51.8.

Markets now await data on Eurozone's PMI due at 09:58 GMT.

-

09:30

Germany: Manufacturing PMI, January 51.0 (forecast 51.8)

-

09:30

Germany: Services PMI, January 52.7 (forecast 52.6)

-

09:01

France: Manufacturing PMI, January 49.5 (forecast 48.1)

-

09:00

France: Services PMI, January 49.5 (forecast 50.9)

-

08:30

Foreign exchange market. Asian session: U.S. dollar traded broadly stronger against its major peers during the Asian

(Time/ Region/ Event/ Period/ Previous/ Forecast/ Actual

01:35 Japan Manufacturing PMI (Preliminary) January 52.0 52.1

01:45 China HSBC Manufacturing PMI (Preliminary) January 49.6 49.5 49.8

The U.S. dollar traded higher against the most major currencies despite the weaker-than-expected number of initial jobless claims from the U.S. The euro slumped against the greenback after the European Central Bank (ECB) President Mario Draghi said at the press conference yesterday that the central bank will launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The central bank kept its interest rate unchanged at 0.05%. The single currency is heading for a sixth weekly decline against the U.S. dollar with upcoming Greek elections this weekend with polls indicating a win of the anti-austerity party Syriza.

The Australian dollar extended losses against the greenback and trading below its lows established in May 2010 although Chinese data on the HSBC Manufacturing PMI picked up as stimulus measures seem having stabilized the world's second largest economy. Data showed a reading of 49.8 in January, beating forecasts of 49.5 and adding 0.2 to the previous month's reading. Still, numbers below 50 indicate contraction. China is Australia's most important trade partner.

New Zealand's dollar continued its fall and traded at the weakest since 2012 against the greenback currently trading at USD0.7486 closing in on lows hit in July 2012.

The Japanese yen traded slightly higher against the greenback after the BoJ left its economic stimulus program unchanged earlier this week but lowered the consumer inflation outlook for 2015 due to falling oil prices. The Japanese preliminary Manufacturing PMI improved from a reading of 52.0 in December to 52.1 in January.

EUR/USD: the euro traded lower against the greenback

USD/JPY: the U.S. dollar traded stronger against the yen

GPB/USD: The British pound traded weaker against the U.S. dollar

The most important news that are expected (GMT0):

(time / country / index / period / previous value / forecast)

07:58 France Services PMI (Preliminary) January 50.6 50.9

07:58 France Manufacturing PMI (Preliminary) January 47.5 48.1

08:28 Germany Manufacturing PMI (Preliminary) January 51.2 51.8

08:28 Germany Services PMI (Preliminary) January 52.1 52.6

08:58 Eurozone Manufacturing PMI (Preliminary) January 50.6 51.0

08:58 Eurozone Services PMI (Preliminary) January 51.6 52.1

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December +1.6% -0.6%

09:30 United Kingdom Retail Sales (YoY) December +6.4% +3.0%

13:30 Canada Retail Sales, m/m November 0.0% +0.1%

13:30 Canada Retail Sales ex Autos, m/m November +0.2% +0.5%

13:30 Canada Consumer Price Index m / m December -0.4% -0.5%

13:30 Canada Consumer price index, y/y December +2.0% +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m December -0.2% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December +2.1% +2.1%

14:00 Belgium Business Climate January -6.9 -6.1

14:45 U.S. Manufacturing PMI (Preliminary) January 53.9 54.1

15:00 U.S. Leading Indicators December +0.6% +0.5%

15:00 U.S. Existing Home Sales December 4.93 5.08

-

07:27

Options levels on friday, January 23, 2015:

EUR / USD

Resistance levels (open interest**, contracts)

$1.1640 (1660)

$1.1570 (787)

$1.1513 (181)

Price at time of writing this review: $1.1328

Support levels (open interest**, contracts):

$1.1293 (2247)

$1.1270 (4958)

$1.1244 (1026)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 65584 contracts, with the maximum number of contracts with strike price $1,2100 (6673);

- Overall open interest on the PUT options with the expiration date February, 6 is 71401 contracts, with the maximum number of contracts with strike price $1,1700 (6720);

- The ratio of PUT/CALL was 1.09 versus 1.11 from the previous trading day according to data from January, 22

GBP/USD

Resistance levels (open interest**, contracts)

$1.5302 (435)

$1.5204 (870)

$1.5107 (254)

Price at time of writing this review: $1.4991

Support levels (open interest**, contracts):

$1.4893 (1363)

$1.4796 (1191)

$1.4698 (233)

Comments:

- Overall open interest on the CALL options with the expiration date February, 6 is 15908 contracts, with the maximum number of contracts with strike price $1,5600 (1117);

- Overall open interest on the PUT options with the expiration date February, 6 is 16703 contracts, with the maximum number of contracts with strike price $1,5100 (1596);

- The ratio of PUT/CALL was 1.05 versus 1.05 from the previous trading day according to data from January, 22

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

02:45

China: HSBC Manufacturing PMI, January 49.8 (forecast 49.5)

-

02:35

Japan: Manufacturing PMI, January 52.1

-

00:32

Currencies. Daily history for Jan 22’2015:

(pare/closed(GMT +2)/change, %)

EUR/USD $1,1364 -2,16%

GBP/USD $1,5009 -0,88%

USD/CHF Chf0,8709 +1,29%

USD/JPY Y118,48 +0,45%

EUR/JPY Y134,65 -1,70%

GBP/JPY Y177,82 -0,43%

AUD/USD $0,8025 -0,72%

NZD/USD $0,7502 -0,65%

USD/CAD C$1,2379 +0,33%

-

00:01

Schedule for today, Friday, Jan 23’2015:

(time / country / index / period / previous value / forecast)

01:35 Japan Manufacturing PMI (Preliminary) January 52.0

01:45 China HSBC Manufacturing PMI (Preliminary) January 49.6 49.5

07:58 France Services PMI (Preliminary) January 50.6 50.9

07:58 France Manufacturing PMI (Preliminary) January 47.5 48.1

08:28 Germany Manufacturing PMI (Preliminary) January 51.2 51.8

08:28 Germany Services PMI (Preliminary) January 52.1 52.6

08:58 Eurozone Manufacturing PMI (Preliminary) January 50.6 51.0

08:58 Eurozone Services PMI (Preliminary) January 51.6 52.1

09:00 Switzerland World Economic Forum Annual Meetings

09:30 United Kingdom Retail Sales (MoM) December +1.6% -0.6%

09:30 United Kingdom Retail Sales (YoY) December +6.4% +3.0%

13:30 Canada Retail Sales, m/m November 0.0% +0.1%

13:30 Canada Retail Sales ex Autos, m/m November +0.2% +0.5%

13:30 Canada Consumer Price Index m / m December -0.4% -0.5%

13:30 Canada Consumer price index, y/y December +2.0% +1.5%

13:30 Canada Bank of Canada Consumer Price Index Core, m/m December -0.2% -0.3%

13:30 Canada Bank of Canada Consumer Price Index Core, y/y December +2.1% +2.1%

14:00 Belgium Business Climate January -6.9 -6.1

14:45 U.S. Manufacturing PMI (Preliminary) January 53.9 54.1

15:00 U.S. Leading Indicators December +0.6% +0.5%

15:00 U.S. Existing Home Sales December 4.93 5.08

-