Noticias del mercado

-

21:00

Dow 17,739.77 -74.21 -0.42%, Nasdaq 4,759.85 +9.45 +0.20%, S&P 500 2,056.85 -6.30 -0.31%

-

18:00

European stocks closed: FTSE 100 6,826.72 +30.09 +0.44%, CAC 40 4,643.27 +90.47 +1.99%, DAX 10,655.92 +220.30 +2.11%

-

18:00

European stocks close: stocks closed higher, the announcement of ECB’s further stimulus measures still supports

Stock indices traded higher. The announcement of ECB's further stimulus measures still supports The European Central Bank (ECB) President Mario Draghi said at the press conference yesterday that the central bank will launch an expanded asset purchase programme of 60 billion euro a month starting from March 2015 until September 2016.

The central bank kept its interest rate unchanged at 0.05%.

Eurozone's preliminary manufacturing PMI increased to 51.0 in January from 50.6 in November, in line with expectations.

Eurozone's preliminary services PMI rose to 52.3 in January from 51.6 in December. Analysts had expected the index to climb to 52.1.

Germany's preliminary manufacturing PMI decreased to 51.0 in January from 51.2 in December, missing forecasts of an increase to 51.8.

Germany's preliminary services PMI increased to 52.7 in January from 52.1 in December, beating expectations for a gain to 52.6.

France's preliminary manufacturing PMI rose to 49.5 in January from 47.5 in December, exceeding forecasts of a rise to 48.1.

France's preliminary services PMI fell to 49.5 in January from 50.6 in December, missing expectations for a gain to 50.9.

Retail sales in the U.K. increased 0.4% in December, exceeding expectations for a 0.6% drop, after a 1.6% gain in November.

The increase was driven by lower petrol prices and higher demand in food.

On a yearly basis, retail sales in the U.K. climbed 4.3% in December, beating expectations for a 3.0% rise, after a 6.4% increase in November.

Indexes on the close:

Name Price Change Change %

FTSE 100 6,832.83 +36.20 +0.53%

DAX 10,649.58 +213.96 +2.05%

CAC 40 4,640.69 +87.89 +1.93%

-

15:36

U.S. Stocks open: Dow -0.20%, Nasdaq -0.06%, S&P -0.21%

-

15:29

Before the bell: S&P futures -0.13%, Nasdaq futures -0.06%

U.S. stock-index futures fluctuated as weaker-than-forecast results from United Parcel Service Inc. offset confidence that central banks will support global growth.

Global markets:

Nikkei 17,511.75 +182.73 +1.05%

Hang Seng 24,850.45 +327.82 +1.34%

Shanghai Composite 3,353.29 +9.95 +0.30%

FTSE 6,808.12 +11.49 +0.17%

CAC 4,628.44 +75.64 +1.66%

DAX 10,621.27 +185.65 +1.78%

Crude oil $46.15 (-0.35%)

Gold $1298.00 (-0.21%)

-

15:16

Stocks before the bell

(company / ticker / price / change, % / volume)

Deere & Company, NYSE

DE

89.99

+0.54%

0.2K

Yandex N.V., NASDAQ

YNDX

17.60

+0.80%

13.2K

Nike

NKE

96.67

+0.86%

2.4K

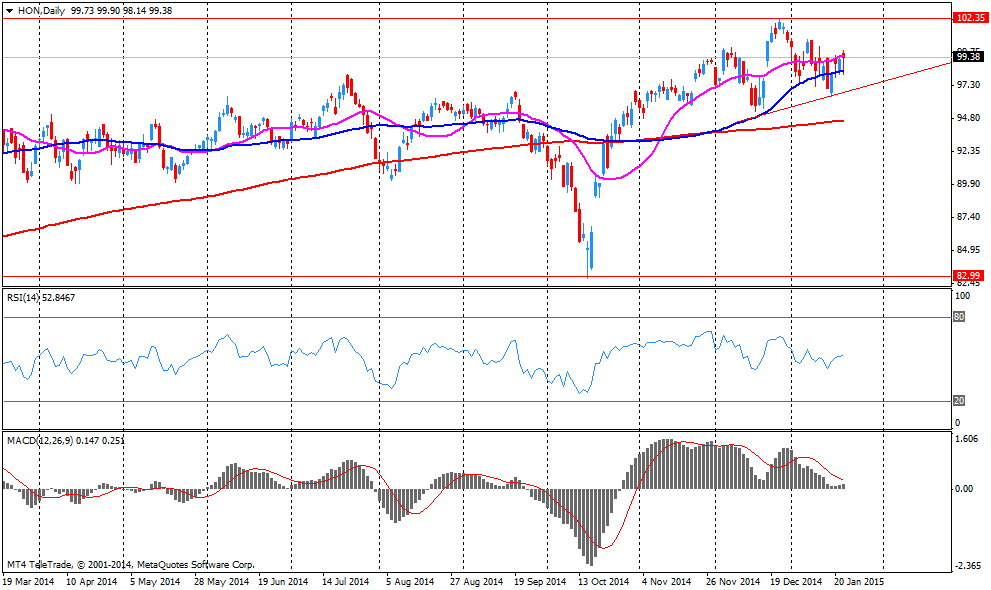

HONEYWELL INTERNATIONAL INC.

HON

101.00

+1.62%

16.0K

Starbucks Corporation, NASDAQ

SBUX

86.60

+4.67%

109.3K

International Business Machines Co...

IBM

155.39

0.00%

0.9K

General Motors Company, NYSE

GM

33.82

0.00%

0.6K

Citigroup Inc., NYSE

C

49.55

-0.04%

1.7K

International Paper Company

IP

55.16

-0.04%

0.4K

JPMorgan Chase and Co

JPM

57.55

-0.07%

1.0K

Hewlett-Packard Co.

HPQ

40.03

-0.07%

0.8K

Boeing Co

BA

135.50

-0.10%

4.8K

Walt Disney Co

DIS

95.03

-0.13%

1.8K

Procter & Gamble Co

PG

91.49

-0.14%

9.8K

Cisco Systems Inc

CSCO

28.45

-0.18%

10.7K

Apple Inc.

AAPL

112.18

-0.20%

302.2K

Pfizer Inc

PFE

32.74

-0.21%

2.7K

Ford Motor Co.

F

14.99

-0.27%

26.2K

Facebook, Inc.

FB

77.44

-0.27%

65.6K

Wal-Mart Stores Inc

WMT

88.01

-0.33%

10.4K

Amazon.com Inc., NASDAQ

AMZN

309.30

-0.33%

5.7K

Travelers Companies Inc

TRV

107.79

-0.35%

0.7K

Caterpillar Inc

CAT

86.50

-0.37%

1.2K

Tesla Motors, Inc., NASDAQ

TSLA

200.85

-0.38%

8.8K

Verizon Communications Inc

VZ

47.55

-0.52%

8.5K

Johnson & Johnson

JNJ

103.18

-0.56%

3.7K

Chevron Corp

CVX

108.30

-0.57%

6.8K

AT&T Inc

T

33.58

-0.62%

3.3K

Exxon Mobil Corp

XOM

92.06

-0.87%

40.6K

ALCOA INC.

AA

15.90

-0.87%

5.2K

Barrick Gold Corporation, NYSE

ABX

12.63

-1.25%

8.9K

Freeport-McMoRan Copper & Gold Inc., NYSE

FCX

19.66

-1.80%

12.1K

FedEx Corporation, NYSE

FDX

177.00

-2.43%

0.2K

-

15:13

Upgrades and downgrades before the market open

Upgrades:

Downgrades:

Exxon Mobil (XOM) downgraded from Neutral to Underperform at Credit Suisse

Chevron (CVX) downgraded from Outperform to Neutral at Credit Suisse

Other:

Starbucks (SBUX) target raised from $88 to $94 at RBC Capital Mkts, from $93 to $101 at Telsey Advisory Group, from $86 to $95 at Oppenheimer

Amazon.com (AMZN) target raised from $372 to $396 at Oppenheimer

Visa (V) target raised from $250 to $290 at Oppenheimer

-

15:04

Company News: Honeywell International Inc (HON) reported better than expected fourth quarter profits

Honeywell International Inc (HON) earned $1.43 per share in the fourth quarter, beating analysts' estimate of $1.42. Revenue in the fourth quarter decreased 1.2% year-over-year to $10.27 billion, but beating analysts' estimate of $10.17 billion.

The company reaffirmed its forecasts for 2015. EPS is expected to be $5.95-$6.15 (analysts' estimate: $6.11), while revenue is expected to be $40.5-$41.1 billion in 2015 (analysts' estimate: $41.12 billion).

Honeywell International Inc (HON) shares rose to $101.00 (+1.62%) prior to the opening bell.

-

14:53

Company News: General Electric (GE) reported better than expected fourth quarter earnings, but revenue missed forecasts

General Electric (GE) earned $0.56 per share in the fourth quarter, beating analysts' estimate of $0.55. Revenue in the fourth quarter increased 4.0% year-over-year to $42.00 billion, missing analysts' estimate of $42.16 billion.

General Electric (GE) shares decreased to $24.26 (-0.08%) prior to the opening bell.

-

14:48

Company News: McDonald's (MCD) reported weaker than expected fourth quarter profits

McDonald's (MCD) earned $1.22 per share in the fourth quarter, missing analysts' estimate of $1.23. Revenue in the fourth quarter dropped 7.3% year-over-year to $6.57 billion, missing analysts' estimate of $6.70 billion.

Company's global comparable sales fell 0.9% (company's estimate: -1.5%).

McDonald's (MCD) shares increased to $92.10 (+1.33%) prior to the opening bell.

-

13:00

European stock markets mid-session: Indices continue to rally after ECB stimulus

European indices continue to rally after the ECB unveiled a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The central bank kept its interest rate unchanged at 0.05%. Banks and cyclical stocks were among the best performers. A weaker euro is broadly seen as major boost to exports.

Although markets are supported by the ECB's unprecedented stimulus concerns over the outcome and the consequences of the Greek elections on January 25th are still weighing as the next Greek government will have to decide whether to extend the international bailout or not. The anti-austerity party Syriza leads in polls by almost 5%.

While the French Services PMI for January was below expectations with a reading of 49.5 compared to 50.9 German Services PMI improved from 52.1 to 52.7 beating estimates by 0.1.

The Manufacturing PMI in France improved according to Markit Economics with a reading of 49.5, compared to forecasts of 48.1 and a previous reading of 47.5.Whereas Germany's Manufacturing PMI fell unexpectedly last month. The index declined from 51.2 to 51.0. Economists expected a reading of 51.8.

Eurozone's PMI Services beat expectations by 0.1 points with a reading of 52.7. Manufacturing PMI was in line with forecasts at 51.0.

In today's session the FTSE 100 index is trading +0.16% quoted at 6,807.79. France's CAC 40 added +1.95% trading at 4,641.39. Germany's DAX 30 is currently trading +1.48% at 10,590.15 points, a new all-time high.

-

10:15

Press Review: ECB’s Quantitative Easing Program Is Open-Ended, Visco Says

BLOOMBERG

ECB's Quantitative Easing Program Is Open-Ended, Visco Says

The European Central Bank's asset-purchase program will continue past September 2016 if it hasn't met its inflation objectives by then, Governing Council member Ignazio Visco said.

"We are open-ended," Visco said on Friday in an interview with Bloomberg Television's Francine Lacqua and Guy Johnson at the World Economic Forum in Davos, Switzerland. "If we see that there are difficulties in achieving this target that we have, we have to continue."

ECB President Mario Draghi pledged on Thursday to buy 60 billion euros ($68 billion) a month of assets including government bonds through September 2016, adding that buying will "in any case be conducted until we see a sustained adjustment in the path of inflation." The quantitative-easing package is designed to stave off a deflationary spiral in the 19-nation currency bloc by flooding the region with liquidity and pushing investors into riskier assets.

REUTERS

Swedish central bank should consider weakening currency: Borg(Reuters) - Sweden's central bank should consider steps to weaken the crown to keep the economy competitive after the European Central Bank launched substantial bond-buying on Thursday, former finance minister Anders Borg told Reuters.

Borg, in government until last year and now chair of the Global Financial System Initiative at the World Economic Forum, said the currency was arguably too strong for the good of the economyand the Riksbank had tools to act.

Source: http://www.reuters.com/article/2015/01/22/us-sweden-currency-borg-idUSKBN0KV2A420150122

BLOOMBERG

Oil Climbs as Saudi King's Death Spurs Policy Speculation

Oil rose after the death of King Abdullah of Saudi Arabia, the biggest producer in the Organization of Petroleum Exporting Countries.

Futures rallied as much as 3.1 percent inNew York and 2.6 percent in London after the Saudi royal court announced the death in a statement. Crown Prince Salman bin Abdulaziz will succeed Abdullah on the throne. The kingdom, the world's largest crude exporter, led OPEC's decision to maintain its oil-production quota at a meeting in November, exacerbating a global glut that's driven prices lower.

-

10:00

European Stocks. First hour: Indices continue rally on ECB boost

European indices continue to rise after the European Central Bank (ECB) President Mario Draghi said at the press conference yesterday that the central bank will launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The central bank kept its interest rate unchanged at 0.05%. Cyclical stocks were among the best performers.

PMI data for France, Germany and the Eurozone were mixed with Germany's Economy, the largest in the Eurozone, picking up momentum. Eurozone's Manufacturing PMI was in line with expectations at 51.0 in January compared to 50.6 in December. The Services PMI beat estimates with a reading of 52.3 compared to economist's forecasts of 52.1 adding 0.7 points.

The FTSE 100 index is currently trading +0.53% quoted at 6,832.90 points. Germany's DAX 30 added +1.40% trading at 10,582.23 at new all-time highs. France's CAC 40 added +1.33%, currently trading at 4,613.41 points.

-

09:38

French and German Manufacturing / Service PMI mixed

While the French Services PMI for January was below expectations with a reading of 49.5 compared to 50.9 German Services PMI improved from 52.1 to 52.7 beating estimates by 0.1.

The Manufacturing PMI in France improved according to Markit Economics with a reading of 49.5, compared to forecasts of 48.1 and a previous reading of 47.5.Whereas Germany's Manufacturing PMI fell unexpectedly last month. The index declined from 51.2 to 51.0. Economists expected a reading of 51.8.

Markets now await data on Eurozone's PMI due at 09:58 GMT.

-

09:00

Global Stocks: global indices continue rally on ECB stimulus

U.S. markets closed higher on Thursday for a fourth consecutive day despite the weaker-than-expected number of initial jobless claims. The number of initial jobless claims in the week ending January 17 in the U.S. fell by 10,000 to 307,000 from 317,000 in the previous week, missing expectations for a decline by 16,000. The previous week's figure was revised to 317,000 from 316,000. Markets were supported by the European Central Bank (ECB). President Mario Draghi said at the press conference yesterday that the central bank will launch a large scale quantitative easing program of 60 billion euro a month starting from March 2015 until September 2016 - a stimulus program well above expectations. The DOW JONES index added +1.48%, closing at 17,813.98. The S&P 500 added +1.53% with a final quote of 2,063.15 points.

Chinese stock markets continued to rise. Hong Kong's Hang Seng is trading +1.16% at 24,806.51 points. China's Shanghai Composite closed at 3,353.29 points +0.30% almost erasing the first weekly loss since November 7th after 10 weeks of consecutive gains. The longest series since 2007.

Japan's Nikkei added gains on Friday rising to a near one-month high extending the global rally, closing +1.05% with a final quote of 17,511.75. The index ended the week with a plus of 3.8 percent after the BoJ left its economic stimulus program unchanged earlier this week but lowered the consumer inflation outlook for 2015 due to falling oil prices. The Japanese preliminary Manufacturing PMI improved from a reading of 52.0 in December to 52.1 in January.

-

02:58

Nikkei 225 17,491.93 +162.91 +0.94%, Hang Seng 24,852.55 +329.92 +1.35%, Shanghai Composite 3,357.1 +13.75 +0.41%

-

00:33

Stocks. Daily history for Jan 22’2015:

(index / closing price / change items /% change)

Nikkei 225 17,329.02 +48.54 +0.28%

Hang Seng 24,522.63 +170.05 +0.70%

Shanghai Composite 3,344.4 +20.79 +0.63%

FTSE 100 6,796.63 +68.59 +1.02%

CAC 40 4,552.8 +67.98 +1.52%

Xetra DAX 10,435.62 +136.39 +1.32%

S&P 500 2,063.15 +31.03 +1.53%

NASDAQ Composite 4,750.4 +82.98 +1.78%

Dow Jones 17,813.98 +259.70 +1.48%

-